21 - Intangible Assets

Diunggah oleh

ralphalonzoHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

21 - Intangible Assets

Diunggah oleh

ralphalonzoHak Cipta:

Format Tersedia

Page 1 of 6

REVIEW OF FINANCIAL ACCOUNTING THEORY AND PRACTICE

INTANGIBLE ASSETS

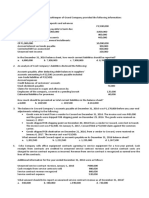

1. Kuyab Company incurred P900,000 of research and development cost to develop a

product for which a patent was granted on January 2, 2005. Legal fees and other costs

associated with the registration of the patent totaled P200,000. On July 31, 2005,

Kuyab paid P400,000 for legal fees in a successful defense of the patent. The total

amount capitalized for this patent through July 31, 2005 should be

a. 1,500,000

b. 1,100,000

c.

600,000

d. 200,000

2. Laguna Company acquired three patents in January 2005. The patents have different

lives as indicated in the following schedule:

Patent A

Patent B

Patent C

Cost

2,000,000

3,000,000

6,000,000

Remaining useful life

10

5

Indefinite

Remaining legal life

8

10

15

Patent C is believed to be uniquely useful as long as the company retains the right to

use it. In June 2005, the company successfully defended its right to Patent B. Legal

fees of P800,000 were incurred in this action. The companys policy is to amortize

intangible assets by the straight-line method to the nearest half year. The company

reports on a calendar-year basis. The amount of amortization that should be

recognized for 2005 is

a. 1,330,000

b. 1,250,000

c. 2,050,000

d. 950,000

3. Nagcarlan Company purchased a patent on January 1, 2002, for P3,570,000. The

patent was being amortized over its remaining legal life of 15 years expiring on January

1, 2017. During 2005 Nagcarlan determined that the economic benefits of the patent

would not last longer than ten years from the date of acquisition. What amount should

be reported in the balance sheet as patent, net of accumulated amortization, at

December 31, 2005?

a. 2,618,000

b. 2,520,000

c. 2,448,000

d. 2,142,000

4. On January 2, 2002, San Pedro Company purchased a patent for a new consumer

product for P3,000,000. At the time of purchase, the patent was valid for 15 years.

However, the patents useful life was estimated to be only 10 years due to the

competitive nature of the product. On December 31, 2005, the product was

permanently withdrawn from sale under governmental order because of a potential

health hazard in the product. What amount should San Pedro charge against income

during 2005, assuming amortization is recorded at the end of such year?

a. 1,800,000

b. 2,400,000

c. 2,100,000

d. 300,000

Page 2 of 6

5. On January 1, 2005, Mambusao Company bought a trademark from Panitan Company

for P6,000,000. Mambusao retained an independent consultant who estimated the

trademarks life to be indefinite. Its carrying amount in Panitans accounting records

was P4,000,000. In Mambusaos December 31, 2005 balance sheet, what amount

should be reported as trademark?

a. 6,000,000

b. 5,700,000

c. 3,800,000

d. 3,600,000

6. On January 1, 2005, Calamba Company signed an agreement to operate as a

franchise of Bay Company for an initial franchise fee of P30,000,000. Of this amount,

P10,000,000 was paid when the agreement was signed and the balance is payable in

equal annual payment of P5,000,000 beginning December 31, 2005. The agreement

provides that the down payment is not refundable and no future services are required

of the franchisor. Calambas credit rating indicates that it can borrow money at 12% for

a loan of this type. Information on present value factors at 12% for 4 period is:

Present value of 1

Present value of an ordinary annuity of 1

a.

b.

c.

d.

0.64

3.04

30,000,000

15,200,000

25,200,000

21,600,000

7. Liliw Company engaged your services to compute the goodwill in the purchase of

Calauan Company which provided the following:

2002

2003

2004

2005

Net income

1,400,000

1,600,000

2,000,000

2,200,000

Net assets

6,000,000

8,000,000

8,800,000

9,200,000

It is agreed that goodwill is measured by capitalizing excess earnings at 25% with

normal return on average net assets at 15%. How much is the purchase price for

Calauan Company?

a. 11,600,000

b. 10,400,000

c. 11,200,000

d. 11,000,000

8. Panay Company is negotiating to acquire Sapian Company. Panay manufactures and

sells wood burning stoves and Sapian Company produces parts that are required to

manufacture stoves. Sapian enjoys an exceptional reputation and Panay management

believes it can continue Sapians level of income and satisfy its own need for parts.

Under the contemplated arrangement, Panay will negotiate for the acquisition of the net

assets of Sapian Company. The recorded amounts and current values of the assets

and liabilities of Sapian are:

Recorded amounts

Current values

Assets

20,000,000

25,000,000

Liabilities

8,000,000

5,000,000

Page 3 of 6

Sapians earnings for the past 5 years averaged P5,000,000. This is believed to be the

a reasonable estimate of future income. The level of income normally experienced by

enterprises similar to Sapian is 15%. Panay and Sapian agreed to capitalize average

excess earnings at 25% in estimating the value of goodwill. How much should Panay

pay in acquiring Sapian?

a. 20,000,000

b. 28,000,000

c. 32,000,000

d. 20,500,000

9. The owners of Majayjay Company are planning to sell the business to new interests.

The cumulative net earnings for the past 5 years was P9,000,000 including casualty

loss of P500,000. The current value of net assets of Majayjay Company was

P20,000,000. Goodwill is determined by capitalizing average earnings at 8%. What is

the amount of goodwill?

a. 1,900,000

b. 1,700,000

c. 3,750,000

d. 1,250,000

10. On January 1, 2005, Carmona purchased Topaz Company at a cost that resulted in

recognition of goodwill of P5,000,000 having an expected benefit period of 10 years.

During January of 2005, Carmona spent an additional P2,000,000 on expenditures

designed to maintain goodwill. Due to these expenditures, at December 31, 2005,

Carmona estimated that the benefit period of goodwill was indefinite. In its December

31, 2005 balance sheet, what amount should Carmona report as goodwill?

a. 5,000,000

b. 7,000,000

c. 4,750,000

d. 4,500,000

11. Sta. Rosa Company has been experiencing significant losses in prior years. On

December 31, 2005, the assets and liabilities are:

Cash

Accounts receivable

Inventory

Property, plant and equipment

Goodwill

Liabilities

10,000,000

20,000,000

30,000,000

50,000,000

5,000,000

40,000,000

On December 31, 2005, the fair value of the net assets of Sta. Rosa is P62,000,000.

How much is the impairment loss applicable to goodwill?

a. 13,000,000

b. 8,000,000

c. 5,000,000

d.

0

12. Luzon Company purchased Jolo Company for P100,000,000. The net assets of Jolo

Company on the date of acquisition amounted to P80,000,000. Thus, there is a

goodwill of P20,000,000. Jolo Company has three segments, each of which is

considered a cash generating unit. The goodwill is allocated respectively to segments

One, Two and Three, P5,000,000, P6,000,000 and P9,000,000.

Page 4 of 6

On December 31, 2005, Segment One suffered significant losses and its recoverable

amount is P30,000,000. On December 31, 2005, the carrying amounts are as follows:

Segment One

Segment Two

Segment Three

Goodwill

28,000,000

50,000,000

67,000,000

20,000,000

In its 2005 income statement, Luzon Company should report impairment loss at

a. 3,000,000

b. 5,000,000

c. 2,000,000

d. 1,000,000

13. On January 1, 2003, Paete Company signed a 12-year lease for a building. Paete has

an option to renew the lease for an additional 8-year period on or before January 1,

2007. During January 2005, Paete made substantial improvements to the building. The

cost of the improvements was P3,600,000, with an estimated useful life of 15 years. At

December 31, 2005, Paete intended to exercise the renewal option. Paete has taken a

full years amortization on this improvement. In the December 31, 2005, balance sheet,

the carrying amount of this leasehold improvement should be

a. 3,240,000

b. 3,360,000

c. 3,400,000

d. 3,300,000

14. On January 1, 2003, Puntavedra Company signed an eigth-year lease for office space.

Puntavedra has the option to renew the lease for an additional six-year period on or

before January 1, 2009. During January 2005, Puntavedra incurred the following costs.

General improvements to the leased premises with useful

life of 10 years

Office furniture and equipment with useful life of 8 years

Moveable assembly line equipment with useful life of 5 years

5,400,000

2,400,000

1,800,000

At December 31, 2005, Puntavedras intention as to the exercise of the renewal option

is uncertain. A full depreciation of leasehold improvement is taken for year 2005. In

Puntavedras December 31, 2005 balance sheet, accumulated depreciation of

leasehold improvement should be

a. 1,200,000

b. 1,300,000

c.

540,000

d. 900,000

15. Maayon Company begins construction of a new facility. Following are some of the

costs incurred in conjunction with the start up activities of the new facility:

Production equipment

1,500,000

Travel costs of salaried employees

400,000

License fees

50,000

Training of local employees for production and maintenance operations 1,300,000

Advertising costs

100,000

What portion of the organizational costs will be expensed?

a. 1,700,000

b. 1,850,000

c. 3,350,000

d. 1,300,000

Page 5 of 6

16. Siniloan Company incurred research and development costs in 2005 as follows:

Equipment acquired for use in various R&D projects

Depreciation on the above equipment

Materials used

Compensation costs of personnel

Outside consulting fees

Indirect costs appropriately allocated

6,000,000

1,200,000

3,000,000

4,000,000

1,500,000

1,300,000

The 2005 total research and development expense should be

a. 11,000,000

b. 15,800,000

c. 9,700,000

d. 9,800,000

17. Bian Company incurred the following costs during 2005:

Design of tools, jigs, molds and dies involving new technology

Modification of the formulation of a process

Trouble shooting in connection of breakdowns during commercial

production

Adaptation of an existing capability to a particular customers need

as part of a continuing commercial activity

In

of

a.

b.

c.

d.

2,500,000

3,200,000

2,000,000

2,200,000

its 2005 income statement, Bian should report research and development expense

2,500,000

3,200,000

4,700,000

5,700,000

18. Dumalag Company provided the following information relevant to the research and

development expenditures for the year 2005:

Current period depreciation on the building housing R and D activities

Cost of market research study

Current period depreciation on a machine used in R and D activities

Salary of R and D director

Salary of Vice-President who spends of his time overseeing

R and D activities

Pension costs for salary of R and D director

Pension costs for salary of Vice-President

1,500,000

1,000,000

500,000

1,200,000

2,400,000

50,000

100,000

The R and D expense for the current period should be

a. 3,875,000

b. 4,875,000

c. 5,750,000

d. 3,800,000

19. Bian Company made the following expenditures relating to Product X:

* Legal costs to file a patent on Product X. Production of the finished

product would not have been undertaken without the patent.

* Special equipment to be used solely for development of Product X.

The equipment has no other use and has an estimated useful life of

four years.

* Labor and material costs incurred in producing a prototype model

* Cost of testing the prototype

500,000

4,000,000

3,000,000

2,000,000

Page 6 of 6

What is the total amount of costs that will be expensed when incurred?

a. 9,000,000

b. 9,500,000

c. 6,000,000

d. 5,000,000

20. On January 1, 2005, Caliraya Company had capitalized cost of P10,000,000 for a new

computer software product with an economic life of 4 years. Sales for 2005 for the

software product amounted to P4,000,000. The total sales of the software over its

economic life are expected to be P20,000,000. However, the pattern of the future sales

from the computer software cannot be determined reliably.

In its 2005 income statement, Caliraya should record amortization of computer software

at

a. 2,500,000

b. 5,000,000

c. 2,000,000

d.

0

21. During 2005, Jamindan Company incurred costs to develop and produce a routine, lowrisk computer software product as follows:

Completion of detail program design

Cost incurred for coding and testing to establish technological feasibility

Other coding costs after establishment of technological feasibility

Other testing costs after establishment of technological feasibility

Costs of producing product masters for training materials

Duplication of computer software and training materials from

product master

Packaging product

1,500,000

500,000

2,500,000

2,000,000

3,000,000

4,000,000

1,000,000

1. In the December 31, 2005 balance sheet, what amount should be capitalized as

software cost subject to amortization?

a. 7,500,000

b. 4,500,000

c. 9,500,000

d. 8,000,000

2. In the December 31, 2005 balance sheet, what amount should be reported as

inventory?

a. 5,000,000

b. 7,000,000

c. 4,000,000

d. 6,500,000

- end -

Anda mungkin juga menyukai

- Reviewer - Intangible AssetsDokumen7 halamanReviewer - Intangible AssetsKim Nicole Reyes100% (4)

- Instructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowDokumen8 halamanInstructions: Choose The Letter That Corresponds To Your Answer and Write Them On A Crosswise YellowRoseBelum ada peringkat

- Ppe 2Dokumen7 halamanPpe 2Lara Lewis Achilles50% (2)

- Financial Accounting TestbankDokumen34 halamanFinancial Accounting Testbankemilio_ii71% (14)

- Third Week - Dsadfor PrintingDokumen14 halamanThird Week - Dsadfor Printingyukiro rineva0% (2)

- Investment Intangible Wasting Assets 1 PDFDokumen8 halamanInvestment Intangible Wasting Assets 1 PDFMeldwin C. Gutierrez50% (2)

- 19 - Revaluation and ImpairmentDokumen3 halaman19 - Revaluation and Impairmentjaymark canayaBelum ada peringkat

- 17 - Land, Building & MachineryDokumen3 halaman17 - Land, Building & Machineryjaymark canayaBelum ada peringkat

- Intacc PpeDokumen32 halamanIntacc PpeIris MnemosyneBelum ada peringkat

- 16 - Property, Plant and EquipmentDokumen2 halaman16 - Property, Plant and EquipmentralphalonzoBelum ada peringkat

- p1 & AP - IntangiblesDokumen13 halamanp1 & AP - IntangiblesJolina Mancera100% (3)

- Quiz - Module 2Dokumen5 halamanQuiz - Module 2Alyanna Alcantara67% (3)

- P1.110 Investment Property.Dokumen1 halamanP1.110 Investment Property.aleish0301100% (1)

- Actrev2 - InvestmentsDokumen19 halamanActrev2 - InvestmentsKenneth Bryan Tegerero Tegio100% (1)

- FAR - PRACTICE SET 5 PROPERTY PLANT AND EQUIPMENT UnprotectedDokumen9 halamanFAR - PRACTICE SET 5 PROPERTY PLANT AND EQUIPMENT UnprotectedxjammerBelum ada peringkat

- Module 5 Answer KeyDokumen3 halamanModule 5 Answer KeyAlyanna Alcantara0% (1)

- CONFRACS - Module 7 - Non-Current Assets Held For SaleDokumen14 halamanCONFRACS - Module 7 - Non-Current Assets Held For SaleMatth FlorezBelum ada peringkat

- Wasting AssetsDokumen4 halamanWasting AssetsAnn Lorraine Mamales0% (1)

- 18 - Depreciation and DepletionDokumen3 halaman18 - Depreciation and Depletionjaymark canayaBelum ada peringkat

- Diagnostic Exam 1 23 AKDokumen11 halamanDiagnostic Exam 1 23 AKAbegail Kaye BiadoBelum ada peringkat

- iNTANGIBLES PROBLEMSDokumen3 halamaniNTANGIBLES PROBLEMStough mamaBelum ada peringkat

- 5 Intangible AssetsDokumen5 halaman5 Intangible AssetsNeighvestBelum ada peringkat

- Father Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)Dokumen11 halamanFather Saturnino Urios University Accountancy Program AIR-Cluster 1 (Drill #2)marygraceomacBelum ada peringkat

- Problem 1Dokumen4 halamanProblem 1RexmarBelum ada peringkat

- BFJPIA Cup 1 - Theory of AccountsDokumen7 halamanBFJPIA Cup 1 - Theory of AccountsAnne Lorrheine CasanosBelum ada peringkat

- VIRAY, NHICOLE S. Asset - PPE - 1 - For PostingDokumen4 halamanVIRAY, NHICOLE S. Asset - PPE - 1 - For PostingZeeBelum ada peringkat

- Q3F - Investment in Associate - 2ndsem 2019-202Dokumen6 halamanQ3F - Investment in Associate - 2ndsem 2019-202Geoff Macarate100% (1)

- PRACTICAL ACCOUNTING I Quiz No. 2Dokumen6 halamanPRACTICAL ACCOUNTING I Quiz No. 2ROB1015120% (2)

- Investment Property and NCAHFS - OdtDokumen5 halamanInvestment Property and NCAHFS - OdtAndrea AtendidoBelum ada peringkat

- Problem 30-1 (IAA)Dokumen7 halamanProblem 30-1 (IAA)Quinnie Apuli0% (1)

- Chapter 31Dokumen14 halamanChapter 31Labley100% (2)

- FAR.2922 - Investments in Equity InstrumentsDokumen5 halamanFAR.2922 - Investments in Equity InstrumentsBea San JoseBelum ada peringkat

- Intangible AssetsDokumen4 halamanIntangible Assetsbrooke100% (1)

- What Amount Should Be Recorded As Depletion For 2016?Dokumen3 halamanWhat Amount Should Be Recorded As Depletion For 2016?Alyanna Alcantara0% (1)

- 9.3 Debt InvestmentsDokumen7 halaman9.3 Debt InvestmentsJorufel PapasinBelum ada peringkat

- PPE Depreciation & ImpairmentDokumen25 halamanPPE Depreciation & ImpairmentSummer Star0% (1)

- Property, Plant and Equipment: Problem 28-1 (AICPA Adapted)Dokumen21 halamanProperty, Plant and Equipment: Problem 28-1 (AICPA Adapted)Jay-B Angelo67% (3)

- Examination About Investment 7Dokumen3 halamanExamination About Investment 7BLACKPINKLisaRoseJisooJennieBelum ada peringkat

- 2Dokumen14 halaman2MARIABelum ada peringkat

- Investment in Equity - MCDokumen5 halamanInvestment in Equity - MCLeisleiRago100% (1)

- Investment Property and Biological AssetsDokumen32 halamanInvestment Property and Biological AssetsCharles Vega67% (3)

- Liabilities BSA 5-2sDokumen7 halamanLiabilities BSA 5-2sJustine GuilingBelum ada peringkat

- Borrowing CostsDokumen19 halamanBorrowing CostsIrfan100% (20)

- Equity Retained Earnings 2Dokumen2 halamanEquity Retained Earnings 2Marked ReverseBelum ada peringkat

- Intermediate Accounting Volume 1 Valix, Peralta and Valix (2020)Dokumen69 halamanIntermediate Accounting Volume 1 Valix, Peralta and Valix (2020)Romuell Banares100% (3)

- Chapter 8 - AgricultureDokumen26 halamanChapter 8 - AgricultureGracias100% (1)

- Pas 16. G4 1Dokumen29 halamanPas 16. G4 1Arvin Garbo50% (2)

- Related Standards: PAS 16, 20, 23 & 36: Property, Plant and Equipment - TheoryDokumen6 halamanRelated Standards: PAS 16, 20, 23 & 36: Property, Plant and Equipment - Theorymae cruzBelum ada peringkat

- FAR.104 PPE Acquisition and Subsequent ExpendituresDokumen7 halamanFAR.104 PPE Acquisition and Subsequent ExpendituresMarlon Jeff Concepcion Cariaga100% (2)

- 21 Intangible AssetsDokumen6 halaman21 Intangible AssetsAdrian MallariBelum ada peringkat

- Far Drill 1Dokumen20 halamanFar Drill 1ROMAR A. PIGABelum ada peringkat

- Resa P2 Final April 2008Dokumen15 halamanResa P2 Final April 2008Arianne Llorente100% (1)

- Far Drill 2Dokumen16 halamanFar Drill 2ROMAR A. PIGABelum ada peringkat

- University of Santo TomasDokumen12 halamanUniversity of Santo TomasJEFFERSON CUTEBelum ada peringkat

- Prelimx No AnswersDokumen7 halamanPrelimx No Answerscarl fuerzasBelum ada peringkat

- Mock CompreDokumen8 halamanMock CompreRegenLudevese100% (2)

- AttDokumen8 halamanAttKath LeynesBelum ada peringkat

- p1 ADokumen8 halamanp1 Aincubus_yeahBelum ada peringkat

- Capstone Theory & ProblemDokumen10 halamanCapstone Theory & ProblemAia SmithBelum ada peringkat

- p1 Midterm 2012Dokumen8 halamanp1 Midterm 2012marygraceomacBelum ada peringkat

- Sunday Monday Tuesday Wednesday Thursday Friday SaturdayDokumen1 halamanSunday Monday Tuesday Wednesday Thursday Friday SaturdayralphalonzoBelum ada peringkat

- FAR - Conceptual FrameworkDokumen8 halamanFAR - Conceptual FrameworkralphalonzoBelum ada peringkat

- T02 - Capital BudgetingDokumen121 halamanT02 - Capital Budgetingralphalonzo75% (4)

- PledgeDokumen11 halamanPledgeralphalonzoBelum ada peringkat

- 08 Investmentquestfinal PDFDokumen13 halaman08 Investmentquestfinal PDFralphalonzo0% (1)

- FAR - Revaluation Increase and DecreaseDokumen1 halamanFAR - Revaluation Increase and DecreaseralphalonzoBelum ada peringkat

- Quarterly Percentage Tax Return: 12 - DecemberDokumen1 halamanQuarterly Percentage Tax Return: 12 - DecemberralphalonzoBelum ada peringkat

- FAR - DerivativesDokumen1 halamanFAR - DerivativesralphalonzoBelum ada peringkat

- TAX - Gross Estate RemindersDokumen2 halamanTAX - Gross Estate RemindersralphalonzoBelum ada peringkat

- Business Law and TaxationDokumen15 halamanBusiness Law and TaxationKhim Dagangon100% (1)

- Chapter 4 and Chapter 5Dokumen9 halamanChapter 4 and Chapter 5ralphalonzoBelum ada peringkat

- MAS - DOL Vs DFLDokumen3 halamanMAS - DOL Vs DFLralphalonzoBelum ada peringkat

- Deductions From Gross IncomeDokumen1 halamanDeductions From Gross IncomeralphalonzoBelum ada peringkat

- Estate Taxation - Oct 2017 - GCC - Self Test - Quiz 1Dokumen4 halamanEstate Taxation - Oct 2017 - GCC - Self Test - Quiz 1ralphalonzoBelum ada peringkat

- PRTC Mas First PBDokumen11 halamanPRTC Mas First PBralphalonzo100% (2)

- Donor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2Dokumen3 halamanDonor - S Tax - Oct 2017 - GCC - Self Test - Quiz 2ralphalonzoBelum ada peringkat

- RFBT - Forms of Partnership ContractsDokumen1 halamanRFBT - Forms of Partnership ContractsralphalonzoBelum ada peringkat

- Afar AUD FAR MAS RFBT TAX TheoryDokumen1 halamanAfar AUD FAR MAS RFBT TAX TheoryralphalonzoBelum ada peringkat

- PRTC AP First PBDokumen9 halamanPRTC AP First PBralphalonzoBelum ada peringkat

- RFBT - Directors and Stockholders' MeetingDokumen1 halamanRFBT - Directors and Stockholders' MeetingralphalonzoBelum ada peringkat

- PRTC at 1st PreboardDokumen11 halamanPRTC at 1st PreboardralphalonzoBelum ada peringkat

- PRTC TOA First PreboardDokumen9 halamanPRTC TOA First PreboardralphalonzoBelum ada peringkat

- PRTC P2 1st PreboardDokumen10 halamanPRTC P2 1st PreboardRommel Royce0% (1)

- PRTC Mas First PBDokumen11 halamanPRTC Mas First PBralphalonzo100% (2)

- HyperinflationDokumen2 halamanHyperinflationralphalonzoBelum ada peringkat

- Cost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%Dokumen10 halamanCost-Volume-Profit Relationslt R,) 56. The Company's Overall Contribution Margin Ratio Fur The Sales Mix Expected Is H. 45%. D. 60%ralphalonzoBelum ada peringkat

- Chapter 1 With Reference To ICAP 2015 Study TextDokumen10 halamanChapter 1 With Reference To ICAP 2015 Study TextralphalonzoBelum ada peringkat

- 7 Remedial PDFDokumen66 halaman7 Remedial PDFMinahBelum ada peringkat

- MAS.M-1405 Cost of Capital Straight ProblemsDokumen12 halamanMAS.M-1405 Cost of Capital Straight ProblemsralphalonzoBelum ada peringkat

- A. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 MillionDokumen11 halamanA. Variable Costs, P18 Million. B. Fixed Costs. P12 Million. C. Operating Income, P4 Million. D. Break-Even Sales Volume, P20 Millionralphalonzo100% (1)

- WSP Install GuideDokumen176 halamanWSP Install GuideStefano EsmBelum ada peringkat

- Sales Agency and Credit Transactions 1Dokumen144 halamanSales Agency and Credit Transactions 1Shaneen AdorableBelum ada peringkat

- EBO 2 - Worldwide Energy Scenario - FINALDokumen15 halamanEBO 2 - Worldwide Energy Scenario - FINALmodesto66Belum ada peringkat

- Villaber Vs ComelecDokumen13 halamanVillaber Vs ComelecJAMBelum ada peringkat

- Anglais L3 FinanceDokumen10 halamanAnglais L3 FinanceRomaric YapoBelum ada peringkat

- Ch.3 Accounting of Employee Stock Option PlansDokumen4 halamanCh.3 Accounting of Employee Stock Option PlansDeepthi R TejurBelum ada peringkat

- Functions of Quality DepartmentDokumen5 halamanFunctions of Quality DepartmentsachinBelum ada peringkat

- India's Foreign PolicyDokumen21 halamanIndia's Foreign PolicyManjari DwivediBelum ada peringkat

- CO1 Week 3 Activities Workbook ExercisesDokumen2 halamanCO1 Week 3 Activities Workbook ExercisesFrank CastleBelum ada peringkat

- Sample Motion To Strike For Unlawful Detainer (Eviction) in CaliforniaDokumen5 halamanSample Motion To Strike For Unlawful Detainer (Eviction) in CaliforniaStan Burman91% (11)

- Swiss Public Transportation & Travel SystemDokumen42 halamanSwiss Public Transportation & Travel SystemM-S.659Belum ada peringkat

- Schiffman CB10 PPT 09Dokumen39 halamanSchiffman CB10 PPT 09chawla_sonam0% (1)

- Sub Contract Agreement TabukDokumen7 halamanSub Contract Agreement TabukHanabishi RekkaBelum ada peringkat

- Glory To GodDokumen2 halamanGlory To GodMonica BautistaBelum ada peringkat

- Reviewer For Fundamentals of Accounting and Business ManagementDokumen4 halamanReviewer For Fundamentals of Accounting and Business ManagementAngelo PeraltaBelum ada peringkat

- Financial Accounting Harrison 10th Edition Test BankDokumen24 halamanFinancial Accounting Harrison 10th Edition Test BankNicoleHallrktc100% (46)

- Commercial Law Recit QuestionsDokumen118 halamanCommercial Law Recit QuestionsHBelum ada peringkat

- Food Court ProposalDokumen3 halamanFood Court ProposalJoey CerenoBelum ada peringkat

- ALBAO - BSChE2A - MODULE 1 (RIZAL)Dokumen11 halamanALBAO - BSChE2A - MODULE 1 (RIZAL)Shaun Patrick AlbaoBelum ada peringkat

- © The Institute of Chartered Accountants of IndiaDokumen24 halaman© The Institute of Chartered Accountants of IndiaPraveen Reddy DevanapalleBelum ada peringkat

- MD - IMO - 269 - EU of ACS2 Sys. Cont.Dokumen1 halamanMD - IMO - 269 - EU of ACS2 Sys. Cont.remakermaritime.cgpBelum ada peringkat

- Major Petroleum CompaniesDokumen75 halamanMajor Petroleum CompaniesShaho Abdulqader MohamedaliBelum ada peringkat

- BARCLAYS BANK INVOICE TRANSFER - PulihkanDokumen3 halamanBARCLAYS BANK INVOICE TRANSFER - PulihkanIndo Tracking67% (3)

- Affidavit of FactDokumen3 halamanAffidavit of FactMortgage Compliance Investigators100% (8)

- Practice On TensesDokumen2 halamanPractice On TensesLinh ĐanBelum ada peringkat

- Earning Updates (Company Update)Dokumen93 halamanEarning Updates (Company Update)Shyam SunderBelum ada peringkat

- National Park PirinDokumen11 halamanNational Park PirinTeodor KrustevBelum ada peringkat

- Aditya DecertationDokumen44 halamanAditya DecertationAditya PandeyBelum ada peringkat

- Identity Mapping ExerciseDokumen2 halamanIdentity Mapping ExerciseAnastasia WeningtiasBelum ada peringkat

- Perry I Dr. - Transitions To School PDFDokumen301 halamanPerry I Dr. - Transitions To School PDFAdrijana Visnjic JevticBelum ada peringkat