Standalone Financial Results, Auditors Report For March 31, 2016 (Result)

Diunggah oleh

Shyam SunderJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Standalone Financial Results, Auditors Report For March 31, 2016 (Result)

Diunggah oleh

Shyam SunderHak Cipta:

Format Tersedia

!,!)L! TD.

4ft. ENT

Ph. No. : 033 40447872

: 033 40448394

Fax

: 033 40448815

2NO FLOOR, 3, WOOOBURN PARK, KOLKATA - 700020

;contact@eilgroup.com

info@eilgroup.com

CIN No.: L27104WB1989PLC047832

28.05.2016

Date :

Ref. :

The Secretary,

The Stock Exchange, Mumbai,

Phiroze jeejeebhoy Towers,

Dalal Street,

Mumbai

400 001

Dear Sir,

The Meeting of the Board of the Directors held on Today i.e 28

th

May 2016, approved the

Audited Financial Results for the quarter and year ended 31st March 2016.

Pursuant to

Regulation

33(3)(d)

of

the

SEBI

(Listing

Obligations

and

Disclosure

Requirements) Regulations, 2015, we enclose the following, duly approved by the Board:

1.

Audited Financial Results for the Quarter and year ended 31st March 2016

2. Auditor's Report on the Financial Results for the year ended 31st March, 2016.

Pursuant to SEBI Circular no. CIRICFD/CMD/5612016 dated May 27,2016 it is declared that

the audit report for the Financial year 2015-16 is with unmodified opinion.

Yours faithfully,

TERflRISE INTERNATIONAL L70

.

I '

Dirpctor

ENTERPRISE INTERNATIONAL LTD.

Ph.

No.

: 033 40447872

: 033 40448394

Fax

: 033 40448615

e-mail: contact@eilgroup.com

REGD. OFFICE: "MALAYALAY", UNIT NO.2A (5)

2ND FLOOR. 3, WOODBURN PARK, KOLKATA 700020

CIN No.: L27104WB1989PLC047832

Ref. :

Date:

Date: 28.05.2016

The Mumbai Stock Exchange

Phiraze Jeejeebhoy Towers

Dalal Street

Mumbai- 400001

Dear Sir.

Ref: Audited Financial Results for the year ended 31st March, 2016

This is to inform you that a Meeting of the Board of Directors of the Company was held today and the Audited Financial Results

of the Company as detailed below were taken on record.

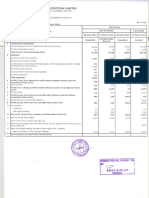

STATEMENT OF AUDITED FINANCIAL RESULTS FOR THE QUARTER

& YEAR

ENDED 31ST MARCH 2016

(Rs In lacs)

51

3 Months

No.

ended

Preceding 3

Corresponding

months

3 months in the

ended

previous year

Particulars

b) Other Operating Income

Total income from operations (Net)

I

!

,

.

31-03-2016 31-12-2015

31-03-2015

31-03-2016

31-03-2015

(Unaudited) (Unaudited)

(Unaudited)

(Audited)

(Audited)

490.96

509.46

1,269.62

2,752.36

7,474.44

509.46

490.96

1,269.62

2,752.36

7,474.44

7,409.72

a) Cost of materials consumed

522.27

350.88

1,194.28

2,554.86

b) Charge in inventories of finished goods, work in progress and stock in trade

(10.06)

120.71

61.64

132.87

10.20

8.92

12.44

36.86

d) Depreciation and amortisation expenses

1.64

1.57

1.58

6.28

7.86

e) Other Expenses

9.34

12.08 I

11.28

48.47

41.15

f) Exchange Difference

g) Travelling Expenses

h) Bank Charges

(1.88)

6.70

1.29

11.44

7.80

4.05

24.95

5.31

9.28

25.18

506.17

1,294.55

2,837.27

(26.62)

39.96

27.17

24.11

7,523.35 I

Total Expenses

544.24

(34.78)

(1S.21)

(24.93)

31.78

21.53

29.78

101.19

(3.00)

6.32

4.85

16.28

1.80

1.55

2.11

6.17

9.28

(4.80)

4.77

2.74

10.11

24.83

Profit t (Loss) from operations before other income, financial costs and exceptional Items (1-2)

Other Income

Profit / (Loss) from ordinary activities before financial costs and exceptional Items (3+4)

Financial Costs

Profit from ordinary activities after financial costs but before exceptional Items (5-6)

Exceptional Items

Profit from Ordinary Activities before Tax, (7+8)

10 Tax Expenses (including Deferred Tax)

13

Net Profit from Ordinary Activities after Tax (9-lO)

12

Extraordinary Items (net o f tax expenses)

13 Net Profit for the period (11-121

14

year ended

Expenses

c) Employee benefits expenses

I

I

Previous

ended

Income from opertions

aj Net Sales/Income from OperationsJNet of excise duty)

Current Year

Share of Profit / (Loss) of associates

inoritY Interest

4.77

2.74

1.36

(1.37)

0.81

(2.96)

(3.44)

3.40

3.55

7.15

(3.44)

3.40

(3.44)

3.40

(48.91)

83.02 :

34.11

(4.80)

r taxes, minority interest and share of Profitt{Loss) of associates (13+14+15)

(84.91)

10.11

3.55

7.15

3.55

7.15

24,83

{8.021

16.81

.

16.81

-

16.81

17

Paid up Equity Share Capital (Face Value of Rs. 10/- each)

298.46

298.46

.46

298.46

18

Reserves excluding revaluation reserves

455.57

459.01

5.57

448.42

19(i) Earning per Share (before extra ordinary items) (of Rs. 10/- each)

(0.11)

0.11

0.12

0.24

0.56

(0.11)

0.11

0.12

0.24

0.56

(a) Basic

(0.11)

0.11

0.12

0.24

0.56

(b) Diluted

(0.11)

0.11

0.12

0.24

0.56

(a) Basic

: (b) Diluted

19(H Earning per Share (after extra ordinary items) (of Rs. 10/- each)

Notes:

1.

The Company operates In Textile Segment whICh is primary reportable segment Therefore segme'1t reporting IS not appllca

ERNATION"''''

ENTERP'RISE INT

2. PrevIous period's figure have been regrouped whereever necessary to conform to current period's claSSification.

Dt

Thanking you,

Yours faithfully,

A EN

: !!!)LTD.

No. : 033 40447872

: 033 40448394

Fax

. 033 40448615

Ph.

2ND FLOOR. 3, WOODBURN PARK, KOLKATA 700020

CIN No.: L27104WB1989PLC047832

Ref. :

Date:

(Rs

STATEMENT OF ASSETS AND LIABILITIES

SL

Particulars

NO.

A

EQUITY AND LIABILITIES

Shareholders' Funds

Lacs)

In

As at Current

As at Previous

Year ended

Year ended

31-03-2016

31-03-2015

(Audited)

(Audited)

(a) Share Capital

-Fully paid up shares

298.46

298.46

0.96

0.96

(b) Reserves & Surplus

455.57

448.42

Sub Total: Shareholders' funds

754.99

747.84

(a) Long Term Borrowings

4.97

4.37

(b) Other Long Term Liabilities

2.00

1.50

(c) DeferredTax Liabilities

5.29

3.45

12.26

9.32

-Forfeited shares

Non-Current Liabilities

Sub Total: Non-Current Liabilities

Current Liabilities

(a) Short Term Borrowings

306.89

121.61

(b) Trade Payables

108.24

868.85

(c) Other Current Liabilities

245.04

140.26

1.29

2.14

661.46

1,132.86

1,428.71

1,890.02

(a) Fixed Assets

119.23

113.99

(b) Non-Current Investments

179.51

59.51

9.81

11.63

(d) Short Term Provisions

Sub-Total: Current Liabilities

TOTAL - EQUITY AND LIABILITIES

B

ASSETS

Non-Current Assets

(c) Long-Term Loans & Advances

(d) Other Non-Current Assets

355.03

Sub-Total: Non-Current Assets

308.55

540.16

(a) Inventories

29.62

162.49

(b) Trade Receivables

85.55

419.95

621.30

418.52

(d) Short Term Loans & Advances

122.93

88.55

(e) Other Current Assets

260.76

260.35

Sub-Total: Current Assets

1,120.16

1,349.86

TOTAL - ASSETS

1,428.71

1,890.02

Current Assets

(e) Cash &

Bank balances

""......

. ......

- ... " .... "l I\'V'" ...

i E:1\NPd lur4ru. LlU.

K>M f'APURIAH & CO

4, SYNAGOGUE STREET,

8th fLOOR,

KOlKATA-700001

Chartered Accountants

' .Ults and Year to Date Results of Enterprise

AuditorJs Report ()nqnat rij '"

. .

llbtJioD 33 of tne SElll (Listing Obligations

lto tbeR

lnternational Lbnitced PU

and .Disclosure Requil"cmmt!) Regula'fknisy 201S

We have

I1lUQlte<i

me

quarterly

of En terprise Int rnatiolud Limited (the

2016 and the year to date financial results for the

company) fortbequarrer nded

year ended 31 lMarch 2016,

being submitted by the company pursuant to

Obligations and

the requirement

Reguiation 33 of

2015,

quarterly financial statements as

as year to date

Requirements)

of the interim financial statentents, which

have been prepared on

tinancial

is to express all opi nion on these

are the responsibility

the

Our

financial results based 011 our

statements, which have prepared

interim

in accordance

the r oogi1ition

ffiCaStrtement principies 1410 down in Accountiug

Standard 25 "lnterim Financial Rcsults"and accounting smndardsspeclftccl under

133 of Companics Act, 2013, respectively rad with the relevant rules issued th ere under, and

India,

other a cto uill ing principles generally accepted

We conducted our audit in

with the auditing standards

India. Those standards req.uire that we pJan and perform the audit to obtain reaSOIl(lO!C

assurance auoutwhether

'financial result'iare free of ",<>., .. ";,,,1

includes examinil1g,on a test

evidence supportIng

amounts disclosed as financial

the acoounting principies used and significant

results, An audit also includes

estimates made by management We believe that our audit provides a reasonable basis forouf

opinion,

in our opinion and to the

of our information

a<:cording to

us, these quarterly and year to date.finandal statement:

explanations

to

(I) have been pre llted in accordance with the requirements

Regulation 33

the SEBI

(Listing Obligations and Disclosure Requirements) Regulations, 2015 1n this regard; and

(ii) give a true and fair view of the net pro fit and other financial information for the

quarter ended

Mach 31,20 i 6 as weIl as the

Maroh 2016

ForK, M, Tapuriah & Co

Chartered Aeoountants

Firm Registration number: 314043

CAK M Tapuriuh

Partner

Membership Number: 05 I 509

Place: Koikata

Date: 28th May, 2016

to date resuits for the year ended 31 s(

Anda mungkin juga menyukai

- Supply Chain Management and Business Performance: The VASC ModelDari EverandSupply Chain Management and Business Performance: The VASC ModelBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report, Results Press Release For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Dec 31, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen2 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen5 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen7 halamanStandalone & Consolidated Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Dokumen8 halamanFinancial Results, Limited Review Report, Results Press Release For December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Announces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Dokumen5 halamanAnnounces Q2 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Dokumen4 halamanFinancial Results & Limited Review Report For Sept 30, 2015 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen6 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Dokumen9 halamanStandalone Financial Results, Form B, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen5 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen6 halamanStandalone & Consolidated Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Financial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Dokumen6 halamanFinancial Results & Limited Review For Dec 31, 2014 (Standalone) (Result)Shyam SunderBelum ada peringkat

- Standalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Dokumen22 halamanStandalone & Consolidated Financial Results, Form A, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Auditors Report For March 31, 2016 (Result)Dokumen7 halamanStandalone Financial Results, Auditors Report For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Announces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Dokumen4 halamanAnnounces Q3 Results (Standalone) & Limited Review Report (Standalone) For The Quarter Ended December 31, 2015 (Result)Shyam SunderBelum ada peringkat

- Revised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanRevised Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- PDF Processed With Cutepdf Evaluation EditionDokumen3 halamanPDF Processed With Cutepdf Evaluation EditionShyam SunderBelum ada peringkat

- Standalone Financial Results For September 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen11 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For September 30, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For September 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For June 30, 2016 (Result)Dokumen3 halamanStandalone Financial Results, Limited Review Report For June 30, 2016 (Result)Shyam SunderBelum ada peringkat

- Transcript of The Investors / Analysts Con Call (Company Update)Dokumen15 halamanTranscript of The Investors / Analysts Con Call (Company Update)Shyam SunderBelum ada peringkat

- Investor Presentation For December 31, 2016 (Company Update)Dokumen27 halamanInvestor Presentation For December 31, 2016 (Company Update)Shyam SunderBelum ada peringkat

- Standalone Financial Results, Limited Review Report For December 31, 2016 (Result)Dokumen4 halamanStandalone Financial Results, Limited Review Report For December 31, 2016 (Result)Shyam SunderBelum ada peringkat

- De Grauwe Keynes' Saving ParadoxDokumen20 halamanDe Grauwe Keynes' Saving ParadoxecrcauBelum ada peringkat

- Architect As Developer PDFDokumen105 halamanArchitect As Developer PDFKarlo De Soto100% (1)

- N ShortDokumen12 halamanN Shortkh8120005280Belum ada peringkat

- Corporate Governance and Financial Performance An Empirical Study of IndianDokumen239 halamanCorporate Governance and Financial Performance An Empirical Study of IndianFaisal ArifBelum ada peringkat

- Previously Incurred Project Cost Future Eligible Project CostDokumen29 halamanPreviously Incurred Project Cost Future Eligible Project CostTammy WilliamsBelum ada peringkat

- Course OutlineDokumen14 halamanCourse OutlineKris MercadoBelum ada peringkat

- Harvard Case Study Toy WorldDokumen18 halamanHarvard Case Study Toy WorldWescsmith93Belum ada peringkat

- MRF LimiteDDokumen22 halamanMRF LimiteDnikitajain021100% (1)

- SF GRP 01 SecCDokumen49 halamanSF GRP 01 SecCUjjwal ChandraBelum ada peringkat

- The Financial Statement Analysis: PGDM Executive 2018-2019Dokumen42 halamanThe Financial Statement Analysis: PGDM Executive 2018-2019Sanchit GuptaBelum ada peringkat

- Equity Derivatives NCFM Ver 1.5Dokumen148 halamanEquity Derivatives NCFM Ver 1.5sanky23Belum ada peringkat

- Sample QCD With Life EstateDokumen2 halamanSample QCD With Life Estatemarioma12Belum ada peringkat

- Smartcat-10609 Verbal Ability and Reading Comprehension Instructions For Questions 1 To 4: The Passage Given Below Is Followed by A Set ofDokumen34 halamanSmartcat-10609 Verbal Ability and Reading Comprehension Instructions For Questions 1 To 4: The Passage Given Below Is Followed by A Set ofsrksamBelum ada peringkat

- LIC Bonus and FAB Rates 2019 PDFDokumen24 halamanLIC Bonus and FAB Rates 2019 PDFAtul A Sharan50% (2)

- 2 MasDokumen15 halaman2 MasJames Louis BarcenasBelum ada peringkat

- Answer KeyDokumen6 halamanAnswer KeyClaide John OngBelum ada peringkat

- 59 IpcccostingDokumen5 halaman59 Ipcccostingapi-206947225Belum ada peringkat

- FInal Black Book VISHAKAHA PROJECTDokumen46 halamanFInal Black Book VISHAKAHA PROJECTrutuja ambreBelum ada peringkat

- Standalone Financial Results For March 31, 2016 (Result)Dokumen3 halamanStandalone Financial Results For March 31, 2016 (Result)Shyam SunderBelum ada peringkat

- BS 421 Assignments 2020Dokumen2 halamanBS 421 Assignments 2020Daniel DakaBelum ada peringkat

- Function and Role of Financial SystemsDokumen33 halamanFunction and Role of Financial Systemsaamirjewani100% (1)

- A172 Tutorial 2 QuestionDokumen4 halamanA172 Tutorial 2 QuestionZichun HoBelum ada peringkat

- Msu Bba Vadodara.: Report On Jhaveri Securities Pvt. LTDDokumen16 halamanMsu Bba Vadodara.: Report On Jhaveri Securities Pvt. LTDShalin PatelBelum ada peringkat

- Securities Regulation Short Outline: I. BackgroundDokumen14 halamanSecurities Regulation Short Outline: I. BackgroundzklvkfdBelum ada peringkat

- aRIA WhitePaper PartIII Myth Vs Reality PDFDokumen14 halamanaRIA WhitePaper PartIII Myth Vs Reality PDFNeculaesei AndreiBelum ada peringkat

- Hard Core (Jan-10)Dokumen31 halamanHard Core (Jan-10)Broyhill Asset ManagementBelum ada peringkat

- Corp Tax OutlineDokumen86 halamanCorp Tax Outlinebrooklandsteel100% (1)

- Corporate Law MGT-513: ARSHAD ISLAM Lecturer City University Peshawar PakistamDokumen9 halamanCorporate Law MGT-513: ARSHAD ISLAM Lecturer City University Peshawar PakistamArshad IslamBelum ada peringkat

- Insurance Awareness PDF Capsule 2017 by AffairscloudDokumen56 halamanInsurance Awareness PDF Capsule 2017 by AffairscloudMegha SharmaBelum ada peringkat