Determinants of Stock Prices of Joint

Diunggah oleh

IJAERS JOURNALHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Determinants of Stock Prices of Joint

Diunggah oleh

IJAERS JOURNALHak Cipta:

Format Tersedia

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

Determinants of Stock Prices of Joint - Stock

Companies in Industrial Sector Listed On Hcm

City Stock Exchange

Vuong Quoc Duy1, Le Long Hau2, Nguyen Huu Dang3

1

Associate Professor and Doctor in Economics, College of Economics, Can Tho University, Vietnam

2

Doctor in Applied Economics, College of Economics, Can Tho University, Vietnam

3

Doctor in Agricultural Economics, College of Economics, Can Tho University, Vietnam

AbstractThis paper investigates the factors that affect markets in general and the stock market of the companies

the price of the shares of industrial companies listed on in industrial sector are particularly necessary and urgent

the Stock Exchange in Ho Chi Minh City (HOSE). The in todays international economic integration.

data used in this study are collected according to the This paper analyzes factors affecting the stock prices of

date of publication unified consumer price index of the companies in the industrial sector listed on HOSE. Then

Central Statistical Office (on the 24th of the last month of solutions are proposed to help investors overcome the

the quarter) from 2012 to 2015. Using regression negative impacts and take advantage of business

analysis showed that EPS and exchange rate (USD / opportunities.

VND) and interest rate correlated to the profitability

ratio of the shares the price of gold and the rate of II. THEORIES & PREVIOUS STUDIES

inflation measured by the consumer price index (CPI) 2.1. Stock market

has negative correlation to rate profitability of the Stock market, in terms of the modern economy, is

shares. defined as a place to trade securities in medium and long-

Keywords Industrial sectors, price, stocks returns, term. The trade is carried out in the primary market when

HOSE. buyers first buy securities from the issuers and in the

secondary market when the buyer resells the securities in

I. INTRODUCTION market primary market.

Vietnam's stock market since its inception has been Naturally, the stock market reflects the exchange

through the ups and down in its development stages in relations, the purchase of ownership of means of

line with the volatility of the domestic economy. production and capital, i.e. the purchase of capital

However, it also fully embodies the essence of a true ownership. In the market economy, capital has been

market, where business owners can raise capital in the circulated as a commodity that has value and use value.

fastest and most effective way to meet their business The stock market is a highly developed form of

needs in time, through the issuance of securities. commodity production.

Particularly, businesses in industrial sectors are In terms of characteristics, the stock market is a part of

considered to be highly attractive. The sector plays an the financial market and specializes in buying and selling

important role in the development of the national medium and long-term securities. The inception of stock

economy in order to ensure domestic demand and exports market is an objective necessity.

and facilitate international trade and bring the country The role of stock market is a mean of raising investment

more revenue with an average growth rate of 9.8% in capital for production in businesses and economic

2015, compared to this of 2014. Therefore, investments development. In addition, it is a tool to encourage people

in this field promise more profitable prospects. This to save and use these savings to invest, thereby promote

research is aimed to find out the factors that affect stock socialization of investment. Furthermore, it also helps

price fluctuations of companies in the industrial sector. businesses use capital efficiently and contributes capital

Then judgments and recommendations on the supply and among sectors in the economy and creates a fast and

demand of shares of companies in the industrial sector uniform development of the economy. Lastly, the stock

made in order to contribute to the development of stock

www.ijaers.com Page | 102

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

market is a tool to attract and control foreign interest rate to go up. If interest rates rise, they will

investments. become a burden for the economy, and vice versa.

The stock market can be classified in following issues. If Moreover, the inflation is the depreciation of the

based on the legal forms, it can be divided into official currency. It changes consumer behaviors and individuals

market and the unofficial market. Regarding to the nature and businesses savings behaviors. Unreasonable

of the issuance or circulation of securities, there are increase in inflation rate would cause difficulties for

primary market and secondary market. If the trading production and business activities and prevent the

methods considered, there are spot market and the future business from growth and innovation. Inflation is often a

market. Lastly, based on the characteristics of the signal of sluggish growth of the economy and interest

commodities circulated, there are stock market, bond rates will rise. Then the businesses profitability drops

market and instruments and securities-origin market. and the share prices fall. The lower inflation rate, the

more capable the stock price will rise and vice versa.

2.2. Stock Price Normally, stock prices tend to rise when the economy is

A stock is evidence confirming the lawful rights and well-developed and tend to fall as the economy

interests of the owners of assets or capital of the issuer. deteriorates. Thus, if the development trends of the

Securities are in the form of certificates, book-entry or economy are predicted, the general development trend of

electronic data including stocks, bonds, fund certificates, the stock market can be predicted. Therefore, predicting

stock options, warrants, call-options, put-options, futures the economic situation to consider its impacts on the

contracts or securities indices. Characteristically, A stock stock price is also very important to investors. Lastly,

is a long-term financing instrument. The stock is a very changes in interest rates of government bonds will affect

effective tool in the market economy to create a huge the value of securities. The increase in benchmark

amount of capital to finance the expanding of production interest rate makes the prices of other securities decrease

or the state's and individuals investments. Securities are and vice versa.

commercial papers with economic value or, in other

words, financial instruments that have the corresponding 2.4. The experimental studies

value and can be sold or transferred. Securities are a very Factors affecting the prices of the stock (rate of return)

typical kind of goods in the mechanism. are a concern of many research economists in recent

years. The resulting lessons from these empirical studies

2.3. Factors affecting the price of stock include two groups of factors: macro factors and internal

The stock price can be influenced by the political, social factors related to the financial situation and performance

and legal environment. Firstly, the political environment of the company. Here, the authors would like to list some

has a strong influence on the stock market. The society typical research as the basis for this article.

always has certain impacts on the operation of the stock 2.4.1. Earnings per share (EPS)

market. Political factors include changes in government EPS is considered as an important variable when

and politics. Because Vietnam is relatively politically calculating share prices. The higher EPS, the stronger the

stable, this factor can be ignored. In addition, the policy companys capability is and the higher the ability is to

system has a huge impact on the stock market itself as pay dividends and more likelythe stock prices is to rise.

well as the operation of businesses. Every policy change Therefore, EPS can be seen as a combined indicator

may entail impacts as stock prices would increase or reflecting the results of a business operations. It helps

decrease, especially during sensitive times. individual and organizational investors and analysts

Besides, the stock price also is affected by the macro- easily understand and compare different shares. Studies

economic factors. Firstly, the exchange rate has an by Al-Qenae et al (2002), Al-Tamimi et al (2007), Mehr-

influence on the stock market on two sides: financial un-Nisa and Nishat (2012), Uddin et al (2013) and

environment and activities of enterprises, particularly Truong Dong Loc (2014) conclude that EPS is positively

those businesses importing raw materials. Rising correlated with the stock price.

exchange rate has a strong impact on the stock market.

Foreign capital is invested heavily in the stock market 2.4.2. Exchange rate (USD / VND)

but the rise in the exchange is a strong reason for foreign The exchange rate is a very important variable affecting

investors to withdraw from the market. A large amount the equilibrium of the balance of trade and balance of

of capital is quickly withdrawn from the market and payments; thus, it affects production, employment and

stock prices will decrease and this in turn will cause the the balance of the economy. The volatility of the

www.ijaers.com Page | 103

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

exchange rate has a strong impact on businesses in 2.4.5. Inflation

general and most seriously on import - export businesses Inflation is defined as the devaluation of the currency, it

in particular. Affecting the prices of imported goods, changes consumer behavior and people's and businesses

exchange rate changes lead to the changes in the prices of savings. The unreasonable inflation rate will cause some

exports and imports, thereby affectthe business activities problems to production and business activities. it slows

then the stock prices. down the business growth and innovation. Increase in

Similar to EPS, regression analysis results indicate that inflation rate is often a signal of an unstable economy,

the USD / VND exchange rate are positively correlated interest rates will increase, the profitability of the

with profitability ratios of the stock. This result is business will be lower and then the stock prices will fall.

consistent with studies by Eita (2012), Aurangzeb The lower inflation, the more capable the stock price will

(2012), Phan Thi Bich Nguyet and Pham Duong Phuong rise and vice versa. This is consistent with the studies by

Thao (2013), Truong Dong Loc (2014). Meanwhile, Al-Qenae et al (2002), Al-Tamimi et al (2007), Liu and

research by Liu and Shrestha (2008) is against the Shrestha (2008), Mehr-un-Nisa and Nishat (2012),

conclusion that exchange rates have an inverse Aurangzeb (2012), Phan Thi Bich Nguyet and Pham

relationship with the company's stock price. Duong Phuong Thao (2013) and Zhang Dong Loc

2.4.3. Interest rate (2014).

Government bonds interest rates are considered as the Usually, stock prices tend to rise when the economy

benchmark rate. Changes in these rates will affect the grows well and tend to fall as the economy deteriorates.

stock prices. The benchmark interest rate increase makes Thus, if the development trends of the economy are

the prices of other securities fall. On the contrary, decline predicted, the general development trend of the stock

in these rates causes the prices of securities to increase. market can be predicted. Therefore, predicting the

Relationship between market interest rates and securities economic situation to consider its impacts on the stock

interest rate is an indirect relationship that impacts the price is also very important to investors.

stock price. If market interest rates are higher than the

interest rate of securities, securities prices will fall, which 2.4 Research Methodology

makes activities on the stock market decline because 2.4.1. Data collection

people like to save rather than invest in the stock market. This study analyzes data from audited balance sheets and

Some experimental studies by Al-Qenae et al (2002), Liu income statements of the companies listed on HOSE,

and Shrestha (2008), Hussainey and Ngoc (2009), Mehr- Vietnam from 2012 to 2015. The selection of the listed

un-Nisa and Nishat (2012), Eita (2012), Aurangzeb companies and the audited reports ensures levels of

(2012 ) also share the same view that interest rates have a accuracy because the figures have been checked for

negative correlation with the stock price. transparency and fairness. In unlisted companies, the

audit of financial statements is not officially required so

2.4.4. Gold price that the figures may not accurately reflect the situation of

In Vietnam, the stock market and real estate market are the company. Therefore, using data from these

already applicable to state channel management companies will not accurately reflect the research results.

measures, while the gold market is not, so cash flows into The data on lending rates, USD / VND exchange rate,

the gold market is inevitable and gold is also seen as an gold price and consumer price index are collected from

investment channel for many people. The changes in the official sources of the State Bank of Vietnam

price of gold in the country are expected to have certain (www.sbv.gov.vn), General statistics Office of Vietnam

effects on the prices of listed shares. The reason is that (www.gso.gov.vn) Saigon Jewelry Company- SJC

when gold prices rise, gold is an attractive investment (www.sjc.com.vn). The data are collected on the same

channel for investors. Meanwhile, cash flow shifts from date of the publication of consumer price index by the

stock markets to gold market make the stock price fall general Statistics Office (the 24th of the last month of the

and vice versa. In other words, the relationship between quarter).

the stock price and the gold price is an inverse The figures in the financial reports after collected will be

relationship. Study by Truong Dong Loc (2014) about calculated on Excel to be indicators used in this research.

the factors affecting share prices of companies listed on

the Ho Chi Minh Stock Exchange also gave similar 2.4.2. Research Methodology

conclusion. Descriptive Statistics is related to the collection of data,

summarizing, presenting, calculating and describing the

www.ijaers.com Page | 104

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

different characteristics to reflect a general object of III. FINDINGS AND DISCUSSION

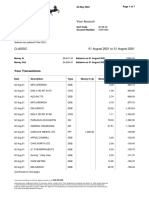

study. In the study the dependent variable and Table.2: Results of regression analysis

independent variables from 2012 to 2015 are described Variables Correlation T-statistic

through mean, median, maximum value, minimum value coefficient Value

and standard deviation of the variables. Through analysis Constant 0.9012 0.63

of these values, the typical level of the variables will be EPS (X1) 0.0026 0.72

seen. Sometimes in some special cases (data with big

USD/VND 0,0005 1,2

changes or unusual differences), the average value does

Exchange rate (X2)

not represent the overall nature for too small or too large

Interest rate (X3) 0,0059 1,36

big value will distort the results of the average. While the

median is an average value which better represents the Gold price (X4) -0,0075 -2,01

average. Maximum and minimum values and standard Inflation rate (X5) -0,002 -0,14

deviation are used to evaluate the degree of representing Observations 464

of the average value for the overall study. If the value of 32,47

Adjusted R2

the standard deviation is larger, the variance of variables 1,74

is larger; thus, representative of the average figures is F- statistic value

lower and vice versa.

Correlation regression analysis is used to determine the EPS (X1) - (Earning Per Share/ profit per share)

relationship between changes in stock prices and the This is the portion of profit which the company attributes

variables: EPS, interest rates, exchange rates, gold prices, to each ordinary outstanding share. EPS is considered as

rate of inflation. Research model is as follow: the single most important variable in calculating the

Yt = 0 + 1X1t + 2X2t +3X3t+4X4t+5X5t +ut share price. In addition, to investors EPS is an indication

In which: Yt (the dependent variable) is the of profitability on each share. Comparison of EPS over

change in price (profitability ratios) of the stocks in the time will help investors know the growth of the

portfolio and is calculated as follows: company. Firms with higher EPS mean higher

Yt = Rt=log(pt) log (pt -1) = log (pt / pt -1) profitability. This means more value for investors and

Pt: price index in the second quarter t; vice versa.

Pt-1: Price Index in quarter t-1. According to the regression results, the EPS and the

X1, X2, X3, X4, X5 are the independent variables profitability ratio of the stock is positively correlated.

and are explained in details. This is consistent with the theory and with results of

previous studies (Al- Qenae et al., 2002; al-Tamimi et al.,

Table.1: The independent variables used in the 2007; Uddin et al., 2013) etc, on the Taiwan and China

regression model stock markets.

Expectatio Particularly, when the EPS increases by 1%, the price of

Variables Explanation

n the equity portfolio rises 0.0026 respectively. This

relationship is statistically significant at 1%. This is the

EPS (X1 EPS of the portfolio

+ explanation for the positive correlation between EPS and

USD/VND profitability ratios of the stocks.

Log of the exchange Exchange rate USD / VND (X2)

Exchange rate +

rate (USD / VND) Similar to EPS, regression analysis results indicate that

(X2)

short-term lending the exchange rate is positively correlated with the

Interest rate profitability ratio of the stocks at a statistically significant

interest rate (% -

(X3) level of 5%. This result is consistent with studies by Eita

/year)

Log of gold price (2012), Aurangzeb (2012), Phan Thi Bich Nguyet and

Gold rate (X4) (SJC) in domestic - Pham Duong Phuong Thao (2013) in Vietnam stock

market market as well as overseas stock markets. However, the

Consumer Price levels of impacts are different in each market.

Inflation rate Index (%) by the Specifically, when the USD / VND exchange rate rises

- 1%, the profitability ratio of the stock rises 0.05%.

(X5) General Bureau of

Statistics This effect can be explained as follows: when the rate

increases, the dollar rises, which is synonymous with

www.ijaers.com Page | 105

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

devaluation the VND. At that time, $ 1 will exchange for channel, and investors can "avoid" inflation. Meanwhile,

over more VND, and so there will be an excess from the cash flow shifts from stock markets to gold markets

increase in this rate. Therefore, the dollar appreciation should make the market stock price fall, and vice versa.

gives investors more business opportunities. This Inflation rate (X5)

encourages more indirect investment flow into Vietnam. In this study, the rate of inflation is measured by

This means that the demand for shares in the market consumer price index (CPI) announced by the general

should increase and the stock price will rise. statistics office. It is consistent with results from previous

Interest rates (X3) studies (Al-Qenae et al., 2002; Al-Tamimi et al., 2007;

Regression results from the study show that the Liu and Shrestha, 2008, Mehr-un-Nisa and Nishat, 2012).

relationship between interest rates and the profitability Regression analysis results obtained from this study

ratio of the stocks is positively correlated. This is show that the profitability ratio of stocks are negatively

inconsistent with the expected hypothesis. Specifically, correlated with the rate of inflation. Specifically, when

as interest rates increase or decrease by 1%, the the rate of inflation rise by 1%, the profit rate of stocks

profitability ratio of the stock will increase or decrease of will decrease .002% and vice versa. The inversely

0.0059%. proportional relationship is statistically significant at 1%.

This result is inconsistent with the findings demonstrated This result is completely in line with what have been

by Al Qenae et al., 2002; Al-Tamimi et al., 2007, Phan happening in Vietnam stock markets recently. For

Thi Bich Nguyet and Pham Duong Phuong Thao (2013). investors, inflation is an important indicator of the

When analyzing an economy in general to invest in the "health" of the economy, and so it has a direct impact on

stock market, it is necessary to take interest rates and the price of the stocks on the market. Rising inflation

fundamentals of investment decision into account. Many means higher cost of inputs for production and business

previous studies have explained that increase in market activities of enterprises. Meanwhile the prices of

interest rates means a fall in bond prices. As a result, products and services will also increase accordingly to

investors will shift from stocks to bonds. This causes the ensure business operations profit. However, the

stock price to fall. However, in the authors opinion, the consumption of products and services will decline due to

differences are in part because of the ineffectiveness of higher selling prices, particularly in the short-term and

the governments monetary policy in recent years. when consumers look for alternative products. This

Therefore, the change in interest rates is not well- makes the targeted profitability is now difficult to

absorbed by the stock market. achieve or even decline, affecting the profit expectations

Gold prices (X4) of the business in the future. As a result, the share prices

In Vietnam, gold is also seen as an investment channel decline. Therefore, inflation is an expression of the

for many people. Therefore, the domestic gold price uncertainty of the economy and the psychology of

changes are expected to have certain effects on the price investors in the stock market will be affected severely.

of the shares listed on the market. For safety, many investors will withdraw from the

The results of the study show that the volatility of the market and invest in other safer channels. Consequently,

gold price is negatively correlated with profitability ratio the share price will fall as inflation rate goes up.

of the stock. Quantitatively, while gold prices increase or Based on the results of the regression model, the F-

decrease by 1%, the profitability ratio of the stock will go statistic value of 1.74 indicates that the model used is

down or up by 0.75%. In terms of statistics, the negative highly reliable at statistical significance at 1%. Besides,

correlation between the gold price movements and the the value of R2 is 32.43%, which means that the

profitability ratio of the stock is significant at the 5% independent variables in the model can explain 32.43%

level. This is consistent with findings by John Leyers of the changes of the dependent variable.

(2007) and Twite (2002) on the Australian stock market.

However, the finding is contradicted with Truong Dong IV. CONCLUSIONS AND SUGGESTIONS

Loc and Vo Thi Hong Doan (2009) who stated that the 4.1. Conclusions

gold price and profitability ratio of the stock are The main objective of the study is to find out the internal

positively correlated. Explanation for this relationship is and macroeconomic factors having impacts on the stock

based on the theory stating that capital flows will shift prices of the companies in industrial sector listed on

from investment channels with lower profitability ratios HOSE. By means of regression analysis of data on stock

to a channel with a higher profitability rate. Therefore, prices and EPS of 29 companies in the industrial sector

when gold prices rise, investment in gold is an attractive and macro indicators such as exchange rates, gold prices,

www.ijaers.com Page | 106

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

interest rates and inflation in the period of 2012-2015. credit institutions to ensure the objectives and maintain

The research concludes that EPS and USD / VND effective operational stability of the banking system to

exchange rate are positively correlated with stock price keep inflation rate at a reasonable level.

fluctuations; on the other hand, gold price and inflation Besides, there should be a focus on collecting

are inversely correlated with stock prices. However, due information, processing data quickly and promptly and

to data is secondary and may be distorted so the results accurately on inflation in order to provide sufficient

may not reflect the most accurate market movements; information to meet the assessment of the state of the

little time and limited knowledge cause unavoidable economy in general and business activities of

shortcomings and errors in the research. manufacturing companies in particular. From that there

4.2 Suggestions are solutions to respond promptly to bad situations to

The study results show that the share price of companies minimize the risks to the economy.

in industrial sector listed on HOSE are influenced by

internal factors (earnings per share - EPS) and

macroeconomic factors (exchange rates, gold prices and 4.2.3 Stable exchange rates

inflation rate). The exchange rate plays an important role in the

However, these effects have different impacts on each commercial activities of the economy. Specifically, in the

stock price index. On that basis, the study makes a current period, while Vietnam is implementing open

number of recommendations for policy - making with the policies to attract foreign investment, especially indirect

aim of increasing the positive impacts and minimizing investment through the draft content allowing foreign

the negative impacts of these factors on the stock prices investors to buy shares, own 51% of the charter capital of

of the companies in industrial sector in Vietnam. the active securities firms, establish foreign-own

securities businesses, buy and own100% of foreign

4.2.1 Fair allocation of earnings per share securities organizations operating in Vietnam. The stable

EPS is used as an indicator of the profitability of exchange rate would help the policy of attracting foreign

enterprises, often regarded as the single most important capital be more efficient; help to build confidence among

variable in calculating the share prices. This is also the investors about a stable business environment to have

principal components of P / E (price-earnings ratio). This many preferential policies; to create steps forward in

coefficient (P / E) is one of the important indicators in attracting more capital from abroad to invest and develop

analyzing securities investment. Income from shares will the securities market in the future.

have a decisive effect on the market price of shares. To achieve stable exchange rates, it is necessary to

Therefore, the joint-stock companies should focus on increase economic activities to generate foreign currency

reasonable dividend to meet the goal of attracting revenues such as improving the balance of international

investment from outside sources and maintaining the payments, foreign currency reserves increase, and the

companys net income to meet business operations and State Bank can use these funds to regulate and maintain

reinvestment in the future at the same time. the exchange rate at a stable level. Besides, the relevant

departments should perform well their functions in macro

4.2.2 Inflation control management to make timely regulatory and suitable

There should be coordination, flexibility between policies when there are fluctuations in the economy and

monetary policy and fiscal policy in order to avoid the the impact on the exchange rate. When being carried out,

adverse effects on effective implementation of each the above solutions will boost the economic potentials

policy. Inflation is affected by many factors such as and there are enough tools to maintain stability of the

economic structure, import and export situations, the foreign exchange market against external shocks to help

credit policy of commercial banks or the fiscal policy of macroeconomic stability, limit extraordinary impact of

the State. However, inflation is possible mainly from the macroeconomic factors on the stock price index.

money supply to the economy. Therefore, inflation

control requires measures on the money supply such as 4.2.4 Executive flexible monetary policy

tight monetary policy, control of interest rates in line The management of monetary policy plays an important

with different situations of the market, directing credit role in the economy. It helps the economy achieve the

policy to key economic activities. The application of this macroeconomic objectives such as inflation and

solution requires the supervision and management of the exchange rate stability and further economic growth.

State Bank as well as the coordinated implementation of Monetary policy uses changes in the money supply to

www.ijaers.com Page | 107

International Journal of Advanced Engineering Research and Science (IJAERS) [Vol-4, Issue-4, Apr- 2017]

https://dx.doi.org/10.22161/ijaers.4.4.14 ISSN: 2349-6495(P) | 2456-1908(O)

affect the entities in the economy. Monetary policy macroeconomic variables and theChinese stock

affects the money supply and then the investment market using heteroscedasticcointegration,

decisions in the securities market. Implementing Managerial Finance, 34,p.744-755.

monetary policies to expand the money supply will cause [8] Mehr-un-Nisa and Mohammad Nishat, 2012. The

the general level of interest rates to fall, encouraging determinants of stock prices inPakistan, Asian

people to save more and investors can borrow at lower Economic and Financial Review, 1(4), p. 276-291.

cost than before. This helps investors seek a more [9] Phan Thi Bich Nguyet and Pham Duong Phuong

attractive investment channel and one of which is in Thao, 2013. Analyze the impact of macroeconomic

securities markets. Hence, the stock rising demand leads factors to Vietnam stock market, Journal of

to share price increases. Development and Intergration, 8 (18), p. 34-41.

Performing active and more flexible monetary policy in [10] Uddin, Reaz, Zahidur Rahman v Rajib Hossain,

order to fit the actual situation helps control inflation, 2013. Determinants of stock prices in financial

macroeconomic stability and economic growth. Besides, sector companies in Bangladesh: A study on Dhaka

this helps to limit the negative impacts on the stock price Stock Exchange (DSE), Interdisciplinary Journal of

index when there are effects from the economy and Contemporary Research in Business,5(3), p. 471-

stimulate confidence in investors to enter the market. 480.

In addition, the state should strengthen their supervision [11] Truong Dong Loc, 2014. Determinants of stock

in the currency markets, quality control activities and returns: Evidence from the Ho Chi Minh Stock

treatment of bad debts at credit institutions to find out Exchange, Can Tho University Journal of Science,

and deal with errors promptly to ensure full operation 33, p. 72-78.

security of the institutions; to help minimize the negative

impacts on the share price index and stock market in

general and the stock prices of companies in the

industrial sector listed on HOSE in particular.

REFERENCES

[1] Al- Qenae, Rashid, Carmen Li v Bob Wearing,

2002. The information contentof earnings on stock

price: The KuwaitStock Exchange, Multinational

FinanceJournal, 6(3), p. 197-221.

[2] Al-Tamimi, Hussein, 2007. Factorsaffecting stock

price in the UAE financialmarkets, The Business

Review, 5(2), p. 225-223.

[3] Aurangzeb, 2012. Factors affectingperformance of

stock market: Evidencefrom South Asian countries,

InternationalJournal of Academic Research in

Businessand Social Sciences, 2(9), p. 1-15.

[4] Eita, Joel Hinaunye , 2012.

Modellingmacroeconomic determinants of

stockmarket prices: Evidence from Namibia,The

Journal of Applied Business Research,28(5), p. 871-

884.

[5] Fama, Eugene F., 1970. Efficient capitalmarkets: A

review of theory and empiricalwork, Journal of

Finance, 25, p. 383-417.

[6] Hussainey, Khaled and Le Khanh Ngoc, 2009. The

impact of macroeconomic indicators onVietnamese

stock prices, Journal of Risk Finance, 10(4), p. 321-

332.

[7] Liu, Ming-Hua and Keshab Shrestha, 2008.

Analysis of the long-term relationship between

www.ijaers.com Page | 108

Anda mungkin juga menyukai

- Beef Cattle Farmers' Economic Behavior in The Minahasa Tenggara Regency, IndonesiaDokumen7 halamanBeef Cattle Farmers' Economic Behavior in The Minahasa Tenggara Regency, IndonesiaIJAERS JOURNALBelum ada peringkat

- Facing Dengue and Malaria As A Public Health Challenge in BrazilDokumen6 halamanFacing Dengue and Malaria As A Public Health Challenge in BrazilIJAERS JOURNALBelum ada peringkat

- Climatic Rhythms and Prevalence of Malaria in The Municipality of Sinende in Northern BeninDokumen8 halamanClimatic Rhythms and Prevalence of Malaria in The Municipality of Sinende in Northern BeninIJAERS JOURNALBelum ada peringkat

- Breastfeeding and Factors Associated With The Prevention of Childhood Obesity: An Integrative Literature ReviewDokumen16 halamanBreastfeeding and Factors Associated With The Prevention of Childhood Obesity: An Integrative Literature ReviewIJAERS JOURNALBelum ada peringkat

- Associativism As Strategy of Reaching Territorial Rights, Programs, Projects and Public Policies of Rural Development: The Case of The São Francisco Do Mainã Community, Manaus, AMDokumen9 halamanAssociativism As Strategy of Reaching Territorial Rights, Programs, Projects and Public Policies of Rural Development: The Case of The São Francisco Do Mainã Community, Manaus, AMIJAERS JOURNALBelum ada peringkat

- Enhancing Cybersecurity: The Power of Artificial Intelligence in Threat Detection and PreventionDokumen6 halamanEnhancing Cybersecurity: The Power of Artificial Intelligence in Threat Detection and PreventionIJAERS JOURNALBelum ada peringkat

- Impacts On The Mental Health of Professionals in A Prisonal System in Alagoas During The Covid-19 PandemicDokumen7 halamanImpacts On The Mental Health of Professionals in A Prisonal System in Alagoas During The Covid-19 PandemicIJAERS JOURNALBelum ada peringkat

- Analysis of The Thermal Behavior of Masonry Concrete Block With Internal Natural Element CoatingDokumen11 halamanAnalysis of The Thermal Behavior of Masonry Concrete Block With Internal Natural Element CoatingIJAERS JOURNALBelum ada peringkat

- Business Logistics and The Relationship With Organizational SuccessDokumen4 halamanBusiness Logistics and The Relationship With Organizational SuccessIJAERS JOURNALBelum ada peringkat

- The Economic Impact of Coronavirus Disease (COVID-19) : A Study On Tourism Indicators in The Kingdom of Saudi ArabiaDokumen4 halamanThe Economic Impact of Coronavirus Disease (COVID-19) : A Study On Tourism Indicators in The Kingdom of Saudi ArabiaIJAERS JOURNALBelum ada peringkat

- The Economic Impact of Coronavirus Disease (COVID-19) : A Study On Tourism Indicators in The Kingdom of Saudi ArabiaDokumen4 halamanThe Economic Impact of Coronavirus Disease (COVID-19) : A Study On Tourism Indicators in The Kingdom of Saudi ArabiaIJAERS JOURNALBelum ada peringkat

- Study of The Extraction Process of The Pleurotus Citrinopileatus Mushroom and Evaluation of The Biological Activity of The ExtractDokumen8 halamanStudy of The Extraction Process of The Pleurotus Citrinopileatus Mushroom and Evaluation of The Biological Activity of The ExtractIJAERS JOURNALBelum ada peringkat

- Morphometric Analysis of The Ekole River As A Consequence of Climate Change: A Case Study in Yenagoa, Bayelsa State, NigeriaDokumen9 halamanMorphometric Analysis of The Ekole River As A Consequence of Climate Change: A Case Study in Yenagoa, Bayelsa State, NigeriaIJAERS JOURNALBelum ada peringkat

- Water Quality Assessment Using GIS Based Multi-Criteria Evaluation (MCE) and Analytical Hierarchy Process (AHP) Methods in Yenagoa Bayelsa State, NigeriaDokumen11 halamanWater Quality Assessment Using GIS Based Multi-Criteria Evaluation (MCE) and Analytical Hierarchy Process (AHP) Methods in Yenagoa Bayelsa State, NigeriaIJAERS JOURNALBelum ada peringkat

- Constructed Wetlands: Technology For Removing Drug Concentration From WaterDokumen12 halamanConstructed Wetlands: Technology For Removing Drug Concentration From WaterIJAERS JOURNALBelum ada peringkat

- Modeling of Geological and Geophysical Data, Onshore Field of Potiguar Basin, Northeastern BrazilDokumen5 halamanModeling of Geological and Geophysical Data, Onshore Field of Potiguar Basin, Northeastern BrazilIJAERS JOURNALBelum ada peringkat

- Childhood/ Pediatric Cancer: Nursing Care in Oncopediatrics With A Central Focus On HumanizationDokumen12 halamanChildhood/ Pediatric Cancer: Nursing Care in Oncopediatrics With A Central Focus On HumanizationIJAERS JOURNALBelum ada peringkat

- Design and Building of Servo Motor Portable Coconut Peller MachineDokumen5 halamanDesign and Building of Servo Motor Portable Coconut Peller MachineIJAERS JOURNALBelum ada peringkat

- Sociodemographic and Clinical Profile of Women With Uterine Cervical Cancer Attended in An Oncological Hospital in The State of Acre, BrazilDokumen9 halamanSociodemographic and Clinical Profile of Women With Uterine Cervical Cancer Attended in An Oncological Hospital in The State of Acre, BrazilIJAERS JOURNALBelum ada peringkat

- Komla Uwolowudu Amegna: International Journal of Advanced Engineering Research and Science (IJAERS)Dokumen9 halamanKomla Uwolowudu Amegna: International Journal of Advanced Engineering Research and Science (IJAERS)IJAERS JOURNALBelum ada peringkat

- Morphometric Analysis of The Ekole River As A Consequence of Climate Change: A Case Study in Yenagoa, Bayelsa State, NigeriaDokumen9 halamanMorphometric Analysis of The Ekole River As A Consequence of Climate Change: A Case Study in Yenagoa, Bayelsa State, NigeriaIJAERS JOURNALBelum ada peringkat

- VCO Rancidity Analysis Refers To Fermentation Time That Produced by Gradual Heating MethodDokumen6 halamanVCO Rancidity Analysis Refers To Fermentation Time That Produced by Gradual Heating MethodIJAERS JOURNAL100% (1)

- Process Sequence Optimization and Structural Analysis of Nanoscale Heterostructure Using Compound Semiconductors AlAsSb/In0.59Ga0.41As/GaAs0.53Sb0.47Dokumen5 halamanProcess Sequence Optimization and Structural Analysis of Nanoscale Heterostructure Using Compound Semiconductors AlAsSb/In0.59Ga0.41As/GaAs0.53Sb0.47IJAERS JOURNALBelum ada peringkat

- Humanization in Undergraduate Medical Education: The Brazilian Learner's PerspectiveDokumen12 halamanHumanization in Undergraduate Medical Education: The Brazilian Learner's PerspectiveIJAERS JOURNALBelum ada peringkat

- Multiprofessional Care For A Patient With Gestational DiabetesDokumen12 halamanMultiprofessional Care For A Patient With Gestational DiabetesIJAERS JOURNALBelum ada peringkat

- Does Blended Learning Approach Affect Madrasa Students English Writing Errors? A Comparative StudyDokumen12 halamanDoes Blended Learning Approach Affect Madrasa Students English Writing Errors? A Comparative StudyIJAERS JOURNALBelum ada peringkat

- Association of Bacterial Vaginosis To Atypia in Squamous Cells of The CervixDokumen15 halamanAssociation of Bacterial Vaginosis To Atypia in Squamous Cells of The CervixIJAERS JOURNALBelum ada peringkat

- Assessment of The Risk of Cardiovascular Diseases and Its Relationship With Heart Rate Variability in Physically Active and Sedentary IndividualsDokumen13 halamanAssessment of The Risk of Cardiovascular Diseases and Its Relationship With Heart Rate Variability in Physically Active and Sedentary IndividualsIJAERS JOURNALBelum ada peringkat

- Mining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaDokumen7 halamanMining and Its Impacts On Environment and Health With Special Reference To Ballari District, Karnataka, IndiaIJAERS JOURNALBelum ada peringkat

- The Psychologist's Role in The Process of Listening To Children Victims of Sexual Violence in Legal ProceedingsDokumen8 halamanThe Psychologist's Role in The Process of Listening To Children Victims of Sexual Violence in Legal ProceedingsIJAERS JOURNALBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Smart Money Back GoldDokumen2 halamanSmart Money Back GoldAbhishek ShatagopachariBelum ada peringkat

- BDB Annual Report 2021 - Part - 4Dokumen111 halamanBDB Annual Report 2021 - Part - 42023149467Belum ada peringkat

- Account Details and Transaction History: Air Asia SaverDokumen4 halamanAccount Details and Transaction History: Air Asia SaverSeema KhanBelum ada peringkat

- FINALREPORTBANKNEW Converted 95201213Dokumen58 halamanFINALREPORTBANKNEW Converted 95201213dinjoBelum ada peringkat

- Accounting For Partnerships: Basic Considerations and FormationDokumen22 halamanAccounting For Partnerships: Basic Considerations and FormationAj CapungganBelum ada peringkat

- SBI Credit Card StudyDokumen68 halamanSBI Credit Card StudyGirish KumarBelum ada peringkat

- FAB2 W3 No Answer KeyDokumen3 halamanFAB2 W3 No Answer KeyClintwest Caliste Autida BartinaBelum ada peringkat

- The Impact of Money Supply and Electronic MoneyDokumen60 halamanThe Impact of Money Supply and Electronic MoneyManuel LlajarunaBelum ada peringkat

- Philippine Accounting StandardsDokumen4 halamanPhilippine Accounting StandardsLala RascoBelum ada peringkat

- Lloyds Bank logo historyDokumen7 halamanLloyds Bank logo historyJawad AhmedBelum ada peringkat

- CHAP19Dokumen35 halamanCHAP19veveng100% (1)

- ACC501 - Final Term Papers 01Dokumen16 halamanACC501 - Final Term Papers 01Devyansh GuptaBelum ada peringkat

- Loyal VC - Brief and Invite DetailsDokumen1 halamanLoyal VC - Brief and Invite DetailsmchroBelum ada peringkat

- 2021 - Q2 - PT Merdeka Copper Gold TBK - 30 Jun 2021 AuditedDokumen119 halaman2021 - Q2 - PT Merdeka Copper Gold TBK - 30 Jun 2021 AuditedJun HarismonBelum ada peringkat

- Book 1Dokumen4 halamanBook 1Maddah HussainBelum ada peringkat

- ICICI Bank Platinum Chip Credit Card Membership GuideDokumen14 halamanICICI Bank Platinum Chip Credit Card Membership GuideVijay TambareBelum ada peringkat

- Banc One Case Study PDF FreeDokumen10 halamanBanc One Case Study PDF FreeFathima KamalBelum ada peringkat

- Final Askari ReportDokumen110 halamanFinal Askari ReportjindjaanBelum ada peringkat

- AR3601-Estimation AssignmentDokumen5 halamanAR3601-Estimation Assignmentvijayakumar mBelum ada peringkat

- NISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFDokumen40 halamanNISM SERIES 1 CURRENCY - LAST DAY EXAM 1 - Unlocked PDFNeeraj Kumar100% (6)

- The International Monetary System Chapter 11Dokumen23 halamanThe International Monetary System Chapter 11Ashi GargBelum ada peringkat

- Receivable Financing: Pledge, Assignment and FactoringDokumen35 halamanReceivable Financing: Pledge, Assignment and FactoringMARY GRACE VARGASBelum ada peringkat

- 1627995250-Lecture - 2 BANKS AND ITS OPERATIONSDokumen4 halaman1627995250-Lecture - 2 BANKS AND ITS OPERATIONSKhushraj SinghBelum ada peringkat

- The Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedDokumen3 halamanThe Evolution of Money From Barter System To Cryptocurrency: When Money First IntroducedMohd AqdasBelum ada peringkat

- CF (MBF131) Exam QDokumen13 halamanCF (MBF131) Exam QSai Set NaingBelum ada peringkat

- Balance SheetDokumen28 halamanBalance SheetrimaBelum ada peringkat

- The Global Financial Crisis ofDokumen30 halamanThe Global Financial Crisis oftylerBelum ada peringkat

- Death of A Partner Test SPCC 23-24 Accounts - Docx (2)Dokumen5 halamanDeath of A Partner Test SPCC 23-24 Accounts - Docx (2)Shivansh JaiswalBelum ada peringkat

- Statements 7344Dokumen4 halamanStatements 7344Валентина ШвечиковаBelum ada peringkat

- Risk Analysis in Capital BudgetingDokumen70 halamanRisk Analysis in Capital BudgetingdhavalshahicBelum ada peringkat