ACTION NEEDED - Policy Application - Encrypted - PDF

Diunggah oleh

Adella HobbsJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

ACTION NEEDED - Policy Application - Encrypted - PDF

Diunggah oleh

Adella HobbsHak Cipta:

Format Tersedia

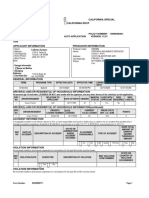

X CALIFORNIA SPECIAL

CALIFORNIA RSVP

CALIFORNIA DELUXE

Infinity Insurance Company POLICY NUMBER: 104601191219001

P.O. Box 830189 AUTO APPLICATION VERSION: 8.10 11/24/2014

Birmingham, AL 35283-0189 / 1-800-782-1020

APPLICANT INFORMATION PRODUCER INFORMATION

Name: Linda White Producer Code: 10460-511830

Address: 4230 HIGHWAY 108 Name: INSURANCE ZEBRA, INC

City/State/Zip: RIVERBANK, CA 95367 Address: 301 Chicon St Ste A

Home Phone: 209-312-8036 Work Phone: City/State/Zip: AUSTIN TX 78702

SSN: Phone: 888-255-4364 Fax: 512-910-8558

Garage Information

X Same as Mailing Address

Garaging Address: 4230 HIGHWAY 108

City/State/Zip: RIVERBANK CA 95367

GENERAL INFORMATION

TERM PROGRAM TYPE EFFECTIVE DATE EFFECTIVE TIME EXPIRATION DATE EXPIRATION TIME

12 MONTHS Special 06/02/2015 12:01:00 AM 06/02/2016 12:01:00 AM

DRIVER(S) AND/OR RESIDENT(S) OF HOUSEHOLD INFORMATION

All persons age 15 and older, LICENSED OR NOT, who reside with the applicant, and any other drivers of the vehicle(s) on this application.

DRV DRIVER/RESIDENT RELATION TO DATE OF GENDER MARITAL LIVES WITH SR22 REQUIRED SR22 CASE NO

NO APPLICANT BIRTH STATUS APPLICANT

1 Linda White Self 12/15/1962 F Married Yes No

2 Steven White Spouse 05/11/1959 M Married Yes

DRIVER(S) AND/OR RESIDENT(S) OF HOUSEHOLD INFORMATION (continued)

DRV DRIVER/RESIDENT DRIVER'S LICENSE DATE LICENSED CURRENT VALID PRIOR STATE DRV. POINTS

NO NUMBER LICENSE LIC. NUM.

1 Linda White A9949347 01/02/1979 CA N/A 0

2 Steven White 06/02/1975 CA N/A 0

ACCIDENT INFORMATION

A chargeable accident is one where a person is 51% or more responsible and results in bodily injury or death or for an accident that resulted only in damage to property exceeding a

threshold of $1,000.00 for occurrences on or after 12/11/11 or $750.00 for occurrences prior to 12/11/11.

DRV DATE OF DESCRIPTION OF ACCIDENT STATE OR IS ACCIDENT TYPE OF ACCIDENT DOES TOTAL AMOUNT

NO ACCIDENT JURISDICTION WHERE CHARGEABLE OF DAMAGE EXCEED

ACCIDENT OCCURED THRESHOLD AMOUNT

Yes No BI Death PD Only Yes No

VIOLATION INFORMATION

All convicted violations and license suspensions or revocations for the past 60 months must be shown.

DRV VIOLATION CONVICTED DESCRIPTION OF VIOLATION DMV VIOLATION STATE OR COUNTRY OF

NO DATE CODE NUMBER VIOLATION OCCURRENCE

Yes No

VEHICLE INFORMATION

Losses are adjusted based on ACV not to exceed current market Value.

VEH YEAR MAKE MODEL DESCRIPTION VEHICLE IDENTIFICATION NUMBER (VIN)

*1 1999 GMC YUKON YUKON SLE/SLT/DENALI 4DR 4X4 1GKEK13R8XJ757186

* Indicates VIN is incorrect and cannot be reported to the state of California.

VEHICLE INFORMATION (continued)

VEH VEHICLE USE VEH USE POINTS ANNUAL MILEAGE CURRENT VALUE

1 Personal 9000-9999 29919

LIENHOLDER / LESSOR INFORMATION

VEH INTEREST NAME ADDRESS PHONE NUMBER ACCOUNT NUMBER

Form Number 02300 R0711 Page 1

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

CUSTOM & SPECIAL ADD-ON EQUIPMENT - refer to manual for rules and procedures

VEH VALUE OF EACH*** DATE OF PURCHASE DESCRIPTION OF EACH ITEM WHERE PURCHASED

***MAXIMUM TOTAL VALUE OF EQUIPMENT IS $9,999 NEW (STEREO VALUE ON ANY VEHICLE CANNOT EXCEED $1,000).

PREMIUM DISCOUNTS/SURCHARGES INFORMATION

APPLIED TO: DISCOUNT/SURCHARGE DESCRIPTIONS

POLICY

VEHICLE 1

DRIVER 1 Good_drv2-D /

Form Number 02300 R0711 Page 2

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

SPECIAL PROGRAM

104601191219001 Linda White

POLICY COVERAGE INFORMATION

COVERAGE LIMITS

BODILY INJURY $15,000 each person / $30,000 each accident

PROPERTY DAMAGE $5,000 each accident

UNINSURED MOTORIST - BI NOT TAKEN

UNINSURED MOTORIST - PD NOT TAKEN

MEDICAL PAYMENTS NOT TAKEN

ROADSIDE ASSISTANCE NOT TAKEN

ACCIDENTAL DEATH NOT TAKEN

POLICY DEDUCTIBLE INFORMATION

COL COM REN RA TOW SPE

Vehicle 1 N/A N/A N/A N/A N/A N/A

POLICY PREMIUM INFORMATION

BI PD UMBI UMPD MED ACC

Vehicle 1 $140.00 $167.00 - - - -

* If asterisk denoted next to premium above, coverage includes the Lessor Liability Endorsement (03332 N0799) with Lessor BI Limits of 100/300 and PD limit of 50.

POLICY PREMIUM INFORMATION (continued)

COL COM CDW REN RA TOW SPE VEHICLE TOTAL

Vehicle 1 - - - - - - - $307.00

PREMIUM INFORMATION

Total Premium: $307.00 Down Payment: $32.46

CA Fraud Fee Recoup: $1.76 Down Payment Method: Credit Card

SR22 Fee: $0.00 Installment Fee: $10.00

Total Charges: $308.76 Installments: 11

Installment Amount: $35.12

Notes to Infinity

Form Number 02300 R0711 Page 3

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

CA_ELE_PP_01 INFINITY INSURANCE COMPANIES

ELECTRONIC SIGNATURE DISCLOSURE AND CONSENT

This Electronic Signature Disclosure and Consent addresses the circumstances under which you agree to use

electronic signatures in doing business with Infinity. If you consent, you may use electronic signatures to sign

documents associated with 1) your application or 2) other insurance transactions during the term of your Infinity

policy. Your consent permits us to send you applicable documents electronically in connection with your

application or other transaction. All electronic communications and documents between Infinity and you will be

considered in writing. Your electronic signature is as legally binding as your signature on a paper document.

Please read this notice carefully before giving your consent. Please print or save for your records a copy

of any electronic communication or document, including this Disclosure and Consent Page, that is

important to you. If you have any trouble with printing or downloading, you may request paper copies by

contacting one of our Customer Service Representatives.

Your Right to Withdraw Your Consent. If you consent and change your mind later, you may withdraw your

consent at any time by calling 800-782-1020. If you do not give consent, or withdraw consent before the

transaction process is complete, we cannot accept and process your transaction until we deliver the appropriate

documents to you on paper.

Change of Your Designated E-Mail Address. If you need to update your e-mail address or other contact

information with Infinity, you may do so by updating your preferences online at www.infinityauto.com or by calling

800-782-1020.

How to Receive Paper Copies. You may obtain paper copies at any time by contacting us at 800-782-1020.

There are no fees associated with requesting paper copies.

Computer Software and Hardware Requirements:

You must have the following listed items and features in order to electronically sign and print Infinity documents:

1. Be able to view the electronic communications and documents on your monitor, which can be done with a

Compatible Internet Browser.

2. Have access to an Internet service account.

3. Use Adobe Acrobat Reader. You will have the option to download your documents in an Adobe Acrobat

PDF file.

4. Be able to receive e-mail. Infinity may require you to validate your e-mail address.

5. Have access to a computer and operating system that can support these functions and software, and that

permits you to either save files on a storage device for later reference or is connected to a printer that will

print out information displayed on your Internet Browser.

If we change the computer software or hardware requirements, we will provide you with advance notice of the

new requirements. If you do not have the required software and/or hardware, or if you do not wish to use

electronic records for any other reason, you can opt for an alternative process by calling 800-782-1020.

Infinity may, in its sole discretion, deliver paper copies of applicable documents if it chooses to do so and

discontinue the provision of electronic documents. Infinity may also require that certain communications from you

be sent to it on paper at a specified address.

X I consent to the use of electronic signatures in connection with my transactions with Infinity,

including delivery of applicable electronic documents. I have been able to read this notice

using my computer and software. I have successfully printed or downloaded a copy of this

notice. I have access to an account with an Internet Service Provider, and I am able to send and

receive e-mail.

I do not consent.

Form Number 00000ESD01

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Special Program

3700 Colonnade Parkway, Suite 600

Birmingham, AL 35243

6/2/2015 Infinity Insurance Company

CA_POL_PP_01

APPLICANT ACKNOWLEDGMENT OF POLICY RATING FEATURES

By California Regulation 2632.5 (Rating Factors) all policies must be rated using 3 mandatory factors. The first is your driving record

which we obtain a copy of your motor vehicle record from the state's DMV. The second is your annual mileage driven and the third is

your years of driving experience.

For the second and third mandatory rating factors, we used the information you declared on your application and it is shown below.

Please verify the information below and inform your Agent /Broker if any of this information is incorrect.

The coverage and terms of the policy options available to me have been fully explained and I have made my selection for this policy

and coverages based on that information.

X Rated on a Garaging Address of:

4230 HIGHWAY 108 RIVERBANK CA 95367

X Rated on Drivers Experience of: Continuous Months Licensed

Linda White 437

Steven White 480

X Rated on a Mileage Range of:

GMC YUKON 9000-9999

OTHER COVERAGES THAT ARE AVAILABLE TO YOU:

ROADSIDE ASSISTANCE - When your vehicle is disabled, for a small charge this coverage will provide fuel delivery, flat tire

assistance, lockout service, jump start or towing. Just sign the road service invoice and drive away with no out of pocket expenses.

Selected X Not Selected

RSVP DIRECT REPAIR- When you purchased your RSVP Coverage, you agreed that if you use one of the body shops in our network,

then we will pay 100% of the fair and reasonable charges, less the deductible. When your vehicle is repaired at a body shop in our

network, we will guarantee the repairs for as long as you own the vehicle. If you use a body shop that is not in our network, then we will

pay 80% of the fair and reasonable charges, less the deductible. If you use a body shop that is not in our network, we may require an

inspection of the repairs prior to making any payment.

Selected X Not Selected

Jun 2, 2015 1050am

AM PM

Linda White (Jun 2, APPLICANT'S

2015) SIGNATURE DATE TIME

Page 5

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

SPECIAL PROGRAM

104601191219001 Linda White

REVIEW OF UNINSURED MOTORISTS COVERAGE

1. Uninsured Motorist Bodily Injury coverage provides that if you suffer bodily injury or sickness, including death, resulting from an accident with a

hit and run driver or a person who does not carry liability insurance, and if he or she is at fault, you may make claim against your own insurance

company for general damages and special damages rather than against the uninsured motorist.

2. Uninsured Motorists Property Damage coverage provides that if your insured car is damaged from a collision with an identified uninsured motor

vehicle, then you may make claim directly against your own insurance company for the property damage to your insured car as long as you are

legally entitled to collect from the owner or operator of the uninsured vehicle. The limit of liability is $3,500 for one automobile damaged in one

accident. Subject to the maximum limit of liability, your insurance company will pay you the actual cash value of your insured car or the amount

necessary to repair or replace it, whichever is less. This coverage is available only if you are covered for Uninsured Motorist Bodily Injury

coverage and your insured car is not covered for collision coverage. A $100 deductible applies.

3. Uninsured Motorists Collision Deductible Waiver coverage provides that if your insured car is damaged as the result of direct physical contact

with an identified uninsured motor vehicle then your deductible under collision coverage will be waived. This coverage is available only if you

are covered for Uninsured Motorists Bodily Injury coverage and your insured car is covered for collision coverage.

AGREEMENT TO COMPLETELY DELETE UNINSURED MOTORISTS COVERAGE FROM THIS POLICY

FORM #01213 R1004

Section 11580.2(2) of the California Insurance Code reads: "The California Insurance Code requires an insurer to provide uninsured motorists

coverage in each bodily injury liability insurance policy it issues covering liability arising out of the ownership, maintenance, or use of a motor

vehicle. Those provisions also permit the insurer and the applicant to delete the coverage completely or to delete the coverage when a motor

vehicle is operated by a natural person or persons designated by name. Uninsured motorists coverage insures the insured, his or her heirs, or legal

representatives for all sums within the limits established by law, which the person or persons are legally entitled to recover as damages for bodily

injury, including any resulting sickness, disease, or death, to the insured from the owner or operator of an uninsured motor vehicle not owned or

operated by the insured or a resident of the same household. An uninsured motor vehicle includes an underinsured motor vehicle as defined in

subdivision(p) of Section 11580.2 of the Insurance Code."

I have read and understand the above and in accordance with the provisions of Sections 11580.2 and 11580.26 of the California Insurance Code

which permit me and the Company to delete uninsured motorists coverage (reviewed above) completely from the policy, I hereby agree with the

Company that the provision in the policy covering bodily injury and property damage caused by an uninsured motor vehicle is deleted completely

from the policy and that the policy does not and will not afford any coverage for bodily injury or property damage caused by an uninsured motor

vehicle.

I also fully understand and agree with the Company that since I have elected not to accept Uninsured Motorists coverage, the Uninsured Motorists

Property Damage coverage (reviewed above) or the Uninsured Motorist Collision Deductible Waiver coverage (reviewed above) is not available to

me. CAUTION: DO NOT SIGN THIS AGREEMENT UNTIL YOU HAVE READ AND UNDERSTAND IT. BY SIGNING HERE I ELECT NOT TO

ACCEPT UNINSURED MOTORISTS COVERAGE.

Jun 2, 2015 1050 am AM PM

Linda White (Jun 2, 2015)

APPLICANT'S SIGNATURE DATE TIME

Form Number 02300 R0711 Page 6

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

SPECIAL PROGRAM

104601191219001 Linda White

AGREEMENT VOIDING AUTOMOBILE INSURANCE WHILE A CERTAIN PERSON IS OPERATING YOUR INSURED CAR

FORM # 00540 R1004 CA_DE_PP_01

In consideration of your premium payment, it is agreed that, with respect to the insurance afforded under this policy, or any continuation, renewal or replacement of the

policy by YOU, or the reinstatement of this policy within 30 days of any lapse thereof, we shall not be liable for loss, damage, and/or liability caused while YOUR

INSURED CAR is being driven or operated by the following named person.

CAUTION: DO NOT SIGN THIS AGREEMENT UNTIL YOU HAVE READ AND UNDERSTAND IT.

NAME OF PERSON BEING EXCLUDED: Steven White

Jun 2, 2015 1050am AM PM

Linda White (Jun 2, 2015)APPLICANT'S SIGNATURE DATE TIME

Page 7

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

MILEAGE INFORMATION

1. If your vehicle is used for commute purposes, please list the address of the workplace, school, or other destination where the vehicle will be

driven. CA_MLG_PP_01

Vehicle # 1 Street N/A City N/A State N/A Zip N/A

2. List the number of days the vehicle will be used for commuting.

Vehicle # 1 5

3. Estimate the total number of annual miles to be driven in the next 12 months.

Vehicle # 1 9000-9999

4. Please give the reason for any difference between the estimate for the upcoming 12 months and the miles driven for the previous 12 months

if applicable.

Vehicle # 1 N/A

5. List the current odometer reading of the vehicle shown on the policy.

Vehicle # 1 Not Answered

6. Attach the service records that reflect the odometer reading for the most recent 12 month period. (Optional - This information is not required,

but may support a lower premium.)

Vehicle # 1 Not Answered

REMARKS OR OTHER CHANGES:

Vehicle # 1 Not Answered

I hereby certify that I have read all the questions on this questionnaire and have disclosed the requested information. I also certify that all

information contained in this questionnaire is accurate and complete. I understand these changes and information included in this questionnaire

may be endorsed and made part of my policy.

Jun 2, 2015 1050am

AM PM

Linda White (Jun 2, 2015) APPLICANT'S SIGNATURE DATE TIME

Page 8

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Acknowledgement That INFINITY Offers Multiple Programs CA_ACK_PP_01

My broker-agent has explained to me that Infinity offers multiple programs. The three programs, Special, RSVP and Deluxe, have

price and coverage differences designed to meet individual needs. I understand that Infinity's explanation below represents only some

of the differences in these programs' coverages and conditions. I understand I may ask my broker to explain any other coverage

distinctions not appearing below that might apply to my situation.

Liability Coverage

Bodily Injury Limits -- Special and Deluxe offers Bodily Injury limits up to $100,000 per person/$300,000 accident, while RSVP's

maximum limits are $25,000 per person/$50,000 accident. In the Special and RSVP Programs, the Bodily Injury and Property

Damage limits will be reduce to the state statutory limits of Bodily Injury $15,000 per person/$30,000 per accident and Property

Damage $5,000 per accident in the event a permissive user is driving the vehicle. The Deluxe Program does not have this limitation.

Replacement Autos -- The Special and Deluxe policies provide uninterrupted coverage for a replacement auto as long as Infinity is

notified within 30 days after the acquisition of a replacement. The RSVP policy provides no liability coverage on a replacement auto

until the time Infinity is asked to add the coverage you want.

Newly Acquired Autos -- Receive 30 days automatic coverage in the Deluxe Policy while the Special allows 14 days automatic

coverage. The RSVP Policy does not allow any automatic coverage. New Auto Replacement cost is provided only in the Deluxe

Program.

Coverage For Damage To The Insured Auto (Collision, Other Than Collision)

RSVP has a provision for choosing repair shops that Infinity recommends. This is important in two respects:

(1) RSVP provides for two levels of repair cost coverage. If a policyholder chooses a repair shop that is not in Infinity's

network, Infinity will cover 80% of the fair and reasonable charges, less the deductible. If a policyholder chooses a repair

shop that is in Infinity's network, Infinity will cover 100% of the fair and reasonable charges, less the deductible. If a

policyholder chooses a repair shop that is not in Infinity's network, Infinity may require an inspection of the repairs prior to

making any payment.

(2) Infinity guarantees repairs performed by recommended repair shops as long as the policyholder owns the auto. Infinity

does not guarantee repairs by repair shops they do not recommend, although such shops may offer guarantees of their

own.

Special and Deluxe provide for payment of 100% of the fair and reasonable repair charges less the deductible, regardless of whether

a policyholder chooses a recommended repair shop. However, by endorsement, Special and Deluxe may be changed to provide the

same two levels of repair cost coverage as RSVP at a reduced premium.

Uninsured Motorists, Collision, Other Than Collision Coverages

RSVP contains a Mandatory Binding Arbitration clause. This means that in the event of a dispute between the policy holder and

Infinity, the two parties will not sue each other, but will settle their disputes through arbitration. Special and Deluxe do not contain this

requirement.

By signing below I acknowledge that the differences in Special, RSVP and Deluxe coverages and costs that are important to

me have been fully explained by my broker-agent. I have been provided with premium quotes for the Special, RSVP and

Deluxe programs and the program I have chosen is selected below. I understand that if I want other price quotes I may make

such requests to my broker-agent or to Infinity (toll free 1-800-782-1020).

RSVP X Special Deluxe

Jun 2, 2015 1050am AM PM

Linda White (Jun 2, 2015)

APPLICANT'S SIGNATURE DATE TIME

Steven Cummings 06/02/2015 12:01:00 CST X AM PM

BROKER-AGENT'S SIGNATURE DATE TIME

*By entering Broker-Agent name electronically, The Broker-Agent certifies that this constitutes his/her electronic Signature.

Page 9

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

SPECIAL PROGRAM

104601191219001 Linda White

THIS APPLICATION BECOMES PART OF YOUR INSURANCE POLICY CA_APP_PP_01

PRIVACY DISCLOSURE: In connection with your application for an automobile insurance policy, we may obtain consumer reports, Motor Vehicle Reports,

Comprehensive Loss Underwriting Evaluations or other personal or privileged information about you and all other residents listed on this application from third parties. It

is not our policy to disclose this information to third parties without your authorization, but in certain circumstances we may do so. You have the right to access and

correct all personal information collected. At your request, we will provide the name and address of the consumer reporting agency that furnished any of this information.

At your request, we will provide you with more detailed information regarding our collection, use, and disclosure of personal information and your rights to access and

correct such information. For more information, call Customer Service at 1-800-782-1020.

APPLICANT'S STATEMENT - READ BEFORE SIGNING

WARNING

ANY PERSON WHO, WITH INTENT TO DEFRAUD OR KNOWING THAT HE OR SHE IS FACILITATING A FRAUD AGAINST AN INSURER,

SUBMITS AN APPLICATION OR FILES A CLAIM CONTAINING A FALSE OR DECEPTIVE STATEMENT IS COMMITTING INSURANCE

FRAUD AND WILL BE PROSECUTED TO THE FULLEST EXTENT OF THE LAW.

I hereby apply to the Company for a policy of insurance as set forth in this application on the basis of my statements contained herein. By signing

below I understand that this application becomes a part of my policy and is a legal document and I certify that:

1. I have listed all operators of the vehicles listed on this application and all information about these persons is correct. This includes anyone that

may operate my vehicle(s) on a regular or frequent basis, children away from home or away at school, and all persons age 15 or older who

live with me. I agree to notify the Company of any changes in operators or licensing of household residents. I acknowledge that failure to

notify Infinity of i. any member of my household age 15 and older, licensed or not, and ii. any change in driving status for any

person currently listed or added on my policy in the future, pursuant to my obligation to keep Infinity informed, is a

misrepresentation that may materially affect the risk accepted by the Company and may render my policy null and void.

2. I have reported any business or commercial use of my vehicle to the Company. I understand that acceptable business use is not covered

unless I have disclosed the specific use on this application and paid a premium for the Business Use Endorsement.

3. My principal residence address and place of vehicle(s) garaging is (are) the address(es) shown in this application for ten (10) or more months

each year.

4. Any custom and special add-on equipment that I want covered has been declared on this application and A PREMIUM PAID FOR

THIS ADDITIONAL COVERAGE.

I understand that:

5. The policy I am purchasing may contain unique exclusions, conditions and restrictions I should read.

6. Coverage will not be afforded and may render my policy null and void if a regular operator is not listed on the declarations page and

a premium paid.

7. No coverage of any kind shall be provided:

a. If an operator that is specifically excluded by endorsement uses my vehicle.

b. If I allow an unlicensed person to operate my vehicle.

8. By purchasing this policy it is my obligation to give the Company prior notification of any changes in the statements and information contained

in this application. Failure to notify the Company of such changes is a misrepresentation that may materially affect the risk accepted by the

Company and may render my policy null and void.

9. The quote I have received has been developed using this application. The Company may verify certain information, and, if necessary correct

the premium in accordance with its rate filings. If I do not want to continue coverage, I understand that cancellation will be calculated based

upon the correct premium. The Company will include a cancellation charge of $20 if cancellation is at my request.

10. No coverage is provided and the policy shall be null and void from inception:

a. If any information in this application is false, misleading, or would materially affect acceptance of the risk by the Company, or

b. If my down payment, partial or full, is not honored by my bank. This applies whether my payment is by check, credit card, or by electronic

funds transfer.

11. The following payment rules apply to this policy:

a. If the Company receives my payment after the due date, I will owe a late charge.

b. If my policy is rewritten with a lapse in coverage due to late payment, I will owe a Rewrite charge, and the rates in effect at that time shall

apply.

c. If my Renewal payment is received after policy expiration, my policy will be renewed with a lapse in coverage, using rates in effect at that

time

d. The company will apply any payment I make first to any installment fee or other non premium charges that are due and then will apply the

balance of my payment to any premium due. If the balance of the payment is less than the premium due, the policy may be canceled.

e. Any outstanding balance from the previous policy term will be satisfied first from any Rewrite or Renewal payment amount.

12. If I choose to receive the RSVP Direct Repair Discount, I understand: THAT MY POLICY BENEFITS WILL BE SUBSTANTIALLY LOWER IF I

CHOOSE TO INCUR REPAIR CHARGES BY A VENDOR WHICH IS NOT A DESIGNATED RSVP PROVIDER. THE COMPANY HAS A

RIGHT TO INSPECT ALL REPAIRS PRIOR TO MAKING A PAYMENT.

13. The producer named in this application is acting as my broker if so indicated in the Producer Statement.

14. Any broker fee is determined, collected, and retained solely by the Broker named on this application.

15. California Insurance Regulations require that brokers present applicants with a written fee disclosure.

16. Agents and brokers receive commission and may receive other consideration from the Company.

The coverage I am applying for has been fully explained to me. I certify that the statements and information in this application are true

and accurate. By signing below, I acknowledge that I have read the warnings and statements listed on this application.

Jun 2, 2015 1050am

Linda White (Jun 2, 2015)

AM PM

APPLICANT'S SIGNATURE - MUST BE SIGNED DATE TIME

Page 10

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

SPECIAL PROGRAM

104601191219001 Linda White

PRODUCER'S STATEMENT

To the best of my knowledge, all information contained herein is correct, the statements herein are those of the applicant. The applicant

and I are retaining a duplicate signed copy hereof.

I am acting as the applicant's broker in this transaction, and I am legally qualified to submit this application on behalf of the

applicant.

X I am acting as Infinity's appointed agent.

Producer: Steven Cummings Date 6/2/2015 Time 12:44 CST X AM PM

Page 11

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

SPECIAL PROGRAM

104601191219001 Linda White

CREDIT CARD PAYMENT AUTHORIZATION - If the insured wants to charge the premium to a credit card, the following must be completed:

CHECK ONE: VISA AMERICAN EXPRESS AMOUNT CHARGED Full Premium $________________

X MASTERCARD X Down Payment $________________

$32.46

Credit Card Number _____________________________

XXXXXXXXXXXX7977 Expiration Date ________

05/2016 (Mo/Yr)

Authorization Number ____________________________ (Company Use)

I understand that if this credit card transaction is denied for any reason, no coverage will be bound or in force.

CARDHOLDER'S SIGNATURE______________________________________

Linda White

RECURRING CREDIT CARD AUTHORIZATION - If the insured wants to charge the installments to a credit card, the following must be

completed:

CHECK ONE: VISA X MASTERCARD AMERICAN EXPRESS

Credit Card Number _____________________________

XXXXXXXXXXXX7977 Expiration Date ___________

05/2016 (Mo/Yr)

Authorization Number ____________________________ (Company Use)

All installemnts on the policy will be charged to the credit card. I understand that if this credit card transaction is denied for any reason, no coverage

will be bound or in force.

CARDHOLDER'S SIGNATURE______________________________________

Linda White

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

www.infinityauto.com

Customer Service Phone: (800)782-1020

Customer Service Fax: (800)782-2218

To: Infinity Special Agency: INSURANCE ZEBRA, INC

Fax: (800)782-2218 Phone: 888-255-4364

Sender: RE: New Policy Fax

Policy Number: 104-60119-1219-001 Date: Uploaded on 6/2/201512:44:57 PM CDT

Named Insured: White, Linda Pages:

These documents should be faxed along with this cover sheet within 72 hours of the policy upload:

no suspense

Comments:

Form: CMNFAX01

Do Not Write Below This Line

If fax not available, mail to:

Infinity Insurance Companies

P.O. Box 830807

Birmingham, AL 35283-0807

Page 13

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Special Program

PO Box 830189

Birmingham, AL 35283-0189

Underwritten by: Infinity Insurance Company

Insured Receipt

Policy Number: 104-60119-1219-001 Agency: INSURANCE ZEBRA, INC

Named Insured: Linda White Address: 301 Chicon St Ste A

Address: 4230 HIGHWAY 108 AUSTIN TX 78702

RIVERBANK, CA 95367

This acknowledges receipt of $32.46 to Infinity by direct payment of cash, check, money order or credit card to the

agency. The payment is made as a down payment on the policy number noted above.

Our acceptance of your payment does not guarantee coverage. If you have paid your down payment or installment by

check and your bank returns the check unpaid, the down payment or installment will be considered never paid to the

insurance company. On a new policy, this means that your insurance never went into force and that you are not

covered. If you are making a payment on a current policy, any outstanding cancellation will take effect and/or any new

payments due will be considered unpaid. Payment of all amounts due is necessary to be considered for reinstatement

on current policies which are in the process of being cancelled. Our acceptance of your check in no way promises

continuation of coverage.

Date: 6/2/2015 Time: 12:44:57 PM CDT

Agency Receipt

Policy Number: 104-60119-1219-001 Agency: INSURANCE ZEBRA, INC

Named Insured: Linda White Address: 301 Chicon St Ste A

Address: 4230 HIGHWAY 108 AUSTIN TX 78702

RIVERBANK, CA 95367

This acknowledges receipt of $32.46 to Infinity by direct payment of cash, check, money order or credit card to the

agency. The payment is made as a down payment on the policy number noted above.

Date: 6/2/2015 Time: 12:44:57 PM CDT

Form No. CMNRCT01

Page 14

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Special Program

3700 Colonnade Parkway, Suite 600

Birmingham, AL 35243

Infinity Insurance Company

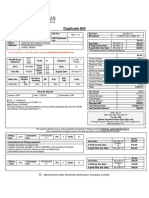

INVOICE

Important: Give this bill to the Applicant -- Do not submit with application.

Policy Number: 104-60119-1219-001 Agency: INSURANCE ZEBRA, INC

Named Insured: Linda White Address: 301 Chicon St Ste A

Address: 4230 HIGHWAY 108 AUSTIN TX 78702

RIVERBANK, CA 95367

This is your First Bill (Installment)

You may not receive another Bill (unless your Premium changes)

Infinity must receive $35.12

To: Infinity Insurance Companies

P.O. Box 830189

Birmingham, AL 35283-0189

By 07/02/2015 to avoid Cancellation or Late Fees.

Do Not Ignore This Statement

Return The Top Portion with Your Payment

Your remaining installments:

Due Date Installment Amount Fee Amount Total Payment Due

07/02/2015 $25.12 $10.00 $35.12

08/02/2015 $25.12 $10.00 $35.12

09/02/2015 $25.12 $10.00 $35.12

10/02/2015 $25.12 $10.00 $35.12

11/02/2015 $25.12 $10.00 $35.12

12/02/2015 $25.12 $10.00 $35.12

01/02/2016 $25.12 $10.00 $35.12

02/02/2016 $25.12 $10.00 $35.12

03/02/2016 $25.12 $10.00 $35.12

04/02/2016 $25.12 $10.00 $35.12

05/02/2016 $25.12 $10.00 $35.12

Page 15

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Special Program

3700 Colonnade Parkway, Suite 600

Birmingham, AL 35243

Infinity Insurance Company

Due Date Installment Amount Fee Amount Total Payment Due

You will receive bills for these amounts and due dates, but your receipt or non-receipt of this bill will not prevent

your policy from cancelling if Infinity does not receive your payment by the due date indicated. You may be

charged a late fee for payments not received by the due date.

When your application is submitted, your first bill and the above installments may change. Watch your mail for such

changes.

For your convenience, credit card and check payments can also be made at InfinityAuto.com or by calling

Customer Service at (800)782-1020.

Form: CMNINV01

Page 16

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Temporary Insurance Card

Company: Infinity Insurance Company

PO Box 830807 Birmingham, AL 35283-0807

Policy No: 104601191219001 Effective Date: 06/02/2015

Vehicle(s) VIN

1999 GMC YUKON 1GKEK13R8XJ757186

Insured(s) Producer

Linda White INSURANCE ZEBRA, INC

301 Chicon St Ste A

AUSTIN TX 78702

8882554364

Insurance Identification Card Issued Pursuant to California Law. NAIC # 22268

This card expires 30 days after effective date shown. Any alteration will void this card!

Page 17

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

301 Chicon St, Suite A - Austin, TX 78702

CaliforniaBrokerFeeAgreement

Linda White

1.Thepartiestothisagreementare__________________________________________(Client)AND

INSURANCEZEBRAINC.CaliforniaDepartmentofInsuranceLicenseNumber:0143637(Broker).

2.CLIENTappointstheBROKERasCLIENTSinsurancebrokerofrecord.

Jun 2, 2015

3.Thisagreementshallbecomeoperativeon__________________(date)andshallcontinueinfullforce

untilterminatedbyeitherparty.

4.BROKERagreestorepresentCLIENThonestlyandcompetently.

5.CLIENTagreestopayBROKERabrokerfeeforBROKERSservices.Thebrokerfeeis$50.00.The

brokerfeeISNOTrefundable.

6.BROKERmaynoworinthefuturechargeCLIENT,andCLIENTagreestopay,additionalfee(s)forthe

serviceslistedbelow.Theadditionalfeesandservicesare:

Services Amount

SR22 $20.00

7.FollowingarethenatureandamountofallfeesknowtoBROKERthatwillbechargedbythepersons

otherthanBROKERortheinsurancecompanyinconnectionwithcurrentplacementofCLIENTS

insurance.ThesefeesarenotretainedbyBROKER.

Linda White (Jun 2, 2015)

_________________________________________ Jun 2, 2015

________________

ClientSignature Date

Steven Cummings (Jun 2, 2015)

_________________________________________ Jun 2, 2015

________________

BrokerSignature Date

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

301 Chicon St, Suite A - Austin, TX 78702

CaliforniaStandardBrokerDisclosure

I Donotsignanybrokerfeeagreementunlessallofitsblanklinesandspacedhavebeenfilledin

andyouhavereadtheagreementcarefully.

II Yourinsurancebrokerrepresentsyou,theconsumer,andisentitledtochargeabrokerfeeifhe/she

chooses.Thisfeeisnotsetbylaw,andmaybenegotiablebetweenyouandthebroker.

III Itisillegalorimproperforaninsurancebrokertochargeyouafeeforplacingcoveragesolelywith

theCaliforniaAutomobileAssignedRiskPlanortheCaliforniaFAIRPlan.Feesmaybechargedfor

placementofothercoverages

IV Brokerfeesareoftennonrefundableevenifyoucancelyourcoverage.Refertoyourbrokerfee

agreementtoseeifyourbrokerfeeisnonrefundable.However,youmaybeentitledtoafullrefundofa

brokerfeeifyourbrokeractedincompetentlyordishonestly.Unresolveddisputesovernonrefundedbroker

feescanbeforwardedtotheDepartmentofInsuranceforreview.

V Youareentitledtoobtainandkeepacompletedcopyofthisdisclosureandanybrokerfee

agreementyousign.

VI Yourbrokermayreceivecommissionfrominsurancecompany(ies)forplacingyourinsurance.This

commissionmaybepaidtoyourbrokerbytheinsurancecompany(ies)inadditiontoanybrokerfeeyou

pay.

VII Ifyouwillbepayingyourpremiumininstallmentstoafinancecompany,bylawyoumustreceivea

copyofapremiumfinancedisclosureandagreement.Besuretoobtainandreadthosedocumentsbefore

signingapremiumfinanceagreement.Also,askthebrokeriftheinsureroffersitsowninstallmentpayment

plan.Insurerinstallmentplansareoftencheaperthanpremiumfinancingthroughaseparatepremium

financecompany.

VIII Ifyourbrokerisplacingautomobilecoverage,yourbrokermustprovideyouwithacopyofthe

currentDepartmentofInsurancepamphletAutomobileInsurance.Ifyourbrokerisplacingresidential

coverage,yourbrokermustprovideyouwithacopyofthecurrentDepartmentofInsurancepamphlet

ResidentialInsurance.Bysigningthisdisclosureyouacknowledgereceiptoftheappropriatepamphlet(s).

Clientinitials:______

LW

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Consumer Guide to AUTOMOBILE INSURANCE

FIVE TIPS TO HELP YOU BUY AUTO INSURANCE

Tip 1: Obtain the brokers of each broker who talks to you about insurance company and an

insurance! If the broker says he or she

business card. insurance broker.

does not have a business card, ask him

or her to write down his or her first,

If you are reading this pamphlet, it was Brokers are not insurance companies;

middle and last name, along with his or

probably given to you by an insurance they are independent insurance

her license number. Keep the business

broker or solicitor. (A solicitor is a salespersons. The broker represents

card or piece of paper along with your

person who works for a broker. In the you, the client. In order to find

other insurance papers.

rest of this pamphlet we will use the insurance for you, a broker will usually

term broker to include both solicitors review the premium rates and coverages

The California Department of Insurance

and brokers.) All brokers must be of several insurance companies.

website (www.insurance.ca.gov) lists all

licensed by the State of California

licensed brokers. You can find out

Department of Insurance. To obtain a A broker will usually have the words

whether the person who helped you buy

license, a broker must take a class on insurance agency, insurance

insurance is licensed by checking this

insurance, pass an exam, and meet other brokers, insurance brokerage, or

website, or by calling the Department of

requirements. However, a few people insurance services in its business

Insurance at (800) 927-HELP or (213)

try to sell insurance without a license. name. An insurance company is

897-8921. If you buy insurance from a

Make sure your broker is currently responsible for paying any claims you

person who does not have a license, you

licensed in California. have; a broker is not. An insurance

are legally entitled to have any broker

company will usually have the word

fee you paid refunded.

By law, a broker must include his or her insurance company, casualty

license number on his or her business company, indemnity company,

card, and on any written price quote Tip 2: Understand the insurance underwriters or assurance

given to you. Obtain the business card difference between an company in its name.

Prepared for consumers by the California Department of Insurance. A broker must give this pamphlet to its insured whenever the broker charges a broker fee and sells an auto

policy, pursuant to Title 10 of the California Code of Regulations Chapter 5, Subchapter 1, Article 6.8, Appendix A.

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Consumer Guide To AUTOMOBILE INSURANCE - FIVE TIPS TO HELP YOU BUY AUTO INSURANCE!

Page 2

Some insurance companies will use the broker says it is ok to do so, or that the certain, future date; get it in writing.

services of another business, called a wrong information will save you Every broker should be able to give you

managing general agent or general money. An insurance company can a binder if you need coverage quickly.

agent. These businesses may perform sometimes deny your claim if you

underwriting, claims handling and signed an application with incorrect Receipt

billing on behalf of the insurance information. Obtain and keep a copy of You will usually have to pay some or all

company issuing the policy. the application. of the premium to the broker when you

apply for insurance. Obtain a signed

Remember, when purchasing insurance Binder receipt for your premium payment.

through a broker you could be dealing When an insurance company accepts an

with several different companies: 1) the application, it typically mails the actual Insurance company payment plans

insurance broker; 2) a managing general insurance policy several weeks later. If Many people choose to pay their

agent; 3) the insurance company. In you need insurance right away or within insurance premium in installments. For

addition, if you need to borrow money a few weeks, the broker should provide these people, the insurance company

to help pay your premium, another type you with an insurance form called a may offer an installment payment plan

of company, a premium finance binder or certificate of insurance. for a small, extra charge. However, not

company, may be involved. These forms provide you with proof that all companies offer such plans.

you have insurance coverage until the

Tip 3: Obtain and keep insurance company actually sends you Premium finance companies

the policy. A binder or certificate Another option for people who can not,

important insurance papers. should show the name of the insurance or prefer not to, pay their insurance

company, the date your insurance takes premium all at once, is to obtain a loan

Application effect, your name, a description of your

When you apply for insurance, the from a premium finance company.

vehicle, the types of coverage you With premium financing, you will pay a

broker will probably help you complete bought, the liability coverage limit if

an insurance application form. This down payment to the broker when you

you bought liability insurance, and apply for the insurance. The finance

form will be sent to the insurance deductibles if you bought

company. Read the application company will pay the full premium to

comprehensive or collision coverage. the insurance company. After that, you

carefully before you sign it. Do not Obtain and keep the binder. Dont

sign the application if any information will reimburse the finance company

accept a brokers word that you are over several months. Be aware that

on it is missing or incorrect, even if the covered or will be covered as of a

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

Consumer Guide To AUTOMOBILE INSURANCE - FIVE TIPS TO HELP YOU BUY AUTO INSURANCE!

Page 3

premium financing typically includes a if an insurance company with an broker makes any promise to you, get it

non-refundable fee and an interest rate installment plan charges more premium in writing. Never sign any form that

that is usually much higher than banks than an insurance company that does has empty spaces have the broker

impose on credit cards. not have an installment plan, your total draw a line through those spaces before

cost of insurance may be less if you you sign the form.

In order to obtain premium financing, a dont have to pay loan fees and interest

premium finance application form must to a premium finance company. Tip 5: Find out more about

be completed. Do not let a broker sign

this form for you obtain it, take your

insurance.

Broker fee disclosure and

time to read it carefully, ask the broker agreement Insurance is expensive. You can save a

to explain anything you dont To charge a broker fee, a broker must lot of money, possibly hundreds of

understand, then sign it if you still want have you sign a broker fee agreement, dollars each year, year after year, by

to have premium financing. The form and must give you a special broker fee learning more about insurance. A good

will contain very important information disclosure. Obtain copies of both of place to start is at the Department of

how much you will have to pay, how these documents. Insurance website at

often, how much the fees are, what the

www.insurance.ca.gov, or by getting

interest rate is, and what the total Tip 4: Take your time and ask brochures from the Department of

principal and interest will be. Once you

sign-up for premium financing, it may questions. Insurance help line, 1-(800) 927-HELP

(4357) or (213) 897-8921. You can

be expensive to cancel it.

Read all forms carefully, and take your obtain pamphlets about many insurance

time. Dont let anyone try to rush you. topics, such as different types of

If a broker suggests using a premium

Ask questions a broker should take insurance, how to file claims, and how

finance company, be sure to ask the

the time to explain everything slowly to buy insurance.

broker about insurance companies that

offer installment payment plans. Even and with words you understand. If a

Last Revised October 27, 2000. Copyright California Department of Insurance. Permission is granted to any person to reproduce this pamphlet for non-commercial purposes, or to comply

with the California Department of Insurance broker fee regulations (Title 10 of the California Code of Regulations Chapter 5, Subchapter 1, Article 6.8, Appendix A).

LW

Document Integrity Verified Adobe Document Cloud Transaction Number: XZ5UXKJ73XT554P

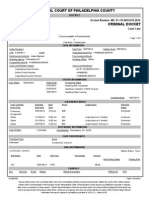

Anda mungkin juga menyukai

- I Am Sharing 'Sabrina Insurance' With YouDokumen21 halamanI Am Sharing 'Sabrina Insurance' With Youhot mops & handy man100% (1)

- Kiralee Arlene Ruck Booking DocumentsDokumen4 halamanKiralee Arlene Ruck Booking DocumentsKevin StoneBelum ada peringkat

- License Expiration AshleyfrostromDokumen2 halamanLicense Expiration Ashleyfrostromapi-522084500Belum ada peringkat

- COMMONWEALTH COURT OF PENNSYLVANIA Re CATERBONE v. Pennsylvania Department of Human Services SNAP BENEFITS EMERGENCY INJUNCTION August 14, 2017Dokumen121 halamanCOMMONWEALTH COURT OF PENNSYLVANIA Re CATERBONE v. Pennsylvania Department of Human Services SNAP BENEFITS EMERGENCY INJUNCTION August 14, 2017Stan J. CaterboneBelum ada peringkat

- Application New FILLEDDokumen2 halamanApplication New FILLEDPartheebanBelum ada peringkat

- Document PDFDokumen1 halamanDocument PDFAnonymous 1Ggwu1yBelum ada peringkat

- pptc203 Eng 3 PDFDokumen2 halamanpptc203 Eng 3 PDFKerren PerdomoBelum ada peringkat

- Consular Electronic Application Center - Print ApplicationDokumen6 halamanConsular Electronic Application Center - Print ApplicationmeesumBelum ada peringkat

- Eticket 0149564965066 2Dokumen1 halamanEticket 0149564965066 2carlo boniolBelum ada peringkat

- Lake Havasu IncidentDokumen82 halamanLake Havasu IncidentJoshua LingBelum ada peringkat

- Military Out of State Vehicle Registration Forms For FloridaDokumen17 halamanMilitary Out of State Vehicle Registration Forms For Floridapnguin1979Belum ada peringkat

- Emily Stallard ChargesDokumen1 halamanEmily Stallard ChargesErin LaviolaBelum ada peringkat

- Exit Poll: Iowa Voters 11.2-11.3 2020Dokumen81 halamanExit Poll: Iowa Voters 11.2-11.3 2020ProgressIowa100% (1)

- Stewart Weldon Massachusetts CORIDokumen5 halamanStewart Weldon Massachusetts CORIThe Republican/MassLive.comBelum ada peringkat

- OHRA Application FormDokumen4 halamanOHRA Application FormwangchanghuiBelum ada peringkat

- Horizon Medical Health Insurance Claim Form: Please Read This Important InformationDokumen2 halamanHorizon Medical Health Insurance Claim Form: Please Read This Important InformationBrianReagerBelum ada peringkat

- Roman Nose Complaint Insp A0635-089-20Dokumen3 halamanRoman Nose Complaint Insp A0635-089-20OKCFOXBelum ada peringkat

- This Is Only A Summary.: Important Questions Answers Why This MattersDokumen10 halamanThis Is Only A Summary.: Important Questions Answers Why This MattersAnonymous D47ZzQZDtBelum ada peringkat

- Jahrid Burgess Court Summary ReportDokumen2 halamanJahrid Burgess Court Summary ReportLeigh EganBelum ada peringkat

- State Inspection of Vicky Bakery in Pembroke PinesDokumen3 halamanState Inspection of Vicky Bakery in Pembroke PinesAmanda RojasBelum ada peringkat

- Court Ruling On Salt Lake City School DistrictDokumen22 halamanCourt Ruling On Salt Lake City School DistrictCourtneyBelum ada peringkat

- Dental BS Delta 1500 PPO Benefit Summary 2018Dokumen4 halamanDental BS Delta 1500 PPO Benefit Summary 2018deepchaitanyaBelum ada peringkat

- Commonwealth of Pennsylvania v. Cameron CountrymanDokumen5 halamanCommonwealth of Pennsylvania v. Cameron CountrymanPenn Buff NetworkBelum ada peringkat

- APSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDokumen2 halamanAPSRTC Official Website For Online Bus Ticket Booking - APSRTConlineDominic ChalmersBelum ada peringkat

- ACFrOgBwQvRHVNt3wkSr-iydMTJjUhN0otU2QiaOeFXKNgOBS1ualGRA - Kc8UvsaB0f7Ives8JzHU3-QYGpyrFZ-czYWYeJHxN6jogwOK3wzaxX7skgOVRzszt-ovdE PDFDokumen3 halamanACFrOgBwQvRHVNt3wkSr-iydMTJjUhN0otU2QiaOeFXKNgOBS1ualGRA - Kc8UvsaB0f7Ives8JzHU3-QYGpyrFZ-czYWYeJHxN6jogwOK3wzaxX7skgOVRzszt-ovdE PDFJade JonesBelum ada peringkat

- ULAPSADokumen2 halamanULAPSANew GlobalBelum ada peringkat

- Iowa Applicarion FormDokumen4 halamanIowa Applicarion FormRajat PatelBelum ada peringkat

- Rebate FormDokumen1 halamanRebate FormDrew MoretonBelum ada peringkat

- Tween 80 MsdsDokumen4 halamanTween 80 Msdserkilic_umut1344Belum ada peringkat

- Charging Documents in Woodbury Drug DeathDokumen27 halamanCharging Documents in Woodbury Drug DeathMinnesota Public RadioBelum ada peringkat

- Postmates Letter Re NYSLA Draft AdvisoryDokumen3 halamanPostmates Letter Re NYSLA Draft AdvisoryThe Capitol PressroomBelum ada peringkat

- R 229Dokumen1 halamanR 229Muneer A ShBelum ada peringkat

- July 30 2021 Pennington County Reinbold ComplaintDokumen7 halamanJuly 30 2021 Pennington County Reinbold ComplaintJoe BowenBelum ada peringkat

- Holly Conklin Narconon SBDC Criminal Record Guns Forfeiture No. CJ-2004-3747 OKLADokumen3 halamanHolly Conklin Narconon SBDC Criminal Record Guns Forfeiture No. CJ-2004-3747 OKLAMary McConnellBelum ada peringkat

- Motor Vehicle Inspection Appointment 15052018165442Dokumen1 halamanMotor Vehicle Inspection Appointment 15052018165442Gilbert KamanziBelum ada peringkat

- CignaDokumen7 halamanCignaUNKNOWN LSABelum ada peringkat

- Kings County MERS To Bank of NY Assignment of 23 Jul 2008 Bank of NY V AlderaziDokumen4 halamanKings County MERS To Bank of NY Assignment of 23 Jul 2008 Bank of NY V AlderaziWilliam A. Roper Jr.Belum ada peringkat

- East Troublesome Fire Insurance Complaint 1Dokumen5 halamanEast Troublesome Fire Insurance Complaint 19newsBelum ada peringkat

- Chetan GehlotDokumen1 halamanChetan GehlotSamaBelum ada peringkat

- Statement of No IncomeDokumen1 halamanStatement of No IncomeRubén García DíazBelum ada peringkat

- State Bank of India NPCILDokumen1 halamanState Bank of India NPCILAshwin GRBelum ada peringkat

- NewLicence PDFDokumen5 halamanNewLicence PDFShah HiBelum ada peringkat

- Disconnect Notice: HgehgeffhhgeefehhfhfeggeehfhghghheffegeeefgggggggfhefgfefhgfghgggDokumen3 halamanDisconnect Notice: HgehgeffhhgeefehhfhfeggeehfhghghheffegeeefgggggggfhefgfefhgfghgggDaniel GonzalesBelum ada peringkat

- Blue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementDokumen6 halamanBlue Shield of California Major Donor and Independent Expenditure Committee Campaign StatementWAKESHEEP Marie RNBelum ada peringkat

- Providers - Blue Shield Promise Health Plan PDFDokumen3 halamanProviders - Blue Shield Promise Health Plan PDFMohamed ElmallahBelum ada peringkat

- PENNSYLVANIA DEPARTMENT OF INSURANCE COMPLAINT Re STAN J. CATERBONE GEICO CLAIM NUMBER - 055746172-0101-030 - With AFFIDAVIT February 25, 2017Dokumen26 halamanPENNSYLVANIA DEPARTMENT OF INSURANCE COMPLAINT Re STAN J. CATERBONE GEICO CLAIM NUMBER - 055746172-0101-030 - With AFFIDAVIT February 25, 2017Stan J. CaterboneBelum ada peringkat

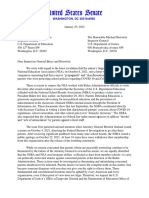

- 2022-01-26 DOJ ED Investigation LetterDokumen3 halaman2022-01-26 DOJ ED Investigation LetterFox NewsBelum ada peringkat

- BBG CIR Personal 09 06 2017 PDFDokumen2 halamanBBG CIR Personal 09 06 2017 PDFJohn Paul Pacheco LealBelum ada peringkat

- National Health Service Corps Application - Loan Repayment Program - HHS HRSA NHSC LRPDokumen17 halamanNational Health Service Corps Application - Loan Repayment Program - HHS HRSA NHSC LRPAccessible Journal Media: Peace Corps DocumentsBelum ada peringkat

- REG 195, Application For Disabled Person Placard or PlatesDokumen3 halamanREG 195, Application For Disabled Person Placard or Platestech20000Belum ada peringkat

- Motor Vehicle Insurance Alteration - 11QA580109MPA-1Dokumen6 halamanMotor Vehicle Insurance Alteration - 11QA580109MPA-1Ästra MosesBelum ada peringkat

- 16-15595 - 8400 Edes Ave PDFDokumen11 halaman16-15595 - 8400 Edes Ave PDFRecordTrac - City of OaklandBelum ada peringkat

- DocumentDokumen4 halamanDocumentIrwin William DavisBelum ada peringkat

- DL 14aDokumen2 halamanDL 14aHarshal ManeBelum ada peringkat

- Cna Liscense NumberDokumen2 halamanCna Liscense Numberapi-548066065Belum ada peringkat

- Wisconsin DMV Registration FormDokumen4 halamanWisconsin DMV Registration FormRhianonCatillazBelum ada peringkat

- SHBP SBC Twin Cities Campus Student Only 2017-2018Dokumen8 halamanSHBP SBC Twin Cities Campus Student Only 2017-2018hotshinhwanatecomBelum ada peringkat

- Rop PDFDokumen4 halamanRop PDFelmyrBelum ada peringkat

- New Business DeclarationDokumen1 halamanNew Business DeclarationLiza GeorgeBelum ada peringkat

- Indian Hills Apartments - NVDokumen2 halamanIndian Hills Apartments - NVTim ClarkBelum ada peringkat

- PDF Audit of Cash Roque 2018 1 Compress PDFDokumen87 halamanPDF Audit of Cash Roque 2018 1 Compress PDFFernando III PerezBelum ada peringkat

- Broadcast Engineering Consultants India Limited: Vacancy Advertisement No. 127Dokumen2 halamanBroadcast Engineering Consultants India Limited: Vacancy Advertisement No. 127Bipin KashyapBelum ada peringkat

- Bank-Reconciliation-Statement-Notes Class 11Dokumen21 halamanBank-Reconciliation-Statement-Notes Class 11DhruvBelum ada peringkat

- Statement of Account: Juanima Porter 102 Bonita CT SUMMERVILLE SC 29485-0000Dokumen5 halamanStatement of Account: Juanima Porter 102 Bonita CT SUMMERVILLE SC 29485-0000Kelley73% (15)

- Current CA Program CASM PricingDokumen3 halamanCurrent CA Program CASM PricingLydia CHBelum ada peringkat

- Cashless Society in IndiaDokumen47 halamanCashless Society in IndiaVishalBelum ada peringkat

- Official Notification - PGCIL RecruitmentDokumen10 halamanOfficial Notification - PGCIL RecruitmentSupriya SantreBelum ada peringkat

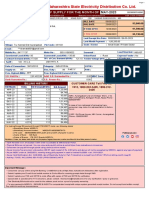

- Bill 670 502039075170 202305Dokumen5 halamanBill 670 502039075170 202305pravin ghatgeBelum ada peringkat

- Duplicate Bill: For Any Queries On This Bill Please Contact Sdo4541@ho - Mahadiscom.inDokumen1 halamanDuplicate Bill: For Any Queries On This Bill Please Contact Sdo4541@ho - Mahadiscom.inkamlesh_1Belum ada peringkat

- Interim Valuation and PaymentDokumen29 halamanInterim Valuation and Paymentfisha83Belum ada peringkat

- Analysis of Bank StatementDokumen1 halamanAnalysis of Bank StatementPrashantTripathiBelum ada peringkat

- FM PracticeDokumen1 halamanFM PracticeNaveed NawazBelum ada peringkat

- MT100Dokumen349 halamanMT100Hari NBelum ada peringkat

- Bharti Airtel Services LTD.: Your Account Summary This Month'S ChargesDokumen7 halamanBharti Airtel Services LTD.: Your Account Summary This Month'S ChargesDinesh KumarBelum ada peringkat

- 1BNC2400C0321C856180081088909A: Online Enrollment Confimation ReceiptDokumen1 halaman1BNC2400C0321C856180081088909A: Online Enrollment Confimation ReceiptNeil BrazaBelum ada peringkat

- View SoaDokumen6 halamanView SoaJypy Torrejos100% (1)

- 18-O-1480 - Exhibit 1 - DDA - Gulch (EZ Bonds) - Intergovernmental AgreementDokumen18 halaman18-O-1480 - Exhibit 1 - DDA - Gulch (EZ Bonds) - Intergovernmental AgreementmaggieleeBelum ada peringkat

- Delegation of Financial PowersDokumen4 halamanDelegation of Financial PowersDhananjaya MnBelum ada peringkat

- Neill-Wycik Owner's Manual From 2000 - 2001 PDFDokumen17 halamanNeill-Wycik Owner's Manual From 2000 - 2001 PDFNeill-WycikBelum ada peringkat

- RD050 Fixed AssetDokumen33 halamanRD050 Fixed Assetnahmedicsm7048Belum ada peringkat

- Stop Payment OrderDokumen1 halamanStop Payment OrderCzarina BaranghayBelum ada peringkat

- Internship Report On Global Ime Bank Limited: Submitted By: Niraj Lamsal Exam Roll No: MU Reg. NoDokumen37 halamanInternship Report On Global Ime Bank Limited: Submitted By: Niraj Lamsal Exam Roll No: MU Reg. NoNiraj LamsalBelum ada peringkat

- Payback CardDokumen25 halamanPayback CardBrandon FrancisBelum ada peringkat

- Pepa Project FinalDokumen25 halamanPepa Project FinalSoundharya SomarajuBelum ada peringkat

- Business Ethics PolicyDokumen9 halamanBusiness Ethics Policyjohnmark00947Belum ada peringkat

- Package Details Followup FileDokumen49 halamanPackage Details Followup FileRenee DisaBelum ada peringkat

- Booking #2923207948Dokumen2 halamanBooking #2923207948olyBelum ada peringkat

- 2023 09 12 22 47 30aug 23 - 110042Dokumen9 halaman2023 09 12 22 47 30aug 23 - 110042pradeepBelum ada peringkat

- Place of SupplyDokumen6 halamanPlace of SupplyMadhuram SharmaBelum ada peringkat

- NIL Cases Dean FebleDokumen35 halamanNIL Cases Dean FeblemzhleanBelum ada peringkat