Machine Learning For Algo Trading

Diunggah oleh

Yash Akhauri100%(3)100% menganggap dokumen ini bermanfaat (3 suara)

599 tayangan29 halamanA great book on machine learning for algorithmic trading.

Judul Asli

Machine Learning for Algo Trading

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniA great book on machine learning for algorithmic trading.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

100%(3)100% menganggap dokumen ini bermanfaat (3 suara)

599 tayangan29 halamanMachine Learning For Algo Trading

Diunggah oleh

Yash AkhauriA great book on machine learning for algorithmic trading.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 29

Machine learning for algo

trading

An introduction for non-

mathematicians

Dr. Aly Kassam

Quantitative Support Services

Overview

High level introduction to machine learning

A machine learning bestiary

What has all this got to do with trading?

Some pitfalls to look out for

What resources exist?

What next?

Quantitative Support Services

ML What is it??

discipline

Machine learning is a scientific

that deals with the construction

and study of algorithms that

can learn from data.[1] Such algorithms

operate by building a model based on

inputs[2]:2 and using that to make

predictions or decisions, rather than

following only explicitly programmed

instructions.

Source: Wikipedia

Quantitative Support Services

A ML bestiary

Decision trees Nave Bayes Bayesian Nets

Neural Networks

K-means clustering

Genetic algorithms

Logistic regression

K-nearest neighbours Associated rule learning

Hidden Markov Models

Support Vector Machines

Principal component analysis

Quantitative Support Services

A ML bestiary

Supervised learning:

K-nearest neighbours

Decision trees

Logistic regression

Support Vector Unsupervised learning:

Machines K-means clustering

Bayesian networks Hidden Markov Models

Neural networks Principal component

analysis

Associate rule learning

Quantitative Support Services

Supervised vs unsupervised

Supervised learning Unsupervised learning

Start with a labelled No labelling on the

training data set data

Used for producing Used for producing

predictive models descriptive models

Examples are: Examples are:

Classification Clustering

Regression Association learning

Quantitative Support Services

Supervised learning

Quantitative Support Services

Support Vector Machines

Used to separate

data into different

classes

Its an example of a

linear separator

Works in multiple

dimensions

Kernels can be used Source: www.stackoverflow.com

to add nonlinearity

Quantitative Support Services

What is the support vector?

The idea behind SVM is to find the hyperplane that results in

the greatest margin between the support vectors.

Quantitative Support Services

Decision trees

Classify data based

on a sequence of Viagra?

questions

Classification trees

Spam: 20

Separate data into Lottery?

Ham: 5

distinct classes

Regression trees

Make real number Spam: 20 Spam: 10

Ham: 40 Ham: 5

predictions

Usually trees are

combined into Source: Machine Learning, Peter Flach, CUP

ensemble models

Quantitative Support Services

Decision tree - Data

Source: Machine learning Decision trees by Nando de Freitas, on YouTube

Quantitative Support Services

Decision trees model

Source: Machine learning Decision trees by Nando de Freitas, on YouTube

Quantitative Support Services

K-nearest neighbours

Similar historical points forecast likely future

behaviour

Can work on scalar values (find the last k

similar values)

Can also work with vectors

Defining a pattern as a vector, forms the

basis of pattern recognition

See:

Machine Learning and Pattern Recognition for

Algorithmic Forex and Stock Trading (all 19

videos!) on YouTube for an example of this

Quantitative Support Services

Unsupervised learning

Quantitative Support Services

Unsupervised learning

As mentioned before, unsupervised learning is more

concerned with descriptive models, e.g.

Clustering (hierarchical or k-means)

Association rule learning (if this, then that)

Dimensionality reduction (e.g. PCA)

Quantitative Support Services

K-means clustering

Divide a universe

of data into a

collection of

similar sets

Find relationships

in the data and

group similar

items together

Quantitative Support Services

Hidden Markov models

A system can exist in a number

of states

Each state can produce a

number of measurable

outcomes based on a

probability distribution

Transitions between states can

occur with probabilities

defined in a transition matrix

Transitions to new states

depend only on the current Source: Wikipedia HMM

state (hence a Markov process)

Quantitative Support Services

What has this to do with trading?

Questions:

What category of problem is trading?

What are good inputs? What are the outputs?

In

In Trade

model decision trades

management

In

ML can apply to many aspects of the trading problem

In Sorting and classifying inputs

Making predictions based on decisions

inputs

Estimating probabilities of movements or outcomes

Quantitative Support Services

Feature selection

Features are important both for

Input data

Predicted response (outputs)

Too many features overfitting Be careful!

Input features Output features

Technical indicators Discrete moves

Changes in Prices, (up/down/flat etc.)

Volumes, Ratios

External series True/false

News feeds Probabilities

Time of day ?

?

Quantitative Support Services

Example 1 Rao and Hong 2010

Rao and Hong try to predict

future prices of 10 stocks and 1

index

They used:

K-means clustering

Hidden Markov model

Support vector machine

Inputs were:

EMA7, EMA50, EMA200

MACD, RSI, ADX,

High, Low, Close,

Close>EMA200, lagged

profits

Quantitative Support Services

Example 1 Rao and Hong 2010

Methodology 1 unsupervised (HMM)

(1) use the K-means to identify 5 hidden states (clusters)

[big price up, small price up, no change, small price down, big price down]

(2) Use HMM and daily lag profits to determine:

What is the probability of seeing a big price drop tomorrow given todays

state and observations.

Methodology 2 supervised (SVM)

Classify each training day as a buy/sell signal, and use the 10

inputs described above to train the SVM

Use a RBF Kernel to produce nonlinear decision boundary

Experimented with adding a new input # of news stories

Quantitative Support Services

Example 1 Rao and Hong 2010

Results HMM Results SVM

Quantitative Support Services

Example 2 Random forests

Two examples:

Lauretto, Silva, Andrade 2013, Evaluation of a Supervised

Learning Approach for Stock Market Operations

Theofilatos, Likothanassis and Karathanasopoulos 2012,

Modeling and Trading the EUR/USD Exchange Rate Using

Machine Learning Techniques

Both teams use Random Forests

(classification trees) to build classifiers

Quantitative Support Services

Example 2 Random forests

Lauretto et al.

methodology

Daily equities data (OHLCV)

Inputs are SMAs, EMAs, ROC,

Stoch, MACD, RSI

Classes are: {Buy-Sell, Sell-Buy,

Do-nothing}

Lauretto et al. results*:

80% successful devised

operations

70% seized opportunities

Average return per operation: 4%

* WTF???

Quantitative Support Services

Example 2 Random forests

Theofilatos et al. Theofilatos et al. results:

methodology

Predicting one day ahead

EUR/USD

Only use autoregressive

inputs, i.e. up to 10 days

lagged data used as

inputs

Compared a bunch of ML

algos, including SVM

(with RBF kernel), RFs,

NN, Nave Bayes

Quantitative Support Services

Problems and gotchas

Are YOU smarter than a machine? Dont forget everything

you already know

If you dont believe it, its probably not real!

How many datasets should you use?

3! Training, validation, out of sample testing

Input data needs pre-processing and scaling

Over-fitting regularisation, out of sample

Computation speed, (online) (re-)training

No peeping!

GI/GO > SNAFU

Quantitative Support Services

Resources

Software Online learning

Quantopian

Coursera

Lucena

Azure Udacity

MATLAB Nando de Freitas

Python, R YouTube channel

WEKA Quantopian

RapidMiner

Lucena

JavaML

LibSVM

(wikipedia)

Quantitative Support Services

What next?

DO NOT DESTROY MANKIND!

Quantitative Support Services

Questions?

Dr. Aly Kassam

aly@quantsupport.com

Quantitative Support Services

Anda mungkin juga menyukai

- Trading Strategy - Technical Analysis With Python TA-LibDokumen7 halamanTrading Strategy - Technical Analysis With Python TA-Libnabamita pyneBelum ada peringkat

- Algorithmic Trading Complete Self-Assessment GuideDari EverandAlgorithmic Trading Complete Self-Assessment GuidePenilaian: 4 dari 5 bintang4/5 (1)

- Intro To Algo Trading EbookDokumen37 halamanIntro To Algo Trading Ebook_karr9991% (11)

- Free Quant ResourcesDokumen6 halamanFree Quant ResourcesKaustubh Keskar100% (2)

- Algorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning TechniquesDari EverandAlgorithmic Trading Methods: Applications Using Advanced Statistics, Optimization, and Machine Learning TechniquesBelum ada peringkat

- Algorithmic Trading Strategy1Dokumen60 halamanAlgorithmic Trading Strategy1irsoft100% (1)

- Learn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python and advanced data analysisDari EverandLearn Algorithmic Trading: Build and deploy algorithmic trading systems and strategies using Python and advanced data analysisBelum ada peringkat

- Beginners-Guide-To-Learn-Algorithmic-Trading 1Dokumen58 halamanBeginners-Guide-To-Learn-Algorithmic-Trading 1rajuptb100% (15)

- Stock Price Analysis Through Statistical And Data Science Tools: an OverviewDari EverandStock Price Analysis Through Statistical And Data Science Tools: an OverviewBelum ada peringkat

- Machine Trading: Deploying Computer Algorithms to Conquer the MarketsDari EverandMachine Trading: Deploying Computer Algorithms to Conquer the MarketsPenilaian: 4 dari 5 bintang4/5 (2)

- Honing An Algorithmic Trading StrategyDokumen21 halamanHoning An Algorithmic Trading Strategyameetsonavane100% (4)

- The High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsDari EverandThe High Frequency Game Changer: How Automated Trading Strategies Have Revolutionized the MarketsBelum ada peringkat

- Algorithmic Trading With MATLABDokumen36 halamanAlgorithmic Trading With MATLABUmbyis100% (1)

- A Guide to Creating A Successful Algorithmic Trading StrategyDari EverandA Guide to Creating A Successful Algorithmic Trading StrategyPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- Finding Alphas: A Quantitative Approach to Building Trading StrategiesDari EverandFinding Alphas: A Quantitative Approach to Building Trading StrategiesPenilaian: 3.5 dari 5 bintang3.5/5 (3)

- Introduction To Algo TradingDokumen50 halamanIntroduction To Algo TradingMark Luther100% (4)

- Tech MoonDokumen10 halamanTech MoonPRATIK JAINBelum ada peringkat

- The Book of Alternative Data: A Guide for Investors, Traders and Risk ManagersDari EverandThe Book of Alternative Data: A Guide for Investors, Traders and Risk ManagersBelum ada peringkat

- Building Winning Algorithmic Trading Systems: A Trader's Journey From Data Mining to Monte Carlo Simulation to Live TradingDari EverandBuilding Winning Algorithmic Trading Systems: A Trader's Journey From Data Mining to Monte Carlo Simulation to Live TradingBelum ada peringkat

- Algorithmic Trading WorkshopDokumen120 halamanAlgorithmic Trading Workshopfredtag439380% (20)

- Trading Systems 2nd edition: A new approach to system development and portfolio optimisationDari EverandTrading Systems 2nd edition: A new approach to system development and portfolio optimisationPenilaian: 4.5 dari 5 bintang4.5/5 (3)

- A Beginners Guide To Algorithmic Trading 2017Dokumen49 halamanA Beginners Guide To Algorithmic Trading 2017Anonymous KeU4gphVL5100% (4)

- Algorithmic Trading Secrets - Trading Tuitions PDFDokumen8 halamanAlgorithmic Trading Secrets - Trading Tuitions PDFvivekpandeyscribd100% (1)

- High Frequency Trading and Probability Theory - Zhaodong WangDokumen193 halamanHigh Frequency Trading and Probability Theory - Zhaodong Wanganjay_7175% (4)

- Algo Trading Black BoxDokumen219 halamanAlgo Trading Black BoxmstennickeBelum ada peringkat

- Algorithmic TradingDokumen27 halamanAlgorithmic TradingSmita Shah83% (6)

- Emerging Trends and Future DirectionDokumen33 halamanEmerging Trends and Future Directionameetsonavane100% (2)

- Machine Learning For Algorithmic TradingDokumen302 halamanMachine Learning For Algorithmic TradingyoyoksdBelum ada peringkat

- Algorithmic TradingDokumen13 halamanAlgorithmic TradingUmang Bhokan100% (1)

- AI Trading System EvaluationDokumen18 halamanAI Trading System Evaluationmichaelguan326Belum ada peringkat

- An Introduction To Serious Algorithmic TradingDokumen40 halamanAn Introduction To Serious Algorithmic TradingJorge Luis67% (3)

- Automated Trading Strategies PDFDokumen64 halamanAutomated Trading Strategies PDFGeorge Protonotarios79% (14)

- Algorithmic TradingDokumen95 halamanAlgorithmic TradingKoncz BalázsBelum ada peringkat

- 2016 WB 2578 QuantInsti ImplementAlgoTradingCodedinPythonNotesDokumen40 halaman2016 WB 2578 QuantInsti ImplementAlgoTradingCodedinPythonNotesBartoszSowulBelum ada peringkat

- NAL Algorithmic Trading and Computational Finance Using Python Brochure 30Dokumen7 halamanNAL Algorithmic Trading and Computational Finance Using Python Brochure 30Rangineni SravanBelum ada peringkat

- Build An Automated Stock Trading System in ExcelDokumen78 halamanBuild An Automated Stock Trading System in Exceljc83% (6)

- Algorithmic TradingDokumen17 halamanAlgorithmic Tradingnadamau22633Belum ada peringkat

- Detection of Price Support and Resistance Levels in PythonDokumen6 halamanDetection of Price Support and Resistance Levels in PythonEconometrista Iel EmecepBelum ada peringkat

- An Automated FX Trading System Using Adaptive Reinforcement LearningDokumen10 halamanAn Automated FX Trading System Using Adaptive Reinforcement LearningDiajeng PermataBelum ada peringkat

- Quant TradingDokumen20 halamanQuant TradingChristopher M. PattenBelum ada peringkat

- Forex Trading Using Neural Network FiltersDokumen4 halamanForex Trading Using Neural Network Filtersryahrc4iglBelum ada peringkat

- Algo Trading FBDokumen8 halamanAlgo Trading FBVivek GadodiaBelum ada peringkat

- Automated Trading in The Forex Market PDFDokumen134 halamanAutomated Trading in The Forex Market PDFPruthvish ShuklaBelum ada peringkat

- Algorithmic Trading in PythonDokumen28 halamanAlgorithmic Trading in Pythonluuvanhoan19930% (1)

- Python A.I. Stock PredictionDokumen24 halamanPython A.I. Stock PredictionALGO INDUSTRY100% (1)

- Python For TradingDokumen47 halamanPython For Tradingdzavkec100% (2)

- High Frequency Trading System DesignDokumen0 halamanHigh Frequency Trading System DesignDerek MorrisBelum ada peringkat

- Algo Trader ToolkitDokumen110 halamanAlgo Trader Toolkitjames100% (6)

- Use of Intraday Alphas in Algorithmic Trading BostonDokumen22 halamanUse of Intraday Alphas in Algorithmic Trading BostonThorsten SchmidtBelum ada peringkat

- Algo TradingDokumen128 halamanAlgo TradingdishaBelum ada peringkat

- Tutorials Finance Python TradingDokumen71 halamanTutorials Finance Python TradingLuis Andrés Muñoz Mercado100% (2)

- Using Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesDokumen78 halamanUsing Quantstrat To Evaluate Intraday Trading Strategies - Humme and Peterson - 2013 - SlidesGallo Solaris100% (1)

- Designing Trading SystemsDokumen20 halamanDesigning Trading Systemsvijay7775303100% (1)

- Algorithmic Trading A Rough and Ready GuideDokumen58 halamanAlgorithmic Trading A Rough and Ready GuideVenkatraman KrishnamoorthyBelum ada peringkat

- Algorithmic and High-Frequency TradingDokumen360 halamanAlgorithmic and High-Frequency TradingSonyyno75% (12)

- Introduction To Algo TradingDokumen9 halamanIntroduction To Algo TradingSolaiBelum ada peringkat

- High Frequency TradingDokumen257 halamanHigh Frequency Tradingsritrader100% (2)

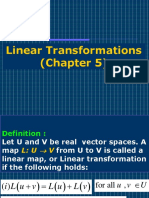

- Sec 5.1-5.5 PDFDokumen60 halamanSec 5.1-5.5 PDFYash AkhauriBelum ada peringkat

- Hidden Marlov & SVMDokumen27 halamanHidden Marlov & SVMYash AkhauriBelum ada peringkat

- DP ThermodynamicsDokumen24 halamanDP ThermodynamicsYash AkhauriBelum ada peringkat

- Trigo Question PaperDokumen8 halamanTrigo Question PaperYash AkhauriBelum ada peringkat

- Assignment OpticsDokumen36 halamanAssignment OpticsYash AkhauriBelum ada peringkat

- Sns QuestionDokumen4 halamanSns QuestionYash AkhauriBelum ada peringkat

- Mole ConceptDokumen31 halamanMole ConceptApex Institute50% (4)

- VectorsDokumen5 halamanVectorsYash AkhauriBelum ada peringkat

- TrigonometryDokumen4 halamanTrigonometryYash Akhauri100% (1)

- Atomic StructureDokumen22 halamanAtomic StructureYash AkhauriBelum ada peringkat

- Projectile MotionDokumen9 halamanProjectile MotionYash Akhauri100% (1)

- Packet Unit 3 - Atomic Structure-Answers ChemistryDokumen11 halamanPacket Unit 3 - Atomic Structure-Answers ChemistryMario J. KafatiBelum ada peringkat

- Building For The Environment 1Dokumen3 halamanBuilding For The Environment 1api-133774200Belum ada peringkat

- Alpha Sexual Power Vol 1Dokumen95 halamanAlpha Sexual Power Vol 1Joel Lopez100% (1)

- Protection in Distributed GenerationDokumen24 halamanProtection in Distributed Generationbal krishna dubeyBelum ada peringkat

- Ed Post Lab Heat of Formation of NaClDokumen4 halamanEd Post Lab Heat of Formation of NaClEdimar ManlangitBelum ada peringkat

- Suspend and Resume Calls: Exit PlugDokumen4 halamanSuspend and Resume Calls: Exit PlugrajuBelum ada peringkat

- Toi Su20 Sat Epep ProposalDokumen7 halamanToi Su20 Sat Epep ProposalTalha SiddiquiBelum ada peringkat

- Invoices For UEG IstanbulDokumen7 halamanInvoices For UEG IstanbulIesaw IesawBelum ada peringkat

- Broiler ProductionDokumen13 halamanBroiler ProductionAlexa Khrystal Eve Gorgod100% (1)

- Blake 2013Dokumen337 halamanBlake 2013Tushar AmetaBelum ada peringkat

- 2a Unani Medicine in India - An OverviewDokumen123 halaman2a Unani Medicine in India - An OverviewGautam NatrajanBelum ada peringkat

- Chapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentDokumen43 halamanChapter Three: Tools For Exploring The World: Physical, Perceptual, and Motor DevelopmentHsieh Yun JuBelum ada peringkat

- Course Projects PDFDokumen1 halamanCourse Projects PDFsanjog kshetriBelum ada peringkat

- 3rd Page 5Dokumen1 halaman3rd Page 5api-282737728Belum ada peringkat

- Why File A Ucc1Dokumen10 halamanWhy File A Ucc1kbarn389100% (4)

- Mule 4 Error Handling DemystifiedDokumen8 halamanMule 4 Error Handling DemystifiedNicolas boulangerBelum ada peringkat

- Participate in Safe Food Handling Practices SITXFSA002 - PowerpointDokumen71 halamanParticipate in Safe Food Handling Practices SITXFSA002 - PowerpointJuan Diego Pulgarín Henao100% (2)

- Intervensi Terapi Pada Sepsis PDFDokumen28 halamanIntervensi Terapi Pada Sepsis PDFifan zulfantriBelum ada peringkat

- Accounting Worksheet Problem 4Dokumen19 halamanAccounting Worksheet Problem 4RELLON, James, M.100% (1)

- Lect.1-Investments Background & IssuesDokumen44 halamanLect.1-Investments Background & IssuesAbu BakarBelum ada peringkat

- Bajaj CNSDokumen3 halamanBajaj CNSAbhijit PaikarayBelum ada peringkat

- Will Smith BiographyDokumen11 halamanWill Smith Biographyjhonatan100% (1)

- Mangas PDFDokumen14 halamanMangas PDFluisfer811Belum ada peringkat

- Kefauver Harris AmendmentsDokumen7 halamanKefauver Harris AmendmentsAnil kumarBelum ada peringkat

- IBPS Clerk Pre QUANT Memory Based 2019 QuestionsDokumen8 halamanIBPS Clerk Pre QUANT Memory Based 2019 Questionsk vinayBelum ada peringkat

- Mixing and Agitation 93851 - 10 ADokumen19 halamanMixing and Agitation 93851 - 10 Aakarcz6731Belum ada peringkat

- Ae - Centuries Before 1400 Are Listed As Browsable DirectoriesDokumen3 halamanAe - Centuries Before 1400 Are Listed As Browsable DirectoriesPolNeimanBelum ada peringkat

- Building A Pentesting Lab For Wireless Networks - Sample ChapterDokumen29 halamanBuilding A Pentesting Lab For Wireless Networks - Sample ChapterPackt PublishingBelum ada peringkat

- ICD10WHO2007 TnI4Dokumen1.656 halamanICD10WHO2007 TnI4Kanok SongprapaiBelum ada peringkat

- Bachelors - Harvest Moon Animal ParadeDokumen12 halamanBachelors - Harvest Moon Animal ParaderikaBelum ada peringkat