EVA As A Value Based Management Tool A Case Study of Selected Indian It Companies

Diunggah oleh

archerselevatorsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

EVA As A Value Based Management Tool A Case Study of Selected Indian It Companies

Diunggah oleh

archerselevatorsHak Cipta:

Format Tersedia

International Journal of Exclusive Global Research - Vol I Issue 6 June

EVA as A Value-Based Management Tool A Case Study of Selected Indian It

Companies

* Sunil Kumar Reddy

** Kiran Kumar K V

* Student PGDM, International School of Management Excellence (ISME),

88, Chembanahalli, Near Dommasandra Circle, Sarjapur Road, Bangalore 562125

** Associate Professor - Finance and Research Scholar,

International School of Management Excellence (ISME), 88, Chembanahalli,

Near Dommasandra Circle, Sarjapur Road, Bangalore 562125

Abstract

Of late business objectives are being measured in terms of value generated to investors,

over and above their investment. Such transition from profit perspective to value

perspective is largely benefitted by Economic Value Added (EVA) that, in a simple fashion,,

gives the true performance of the firm in generating operating profit over and above the

investors required rate of return. The objective of our study was to measure the EVA

generated by selected top IT companies of India and conduct a peer-to-peer comparison.

The study revealed that TCS, Infosys and Wipro have generated the highest EVA.

Incidentally, these were also the top three firms in the industry in terms of their market

capitalisation. To nullify the size factor and determine the real performance of the said

companies, we computed the EVA to capital employed ratio and found that TCS, Tata

Elxsi and Oracle have generated the highest value add per rupee of capital employed.

Keywords: EVA, Indian IT Sector

JEL Code: G30, G31

Introduction

Economic value added is a concept to measure the performance of a firms management in

creating value for the shareholders. Economic value added (EVA) is a theory developed by

Stern Steward and Co. According to the model of EVA, a companies should also deduct

the cost of equity capital from the accounting profit to arrive at a value which is the actual

wealth created for the investors.

It can be defined as a measure of performance of a company which focus more on wealth

creation for the shareholders rather than just the accounting profit. For finding real profit

which a firm has earned, all the cost are deducted from the revenue made and similarly

the cost of using capital should also be deducted whether it is a debt or equity. An

accountant explicitly deducts the cost of debt i.e. interest from the revenue but does not

consider cost of equity. So, positive accounting profit does not mean wealth / value

creation but positive EVA would mean that the management of the company has done well

and has created wealth for their shareholders.

In comparison to the net profit calculated in normal accounting, EVA figure are more

meaningful. An investor can easily understand by looking at the EVA whether he has

earned more than his opportunity cost of capital or not and conclude about his

investment decision. A positive EVA means that the management has worked towards

maximizing the shareholders wealth.

EVA is computed using the below formula:

EVA = NOPAT (CAPITAL * WACC)

Net operating profit after tax (NOPAT) is profits derived from a companys operations

after cash taxes but before financing cost and computed as NOPAT = EBIT (1 t)

www.aeph.in

Page 1 of 6

International Journal of Exclusive Global Research - Vol I Issue 6 June

t refers to effective tax rate which is computed as t = (tax expense / EBT)

CAPITAL refers to total long-term capital employed by the firm that includes long term

debt and shareholders funds.

WACC is computed by multiplying proportions of equity and debt with their respective

costs. After-tax cost of debt (kd) is computed by: kd = (Finance cost/ Long term debt) (1

t); Cost of equity (Ke) is computed using Capital Assets Pricing Model (CAPM) and is given

by ke = rf + (rm rf), where, rf is the risk free rate, which is taken as on the 20th January

2016, 364 days T bills i.e. 7.27%; is the sensitivity of stock to the market with respect

to the company; rm is market return, taken as the 5-Year average annual return of CNX

NIFTY Index preceding 20th January 2016, i.e., 5.49%.

Literature Review

Vijayakumar (Vijayakumar, 2011) attempted to test if EVA could be used as a predictive

tool of the performance of Indian Automobile companies and found that sales and EAT

were strongly related to EVA. Kiran Kumar (Kumar, 2015)computed different ratios using

EVA as a variable and attempted to study the performance of Indian FMCG companies. He

found that companies like UBL, Tata Global Beverages and Godrej Industries have eroded

value in the study period. Raiyani and Joshi (Raiyani & Joshi, 2011)studied the

correlation between the investment in stakeholder relationships and corporate

performance using EVA. They found that Indian banks have destroyed wealth of

shareholders over the years excluding a few.

Objectives

The broad objective of this study is to analyse the effectiveness of using EVA as a measure

of shareholder wealth. In this context specific objectives of study are as below:

To determine the EVA generated by selected Indian IT companies.

To appraise the financial performance of selected Indian IT companies on a value

based framework.

To evaluate superiority of absolute-EVA numbers for comparing firms, over EVA based

ratios

Research Methodology

To achieve above objectives the following methodology of research is followed:

Research Type - This will be descriptive study and as it uses financially data extensively,

this also can categorise as analytical study.

Sample - The sample size is 10 Indian IT companies selected based on the market

capitalisation. Hence sample is selected using judgemental sampling. The sample data is

collected through official sources (www.nseindia.in, www.rbi.org, published annual report

of selected companies). The list of companies selected is given in the below table (Table-1):

www.aeph.in

Page 2 of 6

International Journal of Exclusive Global Research - Vol I Issue 6 June

Table-1

Sl.No

Company

Market Capitalisation

TCS

449543.28

Infosys

254800.07

Wipro

132430.33

HCL

114458.37

Tech Mahindra

45522.37

Oracle

30656.45

Mindtree

12811.73

Mphasis

9319

Hexaware

7397.34

10

Tata Elxsi

6582.93

Data Analysis - For the purpose of computation EVA below data are collected:

Historical share price

EBT

Risk free rate

Long term debt

EBIT

Financial cost

Tax expenses

Shareholders funds

Using above data we computed

Capital employed

Interest rate(Kd) computed as (Financial cost / Long term debt)

Effective tax rate (t) computed as (Tax expense/ EAT)

NOPAT computed as EBIT (1 t)

Cost of equity using CAPM computed as rm + (rf rm)

Period of Study - This study is cross-sectional in nature, hence all financial data used for

this purpose pertain to financial year end 31st March 2015, across selected Indian IT

companies.

Data Analysis, Results and Interpretation

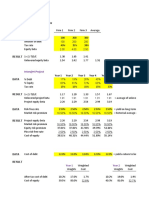

The data collected for respective companies are presented in table presented below (Table2):

Table-2

Company

EBIT

Tax

Expenses

TCS

Infosys

Wipro

HCL

Tech Mahindra

Oracle

Mindtree

MphasiS

Hexaware

Tata Elxsi

26402.68

16798

11520.9

9208.29

3,648

1830.8

690.9

962.4

418.12

155.1225

6238.79

4911

2510.1

1815.11

959.5

638.5

154.5

263.04

97.97

53.1

EBT

26298

16798

11171

9117.1

3,618

1830.8

690.8

934.5

418.12

155.12

www.aeph.in

LongTerm

Debt

939.29

0

1645.3

993.1

500.1

0

0

420.1

418.12

0

Financial Shareholders

Cost

Funds

104.19

0

349.9

91.23

29.9

0

0.1

27.9

0

0

50634.76

48068

37,092

24,224.4

12248.6

3444.1

2012.4

5479.7

1209.5

283.43

Page 3 of 6

International Journal of Exclusive Global Research - Vol I Issue 6 June

The computation of tax rate, interest rate, capital employed and NOPAT are presented in

below table (Table-3):

Table-3

Company

Capital Employed Interest Rate Effective Tax Rate NOPAT

TCS

51574.05

11.09%

23.72%

20139.17

Infosys

50736

0.00%

29.24%

11887.00

Wipro

38737.30

21.27%

22.47%

8932.18

HCL

25217.49

9.19%

19.91%

7375.02

Tech Mahindra

12748.70

5.98%

26.52%

2680.57

Oracle

3444.07

0

34.88%

1192.30

Mindtree

2012.40

0

22.37%

536.38

MphasiS

5899.80

6.64%

28.15%

691.51

Hexaware

1627.62

0

23.43%

320.15

Tata Elxsi

283.43

0

34.23%

102.02

The computation of cost of capital is presented the below table (Table-4):

Table-4

Company

TCS

Infosys

Wipro

HCL

Tech Mahindra

Oracle

Mindtree

Mphasis

Hexaware

Tata Elxsi

Cost of

capital

6.9%

5.7%

7.1%

6.2%

5.2%

7.8%

7.2%

7.1%

7.2%

8.5%

The computation of EVA is presented in table below (Table-5):

Table-5

Company

EVA

TCS

16580.56

Infosys

8995.05

Wipro

6181.62

HCL

5811.53

Tech Mahindra 2017.64

Oracle

923.66

Mindtree

391.48

Mphasis

272.62

Hexaware

202.96

Tata Elxsi

77.93

www.aeph.in

Page 4 of 6

International Journal of Exclusive Global Research - Vol I Issue 6 June

As we can observe from above table all the selected IT companies in India have generated

positive EVA to its owners. Going by absolute numbers we can say that TCS has added the

highest Economic value followed by Infosys and Wipro. These are mainly concentric

because of their higher operating efficiency (As represented by their EBIT). All these three

companies have low debt which may also have contributed to higher EVA. It must be

noted here that as per MM2 proposition the unlevered capital structure of firm will bring

down the perceived risk of investing by the equity shareholders. Therefore, cost of equity

which is a function of (As per CAPM approach) will also come down. Hence, cost of

capital will also come down.

EVA to Capital Employed Ratio Analysis

Even though EVA is a convincing approach to analyse the company performance, while

comparing among peers it become challenge as EVA give absolute rupee value added. This

in turn is ignoring parameters like size of company. To overcome this limitation, we have

computed EVA to Capital Employed Ratio by dividing the EVA by the capital employed by

the firm. Such ratio will create common size parameter enabling us to compare firms of

different size. For our sample companies the same is computed and presented in the

below table (Table-6):

Table-6

Company

EVA to Capital Employed Ratio

TCS

32%

Infosys

18%

Wipro

16%

HCL Tech

23%

Tech Mahindra

16%

Oracle

27%

Mindtree

20%

MphasiS

5%

Hexaware Tech

12%

Tata Elxsi

27%

As we can see from above table TCS is still the best performing company in the terms of

EVA addition followed by Tata Elxsi and Oracle. What this means is for instance, Tata

Elxsi has generated 27% of capital invested by the shareholders as the value addition.

Thus, we can conclude that instead of using pure EVA as performance measure may be

useful to develop ratios based on EVA. This also gives as clear cut picture than traditional

profit based ratios like ROCE as demonstrated in the below table (Table-7) including the

rankings:

www.aeph.in

Page 5 of 6

International Journal of Exclusive Global Research - Vol I Issue 6 June

Company

EVA/Capital ROCE Rank based on EVA/Capital

Rank based

on

ROCE

TCS

32%

38%

Infosys

18%

24%

Wipro

16%

22%

HCL Tech

23%

29%

Tech Mahindra

16%

21%

Oracle

27%

35%

Mindtree

19%

27%

MphasiS

5%

11%

10

10

Hexaware

12%

20%

Tata Elxsi

27%

36%

Conclusion

Companies like Infosys ensure to report EVA in their annual report consistently, that

shows that EVA is not just a theoretical framework; rather, its a structure which can be

practically adopted. The crux of the same lies in the companys belief in value-based

management. Our study shown that EVA is a constructive tool that can be used as a

target-setting, strategy-formulating and performance evaluating instrument, which in its

entirety delivers an enhancement in the firms intrinsic worth.

Our study showed that IT companies overall have been successful in generating positive

EVA, especially, TCS, Infosys, Wipro and HCL have been generating higher EVAs in

absolute numbers. As we also wanted to test a comparative EVA performance, we

analysed the selected companies using EVA to Capital Employed Ratio and found that

TCS, Tata Elxsi and Oracle are the top 3 firms returning maximum value per rupee of

investment.

Works Cited

1. Chandra, P. (2014). Strategic Financial Management. McGraw Hill.

2. Kumar, K. K. (2015). Are Indian FMCG Companies adding Economic Value to its

Owners? A Case Study using EVA-based Ratios. The Management Accountant.

3. Raiyani, J. R., & Joshi, N. K. (2011). EVA Based Performance Measurement: A Case

Study of SBI and HDFC Bank. Management Insight: SMS Varanasi.

4. Vijayakumar, A. (2011). Economic Value Added (EVA) and Shareholders Wealth

Creation: A Factor Analytic Approach. Research Journal of Finance and Accounting.

www.aeph.in

Page 6 of 6

Anda mungkin juga menyukai

- Introduction To Finance: Financial PlanningDokumen38 halamanIntroduction To Finance: Financial PlanningZenedel De JesusBelum ada peringkat

- Critical Financial Review: Understanding Corporate Financial InformationDari EverandCritical Financial Review: Understanding Corporate Financial InformationBelum ada peringkat

- Pablo Fernandez WACCDokumen8 halamanPablo Fernandez WACCDaniel ŠtekovićBelum ada peringkat

- Credit Risk: Pricing, Measurement, and ManagementDari EverandCredit Risk: Pricing, Measurement, and ManagementPenilaian: 1 dari 5 bintang1/5 (2)

- Accounting for Derivatives: Advanced Hedging under IFRS 9Dari EverandAccounting for Derivatives: Advanced Hedging under IFRS 9Penilaian: 5 dari 5 bintang5/5 (1)

- Repuestas Cap 1 Investments 2010 Bodie, Kane, MarcusDokumen6 halamanRepuestas Cap 1 Investments 2010 Bodie, Kane, MarcusElkin CalderonBelum ada peringkat

- Solution Manual Fundamentals of Investments 3rd Edition by Gordon J. Alexander SLP1137Dokumen10 halamanSolution Manual Fundamentals of Investments 3rd Edition by Gordon J. Alexander SLP1137Thar Adelei50% (2)

- Merger Case AnalysisDokumen71 halamanMerger Case Analysissrizvi2000Belum ada peringkat

- Arcelor and Mittal Merger - Priyanshi and NidhiDokumen23 halamanArcelor and Mittal Merger - Priyanshi and Nidhipriyanshi gandhiBelum ada peringkat

- Bank Risk Management Is Used Mostly in The FinancialDokumen9 halamanBank Risk Management Is Used Mostly in The FinancialYash PratapBelum ada peringkat

- Adjusted Present ValueDokumen30 halamanAdjusted Present ValueBhuvnesh PrakashBelum ada peringkat

- CFA Level II: EquityDokumen185 halamanCFA Level II: EquityCrayonBelum ada peringkat

- Anuary 2008 Société Générale Trading Loss IncidentDokumen7 halamanAnuary 2008 Société Générale Trading Loss IncidentgabikubatBelum ada peringkat

- Diageo Was Conglomerate Involved in Food and Beverage Industry in 1997Dokumen6 halamanDiageo Was Conglomerate Involved in Food and Beverage Industry in 1997Prashant BezBelum ada peringkat

- Financial Risk ManagementDokumen18 halamanFinancial Risk Managementdwimukh360Belum ada peringkat

- DCF Analysis PDFDokumen11 halamanDCF Analysis PDFanandbajaj0Belum ada peringkat

- Ch15 SolnsDokumen3 halamanCh15 SolnskerenkangBelum ada peringkat

- RBC Equity Research Imperial PDFDokumen11 halamanRBC Equity Research Imperial PDFHong Ee GohBelum ada peringkat

- Sears Vs Walmart - ExcelDokumen11 halamanSears Vs Walmart - ExcelTamas OberoiBelum ada peringkat

- FCFF Vs FCFE Reconciliation TemplateDokumen2 halamanFCFF Vs FCFE Reconciliation TemplateLalit KheskwaniBelum ada peringkat

- Course Outline 2017Dokumen5 halamanCourse Outline 2017agrawalrishiBelum ada peringkat

- Question and Answer - 44Dokumen30 halamanQuestion and Answer - 44acc-expertBelum ada peringkat

- Caso Glen Mount Furniture CompanyDokumen56 halamanCaso Glen Mount Furniture CompanyJanetCruces100% (2)

- Introduction To Management AccountingDokumen30 halamanIntroduction To Management Accountingkoyelg_2Belum ada peringkat

- Value Added Metrics: A Group 3 PresentationDokumen43 halamanValue Added Metrics: A Group 3 PresentationJeson MalinaoBelum ada peringkat

- Marden Company Group 4Dokumen2 halamanMarden Company Group 4Pulkit Puri100% (1)

- Chapter 18: Valuation and Capital Budgeting For The Levered Firm Questions and Problems: 18.1aDokumen23 halamanChapter 18: Valuation and Capital Budgeting For The Levered Firm Questions and Problems: 18.1aEhsan MohitiBelum ada peringkat

- Integrative Case 10 1 Projected Financial Statements For StarbucDokumen2 halamanIntegrative Case 10 1 Projected Financial Statements For StarbucAmit PandeyBelum ada peringkat

- Mid MonthDokumen4 halamanMid Monthcipollini50% (2)

- Comparable Companies: Inter@rt ProjectDokumen9 halamanComparable Companies: Inter@rt ProjectVincenzo AlterioBelum ada peringkat

- Capital StructureDokumen59 halamanCapital StructureRajendra MeenaBelum ada peringkat

- Robert Simons - Performance Measurement and Control Systems For Implementing Strategy (1) - 540-547Dokumen8 halamanRobert Simons - Performance Measurement and Control Systems For Implementing Strategy (1) - 540-547Mila AgaBelum ada peringkat

- Método de Ratios Financiero Aplicado en Empresas Peruanas ListadasDokumen31 halamanMétodo de Ratios Financiero Aplicado en Empresas Peruanas ListadasPatrick Moreno100% (1)

- Facebook IPO caseHBRDokumen29 halamanFacebook IPO caseHBRCrazy Imaginations100% (1)

- Level II - Equity: Free Cash Flow ValuationDokumen52 halamanLevel II - Equity: Free Cash Flow ValuationjawadatatungBelum ada peringkat

- Super Project Case SolutionDokumen3 halamanSuper Project Case SolutionasaqBelum ada peringkat

- Reading 31 Slides - Private Company ValuationDokumen57 halamanReading 31 Slides - Private Company ValuationtamannaakterBelum ada peringkat

- Floating Rate Note Pricing V3Dokumen9 halamanFloating Rate Note Pricing V3QuantmetrixBelum ada peringkat

- Datar MathewsDokumen12 halamanDatar MathewsLukito Adi NugrohoBelum ada peringkat

- ReportDokumen8 halamanReportZain AliBelum ada peringkat

- CH - 4 - Time Value of MoneyDokumen49 halamanCH - 4 - Time Value of Moneyak sBelum ada peringkat

- Cash Flow Estimation: Given DataDokumen4 halamanCash Flow Estimation: Given DataMd. Din Islam Asif100% (2)

- The Adjusted Present Value Approach (APV)Dokumen3 halamanThe Adjusted Present Value Approach (APV)P Karan JainBelum ada peringkat

- Columbia (David M. Levine, David F. StephanDokumen34 halamanColumbia (David M. Levine, David F. StephanBetty Leon SolanoBelum ada peringkat

- Operating ExposureDokumen31 halamanOperating ExposureMai LiênBelum ada peringkat

- One Page M&A Simple Model Improved BlankDokumen21 halamanOne Page M&A Simple Model Improved BlankAllen FengBelum ada peringkat

- Solución Caso 1Dokumen2 halamanSolución Caso 1Fabiola Escobar Olmedo100% (1)

- CFI Interview QuestionsDokumen5 halamanCFI Interview QuestionsSagar KansalBelum ada peringkat

- Machine Learning Methodologies To Manage Food Waste and Their Current and Future Approaches: A Uetians PerspectiveDokumen16 halamanMachine Learning Methodologies To Manage Food Waste and Their Current and Future Approaches: A Uetians PerspectivetHe tecHniquEsBelum ada peringkat

- 4 - Ejercicios de EjemploDokumen2 halaman4 - Ejercicios de EjemploLuis DiazBelum ada peringkat

- FRM Lecture2Dokumen117 halamanFRM Lecture2Dang Thi Tam AnhBelum ada peringkat

- Investment Banking Valuation - Equity Value - and Enterprise ValueDokumen18 halamanInvestment Banking Valuation - Equity Value - and Enterprise ValuejyguygBelum ada peringkat

- A Note On Valuation in Entrepreneurial SettingsDokumen4 halamanA Note On Valuation in Entrepreneurial SettingsUsmanBelum ada peringkat

- Group 2 - Business Model Innovation at TutorVistaDokumen24 halamanGroup 2 - Business Model Innovation at TutorVistaAli Hasyimi100% (1)

- Debt Policy at Ust Inc Case AnalysisDokumen23 halamanDebt Policy at Ust Inc Case AnalysisLouie Ram50% (2)

- 02.using Bloomberg Terminals in A Security Analysis and Portfolio Management CourseDokumen7 halaman02.using Bloomberg Terminals in A Security Analysis and Portfolio Management Coursendmmdmsmms,s100% (1)

- Free Cash Flow Valuation: Wacc FCFF VDokumen6 halamanFree Cash Flow Valuation: Wacc FCFF VRam IyerBelum ada peringkat

- Capital BudgetingDokumen3 halamanCapital BudgetingMikz PolzzBelum ada peringkat

- Chapter 4 Audit Evidence Documentation Compatibility ModeDokumen33 halamanChapter 4 Audit Evidence Documentation Compatibility ModeAnh PhamBelum ada peringkat

- Different Approaches in Pharmacological ResearchDokumen3 halamanDifferent Approaches in Pharmacological ResearcharcherselevatorsBelum ada peringkat

- Comparative Evaluation of Ethyl Acetate, Hexane and MethanolDokumen6 halamanComparative Evaluation of Ethyl Acetate, Hexane and MethanolarcherselevatorsBelum ada peringkat

- Oil of Lavandula Angustifolia On Amyloid Beta PolymerizationDokumen7 halamanOil of Lavandula Angustifolia On Amyloid Beta PolymerizationarcherselevatorsBelum ada peringkat

- Impact of GST On Small and Medium EnterprisesDokumen5 halamanImpact of GST On Small and Medium Enterprisesarcherselevators0% (2)

- International Journal of Exclusive Global Research - Vol 3 Issue 3 MarchDokumen17 halamanInternational Journal of Exclusive Global Research - Vol 3 Issue 3 MarcharcherselevatorsBelum ada peringkat

- Implication of Demonetization On Indian EconomyDokumen4 halamanImplication of Demonetization On Indian EconomyarcherselevatorsBelum ada peringkat

- Input Tax Credit Under GST in India An OverviewDokumen8 halamanInput Tax Credit Under GST in India An OverviewarcherselevatorsBelum ada peringkat

- Financial Inclusion A Gateway To Reduce Corruption Through Direct Benefit Transfer (DBT)Dokumen7 halamanFinancial Inclusion A Gateway To Reduce Corruption Through Direct Benefit Transfer (DBT)archerselevatorsBelum ada peringkat

- Managing Municipal Solid Waste Some SuggestionsDokumen2 halamanManaging Municipal Solid Waste Some SuggestionsarcherselevatorsBelum ada peringkat

- Post Impact of Demonetization On Retail Sector A Case Study On Retail Outlets at Malur Town of Kolar DistrictDokumen3 halamanPost Impact of Demonetization On Retail Sector A Case Study On Retail Outlets at Malur Town of Kolar DistrictarcherselevatorsBelum ada peringkat

- Demonetization 2016 Impact On Indian EconomyDokumen9 halamanDemonetization 2016 Impact On Indian EconomyarcherselevatorsBelum ada peringkat

- Demonetization-A Boon or BaneDokumen6 halamanDemonetization-A Boon or BanearcherselevatorsBelum ada peringkat

- Living Conditions in Slums A Case Study in Bangalore CityDokumen3 halamanLiving Conditions in Slums A Case Study in Bangalore CityarcherselevatorsBelum ada peringkat

- Role of NSS in Cleanliness With Special Reference To Dakshina KannadaDokumen4 halamanRole of NSS in Cleanliness With Special Reference To Dakshina KannadaarcherselevatorsBelum ada peringkat

- Role of National Service Scheme and Educational Institutions in Sanitation and Cleaning Within in Kolar DistrictDokumen2 halamanRole of National Service Scheme and Educational Institutions in Sanitation and Cleaning Within in Kolar Districtarcherselevators100% (1)

- A Study On Swachh Bharat Abhiyan and Management LessonsDokumen2 halamanA Study On Swachh Bharat Abhiyan and Management LessonsarcherselevatorsBelum ada peringkat

- Eradication of Manual Scavenging Policy and PerspectiveDokumen1 halamanEradication of Manual Scavenging Policy and PerspectivearcherselevatorsBelum ada peringkat

- Role of National Service Scheme in Rural DevelopmentDokumen5 halamanRole of National Service Scheme in Rural Developmentarcherselevators50% (2)

- Swachh Bharat Abhiyan and The MediaDokumen4 halamanSwachh Bharat Abhiyan and The MediaarcherselevatorsBelum ada peringkat

- Swachhatha Related To Children and Their EnvironmentDokumen3 halamanSwachhatha Related To Children and Their EnvironmentarcherselevatorsBelum ada peringkat

- Sanitation and Its Impact On HealthDokumen4 halamanSanitation and Its Impact On HealtharcherselevatorsBelum ada peringkat

- Sanitation and HealthDokumen5 halamanSanitation and HealtharcherselevatorsBelum ada peringkat

- Watershed Approach For Rainwater ManagementDokumen8 halamanWatershed Approach For Rainwater ManagementarcherselevatorsBelum ada peringkat

- Impact of Swachh Bharat in IndiaDokumen2 halamanImpact of Swachh Bharat in IndiaarcherselevatorsBelum ada peringkat

- ECONOMÍA UNIT 5 NDokumen6 halamanECONOMÍA UNIT 5 NANDREA SERRANO GARCÍABelum ada peringkat

- Climate Model Research ReportDokumen13 halamanClimate Model Research Reportapi-574593359Belum ada peringkat

- GCTADokumen5 halamanGCTAPatty CabañaBelum ada peringkat

- HIMYM Episode 4 Season 1Dokumen29 halamanHIMYM Episode 4 Season 1ZayBelum ada peringkat

- Supplier Claim Flow ChecklistDokumen1 halamanSupplier Claim Flow ChecklistChris GloverBelum ada peringkat

- TS4F01-1 Unit 3 - Master DataDokumen59 halamanTS4F01-1 Unit 3 - Master DataLuki1233332100% (1)

- Travel Insurance CertificateDokumen9 halamanTravel Insurance CertificateMillat PhotoBelum ada peringkat

- People V GGGDokumen7 halamanPeople V GGGRodney AtibulaBelum ada peringkat

- Risk AssessmentDokumen11 halamanRisk AssessmentRutha KidaneBelum ada peringkat

- Why Some Platforms Thrive and Others Don'tDokumen11 halamanWhy Some Platforms Thrive and Others Don'tmahipal singhBelum ada peringkat

- Rizal ParaniDokumen201 halamanRizal ParaniMuhammadd YaqoobBelum ada peringkat

- Proposal Teen Age PregnancyDokumen2 halamanProposal Teen Age Pregnancymountain girlBelum ada peringkat

- 3 Longman Academic Writing Series 4th Edition Answer KeyDokumen21 halaman3 Longman Academic Writing Series 4th Edition Answer KeyZheer KurdishBelum ada peringkat

- Sample TRF For Master TeacherDokumen10 halamanSample TRF For Master TeacherBernard TerrayoBelum ada peringkat

- Case Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFDokumen7 halamanCase Study - Royal Bank of Canada, 2013 - Suitable For Solution Using Internal Factor Evaluation Analyis PDFFaizan SiddiqueBelum ada peringkat

- Mangalore Electricity Supply Company Limited: LT-4 IP Set InstallationsDokumen15 halamanMangalore Electricity Supply Company Limited: LT-4 IP Set InstallationsSachin KumarBelum ada peringkat

- CPFContributionRatesTable 1jan2022Dokumen5 halamanCPFContributionRatesTable 1jan2022ysam90Belum ada peringkat

- Dua AdzkarDokumen5 halamanDua AdzkarIrHam 45roriBelum ada peringkat

- Development of Modern International Law and India R.P.anandDokumen77 halamanDevelopment of Modern International Law and India R.P.anandVeeramani ManiBelum ada peringkat

- A Midsummer's Night Dream Script (FULL)Dokumen74 halamanA Midsummer's Night Dream Script (FULL)prahuljoseBelum ada peringkat

- 23-12-22 National ConferenceDokumen4 halaman23-12-22 National ConferenceNIKITA CHAUHANBelum ada peringkat

- 304 1 ET V1 S1 - File1Dokumen10 halaman304 1 ET V1 S1 - File1Frances Gallano Guzman AplanBelum ada peringkat

- Wilferd Madelung, The Sufyānī Between Tradition and HistoryDokumen45 halamanWilferd Madelung, The Sufyānī Between Tradition and HistoryLien Iffah Naf'atu FinaBelum ada peringkat

- Cw3 - Excel - 30Dokumen4 halamanCw3 - Excel - 30VineeBelum ada peringkat

- Leadership and Followership in An Organizational Change Context (Sajjad Nawaz Khan, (Editor) ) (Z-Library)Dokumen381 halamanLeadership and Followership in An Organizational Change Context (Sajjad Nawaz Khan, (Editor) ) (Z-Library)benjaminwong8029Belum ada peringkat

- Pankaj YadavSEPT - 2022Dokumen1 halamanPankaj YadavSEPT - 2022dhirajutekar990Belum ada peringkat

- Kishore M. Daswani - ResumeDokumen3 halamanKishore M. Daswani - ResumeKishore DaswaniBelum ada peringkat

- WFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)Dokumen2 halamanWFP Specialized Nutritious Foods Sheet: Treating Moderate Acute Malnutrition (MAM)elias semagnBelum ada peringkat

- 1 Introduction Strategic Project Management (Compatibility Mode)Dokumen39 halaman1 Introduction Strategic Project Management (Compatibility Mode)Pratik TagwaleBelum ada peringkat

- Introduction To Cybersecurity: Nanodegree Program SyllabusDokumen15 halamanIntroduction To Cybersecurity: Nanodegree Program SyllabusaamirBelum ada peringkat