Selecting The Right Cybercrime-Prevention Solution

Diunggah oleh

Krešimir PuklavecJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Selecting The Right Cybercrime-Prevention Solution

Diunggah oleh

Krešimir PuklavecHak Cipta:

Format Tersedia

IBMSoftware

Thought Leadership White Paper

Selecting the right

cybercrime-prevention solution

Key considerations and best practices for achieving effective, sustainable cybercrime prevention

Contents

1 Introduction

2 Key requirements for effective, sustainable cybercrime prevention

3 Near real-time threat intelligence and visibility

3 Adaptive protection against evolving threats

3 Layered security

4 Early malware detection

5 Limited impact to end users

5 Cost-effective deployment, management and

operations

6 Reliable cybercrime-prevention partner

7 Conclusion

7 For more information

7 About IBM Security solutions

Introduction

Financial institutions, commercial enterprises and government

organizations are all prime targets for cybercrime. Malicious

software, or malware, is the primary attack tool used by

cybercriminals to execute account takeover attacks, steal

credentials and personal information, and initiate fraudulent

transactions. The attack tactics, or crime logic, are constantly

becoming more sophisticated so they can continue to exploit

human and system weaknesses. Fraud-, risk- and IT-security

professionals are looking to establish an effective defense against

these attacks.

IBM Security Trusteer solutions have been helping to protect

users against cybercrime since 2006. Based on our accumulated

experience with hundreds of customers, thousands of fraud cases

and millions of protected endpoints, we have identified the key

principles and best practices for selecting cybercrime-prevention

solutions.

This white paper discusses key considerations and best practices

to help organizations achieve effective and sustainable

cybercrime prevention.

Selecting the right cybercrime-prevention solution

Key requirements for effective,

sustainable cybercrime prevention

When looking at deploying a cybercrime-prevention solution,

organizations must consider multiple requirements. Beyond the

core requirement of providing effective fraud prevention, the

solution must address deployment costs, management

complexity, impact to customers and regulatory compliance.

This white paper will examine some of these requirements

and will compare and contrast various approaches to addressing

them.

Near real-time threat intelligence and visibilityMalware

can bypass virtually all security controls. An effective

cybercrime-prevention solution must be able to assess changes

in the threat landscape. This is essential to maintaining an

effective defense that can protect customers over time.

Rapid protection against evolving threatsBecause all

types of security controls are eventually attacked by malware,

these controls must be able to adapt and stop new attack

vectors. This is a particular concern with hardware-based

solutions, or solutions that rely on statistical approaches to

detect fraud. Often, it is extremely costly and complex for

these types of solutions to respond to new attacks that attempt

to bypass them.

Layered securityUsing multiple layers of security on

endpoints and web applications makes it possible to achieve

powerful and flexible protection. Endpoint security provides

prevention, intelligence and remediation capabilities, and

web-based malware detection provides instant coverage and

lower deployment impact.

Early malware detectionMalware is the root cause of most

fraud. Preventing malware from infecting endpoints and

attacking browsers or web applications can help prevent fraud

from occurring. This requires complete protection of users

online activities, beyond online banking. Early prevention can

also reduce the number of false positives and negatives handled

by fraud and support teams that often result in higher

operational costs and staffing requirements.

Limited impact to end usersTo help ensure that users

adopt fraud-prevention measures, the impact on their

day-to-day workflows must be significantly reduced without

compromising protection. Solutions such as virtual browsers

and hardware tokens sacrifice usability for perceived better

security.

Cost-effective deployment, management and

operationsFraud-prevention solutions should deploy

quickly and require limited intervention from fraud, risk and

support organizations.

Reliable cybercrime-prevention partnerUltimately,

fighting cybercrime is a team effort. Any technology partner

you choose must augment your staff with the expertise and

capabilities to help you sustain an effective defense against

cybercriminals.

IBMSoftware

Near real-time threat intelligence and

visibility

Bottom line: If a financial institution cannot conduct its own

threat research, it should partner with an organization that has

the processes, people and expertise to gather and analyze threat

intelligence and perform continuous risk assessment. Threat

intelligence must be converted into specific actions in a timely

manner to help ensure security controls remain effective.

As noted in the current Federal Financial Institutions

Examination Council (FFIEC) guidance,1 the effectiveness of

security measures used by financial institutions has eroded since

the FFIEC issued its previous guidance in 2005. This realization

has prompted the FFIEC to require financial institutions to

conduct continuous risk assessments and adapt their security

controls to address changes in the threat landscape.

Adaptive protection against evolving

threats

Risk assessment represents a considerable challenge to many

organizations. Fraud and security teams must gather threat

intelligence from various sources, understand the threats that

target their region, industry and specific institution, and

determine if their controls are adequately addressing these

threats. Performing threat analysis requires technology and

expertise that are not available to many financial institutions.

The mirror requirement of threat intelligence is adaptive

protection. Once a new threat or a new attack vector is identified

through the risk-assessment process, a countermeasure must be

rapidly developed and deployed across all protected applications

and users. Financial institutions should assume that even their

latest and greatest security controls will eventually be attacked by

malware, and they must be able to respond immediately when

this happens.

Some cybercrime-prevention solutions attempt to isolate the

user from malware as they access sensitive web applications by

using virtualization technologies contained in hardware devices

or available as software downloads. However, no security control

can eliminate the need to perform risk assessment. Plus, lack of

threat intelligence delays the response to malware attacks until

fraud incidents start to mount. This can be detrimental to a

financial institutions bottom line, brand and customer

retention rate.

Bottom line: Adaptive protection entails a timely, automated

and scalable process to update security controls against emerging

threats. The update process should be transparent to end users

and require limited involvement from the financial institutions

IT and fraud teams.

Layered security

Layered security is a fundamental best practice in cybercrime

prevention. Endpoint controls form the first layer that secures

end user devices against malware infection and attacks on client

applications such as the web browser. Web-based controls create

a second layer that detects high-risk users, devices and sessions.

Combined, these two layers provide a formidable barrier to

cybercrime using different techniques during different parts

of the transaction lifecycle to help prevent and detect

fraudulent activity.

Selecting the right cybercrime-prevention solution

Bottom line: Financial institutions should consider the

solutions overall cybercrime-prevention architecture. Through

phased deployment of multiple protection layers that are

centrally controlled and managed, it is possible to optimize

security without increasing complexity and costs.

Early malware detection

Since the root cause of most fraud losses is malware, preventing

malware from infecting customer machines and tampering with

transactions is critical to helping prevent fraud.

Preventing malware infection requires protection of the users

overall online activity. Users can become infected when visiting

any website, and phishing attacks can happen outside the context

of an online banking session. It is therefore essential to secure all

online activities on the end user machine beyond the specific

online banking site.

Certain approaches to fraud prevention focus on identifying

fraudulent transactions. Fraud detection occurs when a

fraudulent transaction is submitted but before funds are

withdrawn from the account. Due to the statistical nature of

these approaches, a false positive or false negative is likely to

occur. With false positives, the fraud team must review many

legitimate transactions, which is a costly and resource-intensive

process. With false negatives, a direct cost of fraud loss is

virtually guaranteed and subsequent indirect costs, such as brand

damage and customer turnover, soon follow. Cybercriminals also

take many steps to help ensure that fraudulent transactions fly

under the radar by exhibiting as many characteristics of

normal, customer-generated transactions as possible.

Other approaches focus on isolating the online banking session

from malware. History has shown that once a host is infected

with malware, it is possible to attack any security control that

executes on the infected machine. Virtualization-based browser

solutions are no exception, and these, too, are susceptible to

memory injections into their processes executing on the

underlying host.

Conversely, strong endpoint security controls can help prevent

an initial infection, which is the first step in the attack lifecycle.

If malware already resides on the machine, it can be stopped

from attacking the browser and other key services, a vital

component of setting up the attack. A clientless malwaredetection layer can directly identify infected, high-risk users

before an actual fraud attempt occurs, and feed risk data into risk

engines. An adjusted transaction risk score can be used to restrict

access to functions such as adding a payee or transferring money.

In both cases, endpoint-centric security controls can help

directly detect and protect against malware on the endpoint

not just its side effects.

Bottom line: Effectively containing fraud losses favors stopping

malware from ever generating a fraudulent transaction. Look for

a solution that uses malware prevention and detection layers as

cornerstones of security control, as this can help significantly

reduce the number of suspicious transactions that fraud teams

have to deal withand the likelihood of fraud losses.

IBMSoftware

Limited impact to end users

Cybercrime prevention is a balancing act of security,

transparency, usability and interoperability. Server-side solutions

offer transparency but also reduce fraud-prevention capabilities,

as they often lack visibility into endpoint malware, the root cause

of most fraud. Some endpoint solutions require end users to

change the way they access web applications to reduce exposure.

The impact of these solutions on end user acceptance and

adoption of fraud prevention solutions can be substantial.

Other approaches require distribution of hardware devices or

complex software to end users. These deployments incur

shipping, tracking and provisioning costs, cumbersome and

complex update processes, and logistics overhead when devices

have to be replaced if lost or malfunctioning.

Consider the following characteristics of a cybercrimeprevention solution that is simple to deploy and operate:

Typically, end users prefer to continue using their devices and

commercial browsers of choice, as well as to be able to print and

use third-party applications. Furthermore, financial institutions

should aim to provide protection in the background with

limited user interaction.

Bottom line: To encourage end users to adopt fraud-prevention

solutions, financial institutions should choose an option that

limits the impact to their users day-to-day workflows. If users

well-being is ignored in the name of better security, users might

hesitate to employ the proposed security controlswhich can

seriously compromise security efforts.

Cost-effective deployment, management

and operations

While fraud-prevention products should be simple to deploy and

operate, actual implementation costs and complexity levels vary

dramatically among different products.

During initial deployment, some solutions require substantial

effort to establish and sustain a statistical baseline for normal

user activity. Once the baseline is established, fraud teams must

pursue a large number of possible fraud cases that are based

on deviations from the profile, many of which are false positives.

Ultimately, when fraud losses occur or fraudulent transactions

are detected, financial institutions face very limited options

for remediation, as removing malware is a complex and

daunting task.

No changes in user workflow and environmentUsers

prefer not to use awkward devices that can be stolen or

forgotten, or to change the way they use online banking. The

solution should support their browser of choice (Microsoft

Internet Explorer, Mozilla Firefox, Google Chrome and Apple

Safari), their PC platform (Microsoft Windows and Mac) and

third-party applications that support business processes.

No false positivesAccurate fraud detection is a core

requirement of cybercrime prevention. Financial institutions

should not expect a plethora of alerts and warnings to be

investigated. The more visibility the solution has to the threat

landscape, the more accurate it will be in detecting malwaredriven fraud.

Scalable to all channels (retail and business)Financial

institutions need to protect all channels with hundreds to

millions of users. Patching together multiple technologies that

claim security without scalability creates redundancies and

management overhead.

Remediation and malware removalEnd users and financial

institution support teams face the task of restoring endpoints

to a clean state following a malware-driven fraud attempt.

Often, end users have no choice but to reformat their

computer hard drives or restore the operating system to its

factory settings. Both approaches are highly disruptive. A

cybercrime-prevention solution should go beyond detection

and prevention to offer an automated way of removing

malware without the need for complex and disruptive

procedures.

Selecting the right cybercrime-prevention solution

No hardware or software to install at the financial

institutionIT organizations are increasingly adopting

Software-as-a-Service (SaaS) solutions that can reduce the

burden of deploying and maintaining enterprise software

applications. In the case of cybercrime-prevention software,

SaaS allows the solution provider to leverage threat

intelligence across multiple customers and to rapidly update its

protection capabilities, creating a strong network effect.

Bottom line: Cybercrime-prevention solutions should allow for

quick deployments and significantly reduce the rollout and support requirements from financial institutions and end users.

Malware removal and remediation capabilities should enable

infected users to quickly restore their systems to a clean state, so

their productivity is not affected.

Reliable cybercrime-prevention partner

Cybercrime prevention is a process. A financial institutions

trusted cybercrime-prevention partner must be able to

continuously monitor the threat landscape, gather intelligence

and adapt its security controls against emerging threats. The key

ingredient of this process, intelligence, is derived from the

vendors marketplace presence. Simply put, technology is not

enough. The vendor must have the global customer footprint

and operational track record to demonstrate that it can effectively detect changes in the threat landscape, analyze them and

sustain the effectiveness of its security controls over time.

Bottom line: A reliable cybercrime-prevention partner has a

broad global presence, an established customer footprint and a

demonstrated ability to deliver sustainable fraud prevention over

long periods of time.

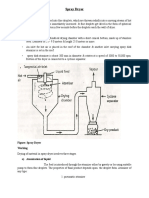

Effective and accurate

Fast time to value

Focus on the root cause

Prevent first, detect next, early

Light integration

Unified platform: any scale

Fraudprevention

architecture

Seamless experience

Transparent to customers

Significantly reduce busy work to staff

Figure 1: Four principles of successful fraud-prevention architecture

Adaptive controls

Near real-time intelligence

Dynamic software vs.

static hardware

IBMSoftware

Conclusion

About IBM Security solutions

When selecting a cybercrime-prevention solution, it is

imperative to realize that, over time, no static security control

can remain effective at stopping malware-driven online banking

fraud. Sustainable cybercrime prevention can be achieved only

by coupling layered adaptive security and near real-time threat

intelligence delivered by a reliable cybercrime-prevention

solution partner. Furthermore, financial institutions must

consider the ability of solutions to leverage security controls

quickly and cost efficiently, without being hindered by poor

usability, limited platform support, long deployment processes

or late detection of fraudulent transactions.

IBM Security offers one of the most advanced and integrated

portfolios of enterprise security products and services.

The portfolio, supported by world-renowned IBM X-Force

research and development, provides security intelligence to

help organizations holistically protect their people,

infrastructures, data and applications, offering solutions for

identity and access management, database security, application

development, risk management, endpoint management, network

security and more. These solutions enable organizations to

effectively manage risk and implement integrated security for

mobile, cloud, social media and other enterprise business

architectures. IBM operates one of the worlds broadest security

research, development and delivery organizations, monitors 15

billion security events per day in more than 130 countries, and

holds more than 3,000 security patents. Additionally, IBM

Global Financing can help you acquire the software capabilities

that your business needs in the most cost-effective and strategic

way possible. Well partner with credit-qualified clients to

customize a financing solution to suit your business and

development goals, enable effective cash management, and

improve your total cost of ownership. Fund your critical IT

investment and propel your business forward with IBMGlobal

Financing. For more information, visit:

Why IBM?

IBM Security solutions are trusted by organizations worldwide

for fraud prevention and identity and access management.

The proven technologies enable organizations to protect their

customers, employees and business-critical resources from the

latest security threats. As new threats emerge, IBM can help

organizations build on their core security infrastructure with

a full portfolio of products, services and business partner

solutions. IBM empowers organizations to reduce their

security vulnerabilities and focus on the success of their

strategic initiatives.

For more information

To learn more about IBM Security Trusteer cybercrimeprevention solutions, please contact your IBM representative or

IBM Business Partner, or visit: ibm.com/security

ibm.com/financing

Copyright IBM Corporation 2014

IBM Corporation

Software Group

Route 100

Somers, NY 10589

Produced in the United States of America

August 2014

IBM, the IBM logo, ibm.com, and X-Force are trademarks of International

Business Machines Corp., registered in many jurisdictions worldwide. Other

product and service names might be trademarks of IBM or other companies.

A current list of IBM trademarks is available on the web at Copyright and

trademark information at ibm.com/legal/copytrade.shtml

Microsoft, Windows, Windows NT, and the Windows logo are trademarks of

Microsoft Corporation in the United States, other countries, or both.

This document is current as of the initial date of publication and may be

changed by IBM at any time. Not all offerings are available in every country

in which IBM operates.

THE INFORMATION IN THIS DOCUMENT IS PROVIDED

AS IS WITHOUT ANY WARRANTY, EXPRESS OR

IMPLIED, INCLUDING WITHOUT ANY WARRANTIES

OF MERCHANTABILITY, FITNESS FOR A PARTICULAR

PURPOSE AND ANY WARRANTY OR CONDITION OF

NON-INFRINGEMENT. IBM products are warranted according to the

terms and conditions of the agreements under which they are provided.

The client is responsible for ensuring compliance with laws and regulations

applicable to it. IBM does not provide legal advice or represent or warrant

that its services or products will ensure that the client is in compliance with

any law or regulation.

Statements regarding IBMs future direction and intent are subject to change

or withdrawal without notice, and represent goals and objectives only.

Statement of Good Security Practices: IT system security involves protecting

systems and information through prevention, detection and response to

improper access from within and outside your enterprise. Improper access

can result in information being altered, destroyed or misappropriated or can

result in damage to or misuse of your systems, including to attack others.

No IT system or product should be considered completely secure and no

single product or security measure can be completely effective in preventing

improper access. IBM systems and products are designed to be part of a

comprehensive security approach, which will necessarily involve additional

operational procedures, and may require other systems, products or services

to be most effective. IBM does not warrant that systems and products are

immune from the malicious or illegal conduct of any party.

Trusteer was acquired by IBMin August of 2013.

1

Federal Financial Institutions Examination Council (FFIEC),

Supplement to Authentication in an Internet Banking Environment,

June 2011. http://www.fdic.gov/news/news/press/2011/pr11111a.pdf

Please Recycle

WGW03042-USEN-01

Anda mungkin juga menyukai

- Four Steps To Protect Your Enterprise From Data LeakageDokumen15 halamanFour Steps To Protect Your Enterprise From Data LeakageKrešimir PuklavecBelum ada peringkat

- Always On SSL White Paper CH PDFDokumen16 halamanAlways On SSL White Paper CH PDFKrešimir PuklavecBelum ada peringkat

- ED BAKER - Blues Riffs For Piano PDFDokumen28 halamanED BAKER - Blues Riffs For Piano PDFBelu Iglesias Barcia100% (3)

- Piano Concerto No. 1 in BB Major, Op. 23-1Dokumen49 halamanPiano Concerto No. 1 in BB Major, Op. 23-1barnaldomortBelum ada peringkat

- 4-43821 030 WP PhishingTactics 0214Dokumen9 halaman4-43821 030 WP PhishingTactics 0214SagarBelum ada peringkat

- Lončarić Biljana - Possibilities of Marketing Evaluation of The Tourist Region of Slavonija and Baranja PDFDokumen32 halamanLončarić Biljana - Possibilities of Marketing Evaluation of The Tourist Region of Slavonija and Baranja PDFKrešimir Puklavec100% (1)

- Barrios, Augustin. El Sueño de La Muñeca, Minueto en Do, Minueto en La, Gavota Al Estilo Antiguo, MabelitaDokumen10 halamanBarrios, Augustin. El Sueño de La Muñeca, Minueto en Do, Minueto en La, Gavota Al Estilo Antiguo, Mabelitasupertzar_st3645Belum ada peringkat

- Ivanović Zoran - TOURISM AND HOSPITALITY MANAGEMENT PDFDokumen150 halamanIvanović Zoran - TOURISM AND HOSPITALITY MANAGEMENT PDFKrešimir PuklavecBelum ada peringkat

- White Paper Firesheep Eng 3Dokumen10 halamanWhite Paper Firesheep Eng 3Krešimir PuklavecBelum ada peringkat

- Strategy Monitoring Security in Cloud EnvironmentsDokumen14 halamanStrategy Monitoring Security in Cloud EnvironmentsKrešimir PuklavecBelum ada peringkat

- Symantec Whitepaper Mobile Shopping PDFDokumen10 halamanSymantec Whitepaper Mobile Shopping PDFKrešimir PuklavecBelum ada peringkat

- DC - DR ABCs Testing FinalDokumen11 halamanDC - DR ABCs Testing FinalneelBelum ada peringkat

- ABCs of Disaster Recovery Testing - HB - FinalDokumen8 halamanABCs of Disaster Recovery Testing - HB - FinalKrešimir PuklavecBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- PA2 Value and PD2 ValueDokumen4 halamanPA2 Value and PD2 Valueguddu1680Belum ada peringkat

- Financial Services : An OverviewDokumen15 halamanFinancial Services : An OverviewAnirudh JainBelum ada peringkat

- How To Calibrate OscilloscopeDokumen2 halamanHow To Calibrate OscilloscopeninoBelum ada peringkat

- Sight Reduction Tables For Marine Navigation: B, R - D, D. SDokumen12 halamanSight Reduction Tables For Marine Navigation: B, R - D, D. SGeani MihaiBelum ada peringkat

- Sample of Accident Notification & Investigation ProcedureDokumen2 halamanSample of Accident Notification & Investigation Procedurerajendhar100% (1)

- Matrices Class 12 Maths Important Questions Chapter 3 - Learn CBSEDokumen41 halamanMatrices Class 12 Maths Important Questions Chapter 3 - Learn CBSEkhateeb ul islam qadriBelum ada peringkat

- Horizontal Machining Centers: No.40 Spindle TaperDokumen8 halamanHorizontal Machining Centers: No.40 Spindle TaperMax Litvin100% (1)

- Direction: Read The Questions Carefully. Write The Letters of The Correct AnswerDokumen3 halamanDirection: Read The Questions Carefully. Write The Letters of The Correct AnswerRomyross JavierBelum ada peringkat

- Leks Concise Guide To Trademark Law in IndonesiaDokumen16 halamanLeks Concise Guide To Trademark Law in IndonesiaRahmadhini RialiBelum ada peringkat

- Primary 2 (Grade 2) - GEP Practice: Contest Problems With Full SolutionsDokumen24 halamanPrimary 2 (Grade 2) - GEP Practice: Contest Problems With Full Solutionswenxinyu1002100% (1)

- Fictional Narrative: The Case of Alan and His FamilyDokumen4 halamanFictional Narrative: The Case of Alan and His Familydominique babisBelum ada peringkat

- Theory Is An Explanation Given To Explain Certain RealitiesDokumen7 halamanTheory Is An Explanation Given To Explain Certain Realitiestaizya cBelum ada peringkat

- Barry Wylant: Design Thinking and The Experience of InnovationDokumen13 halamanBarry Wylant: Design Thinking and The Experience of InnovationVanesa JuarezBelum ada peringkat

- How To Install Windows XP From Pen Drive Step by Step GuideDokumen3 halamanHow To Install Windows XP From Pen Drive Step by Step GuideJithendra Kumar MBelum ada peringkat

- b2 Open Cloze - Western AustraliaDokumen3 halamanb2 Open Cloze - Western Australiaartur solsonaBelum ada peringkat

- Economics and The Theory of Games - Vega-Redondo PDFDokumen526 halamanEconomics and The Theory of Games - Vega-Redondo PDFJaime Andrés67% (3)

- Symasym BBDokumen37 halamanSymasym BBChandraRizkyBelum ada peringkat

- Stmma-Fd: Zhejiang Castchem New Material Co.,Ltd&Castchem (Hangzhou), IncDokumen2 halamanStmma-Fd: Zhejiang Castchem New Material Co.,Ltd&Castchem (Hangzhou), IncYash RaoBelum ada peringkat

- Rock Type Identification Flow Chart: Sedimentary SedimentaryDokumen8 halamanRock Type Identification Flow Chart: Sedimentary Sedimentarymeletiou stamatiosBelum ada peringkat

- TOS 22402 Winter 19th I SCHEME Paper Model Answer PaperDokumen25 halamanTOS 22402 Winter 19th I SCHEME Paper Model Answer Paperirshadmirza753Belum ada peringkat

- Modesto Mabunga Vs PP (GR 142039)Dokumen3 halamanModesto Mabunga Vs PP (GR 142039)Ericha Joy GonadanBelum ada peringkat

- Dryers in Word FileDokumen5 halamanDryers in Word FileHaroon RahimBelum ada peringkat

- HUMAN RIGHTS, RATIONALITY, AND SENTIMENTALITYDokumen13 halamanHUMAN RIGHTS, RATIONALITY, AND SENTIMENTALITYJohn HunterBelum ada peringkat

- Beyond VaR OfficialDokumen76 halamanBeyond VaR OfficialmaleckicoaBelum ada peringkat

- Security Testing MatDokumen9 halamanSecurity Testing MatLias JassiBelum ada peringkat

- Manual de Instruções Iveco Eurocargo Euro 6Dokumen226 halamanManual de Instruções Iveco Eurocargo Euro 6rsp filmes100% (1)

- Practical Finite Element Simulations With SOLIDWORKS 2022Dokumen465 halamanPractical Finite Element Simulations With SOLIDWORKS 2022knbgamageBelum ada peringkat

- Acc418 2020 2Dokumen3 halamanAcc418 2020 2faithBelum ada peringkat

- Horizontal Vertical MarketDokumen4 halamanHorizontal Vertical MarketVikasBelum ada peringkat

- Detailed Lesson Plan in MAPEH III I. ObjectivesDokumen19 halamanDetailed Lesson Plan in MAPEH III I. ObjectivesJenna FriasBelum ada peringkat