Derivatives@SSL 01-02-17 PDF

Diunggah oleh

Ompal SinghJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Derivatives@SSL 01-02-17 PDF

Diunggah oleh

Ompal SinghHak Cipta:

Format Tersedia

1-Feb-17

NIFTY TODAY PREVIOUS Change Market opened gap down and ended lower amid

Cash 8561.30 8632.75 -71.45 caution ahead of the Union Budget while IT pack

witnessed good amount of selling after a reform

Futures 8584.30 8655.35 -71.05

H1-B visa bill was introduce in US Congress.

Basis 23.00 22.60 0.40

Total_OI (Lacs) 205.83 210.23 -4.39 Nifty Feb future registered an intraday movement

of 64 points, making high of 8639.8 and low of

PCR-OI 0.98 0.97 8576.25

HV 14.19% 14.08%

COC 4.46% 4.15% India VIX, a measure of expected market volatility

in near term closed at 16.825, up 0.93% , made

high of 17.09 and low of 15.7125

BANKNIFTY TODAY PREVIOUS Change

Cash 19515.15 19585.25 -70.10 The Market wide open interest up from 414.07 cr.

to 435.35 cr. up by 5.14%

Futures 19588.45 19650.55 -62.10

Basis 73.30 65.30 8.00 FII's were Net Seller of Rs. -532.88 cr in cash

Total_OI (Lacs) 20.58 21.70 -1.12 market; while DII's were Net Buyer of Rs. 237.37 cr.

PCR-OI 0.82 0.92 In Nifty option segment Feb Call side 9000, 8900 &

HV 20.03% 20.60% 8800 strike witnessed addition of 10.55 Lac, 6.39

COC 6.23% 5.29% Lac & 4.01 Lac shares in open interest respectively.

In Nifty Put side 8400, 8200 & 8300 strike

VIX Nifty_Fut_Close witnessed addition of 9.73 Lac, 3.24 Lac & 2.12 Lac

shares in open interest respectively.

8700 8671.10 18 Max OI buildup was observed at 9000 Call and

8655.35

17 8400 Put for current month.

8650

8614.85 16 Market Outlook

8600 8584.30

15 Today the start in market is likely to be positive

14 tracking global peers while all eyes will be on the

8550 Union Budget for further determination of trend.

16.83

15.29

15.17

16.01

16.67

8509.60 13

Nifty future may find resistance at 8675 8715 levels

8500 12 while support may be seen at 8470 8455 levels.

24-Jan 25-Jan 27-Jan 30-Jan 31-Jan

Price_Gainers Price_Losers

Symbol Close Price_Chg OI_Chg Symbol Close Price_Chg OI_Chg

IDEA 107.30 10.62% -3.77% GRASIM 914.05 -5.91% 6.28%

JPASSOCIAT 11.50 6.98% 8.64% ABIRLANUVO 1358.15 -5.70% 4.60%

IFCI 30.95 3.34% 3.36% ADANIENT 87.70 -5.29% 9.12%

JUBLFOOD 878.75 1.30% -0.54% DISHTV 84.20 -4.75% 1.66%

INDUSINDBK 1256.15 0.95% 0.57% JUSTDIAL 363.65 -4.59% -0.14%

OI_Gainers OI_Losers

Symbol Close Price_Chg OI_Chg Symbol Close Price_Chg OI_Chg

ONGC 201.20 -0.10% 17.08% IBREALEST 75.65 -4.18% -11.05%

PFC 129.35 -3.40% 16.84% SRF 1,712.10 0.82% -7.95%

MINDTREE 451.60 -3.48% 14.66% BAJFINANCE 1,040.85 -1.76% -7.29%

WIPRO 457.45 -1.67% 12.87% CESC 737.60 -1.05% -7.18%

OIL 321.95 -3.38% 11.46% BIOCON 1,013.00 -1.12% -6.46%

SBICAP Securities Limited 1

CE PE

Nifty Change in Option Open Interest IV Close Strike Close IV

12 11.45 416.35 8200 34.85 19.81

10

13.73 331.05 8300 51.25 19.24

10.55

8

9.73

6 14.30 253.95 8400 74.15 18.64

6.39

4 14.35 186.80 8500 105.25 18.28

3.24

2.12

1.01

3.35

3.52

4.01

2

1.57

0 14.38 130.60 8600 146.55 17.86

14.21 85.05 8700 198.40 17.50

-1.83

-1.83

-0.75

-1.58

-0.71

-1.31

-0.06

-0.17

-2

-4 14.00 50.95 8800 263.75 17.67

8800

8200

8300

8400

8500

8600

8700

8900

9000

13.85 28.25 8900 339.75 17.53

13.93 15.00 9000 422.50 18.49

Symbol UP_COC Symbol Down_COC STOCK PCR-OI STOCK High_HV

GMRINFRA 19.60% IOC -56.83% TORNTPHARM 400.00% IDEA 123.64%

JPASSOCIAT 14.55% UNIONBANK -55.23% IDEA 129.83% JPASSOCIAT 79.88%

ADANIENT 10.47% RECLTD -47.27% KPIT 128.57% DIVISLAB 71.95%

PTC 9.86% IDEA -42.19% WIPRO 108.81% BHARATFIN 69.18%

ANDHRABANK 9.83% OIL -38.75% BHARTIARTL 106.49% INFRATEL 69.03%

Sector wise OI Change Change

5.56%

4.15%

3.00%

2.54% 2.40%

2.03%

1.41% 1.31%

0.56% 0.33%

0.50% 0.03%

-0.14% -0.26% -0.18%

-0.98% -1.21%

Cement

Automobile

Financial

Pharma

Index

Media

Metals

IT

Banking

Telecom

Others

Capital Goods

Construction

Energy

TEXTILES

FMCG

Oil & Gas

Most Active Stock Options

Sym bol Strike Close No.of Lots Chg in OI Sym bol Strike Close No.of Lots Chg in OI

IDEA 115 CE 4.75 11,481 7,833,000 IDEA 100 PE 4.35 4,891 3,423,000

INFY 980 CE 8.45 4,009 465,500 INFY 900 PE 16.05 4,509 192,500

ICICIBANK 270 CE 11.35 3,091 992,500 ICICIBANK 270 PE 11.15 2,054 747,500

RELIANCE 1060 CE 17.70 2,031 71,000 TCS 2200 PE 48.95 1,816 65,750

ONGC 210 CE 5.20 1,910 1,515,000 TATAMOTORS 520 PE 16.50 1,399 336,000

FII DERIVATIVES STATISTICS FOR 31-Jan-2017

Intraday Trading Ideas

NET

Change in OI

Buy/Sell in

Buy COALINDIA Fut 308.45 SL 304 Trgt 315.2 Crs

(Conts)

Sell PFC Fut 129.35 SL 131 Trgt 126.85 Index Futures -320.00 -8,908

Buy ITC 260 CALL 9.4 SL 7.1 Trgt 12.9 Index Options 500.28 91,480

Buy RELIANCE 1040 CALL 26.7 SL 22 Trgt 34 Stock Futures -996.23 10,135

Stock Options -74.81 10,896

SBICAP Securities Limited 2

SBICAP Securities Limited

(CIN): U65999MH2005PLC155485 | Research Analyst Registration No INH000000602

SEBI Registration No.: NSE Capital Market: INB 231052938 | NSE Derivatives: INF 231052938 |BSE Capital Market: INB 011053031

Currency Derivatives: INE 231052938 | CDSL: INDPCDSL3702006 | IRDA/IR2/2014/241

Regd. & Corporate Office: SBICAP Securities Limited

Marathon Futurex, A & B Wing, 12th Floor, N. M. Joshi Marg, Lower Parel (East), Mumbai-13.

Tel.: 91-22-42273300 / 3301 (Board)

Email: retail.research@sbicapsec.com

DISCLOSURES &DISCLAIMERS

Analyst Certification

The views expressed in this research report (Report) accurately reflect the personal views of the research analysts (Analysts) employed

by SBICAP Securities Limited (SSL) about any and all of the subject issuer(s) or company(ies) or securities. This report has been prepared

based upon information available to the public and sources, believed to be reliable. I/We also certify that no part of my/our compensation

was, is, or will be directly or indirectly related to the specific recommendation(s) or view(s) in this report.

The Analysts engaged in preparation of this Report or his/her relative:-

(a) do not have any financial interests in the subject company mentioned in this Report; (b) do not own 1% or more of the equity securities

of the subject company mentioned in the report as of the last day of the month preceding the publication of the research report; (c) do not

have any material conflict of interest at the time of publication of the Report.

The Analysts engaged in preparation of this Report:-

(a) have not received any compensation from the subject company in the past twelve months; (b) have not managed or co-managed public

offering of securities for the subject company in the past twelve months; (c)have not received any compensation for investment banking or

merchant banking or brokerage services from the subject company in the past twelve months; (d) have not received any compensation for

products or services other than investment banking or merchant banking or brokerage services from the subject company in the past twelve

months; (e) has not received any compensation or other benefits from the subject company or third party in connection with the Report; (f)

has not served as an officer, director or employee of the subject company; (g) is not engaged in market making activity for the subject

company

Name Qualification Designation

Mahantesh Sabarad B. E. MMS Head - Retail Research

Jaldeep Vaishnav PGDBA - Fin Derivatives Analyst

Hemang Gor CFA (ICFAI) Derivatives Analyst

SBICAP Securities Limited 3

Other Disclosures :

SBICAP Securities Limited (SSL),a full service Stock Broking company, is engaged in diversified financial services business including

equity broking, DP services, distribution of Mutual Fund, insurance products and other financial products.SSL is a member of National

Stock Exchange of India Limited and BSE Limited. SSL is also a Depository Participant registered with NSDL & CDSL. SSL is a large

broking house catering to retail, HNI and institutional clients. It operates through its branches and authorized persons spread across the

country and the clients are provided online trading through internet and offline trading through branches and call & trade facility. SSL is a

wholly owned subsidiary of SBI Capital Markets Limited (SBICAP), which is engaged into investment banking, project advisory and

financial services activities and is registered with the Securities and Exchange Board of India as a Category I Merchant Banker. SBICAP

is a wholly owned subsidiary of State Bank of India. Hence, State Bank of India and all its subsidiaries, including, SBICAP and banking

subsidiaries are treated and referred to as Associates of SSL.

We hereby declare that our activities were neither suspended nor we have materially defaulted with any stock exchange authority with

whom we are registered in last five years. However SEBI, Exchanges and Depositories have conducted the routine inspection and based

on their observations have issued advice letters or levied minor penalty for certain procedural lapses. We have not been debarred from

doing business by any Stock Exchange / SEBI or any other authorities; nor has our certificate of registration been cancelled by SEBI at any

point of time.

SSL or its Associates, may: (a) from time to time, have long or short position in, and buy or sell the securities of the company mentioned in

the Report or (b) be engaged in any other in any other transaction involving such securities and earn brokerage or other compensation or

act as a market maker in the financial instruments of the company discussed herein or act as an advisor or lender/borrower to such

company or may have any other potential conflict of interests with respect to any recommendation and other related information and

opinions.

SSL does not have actual / beneficial ownership of one per cent or more securities of the subject company, at the end of the month

immediately preceding the date of publication of the Report. However, since Associates of SSL are engaged in the financial services

business, they might have in their normal course of business financial interests or actual / beneficial ownership of one per cent or more in

various companies including the subject company mentioned herein this Report.

SSL or its Associates might have managed or co-managed public offering of securities for the subject company in the past twelve months

and might have received compensation from the companies mentioned in the Report during the period preceding twelve months from the

date of this Report for services in respect of managing or co-managing public offerings/corporate finance, investment banking or merchant

banking, brokerage services or other advisory services in a merger or specific transaction.

Compensation paid to Analysts of SSL is not based on any specific merchant banking, investment banking or brokerage service

transaction.

SSL or its Associate did not receive any compensation or any benefit from the subject company or third party in connection with preparation

of this Report.

This Report is for the personal information of the authorized recipient(s) and is not for public distribution and should not be reproduced,

transmitted or redistributed to any other person or in any form without SSLs prior permission. The information provided in the Report is

from publicly available data, which we believe, are reliable. While reasonable endeavors have been made to present reliable data in the

Report so far as it relates to current and historical information, but SSL does not guarantee the accuracy or completeness of the data in the

Report. Accordingly, SSL or any of its Associates including directors and employees thereof shall not be in any way responsible or liable for

any loss or damage that may arise to any person from any inadvertent error in the information contained, views and opinions expressed in

this Report or in connection with the use of this Report.

Please ensure that you have read Risk Disclosure Document for Capital Market and Derivatives Segments as prescribed by Securities

and Exchange Board of India before investing in Indian securities market.

The projections and forecasts described in this Report should be carefully evaluated as these :

1. Are based upon a number of estimates and assumptions and are inherently subject to significant uncertainties and contingencies.

2. Can be expected that some of the estimates on which these were based, will not materialize or will vary significantly from actual

results, and such variances may increase over time.

3. Are not prepared with a view towards compliance with published guidelines or generally accepted accounting principles. No

independent accountants have expressed an opinion or any other form of assurance on these.

Should not be regarded, by mere inclusion in this report, as a representation or warranty by or on behalf of SSL the authors of this report, or

any other person, that these or their underlying assumptions will be achieved

This Report is for information purposes only and SSL or its Associates accept no liabilities for any loss or damage of any kind arising out of

the use of this report. Though disseminated to recipients simultaneously, not all recipients may receive this report at the same time. SSL

will not treat recipients as clients by virtue of their receiving this report. It should not be construed as an offer to sell or solicitation of an offer

to buy, purchase or subscribe to any securities this report shall not form the basis of or be relied upon in connection with any contract or

commitment, whatsoever. This report does not solicit any action based on the material contained herein.

SBICAP Securities Limited 4

It does not constitute a personal recommendation and does not take into account the specific investment objectives, financial

situation/circumstances and the particular needs of any specific person who may receive this document. The securities discussed in this

Report may not be suitable for all the investors. SSL does not provide legal, accounting or tax advice to its clients and you should

independently evaluate the suitability of this Report and all investors are strongly advised to seek professional consultation regarding any

potential investment.

Certain transactions including those involving futures, options, and other derivatives as well as non-investment grade securities give rise to

substantial risk and are not suitable for all investors. Foreign currency denominated securities are subject to fluctuations in exchange rates

that could have an adverse effect on the value or price of or income derived from the investment.

The price, value and income of the investments referred to in this Report may fluctuate and investors may realize losses on any

investments. Past performance is not a guide for future performance. Actual results may differ materially from those set forth in projections.

SSL has reviewed the Report and, the current or historical information included here is believed to be reliable, the accuracy and

completeness of which is not guaranteed. SSL does not have any obligation to update the information discussed in this Report.

The opinions expressed in this report are subject to change without notice and SSL or its Associates have no obligation to tell the clients

when opinions or information in this report change. This Report has not been approved and will not or may not be reviewed or approved by

any statutory or regulatory authority in India, United Kingdom or Singapore or by any Stock Exchange in India, United Kingdom or

Singapore. This report may not be all inclusive and may not contain all the information that the recipient may consider material.

The securities described herein may not be eligible for sale in all jurisdictions or to all categories of investors. The countries in which the

companies mentioned in this Report are organized may have restrictions on investments, voting rights or dealings in securities by nationals

of other countries. Distributing /taking/sending/dispatching/transmitting this document in certain foreign jurisdictions may be restricted by

law, and persons into whose possession this document comes should inform themselves about, and observe, any such restrictions. Failure

to comply with this restriction may constitute a violation of laws in that jurisdiction.

-------------------------------------------------------------------------------------------------------------------------------

Legal Entity Disclosure

Singapore: This Report is distributed in Singapore by SBICAP (Singapore) Limited (Registration No. 201026168R), an Associate of SSL

incorporated in Singapore. SBICAP (Singapore) Limited is regulated by the Monetary Authority of Singapore as a holder of a Capital

Markets Services License and an Exempt Financial Adviser in Singapore. SBICAP (Singapore) Limiteds services are available solely to

persons who qualify as Institutional Investors or Accredited Investors (other than individuals) as defined in section 4A(1) of the Securities

and Futures Act, Chapter 289 of Singapore (the SFA) and this Report is not intended to be distributed directly or indirectly to any other

class of persons. Persons in Singapore should contact SBICAP (Singapore) Limited in respect of any matters arising from, or in connection

with this report via email at singapore.sales@sbicap.sgor by call at +65 6709 8651..

United Kingdom: SBICAP (UK) Limited, a fellow subsidiary of SSL, incorporated in United Kingdom is authorised and regulated by the

Financial Conduct Authority. This marketing communication is being solely issued to and directed at persons (i) fall within one of the

categories of Investment Professionals as defined in Article 19(5) of the Financial Services and Markets Act 2000 (Financial Promotion)

Order 2005, as amended (the Financial Promotion Order), (ii) fall within any of the categories of persons described in Article 49 of the

Financial Promotion Order (High net worth companies, unincorporated associations etc.) or (iii) any other person to whom it may

otherwise lawfully be made available (together Relevant Persons) by SSL. The materials are exempt from the general restriction on the

communication of invitations or inducements to enter into investment activity on the basis that they are only being made to Relevant

Persons and have therefore not been approved by an authorised person as would otherwise be required by section 21 of the Financial

Services and Markets Act 2000 (FSMA).

SBICAP Securities Limited 5

Anda mungkin juga menyukai

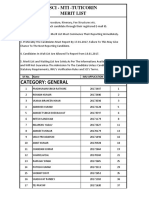

- Sci Merit List - Tuticorin-2b8a2eDokumen4 halamanSci Merit List - Tuticorin-2b8a2eOmpal SinghBelum ada peringkat

- Public Health BNNNDokumen8 halamanPublic Health BNNNOmpal SinghBelum ada peringkat

- Weld ESTIMATEDokumen6 halamanWeld ESTIMATEOmpal SinghBelum ada peringkat

- RRB 2015 Application FormDokumen2 halamanRRB 2015 Application FormOmpal SinghBelum ada peringkat

- S.P. Form-44: Ticket Size Photo To Be Pasted (Not To Be Stapled) SignatureDokumen1 halamanS.P. Form-44: Ticket Size Photo To Be Pasted (Not To Be Stapled) SignatureOmpal SinghBelum ada peringkat

- UPTSyllabusDokumen17 halamanUPTSyllabusOmpal SinghBelum ada peringkat

- AgricultureDokumen16 halamanAgricultureTekchand BhardwajBelum ada peringkat

- Demo Weld Cost Calc XL-UnprotectedDokumen10 halamanDemo Weld Cost Calc XL-UnprotectedA R0% (1)

- Estimation Man HourDokumen241 halamanEstimation Man HourAnonymous ynJByUs52% (42)

- Vigilance A Management ToolDokumen24 halamanVigilance A Management ToolOmpal SinghBelum ada peringkat

- AppendixDokumen5 halamanAppendixAakashParanBelum ada peringkat

- Photograph: Passport Size Photograph (3.5 CM X 4.5 CM)Dokumen3 halamanPhotograph: Passport Size Photograph (3.5 CM X 4.5 CM)Ompal SinghBelum ada peringkat

- Student Slides M8Dokumen6 halamanStudent Slides M8Ompal SinghBelum ada peringkat

- National Productivity Council PDFDokumen1 halamanNational Productivity Council PDFOmpal SinghBelum ada peringkat

- Travelling AllowanceDokumen1 halamanTravelling AllowanceOmpal SinghBelum ada peringkat

- (WWW - Sssdoc.com) Assessment Material  Explain The Application of HACCP PrinciplesDokumen7 halaman(WWW - Sssdoc.com) Assessment Material  Explain The Application of HACCP PrinciplesOmpal SinghBelum ada peringkat

- CONFIDENTIAL PERSONAL INFO QUESTIONNAIREDokumen2 halamanCONFIDENTIAL PERSONAL INFO QUESTIONNAIREOmpal SinghBelum ada peringkat

- HydraulicsDokumen22 halamanHydraulicsOmpal Singh100% (1)

- Industrial Hygiene Part2 Paper VDokumen19 halamanIndustrial Hygiene Part2 Paper VOmpal SinghBelum ada peringkat

- Student Slides M6Dokumen14 halamanStudent Slides M6niyo7Belum ada peringkat

- Advertisement DetailsDokumen4 halamanAdvertisement DetailsOmpal SinghBelum ada peringkat

- Advertisement DetailsDokumen4 halamanAdvertisement DetailsOmpal SinghBelum ada peringkat

- Microsoft Word - Unit - 18Dokumen20 halamanMicrosoft Word - Unit - 18Ompal SinghBelum ada peringkat

- Industrial Hygiene Part1 Paper VDokumen24 halamanIndustrial Hygiene Part1 Paper VOmpal SinghBelum ada peringkat

- Safety in Engineering Paper IIIDokumen42 halamanSafety in Engineering Paper IIIOmpal Singh100% (1)

- 1st Year CurriculumDokumen67 halaman1st Year CurriculumOmpal SinghBelum ada peringkat

- Strength of MaterialDokumen1 halamanStrength of MaterialOmpal SinghBelum ada peringkat

- Strength of MaterialDokumen1 halamanStrength of MaterialOmpal SinghBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Articles of Incorporation Credit Financing CompanyDokumen4 halamanArticles of Incorporation Credit Financing Companyig185011Belum ada peringkat

- Washington Parcel Records with Addresses and Property TypesDokumen501 halamanWashington Parcel Records with Addresses and Property TypesantoniogilmoreBelum ada peringkat

- Derivatives Case StudyDokumen2 halamanDerivatives Case Studysw_rlkBelum ada peringkat

- The Purpose and Use of Financial StatementsDokumen56 halamanThe Purpose and Use of Financial StatementsDang ThanhBelum ada peringkat

- Close CorporationDokumen6 halamanClose CorporationMike E Dm0% (1)

- Chapter Six Consolidation of Financial Statements Under Purchase AccountingDokumen15 halamanChapter Six Consolidation of Financial Statements Under Purchase AccountingMelody Lisa100% (1)

- Reference Materials - Lecture 9Dokumen18 halamanReference Materials - Lecture 9Daniella Pennino0% (1)

- Finman - ReviewerDokumen10 halamanFinman - ReviewerGian CPABelum ada peringkat

- Strike Off CompanyDokumen3 halamanStrike Off CompanyCHUAN YONG TANBelum ada peringkat

- Australian Financial Reporting Manual June 2014Dokumen192 halamanAustralian Financial Reporting Manual June 2014pnrahmanBelum ada peringkat

- Elements of InsuranceDokumen1 halamanElements of InsuranceattyalanBelum ada peringkat

- Failure of Risk Management On Lehman BrothersDokumen34 halamanFailure of Risk Management On Lehman Brotherssubsidyscope_bailoutBelum ada peringkat

- 3 02.03.2020 NCLT Court No - IiiDokumen5 halaman3 02.03.2020 NCLT Court No - IiiVbs ReddyBelum ada peringkat

- Mergers and AcquisitionsDokumen19 halamanMergers and AcquisitionspallavinagamBelum ada peringkat

- Summary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Survey Submitted For End-July 2019Dokumen2 halamanSummary of Corresponding Fees of BSP Supervised Financial Institutions (Bsfis) From The Survey Submitted For End-July 2019tektitemoBelum ada peringkat

- IFCIAnnualReport 2014 15 PDFDokumen136 halamanIFCIAnnualReport 2014 15 PDFarun dasBelum ada peringkat

- Nature of Partnership BusinessDokumen6 halamanNature of Partnership BusinessMillenine Lupa-asBelum ada peringkat

- 7 - Case Study Enron PDFDokumen1 halaman7 - Case Study Enron PDFSKBelum ada peringkat

- Insider Trading ExplainedDokumen7 halamanInsider Trading ExplainedChaitanya DeshpandeBelum ada peringkat

- 01 - Principles of FinanceDokumen50 halaman01 - Principles of FinanceBagusranu Wahyudi PutraBelum ada peringkat

- Chapter 07 SwapsDokumen40 halamanChapter 07 Swapssteven smithBelum ada peringkat

- Overview of SEBI Takeover Regulations, 2011 PDFDokumen54 halamanOverview of SEBI Takeover Regulations, 2011 PDFSumit AroraBelum ada peringkat

- Drill 2 CorporationDokumen2 halamanDrill 2 CorporationweqweqwBelum ada peringkat

- Importance of Committees for Effective Corporate GovernanceDokumen22 halamanImportance of Committees for Effective Corporate GovernanceshankarinadarBelum ada peringkat

- Stan Lee Media Boxes Index of Files and DocsDokumen170 halamanStan Lee Media Boxes Index of Files and DocsinqwizitorBelum ada peringkat

- Corporate Law in PakistanDokumen9 halamanCorporate Law in PakistanArshad IslamBelum ada peringkat

- Mumbai DatabaseDokumen41 halamanMumbai DatabaseSumitBelum ada peringkat

- Company Law SujithDokumen8 halamanCompany Law SujithArshdeep SinghBelum ada peringkat

- Convertible Whole Life Assurance PlanDokumen8 halamanConvertible Whole Life Assurance PlanNaveenBelum ada peringkat

- ACCO 112 - Corporations: Organization and Capital Stock TransactionsDokumen5 halamanACCO 112 - Corporations: Organization and Capital Stock TransactionsGrisselleBelum ada peringkat