Ican Journal June 2014

Diunggah oleh

casarokarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ican Journal June 2014

Diunggah oleh

casarokarHak Cipta:

Format Tersedia

June 2014

Vol. 16 No. 4

P A

ACCOUNTANT

Contents

(Quarterly Journal of The Institute of Chartered Accountants of Nepal)

Editorial Committee

CA. Mahesh Kumar Guragain

CA. Narendra Bhattarai

CA. Kiran Subedi

CA. Pankaj Thapa

CA. Santosh Ghimire

RA. Dev Bahadur Bohara

RA. Dharanidhar Adhikari

RA. Murari Bhattarai

RA. Shankar Gyawali

Mr. Binod Neupane

Chairman

Vice -Chairman

Member

Member

Member

Member

Member

Member

Member

Secretary

Mr. Binaya Paudel

Editorial Support

The Institute of Chartered Accountants of Nepal

Babar Mahal, P O Box 5289, Kathmandu, Nepal

Tel. No. 4269130, 4258569, 2030021, Fax: 977-1-4258568

E-mail: ican@ntc.net.np, Website: www.ican.org.np

Branch Office Biratnagar

Tel: 021-471395, Fax: 021-470077, E-mail: icanbrt@ican.org.np

Branch Office Butwal

Tel: 071-543629, E-mail: icanbtl@ican.org.np

Editorial

President's Message

ACCOUNTING

Fully Depreciated Assets - IAS 16

- CA. Pooja Gupta

AUDITING

Reconciling Stakeholder Expectations of an Audit Through

Better Audit Management

- CA. Nanda Kishore Sharma

Need to Harmonize the Regulation of Audit

- CA. Paramananda Adhikari

14

Risk Based Internal Auditing: Nepalese Banking Perspective

- CA. Ramesh Dhital

17

ECONOMY

Fiscal Risks and Related Teransparency Issues

20

- CA. Chandra Kanta Bhandari

Branch Office Birgunj

Tel: 051-522660, E-mail: icanbrj@ican.org.np

Public Debt: An Emerging Global Concern

Branch Office Pokhara

Tel: 061-537679, E-mail: icanpkr@ican.org.np

24

- Mr. Iswar Raj Shrestha

Economic Vision for the Long Term Growth and

Development of Nepal

Designed & Printed By

Print and Art Service, Putalisadak,Ktm.

Tel: 4244419, 4239154

30

- Dr. Basudev Sharma

Taxation

Subscription Rates

Annual Subscription Rs. 600

(including courier charges for Organizations)

Rs. 400 (including courier charges for Member)

Rs. 300 (if received by self)

Opinions expressed by the contributors in this journal are their own and do not

necessarily represent the views of the Institute. Member Bodies of SAFA may

quote or reprint any part of this journal with due acknowledgements. For others,

solicitation is expected.

Improvements Required in the Functioning of Tax Hierarchy

to Encourage Foreign Investments

34

- CA. N.Krishnaswami

Other

Accepting Globalization The Profession Needs to be Torch

Bearer of Change

41

- CA. Sujeev Shakya

The Financial Reporting Supply Chain in Asia

- Mr. Brian Blood

Contributors

CNC Pvt. Ltd.

First Cover Back

Standard Chartered Bank (Nepal) Ltd.

Page No: 6

Global IME Bank Ltd.

Page No: 53

NB Bank Ltd.

Page No: 56

Shikhar Shoe

Inside Back

SKODA M.A.W.

Back Cover

News

43

46

Students News

Member News

International Participation

Important Notice

13, 23, 29 & 42

Editorial

Editorial

The Institute of Chartered Accountants of Nepal (ICAN) established in 1997

as a national professional accounting body under the Nepal Chartered Accountants

Act, 1997 in the country. In the initial stage of its inception, it started operations

with a limited space on rented building situated in Babarmahal, Kathmandu.

With the increased operations the institute severally felt the need of adequate

infrastructure for better functioning and planned to construct the building of its

own but getting adequate land at the appropriate location was difficult and

challenging task. Due to the honest efforts of the office bearer and members,

the Government of Nepal generously allotted a plot of land on lease some five

years ago at Satdobato, Lalitpur for construction of building. ICAN initiated

campaign to gather the resources for better infrastructure and the entire members

voluntarily contributed in support of this move.

ICAN is finally shifting to own newly constructed modern building with various

required facilities after seventeen years of its establishment at the new location

at Satdobato, Lalitpur. This shifting will be historical moment and a milestone

achievement in the annals of accounting precession in the country.

With the new infrastructure, we believe ICAN will be able to enhance further

its social image and its professional strength through motivated students,

employees, and members at large by delivering more quality and professional

duties.

ICAN building is the outcome of collaborative effort of all the stakeholders

mainly Government, different regulatory bodies, Councils, members, students

and staffs and others who generously contributed monetary as well as their

whole hearted support for construction of the building. We all have the duty

and let us commit to create the building as an Icon of the accounting profession.

for the generation to generations.

Congratulation to whole ICAN Family !

The Editorial Board

ACCOUNTING

President's

Message

Since I took the charge of President last

year on 4 Shrawan 2070 (19 July 2013),

this is my fourth and last message to you

in the ICAN Journal as the President of

the Institute. At this point of time, I would

like to mention some of the major

activities undertaken during my

Presidency and also like to share with

you the activities where we need to put

more efforts to achieve them in order to

make the institute more credible and

professional as a whole.

It is a matter of great pleasure to the

entire membership that our long cherished

dream turned into reality with the

inauguration of newly constructed office

building of the Institute at Satdobato,

Lalitpur by the Rt. Honorable Dr. Ram Baran Yadav, the President

of Nepal on Sunday 13 July 2014 (2071/03/29). We take it as

one of the milestone achievement of the Institute. Without a

doubt the new office building shall provide us adequate

infrastructure facilities and reinforce the sustainability of the

Institute to some extent. This achievement has been accomplished

due to whole hearted support and cooperation of Government

of Nepal and entire membership.

International Financial Reporting Standards (IFRSs) has become

the global standards for the preparation of financial statements

by corporate entities. By virtue of Law ICAN has the

responsibility to make pronouncement and regulate the

implementation of Financial Reporting Standards based on

international developments. As per the roadmap of ICAN for

the IFRS implementation in Nepal, convergence will begin on

phase-wise-basis starting from financial year 2014-15 with

Multinational Manufacturing Companies and State-Owned

Enterprises (SOEs) listed in Security Exchange. The convergence

process shall be completed in fiscal year 2016-17 with the

application of IFRS for SMEs for those corporate entities not

covered by full set of IFRSs. The convergence with IFRS in the

Public Sector Enterprises (PSEs), the Government of Nepal has

fully supported to ICAN pronouncements with a close

coordination of Ministry of Finance. The Institute assumes this

initiative as a significant achievement since it is the outcome

of continuous effort of the Institute to convince the Government.

So far country of G20s, European Union and 40 other countries

The Nepal Chartered Accountant

June 2013

35

around the world have implemented IFRSs. In this context,

Nepal's decision for the way forward is to make more

conducive environment for the more investment

opportunities. In this course, we all regulators and

professionals need to be prepared to support the changing

demands.

ICAN has conducted different exams during a year. ICAN

has reached to have a one time examination systems from

CAP I to CAP III (Professional) levels and membership

examination with same syllabus, questions maintaining

same standard and uniformity. ICAN has setup four exam

centers at branch offices outside Kathmandu. ICAN has

made arrangement for online access to examination result.

Arrangement has been made for the CAs who qualified

from foreign institutions and interested to seek the

membership of ICAN will have to go through one year

internship from 2015.

The existing audit limit specified for RA members has

been increased substantially as per the current market

scenario and hoped that it will extend the scope of audit

and make them responsible.

The existing annual renewal fees of Membership, Certificate

of Practices (COP) and Auditing Firm for all ICAN's

member has been revised to make uniformity in scientific

way so as to maintain global practices.

Editorial policy has been formulated to provide a clear

guidance to Editorial Board (EB), authors, readers,

reviewers to improve the quality of journal.

ICAN has continuously organizing international level

program with the technical support of the Institute of

Chartered Accountants of India (ICAI). This year ICAN

organized ISA & IFRS course and recently organized

certification course on International Taxation.

ICAN is going to host two days International SAFA

Conference on the theme "Governance for Creating

Enabling Environment for Economic Development" on

18th&19th July, 2014 in Kathmandu. The Conference shall

confine on the contemporary issues on national economic

environment, corporate governance including transparency,

accountability, disclosure requirements and compliance

within the legal and regulatory framework. Organizing

such international events also helps enhancing capacity

and credibility of the Institute in the SAFA fraternity.

To establish ICAN as a competent professional and

regulating body it has started to accept the global level

accounting professionals within a certain level of CA

studies. In this course, ICAN has initiated to provide

exemption to ACCA qualified professionals' upto CAP II

level along with some exemption fee. Training to foreign

bodies qualified professionals approaching to ICAN

membership exam also is the another steps of this

approaches.

For maintaining the credibility of the Institute, regulating

the members is of prime importance and undertaking the

activities with this respect is challenging also. With this

view internal and external exercise is underway to form

a Quality Assurance Board (QAB) with adequate power

and duties and making it well-equipped. No doubt, QAB

will take over the existing arrangement of Peer Review

system. I hope this arrangement will reinforce the selfregulation system of the Institute that is highly needed too.

ICAN has been able to get success in maintaining the IFAC

requirement in education, examination and member capacity

building. To comply with IFAC requirement on CPE, ICAN

plans to implement to provide 120 credit hours with in the

three years cycle for accounting professionals.

The recent councils meeting has approved the ICAN

Strategic Plan 2014-16. This is also an achievement for us

to run our Institute with a long-term policy and program.

It is my duty to inform that GON is convinced and taken

initiation to work jointly with the Institute/professionals

for the implementation of International Public Sector

Accounting Standards (IPSAS) in the public sector. I think

this is an area where the government can collaborate with

us and ICAN can contribute significantly in improving the

financial management system in the public sector.

The scope of general-purpose financial statement and

specific purpose financial statements are truly different

fact. For this, at global level auditors report on both types

of financial statements are placed separately. Nepal also

needs to follow the global practices. ICAN is in course to

make pronouncement for separate disclosure requirement

on the preparation of financial statements and Auditor's

Reports thereon.

Council has modified the Criteria for Continued Professional

Education (CPE) to accommodate more professional

activities for the members participations at broader level.

The CPE program of ICAN is found one of the more

effective and successful activity of professional development

for the members in South Asia Region. Considering the

access of technology and its effectiveness ICAN is in

process to apply online CPE system.

ICAN has started to use of online ERP system for

maintaining total data-base of the Institute in a single

basket.

ICAN has contributed to the Government of Nepal by

providing suggestions on making amendments in the

prevailing Anti Money Laundering Act, Banking and

Financial Institutions Act and Banking Offence and

Punishment Act, 2008 as the amendment is in process.

The ethical violation and professional misconduct lodged

against some members, the process of studying and

reviewing the cases by the Disciplinary Committee (DC)

in some cases are finalized and some cases are in final

stage. ICAN is always responding all requests from judicial,

investigating and regulating bodies regarding the

disciplinary actions to our members. To establish ICAN

scope and responsibility on disciplinary actions against its

member, we had a detailed discussion with the secretary

of Ministry of Finance.

Last year the ethical issue of auditors was highly debated

and discussed among regulators, government authorities,

Institute and members. In this connection, many round of

formal and informal meeting were held with the concerned

authorities including written correspondence was made

for finding out the amicable solution of the problem and

have been solved with a minimum understanding with the

authorities. However, we have to be cautious while

rendering our professional services in the days to come.

Repetition of such kind of dispute is really matter of

concern for every stakeholder.

Political stability is very vital for over all development of

country. Once the present government write the constitution

and promulgate the constitution in federal structure that

will create conducive environment to attract for internal

and external investment. Such environment will be useful

for economic growth of the country. In that situation the

role of the accounting profession will also be increased in

contributing in the areas of good governance, transparency,

corporate governance, capital market etc. within the country.

We are being the witness on some of the good economic

indicators after the elected government is in place.

The Institute is regularly attending the meeting, seminar

and capacity development activities organized by SAFA,

CAPA and IFAC. I would like to inform that the decisions

taken, lessons learned and exposure gained from these

events are being applied in our context for the development

of the Institute.

There is no doubt that we have gained respect from society

but in the meantime we also need to compare with the way

the public perceive the other profession so as to justice

towards our self. This is directly related to the professional

conduct which is the basis by which the profession is

judged. We have to keep in mind that our conduct will

help enhancing our professional as well as institutional

image.

On behalf of the professions and ICAN, I extend my

gratitude to Rt. Honorable Dr. Ram Baran Yadav, the

President of Nepal for inauguration of new office building

of the Institute and we are highly encouraged from his

gracious presence.

I will not hesitate to admit that I have not been able to

accomplish the achievement as expected and remained

unfinished. I wish my successor for more initiatives to take

the Institute to a greater height and express my commitment

for regular supports.

In closing, I wish to express my sincere appreciation to

my fellow Council members, Committees members, all

members, regulating bodies, GoN's officials, and ICAN

staff who have worked for the cause of the Institute over

the year.

I Remain,

16th July 2014

CA. Mahesh Kumar Guragain

President

ACCOUNTING

Fully Depreciated Assets - IAS 16

IAS 16 permits 2 models for

subsequent measurement of

your property, plant and

equipment: cost model and

revaluation model.

Revaluing assets with zero

carrying amount will

effectively mean that there is

a Change in the Accounting

Policy and hence the company

will need to apply IAS 8.

Have you come across a situation

when you find that the block of assets

are fully depreciated in the books but

the company is still using them in its

operation to generate revenue?

In this case, the original estimate of

assets useful life proved to be

incorrect.

A survey proves that more than 95%

of the companies do not revise the

useful lives of their assets and book

the depreciation charge based on the

original rates determined for the block

of assets. As a result, the companies

are using fully depreciated assets for

their production processes.

These assets are used beyond their

useful life, they are fully depreciated

and their carrying amount in the books

is zero. What depreciation expense

can you recognize in the profit or loss?

What is the solution then?

None, of course - because the carrying

amount of the assets cannot be sub

zero. As a result, the matching

principle does not work here. The

expenses simply do not match the

benefits gained from these assets.

The standard IAS 16 Property, Plant

and Equipment defines the useful life

as either:

The period over which an asset

is expected to be available for

use by an entity, or

The number of production or

similar units expected to be

obtained from the asset by an

entity.

CA. Pooja Gupta

CA. Gupta is Fellow Member of ICAI &IFRS

author by choice with more than 16 yrs of

professional experience.

Now this is extremely important: IAS

16 requires entities to review assets'

useful lives at least at each financial

year-end.

When faced with such a kind of

situation the company can either:

1. Review the useful life of its assets

at the end of each financial year;

(IAS 8 - Change in Accounting

Estimate) or

2. Use Revaluation Model

(IAS 8 - Change in Accounting

Policy)

Review the useful life of its

assets at the end of each

financial year:

If you change useful life of the assets

then it is treated as a Change in

Accounting Estimate as per IAS 8

Accounting Policies, Changes in

Accounting Estimates and Errors. If

the revised useful life is different from

the original life then, set the new

remaining useful life, take the carrying

amount and recognize the depreciation

charge based on the carrying amount

The Nepal Chartered Accountant

June 2014

ACCOUNTING

and new remaining useful life.

No restatement of previous periods' financial statements

is required. IAS 8 requires recognizing change in accounting

estimates prospectively.

Revaluation Model:

IAS 16 permits 2 models for subsequent measurement of

your property, plant and equipment: cost model and

revaluation model.

Revaluing assets with zero carrying amount will effectively

mean that there is a Change in the Accounting Policy and

hence the company will need to apply IAS 8.

IAS 8 mentions that an Accounting Policy can be changed

in the following scenario:

standards how you will report certain transactions in the

financial statements - not only now, but also in the future.

So, do you think that changing your accounting policy

from cost model to revaluation model would make you

provide better information about your assets, not only now

but also in the future?

Revaluation model is used for buildings and land in

most of the cases, because it's easy to get the fair value

of these assets regularly. In case of movable assets like

plant or machine getting fair value from the market

gets a bit difficult.

Revaluation of the assets have to be done with sufficient

regularity, i.e. atleast annually.

1. The change is required by an IFRS. With our situation,

this definitely is not the case.

Entire class of assets and not an individual assets needs

to be revalued.

2. The change results in the financial statements providing

reliable and more relevant information about the effects

of transactions, other events or conditions on the

entity's financial position, financial performance or

cash flows.

To determine the fair value of the class of assets, IFRS

13 Fair Value Measurement standard needs to be

applied. This standard is complex and difficult for

movable assets.

In our case, the second situation will match to an extent.

But are we really considering the after effects of moving

from a cost model to revaluation model for our block of

assets?

Accounting policy means using the prescribed rules and

The Nepal Chartered Accountant

June 2014

If after considering the above concerns if it is still beneficial

for your company to switch from cost model to revaluation

model, the new depreciation accounting policy need not

be applied retrospectively, just prospectively - no

restatement of previous periods.

AUDITING

Reconciling Stakeholder Expectations of an Audit

Through Better Audit Management

It is for sure that if audit is carried

out with due professional care, it

will definitely lead to reasonable

assurance about the truth and

fairness of the financial statement,

the subject matter of audit. Thus,

it is important for auditors to

realize that the public continues

to expect a low rate of audit

failures and that they must plan

and perform their audit

procedures in a manner that will

minimize the risk of an undetected

material misstatement

To start with, let me quote a proverb

that says "The most difficult phase of

life is not when no one understands

you; it is when you don't understand

yourself". By quoting this proverb, I

am not trying to label all the blames

on the auditors for not delivering as

per the expectation of the stakeholders

but trying to emphasize that the

auditors are required to play a vital

role in reconciling the stakeholders'

expectation by understanding their

roles first and educating the others,

including the regulators and public at

large, what they actually do.

Context

CA. Nanda Kishore Sharma

CA. Sharma is Fellow Member of ICAN

We all appreciate that the auditing

profession worldwide commands

respect and demand for its services

primarily on account of the faith of

the public on its work. Auditing

standards are best practices that an

auditor uses in performance of its

attest function as these are framed to

ensure probity, integrity and quality

in the professional's work, essential

for ensuring the confidence of society

in the financial information being

reported by the business enterprises.

Although the profession has

steadfastly contended that its audit

reports are worthy of reliance,

however, did we have really heard

them and ensured that we have met

their expectation?

The Auditor's Position

The accounting profession has long

contended that an audit conducted in

accordance with generally accepted

auditing standards (GAAS) provides

"reasonable assurance" (as opposed

to "absolute" assurance) that the

subject financial statements are free

of material misstatements if read in

line with relevant accounting

framework. What is and why

reasonable assurance? I think the

problem lies here. We have never tried

to address the "expectation gap"- the

gap between the level of assurance

that financial statement readers expect

of an audit report and the level of

assurance that an audit report actually

provides.

The accounting profession rewrote

its auditing standards to provide moreexplicit guidance on the level of

assurance it provides and has, together

with accounting regulators, stepped

up its oversight and disciplinary

measures. These efforts did not,

however, eradicate financial frauds,

The Nepal Chartered Accountant

June 2014

AUDITING

and the public outrage in response to such massive frauds

as Enron, WorldCom, Satyam, Himalayan Bank, Nepal

Telecom, etc. In an effort to restore public confidence in

the audit process, commercial laws require the management

of public companies to establish and implement effective

internal controls and require their Board to certify as to

the effectiveness of those controls. In addition, the auditing

standards require that each public company's auditors also

evaluate the effectiveness of those controls in deciding

audit procedures and framing their opinion on the financial

statements. It is for sure that if audit is carried out with

due professional care, it will definitely lead to reasonable

assurance about the truth and fairness of the financial

statement, the subject matter of audit. Thus, it is important

for auditors to realize that the public continues to expect

a low rate of audit failures and that they must plan and

perform their audit procedures in a manner that will

minimize the risk of an undetected material misstatement

Stakeholders' Expectation

Audit affects a wide variety of people/parties (we refer to

them as 'stakeholders' of organisations) who have different

expectations. For example, we know that shareholders

want the audit to serve and protect their interests in the

organisations they own but:

directors may want auditors to support them in

discharging their responsibilities;

managers may want auditors to understand their

organisations and add value by providing business

advice and helping them to access finance at reduced

cost;

audit regulators may want auditors to be accountable

for meeting clear standards of performance and

maintaining audit quality;

regulators of organisations may see the audit as

providing comfort that organisations are complying

with their rules and regulations;

creditors and lenders may see the audit as providing

comfort that organisations will continue to be able to

pay for goods and services or finance;

audit firms may want auditing to provide challenging

and rewarding work for auditors so that they can

attract the brightest and best; and

employees may want the audit to provide some comfort

10

The Nepal Chartered Accountant

June 2014

about job security and the future direction of the

organisation.

The audit might be seen as one way of seeking some

comfort over these expectations. While people commonly

refer to stakeholder expectations of audit in a broad sense,

in practice, this can lead to confusion. Agency theory

provides an explanation of the purpose and role of the

statutory audit: relationships between principals

(investors/shareholders) and their agents (management)

are of particular importance in understanding how the

statutory audit has evolved over the centuries and continues

to develop. As agents, directors are delegated responsibility

for managing the affairs of the company by the owners

(the principal) and the financial statements have therefore

become a primary mechanism for shareholders to hold the

directors accountable . The independent opinion provided

enhances the confidence of shareholders in using financial

statements to assess the stewardship of directors and their

running of the company. The statutory audit, like other

assurance services, also requires auditors (or other

professional accountants) to assess and address any potential

threats to their independence.

Expectation Gap

Stakeholders have expectations both about what types of

audited information organisations should provide and about

the assurance aspects of audited information (for example,

what auditors do when they perform statutory audits). The

specific expectations of shareholders in relation to the

financial statements are constantly changing and auditing

and financial reporting standards have evolved in response.

Hence stakeholder dissatisfaction might arise where

expectations from either or both sets of expectations are

not met. If the audit was to attempt to meet all the different

expectations of stakeholders, whether these are additional

or congruent, there would be potential consequences that

could impact on the value of the audit. For example, the

information set to which the audit opinion is attached

would be likely to grow significantly, leading to problems

around assessing completeness and providing relevant and

easily accessible information. Even within the category of

shareholders of organisations there are conflicting interests

to address (long terms v/s short-term).

The expectations of other stakeholders create additional

audit expectation gaps. An expectation gap already exists

AUDITING

in the traditional agency model of audit in that shareholders'

expectations may be different to directors' expectations and

the expectations of auditors. Expectation gaps can be

identified in three specific areas: fraud, internal control

and going concern. This is not an exhaustive list and

expectations about the precision and accuracy of financial

statement balances could also be included.

If the audit was reshaped to meet these expectations then

it is very likely that its purpose would change. As a result,

it may become less meaningful to shareholders and the use

of the audit as a means of addressing the specific principalagent conflict may no longer be relevant. This has

implications for the role of the statutory audit as set out in

law and would affect auditors' responsibilities. This could

lead to a need for auditors to develop different skills and

would have consequences for auditors' risk management

processes and liability.

Also, expectations change over the years, as does the

importance of different stakeholders, particularly as a result

of the increasing level of information provided in the

financial statements and external scrutiny. Expectations

will also vary even within a particular category of

stakeholder.

Responding to Expectation Gap

There is a tendency growing over the years to shift all the

responsibilities towards the auditor without really

understanding their limitations in providing assurances in

all areas, besides assessing the compliance with the reporting

framework and giving opinion thereon.

There are clearly three ways to respond to the expectation

gap:

1.

Making the directors accountable to meet number of

expectation and responding to them,

2.

Adopting quality assurance mechanism by the auditors

in discharging their attest duties, and

3.

Last but not the least, educating all stakeholders,

starting from Ministry of Finance to the management

to public at large what audit really mean and what can

be expected from this exercise.

A) Director's Roles:

It is to be considered that:

directors have regard to all the relationships on which

the company depends with a view to achieving company

success for the benefit of shareholders as a whole; and

improvements be made to company reporting, which

for public and very large private companies would

require the publication of a broad operating and financial

review which explains the company's performance,

strategy and relationships (e.g., with employees,

customers and suppliers as well as the wider

community).

To run any organisation effectively, directors have to think

about its stakeholders. They are responsible for considering

the expectations of stakeholders, for deciding what

expectations they want to respond to (other than those

already enshrined in law), and for meeting them in whatever

way they consider to be the most appropriate. Directors

then identify the most appropriate way to meet expectations

that can and should be addressed. This may or may not

involve the auditors. The audit is not, therefore, the only

answer.

In responding to stakeholder expectations, directors of

organisations need to consider how they might deal with

concerns from stakeholders and how they can build relations

with stakeholders and address and balance their

expectations. There may be a number of ways to address

expectations. For example, organisations might engage

directly with their stakeholders, through website tools,

stakeholder forums and open days or they may use other

risk management techniques. Where stakeholders'

expectations include information in reports, directors of

organisations might consider that there is a need for

mechanisms, other than audit, to provide some comfort

over the information provided. The internal controls and

internal audit functions of the organisation may help to

support the credibility of information provided. Likewise

some organisations might choose to outsource specific

parts of their operations to other organisations with the

relevant experience and expertise that is required.

Alternatively, directors might consider that there is a need

The Nepal Chartered Accountant

June 2014

11

AUDITING

for other services that could be provided by professional

accountants. Such services could be specifically tailored

to meeting the needs of stakeholders, the intended users

of the information. There may therefore be a role for new

assurance services that would be worth exploring further.

B) Auditor's Roles

It is not the role of the audit or auditors to ensure that

organisations are meeting the expectations of their

stakeholders. They have to concentrate on improving their

way of doing work i.e. instituting quality assurance

mechanism within its auditing processes and building trust

by making scrutiny of its works from others. The challenges

the auditing profession are facing can be summarized as:

How can audit quality be further enhanced?

How can profession stay relevant from user

perspectives?

How to ensure profession's long-term sustainability?

Significant increase in complexity of financial reporting

and financial information disclosure?

The steps that auditors shall follow can be presented as 5

sequential steps as depicted in the chart below:

The auditor shall then carry out audit following relevant

auditing standards and tools and evaluate the controls in

place and collect evidences. The Auditor shall then look

at the impact of the finding at both account level and

financial statement as a whole and evaluate the conclusions

drawn from the audit evidences obtained as the basis for

forming an opinion on the Financial Statements, whether:

accounting policies applied are appropriate

estimates made by management are reasonable

information presented is relevant, reliable, comparable

and understandable, and

sufficient disclosures to enable users to understand the

effect of material transactions or events.

It is then the responsibility of the auditor to form an opinion

which is technically correct in the given circumstances

duly evaluating the impact of the audit evidences. It is

worth mentioning here that to ensure that the auditors have

carried out the audit in accordance with technical standards

and audit opinion issued was appropriate in the given

circumstances, it is necessary that the firm has established

quality control mechanism, in line with the requirement

of Nepal Standards on Quality Control.

C) Defining Audit

The auditors shall ensure that they are competent to take

up the assignment and have no threat to their independence

and integrity based on their assessment of risks. Before

they start the actual auditing, they must allocate resources

effectively and draw up client specific audit steps covering

additional audit procedures to address audit risks identified.

12

The Nepal Chartered Accountant

June 2014

The statutory requirement of reporting by auditor of all

accounting frauds and no mis-management by organisation's

staff, management and board (Section 115 (3) of Companies

Act and 65 of BAFIA) has raised a very pertinent question

of whether the auditor is expected to give an "Opinion" or

"Certification". Also there is a common belief of auditor's

signature equivalent to spraying "Ganga Jal" to make

everything "holy". There has been recent incidents of

putting the auditors behind the bars invoking "cheating"

clause of Muluki Ain (Civil Code) based on the above

reporting requirement by auditors. Thus, it's a high time

for every accounting professional to stand together in

educating the larger public, including the legislature about

the true meaning of audit and what they shall expect from

an audit opinion.

Conclusion

It can be argued that the case for regulated, mandatory

corporate social reporting can be made stronger by looking

AUDITING

at stakeholder theory, which is believed to provide an

appropriate framework from which to develop a corporate

single audit that is responsive to the information needs of

multiple corporate stakeholders. However, whether the

current accounting standard structure could develop

corporate social responsibility standards that meet the

needs of all stakeholders is a big question to answer. Even

if those within the current standard setting structure

mandated corporate social reporting, the mandatory aspects

are likely to reflect the interests of the most powerful

stakeholders. It can be concluded that the ultimate success

of a stakeholder- based corporate single audit would depend

on:

the development of reporting and attestation

requirements that lead to the dissemination of reliable

corporate social responsibility information; and

a change in the relative power of the corporate

stakeholder groups that influence the adoption of

regulated, mandatory corporate social reporting.

In seeking to try to reconcile all the expectations there is

a danger that the audit could end up making no one happy.

Thus, there is a need to reconcile the all stakeholders,

including auditors.

I conclude by quoting IFAC Policy Position: Regulation

of the Accountancy Profession, Dec 2007: "The

sustainability of the accountancy profession depends upon

the quality of the services provided by its members and

on the profession's capacity to respond effectively and

efficiently to the demands of the economy and society."

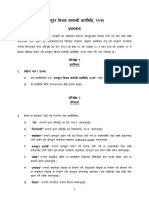

g]kfn rf6{8{ PsfpG6]G6\; ;+:yfsf] ljb]zdf a;]sf ;b:ox?nfO{ ;"rgf

o; ;+:yfsf] sfo{sfl/0fL ;ldltsf] ldlt @)&) cflZjg ! ut] a;]sf] a}7ssf] lg0f{ofg';f/

ljb]zdf /x]sf ;b:ox?sf] k]zfut k|df0fkq gjLs/0fsf ;DaGwdf b]xfo adf]lhd x'g] Joxf]/f

;DalGwt ;a}nfO{ hfgsf/L u/fOG5 .

s_ s'g} ;b:osf] 7]ufgf ;+:yfsf] clen]v cg';f/ ljb]zdf /x]sf] 5 eg] tL ;b:ox?sf]

k]zfut k|df0fkq gjLs/0f ul/g] 5}g .

v_ s'g} ;b:osf] 7]ufgf g]kfndf g} /x]sf] / sDtLdf ljut Ps aif{ b]lv lgh lab]zdf

/x+b} cfPsf] elg ;+:yfnfO{ cf}krfl/s jf cgf}krfl/s ?kdf s'g} klg dfWodaf6

hfgsf/L k|fKt ePdf tL ;b:ox?sf] k]zfut k|df0fkq gjLs/0f ul/g] 5}g.

t/, -s_ / -v_ df h'g;'s} s'/f n]lvPsf] ePtfklg ;DalGwt ;b:on] cfkm" /x+b} cfPsf]

b]zsf] k]zfut k|df0fkq ;lxt cfkm" ljb]zdf k"0f{sflng ;]jfdf g/x]sf] jf n]vfJoj;fo

afx]s cGo k]zf Joj;fodf ;+nUg g/x]sf] / cfkm\gf] 3f]if0ff eGbf km/s k|dfl0ft ePdf

cg'zf;g sf/jfxLsf] nflu tof/ 5' elg 3f]if0ff u/]df lghsf] k]zfut k|df0fkq gjLs/0f

ul/g] 5 .

The Nepal Chartered Accountant

June 2014

13

AUDITING

Need to Harmonize the Regulation of Audit

Introduction

The first major contributing factor

to audit quality is existence of

high quality audit standards

developed by IAASB and issued

to audit practice, called the ISAs,

which are being considered for

adoption worldwide. However,

audit practice supported by two

other bodies of standards namely

professional ethics and

professional education of

International Federation of

Accountants (IFAC).

CA. Paramananda Adhikari

Regulation of audit in 21st century is

in limelight due to the number of

debates that have developed since the

financial reporting scandals of big

corporate giants like Enron,

WorldCom, Xerox, Parmalat, Satyam

and many others after circa 2001.

Question on "regulation of audit" arose

largely as a response to these crises

that they were perceived as the big

audit failures in the corporate history

and the credibility of audit profession

is now in the forefront of the minds

of investors, corporate entities,

regulators, government and public as

well. Moreover, the issues are closely

related to the areas of harmonization

of audit practices, ethical compliance

and education to the members of

auditing professional across the globe.

The debate on audit regulation is

related to serious audit crisis and the

avenues for minimizing not only the

consequences but also in terms of

harmonization of practices across the

globe. Perhaps, harmonization of audit

regulation and practices should be a

goal of high priority among the

national and international regulators

since the world markets have

continued to become a global village.

CA. Adhikari is Technical Director of ICAN

14

The Nepal Chartered Accountant

June 2014

Auditing Profession: How it

is Regulated?

Before the enactment of SOX Act in

2002 in the US, it was perceived that

the auditing profession was selfregulated across the globe and the

Professional Accounting

Organizations (PAOs) authorized to

regulate auditing profession through

the power delegated by the

government. However, after the failure

of big corporate conglomerates, the

auditing profession has lost public

perception and led the credibility

question that create ground for need

to external regulation worldwide. As

a result, auditing profession is no

more self-regulated and in many

countries government carried out the

regulation through an oversight

agency/body. The major concern of

the stakeholders and public is the issue

of independence of the professionals.

Overcoming the independence issue

means having a strong and robust

process that may invite the formation

of public interest oversight agency to

regulate the profession.

Substance of Audit

Regulation

Despite the global initiatives to

improve the audit regulation, concern

arose how to address the credibility

AUDITING

issues of auditing profession in local jurisdiction, since

the national scenario may not be exact with the global

situation. The only possible way to narrow the gap would

be following the audit standards and practices thereon to

the extent possible and harmonize the national regulation

with international regulation that needs to achieve

convergence in regulation, ethical compliances and reporting

practices. The system of harmonization is neither easy nor

automatic but it requires compliance of standards, ethical

pronouncements and strict commitment by the members

of PAOs. Normally, local regulation is built on common

precepts, principles and implements common standards,

then differences may occur in the form but not in substance.

The development of common precepts, principles and

standards can serve as new globalized instruments and

these standards will have global legitimacy and applicability

over the substance in audit regulation.

How to Harmonize the Audit Regulation?

Regulation is the combination of organization rules, policies

and practices that result the accountability and transparency

in policies, practices and reporting to the public. Regulation

is the result that the number of stakeholders, society, general

public perceives and responds to risk. Good regulation

serves the public interest through supporting the building

and maintenance of confidence in processes, in which the

public participates, such as auditing, on which the public

relies heavily upon the financial reporting and function of

auditors. To harmonize the regulation of auditing profession,

it requires the technical knowledge/expertise, skills,

adequate experience, attitude and ethics of those who are

in profession and response to the need for standards to be

adhered by them. Audit regulation can thus be seen as the

system providing confidence in the reliability of financial

markets and services generally, and financial reporting in

particular. The need for and nature of regulation is

dependent on the profession specific and the market

expectations in which it operates. Therefore,

convergence/harmonization in auditing profession would

assist in making the national financial system and reporting

practices similar to the international financial system and

reporting practices which will be more efficient as well as

robust.

Why for Audit Regulation?

The main objective of audit regulation is to safeguard the

public interest from financial and other risks and protection

of market participants from compliance risks. This applies

especially to investors who invest in capital market, others

who trust financial institutions to safeguard their deposits

and ensure reliable rate of return/income on their investment.

Additionally, it is to be said that good regulation should

be viewed as a driving force for reliable and high quality

financial services/reporting practices towards the public.

Regulatory reform for harmonization is need of the hour

due to the perceptions of the public for the inadequacy of

existing systems and lacuna worldwide. It requires action

to avoid a loss of trust and confidence, whether we like it

or not, that would undermine the entire audit profession

that will fill up the perceived vacuum of governance,

transparency, accountability and confidence.

Auditing Standards: Are they Principles or

Rules?

Audit and assurance standards pronounced by the PAOs

in their local jurisdiction and their strict compliances is

the key factor for successful regulation of the audit

profession. If the profession is to perform high quality

work in the public interest, it needs to have high quality

standards that are set in the public interest. Standards are

backbone of the auditing profession and not divergence

jurisdictions to jurisdictions and perceive the uniform

application worldwide. Therefore these are the principles

and not rules. Nevertheless, principles often include rules

to assist in their implementation. Therefore, some people

will ignore legal requirements despite of their form of

expression; others will look to circumvent the law by acting

within its form but ignoring its spirit or substance. If we

trust someone, simply because legal practices apply for

breaking rules or avoiding rules, we do not, in fact, trust

them at all. To make regulation respectful, it should be

designed to serve clear objective, transparent, accountable

with respect to implementation results and it should allow

room for honest judgment, even honest mistakes so as not

to crack down initiative and innovation.

How to Harmonize the Audit Quality?

Question may arise on how harmonization of regulation

can enhance the Audit Quality? And how will progress

towards convergence in audit quality? The first major

contributing factor to audit quality is existence of high

The Nepal Chartered Accountant

June 2014

15

AUDITING

quality audit standards developed by IAASB and issued

to audit practice, called the ISAs, which are being considered

for adoption worldwide. However, audit practice supported

by two other bodies of standards namely professional ethics

and professional education of International Federation of

Accountants (IFAC). The International Ethics Board for

Accountants (IESBA) and International Accounting

Education Standards Board (IAESB) are operate under

the auspices of IFAC and subject to direct oversight by

the Public Interest Oversight Board (PIOB) which works

to ensure that standards set are consistent with due regard

for public interest. Thus the regulation of standard setting

is also subject to international supervision. The other

contributing factor to audit quality is the way in which

standards are implemented and applied in their respective

jurisdictions. The policies and actions that determine the

quality of implementation are depending on local audit

regulators, which must coordinate with international bodies

to harmonize the quality of audit and reporting practices.

Safeguards are actions or other measures that may eliminate

risks or reduce such risks to an acceptable level. Further

auditor's independence play the important role to maintain

the risk associated with the business entities. Auditor's

independences should be both in fact i.e. real independence

and appearance i.e. perceived independence. The SOX

Act, 2002 was a legal reaction of the auditor's independence.

Reputation is a significant driver in any profession including

auditing. Loosing reputation means no confidence/trust by

the public. Therefore, integrity is a prerequisite for all

those who act in the public interest. The auditing standards

are for compliance by the professional auditors to discharge

their responsibilities in favor of public interest. These

standards are subject to broad consultation with the

stakeholders and are monitored on a continuous basis by

the PAOs. Compliance of the standards, also called as the

safeguards, by the professional accountants in practice are

the minimum benchmarks to minimize the risk associated

with audit. These safeguards seek to obtain a quality of

audit which incorporates technical expertise and remains

responsive to the needs of a broad range of stakeholders

as well as the public interest. Moreover, audit quality is

not solely dependent only on Auditing Standards, but also

premised on ethical behavior and professional education

of the members.

The Nepal Chartered Accountant

How to execute/implement the audit quality may be the

emerging issue to the professional auditors. However, the

answer would be successful implementation of standards.

Convergence of audit practice and audit quality will depend

on multiple actors and multiple factors. Audit firms which

develop methodologies for audit practice will shape the

way their members approach their audit assignments.

Smaller firms will shape their practice based on

implementation guidance provided by the standard setting

bodies which in many cases will be, or will be assisted by,

national or international accounting bodies. Regulator of

audit will also play an important role by ensuring

compliance of standards and by developing common

principles and implementation guidance for their practices.

The formation of an international forum of audit regulators

is a promising platform for this work on convergence of

audit quality across the world.

Sum Up

What are the Safeguards?

16

How to Execute the Audit Quality?

June 2014

How the auditing profession should be regulated has been

the subject of much debate in recent years. As a result,

there have been much consequential changes in different

play makers in financial reporting including professional

accountants, their clients, PAOs and government.

Government also seeks to ensure that the profession should

deliver high quality services to the corporate and other

entities and contributes to economic growth and

development of the country. In international arena, the

PIOB is involved for implementation of standards through

its oversight, i.e. IFAC member body compliance program

popularly called SMOs. These SMO obligations are used

as a framework for the development of strong accountancy

profession and they provide clear benchmark for PAOs

and their best endeavors to implement international

standards of audit, ethics and education to harmonize the

audit regulation worldwide. This program can prove to be

a very important support for implementation of international

standards, convergence of audit practice and audit quality.

Therefore, the use of principle based standards for audit,

the formation of an appropriate mix of external and selfregulation and the establishment of transparent, accountable,

effective regulation are guarantees for the achievement of

high quality audit services and reporting practices thereon.

AUDITING

Risk Based Internal Auditing:

Nepalese Banking Perspective

In banking industry, having

realized this fact, Nepal Rastra

Bank has also recommendedvia

Inspection Reports, to implement

Risk Based Internal Audit

(RBIA).Some of the MultiNational entities in Nepal

havealready implemented Internal

Auditing which is linked with

overall risk management

framework of the organization.

Internal Auditing helps an organization

accomplish its objectives by bringing

a systematic, disciplined approach to

evaluate and improve the effectiveness

of risk management, control, and

governance processes.Internal audit

needs to communicate in the language

of the business and of the board of

directors.Basis this, most of the

organizations in Nepal have made the

Internal Audit Department functional.

Even if organizations seem to have

realized the importance of internal

auditing, most of the organization

have set the structure of Internal

Auditing as Compliance Based Audit

and designed to serve the organization

as fault finding exercise.

Under compliance based internal

auditing, auditor assesses almost all

functions of the bank, reviews the

policies, procedures and results of the

bank functions, lists the exceptions

and communicate.

CA. Ramesh Dhital

CA. Dhital is Member of ICAN

However, there are various reasons to

think beyond Compliance Based

Internal Audit considering the

increased audit risk. In banking

industry, having realized this fact,

Nepal Rastra Bank has also

recommendedvia Inspection Reports,

to implement Risk Based Internal

Audit (RBIA).Some of the MultiNational entities in Nepal havealready

implemented Internal Auditing which

is linked with overall risk management

framework of the organization.

Risk Based Internal Auditing

Risk Based Internal Auditing (RBIA)

is defined as a methodology that links

internal auditing to an organization's

overall risk management framework.

RBIA allows internal audit to provide

assurance to the board that risk

management processes are managing

risks effectively, in relation to the risk

appetite.

Every organization is considered as

different, with a different attitude to

risk, different in its structure, different

processes and different environment.

Internal auditors are expected to adapt

these ideas to the structures, processes

and environment of their organization

in order to implement RBIA. RBIA

seeks at every stage to reinforce the

responsibilities of management and

the board for managing risk.

RBIA will assess the effectivenessof

board oversight i.e. initiations,

approvals, oversight proactive,

prudent and reasonablenessof senior

management; soundness of corporate

governance;independence of audit

functions; robustnessof internal

control system; independence of

reporting lines;role of middle offices

The Nepal Chartered Accountant

June 2014

17

AUDITING

to assess all types of risks; strategic orientation; efficiency

of MIS and soundnessof risk management practices.

The risk based audit plan:

Summarize the current assessment of risk management,

controls and governance process.

Includes a list of organizational activity and core

management controls that could be considered forthe

audit.

functional line managers

Review of Credit Files Assessment of risks

Review of past report of NRB Inspections

Analysis of Budget variance/target variance

Analysis of Growth of unit/department and branches

Structure of function

Sample review/transaction

Demonstrate the areas with higher risk.

Review Management commitments

Provide, over a certain period, assurance on important

aspects of the risk management, controls and

governance process.

Quality of prudential reports submitted to NRB

Advantages of RBIA

By following RBIA, internal audit should be able to

conclude that:

Management has identified, assessed and responded

to risks above and below the risk appetite

The responses to risks are effective but not excessive

in managing inherent risks within the risk appetite

Where residual risks are not in line with the risk appetite,

action is being taken to remedy thatRisk management

processes, including the effectiveness of responses and

the completion of actions, are being monitored by

management to ensure they continue to operate

effectively

Risks, responses and actions are being properly

classified and reported.

Risk Assessment

Risk assessment in a bank can be initiated in following

way

Meeting with senior management of Bank

Meetings and interview with compliance officers,

department heads, AML and other Risk

Managers/Officers (related to middle office/control)

Meetings with Risk Management Committee, ALCO

and other risk governance bodies

Meeting with Board members

This enables internal audit to provide the board with

assurance that it needs on three areas:

Risk management processes, both their design and how

well they are working

Management of those risks classified as 'key', including

the effectiveness of the controls and other responses

to them

Complete, accurate and appropriate reporting and

classification of risks

Meeting with External Auditors

Review of documents and Interviews with other

18

The Nepal Chartered Accountant

June 2014

Risk Mitigation and RBIA Execution

AUDITING

Risk can be managed with the help of risk register to

identify the risks associated with all auditable activities.

Firstly, auditor can establish the process map after obtaining

all information from the established policies and procedures

of the bank and conduct interviews with the process owners

followed by a walk through test and draw a process flow

chart to understand the working and steps to complete one

activity under one process. With this auditor can identify

the control weaknesses at each individual step of the process

for determining the extent of checking.

RBIA will require board of directors to take active

responsibility for running the bank. It will force the banks

to have comprehensive risk management programs to cover

major risks leading to formal risk management structure

and function (Risk Management Committee or Risk

Manager).

The implementation and ongoing operation of RBIA has

three stages:

Implementation of RBIA

Implementing RBIA will require greater interaction with

top management of banks,clear understanding of risks and

risk management systems of banks,capacity to assess

quantity, quality and direction of risks,ability to

communicate in clear and concise manner both CAMELS

and Risk Ratings. Accordingly, more time is spent on

planning. All these will lead to timely corrective actions

upon identifying excessive risk taking.

The major changes from compliance based audit to risk

based audit can be analyzed on grounds:

Past Vs Future orientation

Ticking exercise Vs Analysis and Assessments

Scheduled / Routine Vs Risk Based

Symptoms Vs Root Cause

Besides reviewing documents and transactions, emphasis

is given to interviews, interactions and discussions with

Board, Senior Management, Head of the Departments and

Internal Control Questionnaires. Banks credit reviews are

performed in more forward looking approaches (including

borrowers' strength of financials, ability to repay via cash

flow, international best practices and standards)

Stages of implementation and ongoing operation of RBIA

Conclusion

The effectiveness of the Bank's internal control system

should be reviewed regularly by the Board, its committees,

Management and Internal Audit. The Audit Committee

should review the effectiveness of the internal control.

Apart from compliance with policies and standards and

the effectiveness of internal control structures across the

Bank through its program of business/unit audits, the

Internal Audit function should focus on the areas of greatest

risk as determined by a risk-based assessment methodology.

Even though the RBIA has not been mandated, the intention

of the NRB seems to be in this direction. The format of

LFAR also contains Audit Areas' Risk Assessment, Audit

procedures adapted to mitigate identified audit risks and

audit Quality Control Mechanism.RBIA implementation

can take a paceupon clear provision and guidance and

slight alignment in NRB Directive 6,7 and other relevant

NRB circulars on RBIA.

The Nepal Chartered Accountant

June 2014

19

ECONOMY

Fiscal Risks and Related Transparency Issues

Introduction

Fiscal transparency refers to the

clarity, reliability, frequency,

timeliness, and relevance of

public fiscal reporting and the

openness to the public of the

government's fiscal policymaking process.

CA. Chandra Kanta Bhandari

CA. Bhandari is Fellow Member of ICAN

20 The Nepal Chartered Accountant

Government must be open and

responsive to the citizen. To be

claimed as an open and responsive

government, it should always keep on

watch about its fiscal position and get

all stakeholders informed about fiscal

risks, strategies to response those risks.

Fiscal risk generally refers to the

factors that lead to differences between

a government's forecast and actual

fiscal position.

It is imperative that public fiscal

reporting should be comprehensive,

of high quality and timely. It would

help policy makers and government

for effective fiscal policy making and

the management of fiscal risks. So,

Fiscal transparency is now, especially

recent financial crisis in US and

Europe has been regarded as a critical

element in public governance. Fiscal

transparency typically requires

government to develop and adopt a

set of accepted standards for

comprehensive, qualitative and timely

disclosers of fiscal information and

monitor regularly and respond the

risks therein. This also requires

openness to the public of the

government's fiscal policy making

process.

Therefore, Fiscal transparency refers

June 2014

to the clarity, reliability, frequency,

timeliness, and relevance of public

fiscal reporting and the openness to

the public of the government's fiscal

policy-making process. Fiscal

transparency can be maintained

through public fiscal reporting which

refers to the publication and

dissemination of information about

the state of the public finances to

citizens in the form of fiscal forecasts

(in fiscal strategy or budget

documents), government finance

statistics (fiscal reports produced in

accordance with statistical standards),

or government financial statements

or accounts (fiscal reports produced

in accordance with accounting

standards).

Nature and Sources of Fiscal

Risks

Fiscal risks may be relating to or come

from transaction or institution or both.

So, nature and sources of fiscal risk

could be as follows:

Relating to Transaction:

Macroeconomic shocks to budgeted

revenue and spending,

Extra budgetary spending,

Unfunded civil service pensions,

Government guarantees,

ECONOMY

Commodity prices,

Financial transactions,

Public-Private Partnership

Relating to Institution:

Central Government,

Sub-national Government,

Public corporations,

Social security institutions,

Extra-budgetary Funds,

Financial sector

Benefits of Fiscal Transparency

Fiscal transparency helps ensure that government's

economic decisions are informed by a shared and accurate

assessment of the current fiscal position, the costs and

benefits of any policy changes, and the potential risks to

the fiscal outlook. Fiscal transparency also provides

legislatures, markets, and citizens with the information

they need to make efficient financial decisions and to hold

governments to account for their fiscal performance and

their utilization of public resources. It also facilitates

international surveillance of fiscal developments and helps

mitigate the transmission of fiscal spillovers between

countries. Following are the some of the examples on how

fiscal transparency can help in managing fiscal risks:

More frequent and timely public reporting of fiscal

developments can help ensure that fiscal forecasts

are based on the most up-to-date understanding of

the current fiscal position and facilitate rapid policy

responses to shocks;

Comparisons with independent forecasts, and

alternative macro-fiscal forecast scenarios can help

ensure that fiscal forecasts are credible and fiscal

policy settings are robust to a range of macroeconomic

outcomes;

Fiscal risk statements can raise awareness of the

magnitude of potential shocks to the public finances

and encourage government to mitigate or provide

for those risks;

Expanding the institutional coverage of public fiscal

reporting can reduce the scope for off-budget fiscal

activity whose costs can later rebound on the

government;

Implementation of international accounting and

statistical standards can highlight otherwise hidden

costs or obligations and encourage governments to

budget for them;

Aligning the methodologies and standards for fiscal

forecasting, budgeting, and reporting can help

eliminate unexplained inconsistencies between

forecasts and outturns; and

Publication of audit reports in accordance with

internationally accepted standards can highlight

weaknesses in government financial control or

accounting practices and prompt initiation from

governments to address them.

Where we are now?

As to fiscal risk identification, assessment and responding

to risks and making stakeholders informed in this regards,

Nepal lacks in all respects; identification, assessment,

responding and fiscal transparency discloser. Ministry of

Finance, central bank; the Nepal Rasta Bank (as a financial

sector regulator and financial adviser to the government)

and Financial Comptroller General Office (FCGO) are

primarily responsible regarding identification, assessment,

and addressing such identified fiscal risks and disclosing

fiscal transparency. There lacks integrated reporting system.

Though Ministry of Finance has set one of its strategic

goals "Adapt transparent as well as accountable fiscal and

financial information system", it rarely conducts rigorous

studies on fiscal risks except forming high level committees

time to time. It further lacks such manpower having

knowledge, skills and expertise in fiscal management.

Nepal Rasta Bank occasionally forms task force/ or a

committee to study on fiscal issues, however, it is not as

system but as a single event. It publishes Economic Reviews,

Economic Bulletins and Indicators, Working Papers, Study

reports as a routine publication; however, they are

specifically focused on fiscal risks and fiscal transparency

disclosures. The FCGO, as a government's central

accountant and financial management wing, is unable to

include financial and quasi-financial transactions of all

The Nepal Chartered Accountant

June 2014

21

ECONOMY

public sectors and prepare a consolidated financial report

of whole public sectors.

and do have fiscal implications. These comprise

non-financial corporations and financial public

corporations (including the central bank). Broadening

the institutional coverage of fiscal analysis would

improve understanding of fiscal risks Public

corporations need to be part of any comprehensive

analysis of public finances since their debts are often

implicitly or explicitly government-guaranteed.

Challenges in Reporting the Fiscal Position

of the whole Public Sector

Lack of human, physical and other resources as to

robust information system, particularly with central

agency of the government responsible to report

overall financial position of the government.

(b)

More comprehensive reporting of assets and

liabilities - government usually holds significant

number of financial and non-financial assets and

liabilities. So, the government financial statement

is to include comprehensive balance sheets reporting

the value of government financial and nonfinancial

assets and liabilities. Providing a more

comprehensive picture of overall sovereign net worth

requires reporting standards to capture a broader

range of direct and contingent assets and liabilities.

This further requires recognition of provisions in

respect of a broader range of contingent liabilities

in accounts and supplementary summary statistics

provided that the amounts can be reliably valued.

These contingent liabilities should be valued at their

market, fair, or expected present value, taking into

account the probability of the liability being called

and the amount and timing of any resulting payments,

unless there is a clear moral hazard case for nonrecognition.

(c)

Recognition of a broader range of transactions and

other economic flows - to identify fiscal position

and identify risks, government should recognize all

transactions that have financial bearings in broader

range. There are transactions including derivatives

which pose government into significant fiscal risks

where there is lack of standards to provide guidance

on incorporating them in overall fiscal analysis.

(d)

More frequent and timely fiscal reporting - Lack of

timely information about the current fiscal position

can also be an important source of risks.

Governments should publish detailed financial

reports on a quarterly and monthly basis.

(e)

More rigorous approach to fiscal forecasting and

risk analysis - the methodology, construction, and

time horizon of fiscal forecasts and budgets are the

some of important aspects to be considered. The

Recognition and measurement complexities involved

regarding financial and non-financial assets and

liabilities that government hold is another big

challenge.

In some cases, conceptual and practical differences

between the accounting used by national governments

and public corporations.

public corporations that use commercial accounting

do not typically regard investment in fixed assets as

a cost (as it creates a corresponding asset on their

balance sheet), while most governments treat capital

expenditure as a cost as it increases their primary

measure of the deficit (net borrowing);

revenues from the voluntary commercial activities

of public corporations are conceptually different

from those that governments derive from compulsory

taxation, therefore simply adding the two together

would overstate the tax burden;

consolidation of public corporations' gross liabilities

with those of the general government could overstate

the financial vulnerability of the public sector as the

liabilities of public corporations are typically matched

by commercial assets; and

consolidating the central bank with the rest of the

public sector requires a different treatment of the

former's monetary liabilities, as the issuance of base

money generally does not give rise to a fiscal

imbalance.

Strengthening Fiscal Transparency: How?

(a)

More complete coverage of public sector institutions

- in most countries there is a range of public entities

outside the general government whose activities can

22 The Nepal Chartered Accountant

June 2014

ECONOMY

approach should be prospective fiscal reporting

incorporating assumptions of alternative scenarios

and their financial implication rather than using a

single scenario.

(f)

Alignment of standards for budgets, statistics, and

accounts - divergence in the reporting concepts used

in ex ante budgets and ex post statistics and accounts