1750 1383 2 PB PDF

Diunggah oleh

priyaJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

1750 1383 2 PB PDF

Diunggah oleh

priyaHak Cipta:

Format Tersedia

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

A Study of Financial Analysis in Textile Sector

Dr. Meenakshi Anand, Sr. Assistant Professor, Dept. of Financial Studies, The IIS University, Jaipur, Rajasthan, India

Abstract

The textile industry of India plays a substantive role in the economy. This is one of the largest industries in India in terms

of employment generation, and earning foreign exchange. The paper focuses on the financial strength of the textile sector

in India. And to know that up to what extent textile sector has used their available resources effectively. For this purpose

profitability, liquidity and solvency position of textile companies has examined. In this paper comparative ratio analysis

technique has used to know the financial soundness of textile companies.

The result shows the profitability margins has slightly different due to volatile textiles market and volatility in raw material

prices. The liquidity and solvency position is almost same in all the textile companies.

Keywords: Company, Liquidity, Profitability, Solvency, Textile

Introduction ue-addition, accounts for around one-third of our gross

The Indian textile industry is one of the largest in the export earnings and provides gainful employment to

world with a massive raw material and textiles manufac- millions of people. They include cotton and jute growers,

turing base. Our economy is largely dependent on the artisans and weavers who are engaged in the organized

textile manufacturing and trade in addition to other ma- as well as decentralized and household sectors spread

jor industries. According to the Report of Confederation across the entire country. The fundamental strength of

of India Textile Industry (CITI), about 27% of the for- this industry flows from its strong production base of

eign exchange earnings are on account of export of tex- wide range of fibers / yarns from natural fibres like cot-

tiles and clothing alone. The textiles and clothing sector ton, jute, silk and wool to synthetic /man-made fibres

contributes about 14% to the industrial production and like polyester, viscose, nylon and acrylic.

4% to the gross domestic product of the country. Around

8% of the total excise revenue collection is contributed Indian Textile Industry Across The Globe

by the textile industry. So much so, the textile industry Cotton Second largest cotton and cellulosic fibres pro-

accounts for as large as 21% of the total employment ducing country in the world.

generated in the economy. Around 35 million people are Silk India is the second largest producer of silk and

directly employed in the textile manufacturing activities. contributes about 18% to the total world raw silk

Indirect employment including the manpower engaged in production

agricultural based raw-material production like cotton Wool India has 3rd largest sheep population in the

and related trade and handling could be stated to be world, having 6.15 crores sheep, producing 45

around another 60 million. million kg of raw wool, and accounting for 3.1%

of total world wool production. India ranks 6th

A textile is the largest single industry in India (and amongst clean wool producer countries and 9th

amongst the biggest in the world), accounting for about amongst greasy wool producers

20% of the total industrial production. Textile and cloth- Man- The fourth largest in synthetic fibres/yarns glob-

ing exports account for one-third of the total value of Made ally.

exports from the country. There are 1,227 textile mills Fibres

with a spinning capacity of about 29 million spindles. Jute India is the largest producer and second largest

While yarn is mostly produced in the mills, fabrics are exporter of the jute goods

produced in the power loom and handloom sectors as *Source Confederation of India Textile Industry (CITI)

well. The Indian textile industry continues to be predom-

inantly based on cotton, with about 65% of raw materials According to the Textile board of Rajasthan, Textile

consumed being cotton. The yearly output of cotton industry enjoys the leading position in the production of

cloth was about 12.8 billion m (about 42 billion ft). The polyester viscose yarn and synthetic suiting material as

manufacture of jute products (1.1 million metric tons) well as processing of low-cost, low-weight fabric. Bhil-

ranks next in importance to cotton weaving. wara has emerged as India's largest manufacturer of suit-

ing fabrics and yarn. Barmer has been added in the list of

Towns of Export Excellence (TEE). Computer Aided

Textile is one of Indias oldest industries and has a for- Design Centers (CADC) has been established at Bhil-

midable presence in the national economy in as much as wara, helping the decentralized and small Power loom

it contributes to about 14 per cent of manufacturing val-

www.borjournals.com Blue Ocean Research Journals 80

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

units to access new designs and improve the quality of total asset, sales, turnover etc. are analyzed with the help

the fabric. of hypothesis and used ANOVA. In this research also

researcher followed this attributes.

Review of Literature

Virambhai (2010) textile industry productivity and fi- Khatik S.K,Varghese Titto (2013) Financial analysis

nancial efficiency focused on industries current posi- of steel authority of India limited states that financial

tion and its performance. It concluded the compa- analysis is used to analyze whether an entity is stable,

ny/management should try to increase the production, solvent, liquid or profitable enough to be invested in

minimize the cost and operating expenses, exercise .financial analysis is just like doctor who examine the

proper control on liquidity position, reduction of power, fitness of the human body. For analysis of the financial

fuel, borrowing funds, overheads, interest burden, etc position of the SAIL, gross profit ratio, net profit and

operating ratio, productivity investment and solvency

South Asia network of economic research institute report ratios are calculated.

on Impact of financial crisis on Textile industry of Pa-

kistan (2011) March by Imran Alam states when devel- Objective of the Study

oping countries saw record declines in their stock mar- The objective of the study is to identify the financial

kets. These declines were registered in those sectors position of the textile companies. The paper is focused

which were dependent on the markets of developed on analyzing the profitability, liquidity, and solvency

world. Its repercussions were seen in developing coun- position of the selected textile companies. And to know

tries also. Ongoing financial crisis has affected them at what extent the selected textile companies has used

through many channels. However, exports, employment their available resources effectively.

and investment are suspected to be affected most. Textile

sector is the most important sector of Pakistans econo- Hypothesis of the Study

my, contributing about 57% to the export earnings and HO There is no significant difference in profitability,

46% to the employment. The results revealed that rising liquidity and solvency position of the selected textile

unemployment rate; high cost of production, lower de- companies.

mand and exchange rate volatility in foreign countries

had Unpleasant impact on Pakistans export indents. The Ha There is significant difference in profitability,

main cause of the above mentioned deteriorating condi- liquidity and solvency position of the selected textile

tions is said to be the ongoing financial crisis companies.

Marimuthu, K.N(2012) Financial performance of Tex- Research Methodology

tile industry : A study of listed company of Tamil nadu The paper focuses on the examining profitability, liquid-

states that Coimbatore is known as Manchester of South ity and the solvency position of textile companies. The

India. 76% of India's total textile market is from Erode study is explanatory and empirical in nature. It is based

(Tex-City or Loom-City of India) and 56% of knitwear on secondary source of data. It covers the three years

exports come from Tirupur. Each company could invest financial performance of the selected companies. Under

on the basis of current performance compared with pre- this study, the researcher has applied comparative ratio

vious year or with other company. Decision making, analysis to know the financial strength of the textile

additional investment, liquidity position changes in companies. The researcher has chosen three textile com-

working capital depend upon the performance & return panies of Rajasthan i.e. Sangam India Ltd. (SIL), BSL

of company reports. Funds are highly required for day- Ltd. (BSL), Maharaja Shree Ummaid Mills Ltd.

to-day business operations of the firm and how to utilize (MSMUL).

it and in what way should avoid loses from the invest-

ment are discussed here plus, it happens by ineffective Financial Performance Of The Textile

management. The objective of the paper is to analyze the

performance of textile industry in the selected companies Companies

from Tamil Nadu. In addition, the data collected from Sangam India Ltd. (SIL)

the CMIE and used the tools of ANOVA and descriptive SIL is engaged into manufacturing of synthetic and

statistics blended dyed/grey spun yarn, cotton yarn and fabrics

(synthetic, blended, denim, knitted and flock fabrics).

Rakesh and Kulkarni (2012) analyzed the Gujarat tex- The company has been operating in both domestic as

tile industry working capital evaluation on selected five well as overseas market and the income ratio is around

company for the eleven years and performed ratio analy- 80:20.The company has also taken recent initiative in the

sis, descriptive statistics etc. The study concluded with field of denim manufacturing and the contribution has

all the company financial performance with sound effec- grown from 12% in FY11 to 20% in FY12.Textile manu-

tive as well as current and quick ratio, current asset on facturing forms the core activity of the company.

www.borjournals.com Blue Ocean Research Journals 81

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

Table -1.1 gaged in the manufacturing of woolen/worsted yarn,

Financial Performance (Sangam India Ltd.) (Rs. synthetic polyester yarn, synthetics blended viscose fab-

Crore) rics and premium range of worsted suiting, readymade

and silk garments. BSL enjoys a Trading House status

Particulars 2010 2011 2012 and is an ISO 9001 certified company. The company is

present both in domestic and overseas market, exports to

Net Sales 852.25 1171.53 1417.22 over 40 countries. BSL markets its products under vari-

ous brand names such as BSL Suitings, Geoffrey Ham-

PBDIT 130.96 201.20 159.43

monds and La Italia.

PAT 17.16 56.59 17.08

Cash Profit 75.63 113.72 80.35 The company has aggregated capacity 18192 spindles

Paid Up Capital 39.42 39.42 39.42 for yarn manufacturing, 8768 spindles for worsted, Vor-

Tangible Net 187.02 238.37 251.25 tex Spinning 400 Positions, 168 looms for fabric weav-

Worth ing with fabric processing capacity of 264 lakhs meter of

Source Annual Reports of company Fibre & Yarn Dyeing 1382 mts supported by in-house

design studio and new product development center as on

The Company achieved net sales of Rs 1417.22 crore in 31.03.2012.The company also set up a 2.40 MW wind

FY12 registering a growth of 21% over sales of FY11 power plant at Jaisalmer, Rajasthan for captive con-

The export sales have also increased in absolute terms to sumption and has power purchase agreement with Raja-

Rs 308.23 crore in FY12 over Rs 256.76 crore in FY11. sthan Rajya Vidyut Prasaran Nigam Limited.

However, the contribution of export sales to the top line

has marginally declined to 21.67% in FY12 from Table -1.2

22.72% in FY11. Financial Performance ( BSL Ltd.) (Rs. Crore)

SIL is engaged into manufacturing of synthetic and

blended dyed/grey spun yarn, cotton yarn and fabrics

(synthetic, blended, denim, knitted and flock fabrics). It Particulars 2010 2011 2012

also undertakes job processing for various clients to uti-

lize its processing capacities. The yarn business is major Net Sales 217.75 270.92 303.64

contributor to the top line of the company. In FY12, the PBDIT 29.85 35.44 31.93

yarn business contributed nearly 51% of the net sales, PAT 3.78 5.66 0.13

with decrease from the level of 64% as in FY11. P/V Cash Profit 17.40 20.14 14.39

Blended Yarn contributed nearly 43% of the total sales Paid Up Capital 10.29 10.29 10.29

and cotton yarn share was nearly 8% of the total sales. Tangible Net 58.20 63.15 61.30

The companys fabric business has also increased in Worth

FY12. Net Working 26.23 30.67 33.83

Capital

TNW of the Company increased from Rs 238.36 crore in

Source Annual Reports of company

FY11 to Rs 251.25 crore in FY12, due to plough back of

profits net of dividend and dividend tax. In FY11, the Table 1.2 shows that the net sales gone up to Rs 303.63

company has declared dividend of Rs 4.58 crore includ- crore in FY 12 over Rs 270.92 crore in FY 11, register-

ing dividend tax, and net of the profit has been treated ing a growth of around 12.07%. The export sales have

part of net worth. The company has also transferred Rs grown by nearly 19% in FY 12 over FY 11.The Compa-

10 crore to the General Reserves out of the total profit. ny has obtained Eco- Tech- Certification (for balancing

The movement of net worth apart from the equity of Rs eco- colors); this would enable the company to partici-

39.42 Crore pate more competitively in the export market. The com-

pany has maximum sales from fabric which account for

BSL Ltd. (BSL)

77% of the total sales.

BSL is one of the group companies of the LNJ Bhilwara

group and was incorporated in 1970 as a Private Limited The company has installed 20 Toyota weaving Machines

Company under the name of Rajasthan General Udyog imported from Japan in FY12.The machines have stared

Pvt. Ltd. In 1971 the company commenced production commercial production from 01.01.2012. The installa-

with an initial capacity of 8 looms for weaving of Poly- tion of these looms will increase their production result-

ester/ Viscose blended grey cloth at Bhilwara in Raja- ing lower dependence on outside job weaving with im-

sthan. In 1976, the company was converted into public proved quality. In export, the company is focusing more

limited company and its name was subsequently changed on exploring new markets and enhancing the volumes in

to the BSL Limited in July, 1994.BSL is primarily en- existing markets. The company is also exploring new

www.borjournals.com Blue Ocean Research Journals 82

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

markets for Vortex yarn. In domestic market, the com- at Rs. 419.82 witnessing marginal decline of 2.69% vis-

pany is focusing on RMG sector and strengthening of -vis sales for FY 2011. The sales for FY 2012 com-

Net Work. BSL export sales are marked to most of the prised of Rs. 386.82 crore from domestic market and Rs.

Middle East, Latin American countries, which are rela- 33 crore from export market. The decrease in domestic

tively, stable than other parts of the world. . sales attributes to the decrease in the realizable price of

Yarn during the second of half of FY 2012. As per the

Maharaja Shree Ummaid Mills Ltd.(MSMUL) operation model of the company, it had accumulated

MSUML promoted by Shri L N Bangur, belongs to Ban- inventory for six months in October 2011.

gur group. It was incorporated in 1939 as a Private Lim-

ited company at Pali, Rajasthan about 72 kms from However due to ban on the export of cotton the prices of

Jodhpur. MSUML commenced business in 1941 and cotton fall sharply at the end of FY 2012. This led to

became a Public Limited Company in 1952. The compa- decrease in price of finished Yarn. Further due to export

ny is engaged in the manufacturing of cotton and blend- ban on yarn and other factors, company could not realize

ed yarn and cotton fabric. It is one of the oldest Textile the prices of yarn at the desired level. However consider-

mills of our country. The company has been consistently ing the prospects in the export market, company has em-

expanding and modernizing its manufacturing facilities phasized on the export sales. The export sales for FY

since its inception and its present installed capacity is 2012 increased to Rs. 33 crore from Rs. 7.08 crore for

109344 Spindles, 1896 Rotors and 494 looms, Process FY 2011. Presently company is exporting yarn to Korea,

House etc. and a 10.3 MW Heavy Fuel Oil (HFO) based Taiwan, China, Malaysia, Bangladesh, Vietnam, Nigeria,

Captive power plant. The company has further planned Colombia, Egypt, Turkey, Tunisia, Hungary, Greece and

for expansion in fabric segment. Israel. Considering the improvement in the market con-

dition of the textile industry, the growth is expected to be

The company has in-house R & D Department, whose more as compared to last year.

efforts are at present directed to process control and im-

proving quality standards of the existing products Data Interpretation

through a reasonably equipped Standards Quality Con- In the present study for the financial analysis of textile

trol Cell and a Chemical Laboratory. The company en- industry different ratio are calculated to find out the

joys the market leadership in Dyed Poplin of 100% Cot- profitability position of the companys profit before de-

ton for domestic market. Its market is spread out over the preciation, interest and tax to sales (PBDIT) and profit

Northern, Central, Southern and Western India, the com- after tax (PAT) to sales is calculated. For examine the

pany has also marked its entry into the Eastern India as ability to pay its outside obligations solvency ratios like

well. Very recently, the Company entered into suiting / Debt service coverage ratio and total outside liabilities /

shirting segment and has generated good growth. total net worth (TOL/TNW) ratios of the companies are

calculated. To know the liquidity position of the compa-

Table -1.3 nys current ratio has calculated. Table 1.4 shows the

Financial Performance (MSMUL Ltd) comparative analyses of the textile companies are as be

(Rs. in crore)

Particulars 2010 2011 2012

Net Sales 319.54 431.60 419.82

Other Income 0.00 0.00 0.00

PBDIT 28.67 47.82 (4.35)

PAT 14.56 153.56 409.80

Paid Up Capital 8.64 8.64 8.64

Tangible Net

92.97 243.06 650.34

Worth

Source Annual Reports of company

The sale of the company is primarily from the sales of

yarn and fabrics. The sales for FY 2011 stood at Rs.

431.60 crore including Rs 424.52 crore domestic sales

and Rs. 7.08 crore export sales. The sale for FY 2012 is

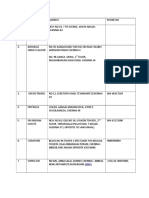

Table -1.4

www.borjournals.com Blue Ocean Research Journals 83

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

Comparative Financial Analysis

Source-calculated from annual reports from 2009-2010 to 2011-2012

Profitability: The (MSMUL) PBDIT for FY 2011 was Rs. 47.82 crore

The (BSL) profitability margins have decreased in FY 12 i.e. 11.08% of the net sales. The PBDIT for FY 2012

over FY 11. The PBDIT has decreased to Rs 32.05 crore declined to negative Rs. 4.35 crore i.e. negative 1.04%

in FY 12 over Rs 35.44 crore in FY 11.Margin has de- of the net sales. As a part of business Model Company

clined from 13.08% in FY11 to 10.56% in FY12 due to accumulates the inventory for the period of six months.

increase in manufacturing expenses and input cost. The The company had accumulated cotton in October for the

profitability margin have also been impacted mainly due six months at the price of Rs. 56000 per candy (i.e. 356

to volatile textiles market and volatility in raw material kg). However due to ban on the export of cotton the

prices. prices of the cotton decreased subsequently to the level

of approx Rs. 34000 per candy. This led to decrease in

PAT has also decreased from Rs 5.66 crore in FY 11 to the prices of finished Yarn and increase in the prices of

Rs 0.13 crore in FY 12. The net profit margin has also inventory accumulated. The cost of sales for FY 2012 at

decreased from 2.09% in FY 11 to 0.04% in FY 12 due Rs. 427.26 crore vis--vis Rs. 386.15 crore for FY 2011.

to higher financial cost in FY12. Cash accruals are at Rs The net profit for FY 2012 is at Rs. 409.80 crore for FY

13.88 crore in FY12 and Rs 18.36 crore in FY11. 2012 as compare to Rs. 153.56 crore in FY 2011. The

increase in net profit is mainly on account of income

The (SIL) has recorded PBDIT of Rs. 159.43 crore in from non operational activity of liquidation of its in-

FY12 as against Rs 201.20 crore in FY11. The Compa- vestments.

nys PBDIT margins declined from 17.17% in FY11 to

11.25% in FY12. During the year the company regis-

tered net profit of Rs 17.08 crore as against net profit of

Rs 56.59 crore in FY11 i.e. decline in PAT margin from

4.83% in FY11 to 1.21% in FY12. The decrease in prof-

itability is mainly due to marginal increase in cost of raw Solvency:

material and direct labour and increase in financial cost. Net worth of (BSL ) has decreased to Rs 61.31 crore in

Further during FY12, due to volatility in the market, FY 12 over Rs 63.15 crore in FY 11. The decrease in net

whole textile sector was hit badly which squeezed the worth is due to hedging loss of Rs 1.50 crore in FY12.

margins. The gearing ratio has slightly increased to 3.28 in FY 12

www.borjournals.com Blue Ocean Research Journals 84

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

over 3.09 in FY 11 due to additional term borrowing for intensive industry and therefore general trend is of high

installation of Vortex Spinning 400 positions in the gearing ratio. Through the comparative ratios analysis

FY12 The gearing ratio of the company has improved to researcher has come to know that the null hypothesis is

3.28 in FY12 from 3.09 times in FY11 due to surplus accepted which shows that there is no significant differ-

profits added to the net worth. ence in the profitability, liquidity and solvency position

in the selected textile companies.

The gearing ratio of the company (SIL) has improved to

3.50 in FY12 from 3.68 times in FY11 due to surplus Reference:-

profits added to the net worth. The gearing is high on [1.] Pandey IM (2007), financial management, vikas

account of various expansions cum modernization pro- publishing house (p) Ltd, new Delhi, India

jects implemented by the company. But the benefits are [2.] A brief Report on Textile industry in India(2013)

likely to accrue in the coming years and with improved march, corporate catalyst India.

operations the scenario is expected to improve. [3.] Annual Reports (2013), Textile Board of India

ministry of textile government of India.

The tangible net worth of MSUML is at Rs. 650.34 crore [4.] The report of ministry of textile (2013) ), July,

as on March 31, 2012 witnessing 167.56% growth vis-- confederation of Indian textile industry

vis Rs. 243.06 crore as on March 31, 2011. The increase [5.] Annual reports of Sangam India Ltd. (SIL)from

in net worth is on account of dilution of companys in- 2009-10 to 2011-12.

vestments. The company has realized Rs. 514.03 crore as [6.] Annual reports of BSL Ltd. (BSL)from 2009-10

a part of miscellaneous income. The TOL/TNW as on to 2011-12.

March 31, 2012 is at 0.32:1 vis--vis 0.68:1 as on March [7.] Annual reports of Maharaja Shree Ummaid Mills

31, 2011. Ltd.(MSMUL).from 2009-10 to 2011-12.

[8.] Report of South Asia network of economic re-

Liquidity search institute (2011), Impact of financial crisis

The current ratio of (BSL) was at 1.18:1 in FY11 and on Textile industry of Pakistan

1.20:1 in FY12. The current ratio was on comfortable [9.] Shrimali Devendra (2012)performance of Indian

side. The estimated current ratio is 1.18 in Fy13 and pro- textile and clothing industry in the united states

jected 1.20 in Fy14 market Abhinav national monthly refereed, jour-

nal of research in commerce and management,

The current ratio (SIL) has marginally reduced from vol .2 issue 3,1 Jan

1.29:1 in FY11 to 1.23:1 in FY12; the current ratio is [10.] Marimuthu,K.N (2012),Financial performance of

low in FY12 due to lower raw material holding level. In textile industry :A study on listed companies of

view of fluctuations in the procurement prices of Poly- Tamil nadu international journal of research in

mer / Viscose (PSF/VSF) and cotton, the Company kept management, economic and commerce,vol.2 ,11

lower stock of these materials at the year end, resulting nov

in decline in raw material holding level in FY12. [11.] Chaudhary, A. (2011), Changing structure of

Indian textile industry after MFA (Multi Fibre

The current ratio (MSMUL) as on March 31, 2012 is at

Agreement) phase out: A global perspective, Far

1.64:1 as against 2.43:1 as on March 31, 2011. The in-

East Journal of Psychology and Business, Vol 2,

terest cover during FY 2012 is at negative 0.86:1 vis--

No. 2,

vis 8.92:1 for FY 2011. The decrease in ICR is mainly

[12.] Verma, S, (2002), Export Competitiveness of

on account of negative PBDIT realized by the company.

Indian Textile and Garment Industry. Indian

Council for Research on International Economic

Conclusion Relations, New Delhi, Working paper No. 94,

Indian textile industry contributes 14% of the total indus-

[13.] Sharma, K.K., (2011). Changing Scenario of

trial production of the country. This paper has explored

Indian Textile Industry under GATT and WTO

the financial position of textile companies. Financial

Regime, Asian Journal of Research in Business

position of textile companies in India is sound and they

Economics and Management, Volume: 1, Issue: 2

are exploring their available resource. The profitability

[14.] Bardia SC,Kastiya Shweta (2010),Liqudity man-

margins has slightly different due to volatile textiles

agement and control: A comparative study of tor-

market and volatility in raw material prices. The moreo-

rent pharma and cipla The IUP journal ,vol

ver liquidity position of companies is also sound, they

ix.no.3 ,july

maintained sufficient funds to meet their short term obli-

[15.] Agarwal MR (2010),financial management, gari-

gations and there total net worth is quiet enough to repay

ma publication house rajasthan

total outside liabilities of the companies, so solvency

position is almost same in all the companies. The textile

industry has traditionally remained a highly capital-

www.borjournals.com Blue Ocean Research Journals 85

Journal of Business Management & Social Sciences Research (JBM&SSR) ISSN No: 2319-5614

Volume 3, No.6, June 2014

[16.] Khatik S.K,Varghese Titto (2013) Financial

analysis of steel authority of India limited re-

search journal Madhya bharti,vol.1 jan.

[17.] Kathuria, S. and A. Bhardwaj, (1998), Export

Quotas and Policy Constraints in the Indian Tex-

tile and Garment Industries, World Bank Policy

Research Working Paper No. 2012, Washington

DC, PP 47-50.

[18.] Manikandan, S, Thirunuvakkarsu, S., (2010),

Tamilnadu Power loom Industry Issues & Chal-

lenges :(A Critical Analysis). International Re-

search Journal, Volume I, Issue 10

[19.] Nordas, H.K., (2004), The Global Textile and

Clothing Industry post the Agreement on Textiles

and Clothing, Discussion paper No.5, World

Trade Organization, from the website:

www.wto.org/english/res_e/booksp_e/discussion_

papers5_e.pdf

www.borjournals.com Blue Ocean Research Journals 86

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Application For New College 2017-18Dokumen46 halamanApplication For New College 2017-18priyaBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- SekarS (0 0)Dokumen2 halamanSekarS (0 0)priyaBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- MBA Marketing Project On Customer SatisfactionDokumen69 halamanMBA Marketing Project On Customer SatisfactionSourav Roy100% (1)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- 11thannualexamcomputerscience2014 15emDokumen4 halaman11thannualexamcomputerscience2014 15emMonica PurushothamanBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- GopiDokumen63 halamanGopipriyaBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Sponsor NewDokumen3 halamanSponsor NewpriyaBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Deepak ProjectDokumen59 halamanDeepak ProjectpriyaBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Deepak ProjectDokumen59 halamanDeepak ProjectpriyaBelum ada peringkat

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- New Goodwill Group Presentation 2011Dokumen61 halamanNew Goodwill Group Presentation 2011priyaBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- BA7202 FM Nov - Dec2014 Rejinpaul QuestionpaperDokumen3 halamanBA7202 FM Nov - Dec2014 Rejinpaul QuestionpaperAnonymous uHT7dDBelum ada peringkat

- AttritionDokumen3 halamanAttritionParames VaranBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- $e Filingofincometaxreturnsforay13 14 130709093313 Phpapp01Dokumen1 halaman$e Filingofincometaxreturnsforay13 14 130709093313 Phpapp01priyaBelum ada peringkat

- K NewDokumen20 halamanK NewpriyaBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Plant LayoutDokumen10 halamanPlant LayoutpriyaBelum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Review 2 German PolymersDokumen27 halamanReview 2 German PolymerspriyaBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Case 1394 Moteur 1 2Dokumen36 halamanCase 1394 Moteur 1 2ionel ianosBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- English Literature Coursework Aqa GcseDokumen6 halamanEnglish Literature Coursework Aqa Gcsef5d17e05100% (2)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Minimization Z Z Z Z Maximization Z Z : LP IPDokumen13 halamanMinimization Z Z Z Z Maximization Z Z : LP IPSandeep Kumar JhaBelum ada peringkat

- Faithful Love: Guitar SoloDokumen3 halamanFaithful Love: Guitar SoloCarol Goldburg33% (3)

- Answer Key: Entry TestDokumen4 halamanAnswer Key: Entry TestMaciej BialyBelum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- What Is The Effective Method For Dissolution of HDPE and LDPE - PDFDokumen12 halamanWhat Is The Effective Method For Dissolution of HDPE and LDPE - PDFAliBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Fallas Compresor Copeland-DesbloqueadoDokumen16 halamanFallas Compresor Copeland-DesbloqueadoMabo MabotecnicaBelum ada peringkat

- Ingredients EnsaymadaDokumen3 halamanIngredients Ensaymadajessie OcsBelum ada peringkat

- Catalyst 4500 SeriesDokumen1.230 halamanCatalyst 4500 SeriesnvleninkumarBelum ada peringkat

- Local, Local Toll and Long Distance CallingDokumen2 halamanLocal, Local Toll and Long Distance CallingRobert K Medina-LoughmanBelum ada peringkat

- MC0085 MQPDokumen20 halamanMC0085 MQPUtpal KantBelum ada peringkat

- Nanomedicine Lecture 2007Dokumen59 halamanNanomedicine Lecture 200778912071Belum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Reverse LogisticsDokumen37 halamanReverse Logisticsblogdogunleashed100% (7)

- I. Level of Barriers in ICT Knowledge, Skills, and Competencies No ICT Knowledge, Skills and Competency Barriers SDA DA N A SADokumen2 halamanI. Level of Barriers in ICT Knowledge, Skills, and Competencies No ICT Knowledge, Skills and Competency Barriers SDA DA N A SAMuhamad KhoerulBelum ada peringkat

- Materials Selection in Mechanical Design - EPDF - TipsDokumen1 halamanMaterials Selection in Mechanical Design - EPDF - TipsbannetBelum ada peringkat

- E10.unit 3 - Getting StartedDokumen2 halamanE10.unit 3 - Getting Started27. Nguyễn Phương LinhBelum ada peringkat

- Atmosphere Study Guide 2013Dokumen4 halamanAtmosphere Study Guide 2013api-205313794Belum ada peringkat

- Statistics 2Dokumen121 halamanStatistics 2Ravi KBelum ada peringkat

- Fish Siomai RecipeDokumen12 halamanFish Siomai RecipeRhyz Mareschal DongonBelum ada peringkat

- Merchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersDokumen43 halamanMerchant Accounts Are Bank Accounts That Allow Your Business To Accept Card Payments From CustomersRohit Kumar Baghel100% (1)

- Trading Book - AGDokumen7 halamanTrading Book - AGAnilkumarGopinathanNairBelum ada peringkat

- FWN Magazine 2018 - Leonor VintervollDokumen48 halamanFWN Magazine 2018 - Leonor VintervollFilipina Women's NetworkBelum ada peringkat

- 1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyDokumen1 halaman1and5.microscopes, Specializedstem Cells, Homeostasis - Answer KeyMCarmen López CastroBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Val Ed SyllabusDokumen25 halamanVal Ed Syllabusroy piamonteBelum ada peringkat

- TMIS07 - Kalam Internship - S7 Tesla MindsDokumen3 halamanTMIS07 - Kalam Internship - S7 Tesla MindsDMJ JonesBelum ada peringkat

- Green Team Work PlanDokumen2 halamanGreen Team Work PlanScott FranzBelum ada peringkat

- Oracle® Secure Backup: Installation and Configuration Guide Release 10.4Dokumen178 halamanOracle® Secure Backup: Installation and Configuration Guide Release 10.4andrelmacedoBelum ada peringkat

- ASM NetworkingDokumen36 halamanASM NetworkingQuan TranBelum ada peringkat

- Dhulikhel RBB PDFDokumen45 halamanDhulikhel RBB PDFnepalayasahitya0% (1)

- Standards Guide 1021 1407Dokumen8 halamanStandards Guide 1021 1407Anjur SiBelum ada peringkat

- Technofeudalism: What Killed CapitalismDari EverandTechnofeudalism: What Killed CapitalismPenilaian: 5 dari 5 bintang5/5 (1)