Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)

Diunggah oleh

Shyam SunderDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Standalone & Consolidated Financial Results, Auditors Report For March 31, 2016 (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

MOVING

WITH

Gorp. Office :404 SatyamApartment, 8 Wardha Road Dhantoli, Nagpur44O 012

Ph : 0712-3250318 / 319 Fax No. 0712 - 6612083

website : www.confidencegroup.co

t402 00MH t99

Date:

30

4PLCO7 97

66

/05 /201.6

To,

The Bombay Stock Exchange,

Department of Corporate Services,

Bombay Stock Exchange Limited,

2 5th Floor, P.J.Towers,

Dalal Street, Mumbai

- 400001

Subiect: Outcome of the Board Meeting held on 30/05/2016.

Ref : Annual Audited Stunalone & Consolidated Financial Result for the Quarter & Year Ended

31st March,2016 under Regulation 33 of SEBI (Listing Obligations and Disclosure Requirements)

Regulations, 2015 ["Listing Regulations"J

Dear

Sir,

With reference to the above subject, the following matters have been considered and approved by

the Board of Directors of the Company at their meeting held on 30/05/201,6:

1J Approved Audited Standalone & Consolidated Financial Results for the Fourth Quarter and Year

ended 31" March. 2016 atong with Auditor's Report

Kindly take the same on record and facilitate.

.

Regards,

'P-7j

J::#:i:+:=

;i?r{':J$+'1\u-

For Confidence Petroleum India Limited

2t

rc

r:i'

lt !4 !

;i;t

"it.\r

l;,.

;$

|:

!!

"r{:,:+".""_*i.$f

-+"7.&;Ed

Director/Authorized Signatory

r.E

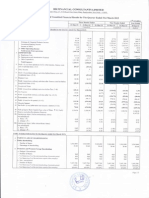

CONFIDENCE PETROLEUM INDIA LIMITED

(Rs. in Lakhs

Statement of Standalone Audited Results for the Quarter and Year Ended 31/03/2016

Year Ended

Quarter Ended

s.l

)articulars

31t03t2016

31t12t2015

31t03t2015

31t03t2016

31t03t2015

(Unaudited)

(Unaudited)

(Unaudited)

(Audited)

(Audited)

9076.06

10187.22

9130.48

35052.85

26628.36

0.0c

0.00

0.00

35052.85

26628.36

ncome from operations

(a) Net sales/ income from operations

(b) Other operating income

0.00

0.0(

9076.06

't0187.22

(a) Cost of materials consumed

3343.08

2936.3i

1635.4C

12964.67

12219.95

(b)

1204.93

5483.52

3783.81

12447.90

6666.73

(737.03)

Iotal income from operations (net)

9130.48

:XPenSeS

Purchases of stock-in-trade

(c) Changes in inventories of finished goods, work-inprogress and stock-in-trade

91.21

(103.e7)

(d) Employee benefits expdrse

(e) Depreciation and amortisation expense

285.75

325.2(

172.79

1192.21

1024.46

2228.21

2826.16

3492.94

403.56

667.9t

1441.84

(f)

2434.2t

5354.40

izzo.eo

8614.13

9907.89

9364.14

33836.86

26332.49

461.94

1n 60

279.33

t233.671

92.21

1215.99

43.2i

142.01

295.87

129.50

472.52

322.56

(141.461

1357.99

425.38

333.41

246.11

355.5

1087.80

139.'t

76.36

t497.021

270.20

(663.661

0.00

0.00

0.0c

0.00

0.00

139-11

43.77

76_36

23.14

-103.53

70.20

83.49

(56.031

95.34

0.00

53.22

0.00

(681.52)

186.71

0.00

1563.66

95.34

0.00

53.22

288.03

186.7',l

(2091.29'

o.00

0.00

Other expenses

(350.521

16.21

826.58

Total expenses

/ (Loss) from operations before other income,

finance c6sts rnd exeenfionel ifems

3 Profit

4 Jther income

5

Profit / (Loss) from ordinary activities before financ'e

coqfs anal evconlional ifems

b Finance costs

7

089.03

Profit / (Loss) from ordinary activities after finance

.dqf<

hilf

haf^ra

cy.ahfidnal

ifcmc

8 Exceptional items

Profit / (Lossl from ordinarv activities before

tar

10 Tax expense

11

Net Profit / (Loss) from,ordinarv activities aftettax

12 Extraordinary items

13 Net Profit / (Loss)

for the period

Share of orofit / (loss) of associates*

15 Net Profit / (Loss)

after taxes

507.6:

95.34

z56U.J5

53.22

288.03

186.71

16 Paid-up equity share capital

2588.35

2588.35

2588.35

e09'1.29',

2588.35

17 Keserve

17011.1e

19770.8(

7036.54

17011.1t

16824.4t

0.04

0.02

0.11

0.04

0.02

0.11

18 Earnings per share (before

(a) Basic

(b) Diluted

NAGPUR

30t05t2016

extraordinary items)

.t

0.07

(0.811

0.07

(0.811

CONFIDENCE PETROLEUM INDIA LIMITED

BALANCE SHEET

Standalone Balance Sheet as at 31st March, 2016

res Rs. In Lacs

AU AI

Particulars

31.03.2016

AD AI

3f .03.2015

EQUITY AND LIABILITIES

II.

(1) Shareholder's Funds

r

t-

l(a) Share Capital

l(b) Reserves and Surplus

11.; von"y received against share *ur.un$

(2) Share application money pending allotment

(3) Non-Current Liabilities

(a) Long-term borrowings

(b) Deferred tax liabilities (Net)

(c) Other Long term liabilities

(d) Long term provisions

(4) Current Liabilities

(a) Short-term borrowinls

(b) Trade payables

(c) Other current liabilities

(d) Short-term provisions

Total

ILAssets

(1) Non-current assets

(a) Fixed assefs

(i) Tangible assets

(ii) Intangible assets

(iii) Capital work-in-progress

(iv) Intangible assets under development

(b) Non-current investments

(c) Deferred tax assets (npt)

(d) Long term loans and advances

(e) Other non-current assets

I

2sBB.35

2588.35

1701 1.18

L6824.48

LL24.42

865.14

2720.66

LI44.36

822.62

2365.10

4180.61

2445.84

235.28

360.23

42L4.77

2443.43

436.59

25.76

31531.70

30865.43

L3954.57

0.00

L427.L4

13998.64

0.00

7372.80

2228.O2

2279.40

142r.76

2.32

B84.19

497L.32

4792.78

L343.74

7317.99

72.67

5152.09

4455.98

1342.53

L267.35

'31.50

31531.70

r30865.43

80.95

(2) Current assets

(a) Current investments

(b) Inventories

(c) Trade receivables

(d) Cash and cash equivalents

(e) Short-term loans and advances

(f) Other current assets

Total

FOR AND ON BEHALF OF THE BOARD

Date:30/05/2016

Place Nagpur

(DTRECTOR)

CONFIDENCE PETROLEUM INDIA LIMITED

SEGMENTWISE REPORT FOR THE QUARTER ENDED 31ST MARC!{,2016

(Rs.In

REVENUE

- Cylinder Division

- LPG Division

SEGMENT WISE RESULT

- Cylinder Division

- LPG Division

CAPITAL EMPLOYED

- Cylinder Division

- LPG Division

CAPITAL EXPENDITURE

- Cylinder Division

- LPG Division

DEPRECIATION

- Cylinder Division

- LPG Division

Lacs)

(Rs.In Lacs)

Quarter ended on

Quarter ended on

31.03.2016

31.12.2015

AUDITED

CONSOLIDATED

UN.AUDITED

CONSOLIDATED

CONFIDENCE PETROLEUM INDIA LIMITED

(Rs. in Lakhsl

Statement of Gonsolidated Audited Results for the Quarter and Year Ended 3110312016

s.N0. Particulars

Quarter Ended

3',I12t2015

31t03t2015

31t03t2016

(Unaudited) (Unaudited)

1

ncome from operations

(a) Net sales/ income from operations

(b) Other operating income

Iotal income from operations (net)

=xpenses

Year Ended

(Unaudited)

31t03t2016

31t03t2015

(Audited)

(Audited)

9282.3e

10257.22

10188.12

35469.1 6

30647.56

0.0c

0.0c

0.0(

0.00

0.00

9282.38

10257.22

10,t88.14

35469.{ 6

30647.56

(a) Cost of materials consumed

3322.08

2943.37

1955.97

12964.67

15297.48

(b) Purchases of stock-in-trade

1426.18

5483.54

3783.81

12669.'15

6666.73

(c) Changes in inventories offinished goods, work-in

-733.80

91.21

51.52

295.58

342.67

421.68

322.08

1254.27

1045.63

1428.40

2317.35

2874.74

680.05

2895.33

5464.09

4311.17

34322.23

30301.45

146.93

346.10

105.71

lztt.zs',

progress and stock-in-trade

(d) Employee benefits expense

(e) Depreciation and amortisation expense

1.059.24

(D Other expenses

Iotal expenses

9962.5'

8935.61

Profit / (Loss) from operations before other income,

10437.11

346.77

294.7(

(248.97"

2.3e

47.7'r

116.98

147.28

171 .97

349.13

342.4i

-131.9S

1294.21

518.08

306.1

256.2i

364.07

1102.82

1171.64

42.94

86.2(

(496.051

191.38

(653.56,

0.0c

0.0(

0.00

0.00

0.00

Profit / (Loss) from ordinary activities before tax

42.94

86.2(

(4e6.0s)

191.38

(653.561

Tax expense

65.1 5

24.75

(140.8e)

83.49

(59.301

11

Net Profit / (Loss) from ordinarv activities after tax

122.21

61.41

0.0c

1355.{6

(681.52

107_89

61.41

1.04

326.36

(26.59

,107.89

fig.23

0.40

G,3A

1.32

59.0!

3.09

349.86

Z5UU.J5

ZCUU.JI

zcd6.Jc

19286.30

21566.58

1732't.24

(0.01,

0.02

(0.14)

(0.01,

0.02

0.14

finrn.a

nncfe anrl avcanlinnal

Other income

Profit / (Loss) from ordinary activities before

fineh.a nacfc and ay.anfinnal ifame

Finance costs

Profit / (Loss) from ordinary activities after finance

costs buf befora exccnf i6nel ifcms

Exceotional items

12 Extraordinary

13 Net Profit /

1

items

(Loss) for the

0.00

I

period

(22,21

Share of orofit / (loss) of associates*

15 Vlinority Interest

Profit / {Lossl after taxes

17 raid-up equity share capital

16 Net

18 Reserve

19

ilamc

0.00

n719

6.61

114-44

lc66

19286.30

{594.261

I

cdJ.oo

t2177.92)

Q7.17:

1.33

lt4at

f]7,,

ZCUU.JC

19167.82

larnings per share (before extraordinary items)

(a) Basic

(b) Diluted

-,.rt :;i!_:4*

0.05

(0.80)

0.05

(0.80)

NAGPUR

J0t05/2016

.1.:'j-.{

i1! roil\'eag,li'

,:,

;t

:..i

ir'

Notes:

1. The Board of Directors

in its meeting held on May

3011' 2016

approved the above results. The

statutory auditors of the company have carried out the Limited Review of the results and

submitted their report.

2. The Consolidated Result does not include results of companies where ConJidence Petroleum

India Ltd is holding a stake of 50% or less.

3. The Company slagged in performance in the current quarter in LPG including Auto

LPG Segment owing to fall in crude prices and increase in market depth with additional

market penetration Sving it mileage in margins both in top line and bottom line.

4. The company has achieved greater efficiency in LPG

of production and cost due

to

Cylinder manufacturing in terms

internal assessment of production cycle and improved

supply chain management.

5.

In terms of amended clause 41 of the listing agreement, the status of investor complaints for

the quarter/ year"ended on N4arch 31"t,201.6 is'0'

6. The

figures of previous yearf qtafter have been regrouped or reclassified wherever necessary.

7. Notes to Segment

Information for the quarter ended 31* March,2016.

1. As per Accounting Standard 17 on Segment Reporting (A517), the Company has reported

"segment Information", as described

below:

a) The

Cylinder Division includes production and marketing operations of LPG /CNG cylinders.

b) The

LPG Division includes LPG marketing and bottling business & Others.

Place: Nagpur

For Confidence Petroleum India Limited

Date:30/05/201.6

Director

BHANDARI & ASSOCIATES

Chartered Accountants

22L,Durian Estate, Goregaon - Mulund Link Road, Goregaon(East)

T

Mumbai - 400 053

el : 022 - 2877 0533 / 4366 1684 Telefax z 022 - 4266L686

Auditor's Report On Quarterly and Annual Consolidated Financial Results of Confidence

petroleum India Limited Pursuant to the Regulation 33 of the SEBI (Listing Obligations and

Disclosure Requirements) Regtilations, 2 01 5

t

We have audited the quarterly and annual Consolidated financial results of M/s. Confidence

petroleum India Limited for the quarter and Year ended 31"t March,2Ot6, attached herewith,

being submitted by the company pursuant to the requirement of Regulation 33 of the SEBI [Listing

Obligations and Disclosure RequirementsJ Regulations, 20L5. These Consolidafed quarterly and

annual financial results have been prepared on the basis of the consolidated financial statements,

which are the responsibility of the company's management. Our responsibility is to express an

opinion on these consolidated financial results'based on our audit of such consolidated financial

statements, which hdve been prepared in accordance with the recognition and measurement

principles laid down in Accounting Standard prescribed, under Section 133 of the Companies Act,

2013 read with relevant rules issued thereunder, as applicable and other accounting principles

generally accepted in India.

We conducted our audit in accordance with the auditing standards generally accepted in India.

Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial results are free of material misstatement(s). An audit includes examining, on

a test basis, evidence supporting the amounts disclosed as financial results. An audit also includes

assessing the accounting principles used and significant estimates made by management. We

believe that our audit provides a reasonable basis for our opinion.

We did not audit the financial statements of 7 [Seven) subsidiaries included in the consolidated

quarterly and annual financial results, whose consolidated financial statements reflect total assets

of Rs. 6441.56 Lacs year ended 31st March,20L6 and Rs. 6321.11Lacs the quarter ended an 31st

March, 201,6 ; as well as the total reyenue of Rs. 421.58 Lacs as at year ended 31st March,2016 and

Rs. 1-30.25 Lacs as at the quarter ended 31st March ,20L6. These Consolidated financial statements

and other financial information have been audited by other auditors whose report(s) has [have)

been furnished to us, and our opinion on the quarterly financial results and annual results, to the

extent they have been derived from such interim financial statements is based solely on the report

of such other auditors.

In our opinion and to the best of our information and according to the explanations given to us

these consolidated quarterly and Annual financial results for the year:

,.,'""tt:.

, '

..t

,,

.,, ta-

*,,,lt.

:i:

:i ;.

H

a.

BHANDARI & ASSOCIATES

Chartered Accountants

22!,Durian Estate, Goregaon Road, Goregaon(East)

!tutuna !1t

Mumbai-400 053

Tef:022 -2877 0683 I 4366 1684 Telefax :022-4266t686

include the quarterly and annual financial results of the following entities flist of entities

incl uded in consolidation);

a, Confidence Go Gas Limited

b. Taraa LPG Bottling Private Limited

c. Agwan Coach Private Limited

d, Keppy Infrastructure Developers Private Limited

e. Hemkunt Petroleum Limited

f. Gas point Bottling Private Limited

[i)

g. PT Surya Go Gas

Indonesia

(ii) have been presented in accordance with the requirer4rlnts of Regulation 33 of the SEBI (Listing

Obligations and Disclosure Requirements) Regulations ,20!5 in this regard; and

[iii) give a true and fair view of the consolidated net profit and other financial infOrmation for the

quarter and year ended 31't March, 2016

t

For Bhandari & Associates

L. R.

l)lo

v-J

Bhandari

Chartered Accountants

Memb. No.:033168

Date:30/05 /20L6

'{

}?l:

h-*-#'

1E

BHANDARI & ASSOCIATES

Chartered Accountants

22L, Durian Estate, Goregaon - Mulund Link Road, Goregaon(East)

T

Mumbai-400 063

/ 4366 t684 Telefax

el : 022 - 2877 0683

O22

4266L686

IndependentAuditor's Report On Financial Results of the Confidence Petroleum trndia

Limited Pursuant to the Regulation 33 of the SEBI (Listing Obligations and Disclosure

Requirements) Regulations, 2015

To Board ofDirectors of

Confidence Petroleum India Limited

Nagpur-12

We have audited the quarterly and annual financial results of M/s. Confidence Petroleum India

Limited for the quarter anci Year ended 31"t March,201:6, attached herewith, being submitted by

the company pursuant to the requirement of Regulation 33 of the SEBI (Listing Obligations and

Disclosure Requirements) Regulations, 2015. These quarterly and annual finapcial results have

been prepared on the basis of the annual financial statements, which are the responsibility of the

company's management. Our responsibility is to express an opinion on these financial results based

on our audit of such financial statements, which have been prepared in accordance with the

recognition and measurement principles laid down in Accounting Standard prescribed, under

Section 133 of the Companies Act, 20'1,3 read with relevant rules issued thereunder, as applicable

and other accounting principles generally accepted in India.

We conducted our audit in accordance with the auditing standards generally accepted in India.

Those standards require that we plan and perform the audit to obtain reasonable assurance about

whether the financial results are free of material missthtement[s). An audit includes examining, on

a test basis, evidence supporting the amounts disclosed as financial results. An audit also includes

assessing the accounting principles used and significant estimates made by management. We

believe that our audit provides a reasonable basis for our opinion.

In our opinion and to the best of our information and according to the explanations given to

us

these quarterly and annual financial results:

[i) are presented in accordance with the requirements of Regulation 33 of the SEBI [Listing

Obligations and Disclosure Requirements) Regulations,20tS in this regard; and

[ii) give a true and fair view of the get profit and other financial information for the quarter and

year ended 31't March,2016.

For Bhandari & Associates

n

Alt

Bhanda.i / "

Chartered Accountants

Memb. No.:033168

Date : 30/05 /2076

L. R.

ljlj,lt'-,,,',,-

Anda mungkin juga menyukai

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For June 30, 2016 (Result)Dokumen2 halamanStandalone Financial Results For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen8 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen15 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokumen11 halamanStandalone & Consolidated Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen8 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For March 31, 2015 (Result)Dokumen5 halamanFinancial Results & Limited Review For March 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Updates On Financial Results For Sept 30, 2015 (Result)Dokumen4 halamanUpdates On Financial Results For Sept 30, 2015 (Result)Shyam SunderBelum ada peringkat

- Announces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokumen4 halamanAnnounces Q1 (Standalone) Results & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Sebi MillionsDokumen3 halamanSebi MillionsShubham TrivediBelum ada peringkat

- Statement of Assets & Liabilites As On March 31, 2016 (Result)Dokumen6 halamanStatement of Assets & Liabilites As On March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokumen3 halamanAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Announces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Dokumen4 halamanAnnounces Q1 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen8 halamanStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Dokumen3 halamanFinancial Results & Limited Review Report For June 30, 2015 (Standalone) (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report, Results Press Release For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- General Automotive Repair Revenues World Summary: Market Values & Financials by CountryDari EverandGeneral Automotive Repair Revenues World Summary: Market Values & Financials by CountryBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- FABM2 WEEK 1 Louise Peralta 11 FairnessDokumen3 halamanFABM2 WEEK 1 Louise Peralta 11 FairnessLouise Joseph PeraltaBelum ada peringkat

- Chapter 3 Adjusting The Accounts PDFDokumen56 halamanChapter 3 Adjusting The Accounts PDFJed Riel BalatanBelum ada peringkat

- ACC Result UpdatedDokumen11 halamanACC Result UpdatedAngel BrokingBelum ada peringkat

- CBSE Class 11 Accounting-End of Period AccountsDokumen34 halamanCBSE Class 11 Accounting-End of Period AccountsRudraksh PareyBelum ada peringkat

- FInancial Accounting Week 1Dokumen4 halamanFInancial Accounting Week 1Siva PraveenBelum ada peringkat

- PP TBK: (Persero)Dokumen220 halamanPP TBK: (Persero)Luthfia ZulfaBelum ada peringkat

- Petrocom Bras CompanyDokumen21 halamanPetrocom Bras Companyspectrum_48Belum ada peringkat

- Ratio AnalysisDokumen62 halamanRatio AnalysisRAGHU MALLEGOWDABelum ada peringkat

- Accounting For Government and Not-For-Profit OrganizationsDokumen8 halamanAccounting For Government and Not-For-Profit OrganizationsAngela QuililanBelum ada peringkat

- Consolidation Following Acquisition: Douglas CloudDokumen57 halamanConsolidation Following Acquisition: Douglas CloudYudhi SutanaBelum ada peringkat

- Quiz Adjusting Entries Multiple Choice WithoutDokumen5 halamanQuiz Adjusting Entries Multiple Choice WithoutRakzMagaleBelum ada peringkat

- ACCT2542 Final Exam With SolutionsDokumen16 halamanACCT2542 Final Exam With SolutionsAnhPham100% (2)

- 4th Quarter Report FY7980Dokumen1 halaman4th Quarter Report FY7980balkrishna4000Belum ada peringkat

- Ratio Analysis 1Dokumen2 halamanRatio Analysis 1yogeshgharpureBelum ada peringkat

- Ias 8 Accounting PolicyDokumen68 halamanIas 8 Accounting PolicyGedion EndalkachewBelum ada peringkat

- Similarities and Differences Between IFRS and US GAApDokumen12 halamanSimilarities and Differences Between IFRS and US GAApAlamin Mohammad100% (1)

- Chapter 2 Basic Concepts in AccountingDokumen4 halamanChapter 2 Basic Concepts in AccountinghidayahBelum ada peringkat

- Accounting CycleDokumen28 halamanAccounting Cycleyram shinBelum ada peringkat

- PWC - IAS 16 - Accounting For Property Under Cost Model - Sep10 PDFDokumen16 halamanPWC - IAS 16 - Accounting For Property Under Cost Model - Sep10 PDFSanath Fernando100% (1)

- LOS 24 and Financial Ratio AnalysisDokumen46 halamanLOS 24 and Financial Ratio AnalysisBenny Mysa Casipong100% (2)

- Sawit-Sumbermas-Sarana TBK Billingual 30 Sep 22 - Released1667285054Dokumen135 halamanSawit-Sumbermas-Sarana TBK Billingual 30 Sep 22 - Released1667285054Kon tTBelum ada peringkat

- Enrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicDokumen5 halamanEnrichment Learning Activity: Name: Date: Year and Section: Instructor: Module #: TopicImthe OneBelum ada peringkat

- Regulatory Deferral Accounts: IFRS Standard 14Dokumen24 halamanRegulatory Deferral Accounts: IFRS Standard 14Teja JurakBelum ada peringkat

- ASC Research Case-Defensive Intangible AssetDokumen2 halamanASC Research Case-Defensive Intangible AssetJoey LessardBelum ada peringkat

- Bellemy Fashion Center Intermediate AcctDokumen17 halamanBellemy Fashion Center Intermediate AcctFamily PicturesBelum ada peringkat

- Orca Share Media1583315619577Dokumen13 halamanOrca Share Media1583315619577Sebastian Vincent Pulga PedrosaBelum ada peringkat

- ACT 431 FinalDokumen18 halamanACT 431 FinalAtabur RahmanBelum ada peringkat

- Tutorial 7Dokumen74 halamanTutorial 7Dylan Rabin PereiraBelum ada peringkat

- Wells Technical InstituteDokumen24 halamanWells Technical Institutelaale dijaanBelum ada peringkat

- TUGAS Pamplin MK1.Dokumen2 halamanTUGAS Pamplin MK1.Nan BaeeeBelum ada peringkat