Bike Industry PDF

Diunggah oleh

Bapun MishraJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Bike Industry PDF

Diunggah oleh

Bapun MishraHak Cipta:

Format Tersedia

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

Study on Two Wheeler Market Segmentation and

its Strategy in India

Saillaja .V

Research Scholar, Bharathiar University, Coimbatore, India

Abstract: Indian Two-Wheeler Industry is the largest in the world as far as the volume of production and sales are concerned. India is

the biggest two-wheeler market on this planet, registering an overall growth rate of 9.5 percent between 2006 and 2014. The growth in

Indian Automobile Industry owed the most to a steep upsurge witnessed in the two-wheeler segment till 2014. The volume growth

recorded in the 2014-15 fiscal year stood at a commendable 14.8 percent on a year-on-year basis. The 'Make in India' campaign of the

Government of India is also going to attract more foreign investment into Indian Two-Wheeler Industry creating further growth

opportunities in the coming years.

Keywords: CAGR-Compounded annual growth rate, Product segmentation, Sub -segmentation, Strategies.

1. Introduction 3) ROYAL ENFIELD

4) Mahindra & Mahindra

Two-Wheeler Market in India 5) SUZUKI

Indian Two-Wheeler Market is noticing a continuous 6) YAMAHA

upsurge in demand and thus resulting in growing production 7) HMSI

and sales volume. This owes a lot to the launching of new 8) HEROMOTOCORP

attractive models at affordable prices, design innovations

made from youths perspective and latest technology utilized 3. Indian Two Wheeler Industry

in manufacturing of vehicles. The sale of two-wheeler

products has increased substantially. The sales volumes in The two-wheeler segment is the only one that has clocked

the two-wheeler sector shot up from 15 percent to 24 percent positive growth at 12.9 per cent YoY (year-on-year) to reach

between 2008-09 and 2013-14. sales of nearly 13.5 million units by October. This can be

attributed to the low cost of two wheelers in India.

A considerable expansion was seen in the sales volume of Largest two wheeler market globally, at a CAGR of

the scooter segment during 2014-15 as far as the two- 14.9% in sales.

wheelers were concerned. This positive node makes many Overall growth - 12.9 % by volume YoY.

new players enter in this density market. The domestic Revenue estimated about Rs. 923 billion in 2014-2015.

motorcycle sales volume moved up to 10 percent, whereas Three major segments: Motorcycles, Scooty and Mopeds.

the scooter segment recorded a growth of 30.7 percent in

sales volume. In the past 2-3 years, around a dozen new 4. Market Segmentation

scooter brands have been introduced in India. But the

motorcycle segment lags behind in this regard. This is due to

Marketers provide a range of product or services choices to

the fact that the recently launched gearless scooters cater to

meet diverse consumer interests, consumers are satisfied and

the needs of both men and women, while motorbikes are a

their overall happiness, satisfaction and quality of life are

segment preferred by men only.

ultimately enhanced. Hence market segmentation is a

positive force for both consumers and marketers alike.

The growth momentum is also propelled by the fact that the

two-wheeler manufacturers in India have understood the

Compounded annual growth rate of various segments

markets needs and have been able to deliver as expected. At

the end of 2014, the global business involving two-wheeler

designing, manufacturing, engineering and selling was at an

average of US$ 3.5 billion per manufacturer. Though,

further growth in Indian Two-Wheeler Industry will depend

heavily on peoples personal disposable incomes that rely on

India's economic growth in days to come.

2. Objective of the Study

To observe the Two wheeler market strategy and

segmentation in India.

Two wheeler market players in India

1) BAJAJ

2) TVS

Volume 4 Issue 10, October 2015

www.ijsr.net

Paper ID: SUB158925 1103

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

5. Sub-Segmentation 2) HONDA - Additional capacity of 6 lakhs units to be

operational before the end of 2016. In the first half of

The Indian automotive industry has sub-segmented the 2016, this expansion will increase HMSIs overall annual

motorcycle in terms of Vehicle pricing, power and mileage. production capacity to 6.4 million units. Honda is

The sub-segments, Vehicle pricing and power is directly strengthening its Make in India resolve through steady

proportional but mileage is inversely proportional. and strategic investments with a long term objective of

creating 39% additional capacity within 3.5 years Future

Sub-Segmentation of Motor Cycles on Basis of Pricing Milestones of Two Wheeler Companies.

Economy : Priced at Rs. 40,000 Rs. 50,000 3) BAJAJ - As a testimony to the Companys strategy

Executive : Priced at Rs. 50,000- Rs. 65,000 global presence, sharp brands and variable cost structure,

Premium: Priced at Rs.65,000 and above. Bajaj Auto improves its operating EBITDA margin from

20.2% in H1 / FY15 to an industry best margin of 21.1%

Sub-Segmentation of Motor Cycles on Basis of Power in Q3 / FY15. Pulsar Adventure Sports and Super

Economy: 100-110 cc Sports models will be launched by end of Q4 / FY15.

Executive: 125+cc Focus on motor cycles without focusing in scooter

Premium: 150 cc segment. Dominant" global share in bikes from 10%

today to 30% or even 40%,.

Sub-Segmentation of Motor Cycles on Basis of Mileage 4) TVS Motors-10 percent share in the fast growing scooter

Economy: 55-65 Km/l market in India, From five percent, 2015 with their new

Executive: 50-55 Km/l launches and innovative customers connect programs.

Premium: 45-55Km/l 5) ROYAL ENFIELD- with the competition getting

intense, Indias oldest motor cycle manufacturing motor

Economy Executive Premium cycle company. exploring newer segments with the idea

Hero motor Hero: Passion Pro Tvs motors: of bigger engines and diesel variants. The company is

corp:Splendor Apache adding more orders each month than dispatches, leading

Tvs motors: Tvs motors: Bajaj auto ltd: target is 450,000 bikes next year, a big jump from the

Star Phoenix Pulsar 78,000 it sold in 2012, to delivery time of 6-12 months.

Bajaj auto ltd: Bajaj auto ltd: HMSI: Unicorn 6) Mahindra & Mahindra: Mahindra Two wheelers,

Discover Discover Paytm tie up to sell bike, scooters online. Mahindra Two

wheeler Eyes-500 dealership by FY16 end. Mahindra 2

Sub- Segmentation of Scooter Segment Wheelers to Launch 150 CC Motorcycle By 2015.

Scooter segment is again sub- segmented as Metal body and 7) SUZUKI Suzuki Motorcycle India Pvt Ltd (SMIPL) is

Fiber body. planning to increase its market presence in India to sell

Sub Segmentation Mileage Power around 1. million (10 lakh) two wheelers by next three

Metal body 35-45 km/l 100+cc years from the last years' sales of four lakh units.

Fiber body 45-55km/l Below 100 cc

8. SWOT- Analysis of Two Wheeler Industry

MOPED Segment

TVS MOTORS enjoys monopoly market in the Moped STRENGTH WEAKNESS

segment with mileage of 60 km/Lit. And the power of 50 to 1. Significant contribution to 1. Rise in raw

70 cc. Indian economy. material cost.

2. Two wheeler market are 2. Due to

6. Productive Capacity expanding from 12% to 14% competition,

growth. pricing reduces

Hero Moto Cop - 7.6 million 3. A favorable industry to Asian and affects to low

HMSI - 4.6 M economic condition. quality of products

Bajaj Auto - 5M 4. Most helpful for a developing and services.

TVS Motors - 2.5M country like India in terms of

Royal Enfield - 1,50,000 transport feasibility.

OPPURTUNITIES THREATS

1. Reduced excise duty

7. Current Strategies followed by the 2. Steep fall in fuel prices 1. Due to heavy

Manufacturers 3. Make in India campaign competition of

invites FDI four wheeler, low

1) Hero Moto Corp Strategy- Hero Moto Corps key 4. Rural market which possess priced cars have

strategies are to build a robust product portfolio across potential has been untapped by emerged in market

categories, explore growth opportunities globally, higher segment vehicles. which causes

continuously improve its operational efficiency, 5. KTM plans to open its plant in threat to two

aggressively expand its reach to customers, continue to India. wheeler on the

invest in brand building activities and ensure customer basis of price.

and shareholder delight. 50 mn+ Sales (cumulative sales

since inception) worlds fastest two-wheeler company to

achieve this.

Volume 4 Issue 10, October 2015

www.ijsr.net

Paper ID: SUB158925 1104

Licensed Under Creative Commons Attribution CC BY

International Journal of Science and Research (IJSR)

ISSN (Online): 2319-7064

Index Copernicus Value (2013): 6.14 | Impact Factor (2014): 5.611

9. Conclusion

Competition is very high in the market and hence change of

strategy is undertaken like expansion with new tie ups to

explore in rural as well as in the premium segments. For the

future, in this stiff competition period, the players eye on

customer satisfaction and after sales service. Technology

plays a very crucial and elixir role for innovation product

differentiation, quality improvement, new product

development, add value creation to customers and key

players in the market thus increasing the growth of the

industry and relative market shares of the key players in the

industry.

References

[1] www.heromotorcorp.com/en-np/uploads/annual

reports/pdf

[2] www.autonews.com

[3] www.yes.honda.co.in/honda-motorcycle-scooter.aspx

[4] www.icmrindia.org

[5] www.indiaautoreport.com

[6] www.markets and markets.com

[7] www.icra.in

[8] Society of Indian two wheeler manufacturers.

[9] LeonSchiffman.G, Leslie lazar kanauk, Consumer

behaviorPrentice Hall of India private limited, New

Delhi, 2003, pg.49

Author Profile

Saillaja. V, is a research scholar of management

studies in bharathiar university and I am keenly

interested in the study of marketing management. I had

received M.B.A. degree from Srimathi Indra Gandhi

college, Bharathidasan University, Trichirapalli,

Tamilnadu, India. Previously worked as assistant professor for

Oxford engineering college,(Affilated to Anna University)

Trichirapalli, India.

Volume 4 Issue 10, October 2015

www.ijsr.net

Paper ID: SUB158925 1105

Licensed Under Creative Commons Attribution CC BY

Anda mungkin juga menyukai

- Bike FinanceDokumen4 halamanBike FinanceBapun MishraBelum ada peringkat

- Bi BlographyDokumen1 halamanBi BlographyBapun MishraBelum ada peringkat

- Back RroundDokumen11 halamanBack RroundBapun MishraBelum ada peringkat

- V. S Naipaul's An Area of Darkness From A Postcolonial PerspectiveDokumen30 halamanV. S Naipaul's An Area of Darkness From A Postcolonial PerspectiveBapun MishraBelum ada peringkat

- Factors Influencing Consumer Buying Behavior On BikesDokumen18 halamanFactors Influencing Consumer Buying Behavior On Bikeschinu489Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- A Project OF Strategic Management ON Tvs MotorsDokumen18 halamanA Project OF Strategic Management ON Tvs MotorsVaishali JariwalaBelum ada peringkat

- CS On KTM 1Dokumen5 halamanCS On KTM 1Nitish KumarBelum ada peringkat

- Amba To PricelistDokumen148 halamanAmba To PricelistRishabh MalikBelum ada peringkat

- Hero HondaDokumen50 halamanHero HondaDinesh RamawatBelum ada peringkat

- Tvs Casa ProjectDokumen85 halamanTvs Casa ProjectIswarya Digumarthi0% (1)

- Marketing Strategies of Two Wheeler DealersDokumen47 halamanMarketing Strategies of Two Wheeler Dealerssuchired70% (27)

- DP 5 Sem 7 Team 14Dokumen41 halamanDP 5 Sem 7 Team 14vamsi karumuriBelum ada peringkat

- Advertising Activities - Bajaj MotorsDokumen44 halamanAdvertising Activities - Bajaj MotorsL. V B ReddyBelum ada peringkat

- Strategic Management Project Report: Yamaha MotorsDokumen22 halamanStrategic Management Project Report: Yamaha Motorsmahtaabk67% (6)

- Tvs Motors: By:Antara Das, Anand Pandey, Ankesh Maheshwari, Bhuvnesh BATCH:2019-21 Program:MbaDokumen28 halamanTvs Motors: By:Antara Das, Anand Pandey, Ankesh Maheshwari, Bhuvnesh BATCH:2019-21 Program:MbaParmesh PandeyBelum ada peringkat

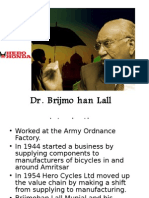

- HERO GROUP and DR Brij Mohal Lall MunjalDokumen14 halamanHERO GROUP and DR Brij Mohal Lall MunjalAzhar k.pBelum ada peringkat

- EV Single Page Brochure1Dokumen29 halamanEV Single Page Brochure1PavaniBelum ada peringkat

- CONTACT (For RENISHAW Products)Dokumen13 halamanCONTACT (For RENISHAW Products)barathkumarBelum ada peringkat

- Customer Perception On BRAND AWARENESS SUZUKI Two Wheelers KarimnaarDokumen57 halamanCustomer Perception On BRAND AWARENESS SUZUKI Two Wheelers KarimnaarbhagathnagarBelum ada peringkat

- Tvs ProjectDokumen68 halamanTvs ProjectDivax0% (1)

- TVS ProfileDokumen29 halamanTVS ProfileMohan RajBelum ada peringkat

- Strategy Management - 10P003 - 10P004Dokumen42 halamanStrategy Management - 10P003 - 10P004Vipul ManglikBelum ada peringkat

- A Project Report On Marketing Yamaha - Prateek KapilDokumen40 halamanA Project Report On Marketing Yamaha - Prateek KapilKshitij Kapil67% (6)

- 2-Wheeler Industry in IndiaDokumen15 halaman2-Wheeler Industry in IndiaNisha AroraBelum ada peringkat

- Abandoned Vehicles List of CyberabadDokumen15 halamanAbandoned Vehicles List of CyberabadprasadBelum ada peringkat

- Research Paper On "Efficient Management of Working Capital: A Study of Automobile Industry in India"Dokumen8 halamanResearch Paper On "Efficient Management of Working Capital: A Study of Automobile Industry in India"yash sultaniaBelum ada peringkat

- YamahaDokumen19 halamanYamahabonker508100% (5)

- 34 Tvs Apache in ShimogaDokumen102 halaman34 Tvs Apache in Shimogaavinash_s1302Belum ada peringkat

- Uttam Pandey ReportDokumen88 halamanUttam Pandey Reporttaranjeet singhBelum ada peringkat

- Project Report On BajajDokumen50 halamanProject Report On BajajHina ChoudharyBelum ada peringkat

- Parts Catalog for Two Wheelers and VehiclesDokumen73 halamanParts Catalog for Two Wheelers and VehiclesRaxit PaRmar100% (1)

- Project Report On Satisfaction Level of Customers For Service Provided by TVS Motors PVT LTD PDFDokumen96 halamanProject Report On Satisfaction Level of Customers For Service Provided by TVS Motors PVT LTD PDFShalini KBelum ada peringkat

- Job Satisfaction AdarshaDokumen70 halamanJob Satisfaction AdarshabhagathnagarBelum ada peringkat

- Project Report On Customer Satisfaction On TVS Apache RTR 160 in AgartalaDokumen43 halamanProject Report On Customer Satisfaction On TVS Apache RTR 160 in AgartalaManajit BhowmikBelum ada peringkat

- 2W Clutch Plate FinalDokumen4 halaman2W Clutch Plate FinalPALANIVELU GOVINDARAJUBelum ada peringkat