Tax Notes Chapter 3

Diunggah oleh

Sam ReyesHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Tax Notes Chapter 3

Diunggah oleh

Sam ReyesHak Cipta:

Format Tersedia

Chapter 3 Persons Subject to Income Tax

Sec. 22(A) of the NIRC, Person means:

A.

B.

C.

D.

Individual

Corporation

Estates and Trusts

Other entities including partnership. [Sec. 22 (B)]

A. INDIVIDUALS

1. Resident citizen (RC) a citizen of the PH residing therein is taxable on all income

derived from sources with and without the PH.

2. Non-resident citizen (NRC) taxable only on income derived from sources within

the PH.

3. Overseas contract worker (OCW) commonly referred to as OFWs individual

citizen of the PH who is working and deriving oncome from abroad as an overseas

contract worker is taxable only on income derived from sources within the PH.

Provided, that a seaman who is a Filipino citizen and who receives compensation

for services rendered abroad as a member of the complement of a vessel engaged

exclusively in international trade shall be treated as an overseas contract worker.

4. Resident alien (RA) taxable only on income derived from sources within the PH.

5. Non-resident alien engaged in trade or business (NRAETB) - taxable only on

income derived from sources within the PH.

6. Non-resident alien NOT engaged in trade or business (NRANETB) - taxable

only on income derived from sources within the PH.

B. CORPORATIONS

1. Domestic Corporation (DC) taxable on all income derived from sources within

and without the PH.

2. Resident foreign corporation (RFC) taxable only on income derived from

sources within the PH.

3. Non-resident foreign corporation (NRFC) taxable on income derived from

sources within the PH.

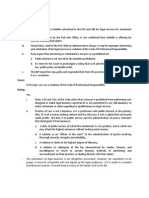

Taxpayer

1. RC

2. RA, NRC, NRAETB,

NRANETB

3. DC

4. RFC & NRFC

Items on gross

income

Within

Without

C. ESTATES AND TRUSTS

In Sec 60, tax shall apply to income of estates or of any kind of property held in trust,

including:

1. Income accumulated in trust for the benefit of unborn or unascertained person or

persons with contingent interests, and income accumulated or held for future

distribution under the terms of the will or trust;

2. Income which is to be distributed currently by the fiduciary to the beneficiaries, and

income collected by a guardian of an infant which is to be held or distributed as the

court may direct;

3. Income received by the estates of deceased persons during the period of

administration or settlement of the estate; and

4. Income which, in the discretion of the fiduciary, may be either distributed to the

beneficiaries or accumulated.

D. OTHER ENTITIES INCLUDING PARTNERSHIPS

In Sec. 22 (B), the term corporation shall include:

1. Partnerships, no matter how created or organized, but does not include:

a. General professional partnerships

b. Joint venture or consortium formed for the purpose of undertaking construction

projects

c. Joint venture or consortium formed for the purpose of engaging in petroleum,

coal, geothermal and other energy operations pursuant to an operating

consortium agreement under a service contract with the Government.

2. Joint-stock companies

4. Association

3. Joint accounts

5. Insurance companies

Anda mungkin juga menyukai

- Republic of The Philippines Department of Finance: Privatization and Management OfficeDokumen6 halamanRepublic of The Philippines Department of Finance: Privatization and Management OfficeSam ReyesBelum ada peringkat

- Affidavit of Non-EmploymentDokumen1 halamanAffidavit of Non-EmploymentSam ReyesBelum ada peringkat

- Affidavit of Non Employment RamalesDokumen1 halamanAffidavit of Non Employment RamalesSam ReyesBelum ada peringkat

- 2021 Bar RequirementsDokumen1 halaman2021 Bar RequirementsSam ReyesBelum ada peringkat

- Republic of the Philippines passes anti-sexual harassment lawDokumen3 halamanRepublic of the Philippines passes anti-sexual harassment lawErika Jane Madriago PurificacionBelum ada peringkat

- Student ApplicationforgraduationDokumen1 halamanStudent ApplicationforgraduationSam ReyesBelum ada peringkat

- Corporation Law Course SyllabusDokumen22 halamanCorporation Law Course SyllabusJasOn EvangelistaBelum ada peringkat

- Manage documents, plans, reports for PMO propertiesDokumen2 halamanManage documents, plans, reports for PMO propertiesSam ReyesBelum ada peringkat

- Academic Appeal Request Form: "T C 1 P U"Dokumen3 halamanAcademic Appeal Request Form: "T C 1 P U"Sam ReyesBelum ada peringkat

- NotesDokumen3 halamanNotesSam ReyesBelum ada peringkat

- Anti-Trafficking of Persons Act of 2003 - RA 9208Dokumen11 halamanAnti-Trafficking of Persons Act of 2003 - RA 9208Ciara NavarroBelum ada peringkat

- Dean Gemy Lito L. Festin., Ll. MDokumen1 halamanDean Gemy Lito L. Festin., Ll. MSam ReyesBelum ada peringkat

- NotesDokumen3 halamanNotesSam ReyesBelum ada peringkat

- Bautista FINALDokumen21 halamanBautista FINALSam ReyesBelum ada peringkat

- Student ApplicationforgraduationDokumen1 halamanStudent ApplicationforgraduationSam ReyesBelum ada peringkat

- Conflicts ReportingDokumen9 halamanConflicts ReportingSam ReyesBelum ada peringkat

- Maquiling Vs COMELEC DigestDokumen3 halamanMaquiling Vs COMELEC DigestSam Reyes100% (2)

- Corporation Law - Class Participation Parts 3 and 4Dokumen10 halamanCorporation Law - Class Participation Parts 3 and 4Sam ReyesBelum ada peringkat

- Polirev Concepts - Election LawDokumen11 halamanPolirev Concepts - Election LawSam ReyesBelum ada peringkat

- Special Penal Laws PDFDokumen121 halamanSpecial Penal Laws PDFConnor McMahan100% (2)

- 2016 Revised Rules On Small Claims - Sample FormsDokumen33 halaman2016 Revised Rules On Small Claims - Sample FormsEliEliBelum ada peringkat

- Ra 10022Dokumen23 halamanRa 10022Kristin SotoBelum ada peringkat

- 2 General Guidelines Conflicts2019Dokumen14 halaman2 General Guidelines Conflicts2019Sam ReyesBelum ada peringkat

- 2-Summons, As AmendedDokumen1 halaman2-Summons, As AmendedVladimir Sabarez LinawanBelum ada peringkat

- Labor Law 2015 ChanDokumen133 halamanLabor Law 2015 ChanIris Torrente100% (9)

- Batch 8Dokumen61 halamanBatch 8Sam ReyesBelum ada peringkat

- IHLDokumen8 halamanIHLSam ReyesBelum ada peringkat

- SPL Final ExamDokumen7 halamanSPL Final ExamSam ReyesBelum ada peringkat

- Olaguer vs. Military Commission No. 34Dokumen4 halamanOlaguer vs. Military Commission No. 34Sam Reyes100% (2)

- Labor Law 2015 ChanDokumen133 halamanLabor Law 2015 ChanIris Torrente100% (9)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Home Savings & Loan Bank v. Dailo DigestDokumen1 halamanHome Savings & Loan Bank v. Dailo DigestAce DiamondBelum ada peringkat

- Group 3 PaleDokumen16 halamanGroup 3 PaleRinielBelum ada peringkat

- Kone Elevators CaseDokumen2 halamanKone Elevators Casealok_jallanBelum ada peringkat

- Defendants Motion For Summary JudgmentDokumen13 halamanDefendants Motion For Summary JudgmentGuy Madison NeighborsBelum ada peringkat

- Good King Wenceslas: G G G J G G K KDokumen2 halamanGood King Wenceslas: G G G J G G K KartistoideBelum ada peringkat

- Enriquez vs. Sun Life Insurance of CanadaDokumen2 halamanEnriquez vs. Sun Life Insurance of CanadaJohn Mark RevillaBelum ada peringkat

- WILLS ESSENTIALS: EXECUTION, REVOCATION, BENEFICIARIESDokumen3 halamanWILLS ESSENTIALS: EXECUTION, REVOCATION, BENEFICIARIESeyehudah100% (1)

- Web Search - Hollis Randall Hillner OPPT TrusteeDokumen12 halamanWeb Search - Hollis Randall Hillner OPPT TrusteeVincent J. CataldiBelum ada peringkat

- 67.city of Cabanatuan v. LazaroDokumen2 halaman67.city of Cabanatuan v. LazaroAsh MangueraBelum ada peringkat

- Sections List:-Business Law: Ca Ankit OberoiDokumen8 halamanSections List:-Business Law: Ca Ankit OberoiAkash BabuBelum ada peringkat

- CITY OF MANILA Petitioners vs. HON. ANGEL VALERA COLET As Presiding Judge Regional Trial Court of Manila Br. 43 and MALAYSIAN AIRLINE SYSTEM Respondents. G.R. No. 120051 December 10 2014 PDFDokumen27 halamanCITY OF MANILA Petitioners vs. HON. ANGEL VALERA COLET As Presiding Judge Regional Trial Court of Manila Br. 43 and MALAYSIAN AIRLINE SYSTEM Respondents. G.R. No. 120051 December 10 2014 PDFTan Mark AndrewBelum ada peringkat

- Quit Claim Affidavit Title DisputeDokumen2 halamanQuit Claim Affidavit Title Disputefaith rollanBelum ada peringkat

- MCQs On Transfer of Property ActDokumen46 halamanMCQs On Transfer of Property ActRam Iyer75% (4)

- Applcation of Class CDokumen11 halamanApplcation of Class CvermaxeroxBelum ada peringkat

- NDA (Musical or Audio Recording) - Legal GuideDokumen9 halamanNDA (Musical or Audio Recording) - Legal GuideCanadaLegal.comBelum ada peringkat

- REVIEW NOTES FOR LAW ON AGENCY RELATIONSHIPSDokumen11 halamanREVIEW NOTES FOR LAW ON AGENCY RELATIONSHIPSJanetGraceDalisayFabreroBelum ada peringkat

- Hook's DeclarationDokumen8 halamanHook's DeclarationLaw&CrimeBelum ada peringkat

- Manila Banking Corp Vs TeodoroDokumen4 halamanManila Banking Corp Vs TeodoroKT100% (1)

- Lim vs. RementeriaDokumen6 halamanLim vs. RementeriaRobby DelgadoBelum ada peringkat

- Matabuena vs. FernandezDokumen2 halamanMatabuena vs. FernandezJohney DoeBelum ada peringkat

- Ang Vs American Steamship Agencies, 19 Scra 631Dokumen3 halamanAng Vs American Steamship Agencies, 19 Scra 631Dennis YuBelum ada peringkat

- Funa vs. VillarDokumen3 halamanFuna vs. VillarmikmgonzalesBelum ada peringkat

- Import & Export Procedures for Diamonds in BelgiumDokumen8 halamanImport & Export Procedures for Diamonds in BelgiumYashil PatelBelum ada peringkat

- Bridgestone v. IBM Lawsuit Over Failed IT ProjectDokumen13 halamanBridgestone v. IBM Lawsuit Over Failed IT ProjectnBelum ada peringkat

- Escritor V IAC DigestDokumen2 halamanEscritor V IAC DigestSherwinBries100% (1)

- Moreno Vs Atty Ernesto AranetaDokumen2 halamanMoreno Vs Atty Ernesto AranetaAJMordeno100% (1)

- Reyes vs. BagatsingDokumen1 halamanReyes vs. BagatsingPauline DgmBelum ada peringkat

- Mataas Na Lupa Tenants Assoc. vs. DimayugaDokumen10 halamanMataas Na Lupa Tenants Assoc. vs. DimayugaGemrose SantosBelum ada peringkat

- Motion To Strike 3Dokumen8 halamanMotion To Strike 3Myers, Boebel and MacLeod L.L.P.Belum ada peringkat

- Khan v Simbillo: Advertising Legal Services Violates CodeDokumen1 halamanKhan v Simbillo: Advertising Legal Services Violates CodeEqui Tin0% (1)