5 Aug 16

Diunggah oleh

pravin_37810 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

29 tayangan1 halamandd

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Inidd

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

29 tayangan1 halaman5 Aug 16

Diunggah oleh

pravin_3781dd

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

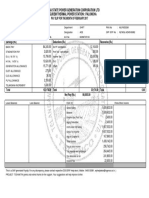

MAHARASHTRA STATE POWER GENERATION CO. LTD.

Name : PRAMOD GULABRAO PURIJI DESG/ESG : Assistant Engineer

Empl ID : 1008 Birth Date :14.06.1960 PG/EG : Grade B Employee

CPF No./UAN: 01961993 / 100276602764 Retire Due :30.06.2018 LAP Avl/Bal: 30 / 260

PAN No. : ACIPP9108N Due Incr Dt :27.05.2017 SCL Avl/Bal: 0 / 20

Pay Period : 01.08.2016 - 31.08.2016 Basic Rate : 48,885.00 HAP Avl/Bal: 0 / 360

Bank Ac No : 440 Emp.Status :Active Comm Avl : 0

Bank Name : BANK OF INDIA Seniority No: 112 ASST ENG - DIP EOL Avl : 0

Pay Scale : MG16 - 26710-1060-32010-1125-60135 Absent(C/P): 0 / 0

PSA :TPS CHANDRAP

Earnings Deductions Loan Balances

Basic Salary 48,885.00 Ee PF contribution 12,847.00 Computer Principal 23,625.00

Dearness Allow 58,173.00 Er Pension contribution 1,250.00

Special Compen Allow 200.00 Prof Tax - split period 200.00

Elec. Charges Allow 265.00 Income Tax 23,793.00

Factory Allowance 325.00 Electricity Charges 993.00

Conveyence Allowance 1,053.00 Staff Welfare Fund 10.00

Sp. Incentive Allow 1,500.00 Revenue Stamp 1.00

Tech J A / Book Allow 440.00 Emp Dep Wel T Fund 30.00

Entertainment Allow 335.00 Computer Principal 1,125.00 Deductions not taken in the month

FB Generation Allow 565.00 CSTPS ECCSoc Chandrapur 14,691.00

Ar Leave Encashment 107,823.00 Engineer CCSoc Nagpur 24,458.00

Night Shift Allow (IT15) 800.00

Ar. Over Time(Double) 21,738.50

Adjustments 0.50

Total 242,102.50 Total 78,148.00 Take Home Pay 163,955.00

Perks/Exemption Other Income/Deduction Form 16 summary Form 16 summary

Conveyance An 12,636.00 Ann Reg Incom 1337778.00 Gross Salary 1,583,869.38

Other Exempti 5,280.00 Ann Irr Incom 196454.94 Exemption U/S 10 17,916.00

Prev Yr Incom 49,636.44 Balance 1,565,953.38

Gross Salary 1583869.38 Empmnt tax (Prof Tax) 2,400.00

Incm under Hd Salary 1,563,553.38

Gross Tot Income 1,563,553.38

Agg of Chapter VI 150,000.00

Total Income 1,413,554.00

Tax on total Income 249,066.20

Tax payable and surcharg 256,539.00

Tax payable by Ee. 256,539.00

Tax deducted so far 66,199.00

Income Tax 23,793.00

Note: Er Pension contribution is not included in total deduction amount.

Kindly contact HR if information is incorrect on payslip.Service Book record will be considered as final for leave balances.

! SUBMIT ACTUAL INVESTMENT FOR INCOME TAX 2016-2017!

Date:10.03.2017

Anda mungkin juga menyukai

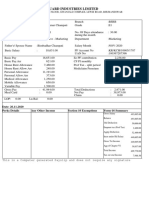

- Deductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Dokumen1 halamanDeductions (B) Earnings (A) : Print Date: 03.11.2019, Print Time: 20:51:14Fire SuperstarBelum ada peringkat

- Form PDFDokumen2 halamanForm PDFSuresh DoosaBelum ada peringkat

- PayslipSalary Slips - 10-2020 PDFDokumen1 halamanPayslipSalary Slips - 10-2020 PDFSukant ChampatiBelum ada peringkat

- Pay Slip BSNLDokumen1 halamanPay Slip BSNLJohn FernendiceBelum ada peringkat

- Form 1Dokumen1 halamanForm 1Ganesh DasaraBelum ada peringkat

- Payslip 90002364 10 2020Dokumen1 halamanPayslip 90002364 10 2020souvik deyBelum ada peringkat

- PayslipSalary Slips - 9-2020 PDFDokumen1 halamanPayslipSalary Slips - 9-2020 PDFSukant ChampatiBelum ada peringkat

- Payslip For Nov-16 PDFDokumen1 halamanPayslip For Nov-16 PDFManoj KumarBelum ada peringkat

- Reliance Securities employee payslip summaryDokumen1 halamanReliance Securities employee payslip summaryAnkit SinghBelum ada peringkat

- TELANGANA STATE POWER GENERATION CORPORATION PAY SLIP FOR FEBRUARY 2017Dokumen1 halamanTELANGANA STATE POWER GENERATION CORPORATION PAY SLIP FOR FEBRUARY 2017Ganesh DasaraBelum ada peringkat

- PayslipSalary Slips - 11-2020-1 PDFDokumen1 halamanPayslipSalary Slips - 11-2020-1 PDFSukant ChampatiBelum ada peringkat

- 175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHDokumen1 halaman175,120.00 31555288280 42,409.00 132,711.00 Credited To: SBI, DIGWADIHshamb2020Belum ada peringkat

- FUTURE RETAIL PAYSLIPDokumen2 halamanFUTURE RETAIL PAYSLIPN Quinton SinghBelum ada peringkat

- India Local Monthly130122210312905Dokumen1 halamanIndia Local Monthly130122210312905NAGARJUNABelum ada peringkat

- Techfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032Dokumen1 halamanTechfoco Global Services PVT LTD No 5, 5Th Cross Street, Balaji Nagar Ekkatuthangal, Chennai - 600 032manoj mohanBelum ada peringkat

- PaySlip1 DecDokumen1 halamanPaySlip1 Decjesten jadeBelum ada peringkat

- Payslip 8 2022Dokumen1 halamanPayslip 8 2022Md SharidBelum ada peringkat

- AUGUST PayslipDokumen1 halamanAUGUST PayslipRakesh MandalBelum ada peringkat

- Fuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 DaysDokumen1 halamanFuji Technical Services PVT LTD: Attendance Details Value Paid Days 31 Daysanup_nairBelum ada peringkat

- Aswini Salary Slip FebDokumen1 halamanAswini Salary Slip FebAvnish MisraBelum ada peringkat

- Powerweave Software Services Pvt. LTDDokumen1 halamanPowerweave Software Services Pvt. LTDSnehal ManeBelum ada peringkat

- Mar18 PDFDokumen1 halamanMar18 PDFomkassBelum ada peringkat

- UnknownDokumen1 halamanUnknownBSNL BBOVERWIFIBelum ada peringkat

- Indiabulls Securities LimitedDokumen1 halamanIndiabulls Securities Limitedraj200224Belum ada peringkat

- 2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Dokumen1 halaman2nd FLOOR, Gold Field, Sion Dharavi Link Road, Sion (W), Mumbai-400017Faisal NumanBelum ada peringkat

- Yogesh August PayslipDokumen1 halamanYogesh August Payslipशिवभक्त बाळासाहेब मोरेBelum ada peringkat

- Cipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureDokumen2 halamanCipla Limited Cipla House Lower Parel: Disclaimer: This Is A System Generated Payslip, Does Not Require Any SignatureImtiyaz Alam SahilBelum ada peringkat

- Apr 2021Dokumen1 halamanApr 2021Suraj KadamBelum ada peringkat

- MIOT Hospitals pay slip Oct 2022Dokumen1 halamanMIOT Hospitals pay slip Oct 2022jesten jadeBelum ada peringkat

- Chola Business Services Pay SlipDokumen3 halamanChola Business Services Pay SlipsathyaBelum ada peringkat

- Subramani PayslipDokumen2 halamanSubramani PayslipMr. HarshaBelum ada peringkat

- RPT Pay SlipDokumen1 halamanRPT Pay SlipAllia sharmaBelum ada peringkat

- Aug - 23 Salary SlipDokumen1 halamanAug - 23 Salary SlipBack-End MarketingBelum ada peringkat

- Aug PDFDokumen1 halamanAug PDFRBelum ada peringkat

- Pay Slip DetailsDokumen1 halamanPay Slip DetailsTirumalesha DadigeBelum ada peringkat

- Pushparaj R PayslipDokumen3 halamanPushparaj R PayslipHenry suryaBelum ada peringkat

- Salary Reciept - SeptDokumen1 halamanSalary Reciept - SeptdivanshuBelum ada peringkat

- SalarySlip 5876095Dokumen1 halamanSalarySlip 5876095Larry WackoffBelum ada peringkat

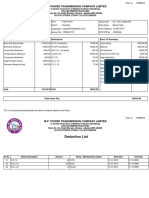

- M.P. Power Transmission Company LimitedDokumen2 halamanM.P. Power Transmission Company LimitedKanhaiya SharmaBelum ada peringkat

- Payslip Jan 2023Dokumen1 halamanPayslip Jan 2023Palanivelan KamarajBelum ada peringkat

- Date:27 12 2015Dokumen1 halamanDate:27 12 2015Anonymous pKsr5vBelum ada peringkat

- Earnings Deductions: B9 Beverages LimitedDokumen1 halamanEarnings Deductions: B9 Beverages LimitedStark Satindra SunnyBelum ada peringkat

- HTMLReportsDokumen1 halamanHTMLReportsRashmi Awanish PandeyBelum ada peringkat

- Earnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Dokumen1 halamanEarnings Deductions Reimbursements: Nexteer Automotive India PVT LTD Payslip For The Month of April 2021Nanha-Munna swaggerBelum ada peringkat

- Awais Ahmed (UTL0477)Dokumen1 halamanAwais Ahmed (UTL0477)Awais AhmedBelum ada peringkat

- Serv Let ControllerDokumen1 halamanServ Let ControllerParas PareekBelum ada peringkat

- PaySlip-210 (ASHISH SHARMA) - APR - 2018 PDFDokumen1 halamanPaySlip-210 (ASHISH SHARMA) - APR - 2018 PDFAnonymous OXzOm4oBelum ada peringkat

- Intelligroup Asia Private Limited: Salary Slip Salary Slip January 2022Dokumen1 halamanIntelligroup Asia Private Limited: Salary Slip Salary Slip January 2022Darren Joseph VivekBelum ada peringkat

- Oct PayslipDokumen1 halamanOct PayslipPandu RjBelum ada peringkat

- Payslip Jun PDFDokumen1 halamanPayslip Jun PDFtrack ViewBelum ada peringkat

- DDICGDIAP72DINOV22Dokumen1 halamanDDICGDIAP72DINOV22raghav bharadwajBelum ada peringkat

- PAYSLIPSDokumen52 halamanPAYSLIPSrishichauhan25Belum ada peringkat

- Pay Slip for Vishal GuptaDokumen1 halamanPay Slip for Vishal GuptavishalBelum ada peringkat

- Bertelsmann Marketing Services India PVT LTD 15Th Floor, Tower C, BLDG No 8, DLF Cyber City GURGAON - 122002Dokumen1 halamanBertelsmann Marketing Services India PVT LTD 15Th Floor, Tower C, BLDG No 8, DLF Cyber City GURGAON - 122002mohit1990dodwalBelum ada peringkat

- Payslip Aug2022Dokumen1 halamanPayslip Aug2022Raut AbhimanBelum ada peringkat

- Form16 Fiserv 2018-19Dokumen8 halamanForm16 Fiserv 2018-19SiddharthBelum ada peringkat

- Salary Slip Amars Aug 09Dokumen1 halamanSalary Slip Amars Aug 09Jonathan MendozaBelum ada peringkat

- PaySlip 221253181486P PDFDokumen1 halamanPaySlip 221253181486P PDFpraveenBelum ada peringkat

- Payslip Jul 2023Dokumen1 halamanPayslip Jul 2023Kartika RaguvanshiBelum ada peringkat

- Paystub 202109Dokumen1 halamanPaystub 202109Ankush BarheBelum ada peringkat

- EPS 95 Option FormatDokumen1 halamanEPS 95 Option Formatpravin_3781100% (1)

- DefectDokumen2 halamanDefectpravin_3781Belum ada peringkat

- Adobe Scan 04-Nov-2022Dokumen1 halamanAdobe Scan 04-Nov-2022pravin_3781Belum ada peringkat

- Boiler Shutdown ListDokumen3 halamanBoiler Shutdown ListNIKHIL KSHIRSAGARBelum ada peringkat

- Iso Section Manual Old Cstps-Opn U#5Dokumen37 halamanIso Section Manual Old Cstps-Opn U#5pravin_3781Belum ada peringkat

- Morning SMS - 15.05.2017Dokumen2 halamanMorning SMS - 15.05.2017pravin_3781Belum ada peringkat

- EstimateDokumen1 halamanEstimatepravin_3781Belum ada peringkat

- Turbine Defect - 02 Sept 17Dokumen2 halamanTurbine Defect - 02 Sept 17pravin_3781Belum ada peringkat

- Transco 2017Dokumen13 halamanTransco 2017pravin_3781Belum ada peringkat

- 24 HR Report Boiler Side DateDokumen3 halaman24 HR Report Boiler Side DateAnonymous pKsr5vBelum ada peringkat

- Aph Baskets Unit-7 (2016)Dokumen3 halamanAph Baskets Unit-7 (2016)pravin_3781Belum ada peringkat

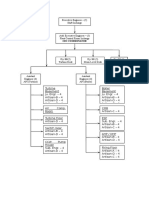

- Power Plant Organizational ChartDokumen1 halamanPower Plant Organizational Chartpravin_3781Belum ada peringkat

- U3 U4 U5 U6 U7 Gen. LD Loss Heads of Losses (Tick: The Appropriate)Dokumen2 halamanU3 U4 U5 U6 U7 Gen. LD Loss Heads of Losses (Tick: The Appropriate)pravin_3781Belum ada peringkat

- Daily Report TapiDokumen2 halamanDaily Report Tapipravin_3781Belum ada peringkat

- Process ChartDokumen12 halamanProcess Chartpravin_3781Belum ada peringkat

- Iso Section Manual Cstps-Opn U 5Dokumen30 halamanIso Section Manual Cstps-Opn U 5pravin_3781Belum ada peringkat

- Check ListDokumen1 halamanCheck Listpravin_3781Belum ada peringkat

- Process ChartDokumen12 halamanProcess Chartpravin_3781Belum ada peringkat

- ECS FormDokumen1 halamanECS FormAnonymous pKsr5vBelum ada peringkat

- Res FormDokumen1 halamanRes Formpravin_3781Belum ada peringkat

- Ims Section Manual Unit-6Dokumen32 halamanIms Section Manual Unit-6pravin_3781Belum ada peringkat

- MAHARASHTRA POWER Salary Slip and Form 16 Summary for Pramod PuriDokumen1 halamanMAHARASHTRA POWER Salary Slip and Form 16 Summary for Pramod Puripravin_3781Belum ada peringkat