Camoin Student Housing Market Student Nov. 2016

Diunggah oleh

rickmoriarty0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

5K tayangan17 halamanAn analysis of the student housing market in Syracuse, N.Y., by Camoin Associates, dated November 2016, for the Syracuse Industrial Development Agency.

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAn analysis of the student housing market in Syracuse, N.Y., by Camoin Associates, dated November 2016, for the Syracuse Industrial Development Agency.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

5K tayangan17 halamanCamoin Student Housing Market Student Nov. 2016

Diunggah oleh

rickmoriartyAn analysis of the student housing market in Syracuse, N.Y., by Camoin Associates, dated November 2016, for the Syracuse Industrial Development Agency.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 17

STUDENT HOUSING MARKET ANALYSIS

November 2016

Prepared for:

Syracuse Industrial Development Agency

201 East Washington Street

Syracuse, New York 13202

Rgicamoin

associates

sua.so0 2608

Camoin Associates has provided economic development consulting services to

‘municipalities, economic development agencies, and private enterprises since

1999. We specialize in real estate market analysis to evaluate the feasibility and

impacts of proposed projects. Through the services offered, Camoin Associates

has had the opportunity to serve EDOs and local and state governments from

Maine to Texas; corporations and organizations that include Lowes Home

Improvement, FedEx, Volvo (Nova Bus) and the New York Islanders; as well as

private developers proposing projects in excess of $600 milion. Our reputation

for detailed, place-specific, and accurate analysis has led to projects in over

‘twenty-nine states and garnered attention from national media outlets including

Marketplace (NPR), Forbes magazine, and The Wall Street Journal. Additionally,

our marketing strategies have helped our clients gain both national and local

media coverage for their projects in order to build public support and leverage

additional funding. The firm currently has offices in Saratoga Springs, NY,

Portland, ME, and Brattleboro, VT. To learn more about our experience and

projects in all of our service lines, please visit our website at

‘uoww.camoinassociates.com, You can also find us on Twitter @camoinassociate

and on Facebook.

Michael N'dolo

Vice President, Project Principal

Rachel Selsky

Senior Economic Development Analyst, Project Manager

Alex Tranmer

Economic Development Analyst

Contents

Bgl Camoin Associates | Syracuse Student Housing Analysis

Executive

Summary

Camoin Associates was commissioned by the Syracuse Industrial Development Agency to conduct a

student housing market analysis to understand the existing student housing market in the Syracuse

Region and what demand exists for new housing. A particular focus was around new, private housing

complexes geared towards undergraduate students that are becoming more common around the

country.

Camoin Associates conducted a market analysis including interviews with local landlords and

representatives of the educational institutions, data callection and analysis, and finally national market

research. Based on the review of the data, interviews, and market research, the following takeaways

have been developed for the Syracuse Industrial Development Agency:

= The majority of housing in the designated study region is renter-occupied. Rental rates have a

substantial range, from $350-$1,400, but the median rent is about $630. Newer rental

properties have rates starting around $900 and increase with additional amenities and space.

~The study region's existing housing stock is aging. if older homes are not adequately maintained,

students from Syracuse University (SU) seeking off-campus housing may continue to gravitate

away from poorly kept houses towards newer apartment complexes or renovated buildings. This

could further advance changes in neighborhood dynamics that university officials have observed

in the last several years

~ Enrollment at SU and, to a much lesser degree, Le Moyne College and SUNY ESF, drive the

demand for student housing in the city. Since both institutions have stated that they do not.

intend to increase enrollment levels in the near future, there will not likely be an increase in

aggregate demand for student housing. With that said, approximately 13,000 SU students! live

off campus and represent a very large pool of rental tenants in direct proximity to campus.

= Syracuse University has stated that the vast majority of its students who live off-campus are able

to find housing in the city, with less than 100 students commuting to the school. Therefore, we

do not believe that the student housing market is constrained by supply’

- However, there does appear to be substantial unmet demand for high-quality student housing

options, Students appear to be willing to pay for quality housing at prices above the current

market clearing price should the supply of quality housing options increase.

~ Therefore, an increase in student housing options within Syracuse would not likely increase the

number of students who are able to find housing within Syracuse. Instead, it would shift renters

away from low-quality spaces into newer, quality units. The resulting vacancies in adjacent

neighborhoods would require substantial investments by owners or would have to be filled with

non-student renters.

Based on the findings above, we believe that the privately-owned and operated student housing

Projects bringing on line approximately 690 units (accommodating 1,693 beds/individuals) could

successfully fill a housing market gap for newer units with additional amenities in the midst of Syracuse's

aging housing stock. However, our research does not suggest there will be an increase in demand in the

near future so the increased supply of new residential units means that existing substandard rental

property owners will need to adjust to better suit student housing preferences (i.e. make substantial

investments) or seek out a new target market to fill their properties.

‘SU has approximately 21,000 undergraduate and graduate students, of which 8,000 lve on campus.

2 In some college towns, the housing situation isso tight that students, faculty and others who would like to lve closer to

‘campus cannot find adequate housing options and therefore are “forced” ta live outside of the community and commute in. In

these cases, the increased supply of housing options would result in these commuters having an option tive closer to campus

‘and it would benefit the host community

Bgl Comoin Associates | Syracuse Student Housing Analysis

Introduc

n

‘The Syracuse Region is fortunate to have major institutions of higher education call the city their home

including Syracuse University, Le Moyne College and State University of New York College of

Environmental Science and Forestry (ESF). With institutions of higher learning often come a wide variety

‘of employment opportunities, national name recognition, innovation and technology development, and

many young adults and faculty looking for places to live within close proximity. That final point regarding

the residential aspect is something that is of particular interest to the Syracuse Industrial Development

‘Agency (“IDA” or the “Agency”) as itis working to better understand the current and future demand for

student housing in the city of Syracuse. This work has been initiated based on the fact that there has

been significant interest in private student housing development in recent years to serve the student,

population. There is interest in determining whether the demand actually exists to fill these new

developments and the subsequent impact that these developments will have on existing Syracuse

neighborhoods.

Camoin Associates was commissioned by the Syracuse IDA to conduct a student housing market

‘analysis, targeting the undergraduate populations of three local institutions, to understand the e

housing market and what demand exists for new housing. The following is a summary of the work

conducted related to this student housing market analysis including data collection, interviews, market

research, and finally “takeways” for the IDA.

ing

Study Area

The data collected for the student housing market analysis was based on the census tracts provided to

Us by the Syracuse IDA, which include educational institutions with undergraduate populations.’ The

study area highlighted in blue on the map below will be referred to as the “University Housing Region”

throughout the report.

= Syracuse University

Main Campus

= Syracuse University

South Campus

= SUNY College of

Environmental Science

and Forestry (ESF)

= Le Moyne College

= Downtown Syracuse

and adjacent tracts

> census tracts (CTS) include: 360670043.02, 360670056.01, 360670056.02, 360670146.00, 360670032.00,

'360670043.01, 360670044,00, 360670055,00, 360670034.00, 360570042.00, 360670045.00, 360670035.00. It

should be noted that CTs on the Western portion of the map fall in the City of Syracuse and CTs on the Eastern

portion of the map fall within the Town of De Witt

Tigh covsin Asoc | sent Houtng Mars Anas e

The University Housing Region's population grew by just Population 35,481 36141 37,312

over 1,830 people between 2000 and 2016. At the same Households 13,242 11.908 12.620

time, households decreased by 612. Household size

HouseholdSize 2.225 2.2

remained fairly consistent, with a slight increase in

2010, only to drop back down to the 2000 figure, 2.12 Source:SR! Median Age

236 (239

Source: ESRI

2016 University Housing Region

Population by Age

on

50

0-0

5)

‘The median age in 2010 was 23.6. This increased by 0.3

to 23.9 in 2016. About half of the University Housing 2s

Region’s population is between the ages of 15 and 24, foe

with another 14% comprising the next age cohort, 25- aoe

34 year olds. The data clearly shows the importance of A

the student population in this market so

on

7-34

et

% WK 20% 30% 40% SK Om

Percentage of Population

Source: ESRI

Nearly 40% of the University Housing Region’s households earn less

than $15,000 annually, while another 23% make between $15,000

and $34,999. Median Household Income was slightly over $24,000

in 2016. It should be noted that students living on- and off-campus

are included in population figures, however, because on-campus

housing facilities are not counted as “households” by the U.S.

Census, incomes of students living in on-campus are not accounted

for in calculations for median household income. However,

students that do live off-campus are counted towards household

nits and therefore would be included in median household income

data.

Wil corso Asoc | sens Houng art Ara

2016 Household by Income

Household Income Basa

<$15,000

$15,000- $24,999

‘$25,000 - $34,999

$35,000 - $49,999,

'$50,000- $74,999

‘$75,000 - $99,999

{$100,000 - $149,999

‘$150,000 - $199,999

'$200,000+

38.0%

12.8%

10.0%

11.4%

10.5%

7.0%

6.9%

1.8%

17%

Median Household Income $ 24,086

Source: ESRI

jousing Supply Housing Units by Units in Structure

Nearly a third of the 12,935 homes in the University Housing EE

Region are single family, detached homes. The next largest 1, detached 3930 304%

segment of the housing supply is comprised of structures ease 232 19%

containing 50 or more units, making up 16% of the city'stotal Te ES

supply. Structures with 2 units and 5-9 units each account for 3 og =

13% of the total supply. Single family homes that have been

converted into apartment units fall under the housing category 509 oe

that reflects the total number of livable units in the home. For -_-10t029 1,255 9.7%

example, if a landlord breaks a typical single family homes into6 20t0 49 1,013 7.8%

units, the house would fll nto the 5-9 units housing category. It SOor more 2075 16.0%

should be noted that the number of units ina housing structure Mobile home 33 0.3%

does not necessarily reflect that total number of beds or Boat, RV, van,ete, = .

bedrooms in that structure, A typical single family home likely tga 12935 100%

has 3+ beds depending on family size. souees ES

Housing Stock Condition

‘The age of an area's housing stock is an important indicator because it can provide a high-level estimate

of the quality of the housing stock. Although well-maintained older homes can contribute to the

preservation of an area's local history and community character, older houses also tend to be costlier to

maintain for owners or landlords and have more structural and environmental concerns.

‘The study area’s housing stock is aging. The table below shows that over a quarter of housing was built

prior to 1939 and only 8% of homes were built within the last 25 years. The aging housing stock is taxing

on landlords in the area who have to attend to deteriorating plumbing or other major interior and

exterior systems.

Housing Units by Year Structure Built

Built 2010 or later a (06%

Built 2000 to 2009 300 23%

Built 1990 to 1999 587 4.5%

Built 1980 to 1989 1,022 7.9%

Built 1970 to 1979 1,861 14.4%

Built 1960 to 1969 1,680 13.0%

Built 1950 to 1959 2445 18.9%

Built 1940 to 1949 1588 123%

Built 1939 or earlier 3371 26.1%

Total 12,935 100.0%

Median Year Structure Built 1956

Source: ESRI

Tigh covsin Asoc | sent Houtng Mars Anas e

Occupancy & Vacancy Rates

Occupancy and vacancy trends show that rental units far outweigh owner occupied units in the

University Housing Region. As of 2016, only a quarter of housing units were owner occupied, while

another 69% were renter occupied. The remaining 7% of units were vacant. The vacancy rate has.

fluctuated over the course of the last decade and a hall, ranging from 10% in 2000 to 6% in 2010. The

total housing units in the area also fluctuated, shrinking by just over 2,000 units between 2000 and 2010

and then recovering 916 units to reach 13,632 in 2016. A housing market is considered “healthy” at

around 5% vacancy, beyond that there become concerns regarding over supply.

Occupancy Trends

a

Total Housing Units

# a # a # ca

(Owner Occupied Housing Units 3416 23.2% 3,344 © 263% © 3,217 23.6%

Renter Occupied Housing Units 9,820 66.7% 8571 67.4% 9,420 69.1%

‘Vacant Housing Units 1487 101% 814. 6.4%_— 1,009 7.4%

Source: ESRI

Residential Values

‘The largest segment of owner occupied housing, 30%, is valued between $100,000 and $149,999. The

rnext highest bracket, $150,000-$199,999, is the second largest segment, accounting for 25% of owner

occupied homes.

2016 Owner Occupied

Housing Units by Value

<$50,000 4.3%

$50,000 - $99,999 24.0%

$100,000- $149,999 30.0%

$150,000- $199,999 28.6%

$200,000 - $249,999 8.2%

$250,000 - $299,999 2.4%

$300,000 - $399,999 1.0%

$400,000 - $499,999 1.2%

‘$500,000 - $749,999 2.6%

$750,000 - $999,999 0.8%

$1,000,000 + 0.9%

Source: ESRI

The median home value in the University Housing Region is currently $136,227, This figure is expected

to rise by over $23,000 in the coming five years to $159,696.

Median Home Value

$ 136,227 $ 159,696

Source: ESRI

Tigh covsin Asoc | sent Houtng Mars Anas e

Rental Market

The median rent in the University Housing region is $634, and nearly two-thirds of renters pay for

Utilities on top of their rental costs. The largest portion of renters, 10%, pay between $600-$649 for

monthly rents. The second and third largest portions, 9% and 8%, pay $800-$899 and $550-599,

respectively.

Renter-Occupied Housing Units by

Contract Rent

EE

With cash rent 7,769 99.3%

Less than $100 274 | 35%

$100 to $149 99 13%

$150 to $199 188 2.4%

$200 to $249 502 (6.496

$250 to $299 3860 4.9%

$300 to $349 239 18%

$350 to $399 a 18%

$400 to $449 25 29%

$450 to $499 27 35%

$500 to $549 sor (ea%

$550 to $599 620 | 79%

$600 to $649 7 GOO

$650 to $699 565 72%

$700 to $749 350 4.5%

$750 to $799 4n | 60%

$800 to $899 663 | 85%

$900 to $399 307, 3.9%

$1,000 to $1,249 535 (ea%

$1,250 to $1,499 345) 4.4%

$1,500 to $1,999 mm 35%

$2,000 or more 29 1.6%

No cash rent 52 0.0%

Total == 7,824 100%

‘Median ContractRent: $634.

Source: ESRI

Renter-Occupied Housing Units by Inclusion of

Utilities in Rent

P|

Payextraforone ormore utilities 4,909 62.8%

Noextrapaymentforany utilities 2,912 37.2%

Source: ESRI

Tigh covsin Asoc | sent Houtng Mars Anas e

Student Housing Market Ana

Based on articles published by the national residential data company AXIOMetrics, privately owned

student housing properties have been performing strongly in recent years, with tens of thousands of

new beds coming online every year. The peak of the market was in 2013 and 2014, but the sector

continues to grow and thrive. The leasing velocity (how quickly the units are rented) is holding steady or

slightly improving as the units preleased for Fall 2016 much faster than Fall 2015. Effective rent rates are

also increasing with an average of $617 per bed for Fall 2016 which is up more than 2% from Fall 2015.*

‘At universities in the Northeast with over enrollment over 20,000, there were 7 new major student

housing projects in quarter 1 and 2 of 2014 and another 3 in the same quarters of 2015.° Some of the

key factors driving development of projects include investment capital coming into the sector and

Increased college enrollment during the recession. Student housing is typically unaffected by external

economic forces like increased unemployment which leads to consistent demand for housing providers.

Vacancy rates at privately-owned off campus developments are very low with a 4.2% rate in January

2015 based on data from AXIOMetrics. ©

Beyond developing units to cater towards students, another trend in the college town market is,

developing units to serve the faculty, staff, and young professionals that locate in college towns. The

rents at these types of developments are aimed at a different market and specifically make the units

unattractive to students to ensure a more comfortable environment for their intended clientele,

including higher rent rates, inconvenient timing of leases, and denying applicants who may rely ona

guarantor (such as parents) to pay the rent. In some cases, these types of developments have had a

ripple effect, which has led to the development of adjacent older-neighborhoods. For example, in

Powelton Village, which is home to Drexel University, a development geared towards young

professionals was built and then a company called Post Brothers Apartments bought adjacent ageing

rental buildings and renovated them.’ This trend seems to be a better fit for major urban areas where a

higher price point can be demanded, residential development is in high demand, and developers need

to maintain their competitiveness through updated units.

Locally, there are three potential drivers for student housing including Syracuse University, SUNY College

of Environmental Science and Forestry, and LeMoyne College. All three of these institutions were

contacted in relation to this project and asked for input regarding thelr current and projected

enrollment, their plans for student housing development and changes, their role in assisting with

student housing in the community, and how they see trends in the student housing market. SUNY ESF

‘was not able to be reached for verification of these topies, however information surrounding the school

was sourced directly from their website.

‘The main finding of these interviews is that these institutions did not intend to increase enrollment in

the near future and therefore there will be no new demand for student housing. The following is a

summary of the interviews:

* (Gunn, 2015)

* (Colliers International, 2015)

© (ABODO National Student Housing, 2015)

7 {Kaysen, 2016)

ci soca | ude! Hung Mart Anat e

Ly

Syracuse University

Fall 2015 enrollment at Syracuse University (SU) was 21,789 with 14,566

full time undergraduate and 4,765 graduate students (including law 2

school). Part time undergraduate students totaled 630 and parttime

graduate and law students reached 1,828.°

Z suos

7) curvoresS

SCIENTIA

CORONAT

The University requires that freshmen and sophomores live on campus

and have 8,000 available beds ~ typically these are nearly 100%

occupied, The University has seen fluctuations in class size depending on

how many incoming students accept but overall they have been ~y, HES

relatively steady and do not intend to increase enrollment. Interviews Diy WO”

with several SU officials confirmed that the University does not have any “D

immediate intentions to build new (or replace existing) beds for students on campus. While there are

plans to eventually relocate South Campus student housing to Main campus, and to consider adding

more beds to the on-campus housing stock, academic buildings and endeavors take priority over

student housing development. More information on future plans for the University can be explored in

the school’s Campus Framework, referenced in the Resources table.

Since the University only has 8,000 beds on campus, there is a significant number of students that need

+o find off-campus housing and the vast majority of them do so by finding units within the City of

Syracuse. Based on their experience working with students, the University staff say that proximity to

campus and price are the two main drivers for students looking for off-campus apartments. Safety is a

primary concern for parents. Historically, demand has been so high for off-campus housing that

students have had to sign leases with landlords for the following year to ensure that they are able to get

housing. However, based on recent experience, it seems as though the demand is down and people are

able to get leases closer to the start date.

Between 2005 and 2010 there were 3,500 new beds added to the housing stock on the Syracuse

University campus that were built by private developers. After the final project was complete in 2010

the University staff that assist students with off-campus housing issues started to see an increase in the

vacancy rates as well as an increase in crime rates in the neighborhoods where students used to live but

are now changing as students move to the on-campus private units.

SUNY College of Environmental Science and Forestry

SUNY ESF is the smallest of the undergraduate institutions studied in the

selected study area. In total, the undergraduate enrollment is about 1,650 and

graduate students total about 600. The incoming 2016 class was 327 students.

According to their website, all incoming Freshman are required to live on-

e campus in Centennial Hall unless they live within a 30-mile radius of the school

and commute into campus. The Syracuse University Office of Off-Campus and

Commuter Services also aides upper year students from SUNY ESF in their off-

campus apartment hunting,

§ (Syracuse University, 2015)

Ly

Jamoin Astocites | Student Housing Market Analyst

Le Moyne College

Le Moyne College has enrollment of 2,300 full time undergraduate

students, all of which are required to live on campus for their full

‘tenure at the school unless they are living within driving distance at

their parents’ home. This policy, they believe, helps improve

graduation outcomes and improves experience for students and they

do not intend to change it. From year to year there may be 75-100

seniors that are unable to receive housing on campus (this is done

‘through a lottery system) and they are then allowed to live off-

campus and they tend to live in the single and multi-family housing

nits in the nearby neighborhoods. Le Moyne College does not get

involved in helping the seniors find housing off campus but, from

what the college hears, it has never been an issue.

Le Moyne College is not intending to increase enrollment, however they do have some plans in place to

add 50-75 new beds in the near future which will include replacing 18-20 existing and the rest will be

new, so the number of students needing to go off-campus their senior year will decrease slightly.

Current Off-Campus Student Housing

For students looking to move off campus in their upperclassmen years, there is wide-range of rental

properties, in terms of price and quality in the neighborhoods surrounding the institutions. Syracuse

University officials verified that students are typically willing to spend around $600-$650 on monthly

rent payments, however there is a significant range in what some students are able to pay for a higher

end apartment, reaching monthly rents of $1,400 at complexes like Cooper Beech and Park Place. On

the other end of the spectrum, students can find places for $350, although the quality and size will

match the price. Rents may not include heating costs, which can exceed $100 in the winter time

depending on the condition of the rental property. Due to the aging housing stock in Syracuse - drafty

houses, older windows and dated appliances all play a part in larger utility bills,

Rents typically do not align with the school year and still run on a 12-month schedule. Although there

are some rental properties that will allow 6-month, 10-month or 11.5 month contracts. Additionally,

many landlords require students to sign leases 1-year prior to when they will actually be living in the

house.

While cost is a primary concern of students looking for off-campus housing, proximity to campus is also

at the top of the list. A five to fifteen-minute walk is generally a manageable distance, as is housing in

the Free Fare Zone of SU, which is any local bus stop between the intersection of East Genesee Street

and Irving Avenue and East Genesee Street and Westcott Street. Aside from cost and proximity to

campus, other amenities that are sought after by students include: off-street parking, outdoor space, in-

house laundry, large living rooms, furnished spaces and/or a unit that welcomes pets. On top of these

items, landlords in the area are noticing that more tenants are seeking energy efficiency upgrades, and

higher end finishes in kitchens, like granite counter tops and stainless appliances.

From market research and interviews it appear that a stratification of rental properties is emerging in

the Syracuse area, meaning that while some properties are upgrading or building new to cater to.

individuals with higher budgets, other properties are struggling to compete with new build spaces and

instead try to attract students with smaller budgets. Landlords without significant resources to upgrade

their properties are going to have a tough time competing with new and renovated properties in the

ci soca | ude! Hung Mart Anat e

Ly

coming years and will ikely have to sell out to the larger landlords or exit the rental market. This will

advance the trend of landlord consolidation and mean that fewer people control more property in the

city

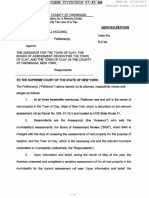

(OUR AMENITIES MAKE ALL THE DIFFERENCE!

In addition to the existing private student housing

projects, there are anumiber of new developments that Og ear eo

are being considered in the study area, Typically, the eaten meri catenin

projects are characterized by: °

- Higher average rent rates than typical off-campus nee

housing. Rental fees for the private student tempat ~~

housing complexes are at least as much as living on

campus. ® =)

= Cater to juniors and seniors and some graduate ee es

students who are looking for convenience, safety, ce

and amenities °

= Wide range of amenities offered including on-site ont meee

gyms, golf video simulation, study areas, parking oe

garage, game rooms, tanning beds, and 24-hour °

on-site management. ues oe

= Units range from 1-4 bedroom with kitchen and Raniggh a eestor’:

shared living space in each unit. ~ —s

wee ie

A project that recently came online for rentals and is Aremiecatietieaes: irae

operational in the area is:

- UPoint (formerly Blvd 404)—aS4-unit student |. Swan nme

apartment at 404 University Avenue = ce

© Offers two, three and four bedroom units

with ee terms of 11% months 9. aon

© Includes utilities like electricity, Internet gematsrnaneeet bck) Suenxstesh tne

and Cable TV ee

‘©. Price point ranges from $959-$1,349 ©

© Amenities include a gym, granite \e

countertops, stainless steel, washer and saransjrimm nmin

dryer, maid service, garage parking, coffee

bar, study spaces and Wi-Fi throughout the

building

Off campus Housing Amenities List

° Private student housing development is defined as residential projects being built and operated by private

developers designed to cater to the student population,

ci soca | ude! Hung Mart Anat e

‘There are at least four other private student housing projects

that are in various stages of planning and pre-development that

would add a combined 690 units (totaling 1,693 beds) targeting

‘the undergraduate market. With 13,623 total (including owner

occupied, renter occupied, and vacant) units currently in

Syracuse, the addition of 690 units would be a 5% increase. Afull ees

list of existing student housing properties, along with proposed source: U Point Syracuse website

student housing projects in the study area, see Appendix B,

Based on the review of the data, interviews, and market research the following takeaways have been

developed for the Syracuse Industrial Development Agency:

~The majority of housing in the University Housing Region is renter occupied. Rental rates have a

substantial range, from $350-$1,400, but the median rent is about $630. Newer rental

properties have rates starting around $900 and increase with additional amenities and space.

~The University Housing Region’s existing housing stock is aging. If older homes are not

adequately maintained, juniors and seniors from SU seeking off campus housing may continue

to gravitate away from poorly kept houses and towards newer apartment complexes or

renovated buildings. This could further advance changes in neighborhood dynamics that

university officials have already observed in the last several years.

~ Enrollment at Syracuse University and, to a lesser degree, Le Moyne College and SUNY ESF, drive

the demand for student housing in the city and since these institutions have stated that they do

ot intend to increase acceptance rates or enrollment levels in the near future there will not

likely be demand for increased student housing options.

= In some college towns the housing situation is so tight that students, faculty and others who

‘would like to live closer to campus cannot find adequate housing options and therefore are

“forced” to live outside of the community and commute in. In these cases, the increased supply

of housing options would result in these commuters having an option to live closer to campus

and it would benefit the college town. Syracuse University has stated that the vast majority of

‘their students who live off-campus are able to find housing in the city, with less than 100

students commuting to the school, so an increase in student housing options within Syracuse

‘would not likely increase the number of students who are able to find housing within Syracuse

and would instead leave units vacant or filled with non-student renters.

In conclusion, the data and interviews suggest that demand does not exist for an overall increase in

supply of student housing options in the University Housing Region. This does not mean that the

privately owned and operated units would not be successful, as there is likely a demand for higher

quality units with more amenities, but these new units coming on-line would result in students who are

currently living in adjacent city neighborhoods moving to these new developments and there being a

void in demand for the vacated units.

ci soca | ude! Hung Mart Anat 6

‘ABODO National Student Housing. (2015). ABODO Student Housing Report 2015.

Colliers international. (2015). Tier 1 Housing Markets Q1 & Q@ Snapshot. Retrieved October 15, 2016,

from Ti: http://www.colliers.com/-

/media/files/united%20states/pg%20and%20service%20lines/student%20housing/research/201

S5/tier-L-market-snapshot_q2%2015_091115.pdf

Gunn, T. (2015, April 15). AXIOMetrics. Retrieved from Student Housing Research: Market Gains

Strength: http://www. axiometrics.com/blog/student-housing-research-market-gains-strength

Kaysen, R. (2016, January 19). College Towns Get New Housing, but It's Decidely Not Dorms. New York

Times, Retrieved October 15, 2016, from

http://www. nytimes.com/2016/01/20/realestate/commercial/developers-give-new-meaning-

to-college-towns.html?_r=1

Syracuse University, (2015). SU Facts. Retrieved from About Syraucse University :

http://www.syr.edu/about/facts.htm

‘Syraucse Univeristy. (2016). Campus Framework - Draft Overview.

Tigh covsin Asoc | sent Houtng Mars Anas e

Existing Syracuse Student Housing/University Hill Development

## OF Units

EDR Syracuse Campus West, LIC 150 Henry St, Syracuse, NY 13210 260

EDR Syracuse, LLC 315 Small Rd, Syracuse, NY 13210 120

Genesse Armory, LLC 1055 E Genesse St Syracuse, NY 13210 133

Orange Grove, LLC/ UPoint 406 University Ave Syracuse, NY 13210 40

‘ACC OP (PARK POINT SU) LLC 417 Comstock Ave 66

Skyler Commons, LLC ‘908 Harrison St Syracuse, NY 13210 100

Centennial Hall Expansion 142 Oakland St 39

‘Aspen Heights 307 East Brighton Avenue 180

Total: 938

Source: Syracuse IDA

Proposed Student Housing Projects in Syracuse

Studious Apartments 1200-24 E Genesee St & Walnut Avenue 126 263

The Standard 610-14 University Ave & Adams St 210 608

900 East Genesee Street ‘901-5 East Genesee Street & Irving Ave 239, 581

Varsity BLVD 732-40 South Crouse Avenue Unavailable Unavailable

Campus BLVD 721-29 South Crouse Avenue 15 245

Total Proposed: 630 1693

Source: Syracuse IDA

Note: These unit and bed counts are current as of November 2016 and based on predevelopment meetings

with the City of Syracuse, Exact number of units and bed counts are subject to change,

Tigh covsin Asoc | sent Houtng Mars Anas e

Camoin Associates, Inc. ;

120 West Avenue, Suite 303

sortoge Spgs NY 2866 | am camoin

@camoinassociate

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5795)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- 2017 Regional Economic Development Council AwardsDokumen140 halaman2017 Regional Economic Development Council Awardsrickmoriarty100% (1)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Syracuse School District Stimulus SurveyDokumen23 halamanSyracuse School District Stimulus SurveyrickmoriartyBelum ada peringkat

- 2018 REDC Award BookletDokumen136 halaman2018 REDC Award Bookletrickmoriarty100% (1)

- Great Northern Mall Tax LawsuitDokumen7 halamanGreat Northern Mall Tax LawsuitrickmoriartyBelum ada peringkat

- Full-Day Pre-K Expansion - Final ($90m Allocation)Dokumen6 halamanFull-Day Pre-K Expansion - Final ($90m Allocation)rickmoriartyBelum ada peringkat

- Department of Public Service: WyorkDokumen4 halamanDepartment of Public Service: WyorkrickmoriartyBelum ada peringkat

- Central NY Regional Economic Development Council 2017-2018 Progress ReportDokumen159 halamanCentral NY Regional Economic Development Council 2017-2018 Progress ReportrickmoriartyBelum ada peringkat

- Post-Standard Front Page Sept. 18, 2016Dokumen1 halamanPost-Standard Front Page Sept. 18, 2016rickmoriartyBelum ada peringkat

- How CNY WorksDokumen19 halamanHow CNY WorksrickmoriartyBelum ada peringkat

- Amazon Proposal Centerstate CEODokumen23 halamanAmazon Proposal Centerstate CEONewsChannel 9Belum ada peringkat

- CenterState CEO 2016 Economic ChampionsDokumen4 halamanCenterState CEO 2016 Economic ChampionsrickmoriartyBelum ada peringkat

- 5linx Founders Criminal ComplaintDokumen16 halaman5linx Founders Criminal Complaintrickmoriarty100% (2)

- Syracuse-Buffalo Immigration StudyDokumen17 halamanSyracuse-Buffalo Immigration StudyrickmoriartyBelum ada peringkat

- Syracuse-Buffalo Immigration StudyDokumen17 halamanSyracuse-Buffalo Immigration StudyrickmoriartyBelum ada peringkat

- 2016 REDC Central New York AwardsDokumen11 halaman2016 REDC Central New York AwardsrickmoriartyBelum ada peringkat