Bcug The Latest 12 Months1

Diunggah oleh

satish sJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bcug The Latest 12 Months1

Diunggah oleh

satish sHak Cipta:

Format Tersedia

Australian BullCharts1 User Group

The Fourth 12 Months August 2009 to July 2010

A summary of discussions

from Meeting #37 to Meeting #48

This BullCharts User Group has now been in operation for 4 years, commencing in August 2006.

This document briefly describes the fourth year of operation, and goes on to summarise key

items of interest that have been discussed in the meetings in this past year. A similar summary

document was prepared for each of the earlier 12 month periods. These are available for

download from the User Group Yahoo Forum.

If you missed these meetings, then you missed out on the topics and items mentioned below.

Some of the information is available in the Yahoo Forum (free access) as separate files or in the

minutes of the meetings, or from the people or web sites referred to below. In some cases,

Robert has included the slide presentations in his Share Market Toolbox web site.

But first, how did the Group come about? Refer to the earlier summary documents for details...

This fourth year has seen some minor changes (or ongoing refinements) to our operations.

Meeting Attendances and Numbers

Throughout the year, the meeting numbers have fluctuated from 15 to 30 a little higher than

the previous 12 months. We have about 50 people who attend meetings from time to time, with

38 people having been to at least one meeting in the last 6. If they were to all come along to the

same meeting, then the room will be a little crowded.

Our list of interested people continues to grow, to about 100. We have been afraid of growing

the meeting size to a difficultly large number; but this has not yet happened.

Venue

The user group had its first meeting at the Box Hill RSL with 13 people attending. We then

sought out a larger and more suitable venue and found the Leighoak Hotel, which has been

providing the venue for free as a community benefit. However, during the last 12 months they

changed their policy and now charge a $100 flat fee for use of the room. Luckily for us, the

BullCharts company is picking up this cost on our behalf so that we can continue to have free

membership for our users (many thanks to Brendon Lansdowne from BullCharts in Sydney for

arranging this).

The User Group Membership base

Without doing a detailed survey of the members, it seems as though our user group membership

is roughly comprised as follows. A handful of people are full-time traders, or at least live off the

earnings of trading. A majority of members appear to be part-time traders who don't have

enough capital to live off trading, so they have a regular day job. Some of the people who

come along are evaluating BullCharts before deciding whether to buy or not. Many of the

members do have BullCharts; and a small number don't. The latter group of people seem to like

the opportunity to socialise with like-minded people from time to time and there is nothing

wrong with that.

The Yahoo Forum

Our Yahoo Forum now has a total of 100 members; but 20 of the registered email addresses

seem to be no longer valid. Everyone registered in the Yahoo Forum receives the automatic

Yahoo Calendar reminders for the monthly meetings, as well as messages sent to the group.

1

BullCharts is an innovative charting and technical analysis system. It provides a feature rich and powerful

set of tools with access to the latest strategies from local and overseas authors in analysing the dynamics

of the stock market. For more info see: http://www.bullcharts.com.au/

RobB:...BCUG-The-4th-12Months.odt Page 1 of 6 Printed: 24. Aug. 2010;

Australian BullCharts User Group the Fourth 12 months

Some of the people on our list, and members of the Yahoo Forum, are located out of Melbourne, or

interstate. It would be good if we could offer them something more than we do currently.

Other User Groups?

The Brisbane BullCharts User Group was established in 2008; but unfortunately the members there

found it difficult to find suitable meeting nights, and then folded. Our group here was renamed to the

Australian BullCharts User Group in 2009, and continues to be the only BullCharts User Group.

The ATAA

One observation that is worth making is that there are more and more people who are members of both

this User Group and the ATAA. A typical ATAA meeting in 2006 had about two BullCharts users

present; but now has more than ten. And the user group meetings used to have only two ATAA

members, but now has several.

Special Interest Groups?

Upon reflection, there are some potential changes that might now be appropriate. Including a possible

separate meeting of interested people in a Traders Group forum to talk specifically about topics of

interest to traders, including strategies, and state of the market. A separate meeting would allow more

time than we can do in these monthly software User Group meetings. However, recent moves within

the ATAA to accommodate their own Special Interest Groups might mean that there is no longer any

need for this user group to consider this.

Real Trading and Investing

We continue to refine our meeting agenda from time to time to try to accommodate the wishes of the

majority of the meeting participants. Here is an observation when perusing the minutes of our last 12

meetings. We introduced a Round Table Stock Talk agenda item during the 2007 bull market, in

which we invited people to describe trades they had made, and how they used BullCharts to spot these

opportunities. Over the last 2 years there have been a significantly smaller number of these situations

for people to talk about.

Always happy to entertain discussion on these matters.

Robert B. Brain

(Australian BullCharts User Group meeting convenor)

part-time trader, consultant and educator

www.robertbrain.com

Robert and his Share Market Toolbox provided

support services to the User Group.

General Disclaimers:

1. Any material omitted below is purely accidental, and the mistake will be gladly rectified on lodgement of

an official complaint.

2. All of the below information is general in nature, and is not a recommendation or course of action that

might lead to a financial investment. Professional financial advice should always be sought before

making investment decisions.

3. The mention of any products or people below is NOT a recommendation or endorsement.

(continued .../)

RobB:...BCUG-The-4th-12Months.odt Page 2 of 6 Printed: 24. Aug. 2010;

Australian BullCharts User Group the Fourth 12 months

A summary of key items from the fourth year of User Group meetings follows.

10. Brendon Lansdowne (BullCharts Sydney)

1. Meeting topics visited in July 2010 whilst in Melbourne for the

The following key topics have been discussed at the Trading and Investing Expo, and talked to the

meetings: group about the BullCharts company (Bull

1. Markets, and index performance Systems). The main topic was the pending

(the XAO and XJO). release of BullCharts version 3.8.7 with key

features:- Portfolio Manager and Trade

2. Guest Speakers & Planner, as well as the Advance/Decline

indicator and an increase in the number of

presentations Alerts form 100 to 300. (Lots of notes in the

2. Trading the SPI - Gerard Hogan. (See key meeting minutes July 2010 in the Yahoo

points in the Sept 09 meeting minutes in the Forum).

Yahoo Forum.)

3. Stop Loss! Seven ways to determine a 3. Trading and Strategies

stop position Robert Brain. (See key 11. Gerard (Aug 09) applies a filter to his stock

points in the Oct 09 meeting minutes in the selection. He puts the ActVest indicator on

Yahoo Forum, and the presentation slides in the XJO (S&P/ASX 200). And John filters

Brainy's Share Market Toolbox.) using the XJO and Daily RSI or Weekly

MACD looking for divergences.

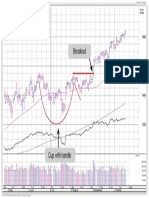

4. Leon Wilson's book Breakout Trading

Mary de la Lande. (See key points in the NOTE: Remember to back-test any strategy

Nov 09 meeting minutes in the Yahoo BEFORE implementing it.

Forum.).

5. Robert's Analysis of 2 decades of 4. Chart Types

Aussie Bear markets. (See key points in 12. No new chart types in this year.

the Dec 09 meeting minutes in the Yahoo

Forum, and the presentation slides in Brainy's

Share Market Toolbox.) 5. Indicators

6. Guppy MMA indicator. Robert gave a 13. Discussed many during the meetings.

presentation and demo of Guppy's Multiple 14. JB Volatility Profit Taker

Moving Average (GMMA) indicator, and how Nick Birjak lead a discussion (Aug 09) on the

to interpret it (Feb 10). (See key points in JB Profit Taker

the meeting minutes in the Yahoo Forum, indicator that is

and the presentation slides in Brainy's included in

Share Market Toolbox.) BullCharts. On

7. Stuart McPhee Developing a Simple BHP, this looks

Trading Strategy. As visiting guest like the screen

speaker, Stuart delivered a great presentation shot at right. (JB

on developing trading strategies (summary = Jim Berg; for

included overleaf), including lots of questions more details,

and discussion. Insert the Indicator on your own chart, and

look at the indicator properties, then click on

8. A sample real-life trade. Robert led a the Formula tab for more details).

presentation and we looked at the following

topics: (a) How did we spot it? (b) Where is Nick first does a scan for JB Rising Trend

our initial stop? (c) What is our target? (weekly), then saves the Scan results Table

(d) What is our risk? as a Watchlist, and then scans that watchlist

(e) What is the Reward/Risk ratio? for confirmed entries. We noted that with

(f) Do we take it? (g) How to up the Trailing some stocks, it can take up to 10-15 days for

Stop? (See key points and the presentation a stock to pay off.

slides in Brainy's Share Market Toolbox.). More details on Jim Berg and his materials on

9. Real live scans. Robert led a discussion his web site: www.sharetradingeducation.com

and BullCharts demonstration on this topic.

We looked at how to create and run some

scans in BullCharts, including use of some

key BullCharts features.

RobB:...BCUG-The-4th-12Months.odt Page 3 of 6 Printed: 24. Aug. 2010;

Australian BullCharts User Group the Fourth 12 months

15. Alan Hull Act Trade and Act Vest and off several times during a session. What

Pebby explained how Alan's Blue Chip report can happen is IntelliCharts can duplicate the

works. We looked at the BullCharts ActTrade line studies and text annotations. It might look

indicator on the like there is only one copy there. But if you

Small Ordinaries select it and try to delete it, the item appears

index (XSO) to see to still be there. But what is actually

what sort of signals happening is that you have deleted the top

it currently gives. It copy of the item, and any remaining items are

looked similar to the still on the chart. Just keep clicking and

screen shot at right deleting, and you will eventually get down to

(except that this the last one in the stack. He has an

shot is updated with explanation and work around for this on his

Daily candles web site in the BullCharts FAQ page:

superimposed on www.robertbrain.com/bullcharts/faq.html

the Weekly chart 21. Layer Manager and toolbar buttons.

Robert's special

adaptation of the 22. Copy and paste glitch Graham P

indicator which reported a problem with copying text to/from

makes it easier to implement Alan's strategy). the Windows clipboard and BullCharts (it used

More details are on Alan's web site, and in his to work for him on Windows XP). Graham is

Course Notes (download from the web) now using Windows Vista and BullCharts

www.alanhull.com v3.8.2 (so it might be a Vista problem). We

asked if anyone else has seen this problem

16. Your favourite indicator (Jan 10). A

no one.

group discussion. Common indicators used

around the table include: Moving Average 23. Windows Vista and Windows 7

(MA), MA Crossover, Guppy MMA, Bollinger Interesting to note: Vista users:- Ian Morgan,

Bands, MACD, RSI, Momentum, OBV, Greg Hilton, Wen Zhao. Also Windows 7

Parabolic SAR, Directional Movement (ADX, users:- Chandra.

+DI, -DI), SIROC, Stochastic, Alan Hull's

24. Windows 7 Graham Parker recently

ActVest/Trade and ROAR, JB Volatility Profit

moved to Windows 7 (we already have a

Taker, Chaikin's Money Flow, Average True

couple of people using BullCharts on Win 7

Range (ATR), Wilson ATR Trailing Stop.

it runs fine). Graham initially experienced

Note: It was interesting to note that only about one glitch, to do with Watchlists, and the

4 hands at most went up for any one indicator. location of the Watchlists folder and files.

And some indicators are used by just one or The support staff helped resolve this quickly.

two people.

25. Delete drop-down Belinda asked about

a possible problem with Delete from the

6. Scans drop-down dialogue box. Robert explained

17. (see discussion on presentations). that this is a known issue sometimes when

you click an object and then right-click to

delete it, the Delete option is not shown in the

7. Line studies, chart tools drop-down dialogue. Someone suggested

and other features that one way to fix this is to go to this menu

option: Tools > Preferences > General (tab),

18. Quick, short sessions on various toolbar and then for the 4th item Remember

buttons. Many discussed refer to Robert's menu/toolbar layout and customizations,

web-based Indexed Archived Tip Sheets (click simply untick, and then re-tick the check box.

here...) for a long list.

26. Dividends when are they? this

information is in BullCharts in the Security

8. Tips, Shortcuts Summary section for each stock, or you can

19. Delete a line study Some users had download Chris's indicator from the Yahoo

noticed that sometimes it is difficult to delete a Forum and apply the indicator to a price chart

line study from a chart. We tried this on a to automatically flag the date on the chart.

chart, insert a trend line, then right-click on it 27. Gann Swing + Price Plot John Beattie

and notice that on some occasions when you asked (May 10) about overlaying a standard

do this, the Delete option is not on the drop- price chart onto a Gann Swing chart. This

down list, and sometimes it is there. There concept puzzled a few of us; but we explored

does appear to be a bug. the option and discovered the points that are

20. IntelliCharts Robert pointed out that included with a sample chart (see the meeting

IntelliCharts can cause a glitch if you turn it on minutes in the Yahoo Forum).

RobB:...BCUG-The-4th-12Months.odt Page 4 of 6 Printed: 24. Aug. 2010;

Australian BullCharts User Group the Fourth 12 months

28. Defaults value in indicators John

Beattie asked about this feature. Notice that

10. Markets overview and

for each indicator there is a Defaults button discussions

that allows you to set the current parameters

33. We looked at a Weekly chart of the XJO

(and colours and other options) as the

(Aug 09) with the 30-week MA (as per Stan

default value for all future uses of the

Weinstein's

indicator. This button is in the lower left

teachings). See

corner of the indicator properties dialogue

chart at right.

box. And one of the options therein is to

Robert also

reset to factory defaults so it doesn't

pointed out that if

matter if you mess up your own defaults.

you look at this

29. Overseas stocks? How to display chart going back

these? over a few years,

It is possible to view price charts for you will notice

overseas stocks. If you know the stock that whenever the

code, you can enter it in the same way that price gets too far

you would to view an Australian stock; but up ahead of the 30-week MA, then there

with a US. prefix. For example, to view tends to be a pause in price as it falls back to

Microsoft with the US stock code MSFT, kiss the indicator. The current chart suggests

type in: US.MSFT . Or for the company 3M, this might happen soon.

type: US.MMM Overseas indexes are a little

34. Have looked at the XAO (All Ords) and

different eg. DJIA = US.^DJA Robert has

charts of the Top 20 stocks (the XTL index).

this information stored in one of his eBook

(PDF) Articles in the Share Market Toolbox 35. We looked at VPG Valad Property (May

it is Article number BC-05-100 Stock 2010 you had to be there to hear it).

Codes, Indices, Currencies. Toolbox

36. Marcus Padley recently commented in

members can view this from the eBooks web

The Age (Saturday?) re: CFDs, leave them

page: www.robertbrain.com/ebooks/ (non-

alone.

members can see the Page1 of the article

on the same web page.

11. Events

9. Other BullCharts items The following events were mentioned:

37. Trading & Investing Expo: Fri-Sat 2-3 Oct,

30. Suggested new features:- Graham P

2009 www.TradingAndInvestingExpo.com.au. and

Position Size (and Stop) Calculator.

23-24 July, 2010. ATAA Members usually

James P Market Depth display on vertical

have free tickets available.

Price Axis.

38. ATAA Conference (in October each year).

31. US Stocks How to chart US stocks in www.ataa.com.au/conference

BullCharts? The general format of the

security code is, for example, US.GOOG (for 39. Jake Bernstein will do a special ATAA

Google), US.AAPL (Apple). You will need to presentation on Tuesday 20 October 2009

wait a few seconds for the data to be see the ATAA (or committee members) for

downloaded from the remote server to your details. This is while he is in Australia for the

PC (unlike your Australian Securities End of ATAA Conference, and with

Day data which is stored locally on your www.ADEST.com.au (David Hunt).

computer's hard drive). Global index codes

40. Robert's Technical Analysis Introduction

are like the example: US.^DJI (Dow Jones

seminar runs every two months (Blue Chip

indicator). For a list of these, see the

Price Chart Secrets seminar see the

BullCharts web site, or there are two versions

Toolbox).

on Robert's Toolbox site here:

www.robertbrain.com/bullcharts/ in the FAQ 41. Sunday Traders Club (Alan Hull) at

section, for (i) a short 2-page list of common Wantirna Club, Wantirna South. RSVP: by

index codes, and (ii) a more detailed 29-page email to: enquiries@alanhull.com or phone

version. 9801 5555. Info flyer is uploaded to the

Yahoo Forum > Files section >

32. Actions menu item A number of useful

Clubs,Seminars,Expos (link here...).

items.

42. The Symposium Resources seminars

www.symposium.net.au are gaining popularity.

RobB:...BCUG-The-4th-12Months.odt Page 5 of 6 Printed: 24. Aug. 2010;

Australian BullCharts User Group the Fourth 12 months

55. Sky Business Channel (Foxtel 602) The

12. Web sites, magazines, Perrett Report www.businesschannel.com.au

eNewsletters, etc. 56. Richard Farleigh http://farleigh.com/

The following web sites and magazines have been

referred to during meetings:

43. Market data good source is 13. Books discussed

http://asx.netquote.com.au 57. The Daily Trading Coach, Brett N

Steenbarger on trading psychology (Andrew

44. Educated Investor bookshop (Collins

is reading). See Brett's web site:

Street, city) is selling DVDs.

www.brettsteenbarger.com

www.educatedinvestor.com.au

58. Justine Pollard's Smart Trading Plans is a

45. The Sunday Age has market commentary.

good book.

46. Darryl Morley (Herald Sun on 59. Stop Orders, Tony Loton;

Wednesdays)

60. Sell and Sell Short, Alexander Elder;

47. A great web site for chart patterns 61. Your Trading Room to watch live trading

Bulkowski www.thepatternsite.com (Greg H):- http://www.yourtradingroom.com/ ;

48. New web site and business: 62. Watch (US securities) trading about 8:30am

www.markettiming.com.au featured on Sky (Paul C) http://realitytrader.com/.

Business Channel 602. 63. Coming soon The Wiley Trading Guide

49. The ASX Share Market Game comes up from J.Wiley.

twice each year. www.asx.com.au [available now Wiley Press Release; and at

LawBooks.com.au ]

50. ASX web site studied key features of the 64. Secrets of Stock Market Traders Exposed

site (March 10). Some good research and Dale Beaumont.

pricing tools and information.

51. Dividends see Board Room Radio web

site http://www.brr.com.au

14. Yahoo Forum

The key features of the Yahoo Forum now include:

52. Paul C visited the Brisbane ATAA meeting 65. Message posts

and saw Davin Clarke speak. Note free

seminar. See web site:- www.trade4edge.com 66. Files storage:

53. Brian Costello www.entello.com.au The latest list of members and basic

details an dother stuff.

54. Trading With The Gods Alan Oliver

www.tradingwithgods.com

General Disclaimers:

1. Any material omitted above is purely accidental, and the mistake will be gladly rectified on lodgement of

an official complaint.

2. All of the above information is general in nature, and is not a recommendation or course of action that

might lead to a financial investment. Professional financial advice should always be sought before

making investment decisions.

3. The mention of any products or people above is NOT a recommendation or endorsement.

RobB:...BCUG-The-4th-12Months.odt Page 6 of 6 Printed: 24. Aug. 2010;

Anda mungkin juga menyukai

- Simple Supper Trading SystemDokumen3 halamanSimple Supper Trading Systemsatish sBelum ada peringkat

- 1208452Dokumen4 halaman1208452satish sBelum ada peringkat

- News Release: Nomura Individual Investor SurveyDokumen17 halamanNews Release: Nomura Individual Investor Surveysatish sBelum ada peringkat

- Unusual Options Activity Halftime Report - : There Is A Risk of Loss in All TradingDokumen3 halamanUnusual Options Activity Halftime Report - : There Is A Risk of Loss in All Tradingsatish sBelum ada peringkat

- Es130617 1Dokumen4 halamanEs130617 1satish sBelum ada peringkat

- The Stock Market Update: September 11, 2012 © David H. WeisDokumen1 halamanThe Stock Market Update: September 11, 2012 © David H. Weissatish sBelum ada peringkat

- Dig Ppo: Percentage Price OscillatorDokumen4 halamanDig Ppo: Percentage Price Oscillatorsatish sBelum ada peringkat

- Wabash National Corp WNC: Last Close Fair Value Market CapDokumen4 halamanWabash National Corp WNC: Last Close Fair Value Market Capsatish sBelum ada peringkat

- Position SizingDokumen29 halamanPosition SizingIan Moncrieffe94% (18)

- Crystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural InformationDokumen3 halamanCrystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural Informationsatish sBelum ada peringkat

- Top 20 Day Trading Rules For SuccessDokumen4 halamanTop 20 Day Trading Rules For Successbugbugbugbug100% (3)

- Sharpening Skills WyckoffDokumen16 halamanSharpening Skills Wyckoffsatish s100% (1)

- Raschke0204 PDFDokumen10 halamanRaschke0204 PDFAnonymous xU5JHJe5Belum ada peringkat

- The Art of Timing The TradeDokumen1 halamanThe Art of Timing The Tradesatish s0% (3)

- Power PatternsDokumen41 halamanPower Patternsedmond1100% (1)

- ETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst FundsDokumen5 halamanETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst Fundssatish sBelum ada peringkat

- BattenBook Chapter7Enhanced PDFDokumen55 halamanBattenBook Chapter7Enhanced PDFsatish sBelum ada peringkat

- CH 4Dokumen38 halamanCH 4satish sBelum ada peringkat

- Greatness SurveyDokumen14 halamanGreatness SurveyNew York PostBelum ada peringkat

- Money Management Controlling Risk and Capturing Profits by Dave LandryDokumen20 halamanMoney Management Controlling Risk and Capturing Profits by Dave LandryRxCapeBelum ada peringkat

- Uniti Group Inc UNIT: Last Close Fair Value Market CapDokumen4 halamanUniti Group Inc UNIT: Last Close Fair Value Market Capsatish sBelum ada peringkat

- Forecasting Stock Returns: What Signals Matter, and What Do They Say Now?Dokumen20 halamanForecasting Stock Returns: What Signals Matter, and What Do They Say Now?dabiel straumannBelum ada peringkat

- Trading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLDokumen8 halamanTrading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLsatish sBelum ada peringkat

- Smartbuild - Smart Design For Smart SystemsDokumen1 halamanSmartbuild - Smart Design For Smart Systemssatish sBelum ada peringkat

- Incoming Material InspectionDokumen18 halamanIncoming Material InspectionjeswinBelum ada peringkat

- Kuhn FEMADokumen1 halamanKuhn FEMAsatish sBelum ada peringkat

- How To Buy Common Patterns1 2Dokumen1 halamanHow To Buy Common Patterns1 2satish sBelum ada peringkat

- An Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange MarketDokumen7 halamanAn Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange Marketsatish sBelum ada peringkat

- Pega 7 1 Sla1Dokumen3 halamanPega 7 1 Sla1satish sBelum ada peringkat

- Greenhill & Co Inc GHL: DividendsDokumen5 halamanGreenhill & Co Inc GHL: Dividendssatish sBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Belden - IIT - Industrial Networks OverviewDokumen40 halamanBelden - IIT - Industrial Networks Overviewmaricon estrosasBelum ada peringkat

- CoC 6e - The Resurrected I - One Grace Under PressureDokumen40 halamanCoC 6e - The Resurrected I - One Grace Under PressureSergio Iván Rivas ChapaBelum ada peringkat

- Python Download Pip: "Hello, World!"Dokumen14 halamanPython Download Pip: "Hello, World!"Allan Edward GJBelum ada peringkat

- 2018-11 FS9100 DatasheetDokumen3 halaman2018-11 FS9100 DatasheetNguyen Van HaiBelum ada peringkat

- Balok 200x300Dokumen9 halamanBalok 200x300ajiBelum ada peringkat

- Resume in Kannada LanguageDokumen7 halamanResume in Kannada Languagefsna80xf100% (1)

- College Management System Deewan BcaDokumen76 halamanCollege Management System Deewan BcasunnyBelum ada peringkat

- F3 Computer Science-Data TransmissionDokumen15 halamanF3 Computer Science-Data TransmissionIss MeBelum ada peringkat

- A2-1 InstructionsDokumen2 halamanA2-1 Instructions1999jogeshBelum ada peringkat

- Vinod ResumeDokumen3 halamanVinod ResumeVinod ChauhanBelum ada peringkat

- Gujarat Technological University: G. H. Patel College of Engineering and Technology, Vallabh VidyanagarDokumen22 halamanGujarat Technological University: G. H. Patel College of Engineering and Technology, Vallabh VidyanagarniteshBelum ada peringkat

- SAP HANA 1909 BlogDokumen3 halamanSAP HANA 1909 BlogLovi SharmaBelum ada peringkat

- MIMXRT1060 Evaluation Kit Board Hardware User's GuideDokumen15 halamanMIMXRT1060 Evaluation Kit Board Hardware User's GuideAnonymous xVToPcfG6CBelum ada peringkat

- Implementationof DSPBased SPWMfor SingleDokumen7 halamanImplementationof DSPBased SPWMfor Singlemd abdullahBelum ada peringkat

- Sales Order Management Certification ExamDokumen8 halamanSales Order Management Certification ExamALHBelum ada peringkat

- CCS336 CSM PART A AND B Question and AnswersDokumen83 halamanCCS336 CSM PART A AND B Question and AnswersNISHANTH M100% (1)

- Computerized Audit ToolsDokumen2 halamanComputerized Audit ToolsElliot RichardBelum ada peringkat

- Design and Implement Special Stack Data Structure - Added Space Optimized Version - GeeksforGeeksDokumen35 halamanDesign and Implement Special Stack Data Structure - Added Space Optimized Version - GeeksforGeekslongphiycBelum ada peringkat

- UP Invitation Letter (Trainings)Dokumen5 halamanUP Invitation Letter (Trainings)Jose Emmanuel MANINGASBelum ada peringkat

- Soliphant M FTM51 - Final Inspection Protocol - SERNR - R705FB0107A (En)Dokumen1 halamanSoliphant M FTM51 - Final Inspection Protocol - SERNR - R705FB0107A (En)Ahmad DagamsehBelum ada peringkat

- All You Need To Know About Artificial IntelligenceDokumen18 halamanAll You Need To Know About Artificial Intelligenceobialor ikennaBelum ada peringkat

- Unit 5 Electronics Operational AmplifierDokumen25 halamanUnit 5 Electronics Operational AmplifierYared Birhanu100% (1)

- IIS Interview Questions and AnswersDokumen15 halamanIIS Interview Questions and AnswersdanixhBelum ada peringkat

- Official Withdrawal Request Form Official Withdrawal Request FormDokumen2 halamanOfficial Withdrawal Request Form Official Withdrawal Request FormLjane de GuzmanBelum ada peringkat

- Classifications 4 (1) .2.0 Troubleshooting& FAQs GuideDokumen27 halamanClassifications 4 (1) .2.0 Troubleshooting& FAQs Guidenimai mohantyBelum ada peringkat

- TwinCAT TimersDokumen6 halamanTwinCAT TimersveithungengBelum ada peringkat

- Guidebook For Learners of AICTE-NITTT Module 5: (Technology Enabled Learning & Life-Long Self Learning)Dokumen54 halamanGuidebook For Learners of AICTE-NITTT Module 5: (Technology Enabled Learning & Life-Long Self Learning)rollingstone2804Belum ada peringkat

- Artis - & - Personal - LIVE - Release Communication - 2020 10 19Dokumen5 halamanArtis - & - Personal - LIVE - Release Communication - 2020 10 19Văn Thế NamBelum ada peringkat

- Cambridge O Level: Computer Science 2210/22Dokumen12 halamanCambridge O Level: Computer Science 2210/22shabanaBelum ada peringkat

- Project Synopsis: MycityDokumen3 halamanProject Synopsis: MycityPranam RaiBelum ada peringkat