Mactan Cebu Airport Authority Tax Exemption Case (1996

Diunggah oleh

NN DDL0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

33 tayangan1 halamanThe Mactan Cebu International Airport Authority claimed exemption from real estate taxes under its charter. However, the city demanded payment, arguing the authority's tax exemption was removed by the Labor Code. The Supreme Court ruled the authority was a "taxable person" and its tax exemption only applied to real estate taxes, not all taxes. Tax exemptions must be strictly construed against the taxpayer. Therefore, the authority had to pay the real estate taxes demanded by the city.

Deskripsi Asli:

Judul Asli

26 Mactan v. Marcos.docx

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe Mactan Cebu International Airport Authority claimed exemption from real estate taxes under its charter. However, the city demanded payment, arguing the authority's tax exemption was removed by the Labor Code. The Supreme Court ruled the authority was a "taxable person" and its tax exemption only applied to real estate taxes, not all taxes. Tax exemptions must be strictly construed against the taxpayer. Therefore, the authority had to pay the real estate taxes demanded by the city.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

33 tayangan1 halamanMactan Cebu Airport Authority Tax Exemption Case (1996

Diunggah oleh

NN DDLThe Mactan Cebu International Airport Authority claimed exemption from real estate taxes under its charter. However, the city demanded payment, arguing the authority's tax exemption was removed by the Labor Code. The Supreme Court ruled the authority was a "taxable person" and its tax exemption only applied to real estate taxes, not all taxes. Tax exemptions must be strictly construed against the taxpayer. Therefore, the authority had to pay the real estate taxes demanded by the city.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

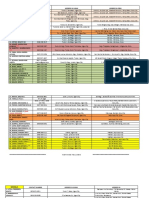

Mactan Cebu International Airport Authority v.

Marcos (1996)

Facts:

Petitioner Mactan Cebu International Airport Authority was created by virtue of

R.A. 6958, mandated to principally undertake the economical, efficient, and

effective control, management, and supervision of the Mactan International

Airport and Lahug Airport, and such other airports as may be established in

Cebu.Since the time of its creation, petitioner MCIAA enjoyed the privilege of

exemption from payment of realty taxes in accordance with Section 14 of its

charter. However, on October 11, 1994, Mr. Eustaquio B. Cesa, Officer in

Charge, Office of the Treasurer of the City of Cebu, demanded payment from

realty taxes in the total amount of P2229078.79.

Petitioner objected to such demand for payment as baseless and unjustified

claiming in its favor the afore cited Section 14 of R.A. 6958. It was also

asserted that it is an instrumentality of the government performing

governmental functions, citing Section 133 of the Local Government Code of

1991.

o Section 133. Common limitations on the Taxing Powers of Local

Government Units. The exercise of the taxing powers of the provinces,

cities, barangays, municipalities shall not extend to the levi of the

following: xxx Taxes, fees or charges of any kind in the National

Government, its agencies and instrumentalities, and LGUs. xxx

Respondent City refused to cancel and set aside petitioners realty tax

account, insisting that the MCIAA is a government-controlled corporation

whose tax exemption privilege has been withdrawn by virtue of Sections 193

and 234 of Labor Code that took effect on January 1, 1992.

Issue + Ruling:

WON Mactan Cebu International Airport Authority is a taxable person. YES.

Taxation is the rule and exemption is the exception. MCIAAs exemption from

payment of taxes is withdrawn by virtue of Sections 193 and 234 of Labor

Code. Statutes granting tax exemptions shall be strictly construed against the

taxpayer and liberally construed in favor of the taxing authority.

The petitioner cannot claim that it was never a taxable person under its

Charter. It was only exempted from the payment of realty taxes. The grant of

the privilege only in respect of this tax is conclusive proof of the legislative

intent to make it a taxable person subject to all taxes, except real property tax.

Anda mungkin juga menyukai

- The National Government, Which Historically Merely Delegated To Local Governments The Power To TaxDokumen37 halamanThe National Government, Which Historically Merely Delegated To Local Governments The Power To Taxlleiryc7Belum ada peringkat

- Affidavit of Loss Deed of SaleDokumen8 halamanAffidavit of Loss Deed of SaleRen ConchaBelum ada peringkat

- Cebu Portland Cement Co. v. Municipality ofDokumen5 halamanCebu Portland Cement Co. v. Municipality ofDenise LabagnaoBelum ada peringkat

- Sample Balane Legitimes Quiz PDFDokumen1 halamanSample Balane Legitimes Quiz PDFJames Francis VillanuevaBelum ada peringkat

- Deed of Absolute SaleDokumen5 halamanDeed of Absolute SaleSarah BaylonBelum ada peringkat

- Reyes V Lim and Pemberton V de LimaDokumen2 halamanReyes V Lim and Pemberton V de LimaCheska Mae Tan-Camins WeeBelum ada peringkat

- 20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931Dokumen7 halaman20 El Oriente, Fabrica de Tabacos, Inc., vs. Posadas 56 Phil. 147, September 21, 1931joyeduardoBelum ada peringkat

- Lacoste vs. HemandasDokumen28 halamanLacoste vs. HemandasZaira Gem GonzalesBelum ada peringkat

- Case Digest #3 - CIR Vs - Mirant PagbilaoDokumen3 halamanCase Digest #3 - CIR Vs - Mirant PagbilaoMark AmistosoBelum ada peringkat

- American Bible Society vs. City of ManilaDokumen2 halamanAmerican Bible Society vs. City of ManilaMida SalisaBelum ada peringkat

- Nacionalista V ComelecDokumen12 halamanNacionalista V ComelecSheena Reyes-BellenBelum ada peringkat

- Sears, Roebuck & Co. v. Stiffel Co., 376 U.S. 225 (1964)Dokumen7 halamanSears, Roebuck & Co. v. Stiffel Co., 376 U.S. 225 (1964)Scribd Government DocsBelum ada peringkat

- CIR v. CA (Jan. 20, 1999)Dokumen14 halamanCIR v. CA (Jan. 20, 1999)Crizza RondinaBelum ada peringkat

- Co-Ownership, Partition, Possession: Property Lecture 4 - 2019Dokumen18 halamanCo-Ownership, Partition, Possession: Property Lecture 4 - 2019Cindy-chan DelfinBelum ada peringkat

- Abra Valley Vs Aquino (Education Institution Exclusive Use Exemption)Dokumen2 halamanAbra Valley Vs Aquino (Education Institution Exclusive Use Exemption)Keanu RibsBelum ada peringkat

- DIRECTORYDokumen5 halamanDIRECTORYIrish DimitimanBelum ada peringkat

- Northern Luzon Island vs. GraciaDokumen3 halamanNorthern Luzon Island vs. GraciaJessica AbadillaBelum ada peringkat

- Ormoc Sugar Company v. Treasurer of Ormoc CityDokumen4 halamanOrmoc Sugar Company v. Treasurer of Ormoc CityCedrick Contado Susi BocoBelum ada peringkat

- U.S. Supreme Court Decision on Immigration Head TaxDokumen9 halamanU.S. Supreme Court Decision on Immigration Head Taxomerremo2010Belum ada peringkat

- Nasiad V CTADokumen2 halamanNasiad V CTAAntonio RebosaBelum ada peringkat

- LIM v. PACQUING FinalDokumen14 halamanLIM v. PACQUING FinalJerry CaneBelum ada peringkat

- Lung Center of The PH v. QCDokumen3 halamanLung Center of The PH v. QCJB GuevarraBelum ada peringkat

- LUNG CENTER OF THE PHILIPPINES, Petitioner, vs. QUEZON CITY and CONSTANTINO P. ROSASDokumen3 halamanLUNG CENTER OF THE PHILIPPINES, Petitioner, vs. QUEZON CITY and CONSTANTINO P. ROSASPrieti HoomanBelum ada peringkat

- Hacienda Luisita Vs PARCDokumen12 halamanHacienda Luisita Vs PARCJumen TamayoBelum ada peringkat

- Lina Vs Paño - G.R. No. 129093. August 30, 2001Dokumen8 halamanLina Vs Paño - G.R. No. 129093. August 30, 2001Ebbe Dy100% (1)

- 027-Lutz v. Araneta, 98 Phil 148Dokumen3 halaman027-Lutz v. Araneta, 98 Phil 148Jopan SJ100% (1)

- DAR v. DECS, G.R. 158228Dokumen3 halamanDAR v. DECS, G.R. 158228JP DCBelum ada peringkat

- Case Digest Political LawDokumen21 halamanCase Digest Political LawJayne CabuhalBelum ada peringkat

- Philippine Supreme Court upholds constitutionality of Act prohibiting sale of liquor to non-Christian tribesDokumen5 halamanPhilippine Supreme Court upholds constitutionality of Act prohibiting sale of liquor to non-Christian tribesChristopher AdvinculaBelum ada peringkat

- 16 Ormoc Sugar Vs ConejosDokumen4 halaman16 Ormoc Sugar Vs ConejosEMBelum ada peringkat

- Dee Hwa Liong Foundation Medical Center v. Asiamed Supplies and EquipmentDokumen1 halamanDee Hwa Liong Foundation Medical Center v. Asiamed Supplies and EquipmentRafaelBelum ada peringkat

- Abs-Cbn v. Cta and NPC v. CbaaDokumen2 halamanAbs-Cbn v. Cta and NPC v. CbaaRyan BagagnanBelum ada peringkat

- Republic v. Marcos Sandiganbayan Civil Case No 0141 (No Footnotes)Dokumen28 halamanRepublic v. Marcos Sandiganbayan Civil Case No 0141 (No Footnotes)Fortunato MadambaBelum ada peringkat

- Philconsa v. Mathay: - Class Topic/Badge: Senators and Representatives G.R. No. L-25554 October 4, 1966Dokumen1 halamanPhilconsa v. Mathay: - Class Topic/Badge: Senators and Representatives G.R. No. L-25554 October 4, 1966DEAN JASPERBelum ada peringkat

- THE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Dokumen8 halamanTHE CITY OF DAVAO, REPRESENTED BY THE CITY TREASURER OF DAVAO CITY, Petitioner, v.THE INTESTATE ESTATE OF AMADO S. DALISAY, REPRESENTED BY SPECIAL ADMINISTRATOR ATTY. NICASIO B. PADERNA, Respondent.Pame PameBelum ada peringkat

- Valenzuela vs. Caltex PhilDokumen7 halamanValenzuela vs. Caltex PhilDom Robinson BaggayanBelum ada peringkat

- Pre-Trial Brief: Shiena Marie ConsingDokumen3 halamanPre-Trial Brief: Shiena Marie ConsingArgie E. NACIONALBelum ada peringkat

- Evidence Conflict Cases Compilation Batch 1Dokumen341 halamanEvidence Conflict Cases Compilation Batch 1Jpakshyiet100% (1)

- Torts - A29 - Fontanilla vs. Maliaman, 179 SCRA 685 (1989)Dokumen11 halamanTorts - A29 - Fontanilla vs. Maliaman, 179 SCRA 685 (1989)John Paul VillaflorBelum ada peringkat

- HARTY vs. MUNICIPALITY of VICTORIADokumen6 halamanHARTY vs. MUNICIPALITY of VICTORIATia RicafortBelum ada peringkat

- Plaintiff-Appellee Defendant-Appellant Magno T. Bueser Solicitor GeneralDokumen3 halamanPlaintiff-Appellee Defendant-Appellant Magno T. Bueser Solicitor GeneralEulaBelum ada peringkat

- LGUs challenge SC ruling allowing tax deferralDokumen7 halamanLGUs challenge SC ruling allowing tax deferralJon JamoraBelum ada peringkat

- HW12 Hrs of Bautista V LindoDokumen6 halamanHW12 Hrs of Bautista V LindoJade Palace TribezBelum ada peringkat

- G.R. No. 14129, July 31, 1962 People Vs ManantanDokumen5 halamanG.R. No. 14129, July 31, 1962 People Vs ManantanJemard FelipeBelum ada peringkat

- COMELEC V. ESPAOLDokumen2 halamanCOMELEC V. ESPAOLYPEBelum ada peringkat

- SuccessionDokumen115 halamanSuccessionJanice Mandalones TorejosBelum ada peringkat

- G.R. No. 200238 - Dissenting Opinion of Justice Carpio On PSBank TRODokumen10 halamanG.R. No. 200238 - Dissenting Opinion of Justice Carpio On PSBank TROBlogWatchBelum ada peringkat

- Bermejo v. Barrios, 1970Dokumen5 halamanBermejo v. Barrios, 1970Randy SiosonBelum ada peringkat

- Recentjuris Remedial LawDokumen81 halamanRecentjuris Remedial LawChai CabralBelum ada peringkat

- Gonzales-vs-Sandiganbayan CrimproDokumen2 halamanGonzales-vs-Sandiganbayan CrimproBon YuseffBelum ada peringkat

- Conflicts Missing2Dokumen102 halamanConflicts Missing2lex libertadoreBelum ada peringkat

- I. INTRODUCTION - Concepts and Principles A. Public Office and Public Officers 1) DefinitionsDokumen10 halamanI. INTRODUCTION - Concepts and Principles A. Public Office and Public Officers 1) DefinitionsLara Michelle Sanday BinudinBelum ada peringkat

- Spa FILINVESTDokumen2 halamanSpa FILINVESTMichael Kevin MangaoBelum ada peringkat

- Code of Professional ResponsibilityDokumen8 halamanCode of Professional ResponsibilityJenniferAlpapara-QuilalaBelum ada peringkat

- Supreme Court upholds VAT under EO 273Dokumen18 halamanSupreme Court upholds VAT under EO 273Aya AntonioBelum ada peringkat

- Balmaceda Vs CorominasDokumen9 halamanBalmaceda Vs Corominaskoey100% (1)

- Zulueta vs. Ca. Martin (February 20, 1996)Dokumen2 halamanZulueta vs. Ca. Martin (February 20, 1996)JeromeBernabeBelum ada peringkat

- Merza vs. Porras 93 Phil., 142, May 25, 1953Dokumen3 halamanMerza vs. Porras 93 Phil., 142, May 25, 1953TEtchie TorreBelum ada peringkat

- Mactan Cebu International Airport Authority V MarcosDokumen2 halamanMactan Cebu International Airport Authority V Marcosfranzadon100% (1)

- MCIAA Vs MARCOSDokumen1 halamanMCIAA Vs MARCOSkaiaceegeesBelum ada peringkat

- 48 Lhuiller vs. British AirwaysDokumen2 halaman48 Lhuiller vs. British AirwaysNN DDLBelum ada peringkat

- Imbong vs. Ochoa KEY TAKE-AWAY: The Reproductive Health Law Is A Consolidation and Enhancement ofDokumen14 halamanImbong vs. Ochoa KEY TAKE-AWAY: The Reproductive Health Law Is A Consolidation and Enhancement ofNN DDLBelum ada peringkat

- Case Facts Issue + RulingDokumen4 halamanCase Facts Issue + RulingNN DDLBelum ada peringkat

- Is Mcgee Qualified To Adopt His Step-Children?Dokumen2 halamanIs Mcgee Qualified To Adopt His Step-Children?NN DDLBelum ada peringkat

- Applied Cybersecurity: Strategies For Avoidance, Protection & Defense Against Cybercrime, Privacy & Big DataDokumen3 halamanApplied Cybersecurity: Strategies For Avoidance, Protection & Defense Against Cybercrime, Privacy & Big DataNN DDLBelum ada peringkat

- BrownDokumen5 halamanBrownNN DDLBelum ada peringkat

- Mactan Electric v. NPC FactsDokumen1 halamanMactan Electric v. NPC FactsNN DDLBelum ada peringkat

- NJKDokumen2 halamanNJKNN DDLBelum ada peringkat

- Holy Child v Sto Tomas labor disputeDokumen3 halamanHoly Child v Sto Tomas labor disputeNN DDLBelum ada peringkat

- Divorce Decree RecognitionDokumen2 halamanDivorce Decree RecognitionNN DDLBelum ada peringkat

- Shell denied tax refund for fuel sales to carriersDokumen2 halamanShell denied tax refund for fuel sales to carriersNN DDLBelum ada peringkat

- Raynera v. Hiceta Facts: Were Respondents Negligent? NODokumen2 halamanRaynera v. Hiceta Facts: Were Respondents Negligent? NONN DDLBelum ada peringkat

- Me-Shurn Corporation and Sammy Chou v. Me-Shurn Workers MSWU and Rosalina Cruz FactsDokumen3 halamanMe-Shurn Corporation and Sammy Chou v. Me-Shurn Workers MSWU and Rosalina Cruz FactsNN DDLBelum ada peringkat

- T & H Shopfitters Corporation/Gin Queen Corporation v. Zaldivar, Et Al FactsDokumen2 halamanT & H Shopfitters Corporation/Gin Queen Corporation v. Zaldivar, Et Al FactsNN DDLBelum ada peringkat

- Pardo de Tavera v. Cacdac Facts:: Were The Gordons Qualified To Adopt? YESDokumen2 halamanPardo de Tavera v. Cacdac Facts:: Were The Gordons Qualified To Adopt? YESNN DDLBelum ada peringkat

- 77 Glan v. IACDokumen2 halaman77 Glan v. IACNN DDLBelum ada peringkat

- 72 Teague v. FernandezDokumen2 halaman72 Teague v. FernandezNN DDLBelum ada peringkat

- Raynera v. Hiceta Facts: Were Respondents Negligent? NODokumen2 halamanRaynera v. Hiceta Facts: Were Respondents Negligent? NONN DDLBelum ada peringkat

- 53 MMTC v. CADokumen2 halaman53 MMTC v. CANN DDLBelum ada peringkat

- 46 Oh Hek How v. RPDokumen1 halaman46 Oh Hek How v. RPNN DDLBelum ada peringkat

- 43 PBCom v. CADokumen2 halaman43 PBCom v. CANN DDLBelum ada peringkat

- 57 Urbano v. IACDokumen1 halaman57 Urbano v. IACNN DDLBelum ada peringkat

- 50 Velilla v. PosadasDokumen2 halaman50 Velilla v. PosadasNN DDLBelum ada peringkat

- BrownDokumen5 halamanBrownNN DDLBelum ada peringkat

- 24 Sonza v. ABS-CBN Broadcasting CorporationDokumen2 halaman24 Sonza v. ABS-CBN Broadcasting CorporationNN DDLBelum ada peringkat

- Legaspi V TanDokumen6 halamanLegaspi V TanNN DDLBelum ada peringkat

- LiiveDokumen3 halamanLiiveNN DDLBelum ada peringkat

- Ethics AlwaysDokumen4 halamanEthics AlwaysNN DDLBelum ada peringkat

- 72 Eastern Telecommunications Philippines, Inc. vs. Commissioner of Internal RevenueDokumen14 halaman72 Eastern Telecommunications Philippines, Inc. vs. Commissioner of Internal RevenueNN DDLBelum ada peringkat

- 36 Zalamea v. CADokumen2 halaman36 Zalamea v. CANN DDLBelum ada peringkat

- Harvard Lectures - GlobalisationDokumen4 halamanHarvard Lectures - GlobalisationacademicenglishukBelum ada peringkat

- Rem 321 Condo ReviewerDokumen14 halamanRem 321 Condo ReviewerJanzel Santillan100% (1)

- Asahi Breweries' Focus Differentiation StrategyDokumen6 halamanAsahi Breweries' Focus Differentiation StrategyRitika SharmaBelum ada peringkat

- BA 2802 - Principles of Finance Solutions To Problems For Recitation #1Dokumen8 halamanBA 2802 - Principles of Finance Solutions To Problems For Recitation #1Eda Nur EvginBelum ada peringkat

- Journal of International Business Studies explores the relationship between economic exchange and political conflictDokumen6 halamanJournal of International Business Studies explores the relationship between economic exchange and political conflictCipolesin BocatoBelum ada peringkat

- Adjust Bank ReconciliationDokumen6 halamanAdjust Bank ReconciliationChristine Joy SalvadorBelum ada peringkat

- Micromodule 2 Package 1 Activity AnswersDokumen5 halamanMicromodule 2 Package 1 Activity AnswersHannah Alvarado BandolaBelum ada peringkat

- Position of Responsibility: Bindu Chandra Shekhar MishraDokumen2 halamanPosition of Responsibility: Bindu Chandra Shekhar Mishraankit mohanBelum ada peringkat

- Trần Thị Thu Dung-21DH485395- (T6 - 7-9) - ScriptDokumen3 halamanTrần Thị Thu Dung-21DH485395- (T6 - 7-9) - ScriptLê Uyển MiBelum ada peringkat

- Ahu Persembe - The Effects of Foreign Direct Investment in Turkey On Export PerformanceDokumen20 halamanAhu Persembe - The Effects of Foreign Direct Investment in Turkey On Export PerformanceAhu Oral100% (1)

- BDO Business StudyDokumen14 halamanBDO Business StudyPhaul QuicktrackBelum ada peringkat

- Burshane LPG (Pakistan) LimitedDokumen21 halamanBurshane LPG (Pakistan) LimitedIFTIKHAR UL HAQBelum ada peringkat

- 361 Bank PDFDokumen11 halaman361 Bank PDFForrestBelum ada peringkat

- DIENA Case SolutionDokumen8 halamanDIENA Case SolutionSuryansh SinghBelum ada peringkat

- Mahindra BPRDokumen17 halamanMahindra BPRxchjqsjnBelum ada peringkat

- Quiz 1Dokumen4 halamanQuiz 1soldiersmithBelum ada peringkat

- Ebptg10v1 PDFDokumen376 halamanEbptg10v1 PDFPhương VũBelum ada peringkat

- Accounting For InvestmentDokumen14 halamanAccounting For Investmentefe davidBelum ada peringkat

- The End of PovertyDokumen4 halamanThe End of Povertykairawr50% (2)

- Fundamental Law of EconomicsDokumen12 halamanFundamental Law of Economicsbrigitte shane gedorioBelum ada peringkat

- Chapter - Iv Theoretical FrameworkDokumen10 halamanChapter - Iv Theoretical FrameworkNahidul Islam IUBelum ada peringkat

- Indicative Checklist For Tax AuditDokumen22 halamanIndicative Checklist For Tax AuditHalf-God Half-ManBelum ada peringkat

- Economic Analysis: Angat Water Transmission Improvement Project (RRP PHI 46362-002)Dokumen4 halamanEconomic Analysis: Angat Water Transmission Improvement Project (RRP PHI 46362-002)Nina Arra RiveraBelum ada peringkat

- Allotment Contracts (Final)Dokumen11 halamanAllotment Contracts (Final)amadeuBelum ada peringkat

- The Corporation - Reaction PaperDokumen3 halamanThe Corporation - Reaction PaperDenverBelum ada peringkat

- Internal & external factors driving change in marketsDokumen3 halamanInternal & external factors driving change in marketsJohn Paul Madrid ArevaloBelum ada peringkat

- Unit 1Dokumen7 halamanUnit 1Jody AhmedBelum ada peringkat

- Knowledge Management Research Report-1998, KPMG ConsultingDokumen1 halamanKnowledge Management Research Report-1998, KPMG ConsultingDinakara KenjoorBelum ada peringkat

- MCQDokumen7 halamanMCQLiyan ShahBelum ada peringkat

- Career: Board of Director Mary Kay 1. David HollDokumen4 halamanCareer: Board of Director Mary Kay 1. David HollAmeer Al-asyraf MuhamadBelum ada peringkat