AR Exerise

Diunggah oleh

Nasir Mazhar0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

20 tayangan1 halamandfgdfgdfgdg

Judul Asli

AR+Exerise

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inidfgdfgdfgdg

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

20 tayangan1 halamanAR Exerise

Diunggah oleh

Nasir Mazhardfgdfgdfgdg

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF atau baca online dari Scribd

Anda di halaman 1dari 1

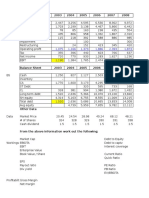

Duchetti Corporation utilizes an accounting software package that is capable of producing a detailed

aging of outstanding accounts receivable. Following is the aging schedule as of December 31, 20X5.

AGE [AMOUNT OUTSTANDING

010 20days $3,600,000

3110.60 days 2,100,000

61 t0 120 days 600.000

Over 120days 75000

Bruno Duchetti has owned and operated Duchetti Corporation for many years and has a very good sense

of the probability of collection of outstanding receivables, based on an aging analysis, The following table

reveals the likelihood of collection:

AGE PROBABILITY OF COLLECTION

0t0 30 days 97%

31 to 60 days 85%

61 to 120 days 70%

(Over 120 days 50%

a) Prepare an aging analysis and show how accounts receivable and the related allowance for

uncollectibles should appear on the balance sheet at December 31.

) Prepare the necessary journal entry to update the allowance for uncollectibles, assuming the

balance prior to preparing the aging was a $45,000 credit.

©) Prepare the necessary journal entry to update the allowance for uncollectibles, assuming the

balance prior to preparing the aging was a $15,000 debit. How could the allowance account

have contained a debit balance?

Anda mungkin juga menyukai

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- A Tale of Three KingsDokumen9 halamanA Tale of Three KingsRitika Kumari100% (1)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Cold ChainDokumen26 halamanCold ChainNasir MazharBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Chap 11 Taxation, Prices, Efficiency, and The Distribution of IncomeDokumen22 halamanChap 11 Taxation, Prices, Efficiency, and The Distribution of IncomeNasir Mazhar100% (1)

- Coso Internal Control Integrated FrameworkDokumen168 halamanCoso Internal Control Integrated FrameworkDavid Apaza QuenayaBelum ada peringkat

- WAREHOUSING MANAGEMENT FinalDokumen31 halamanWAREHOUSING MANAGEMENT FinalEr Rahul Punk RockBelum ada peringkat

- Nutshell To Win Friends and Influence PeopleDokumen5 halamanNutshell To Win Friends and Influence PeopleSrikanth PremkumarBelum ada peringkat

- Export Credit and FinanceDokumen11 halamanExport Credit and FinanceBilal Javed JafraniBelum ada peringkat

- 02 ECorp AR 2014 Full PDFDokumen129 halaman02 ECorp AR 2014 Full PDFNasir MazharBelum ada peringkat

- Exclusive Article DR NoorDokumen4 halamanExclusive Article DR NoorNasir MazharBelum ada peringkat

- Matching Dell: Solution To Case Study QuestionsDokumen8 halamanMatching Dell: Solution To Case Study QuestionsNasir MazharBelum ada peringkat

- Business Performance 2Dokumen1 halamanBusiness Performance 2Nasir MazharBelum ada peringkat

- Shehla Zia V Wapda HR No 15 K of 1992 PLD 1994 SC 693Dokumen23 halamanShehla Zia V Wapda HR No 15 K of 1992 PLD 1994 SC 693Nasir MazharBelum ada peringkat

- Water Supply Expected DemandDokumen1 halamanWater Supply Expected DemandNasir MazharBelum ada peringkat

- Newfield QuestionDokumen8 halamanNewfield QuestionNasir MazharBelum ada peringkat

- Cost Behavior: Analysis and Use: Mcgraw-Hill /irwinDokumen72 halamanCost Behavior: Analysis and Use: Mcgraw-Hill /irwinNasir MazharBelum ada peringkat

- Job Application ResumeDokumen2 halamanJob Application ResumeNasir MazharBelum ada peringkat

- Estimation and Costing BN Datta CH 1 and 2Dokumen31 halamanEstimation and Costing BN Datta CH 1 and 2Shubham Soni88% (42)

- CodeOfCorporateGovernance 2012 AmendedJuly2014 PDFDokumen41 halamanCodeOfCorporateGovernance 2012 AmendedJuly2014 PDFZeeshan HassanBelum ada peringkat

- Session+8+PPE+ AutosavedDokumen38 halamanSession+8+PPE+ AutosavedNasir MazharBelum ada peringkat

- SECP Act 1997 Updated Till 2016Dokumen2 halamanSECP Act 1997 Updated Till 2016Nasir MazharBelum ada peringkat

- Chapter 09Dokumen7 halamanChapter 09Nasir MazharBelum ada peringkat

- Job Application ResumeDokumen2 halamanJob Application ResumeNasir MazharBelum ada peringkat