EffectiveManagementofThirdPartyClaims SanjayDatta

Diunggah oleh

souravroy.sr59890 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan28 halamanIndian Motor Third Party claim management presentation

Judul Asli

EffectiveManagementofThirdPartyClaims_SanjayDatta

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniIndian Motor Third Party claim management presentation

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

14 tayangan28 halamanEffectiveManagementofThirdPartyClaims SanjayDatta

Diunggah oleh

souravroy.sr5989Indian Motor Third Party claim management presentation

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 28

Effective Management of Third

Party Claims

December 18, 2013

Key Outlines

Third Party Evolution over the years

Third Party Claims Character & Issues

Key Outlines

Third Party Evolution over the years

Third Party Claims Character & Issues

Industry Growth &TP Contribution-

GWP

Motor Third Industry* Proportion

Party

FY 2011-12 9,085 52,877 17.2%

FY 2012-13 12,057 62,961 19.2%

Growth Rate 32.7% 19.1%

*Industry total excludes mono-line insurance companies

Data Source: IIB and IRDA

Third Party Premium & Policy Count

Third Party is

experiencing rapid

growth

13.8% in policy count

32.7% in GWP

Data Source: IIB

Motor Third Party Pool

UWY Ultimate Loss Ratio Ultimate Loss Ratio

(Lower End) (Upper End)

2007-08 159% 197%

2008-09 188% 233%

2009-10 200% 249%

2010-11 213% 263%

2011-12 145% 145%

2012-13 (Declined 210% 240%

Risk Pool)

Key Outlines

Third Party Evolution over the years

Third Party Claims Character & Issues

REPORTING AND

SETTLEMENT DELAYS

Claim Delays Indian Experience

Source: Claim Development Analysis of Motor Third

Party Claims by IIB

Do we know the tail of this business?

Reported Claim Frequency - UK

Abnormal Rise

Source: Update from Third Party Working Party

- David Brown and Rob Treen

Claim Settlement Rates - UK

Source: Update from Third Party Working Party

- David Brown and Rob Treen

Claim Settlement Rates - US

CLAIM SEVERITY

Claim Severity by time lag - India

Source: IIB report on Motor Third Party Claims

Analysis of Claim Severity By Time lag bands

and Nature of loss

Reasons

Interest Income

Large claims get settled late

Inflation other than wage inflation

Fraud

????

Claim Severity by time lag - UK

Source: Update from Third Party Working

Party - David Brown and Rob Treen

Claim Severity by time lag - UK

Source: Update from Third Party Working Party

- David Brown and Rob Treen

ACCUMULATION

Accumulation

Source: Update from Third Party Working Party

- David Brown and Rob Treen

Indian Experience - ??????

OTHERS

Challenges

Inflation Is CPI the right measure to change

rates?

Studies suggest wage inflation index is better

Is there an Indian index?

Mix of Injury and Death claims is it changing?

Large Claims

What is the size of a large claim today?

Was it a large claim 5 years ago?

Court Awards

Sarla Verma, Rajesh Rajgir .......whats next?

Change in legislation

Third Party De-tariffing

Product Construct is governed by the Act and

being mandatory in nature needs to be templated

However pricing could be de-tariffed

Leading to better price discovery

More efficient claims management

However key concern remains recognition of

claims development and claims inflation

Council and IIB could play key role in access to

data and standardizing approaches

IAI could train members on pricing and reserving

long tail lines

TP coverage in EU area

Pricing Regulation

Motor Third Party Pool

In the event of de-tariffing the pool could become

redundant

Each company can price segments and

underwrite as per its risk appetite

If certain segments arise which are perceived

high risk (high cost of insurance) a new declined

pool mechanism could be contemplated with

appropriate subsidy mechanism

Thank You

Anda mungkin juga menyukai

- Delloite AutomotiveDokumen28 halamanDelloite AutomotiveKsl Vajrala100% (1)

- Salom Brothers Prepayment ModelDokumen42 halamanSalom Brothers Prepayment Modelsouravroy.sr5989100% (1)

- The Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresDari EverandThe Handbook of Credit Risk Management: Originating, Assessing, and Managing Credit ExposuresBelum ada peringkat

- Third Party Vendor Risk Management For The Banking IndustryDokumen11 halamanThird Party Vendor Risk Management For The Banking IndustryRamkumarBelum ada peringkat

- Cds PrimerDokumen15 halamanCds PrimerJay KabBelum ada peringkat

- .Books 100 Best Books For An Education Will DurantDokumen2 halaman.Books 100 Best Books For An Education Will DurantRaghuCheenepalle100% (1)

- Individual TaxpayersDokumen3 halamanIndividual TaxpayersJoy Orena100% (2)

- Global - IT Services, February 2019Dokumen32 halamanGlobal - IT Services, February 2019ashvarybabulBelum ada peringkat

- Line Sets in Oracle Order ManagementDokumen9 halamanLine Sets in Oracle Order ManagementS S PatelBelum ada peringkat

- Insurance BPO - Service Provider Landscape With PEAK Matrix Assessment 2013Dokumen10 halamanInsurance BPO - Service Provider Landscape With PEAK Matrix Assessment 2013everestgrpBelum ada peringkat

- A320 21 Air Conditioning SystemDokumen41 halamanA320 21 Air Conditioning SystemBernard Xavier95% (22)

- Proposed Construction of New Kutulo Airstrip - RetenderDokumen112 halamanProposed Construction of New Kutulo Airstrip - RetenderKenyaAirportsBelum ada peringkat

- Cold Storage Project ProfileDokumen19 halamanCold Storage Project ProfileSachin BandariBelum ada peringkat

- Y-Site Drug Compatibility TableDokumen6 halamanY-Site Drug Compatibility TableArvenaa SubramaniamBelum ada peringkat

- The INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech VisionariesDari EverandThe INSURTECH Book: The Insurance Technology Handbook for Investors, Entrepreneurs and FinTech VisionariesBelum ada peringkat

- Analysis of ToyotaDokumen16 halamanAnalysis of Toyotalucianobielli_311046Belum ada peringkat

- Data Collection ProcedureDokumen58 halamanData Collection ProcedureNorjenn BarquezBelum ada peringkat

- PEST Analysis Reveals Factors Impacting Automotive IndustryDokumen10 halamanPEST Analysis Reveals Factors Impacting Automotive Industryshoky10Belum ada peringkat

- RACP - ABPF - Tech DPR - Cold StoreDokumen26 halamanRACP - ABPF - Tech DPR - Cold Storesouravroy.sr5989Belum ada peringkat

- Wireless Tele Services-Sep11 - BNP ParibasDokumen67 halamanWireless Tele Services-Sep11 - BNP ParibassachinrshahBelum ada peringkat

- Growth of Horizontal BPO in LATAMDokumen10 halamanGrowth of Horizontal BPO in LATAMeverestgrpBelum ada peringkat

- Financial Ratios ActivityDokumen3 halamanFinancial Ratios ActivityNCF- Student Assistants' OrganizationBelum ada peringkat

- Monopoly - Indian RailwaysDokumen35 halamanMonopoly - Indian Railwaysvrj1091Belum ada peringkat

- Xu10j4 PDFDokumen80 halamanXu10j4 PDFPaulo Luiz França100% (1)

- Design Guide For Slug Force Calculation ProcedureDokumen6 halamanDesign Guide For Slug Force Calculation ProcedurePratik PatreBelum ada peringkat

- Fasten Case AnalysisDokumen7 halamanFasten Case AnalysisSam Dhuri33% (3)

- Emerging FinTech: Understanding and Maximizing Their BenefitsDari EverandEmerging FinTech: Understanding and Maximizing Their BenefitsBelum ada peringkat

- JF Wicklow Sept04Dokumen17 halamanJF Wicklow Sept04Prem KumarBelum ada peringkat

- Reading 7 Economics of RegulationDokumen12 halamanReading 7 Economics of Regulationtristan.riolsBelum ada peringkat

- Report of Justice Rangarajan CommitteeDokumen89 halamanReport of Justice Rangarajan CommitteeManav RathoreBelum ada peringkat

- Kroenke Umis10e Inppt 03Dokumen37 halamanKroenke Umis10e Inppt 03linhtran3062003Belum ada peringkat

- Filters: View Summary of This Report @Dokumen6 halamanFilters: View Summary of This Report @api-295710924Belum ada peringkat

- C. Ritter - Data, Algorithms, and EU Competition LawDokumen30 halamanC. Ritter - Data, Algorithms, and EU Competition LawHsn GnBelum ada peringkat

- MRO Survey 2023 MRO Levels OffDokumen18 halamanMRO Survey 2023 MRO Levels OffauliyarasyidBelum ada peringkat

- Reading 7 Economics of Regulation - AnswersDokumen15 halamanReading 7 Economics of Regulation - Answerstristan.riolsBelum ada peringkat

- Motor Vehicle Sensor Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018Dokumen9 halamanMotor Vehicle Sensor Market - Global Industry Analysis, Size, Share, Growth, Trends and Forecast, 2012 - 2018api-247970851Belum ada peringkat

- Financial Misrepresentation and Its Impact On Rivals: Eitan Goldman, Urs Peyer, and Irina StefanescuDokumen31 halamanFinancial Misrepresentation and Its Impact On Rivals: Eitan Goldman, Urs Peyer, and Irina StefanescuAtiq Ur RehmanBelum ada peringkat

- Chip Shortage Report V17 FINALDokumen17 halamanChip Shortage Report V17 FINALblacksmithMGBelum ada peringkat

- 209371461.html Evolution-Challenges-And-Solutions/1738148Dokumen9 halaman209371461.html Evolution-Challenges-And-Solutions/1738148Likith RBelum ada peringkat

- 2015 AGCS Global Claims Review 2015Dokumen40 halaman2015 AGCS Global Claims Review 2015Maria TringaliBelum ada peringkat

- Financial Statement General Insurance 04082018Dokumen32 halamanFinancial Statement General Insurance 04082018Dilip TateBelum ada peringkat

- Factors Affecting GM: Chevrolet India (SLEPT Analysis) : LegislationDokumen6 halamanFactors Affecting GM: Chevrolet India (SLEPT Analysis) : LegislationABHISHEK SINGHBelum ada peringkat

- Tinder Competitive PositionDokumen9 halamanTinder Competitive PositionAvinash WidhaniBelum ada peringkat

- In Dust Rials Primer 2010Dokumen18 halamanIn Dust Rials Primer 2010Alex HeshmatyBelum ada peringkat

- Porter 5 and PestDokumen16 halamanPorter 5 and Pestvaibhav chaurasiaBelum ada peringkat

- CCI - Car Parts CaseDokumen13 halamanCCI - Car Parts Caseirajiv100% (1)

- Abi Bro6778 State of Market 2019 WebDokumen16 halamanAbi Bro6778 State of Market 2019 WebYana So NanaBelum ada peringkat

- PESTLE Analysis of Pakistan's Automobile IndustryDokumen2 halamanPESTLE Analysis of Pakistan's Automobile IndustryWaleed KhalidBelum ada peringkat

- Final Wireless Telecommunications Industry PaperDokumen19 halamanFinal Wireless Telecommunications Industry Papervp_zarateBelum ada peringkat

- Worldwide Vulnerability Assessment Market and 13 Companies AnalysisDokumen12 halamanWorldwide Vulnerability Assessment Market and 13 Companies Analysisapi-114525849Belum ada peringkat

- Gartner - Automotive Trends For 2023Dokumen21 halamanGartner - Automotive Trends For 2023pearl.yeo.atBelum ada peringkat

- The Insurance Sector Came Into Being As There Was A Need To Financially Support People in The Time of NeedDokumen3 halamanThe Insurance Sector Came Into Being As There Was A Need To Financially Support People in The Time of Needvitthal kendreBelum ada peringkat

- TL I Development Authority: 7FtwmDokumen29 halamanTL I Development Authority: 7FtwmkomalbhattBelum ada peringkat

- Blockchain Business Project: Business Plan Ronit Roy 2020JULB01009 Pujit Singh 2020JULB01090 Udit Singh 2020JULB01085Dokumen11 halamanBlockchain Business Project: Business Plan Ronit Roy 2020JULB01009 Pujit Singh 2020JULB01090 Udit Singh 2020JULB01085Ronit RoyBelum ada peringkat

- TACC613 M&A: Analysis of AP Eagers' Acquisition of Automotive Holding GroupDokumen6 halamanTACC613 M&A: Analysis of AP Eagers' Acquisition of Automotive Holding GroupKarma SherpaBelum ada peringkat

- Unit Ii: Porters Five Force ModelDokumen5 halamanUnit Ii: Porters Five Force ModelAnonymous NZLpkOi0xwBelum ada peringkat

- Global Automotive Sector - Euler ReportDokumen14 halamanGlobal Automotive Sector - Euler ReportAkshay SatijaBelum ada peringkat

- A Report ON Customers Perception Towards Life Insurance After PrivatizatonDokumen44 halamanA Report ON Customers Perception Towards Life Insurance After PrivatizatonAnshita GargBelum ada peringkat

- Tesla Insurance Tesla FilingDokumen534 halamanTesla Insurance Tesla FilingJoey KlenderBelum ada peringkat

- b2b Woek FileDokumen6 halamanb2b Woek File2022-24 Akshat MalavBelum ada peringkat

- Case - BW ComboDokumen3 halamanCase - BW CombomanandattBelum ada peringkat

- Assignment No - 5Dokumen16 halamanAssignment No - 5anifBelum ada peringkat

- JPM Software Technology 2013-07-12 1161609Dokumen24 halamanJPM Software Technology 2013-07-12 1161609Dinesh MahajanBelum ada peringkat

- Ecb - Safe202311 C94d2c3a78.enDokumen37 halamanEcb - Safe202311 C94d2c3a78.enAbdelmadjid djibrineBelum ada peringkat

- Global Passive Safety Systems Market: Trends and Opportunities (2013-18) - New Report by Daedal ResearchDokumen11 halamanGlobal Passive Safety Systems Market: Trends and Opportunities (2013-18) - New Report by Daedal ResearchDaedal ResearchBelum ada peringkat

- Ford and World Automobile IndustryDokumen6 halamanFord and World Automobile IndustrySahoo SK100% (1)

- University of Liberal Arts Bangladesh (ULAB) : Course Title: Strategic Management Course Code: BUS 307 Section: 03Dokumen23 halamanUniversity of Liberal Arts Bangladesh (ULAB) : Course Title: Strategic Management Course Code: BUS 307 Section: 03Dhiraj Chandro RayBelum ada peringkat

- Global Automobile Industry Evolving Towards Electrification and ConnectivityDokumen4 halamanGlobal Automobile Industry Evolving Towards Electrification and ConnectivityGazal ReyazBelum ada peringkat

- IBM Introduction and OpportunitiesDokumen5 halamanIBM Introduction and OpportunitiesMai ChiBelum ada peringkat

- Online Insurance E-Commerce TrendsDokumen7 halamanOnline Insurance E-Commerce TrendsAravinthan RangasamyBelum ada peringkat

- Motor Declined Risk PoolDokumen5 halamanMotor Declined Risk PoolShantanuBelum ada peringkat

- Bumpy Road Ahead For Infrastructure Sector H2 Outlook Negative - Report - Economic TimesDokumen3 halamanBumpy Road Ahead For Infrastructure Sector H2 Outlook Negative - Report - Economic TimessaadsaaidBelum ada peringkat

- Of Matters Military: Indian Defence Deals (Need for Transparency and Probity)Dari EverandOf Matters Military: Indian Defence Deals (Need for Transparency and Probity)Belum ada peringkat

- Understanding Government Contract Source Selection: The 9 Behaviors of Great Problem SolversDari EverandUnderstanding Government Contract Source Selection: The 9 Behaviors of Great Problem SolversBelum ada peringkat

- Major potato producing states and production in IndiaDokumen9 halamanMajor potato producing states and production in Indiasouravroy.sr5989Belum ada peringkat

- GREEN Cold Chain For Colombia - DownloadDokumen12 halamanGREEN Cold Chain For Colombia - DownloadShardul TagalpallewarBelum ada peringkat

- 0109173321es 15 PDFDokumen135 halaman0109173321es 15 PDFSubrat RastogiBelum ada peringkat

- ILFS Report BiharDokumen155 halamanILFS Report Biharsouravroy.sr5989Belum ada peringkat

- Potatoes, Nutrition and DietDokumen2 halamanPotatoes, Nutrition and Dietsouravroy.sr5989Belum ada peringkat

- Profile PotatoDokumen70 halamanProfile PotatoJunior MagalhãesBelum ada peringkat

- DPR Format ColdStore HillArea PDFDokumen3 halamanDPR Format ColdStore HillArea PDFsouravroy.sr5989Belum ada peringkat

- ChallengeColdChain DevelopmentDokumen25 halamanChallengeColdChain DevelopmentAnurag KushwahaBelum ada peringkat

- Modern Cold Storage Project ProfileDokumen6 halamanModern Cold Storage Project Profileडा. सत्यदेव त्यागी आर्यBelum ada peringkat

- Cold Storage Market Potential in AssamDokumen6 halamanCold Storage Market Potential in AssamChetan AgrawalBelum ada peringkat

- COLD - STORAGE - Bankable Projects PDFDokumen23 halamanCOLD - STORAGE - Bankable Projects PDFVivek VikramBelum ada peringkat

- ChallengeColdChain DevelopmentDokumen25 halamanChallengeColdChain DevelopmentAnurag KushwahaBelum ada peringkat

- Check List For Cold Storage Project SanctionDokumen1 halamanCheck List For Cold Storage Project Sanctionsouravroy.sr5989Belum ada peringkat

- PWC Report On India As An Emerging Health MarketDokumen26 halamanPWC Report On India As An Emerging Health MarketBen GoodBelum ada peringkat

- Cold Storage Market Potential in AssamDokumen6 halamanCold Storage Market Potential in AssamChetan AgrawalBelum ada peringkat

- 06 Kunce ChatterjeeDokumen66 halaman06 Kunce Chatterjeesouravroy.sr5989Belum ada peringkat

- Workshop d03 Stuart White Simon MargettsDokumen41 halamanWorkshop d03 Stuart White Simon Margettssouravroy.sr5989Belum ada peringkat

- Pumping Station Modification PDFDokumen15 halamanPumping Station Modification PDFcarlosnavalmaster100% (1)

- Microsoft Windows 98 Second Edition README For Tips and Tricks, April 1999Dokumen8 halamanMicrosoft Windows 98 Second Edition README For Tips and Tricks, April 1999scriBelum ada peringkat

- ISB - PM - Week 4 - Required Assignment 4.2 - TemplateDokumen2 halamanISB - PM - Week 4 - Required Assignment 4.2 - Templatesriram marinBelum ada peringkat

- Asset-V1 RICE+46 6 4010+2021 Q1+type@asset+block@MCQs For HO SDH New WBCS 2nd SM 2nd Class Constitution QDokumen5 halamanAsset-V1 RICE+46 6 4010+2021 Q1+type@asset+block@MCQs For HO SDH New WBCS 2nd SM 2nd Class Constitution QSourin bisalBelum ada peringkat

- Interpretation 1Dokumen17 halamanInterpretation 1ysunnyBelum ada peringkat

- The Problem and Its SettingDokumen36 halamanThe Problem and Its SettingRodel CamposoBelum ada peringkat

- Patient Safety IngDokumen6 halamanPatient Safety IngUlfani DewiBelum ada peringkat

- Ap22 FRQ World History ModernDokumen13 halamanAp22 FRQ World History ModernDylan DanovBelum ada peringkat

- Guidelines For Planning Conjunctive Use of SUR Face and Ground Waters in Irrigation ProjectsDokumen34 halamanGuidelines For Planning Conjunctive Use of SUR Face and Ground Waters in Irrigation Projectshram_phdBelum ada peringkat

- Proforma PromotionDokumen1 halamanProforma PromotionRavinderSinghBelum ada peringkat

- Office of The Protected Area Superintendent: Mt. Matutum Protected LandscapeDokumen3 halamanOffice of The Protected Area Superintendent: Mt. Matutum Protected LandscapeNurah LaBelum ada peringkat

- Draft SemestralWorK Aircraft2Dokumen7 halamanDraft SemestralWorK Aircraft2Filip SkultetyBelum ada peringkat

- Hutchinson - Le Joint Francais - National O-RingDokumen25 halamanHutchinson - Le Joint Francais - National O-RingkikorrasBelum ada peringkat

- Acuite-India Credit Risk Yearbook FinalDokumen70 halamanAcuite-India Credit Risk Yearbook FinalDinesh RupaniBelum ada peringkat

- Graphics Coursework GcseDokumen7 halamanGraphics Coursework Gcseafiwhlkrm100% (2)

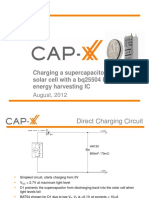

- 1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFDokumen12 halaman1208 CAP XX Charging A Supercapacitor From A Solar Cell PDFmehralsmenschBelum ada peringkat

- Vaccination Management System of Brgy 6 (Table of Contents)Dokumen8 halamanVaccination Management System of Brgy 6 (Table of Contents)Ryan Christian MenorBelum ada peringkat

- What is Software Development Life Cycle (SDLC)? Key Phases and ActivitiesDokumen11 halamanWhat is Software Development Life Cycle (SDLC)? Key Phases and ActivitiessachinBelum ada peringkat

- Is 4032 - 1985Dokumen45 halamanIs 4032 - 1985yogeshbadyalBelum ada peringkat