Does The Head & Shoulders Formation Work?: Detecting Trend Changes?

Diunggah oleh

satish sDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Does The Head & Shoulders Formation Work?: Detecting Trend Changes?

Diunggah oleh

satish sHak Cipta:

Format Tersedia

CHARTING

fSee Traders Glossary for definition $See Editorial Resource Index

mCHARTING

Does The Head & Shoulders

Detecting Trend Changes?

Formation Work?

Rarely will you come across a technique that

detects an imminent change in trend, but heres a

method that can help you do just that.

by Martin Boot

he head and shoulders

pattern has long been

considered one of the most

reliable in technical analysis.

That should mean that more

often than not, every trader

can make high returns on

their holdings.

Unfortunately, its not that simple.

I am engaged in a major research project

involving statistical analysis of 8,513 New York

Stock Exchange (NYSE) and Nasdaq stocks over a

four-year period. I test well-known technical

indicators as well as technical patterns, and the

results have been revealing. They seem to be more

in sync with daily trading practices than other

results I have found in the literature. Recently, I

completed my study of the well-known head and

shoulders pattern, which is considered to indicate

and even predict a change in trend. Here are the

results.

THE PATTERN

The head and shoulders pattern caught my attention

after I read Thomas Bulkowskis article in the

August 1997 Technical Analysis of STOCKS & frequent in my studies than what Bulkowski stated in his

COMMODITIES, in which he evaluated 300 stocks over a analysis.

two-year time span. In it, Bulkowski reported an 83% success

rate with the pattern. You can easily define this kind of pattern

Program logic

in a computer program and instruct the computer to trade

Shape: After an upward price trend, the formation appears as three

broken necklines)". Using logic from TechniFilter Plus (see

sidebar, Head and shoulders top report) for identifying them,

bumps, the center one being the tallest, and resembling a bust.

I decided to write a program to trade the head and shoulders

pattern.

When I applied it to my daily trading, I didnt experience

an 83% success rate in the head and shoulders top formation,

as you will see. Further, I found the pattern to be more

1 April 2002 Technical Analysis of STOCKS & COMMODITIES

Symmetry: The two shoulders appear at about the same price levels. The Thisonnects the lows of the two troughs between the three peaks. The line can slope

distance from each shoulder to the head is approximately the same. There can be a up or down and is often used as a trigger point once prices pierce the line.

variation in the appearance of the formation, but symmetry is usually good.

Downside breakout: Once prices pierce the neckline, they may pull back

Volume: This will be the highest on the left shoulder, followed by the head. The briefly, and then continue moving down

right shoulder will have the lowest volume of the three peaks.eckline:

2 April 2002 Technical Analysis of STOCKS & COMMODITIES

.

LTS

e.tive of the program is to find these :: : ns in my database of 8,315 NYSE and 4 stocks

over a period of four years (1997- The #Siqs Issues results are:

0 755

teems 83,282

1 301

2 367

t't'Tiing as predicted 28,558=>34.2911% 3 346

4 404

: cerforming aspredicted 54,723 => 65.7089% 5 363

ge 10 patterns per stock 6 387

7 427

8 457

r -ogram measured time periods of five, 9 448 20, days after the broken neckline and found

1

: Ilowing: 10 440

11 481

of correct signals for 5 days = 25,914 -. erage price 12 449 change = -13.8936%

No. of incorrect signals = 57,368 - .erage price change: 13 416 20.4899%

14 355

'Jo. of correct signals for 20 days = 28,961 Average price 15 365 change = -15,4106%

No. of incorrect price change = 54,321 Average price 16 319 change = 18.9551%

17 301

18 268

No. of correct signals for 60 days = 30,800 Average price change = -9.65398%

19 193

No. of incorrect signals = 52,482 Average price change = 20 171 25.2319%

21 129

22 104

~r.e distribution of the head and shoulders pattern 23 70 over the tY.abase issues is displayed in Figure 1.

In 755 stocks the 7 -item did not occur at all. In 301 stocks the pattern occurred nee. and in 367

24 70

stocks the pattern occurred twice. I also and that after five days following the completion of

25 41

a head end shoulders top, many stocks saw a downward movement between 10% and 99%.

26 29

27 17

OBSERVATIONS

28 13

i found these observations:

29 10

The head and shoulders pattern occurs 30 7 frequently in stock prices.

35% (or approximately one third) of the occurrences are profitable.

The largest profit comes within a four- week time frame; after 12 weeks the

average profit drops below the profit of the first week.

8.8% of the stocks never saw a head and shoulders pattern over the last four years, which means that more than

90% of the stocks formed the pattern several times.

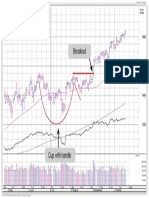

FIGURE 1: DISTRIBUTION OF THE HEAD AND SHOULDERS PATTERN. The pattern does occur frequently among stocks, but is it reliable? .

1.5% saw 25 or more head and shoulders patterns in their price development.

There is a clustering of patterns between one and 17 occurrences.

If the signal is correct, a downward movement between 10% and 99% can be observed after five days.

ANALYSIS

These findings do not reinforce the statements in Bulkowskis article. From a statistical point of view, the head and shoulders

formation does not herald a change of trend in a financial security. If the formation is correct, then substantial gains can be

obtained even within a one-week time frame.

My findings show that approximately 35% of the occurrences are profitable, but how do you turn this into a higher

percentage? The key is to locate it in the proper time frame. The pattern should indicate a trend break. So, if you know a trend

break is imminent, you can rely on the head and shoulders pattern.

But how do you know when a trend break is imminent? Idont know of any technical analysis technique that can predict such an

event with a high probability. Unfortunately, most technical analysis techniques lag, and when a trend is defined, it is usually in

3 April 2002 Technical Analysis of STOCKS & COMMODITIES

For more information circle No. 8

hindsight. Once the top/ bottom sequence has changed, you know the trend has as well, but it is too late to make any predictions.

There is no guarantee that a break in the neckline in a recent head and shoulders pattern will continue. CHARTING

TECHNIFILTER PLUS HEAD & SHOULDERS TOP REPORT Head and shoulders patterns can be

To ignore any extraneous peaks and valleys, this report uses a 5% zigzag.

helpful in determining trendline

Column/Title Description breakouts. However, simply

identifying them will not provide a

[1] Symbol Ticker symbol high success rate.

[2] Rt shoulder

predict a time frame for trend changes. Their studies show that

[3] Head Returnsthevalueofthemostrecentpeak, head and shoulders formations are present at some of these

primary cycles.

which is considered the right shoulder ot a head and According to Merriman, between 1982 and 1997, 44

shoulders pattern. primary cycles unfolded in the Standard & Poors futures

[4] Lft (SPX). These primary cycles have a definite morphology that

shoulder Returns the value of the second peak- back, which can be roughly described as a three-phase wave, with the third

would be the head of the pattern. The head is a phase being the one where the trend changes.

[5] Current higher peak than either shoulder.

slope According to Merriman, in this phase, the head and

shoulders formation occurred seven times in the SPX. The

Returns the value of the third peak-back, which is

confirmation of the primary cycle crest or trough took place

the left shoulder of the pattern. Returns the value of

the slope from the right shoulder to when the neckline was broken, after which the market usually

the current day. This gives you an idea made a strong move in the direction of the breakout. I have

[6] Neckline

of how quickly price has moved since found that both stock market indexes and individual stocks

crs follow this cyclical pattern described by Merriman.

the right shoulder was formed.

Returns 1 if the neckline has been

Condition broken in the most recent two days,

CONCLUSION

and zero if no cross occurred. Head and shoulders patterns can be helpful in determining

[5]<0 & [2]<3 & [3]>[4] trendline breakouts. However, simply identifying them will not

Which means provide a high success rate; but by determining in which phase

of a cycle the formation occurs, you can turn the head and

A negative-current slope and a head shoulders pattern into a gold mine

[5]<0&[2]<[3]&[3]>[4]&[6]=1

and shoulders pattern (that is, the

second peak-back is higher than the

first and third peak-backs).

Have a head and shoulders pattern and broken neckline.

.

Boot, Martin [2000], Trend-Following With The ADX,

Martin Boot is a computational linguist, psychotherapist, Technical Analysis of STOCKS & COMMODITIES, Volume

18; September.

writer, and trader. Bulkowski, Thomas [1997], The Head And Shoulders

Formation, Technical Analysis of STOCKS &

SUGGESTED READING

COMMODITIES, Volume 15: August.

[2000]. Encyclopedia Of Chart Patterns, John Wiley

& Sons.

Merriman, Raymond [1997], The Ultimate Book On Stock

Market Timing: Cycles And Patterns In The Indexes, Seek-

It Publications.

[1999]. Technical Studies And The Primary Cycle,

Technical Analysis of STOCKS & COMMODITIES, Volume

17: March.

TechniFilterPlus 8 Reference Manual: Reports, Strategies &

Formulas, RTR Software.

4 April 2002 Technical Analysis of STOCKS & COMMODITIES

$TechniFilter Plus (RTR Software)

fSee Traders Glossary for definition iSee Editorial Resource Index E3S

5 April 2002 Technical Analysis of STOCKS & COMMODITIES

Anda mungkin juga menyukai

- Seller Finance Real EstateDokumen68 halamanSeller Finance Real EstateChris Goff67% (3)

- DoesTrendFollowingWorkOnStocks 120513Dokumen22 halamanDoesTrendFollowingWorkOnStocks 120513apoinjnBelum ada peringkat

- Catalogue V 23Dokumen18 halamanCatalogue V 23percysearchBelum ada peringkat

- MarketSizing 20130129Dokumen26 halamanMarketSizing 20130129Ankesh Dev100% (1)

- Test The Investor's Stock Ranking System: A of DailyDokumen15 halamanTest The Investor's Stock Ranking System: A of DailyTuan DangBelum ada peringkat

- Sharpening Skills WyckoffDokumen16 halamanSharpening Skills Wyckoffsatish s100% (1)

- Catalogue V 24Dokumen18 halamanCatalogue V 24percysearchBelum ada peringkat

- Volume Spread Analysis Karthik MararDokumen34 halamanVolume Spread Analysis Karthik Mararku43to95% (19)

- Breakaway GapsDokumen4 halamanBreakaway GapsNikos PasparakisBelum ada peringkat

- Market Technician No39 PDFDokumen16 halamanMarket Technician No39 PDFrosehawkfireBelum ada peringkat

- TechnicalAnalyst MarketBottoms1 09Dokumen5 halamanTechnicalAnalyst MarketBottoms1 09applicoreBelum ada peringkat

- Constructing Low Volatility Strategies: Understanding Factor InvestingDokumen33 halamanConstructing Low Volatility Strategies: Understanding Factor InvestingLoulou DePanamBelum ada peringkat

- Are Institutions Momentum Traders?: Timothy R. Burch Bhaskaran SwaminathanDokumen39 halamanAre Institutions Momentum Traders?: Timothy R. Burch Bhaskaran Swaminathansatish sBelum ada peringkat

- Feasibility Report Amusement Park NRDADokumen28 halamanFeasibility Report Amusement Park NRDANityaMurthy89% (9)

- Bandy NAAIM PaperDokumen30 halamanBandy NAAIM Paperkanteron6443Belum ada peringkat

- RSI CalcDokumen2 halamanRSI CalcregdddBelum ada peringkat

- Barbara Star - PresentationDokumen51 halamanBarbara Star - PresentationKenneth Anderson100% (1)

- Finance1 Problem1 121013094019 Phpapp01 PDFDokumen13 halamanFinance1 Problem1 121013094019 Phpapp01 PDFMauro SacamayBelum ada peringkat

- A Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Dokumen4 halamanA Sleep Well Bond Rotation Strategy With 15 Percent Annualized Return Since 2008Logical InvestBelum ada peringkat

- Air Thread Case FinalDokumen49 halamanAir Thread Case FinalJonathan GranowitzBelum ada peringkat

- The Art of Timing The TradeDokumen1 halamanThe Art of Timing The Tradesatish s0% (3)

- Are Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?Dokumen45 halamanAre Hedge Funds Becoming Regular Asset Managers or Are Regular Managers Pretending To Be Hedge Funds?mayur8898357200Belum ada peringkat

- Tdı enDokumen3 halamanTdı enCYHN RSYBelum ada peringkat

- MTA Educational Web Series: Using Cycles in TradingDokumen20 halamanMTA Educational Web Series: Using Cycles in TradingArchati ZBelum ada peringkat

- Defensive Portfolio Construction Based On Extreme VaR SCHIMIELEWSKI and STOYANOVDokumen9 halamanDefensive Portfolio Construction Based On Extreme VaR SCHIMIELEWSKI and STOYANOVRuTz92Belum ada peringkat

- Moskowitz Time Series Momentum PaperDokumen23 halamanMoskowitz Time Series Momentum PaperthyagosmesmeBelum ada peringkat

- Es130617 1Dokumen4 halamanEs130617 1satish sBelum ada peringkat

- Trade Policy Update: A View From The Business CommunityDokumen53 halamanTrade Policy Update: A View From The Business CommunityNational Press FoundationBelum ada peringkat

- TASC Magazine March 2009Dokumen70 halamanTASC Magazine March 2009Trend ImperatorBelum ada peringkat

- Final Project On Volatility - New 2Dokumen99 halamanFinal Project On Volatility - New 2vipul099Belum ada peringkat

- Getting Clear With Short-Term Swings: Which Way Goes The Price?Dokumen4 halamanGetting Clear With Short-Term Swings: Which Way Goes The Price?trash6666Belum ada peringkat

- Breakfast With Dave 082010Dokumen15 halamanBreakfast With Dave 082010richardck50Belum ada peringkat

- 172TOMLDokumen4 halaman172TOMLanalyst_anil14Belum ada peringkat

- D.Bolze - Crown PatternDokumen5 halamanD.Bolze - Crown PatternamyBelum ada peringkat

- BPM Module 3Dokumen14 halamanBPM Module 3Rechelle100% (4)

- Oct08 Ss BarclayscapitalDokumen2 halamanOct08 Ss BarclayscapitalVincent Cheng ChengBelum ada peringkat

- Pestle For ToyotaDokumen2 halamanPestle For ToyotaAshvin Bageeruthee100% (3)

- Adaptive Asset AllocationDokumen14 halamanAdaptive Asset AllocationQuasiBelum ada peringkat

- 06-10-10 Breakfast With DaveDokumen8 halaman06-10-10 Breakfast With DavefcamargoeBelum ada peringkat

- Allen Gale 04allen Gale 2004Dokumen39 halamanAllen Gale 04allen Gale 2004hectorgm77Belum ada peringkat

- Respondents Currently Investing Money in Share Market?Dokumen16 halamanRespondents Currently Investing Money in Share Market?Ajay RaiBelum ada peringkat

- Delta Surface Methodology - Implied Volatility Surface by DeltaDokumen9 halamanDelta Surface Methodology - Implied Volatility Surface by DeltaShirley XinBelum ada peringkat

- Amount of Fish CaughtDokumen1 halamanAmount of Fish CaughtAnonymous sMqylHBelum ada peringkat

- Bollinger BandsDokumen8 halamanBollinger BandsOxford Capital Strategies LtdBelum ada peringkat

- Finance 21 QuestionsDokumen10 halamanFinance 21 QuestionsAmol Bagul100% (1)

- WB 1960 WavAdv Relative Strength PDFDokumen41 halamanWB 1960 WavAdv Relative Strength PDFLei ChenBelum ada peringkat

- Candlesticker by AmericanbullsDokumen2 halamanCandlesticker by Americanbullskahfie100% (1)

- Technical Analysis 20001Dokumen38 halamanTechnical Analysis 20001vlsijpBelum ada peringkat

- Bloomberg 2013 December-Tf LastDokumen31 halamanBloomberg 2013 December-Tf LastMashahir AhmedBelum ada peringkat

- By Maria Crawford Scott: Editor, AAII JournalDokumen61 halamanBy Maria Crawford Scott: Editor, AAII JournaljunkyjunkstonBelum ada peringkat

- PDF Mark Minervini Webinar Notes - CompressDokumen3 halamanPDF Mark Minervini Webinar Notes - Compressmbbdzcr ignviyrideyBelum ada peringkat

- 2013 Picking NewslettersDokumen24 halaman2013 Picking NewslettersganeshtskBelum ada peringkat

- R.senthil KumarDokumen4 halamanR.senthil Kumar9030841912Belum ada peringkat

- Creating A Heirarchy of Trading DecisionsDokumen6 halamanCreating A Heirarchy of Trading DecisionsWayne H WagnerBelum ada peringkat

- UW Cinematheque Spring 2013 Screening CalendarDokumen22 halamanUW Cinematheque Spring 2013 Screening CalendarIsthmus Publishing CompanyBelum ada peringkat

- Faq DSP Quant FundDokumen17 halamanFaq DSP Quant Fundkaya nathBelum ada peringkat

- Launch of Conviction ListDokumen11 halamanLaunch of Conviction ListWilson WongBelum ada peringkat

- ScrutsDokumen6 halamanScrutsRodrigo OliveiraBelum ada peringkat

- Morningstar Manager Research - A Global Guide To Strategic Beta Exchange-Traded ProductsDokumen62 halamanMorningstar Manager Research - A Global Guide To Strategic Beta Exchange-Traded ProductsSpartacusTraciaBelum ada peringkat

- Momentum and Contrarian StrategiesDokumen42 halamanMomentum and Contrarian StrategiessoumensahilBelum ada peringkat

- Rating TDokumen9 halamanRating TMehul J VachhaniBelum ada peringkat

- What Is Mean Reversion?Dokumen3 halamanWhat Is Mean Reversion?Jonhmark AniñonBelum ada peringkat

- Rule-Based Investing According To Good Investing PrinciplesDokumen26 halamanRule-Based Investing According To Good Investing Principlesrchawdhry123Belum ada peringkat

- Stoch 02-09-08 Update PDFDokumen2 halamanStoch 02-09-08 Update PDFchauchauBelum ada peringkat

- SSRN Id937847Dokumen18 halamanSSRN Id937847Srinu BonuBelum ada peringkat

- 1989 The Box Spread Arbitrage Conditions Theory, Tests, and Investment StrategiesThe Box Spread Arbitrage Conditions Theory Tests and Investment StrategiesDokumen19 halaman1989 The Box Spread Arbitrage Conditions Theory, Tests, and Investment StrategiesThe Box Spread Arbitrage Conditions Theory Tests and Investment Strategiesthe4asempireBelum ada peringkat

- SSRN Id2759734Dokumen24 halamanSSRN Id2759734teppeiBelum ada peringkat

- Market Technician No40Dokumen20 halamanMarket Technician No40ppfahd100% (1)

- 005SMO (1) Coral ExplanationDokumen5 halaman005SMO (1) Coral ExplanationtiagonbcBelum ada peringkat

- Lifespan Investing: Building the Best Portfolio for Every Stage of Your LifeDari EverandLifespan Investing: Building the Best Portfolio for Every Stage of Your LifeBelum ada peringkat

- Unusual Options Activity Halftime Report - : There Is A Risk of Loss in All TradingDokumen3 halamanUnusual Options Activity Halftime Report - : There Is A Risk of Loss in All Tradingsatish sBelum ada peringkat

- 1208452Dokumen4 halaman1208452satish sBelum ada peringkat

- News Release: Nomura Individual Investor SurveyDokumen17 halamanNews Release: Nomura Individual Investor Surveysatish sBelum ada peringkat

- The Stock Market Update: September 11, 2012 © David H. WeisDokumen1 halamanThe Stock Market Update: September 11, 2012 © David H. Weissatish sBelum ada peringkat

- Simple Supper Trading SystemDokumen3 halamanSimple Supper Trading Systemsatish sBelum ada peringkat

- Dig Ppo: Percentage Price OscillatorDokumen4 halamanDig Ppo: Percentage Price Oscillatorsatish sBelum ada peringkat

- ETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst FundsDokumen5 halamanETF & Mutual Fund Rankings: All Cap Growth Style: Best & Worst Fundssatish sBelum ada peringkat

- Crystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural InformationDokumen3 halamanCrystal Structures. Miscellaneous Inorganic Compounds, Silicates, and Basic Structural Informationsatish sBelum ada peringkat

- Wabash National Corp WNC: Last Close Fair Value Market CapDokumen4 halamanWabash National Corp WNC: Last Close Fair Value Market Capsatish sBelum ada peringkat

- Uniti Group Inc UNIT: Last Close Fair Value Market CapDokumen4 halamanUniti Group Inc UNIT: Last Close Fair Value Market Capsatish sBelum ada peringkat

- Trading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLDokumen8 halamanTrading by Quantum Rules - Quantum Anthropic Principle: Ep@alpha - Uwb.edu - PLsatish sBelum ada peringkat

- Medication Deferral ListDokumen2 halamanMedication Deferral Listsatish sBelum ada peringkat

- Smartbuild - Smart Design For Smart SystemsDokumen1 halamanSmartbuild - Smart Design For Smart Systemssatish sBelum ada peringkat

- An Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange MarketDokumen7 halamanAn Implementation of Genetic Algorithms As A Basis For A Trading System On The Foreign Exchange Marketsatish sBelum ada peringkat

- How To Buy Common Patterns1 2Dokumen1 halamanHow To Buy Common Patterns1 2satish sBelum ada peringkat

- Questions and Answers May 2013: Morningstar's Quantitative Equity RatingsDokumen3 halamanQuestions and Answers May 2013: Morningstar's Quantitative Equity Ratingssatish sBelum ada peringkat

- Fast Track 6 2 ILT Datasheet 1Dokumen1 halamanFast Track 6 2 ILT Datasheet 1Swapnil BankarBelum ada peringkat

- Looking For Short Term Signals in Stock Market Data: A. BocharovDokumen10 halamanLooking For Short Term Signals in Stock Market Data: A. Bocharovsatish sBelum ada peringkat

- Structure of Mutual Funds in IndiaDokumen7 halamanStructure of Mutual Funds in IndiashubhamBelum ada peringkat

- Metincan Duruel IE 399Dokumen15 halamanMetincan Duruel IE 399Ekin GulumBelum ada peringkat

- Lecture 4 Handouts - PCFM - Fall 2021 01102022 124433pmDokumen18 halamanLecture 4 Handouts - PCFM - Fall 2021 01102022 124433pmKennie's FashionityBelum ada peringkat

- Technology Paper Wind PowerDokumen28 halamanTechnology Paper Wind PoweranandmaverickBelum ada peringkat

- 4 Reporting and Analyzing Merchandising OperationsDokumen45 halaman4 Reporting and Analyzing Merchandising OperationsAngelica AllanicBelum ada peringkat

- Test Your Knowledge - Ratio AnalysisDokumen29 halamanTest Your Knowledge - Ratio AnalysisMukta JainBelum ada peringkat

- Management Accounting ServicesDokumen16 halamanManagement Accounting ServicesDaniel RaeBelum ada peringkat

- Pricing of Index FutureDokumen3 halamanPricing of Index Futuresa281289Belum ada peringkat

- 000 2005 To 2014 Mercantile Law Questions Corpo, Fia, SRCDokumen31 halaman000 2005 To 2014 Mercantile Law Questions Corpo, Fia, SRCshezeharadeyahoocomBelum ada peringkat

- Measuring and Evaluating The Performance of Banks and Their Principal CompetitorsDokumen22 halamanMeasuring and Evaluating The Performance of Banks and Their Principal CompetitorsMarwa HassanBelum ada peringkat

- Nucleon IncDokumen10 halamanNucleon Incsummi64Belum ada peringkat

- Hard AfDokumen9 halamanHard AfVincenzo CassanoBelum ada peringkat

- A-Central-Bankers-Guide-to-Gold-as a-Reserve-Asset-Second-EditionDokumen52 halamanA-Central-Bankers-Guide-to-Gold-as a-Reserve-Asset-Second-Edition武當Belum ada peringkat

- 03 Risk Management Applications of Option StrategiesDokumen15 halaman03 Risk Management Applications of Option StrategiesTejas JoshiBelum ada peringkat

- Retirement Planning ProcessDokumen1 halamanRetirement Planning ProcessShinam JainBelum ada peringkat

- The Role of GovernmentDokumen2 halamanThe Role of GovernmentAmar BaharudinBelum ada peringkat

- THREE Bonds and Stock Valuation.. STOCKDokumen19 halamanTHREE Bonds and Stock Valuation.. STOCKRaasu KuttyBelum ada peringkat

- Business Plan Template InteractiveDokumen18 halamanBusiness Plan Template InteractiveAlex GranderBelum ada peringkat

- Somalia-IMF Review ReportDokumen60 halamanSomalia-IMF Review ReportdavidxyBelum ada peringkat

- Amira Nature Foods v. Prescience Point - Complaint PDFDokumen70 halamanAmira Nature Foods v. Prescience Point - Complaint PDFMark JaffeBelum ada peringkat

- F3ch2dilemna Socorro SummaryDokumen8 halamanF3ch2dilemna Socorro SummarySushii Mae60% (5)

- Patrick Morgan: HighlightsDokumen1 halamanPatrick Morgan: HighlightsGhazni ProvinceBelum ada peringkat