Applied Auditing

Diunggah oleh

JessicaHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Applied Auditing

Diunggah oleh

JessicaHak Cipta:

Format Tersedia

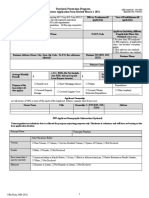

College of Business Management and Accountancy

Aquinas University of Legazpi

S.Y. 2016 - 2017

Accounting 502: Applied Auditing

Quiz#2: Book Value per Share, Earnings per share and Audit of liability

Name: _________________________________ Date: __________________ Score: _______________

Instruction: Encircle the letter of the correct answer. Solution is required. Answers without solution will not earn a

point.

Problem # 1

Below is the shareholders equity section of Jon Snow Company on December 31, 2014:

Preference share, 7%, P100 par value, 30,000 shares issued, total

liquidation value, P3.2 Million

P3,000,000

Ordinary shares, no par, 50,000 shares, issued

1,500,000

Donated Capital

500,000

Accumulated Profits

4,500,000

All preference dividends have been fully paid.

1. How much is the book value per share of ordinary shares?

a. P125.80

b. P130.00

c. P126.00

d. P300.00

Problem 2

Cersei Corporations current statement of financial position reports the following shareholders equity:

5% cumulative preference shares, par value, P100 per share; 25,000

shares issued and outstanding

P2,500,000

Ordinary shares, par value P35 per share; 100,000 shares issued and

outstanding

3,500,000

Share premium in excess of par value of ordinary share

1,250,000

Accumulated profits and losses

3,000,000

Dividends in arrears on the preference share amount to P250,000. If Cersei were to be liquidated, the preference

shareholders would receive par value plus a premium of P500,000.

2. How much would be the book value per share of ordinary share?

a. P70.00

b. P75.00

c. P72.50

d. P77.50

Problem#3

The following information pertains to Daenerys Corporations outstanding shares for 2014:

Ordinary shares, P5 par value

Shares outstanding, January 1, 2014

20,000

2 for 1 share split, April 1, 2014

20,000

Shares issued, July 1, 2014

10,000

Preference shares, P10 par value, 5% cumulative:

Shares outstanding

4,000

3. How many shares should Daenerys use to calculate the 2014 basic earnings per share?

a. 40,000

b. 50,000

c. 45,000

d. 54,000

Problem#4

On January 2, 2014, Tyron Company issued at par P3,000,000, 5-year, 10% bonds convertible in total into 200,000

shares of Tyrons ordinary shares. Without the conversion option, the bonds were selling at the prevailing rate of

interest of 12%. Interest is payable every December 31. No bonds were converted during 2014. Throughout 2014,

Tyron had 500,000 shares of ordinary shares outstanding. Tyrons 2014 net income was P5,500,000. Tyrons tax rate

is 32%.

4.

No other potentially dilutive securities other than the convertible bonds were outstanding during 2014. For 2014,

how much is the diluted earnings per share?

a. P7.86

b. P8.28

c. P8.18

d. P11.00

Problem#5

Jamie Lannister Company had share capital of two million shares P1 each fully paid up. On January 2, 2014, Jamie

Lannister Company issued one million P1 ordinary shares. The full price of the new shares was P1.50 and they were

50% paid up on issue. The dividend participation is to be 50% until fully paid up. The shares remained 50% paid at

December 31, 2014. During the year to December 31, 2014, the average fair value of one ordinary share was P2.00.

Net income for the year was P8,000,000.

5. How much is the basic earnings per share?

a. P2.67

b. P3.20

c. P3.05

d. P4.00

6.

How much is the diluted earnings per share?

a. P2.67

b. P3.20

c. P3.05

d. P4.00

Problem#6

The following information relates to Aliabad Company as of December 31, 2014. Answer the following questions

relating to each of the independent situations as requested.

7. Beginning 2014, Aliabad Company began marketing a new beer called Red Colt. To help promote the product,

the management is offering a special beer mug to each customer for every 20 specially marked bottle caps of Red

Colt. Aliabad estimates that out of the 300,000 bottles of Red Colt sold during 2014, only 50% of the caps will be

redeemed. For the year 2014, 8,000 mugs were ordered by the company at a total cost of P360,000. A total of

College of Business Management and Accountancy

Aquinas University of Legazpi

S.Y. 2016 - 2017

4,500 mugs were already distributed to customers. What is the amount of the liability that Aliabad Company

should report on its December 31, 2014 statement of financial position?

a. P135,000

b. P337,500

c. P202,500

d. P360,000

8.

On January 2, 2012, Aliabad Company introduced a new line of products that carry a three-year warranty against

factory defects. Estimated warranty costs related to peso sales are as follows: 1% of sales in the year of sale, 2%

in the year after sale and 3% in the second year after sale.

Sales and actual warranty expenditures for the period 2012 to 2014 were as follows:

Yea

Sales

Actual Warranty Expenditures

r

200

P100,000

P750

8

200

250,000

3,750

9

201

350,000

11,250

0

What amount should Aliabad Company report as warranty expense in 2014?

a. P3,500

b. P11,500

c. P11,250

d. P21,000

Anda mungkin juga menyukai

- RFM Business Review PDFDokumen32 halamanRFM Business Review PDFJessicaBelum ada peringkat

- Review of Related LiteratureDokumen6 halamanReview of Related LiteratureJessicaBelum ada peringkat

- Sample Midterm Exam For ITDokumen2 halamanSample Midterm Exam For ITJessicaBelum ada peringkat

- Accounting Books - Journals and LedgersDokumen17 halamanAccounting Books - Journals and LedgersJessicaBelum ada peringkat

- DMCI Power Corporation - PowerDokumen22 halamanDMCI Power Corporation - PowerJessicaBelum ada peringkat

- Applied Auditing Audit of Investment: Problem No. 1Dokumen3 halamanApplied Auditing Audit of Investment: Problem No. 1JessicaBelum ada peringkat

- SMC Global 2016 Annual Report 17-ADokumen202 halamanSMC Global 2016 Annual Report 17-AJessicaBelum ada peringkat

- Research#2 PDFDokumen18 halamanResearch#2 PDFJessicaBelum ada peringkat

- Meralco Audited Fs - 2016Dokumen142 halamanMeralco Audited Fs - 2016JessicaBelum ada peringkat

- Pepsi CalculationDokumen1 halamanPepsi CalculationJessicaBelum ada peringkat

- Bank Deposit Basics: Accounts, Transactions & StatementsDokumen15 halamanBank Deposit Basics: Accounts, Transactions & StatementsJessica80% (5)

- Financial StatementDokumen10 halamanFinancial StatementJessica100% (1)

- Introduction To AccountingDokumen9 halamanIntroduction To AccountingJessicaBelum ada peringkat

- Introduction To AccountingDokumen9 halamanIntroduction To AccountingJessicaBelum ada peringkat

- Accounting 601 (Edited)Dokumen7 halamanAccounting 601 (Edited)JessicaBelum ada peringkat

- Time Value of MoneyDokumen27 halamanTime Value of MoneyJessicaBelum ada peringkat

- Applied AuditingDokumen3 halamanApplied AuditingJessicaBelum ada peringkat

- Time Value of MoneyDokumen27 halamanTime Value of MoneyJessicaBelum ada peringkat

- Audit Liabilities to Evaluate Financial ReportingDokumen2 halamanAudit Liabilities to Evaluate Financial ReportingJessicaBelum ada peringkat

- Survey QuestionaireDokumen4 halamanSurvey QuestionaireJessicaBelum ada peringkat

- Course OutlineDokumen2 halamanCourse OutlineJessicaBelum ada peringkat

- Preface To Philippine StandardsSEFSDFASDFASSDFDokumen7 halamanPreface To Philippine StandardsSEFSDFASDFASSDFTEph AppBelum ada peringkat

- Advanced Financial AccountingDokumen4 halamanAdvanced Financial AccountingJessicaBelum ada peringkat

- Aquinas University of LegazpiDokumen3 halamanAquinas University of LegazpiJessicaBelum ada peringkat

- Systems Engineering For DummiesDokumen74 halamanSystems Engineering For DummiesSalvador Diaz100% (8)

- PSQC 1Dokumen35 halamanPSQC 1Airah Abcede FajardoBelum ada peringkat

- Intro Basic Accounting Part 1Dokumen3 halamanIntro Basic Accounting Part 1Jessica100% (2)

- At-030507 - Auditing in A CIS EnvironmentDokumen15 halamanAt-030507 - Auditing in A CIS EnvironmentRandy Sioson100% (9)

- At-5915 - Other PSAs and PAPSsDokumen11 halamanAt-5915 - Other PSAs and PAPSsPau Laguerta100% (1)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Estates and Trust PDFDokumen4 halamanEstates and Trust PDFJustin Robert Roque100% (1)

- N550 - Financial Accounting N4 Memo Nov 2019Dokumen7 halamanN550 - Financial Accounting N4 Memo Nov 2019Thembelihle SitholeBelum ada peringkat

- Question Bank NvsDokumen6 halamanQuestion Bank NvsDeepak DileepBelum ada peringkat

- Cost and Management AuditDokumen464 halamanCost and Management AuditAnkit Shaw100% (2)

- Nature, Scope, Need and Problems For International BusinessDokumen5 halamanNature, Scope, Need and Problems For International BusinessSonia LawsonBelum ada peringkat

- Standardize Cosmo's Balance SheetDokumen5 halamanStandardize Cosmo's Balance SheetRakshit SharmaBelum ada peringkat

- 12-Month Income Statement Profit-And-Loss Statement - Sheet1Dokumen2 halaman12-Month Income Statement Profit-And-Loss Statement - Sheet1api-462952636100% (1)

- Investments Introduction NotesDokumen17 halamanInvestments Introduction NotesVidhiGondaliaBelum ada peringkat

- Sbi Project of HRDokumen41 halamanSbi Project of HRDev YadavBelum ada peringkat

- Clarkson QuestionsDokumen5 halamanClarkson QuestionssharonulyssesBelum ada peringkat

- Answers, Solutions and Clarifications To Form 6Dokumen5 halamanAnswers, Solutions and Clarifications To Form 6Annie LindBelum ada peringkat

- Financing Maritime Infrastructure in NigeriaDokumen57 halamanFinancing Maritime Infrastructure in Nigeriajustin onagaBelum ada peringkat

- Short Run Decision AnalysisDokumen31 halamanShort Run Decision AnalysisMedhaSaha100% (1)

- BondsDokumen17 halamanBondsjaneBelum ada peringkat

- Table of ContentsDokumen1 halamanTable of ContentsShaikh Saifullah KhalidBelum ada peringkat

- Phil Gold Processing & Refining Corp: RF Monthly-Lgm 3Dokumen1 halamanPhil Gold Processing & Refining Corp: RF Monthly-Lgm 3bonemarkcosBelum ada peringkat

- Calpine Corp. The Evolution From Project To Corporate FinanceDokumen4 halamanCalpine Corp. The Evolution From Project To Corporate FinanceDarshan Gosalia100% (1)

- Singapore Illustrative Financial Statements 2016Dokumen242 halamanSingapore Illustrative Financial Statements 2016Em CaparrosBelum ada peringkat

- NLC Payroll EtcDokumen8 halamanNLC Payroll EtcJessica CrisostomoBelum ada peringkat

- FIA FA2 Final Assessment - Questions J13Dokumen18 halamanFIA FA2 Final Assessment - Questions J13Valentina100% (4)

- 08 AnnexesDokumen109 halaman08 AnnexesCassieBelum ada peringkat

- Toby Crabel - Opening Range Breakout (Part1-8)Dokumen39 halamanToby Crabel - Opening Range Breakout (Part1-8)saisonia75% (8)

- Bennett v. Commissioner IRS, 1st Cir. (1998)Dokumen9 halamanBennett v. Commissioner IRS, 1st Cir. (1998)Scribd Government DocsBelum ada peringkat

- Borrower Application 2483 RevisedDokumen5 halamanBorrower Application 2483 RevisedJustin Davies33% (3)

- Real StripsDokumen64 halamanReal StripsNitesh KumarBelum ada peringkat

- Darlington Business Venture Balance Sheet BasicsDokumen10 halamanDarlington Business Venture Balance Sheet BasicsVipul DesaiBelum ada peringkat

- Dynacor Gold Mines Inc.: Management Discussion and Analysis For The Six-Month Period Ended June 30, 2021Dokumen26 halamanDynacor Gold Mines Inc.: Management Discussion and Analysis For The Six-Month Period Ended June 30, 2021JIMI MARCOS ALTAMIRANO HUAMANIBelum ada peringkat

- FIDIC (Silver Book)Dokumen15 halamanFIDIC (Silver Book)a74engBelum ada peringkat

- Financial Policy For IvcsDokumen11 halamanFinancial Policy For Ivcsherbert pariatBelum ada peringkat

- Letter To The Mayor (Sunshine City) FinalDokumen2 halamanLetter To The Mayor (Sunshine City) Finalapi-288606068Belum ada peringkat