Ilink Waiver Rider (Ilwr)

Diunggah oleh

Purawin SubramaniamHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Ilink Waiver Rider (Ilwr)

Diunggah oleh

Purawin SubramaniamHak Cipta:

Format Tersedia

PRODUCT SPECIFICATION

ILINK WAIVER RIDER

PRODUCT CLASSIFICATION

Product Code: ILWR

Product Name: I-Link Waiver Rider

Annexure: R39

This rider is designed to waive the Basic and Term Rider premium in the event the life assured is

diagnosed with any one of the 33 critical illnesses. It is classified as a permanent rider under the

ordinary individual life business.

RIDER DESCRIPTION

Unit Deducting Rider (UDR)

Non-participating in the companys profit or without bonus rider

BENEFITS

1. Critical Illnesses

In the event the life assured being diagnosed with any one of the 33 critical illnesses, the Basic

and Term Rider premium due on or after the date of first diagnosis on this policy will be waived.

All Riders other Premium Paying Riders attached to this Policy (if any) shall be terminated

inclusive of this Premium waiver Rider.

2. Rider Expiry

Rider terminates with no benefit payable at the time of expiry

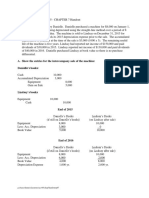

PREMIUM

1. Premium Paying Term is same as Rider term.

2. Regular premium following basic policy e.g. Yearly, Half-yearly, Quarterly, Monthly (monthly

direct not allowed)

3. Method of payment following basic policy e.g. Angkasa deduction, Private Deduction, Credit

Card, Auto-debit Bank (MBB, BSN, BCBB, RHB, PBB), Standing instruction (SI) or Direct.

4. Premiums are payable as long as the basic policy is In-force or the rider sum assured been

exhausted or until the expiry of the rider term whichever is earlier.

5. The published rate are yearly premium, for other modes multiply the yearly premium with the

frequency factors shown below: -

Mode Factor

Half-Yearly 0.54

Quarterly 0.27

Monthly 0.09

ILWR Page 1 14-01-2007

LIFE OPERATIONS DIVISION

PRODUCT SPECIFICATION

ILINK WAIVER RIDER

SUM ASSURED (COMPUTATION)

Total Premium to be waived (Basic Premium + Term Rider) / 100 x Waiver Rider Rates + Policy Fee

Sum assured will not be stated on the scheduled. On the schedule in the place of sum assured

Waiver of Premium will be printed.

AGE AT ENTRY

Minimum: 1 years old next birthday, subject to minimum 30 days old

Maximum: 65 years old next birthday.

RIDER TERM

Minimum: 5 years

Maximum: 69 years

However, the age at entry plus the term of the rider should not exceed 70 years.

UNDERWRITING

1. Medical Limit

Not Applicable

2. Employment

Life Assured must be gainfully employed

3. Occupational Class

Not Applicable

4. Addition and Deletion of Riders

Rider can be attached to I-Link product

Rider can only be attached at the time of new business

Cannot be added to an existing policy

5. Backdating

Maximum 30 days from date of entry provided life assured has not attained age 65 but not later

st

than 1 September 2005.

DISCOUNT

1. Large Sum Assured Discount

Not Applicable

2. Female Discounts

Separate premium rate for male and female

3. Policy Fee

RM 25.00 per annum (for other frequency multiply with frequency factors)

ILWR Page 2 14-01-2007

LIFE OPERATIONS DIVISION

PRODUCT SPECIFICATION

ILINK WAIVER RIDER

NON-GUARANTEED

The premium rate are not guaranteed, and the company may revise the rate by giving 3 months

notice to the Policy Owners last known address and the Policy Owner may choose: -

Option (1): Pay the revised premium and maintain the rider sum assured.

Option (2): Terminate this rider and the associated Premium Waiver Benefit rider.

If no respond within three (3) months notice period, option (1) will be automatically apply.

NOTICE OF CLAIM AND PROCEDURE

The Payer Benefit Rider claim would be considered when: -

A written notice must be given to the Company as soon as possible but later than 6 months

from the date of initial diagnosis of the disease.

All certificates, payment receipts, bills, invoices, information and evidence required by the

Company are furnished at the cost of the Policy Owner

All payment receipts, bills, invoices that are submitted to the Company for the purposes of a

claim shall not be returned

EXCLUSION

The premium waiver shall not be applicable in the event of the following: -

Disease diagnosed within 60 days from policy Issued date or rider reinstatement date

Any critical illness that is pre-existing and/or has been diagnosis

Payer is diagnosed of having suffered from Myocardial Infarction or Coronary Bypass Surgery

prior to Issued date or reinstatement date

Self-inflicted injuries or suicide while sane or insane, under the influence of alcohol, drugs or

narcotic

War, invasion, civil war, rebellion, participation in riot, strike or civil commotion

Engaging in aerial flights including parachuting and skydiving other than as a fare paying

passenger or crew member on a regular public air service

gliding, motor racing, horse racing or submarine operations

TERMINATION

This Rider will terminate and the rider premium will cease to be payable: -

A written request for termination of the Rider is received

At age 70 years

The basic policy lapses, cancelled, surrendered or is converted into a paid-up assurance

Expiry date of this Rider

On the death or permanent and total disability of the Person Insured

In the event of total claim for 100% or more of the rider sum assured

If the Person Insured qualifies for Income Benefit

Premiums received after termination of the Rider shall not be considered to be a continuation of this

Rider but any premium(s) paid shall be refunded and the Company shall be under no liability

whatsoever in respect of this Rider.

ILWR Page 3 14-01-2007

LIFE OPERATIONS DIVISION

Anda mungkin juga menyukai

- Structural Dynamics - ESA 322 Lecture 3aDokumen34 halamanStructural Dynamics - ESA 322 Lecture 3aPurawin SubramaniamBelum ada peringkat

- Journal 2Dokumen1 halamanJournal 2Purawin SubramaniamBelum ada peringkat

- Manufact LabDokumen4 halamanManufact LabPurawin SubramaniamBelum ada peringkat

- Your Final Expenses Your Family Emergency FundsDokumen1 halamanYour Final Expenses Your Family Emergency FundsPurawin SubramaniamBelum ada peringkat

- Aircraft AssignmentDokumen36 halamanAircraft AssignmentPurawin SubramaniamBelum ada peringkat

- Proposal Work Industrial Visit To Spirit Aerosystems Malaysia SDN BHD Organized byDokumen8 halamanProposal Work Industrial Visit To Spirit Aerosystems Malaysia SDN BHD Organized byPurawin SubramaniamBelum ada peringkat

- Lecture 01Dokumen63 halamanLecture 01Purawin SubramaniamBelum ada peringkat

- Structural Dynamics Lecture OverviewDokumen36 halamanStructural Dynamics Lecture OverviewPurawin Subramaniam0% (1)

- Structural Dynamics - ESA 322 Lecture 1Dokumen34 halamanStructural Dynamics - ESA 322 Lecture 1Purawin SubramaniamBelum ada peringkat

- Company ContactsDokumen2 halamanCompany ContactsPurawin SubramaniamBelum ada peringkat

- Lecture 05 Orbital MechanicsDokumen30 halamanLecture 05 Orbital MechanicsPurawin SubramaniamBelum ada peringkat

- ESA 366 Flight PerformanceDokumen2 halamanESA 366 Flight PerformancePurawin SubramaniamBelum ada peringkat

- Project ProposalDokumen11 halamanProject ProposalPurawin SubramaniamBelum ada peringkat

- Cover LetterDokumen1 halamanCover LetterPurawin SubramaniamBelum ada peringkat

- Wing Aspect Ratio & Aerodynamic CharacteristicsDokumen7 halamanWing Aspect Ratio & Aerodynamic CharacteristicsPurawin SubramaniamBelum ada peringkat

- USM Academic CalendarDokumen2 halamanUSM Academic CalendarPurawin SubramaniamBelum ada peringkat

- Report Industrial VisitDokumen1 halamanReport Industrial VisitPurawin SubramaniamBelum ada peringkat

- Report Industrial VisitDokumen1 halamanReport Industrial VisitPurawin SubramaniamBelum ada peringkat

- Purawin SubramaniamDokumen2 halamanPurawin SubramaniamPurawin SubramaniamBelum ada peringkat

- Aerodynamics Quiz & TestDokumen19 halamanAerodynamics Quiz & TestPurawin SubramaniamBelum ada peringkat

- aircraftPerformance2FullVersion PDFDokumen22 halamanaircraftPerformance2FullVersion PDFconda0001Belum ada peringkat

- JW PP KJ - AeroangkasaDokumen1 halamanJW PP KJ - AeroangkasaPurawin SubramaniamBelum ada peringkat

- Purawin SubramaniamDokumen2 halamanPurawin SubramaniamPurawin SubramaniamBelum ada peringkat

- Journal of ESA 244: AerodynamicsDokumen2 halamanJournal of ESA 244: AerodynamicsPurawin SubramaniamBelum ada peringkat

- ESA272 CompiledDokumen90 halamanESA272 CompiledPurawin SubramaniamBelum ada peringkat

- EML 222/2 Engineering Lab Ii: Experiment ReportDokumen14 halamanEML 222/2 Engineering Lab Ii: Experiment ReportPurawin Subramaniam100% (1)

- Efficient Windscreen Air Blower CAD DesignDokumen4 halamanEfficient Windscreen Air Blower CAD DesignPurawin SubramaniamBelum ada peringkat

- ESA 272 IntroductionDokumen30 halamanESA 272 IntroductionPurawin SubramaniamBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- General Deduction Formula-Chapter 4 Slides 2021 With Examples Highlighted PDFDokumen28 halamanGeneral Deduction Formula-Chapter 4 Slides 2021 With Examples Highlighted PDFKhensaniBelum ada peringkat

- Chapter 18 - Financial Management Learning GoalsDokumen25 halamanChapter 18 - Financial Management Learning GoalsRille LuBelum ada peringkat

- QUIZ W1 W3 MaterialsDokumen11 halamanQUIZ W1 W3 MaterialsLady BirdBelum ada peringkat

- BS GroupingsDokumen438 halamanBS GroupingsShivakumar RaoBelum ada peringkat

- Zumra Company S Annual Accounting Year Ends On December 31 It PDFDokumen1 halamanZumra Company S Annual Accounting Year Ends On December 31 It PDFhassan taimourBelum ada peringkat

- Merger - Ashish Sharma - 0101151295 PDFDokumen34 halamanMerger - Ashish Sharma - 0101151295 PDFAshish SharmaBelum ada peringkat

- IIMMDokumen24 halamanIIMMarun1974Belum ada peringkat

- Stracoma FinalssDokumen53 halamanStracoma FinalssAeron Arroyo IIBelum ada peringkat

- CIR Appeals CTA Ruling on ICC Tax DeductionsDokumen4 halamanCIR Appeals CTA Ruling on ICC Tax DeductionsJane MarianBelum ada peringkat

- Chapter 7 (Pindyck)Dokumen31 halamanChapter 7 (Pindyck)Rahul SinhaBelum ada peringkat

- Trade CycleDokumen17 halamanTrade CycleNirang GoyalBelum ada peringkat

- Latitude & High Park Green Hotel & Condo Proposed Development ProformaDokumen1 halamanLatitude & High Park Green Hotel & Condo Proposed Development ProformaReden Mejico PedernalBelum ada peringkat

- Chapter 7 Handout Solution - Accounting 405-1Dokumen5 halamanChapter 7 Handout Solution - Accounting 405-1Bridget ElizabethBelum ada peringkat

- Viability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityDokumen16 halamanViability of Class Division While Accessing Tax - An Appraisal Dr. Ram Manohar Lohia National Law UniversityHimanshumalikBelum ada peringkat

- Chapter-2 - Dividend DecisionsDokumen54 halamanChapter-2 - Dividend DecisionsRaunak YadavBelum ada peringkat

- Warren Buffet LessonsDokumen79 halamanWarren Buffet Lessonspai_ganes8002Belum ada peringkat

- Bunin Business Planning For Financing For Linkedin 10-12-12 Show 97-2003 No PWDokumen43 halamanBunin Business Planning For Financing For Linkedin 10-12-12 Show 97-2003 No PWJeffrey H. BuninBelum ada peringkat

- Cost Accounting - Customer Profitability AnalysisDokumen18 halamanCost Accounting - Customer Profitability AnalysisNayeem AhmedBelum ada peringkat

- FIN STMT ANLYSDokumen39 halamanFIN STMT ANLYSNor CahayaBelum ada peringkat

- Universal Standards On Social Performance ManagementDokumen21 halamanUniversal Standards On Social Performance ManagementTherese MarieBelum ada peringkat

- International Compensation ManagementDokumen11 halamanInternational Compensation ManagementMahbub Zaman Refat100% (2)

- PartnershipDokumen330 halamanPartnershipAbby Sta Ana100% (2)

- Lic PPT FMSDokumen56 halamanLic PPT FMSRam Kishen KinkerBelum ada peringkat

- Cagayan State University Taxation Law 1 NotesDokumen21 halamanCagayan State University Taxation Law 1 NotesBill DanaoBelum ada peringkat

- Tax in DenmarkDokumen20 halamanTax in Denmarkkelevra16Belum ada peringkat

- Current Liabilities In-depthDokumen44 halamanCurrent Liabilities In-depthkristineBelum ada peringkat

- Full Projecte EditedDokumen131 halamanFull Projecte Editedshabin_aliBelum ada peringkat

- IASB Conceptual FrameworkDokumen26 halamanIASB Conceptual FrameworkALEXERIK23100% (4)

- Elements of Financial StatementsDokumen2 halamanElements of Financial StatementsJonathan NavalloBelum ada peringkat

- Justice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationDokumen3 halamanJustice Teresita Leonardo-De Castro Cases (2008-2015) : TaxationNicco AcaylarBelum ada peringkat