Cir VS PLDT

Diunggah oleh

Kling KingJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Cir VS PLDT

Diunggah oleh

Kling KingHak Cipta:

Format Tersedia

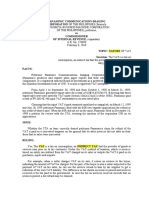

CIR VS PLDT

FACTS:

PLDT is a grantee of a franchise under Republic Act (R.A.) No. 7082 to install, operate and maintain a telecom

system throughout the Philippines.

It imports various equipment, machineries and spare parts for its business on different occasion from 1992 to

1994.

PLDT paid the BIR the amount of P164, 510,953.00, broken down as follows: (a) compensating tax of

P126,713,037.00; advance sales tax of P12,460,219.00 and other internal revenue taxes of P25,337,697.00.

For similar importations made between March to May 1994, PLDT paid P116, 041,333.00 value-added tax (VAT).

On March 15, 1994, PLDT addressed a letter to the BIR seeking a confirmatory ruling on its tax exemption

privilege under Section 12 of R.A. 7082, with a provision that: the grantee, shall pay a franchise tax

equivalent to three percent (3%) of all gross receipts of the telephone or other telecommunications businesses

transacted under this franchise by the grantee, its successors or assigns, and the said percentage shall be in

lieu of all taxes on this franchise or earnings thereof.

When its claim was not acted upon by the BIR, PLDT went to the CTA.

The CTA ruled for PLDT, but punctuated by a dissenting opinion of Associate Judge Saga who maintained that the

phrase in lieu of all taxes found in Section 12 of R.A. No. 7082, supra, refers to exemption from direct taxes

only and does not cover indirect taxes, such as VAT, compensating tax and advance sales tax.

The CIR appealed to the CA. The CA affirmed the CTAs decision. Hence, the SC addressed the main issue

tendered herein.

ISSUE: WON the 3% franchise tax exempts the PLDT from paying all other taxes, including indirect taxes.

HELD: NO.

Direct taxes are those exacted from the very person who, it is intended or desired, should pay them. They are

impositions for which a taxpayer is directly liable on the transaction or business he is engaged in.

Indirect taxes are taxes wherein the liability for the payment of the tax falls on one person but the burden thereof

can be shifted or passed on to another person, such as when the tax is imposed upon goods before reaching the

consumer who ultimately pays for it.

The NIRC classifies VAT as an indirect tax the amount of which may be shifted or passed on to the buyer,

transferee or lessee of the goods. The 10% VAT on importation of goods is in the nature of an excise tax levied

on the privilege of importing articles. It is imposed on all taxpayers who import goods. It is not a tax on the

franchise of a business enterprise or on its earnings, as stated in Section 2 of RA 7082.

Advance sales tax has the attributes of an indirect tax because the tax-paying importer of goods for sale or of

raw materials to be processed into merchandise can shift the tax or lay the economic burden of the tax on the

purchaser by subsequently adding the tax to the selling price of the imported article or finished product.

Compensating tax also partakes of the nature of an excise tax payable by all persons who import articles,

whether in the course of business or not.

The liability for the payment of the indirect taxes lies with the seller of the goods or services, not in the buyer

thereof. Thus, one cannot invoke ones exemption privilege to avoid the passing on or the shifting of the VAT to

him by the manufacturers/suppliers of the goods he purchased. Hence, it is important to determine if the tax

exemption granted to a taxpayer specifically includes the indirect tax which is shifted to him as part of the

purchase price, otherwise it is presumed that the tax exemption embraces only those taxes for which the buyer is

directly liable. Since RA 7082 did not specifically include indirect taxes in the exemption granted to PLDT, the

latter cannot claim exemption from VAT, advance sales tax and compensating tax.

The clause in lieu of all taxes in Section 12 of RA 7082 is immediately followed by the qualifying clause on

this franchise or earnings thereof, suggesting that the exemption is limited to taxes imposed directly on PLDT

since taxes pertaining to PLDTs franchise or earnings are its direct liability. Accordingly, indirect taxes, not

being taxes on PLDTs franchise or earnings, are not included in the exemption provision.

PLDTs allegation that the Bureau of Customs assessed the company for advance sales tax and compensating

tax for importations entered between October 1, 1992 and May 31, 1994 when the value-added tax system

already replaced, if not totally eliminated, advance sales and compensating taxes, is with merit. Pursuant to

Executive Order No. 273, a multi-stage value-added tax was put into place to replace the tax on original and

subsequent sales tax. Therefore, compensating tax and advance sales tax were no longer collectible internal

revenue taxes under the NIRC when the Bureau of Customs made the assessments in question and collected the

corresponding tax. Stated a bit differently, PLDT was no longer under legal obligation to pay compensating tax

and advance sales tax on its importation from 1992 to 1994. A refund of the amounts paid as such taxes is thus

proper.

P87,257,031.00 of compensating tax + P7,416,391.00 advanced sales tax = P94,673,422.00 total refund.

Anda mungkin juga menyukai

- ABAKADA Guro Party List Vs ErmitaDokumen1 halamanABAKADA Guro Party List Vs ErmitaHelene Grace BeloniBelum ada peringkat

- MIAA Vs CA, GR No. 155650, July 20, 2006Dokumen3 halamanMIAA Vs CA, GR No. 155650, July 20, 2006Vel June De LeonBelum ada peringkat

- Title: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncDokumen3 halamanTitle: Commissioner of Internal Revenue vs. St. Luke's Medical Center, IncKim GuevarraBelum ada peringkat

- Audit of CashDokumen9 halamanAudit of CashEmma Mariz Garcia25% (8)

- Javellana, Lucky Tax2 Case Digest Part 1Dokumen19 halamanJavellana, Lucky Tax2 Case Digest Part 1luckyBelum ada peringkat

- Pablo Francisco Vs CADokumen2 halamanPablo Francisco Vs CAKling King100% (1)

- Prepare The Cash BookDokumen4 halamanPrepare The Cash BookShaloom TV100% (1)

- MCIAA Vs Marcos Case DigestDokumen3 halamanMCIAA Vs Marcos Case DigestLuigi JaroBelum ada peringkat

- Lto Versus City of Butuan DigestDokumen2 halamanLto Versus City of Butuan Digestbernieibanez48Belum ada peringkat

- Certified International Payment Systems ProfessionalDokumen6 halamanCertified International Payment Systems ProfessionalMakarand LonkarBelum ada peringkat

- Villanueva V City of IloiloDokumen3 halamanVillanueva V City of IloiloPatricia Gonzaga100% (1)

- Arafiles Vs Phil. JournalilstsDokumen1 halamanArafiles Vs Phil. JournalilstsKling KingBelum ada peringkat

- Arafiles Vs Phil. JournalilstsDokumen1 halamanArafiles Vs Phil. JournalilstsKling KingBelum ada peringkat

- Maceda VS Macaraig, GR No 88291, May 31, 1981Dokumen43 halamanMaceda VS Macaraig, GR No 88291, May 31, 1981KidMonkey2299Belum ada peringkat

- Gmail - APEC Schools - S202103135 - SY21 Assessment of FeesDokumen2 halamanGmail - APEC Schools - S202103135 - SY21 Assessment of FeesMerry Chris Anne AdonaBelum ada peringkat

- Columbia Vs CADokumen2 halamanColumbia Vs CAKling King100% (1)

- Pepsi-Cola V City of ButuanDokumen3 halamanPepsi-Cola V City of ButuanPatricia Gonzaga100% (1)

- Gerochi, Et Al. vs. Department of Energy, Et Al.Dokumen2 halamanGerochi, Et Al. vs. Department of Energy, Et Al.Kent UgaldeBelum ada peringkat

- Bill details and charges for May 2018Dokumen3 halamanBill details and charges for May 2018Mah Jabeen0% (1)

- Misamis Oriental Vs CEPALCO, 181 SCRA 38Dokumen2 halamanMisamis Oriental Vs CEPALCO, 181 SCRA 38Ron LaurelBelum ada peringkat

- Caltex Philippines v COA Offset Tax Claims ReimbursementsDokumen23 halamanCaltex Philippines v COA Offset Tax Claims ReimbursementsMachida AbrahamBelum ada peringkat

- P&G Phils Can Claim Tax RefundDokumen3 halamanP&G Phils Can Claim Tax RefundKarl MinglanaBelum ada peringkat

- GHHHGDokumen2 halamanGHHHGDiana ElenaBelum ada peringkat

- Southern Cross Cement CorporationDokumen3 halamanSouthern Cross Cement CorporationRaymond AlhambraBelum ada peringkat

- 16 Roxas V CTA 23 SCRA 276 (1968) - DigestDokumen8 halaman16 Roxas V CTA 23 SCRA 276 (1968) - DigestKeith Balbin0% (1)

- Philippine Acetylene Tax RulingDokumen12 halamanPhilippine Acetylene Tax RulingKeith BalbinBelum ada peringkat

- Pepsi Cola vs. City of ButuanDokumen1 halamanPepsi Cola vs. City of ButuanArdy Falejo FajutagBelum ada peringkat

- CITY GOVERNMENT OF QUEZON CITY v. BAYAN TELECOMMUNICATIONS DIGESTDokumen3 halamanCITY GOVERNMENT OF QUEZON CITY v. BAYAN TELECOMMUNICATIONS DIGESTJose Edmundo DayotBelum ada peringkat

- Juan Luna SubdivisionDokumen1 halamanJuan Luna SubdivisionRobert QuiambaoBelum ada peringkat

- Digested Cases in Taxation2Dokumen5 halamanDigested Cases in Taxation2Dakila Maloy100% (1)

- CIR v. PLDTDokumen3 halamanCIR v. PLDTHoney BiBelum ada peringkat

- Panasonic VAT Refund Denied Due to Missing Zero-Rated NotationDokumen3 halamanPanasonic VAT Refund Denied Due to Missing Zero-Rated NotationCaroline A. Legaspino100% (1)

- NAPOCOR v. Province of AlbayDokumen2 halamanNAPOCOR v. Province of AlbayGain DeeBelum ada peringkat

- Pepsi-Cola v. City of ButuanDokumen12 halamanPepsi-Cola v. City of ButuanJana marieBelum ada peringkat

- BBB vs AAA: No compromise under RA 9262 for cases of violence against womenDokumen1 halamanBBB vs AAA: No compromise under RA 9262 for cases of violence against womenG Ortizo100% (1)

- CIR Vs SM Prime Holdings IncDokumen2 halamanCIR Vs SM Prime Holdings IncewnesssBelum ada peringkat

- Tax VAT CIR Vs GotamcoDokumen3 halamanTax VAT CIR Vs GotamcoRhea Mae A. SibalaBelum ada peringkat

- PILMICO v. CIRDokumen2 halamanPILMICO v. CIRPat EspinozaBelum ada peringkat

- Marubeni Tax Amnesty CaseDokumen9 halamanMarubeni Tax Amnesty CaseMariano RentomesBelum ada peringkat

- CD - 81. Allied Banking v. Quezon CityDokumen2 halamanCD - 81. Allied Banking v. Quezon CityCzarina CidBelum ada peringkat

- Batistis vs. PeopleDokumen1 halamanBatistis vs. PeopleKling KingBelum ada peringkat

- EO 73 challenged for increasing real property taxesDokumen1 halamanEO 73 challenged for increasing real property taxesAwin LandichoBelum ada peringkat

- Tax Law Review: CIR vs DLSUDokumen3 halamanTax Law Review: CIR vs DLSUAnonymous 5MiN6I78I0Belum ada peringkat

- DANDY L. DUNGO and GREGORIO A. SIBAL, JR., Vs PeopleDokumen3 halamanDANDY L. DUNGO and GREGORIO A. SIBAL, JR., Vs PeopleKling KingBelum ada peringkat

- Commissioner of Internal Revenue vs. Sekisui JushiDokumen6 halamanCommissioner of Internal Revenue vs. Sekisui Jushivince005Belum ada peringkat

- CIR Vs HantexDokumen20 halamanCIR Vs HantexDarrel John SombilonBelum ada peringkat

- Eusebio Villanueva V City of Iloilo (Summary)Dokumen4 halamanEusebio Villanueva V City of Iloilo (Summary)Coyzz de GuzmanBelum ada peringkat

- Davao Light and Power v. Commissioner of Customs, L-28902 Case DigestdocxDokumen1 halamanDavao Light and Power v. Commissioner of Customs, L-28902 Case DigestdocxSapere AudeBelum ada peringkat

- Phil. Acetylene Co. Inc. VS Cir, GR No L-19707, Aug 17, 1967Dokumen11 halamanPhil. Acetylene Co. Inc. VS Cir, GR No L-19707, Aug 17, 1967KidMonkey2299Belum ada peringkat

- PLDT v. City of DavaoDokumen1 halamanPLDT v. City of Davaoashnee09Belum ada peringkat

- Export Processing Zone Authority vs. CHRDokumen1 halamanExport Processing Zone Authority vs. CHRKling KingBelum ada peringkat

- Sec of Finance v. LazatinDokumen10 halamanSec of Finance v. Lazatinana abayaBelum ada peringkat

- MGC Vs Collector SitusDokumen5 halamanMGC Vs Collector SitusAira Mae P. LayloBelum ada peringkat

- Progressive Development Corp. Vs Quezon City - GR No. L-36081 - April 24, 1989Dokumen3 halamanProgressive Development Corp. Vs Quezon City - GR No. L-36081 - April 24, 1989BerniceAnneAseñas-ElmacoBelum ada peringkat

- Fort Bonifacio Development Corp v. CIR, G.R. No. 173425, 2013 Case DigestDokumen4 halamanFort Bonifacio Development Corp v. CIR, G.R. No. 173425, 2013 Case Digestbeingme2Belum ada peringkat

- Manila Electric Co Inc Vs Province of Laguna TAX 1Dokumen3 halamanManila Electric Co Inc Vs Province of Laguna TAX 1Libay Villamor IsmaelBelum ada peringkat

- VAT Taxation ConstitutionalDokumen2 halamanVAT Taxation ConstitutionalGenesis LealBelum ada peringkat

- Case DigestDokumen25 halamanCase DigestJay TabuzoBelum ada peringkat

- Vegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Dokumen2 halamanVegetable Oil Corp. V Trinidad, G.R. No. 21475, March 26, 1924, 45 Phil. 822Maria Fiona Duran MerquitaBelum ada peringkat

- Maceda V MacaraigDokumen2 halamanMaceda V MacaraigbrendamanganaanBelum ada peringkat

- Abakada Guro Vs ErmitaDokumen1 halamanAbakada Guro Vs Ermitaapril75Belum ada peringkat

- People Vs GiveraDokumen1 halamanPeople Vs GiveraKling KingBelum ada peringkat

- CIR v. PLDTDokumen2 halamanCIR v. PLDTKing Badong100% (1)

- Philreca V Dilg - Public PolicyDokumen2 halamanPhilreca V Dilg - Public PolicyCherry SormilloBelum ada peringkat

- SISON V ANCHETADokumen4 halamanSISON V ANCHETAMayflor BalinuyusBelum ada peringkat

- GR No. L-18840 Kuenzle & Streiff V CirDokumen7 halamanGR No. L-18840 Kuenzle & Streiff V CirRene ValentosBelum ada peringkat

- Diaz Et Al Vs Sec of Finance and CirDokumen1 halamanDiaz Et Al Vs Sec of Finance and CirKim Lorenzo CalatravaBelum ada peringkat

- Police Power vs Eminent Domain in Senior Citizen DiscountsDokumen2 halamanPolice Power vs Eminent Domain in Senior Citizen DiscountsJohn Dy Castro FlautaBelum ada peringkat

- Lorenzo v. Posadas JRDokumen4 halamanLorenzo v. Posadas JRGRBelum ada peringkat

- Medicard PhilippinesDokumen2 halamanMedicard PhilippinesNFNLBelum ada peringkat

- Case Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasDokumen1 halamanCase Digest: Lung Cenlungasdlkfjdsflter of The Philippines vs. Quezon City and Constantino RosasAJMordenoBelum ada peringkat

- Phil Rural Electric v. DILG - DigestDokumen1 halamanPhil Rural Electric v. DILG - DigestMik MabuteBelum ada peringkat

- 07 LTO V City of ButuanDokumen10 halaman07 LTO V City of ButuanKathBelum ada peringkat

- e-SCRA COM IR vs. Solid BankDokumen42 halamane-SCRA COM IR vs. Solid Bankflordelei hocateBelum ada peringkat

- Chavez vs. OngpinDokumen1 halamanChavez vs. OngpinMichelleBelum ada peringkat

- Pinlac VS PeopleDokumen1 halamanPinlac VS PeopleKling KingBelum ada peringkat

- Laura Corpuz Vs Felardo PajeDokumen1 halamanLaura Corpuz Vs Felardo PajeKling KingBelum ada peringkat

- Albenson Vs CADokumen2 halamanAlbenson Vs CAKling KingBelum ada peringkat

- Albenson Vs CADokumen2 halamanAlbenson Vs CAKling KingBelum ada peringkat

- Villamor Vs Comelec and AmytisDokumen6 halamanVillamor Vs Comelec and AmytisKling KingBelum ada peringkat

- .Afialda V. Hisole Case DigestDokumen1 halaman.Afialda V. Hisole Case DigestKling KingBelum ada peringkat

- Canta VS PeopleDokumen1 halamanCanta VS PeopleKling KingBelum ada peringkat

- BJDC CONSTRUCTION Vs LANUZODokumen5 halamanBJDC CONSTRUCTION Vs LANUZOKling KingBelum ada peringkat

- Anonuevo Vs CADokumen1 halamanAnonuevo Vs CAKling KingBelum ada peringkat

- Anonuevo Vs CADokumen1 halamanAnonuevo Vs CAKling KingBelum ada peringkat

- Amonoy Vs GutierezDokumen1 halamanAmonoy Vs GutierezKling KingBelum ada peringkat

- .Afialda V. Hisole Case DigestDokumen1 halaman.Afialda V. Hisole Case DigestKling KingBelum ada peringkat

- Albenson Vs CADokumen2 halamanAlbenson Vs CAKling KingBelum ada peringkat

- Amonoy Vs GutierezDokumen1 halamanAmonoy Vs GutierezKling KingBelum ada peringkat

- Lichauco VS Figueras HermanosDokumen2 halamanLichauco VS Figueras HermanosKling KingBelum ada peringkat

- Cagayan Vs RapananDokumen4 halamanCagayan Vs RapananKling KingBelum ada peringkat

- Manila Electric Company vs RemoquilloDokumen2 halamanManila Electric Company vs RemoquilloKling KingBelum ada peringkat

- Borromeo Vs Family CareDokumen2 halamanBorromeo Vs Family CareKling KingBelum ada peringkat

- BJDC CONSTRUCTION Vs LANUZODokumen5 halamanBJDC CONSTRUCTION Vs LANUZOKling KingBelum ada peringkat

- Barrientos VS DaarolDokumen3 halamanBarrientos VS DaarolKling KingBelum ada peringkat

- Criminal Law 2017Dokumen1 halamanCriminal Law 2017Kling KingBelum ada peringkat

- Pay Bill GazettedDokumen3 halamanPay Bill Gazettedibrahimshahghotki_20Belum ada peringkat

- Auction Name Domain Name Amount: Total EUR 201,00Dokumen1 halamanAuction Name Domain Name Amount: Total EUR 201,00ddfd fdfBelum ada peringkat

- CBK Power Vs CirDokumen3 halamanCBK Power Vs CirKim Lorenzo CalatravaBelum ada peringkat

- F2 Individual Trainee Application Form Version 14 September 2023Dokumen2 halamanF2 Individual Trainee Application Form Version 14 September 2023qa-qcBelum ada peringkat

- Chapter 16 - Efficient and Equitable Taxation: Public FinanceDokumen36 halamanChapter 16 - Efficient and Equitable Taxation: Public FinanceDiego PalmiereBelum ada peringkat

- Tez 721423500012 R PosDokumen4 halamanTez 721423500012 R PosBabu DerangulaBelum ada peringkat

- Einvoice 1661931542084Dokumen1 halamanEinvoice 1661931542084Jessica MathisBelum ada peringkat

- BLTST119ExOr NY PDFDokumen1 halamanBLTST119ExOr NY PDFmoresubscriptionsBelum ada peringkat

- Asaan Remittance Account - FAQsDokumen3 halamanAsaan Remittance Account - FAQsqazi12Belum ada peringkat

- First Data Annual Report 2011Dokumen178 halamanFirst Data Annual Report 2011SteveMastersBelum ada peringkat

- Bir Ruling 103-10 - Cod and NodDokumen5 halamanBir Ruling 103-10 - Cod and NodJerwin DaveBelum ada peringkat

- Statements 9261Dokumen6 halamanStatements 9261Jaun Tew Theory PhuorrBelum ada peringkat

- Salary Slip of MR Indra Nath Mishra March 20Dokumen1 halamanSalary Slip of MR Indra Nath Mishra March 20Indra MishraBelum ada peringkat

- Burgum Hate Rural AmericaDokumen4 halamanBurgum Hate Rural AmericaRob PortBelum ada peringkat

- Unadjusted Part of Mobilization Advance Received Prior To July 01Dokumen3 halamanUnadjusted Part of Mobilization Advance Received Prior To July 01CA Ishu BansalBelum ada peringkat

- Form 704Dokumen704 halamanForm 704Dhananjay KulkarniBelum ada peringkat

- Fixedline and Broadband Services: Your Account Summary This Month'S ChargesDokumen2 halamanFixedline and Broadband Services: Your Account Summary This Month'S ChargesJeneshBelum ada peringkat

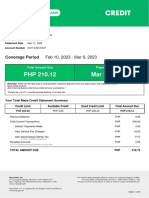

- MayaCredit SoA 2023MARDokumen2 halamanMayaCredit SoA 2023MARJan SaysonBelum ada peringkat

- GermanDokumen28 halamanGermanVaibhavi SinghBelum ada peringkat

- MIDTERMSDokumen3 halamanMIDTERMSkeouhBelum ada peringkat

- C1 - A New Hire, S Dilemma Reporting CorruptionDokumen3 halamanC1 - A New Hire, S Dilemma Reporting CorruptionNutanBelum ada peringkat

- Limitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Dokumen9 halamanLimitation On Interest Deduction (Section 94B of Income Tax Act, 1961)Taxpert Professionals Private LimitedBelum ada peringkat

- Disbursement Voucher: Quezon City GovernmentDokumen1 halamanDisbursement Voucher: Quezon City GovernmentAnnamaAnnamaBelum ada peringkat

- Bill PDFDokumen1 halamanBill PDFMaroshia MajeedBelum ada peringkat