Transfer Pricing 2

Diunggah oleh

Nisa IstafadDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Transfer Pricing 2

Diunggah oleh

Nisa IstafadHak Cipta:

Format Tersedia

www.sciedu.

ca/afr

Accounting and Finance Research

Vol. 3, No. 1; 2014

A Study on Accounting of Transfer Pricing and Its Effect on Taxation

Dr. Metin Uyar (Ph.D.)1

1

Social Sciences Institute, Arel University, stanbul, Turkey (Part time lecturer in Accounting)

Correspondence: Dr. Metin Uyar, Social Sciences Institute, Arel University, stanbul, Turkey. E-mail:

strongfitsdr@gmail.com

Received: January 29, 2014

Accepted: February 14, 2014

Online Published: February 15, 2014

doi:10.5430/afr.v3n1p79

URL: http://dx.doi.org/10.5430/afr.v3n1p79

Abstract

The dimension of accounting of transfer pricing as one of the essential instruments of profit transfers between

businesses has not been studied sufficiently. In this study, a review was conducted on occurrence of transfer pricing

and how accounting transactions will be conducted required to be conducted by the entities. However, it is evaluated

how transfer pricing will affect corporate tax via a case study. In order to make the study more concrete, the

conceptual framework was revealed in the light of previous literature and accordingly a scenario was developed. In

line with information in the scenario developed, it was indicated first how transfer pricing was conducted, and then a

recommendation was stated in the accounting records required to be conducted for improvement by the entities.

However, tax effect of the present case was determined before and after adjustment. According to such, it is

concluded that related parties of transfer pricing should follow a record process considering simultaneous movement

form and off-balance sheet accounts in adjustment transactions.

Keywords: Transfer pricing, Tax effect, Accounting entry, Adjusting entry, Subsidiary company, Parent company

1. Introduction

In this study, it is analyzed via literature review and case study how companies transfer profit through transfer

pricing and how such effect on taxation. In the recent period, transfer pricing subject gaining importance being one

of the agenda items related to modern accounting or cost management and through increase of national and

international firms is an issue to be studied (Tippett & Wright, 2006). Conveyance of the profit to the intended place

through price differentiation in the purchase-sale transactions of goods or services of the business entities realized

with the related parties.The aim of transfer pricing is to maximize the value of the corporation . The internal goals of

a transfer pricing system include performance evaluation of subsidiaries and their managers, motivation and goal

(behavioral) congruence (Abdallah, 2004). (Transfer prices may apply to departments, divisions, subsidiaries, or

affiliate business units (Cravens, 1997).Transfer price can be an effective tool for companies to achieve many

different objectives, such as profit maximization, cash flow management, marketing strategy implementation,

production coordination, and employee motivation. For example, a multinational company might need to keep the

import price of its foreign subsidiary at a low level so as to enable it to enter a new market, obtain a target market

share, or maintain a certain product mix. Among the various objectives, achieving maximum corporate-wide profit

and divisional evaluation are often cited by managers as the most important goals of transfer pricing. Interestingly,

these two objectives are often in conflict with each other. Since transfer prices provide valuation for trade between

divisions inside a company, they inevitably affect the divisional profit. Supposedly the transfer prices facilitate

coordination between, and performance measure for, the divisions.

The companies have every incentive to use transfer price to move profit between tax jurisdictions with differential

tax rates, thus minimizing total corporate tax. A parent company in a high tax country can purchase goods from its

subsidiary in a low tax country at a price substantially above the market price. The subsidiary will report high profit,

which will be taxed at the lower rate. The parent company will report a low profit, or even appear to be in financial

distress. Hence the multinational companies will benefit from the lower global tax expense. The tax authority of the

subsidiary will not object to the transfer price, since their tax revenue is increased by an artificially high profit, but

the tax administrators of the parent company will find the existing transfer price and lost tax revenue objectionable

(Wong, Nassiripour, Mir & Healy, 2011). Transfer pricing is a pricing strategy on products, semi-finished products or

components transferred between the related parties or the units in order to review the compliance with the purpose

and ideal performance based on maximum profit and minimum tax (Borkowski, 1997).Transferring the transfer

Published by Sciedu Press

79

ISSN 1927-5986

E-ISSN 1927-5994

www.sciedu.ca/afr

Accounting and Finance Research

Vol. 3, No. 1; 2014

pricing to the accounting records due to such important bases is of great importance for applications, researchers and

professionals. Literature scanning and applicable laws are studied first following the study, and then the transactions

are recorded in the books providing with daily samples. Lastly, negotiation and results are evaluated.

2. Literature Analysis and Conceptual Framework

Transfer pricing is a response to decentralized organizational structures under which responsibility centers trade

amongst themselves (Grabski, 1985). This is defined as the price paid in a business transaction, whether for;

tangible property, intellectual property or the provision of services between companies under related party control

(Abdallah, 2004). The transfer price of these tangible and intangible resources is becoming an important issue in

international supply chains, as decisions on policies to guide pricing decisions become increasingly complicated.

Transfer pricing has area of application in holdings, company groups and large entities and departments operating at

international level as it is applied interdepartmental level of a business entity. The subject of transfer pricing may be

established on raw materials, commercial materials, services, projects, patents and licenses. Multinational businesses

may reduce tax burden for shifting the profits to the countries applying lower tax rates through transfer pricing. The

purpose is to concentrate profits of the related businesses on the other area of operation. In this manner the

opportunity of the related parties to conduct auto-financing through transfer pricing is increased.

In Cravens (1997), it is observed that multinational companies have purposes such as motivation and competition

statuses in their application of transfer pricing. However, such tendency brought some tax problems. Indeed the most

important feature of transfer pricing is its effect on tax side. Therefore, a price policy shall be applied to increase

performance of both parties in determining price. In this manner, it is aimed at preserving the competition power. As

these prices are the most suitable prices for the benefits of the entity, the tax dimension thereof establishes problems

for governments. In classical transfer pricing, generally cost based transfer pricing is used. Operation based costing

method is used to response criticisms in linking the indirect production expenses with the finished products. The

expenses of the operations conducted in production phase conduct faulty calculation of the costs of products, markets

and customers since they are loaded without considering the properties of the market and customers. A department

manager considering not making any new investment would desire to sell some part of the products to other

departments of the company in the vertical integration structure. The company policy shall require such

inter-departmental sales to be discounted. Other departments shall purchase such product with pleasure and shall

make payments at lower prices. Such a behavior shall increase the earnings of the purchasing department and the

firm as a whole (Adams & Drtina, 2008). Samuelson (1982) demonstrated that the market prices of the

intra-company traded goods, and the resultant transfer prices, can be affected by production and sales decisions by

the companies. Eden (1983) used a partial equilibrium model to analyze the effect of the Canadian tariff regulations

on company transfer prices. He found that the companies can change their production levels to counteract the effect

of the tariff regulation. Halperin & Srinidhi (1987) extended Samuelsons model to examine the effect of alternative

transfer pricing methods specified in the U.S. Section 482 tax rule, namely, non-market resale price and cost-plus

price. Prusa (1990) reached similar conclusions by using information economics theory, where the companies and the

tax authority possess asymmetric information. In summary, researchers found that companies can often change their

environmental, marketing, and production decisions to manipulate the arms length transfer price. Alfons (2009)

provided empirical evidence that multinational companies did shift profit to their German affiliates when their host

country tax rates were higher than that in Germany. Clausing (2003) states that the reason for harsh measures related

to transfer pricing in the US being one of the leading countries in terms of transfer pricing volume is the fact that

approximately 40% of all trade consists of the trade between the related parties or another say trade operations

between the partners.

Some researchers (Anctil & Dutta 1999, Smith 2002, Baldenius, Melumad & Reichelstein, 2004) recommended

decoupling, that is, using different transfer prices for tax and performance evaluation purposes. However, big size

companies are reluctant to use two sets of books lest that tax authorities might question the validity of the prices

reported on their tax returns. Some researchers used an empirical approach to find out managers perceived relative

importance of the various objectives and constraints in transfer pricing strategies. Burns (1980) received surveys

from 62 of the Fortune 500 firms. She concluded that the five most important variables were: U. S. market conditions,

level of competition in the foreign country, maintaining reasonable profit for the foreign subsidiary, U.S. taxes, and

economic conditions in the foreign country. In a study related to international level transfer pricing it is stated that it

is a common method in provision of any and all goods, services, financial and non-financial assets between the firm

members in the different areas of the world (Elliott & Emmanuel, 2000).The price applied, in exchanging goods or

services between the headquarters of the firm and its branch abroad or between branches in two different countries, is

the international transfer pricing. In Chan & Hung-Chow (1997), it is stated that there was no sufficient experience

Published by Sciedu Press

80

ISSN 1927-5986

E-ISSN 1927-5994

www.sciedu.ca/afr

Accounting and Finance Research

Vol. 3, No. 1; 2014

and opportunities about transfer pricing, however, since sufficient levels were not attained about the conceptual

framework it is concluded that developing countries are more fragile. It is seen that different techniques are used in

defining transfer pricing. Most notable ones of such techniques are cost based pricing, market based pricing and

bargaining based pricing. It is required to consider the effects of some factors in selection of the method to be applied

in defining the transfer pricing. Li & Ferreira (2008) suggest a detailed model in this subject. According to the model,

the factors effecting on transfer pricing are nature of internal transfers, internal technological environment, internal

social environment, external technological environment and external institutional environment.

3. Methodology and Application

The method of this study includes sample case review. A case study is conducted below pursuant to the opinion that

it was not studied how transfer pricing will be recognized in the accounting records as stated in the above section

Introduction and Conceptual Framework, developing an advice in accounting of transfer transactions, and the tax

effect has been revealed as per such advice. It is seen that transfer pricing in accounting system has two fundamental

structures. One of them is OECD transfer pricing guide. The other one is IAS 36 ( International Accounting Standard

36: Impairment of Assets).

The concept of Camouflaged Earnings through Transfer Pricing is defined in the different countries laws as Turkey,

Germany, England: If the entities will sell or purchase goods of services at a price or consideration determined

violating the principle of arms length prices, the earnings shall be deemed as distributed as camouflaged fully or

partially through transfer pricing. Purchases, sales, production and construction transactions, leasing and subletting

transactions, lending or loaning funds and other transactions requiring salary and other similar payments are

considered as good or service purchase or sales in any circumstance and conditions. In IAS 36, the unit generating

cash is defined as the subject of transfer pricing. The smallest noticeable asset group generating cash independent of

cash inflows from the other assets or other asset groups is defined as the unit generating cash. The standard, related

to impairment test of the cash generating unit utters intercompany transfers in determination of the cash flows. If the

cash inflows generated by an asset or cash generating unit shall be affected from the intercompany transfer pricing

applications, the company is required to apply the most possible price estimate (estimates) expected to be occurred in

the future in a transaction to be conducted in mutual bargaining environment in estimation of the followings. It was

not seen how transfer pricing will be recorded in accounting and where it will be placed in national/ international

accounting standards. The following examples establish a solution proposal related to accounting of transfer pricing.

3.1 Sample Case and Accounting

Scenario: An electronic company listed 5000 units of the products having the unit cost of $50 at the sale price of $42

to one of its subsidiary company. And it sold 10,000 units to a non related customer at $60 in line with the equivalent

price. The firm as being the subsidiary sold 4,000 pieces of such units to another firm at 58$. The parent company is

within 20% tax slice as the subsidiary company is subject to 15% tax since it has tax benefits granted to its specific

geographic area.

The General Journal of the Parent Company

/

Debit

210.000

Accounts Receivable

Sales

Credit

210.000

Sold 5000 units products to subsidiary.

/

/

Cost of Goods Sold

250.000

Inventory

250.000

Cost of sale.

/

Accounts Receivable

600.000

Sales

600.000

Sold 10,000 units product.

/

Cost of Goods Sold

500.000

Inventory

500.000

Cost of sale.

Published by Sciedu Press

81

ISSN 1927-5986

E-ISSN 1927-5994

www.sciedu.ca/afr

Accounting and Finance Research

Vol. 3, No. 1; 2014

The General Journal of the subsidiary (Related Party)

/

Debit

210.000

Inventory

Accounts Payable

Purchased from Parent company

/

/

Accounts Receivable

Credit

210.000

232.000

Sales

232.000

Sold

/

Cost of Goods Sold

168.000

Inventory

168.000

Cost of sale

As you may see, the parent company applied different price to its affiliate as it applied another price to a non related

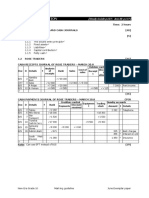

customer. Therefore the calculation of profit or loss shall be as per the Table 1.

Table 1. Calculation of Tax for the Period

Panel A: The Parent Companys Tax

Panel B: The Subsidiarys Tax

Revenue

$810.000

Revenue

$232.000

Expense

$750.000

Expense

$168.000

Taxable Income

$60.000

Taxable Income

$64.000

Tax 20%

$12.000

Tax 15%

$9.600

In the Table 1 Panel A it is seen that the company provides 810,000$ income from its main operation and its expenses

are 750,000$ causing tax accrual of $12,000. According to the Panel B, although the affiliated firm obtained more

profit it was subject to less tax accrual due to its tax benefits. Total tax amount required to be paid by two companies

is determined as $21,600. In another say, camouflaged earnings was provided through transfer pricing. The profit

was transferred from the parent company to the affiliated company. Due to such transaction being possible to be

found out in any possible tax reviews the parent company and the affiliate should conduct adjustment related to the

tax. Conduct of the adjustment (correction) transactions shall be changed by the period of determination of the

camouflaged earnings distribution through transfer pricing method. There are three possible scenarios available such

as noticing the distribution of camouflaged earnings in the same provisional tax period, noticing the distribution of

camouflaged earnings in the next provisional tax period, and noticing the distribution of camouflaged earnings in the

next year.

3.2 Adjustments and Their Effects on Taxation

The recording of the parent company should be as following if noticed within the same provisional tax period or at

the end of the period.

/

Debit

90.000

Accounts Receivable

Sales

Credit

90.000

Adjusting entry

The recording by the subsidiary shall be as following.

/

Debit

90.000

Inventory

Accounts Payable

Credit

90.000

Adjusting entry

Published by Sciedu Press

82

ISSN 1927-5986

E-ISSN 1927-5994

www.sciedu.ca/afr

Accounting and Finance Research

Vol. 3, No. 1; 2014

The Parent Company shall make account correction through adding it to the off balance accounts and adding to the

earnings for the period. In such a case, the calculation of the new tax shall be as per the Table 2.

//

Debit

Non-deductible expenses debited account

Credit

90.000

Non-deductible expenses credited account

90.000

Off balance accounts- Adjusting entry

//

Debit

Deductible revenues debited account

Credit

90.000

Deductible revenues credited account

90.000

Off balance accounts- Adjusting entry

Table 2. Post-Adjustment Tax Effect

Panel A: The Parent Companys Tax

Panel B: The Subsidiary Companys Tax

Income

$60.000

Income

$64.000

Non-Deductible Expenses

$90.000

Deductible Revenues

$90.000

Taxable Income

$150.000

Taxable Income

-$26.000

Tax 20%

$30.000

Tax

In the Table 2 Panel A, the parent company was forced to add $90,000 to the earnings of the business previously

calculated. The reason for such increase is the increase in the cost of the goods sold. With addition of expenses of

$90,000 as non-deductibles, the tax of the new business increased to $30,000. Therefore, there is an increase of

$18,000. Otherwise, tax loss fine shall be charged on the company for the loss of tax being

30.000-12.000=18.000$ and delay penalty shall be applied on the original tax as per the applicable provisions of the

laws. In Panel B, the affiliate shall be relieved of the additional corporate tax burden through correction with the

adjusted corporate tax return. As the tax amount required to be paid by both companies was 21.600$ (12.000+9.600),

$8,400 lower tax collection from both firms in aggregate would be prevented. In this manner, the losses of the

government shall be reduced.

4. Conclusion

In this study, it was reviewed how the entitled distribute camouflaged earnings through transfer pricing and how it

affects the taxation. A scenario was prepared to conduct the analysis and accounting solution proposal was realized

for the case presented in such scenario. Transfer pricing is pricing of goods or services provided from a department

of a business entity to other departments within the same business entity (Garrison & Noreen, 2000).In another say, it

is pricing of purchase-sales between the departments of a business entity structured in the form of decentralized

management. The goods or services transferred between the departments in the business being subject to transfer

pricing are called interim goods (Hongren et al., 2000). Transfer of interim goods between business units consists of

incomes for the selling department and cost for purchasing department. As it may be seen in the firms included in the

scenario, transfer pricing is a method to insure tax shield/ benefit for the group firms or international firms through

intercompany profit transfer. With this method, if the firms would not make such adjustments it is seen evidently that

the government and accordingly the entire society will be affected in negative manner. As it is specified in the

analysis of the firms included in the scenario the firms being subject to different tax ratios may cause tax losses easily.

In a system where no adequate supervision or accounting expertness is available, it would be easy for the firms to

obtain more profits and have competitive advantage over their rivals. As it may be seen from the example, in the

event of failure to make the adjustment the society will be subject to loss of $8,400.

Regulatory bodies should employ more careful and skilled auditors in order to prevent any problem which may occur

in this subject. The latest IT applications and in particular e-technologies should have more place in the accounting

system. Activities aimed at raising awareness and consciousness of the executors and auditors about transfer pricing

should be promoted. It should be noted that transfer pricing is used as transfer of wealth to abroad, which should be

retained in a country. Therefore, financial transactions related to profit transfers should be controlled. Sharing of the

comparative (arms length) prices by the public at catalogue level shall have reducing effects on transfer pricing

application. Studies should be conducted on this topic. In adjustment of the accounting records, the tax base amount

Published by Sciedu Press

83

ISSN 1927-5986

E-ISSN 1927-5994

www.sciedu.ca/afr

Accounting and Finance Research

Vol. 3, No. 1; 2014

should be corr3ected through using the off balance accounts. In this manner, deductible income element shall occur

for the affiliate, and non-deductible income shall occur for the parent company. With the accounting entrances of

such two elements transfer pricing adjustment transactions would be completed. Then, the applicable documents and

certificates shall be prepared and notified.

References

Abdallah, W. M. (2004. Critical Concerns in Transfer Pricing and Practice, London; Praeger Publishers.

Adams, L. & Drtina, R. (2008). Transfer Pricing for Aligning Divisional and Corporate Decisions, Business Horizons,

51, 411-417. http://dx.doi.org/10.1016/j.bushor.2008.03.008

Alfons, J. W. (2009) Profit Shifting in the EU: Evidence from Germany, International Tax and Public Finance, 16

(3), 281-297. http://dx.doi.org/10.1007/s10797-008-9068-x

Anctil, R. M. & Dutta S. (1999) Negotiated Transfer Pricing and Divisional vs. Firm-Wide Performance Evaluation,

The Accounting Review, 74 (1), 87-104. http://dx.doi.org/10.2308/accr.1999.74.1.87

Baldenius, T., Melumad, N. & Reichelstein S. (2004). Integrating Managerial and Tax Objectives in Transfer Pricing,

The Accounting Review, 79 (3), 591- 615. http://dx.doi.org/10.2308/accr.2004.79.3.591

Borkowski, S. C. (1997). The Transfer Pricing Concerns of and Developing Countries, The International Journal of

Accounting, 32(3), 321-336. http://dx.doi.org/10.1016/S0020-7063(97)90014-5

Burns, J. O. (1980). Transfer-Pricing Decisions in U. S. Multinational Corporations, Journal of International

Business Studies, 10(Fall), 23-39. http://dx.doi.org/10.1057/palgrave.jibs.8490603

Eden, L. (1983) Transfer Pricing Policies under Tariff Barriers, Canadian Journal of Economics, 16(November),

669-685. http://dx.doi.org/10.2307/135047

Chan, K. & Hung - Chow, L.(1997). An Empirical Study of Tax Audits in China on International Transfer Pricing,

Journal of Accounting & Economics, 23, 83-112. http://dx.doi.org/10.1016/S0165-4101(96)00445-4

Clausing, K. A. (2003).Tax-Motivated Transfer Pricing and U.S. Intrafirm Trade Prices, Journal of Public Economics,

87, 2207-2223. http://dx.doi.org/10.1016/S0047-2727(02)00015-4

Cravens, S.K. (1997). Examining The Role Of Transfer Pricing As A Strategy For Multinational Firms, International

Business Review, 6 (2), 127-145. http://dx.doi.org/10.1016/S0969-5931(96)00042-X

Elliott, J. & Emmanuel, C. (2000).International Transfer Pricing: Searching for Patterns, European Management

Journal, 18(2), 216-222. http://dx.doi.org/10.1016/S0263-2373(99)00093-6

Garrison,R & Noreen,E. (2013) Managerial Accounting, McGrew-Hill, USA

Grabski, S. V. (1985). Transfer Pricing in Complex Organisations: A Review and Integration of Recent Empirical and

Analytical Research, Journal of Accounting Literature, 4, 33-75.

Halperin, R. & Srinidhi, B. (1987). The Effects of the U. S. Income Tax Regulations Transfer-Pricing Rules on

Allocative Efficiency, The Accounting Review, 62(October), 668-706.

Hongren C.T., Datar, S. M. & Rajan M. (2011).Cost Accounting A Managerial Emphasis, Printice Hall

Li, D. & Ferreira, M.P. (2008). Internal and external factors on firms transfer pricing decisions: insights from

organization studies, Notas Economicas, Junho, 23-38.

Prusa, T. J. (1990). An Incentive Compatible Approach to the Transfer Pricing Problem, Journal of International

Economics, 28, 155-172. http://dx.doi.org/10.1016/0022-1996(90)90054-P

Samuelson, L. (1982). The multinational firm with arms length transfer price limits. Journal of International

Economics, 13(3-4), 365374. http://dx.doi.org/10.1016/0022-1996(82)90064-2

Smith, M. (2002) Tax and Incentive Trade-Offs in Multinational Transfer Pricing, Journal of Accounting, Auditing &

Finance, 17(3), 209-236.

Tippet, M. & Wright, B. (2006). The Teaching of Transfer Pricing: Theory and Examples, Journal of Accounting

Education, 24, 173-196. http://dx.doi.org/10.1016/j.jaccedu.2006.05.002

International Accounting Standart 36: Impairment of Assets

Wong, H., Nassiripour, S., Mir, R. & Healy, W. (2011). Transfer Price Setting in Multinational Corporations,

International Journal of Business and Social Science, 2(9), 10-14.

Published by Sciedu Press

84

ISSN 1927-5986

E-ISSN 1927-5994

Anda mungkin juga menyukai

- The Pricing Journey: The Organizational Transformation Toward Pricing ExcellenceDari EverandThe Pricing Journey: The Organizational Transformation Toward Pricing ExcellenceBelum ada peringkat

- VodafoneDokumen5 halamanVodafoneSash Dhoni7Belum ada peringkat

- What Is Transfer Pricing PolicyDokumen18 halamanWhat Is Transfer Pricing Policybinnykaur100% (1)

- Transfer Pricing - A Case Study of VodafoneDokumen5 halamanTransfer Pricing - A Case Study of VodafonePavithra GowthamBelum ada peringkat

- Transfer Pricing-A Case Study of Vodafone: ArticleDokumen5 halamanTransfer Pricing-A Case Study of Vodafone: ArticleNeha GuptaBelum ada peringkat

- Expenses Control The Two Kinds of Expenses To ControlDokumen19 halamanExpenses Control The Two Kinds of Expenses To ControlNathanFrancisBelum ada peringkat

- Transfer Pricing Research PaperDokumen7 halamanTransfer Pricing Research Papergvzcrpym100% (1)

- Transfer Pricing-A Case Study of Vodafone: ArticleDokumen5 halamanTransfer Pricing-A Case Study of Vodafone: ArticleRazafinandrasanaBelum ada peringkat

- Transfer Pricing-A Case Study of VodafoneDokumen5 halamanTransfer Pricing-A Case Study of VodafonefiercemynkBelum ada peringkat

- Transfer PricingDokumen13 halamanTransfer PricingRaj Kumar Chakraborty100% (2)

- Transfer Pricing EssayDokumen8 halamanTransfer Pricing EssayFernando Montoro SánchezBelum ada peringkat

- Accounting Practice Subsidiaries Affiliates: What Is Transfer Pricing?Dokumen14 halamanAccounting Practice Subsidiaries Affiliates: What Is Transfer Pricing?Kei CambaBelum ada peringkat

- The Transfer Pricing ProblemDokumen3 halamanThe Transfer Pricing ProblemnisaBelum ada peringkat

- Doupnik ch11Dokumen33 halamanDoupnik ch11Catalina Oriani0% (1)

- Transfer Pricing SruthiDokumen12 halamanTransfer Pricing Sruthisruthi karthiBelum ada peringkat

- Transfer Pricing Allows For The Establishment of Prices For The Goods and Services Corporations, Though Tax Authorities May Contest Their ClaimsDokumen6 halamanTransfer Pricing Allows For The Establishment of Prices For The Goods and Services Corporations, Though Tax Authorities May Contest Their Claimsanetla100% (1)

- Pricing Policy and DecisionsDokumen5 halamanPricing Policy and DecisionsAR ShantoBelum ada peringkat

- Acma TPDokumen11 halamanAcma TPZeedan MomtazBelum ada peringkat

- AsalDokumen2 halamanAsalanetlaBelum ada peringkat

- Transfer Pricing and Sourcing Strategies For Multinational FirmsDokumen15 halamanTransfer Pricing and Sourcing Strategies For Multinational FirmsUppiliappan GopalanBelum ada peringkat

- Transfer Pricing: New Focus in IndiaDokumen9 halamanTransfer Pricing: New Focus in IndiaPareshBhangaleBelum ada peringkat

- ARIF CostingDokumen3 halamanARIF CostingZaheer AmanBelum ada peringkat

- L (Dokumen9 halamanL (Aniket BardeBelum ada peringkat

- MNC Transfer PRDokumen1 halamanMNC Transfer PRPriyanka ChaudhuriBelum ada peringkat

- 8 - TRANSFER PRICING PRACTICES TAXES AND TUNNELING INCENTIVES, IJEBMR - 482 - Anggiat - 3Dokumen8 halaman8 - TRANSFER PRICING PRACTICES TAXES AND TUNNELING INCENTIVES, IJEBMR - 482 - Anggiat - 3raya hasibuanBelum ada peringkat

- International Transfer Pricing and Subsidiary PerformanceThe Role of Organizational JusticeDokumen20 halamanInternational Transfer Pricing and Subsidiary PerformanceThe Role of Organizational JusticeFridRachmanBelum ada peringkat

- SMA Group 5 - Transfer PricingDokumen16 halamanSMA Group 5 - Transfer PricingShreya PatelBelum ada peringkat

- Conclusion Chapter 5 AnalysisDokumen4 halamanConclusion Chapter 5 AnalysisMIGUEL ALVIOLABelum ada peringkat

- (Anurag) Hons 9th Sem ProjectDokumen6 halaman(Anurag) Hons 9th Sem Projectnicky.anurag1008Belum ada peringkat

- Transfer Pricing: Strategies, Practices, and Tax MinimizationDokumen52 halamanTransfer Pricing: Strategies, Practices, and Tax MinimizationHoàng NguyênBelum ada peringkat

- Management Acc Midterm Assignment (Takibul Hasan-18100042)Dokumen30 halamanManagement Acc Midterm Assignment (Takibul Hasan-18100042)Takibul HasanBelum ada peringkat

- Transfer Pricing: Dr. Shakuntala Misra National Rehabilitation University LucknowDokumen14 halamanTransfer Pricing: Dr. Shakuntala Misra National Rehabilitation University LucknowGaurav PandeyBelum ada peringkat

- Transfer PricingDokumen9 halamanTransfer PricingSamuel LagesseBelum ada peringkat

- TransferpricingDokumen24 halamanTransferpricingollieBelum ada peringkat

- BF00565413Dokumen36 halamanBF00565413Gabriel SilvaBelum ada peringkat

- Transfer Pricing: (Document Subtitle)Dokumen11 halamanTransfer Pricing: (Document Subtitle)Amal HameedBelum ada peringkat

- Analysis of Taxes Payment Audit Quality PDFDokumen11 halamanAnalysis of Taxes Payment Audit Quality PDFayuhamiyatiBelum ada peringkat

- Tax-Tp 1Dokumen13 halamanTax-Tp 1tami hwBelum ada peringkat

- A Practical Guide To Transfer Pricing Policy Design and ImplementationDokumen11 halamanA Practical Guide To Transfer Pricing Policy Design and ImplementationQiujun LiBelum ada peringkat

- The Ethics of International Transfer Pricing: Messaoud MehafdiDokumen17 halamanThe Ethics of International Transfer Pricing: Messaoud MehafdiFir BhiBelum ada peringkat

- Multinational Transfer PricingDokumen5 halamanMultinational Transfer Pricingstuddude88Belum ada peringkat

- Transfer PricingDokumen18 halamanTransfer PricingYusra RaoufBelum ada peringkat

- Dissertation Transfer PricingDokumen7 halamanDissertation Transfer PricingHelpMeWithMyPaperAnchorage100% (1)

- 437-Article Text-1345-1-10-20210714Dokumen9 halaman437-Article Text-1345-1-10-20210714Morad Abou AbdillahBelum ada peringkat

- Transfer Pricing 8Dokumen34 halamanTransfer Pricing 8nigam_miniBelum ada peringkat

- Transportation COstDokumen29 halamanTransportation COstShiv SharmaBelum ada peringkat

- Effect of Tax, Tunneling Incentive, Good Corporate Governance, Profitability, and Bonus Mechanism On Transfer PricingDokumen10 halamanEffect of Tax, Tunneling Incentive, Good Corporate Governance, Profitability, and Bonus Mechanism On Transfer PricingAJHSSR JournalBelum ada peringkat

- Operating CostingDokumen7 halamanOperating CostingARCPMBelum ada peringkat

- Transfer Price Concepts in FinanceDokumen8 halamanTransfer Price Concepts in FinanceRohit DaswaniBelum ada peringkat

- Determinants of Transfer Pricing Aggressiveness EmpiricalDokumen15 halamanDeterminants of Transfer Pricing Aggressiveness EmpiricalĐoàn Thái DuyBelum ada peringkat

- Emerging Transfer Pricing Audit Issues in IndiaDokumen7 halamanEmerging Transfer Pricing Audit Issues in IndiajoysamuelBelum ada peringkat

- Acct391 Ep3Dokumen3 halamanAcct391 Ep3arijana.dulovicBelum ada peringkat

- Current Developments in Cost Accounting: Main Content Side ColumnDokumen19 halamanCurrent Developments in Cost Accounting: Main Content Side ColumnSanket PawsheBelum ada peringkat

- 09-0002 Thought Leadership Journal ComDokumen41 halaman09-0002 Thought Leadership Journal Comlittleangel_912Belum ada peringkat

- Process OverviewDokumen4 halamanProcess OverviewMark Jason Crece AnteBelum ada peringkat

- Tax Havens and Transfer Pricing Intensity: Evidence From The French CAC-40 Listed FirmsDokumen13 halamanTax Havens and Transfer Pricing Intensity: Evidence From The French CAC-40 Listed FirmsFazra SalsabilahBelum ada peringkat

- Chapter 7 - PricingDokumen19 halamanChapter 7 - PricingMaria JosefaBelum ada peringkat

- Research Paper On Transfer PricingDokumen4 halamanResearch Paper On Transfer Pricingafmcifezi100% (1)

- Pricing Policy1Dokumen9 halamanPricing Policy1Satish PenumarthiBelum ada peringkat

- Transfer Pricing Eco CfaDokumen17 halamanTransfer Pricing Eco CfaJoseph GrahamBelum ada peringkat

- Chaper 1 & 2Dokumen22 halamanChaper 1 & 2Nisa IstafadBelum ada peringkat

- Compliance Audit Terhadap Standar Operasional Prosedur: Penjualan MobilDokumen16 halamanCompliance Audit Terhadap Standar Operasional Prosedur: Penjualan MobilNisa IstafadBelum ada peringkat

- Jurnal SAM 4Dokumen15 halamanJurnal SAM 4Nisa IstafadBelum ada peringkat

- Impact of Accounting InformationDokumen4 halamanImpact of Accounting InformationNisa IstafadBelum ada peringkat

- Added Value InformationDokumen16 halamanAdded Value InformationNisa IstafadBelum ada peringkat

- Cost Information For Pricing and Product PlanningDokumen44 halamanCost Information For Pricing and Product PlanningNisa IstafadBelum ada peringkat

- Arb PanelDokumen46 halamanArb PanelKarthik VelletiBelum ada peringkat

- SdereDokumen22 halamanSdereshaan_1284Belum ada peringkat

- AT - RA 9298 Red Sirug Page 4Dokumen2 halamanAT - RA 9298 Red Sirug Page 4Paula Mae DacanayBelum ada peringkat

- Account TitlesDokumen4 halamanAccount TitlesErin Jane FerreriaBelum ada peringkat

- Course Catalog: AccountingDokumen5 halamanCourse Catalog: AccountingbhattaramrevanthBelum ada peringkat

- Questions On Shareholders' EquityDokumen36 halamanQuestions On Shareholders' EquityAlloysius ParilBelum ada peringkat

- Management Accounting and Analysis: Name: Rana Vivek SinghDokumen8 halamanManagement Accounting and Analysis: Name: Rana Vivek SinghRana Vivek SinghBelum ada peringkat

- Adeyemi David Kalejaiye CV 02-2010Dokumen2 halamanAdeyemi David Kalejaiye CV 02-2010Princess Bolar KalejaiyeBelum ada peringkat

- Practice Set 2Dokumen4 halamanPractice Set 2Mylene CandidoBelum ada peringkat

- FI Data ExtractionDokumen19 halamanFI Data ExtractionEmanuelPredescu100% (1)

- Midterm Exam - Financial Accounting 3 With AnswersDokumen11 halamanMidterm Exam - Financial Accounting 3 With Answersjanus lopezBelum ada peringkat

- CHAPTER 3 Accounting Cycle (I)Dokumen33 halamanCHAPTER 3 Accounting Cycle (I)Zemene HailuBelum ada peringkat

- Financial Accounting 1 Course OutlineDokumen4 halamanFinancial Accounting 1 Course OutlineFarman AfzalBelum ada peringkat

- June Grade 10 Marking Guideline PDFDokumen7 halamanJune Grade 10 Marking Guideline PDFBasetsana MakuaBelum ada peringkat

- Test Bank Advanced Accounting 10E by Beams Chapter 05Dokumen24 halamanTest Bank Advanced Accounting 10E by Beams Chapter 05Ahmed SuleymanBelum ada peringkat

- Chapter 11 Corporations: Organization, Capital Stock Transactions, and DividendsDokumen12 halamanChapter 11 Corporations: Organization, Capital Stock Transactions, and Dividendsehab_ghazallaBelum ada peringkat

- UntitledDokumen16 halamanUntitledSindhura PuppalaBelum ada peringkat

- Pie in The SkyDokumen15 halamanPie in The SkyDevesh AgarwalBelum ada peringkat

- Presentation 3Dokumen7 halamanPresentation 3shashank kumarBelum ada peringkat

- Ali Asghar Textile Mills LTD: Ratios: TotalDokumen7 halamanAli Asghar Textile Mills LTD: Ratios: TotalakhlaqjatoiBelum ada peringkat

- The Mpassbook Statement Is Generated For Selected Date Range Between 01-01-2019 TO 01-01-2020. Customer DetailsDokumen4 halamanThe Mpassbook Statement Is Generated For Selected Date Range Between 01-01-2019 TO 01-01-2020. Customer Detailsarj1986Belum ada peringkat

- TSB CFAP 6 Mock 1 - April 27 2019Dokumen3 halamanTSB CFAP 6 Mock 1 - April 27 2019KAMRAN BAIG0% (1)

- 18 IFAS MOU Between IHQ and Territories v15Dokumen28 halaman18 IFAS MOU Between IHQ and Territories v15Arsénio Leonardo Mata100% (1)

- Accounting Principles and ConceptsDokumen31 halamanAccounting Principles and ConceptskunyangBelum ada peringkat

- Basic Accounting Quizbowl QuestionsDokumen3 halamanBasic Accounting Quizbowl QuestionsMelu100% (2)

- Journal & LedgerDokumen36 halamanJournal & Ledgerapi-373125733% (3)

- AUIDT Analysis Auidt Report Form Indonesia and American in Term of Audit StructureDokumen3 halamanAUIDT Analysis Auidt Report Form Indonesia and American in Term of Audit StructureAzlanBelum ada peringkat

- Chapter 4 Adjusting EntriesDokumen43 halamanChapter 4 Adjusting EntriesCamille Gene Solidum100% (1)

- Modern Auditing 7th EditionDokumen15 halamanModern Auditing 7th Editionastoeti_sriBelum ada peringkat

- Oil Gas Accounting Performance MeasurementDokumen5 halamanOil Gas Accounting Performance MeasurementWassef MBBelum ada peringkat

- Summary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsDari EverandSummary of The New Menopause by Mary Claire Haver MD: Navigating Your Path Through Hormonal Change with Purpose, Power, and FactsBelum ada peringkat

- Summary of 12 Rules for Life: An Antidote to ChaosDari EverandSummary of 12 Rules for Life: An Antidote to ChaosPenilaian: 4.5 dari 5 bintang4.5/5 (295)

- Summary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesDari EverandSummary: Atomic Habits by James Clear: An Easy & Proven Way to Build Good Habits & Break Bad OnesPenilaian: 5 dari 5 bintang5/5 (1636)

- The Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessDari EverandThe Compound Effect by Darren Hardy - Book Summary: Jumpstart Your Income, Your Life, Your SuccessPenilaian: 5 dari 5 bintang5/5 (456)

- How To Win Friends and Influence People by Dale Carnegie - Book SummaryDari EverandHow To Win Friends and Influence People by Dale Carnegie - Book SummaryPenilaian: 5 dari 5 bintang5/5 (557)

- Summary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityDari EverandSummary of The Algebra of Wealth by Scott Galloway: A Simple Formula for Financial SecurityBelum ada peringkat

- The Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaDari EverandThe Body Keeps the Score by Bessel Van der Kolk, M.D. - Book Summary: Brain, Mind, and Body in the Healing of TraumaPenilaian: 4.5 dari 5 bintang4.5/5 (267)

- Can't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsDari EverandCan't Hurt Me by David Goggins - Book Summary: Master Your Mind and Defy the OddsPenilaian: 4.5 dari 5 bintang4.5/5 (386)

- Summary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessDari EverandSummary of The Anxious Generation by Jonathan Haidt: How the Great Rewiring of Childhood Is Causing an Epidemic of Mental IllnessBelum ada peringkat

- The One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsDari EverandThe One Thing: The Surprisingly Simple Truth Behind Extraordinary ResultsPenilaian: 4.5 dari 5 bintang4.5/5 (709)

- Chaos: Charles Manson, the CIA, and the Secret History of the Sixties by Tom O'Neill: Conversation StartersDari EverandChaos: Charles Manson, the CIA, and the Secret History of the Sixties by Tom O'Neill: Conversation StartersPenilaian: 2.5 dari 5 bintang2.5/5 (3)

- Extreme Ownership by Jocko Willink and Leif Babin - Book Summary: How U.S. Navy SEALS Lead And WinDari EverandExtreme Ownership by Jocko Willink and Leif Babin - Book Summary: How U.S. Navy SEALS Lead And WinPenilaian: 4.5 dari 5 bintang4.5/5 (75)

- Summary of Atomic Habits by James ClearDari EverandSummary of Atomic Habits by James ClearPenilaian: 5 dari 5 bintang5/5 (170)

- The War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesDari EverandThe War of Art by Steven Pressfield - Book Summary: Break Through The Blocks And Win Your Inner Creative BattlesPenilaian: 4.5 dari 5 bintang4.5/5 (275)

- Summary of The Algebra of Wealth: A Simple Formula for Financial SecurityDari EverandSummary of The Algebra of Wealth: A Simple Formula for Financial SecurityPenilaian: 4 dari 5 bintang4/5 (1)

- Book Summary of The Subtle Art of Not Giving a F*ck by Mark MansonDari EverandBook Summary of The Subtle Art of Not Giving a F*ck by Mark MansonPenilaian: 4.5 dari 5 bintang4.5/5 (577)

- Steal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativeDari EverandSteal Like an Artist by Austin Kleon - Book Summary: 10 Things Nobody Told You About Being CreativePenilaian: 4.5 dari 5 bintang4.5/5 (128)

- The Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindDari EverandThe Whole-Brain Child by Daniel J. Siegel, M.D., and Tina Payne Bryson, PhD. - Book Summary: 12 Revolutionary Strategies to Nurture Your Child’s Developing MindPenilaian: 4.5 dari 5 bintang4.5/5 (57)

- Summary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursDari EverandSummary of Million Dollar Weekend by Noah Kagan and Tahl Raz: The Surprisingly Simple Way to Launch a 7-Figure Business in 48 HoursBelum ada peringkat

- Summary of Eat to Beat Disease by Dr. William LiDari EverandSummary of Eat to Beat Disease by Dr. William LiPenilaian: 5 dari 5 bintang5/5 (52)

- Summary of The Compound Effect by Darren HardyDari EverandSummary of The Compound Effect by Darren HardyPenilaian: 4.5 dari 5 bintang4.5/5 (71)

- Summary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönDari EverandSummary of When Things Fall Apart: Heart Advice for Difficult Times by Pema ChödrönPenilaian: 4.5 dari 5 bintang4.5/5 (22)

- The Man Who Solved the Market: How Jim Simons Launched the Quant Revolution by Gregory Zuckerman: Conversation StartersDari EverandThe Man Who Solved the Market: How Jim Simons Launched the Quant Revolution by Gregory Zuckerman: Conversation StartersPenilaian: 1.5 dari 5 bintang1.5/5 (2)

- Mindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessDari EverandMindset by Carol S. Dweck - Book Summary: The New Psychology of SuccessPenilaian: 4.5 dari 5 bintang4.5/5 (328)

- Good to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tDari EverandGood to Great by Jim Collins - Book Summary: Why Some Companies Make the Leap...And Others Don'tPenilaian: 4.5 dari 5 bintang4.5/5 (64)

- Make It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningDari EverandMake It Stick by Peter C. Brown, Henry L. Roediger III, Mark A. McDaniel - Book Summary: The Science of Successful LearningPenilaian: 4.5 dari 5 bintang4.5/5 (55)

- The Effective Executive by Peter Drucker - Book Summary: The Definitive Guide to Getting the Right Things DoneDari EverandThe Effective Executive by Peter Drucker - Book Summary: The Definitive Guide to Getting the Right Things DonePenilaian: 4.5 dari 5 bintang4.5/5 (19)

- Psycho-Cybernetics by Maxwell Maltz - Book SummaryDari EverandPsycho-Cybernetics by Maxwell Maltz - Book SummaryPenilaian: 4.5 dari 5 bintang4.5/5 (91)