Required File Structure For Summary Alphalist of Withholding Taxes (Sawt)

Diunggah oleh

ann0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

90 tayangan2 halamanThis document provides the required file structure for the Summary Alpha List of Withholding Taxes (SAWT) that must be submitted to the Bureau of Internal Revenue. It specifies the header, details, and control sections with the field name, type, width, format, and description for each column of the SAWT file. The header includes identifying information for the payee. The details section contains rows of withholding transaction data. The control section includes totals for verification at the end.

Deskripsi Asli:

technical requirement BIR form upload

Judul Asli

27815rmc no. 3-2006_annex a

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThis document provides the required file structure for the Summary Alpha List of Withholding Taxes (SAWT) that must be submitted to the Bureau of Internal Revenue. It specifies the header, details, and control sections with the field name, type, width, format, and description for each column of the SAWT file. The header includes identifying information for the payee. The details section contains rows of withholding transaction data. The control section includes totals for verification at the end.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

90 tayangan2 halamanRequired File Structure For Summary Alphalist of Withholding Taxes (Sawt)

Diunggah oleh

annThis document provides the required file structure for the Summary Alpha List of Withholding Taxes (SAWT) that must be submitted to the Bureau of Internal Revenue. It specifies the header, details, and control sections with the field name, type, width, format, and description for each column of the SAWT file. The header includes identifying information for the payee. The details section contains rows of withholding transaction data. The control section includes totals for verification at the end.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

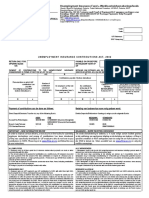

ANNEX A

REQUIRED FILE STRUCTURE FOR

SUMMARY ALPHALIST OF WITHHOLDING TAXES (SAWT)

Attachment to BIR Form Nos. 1700, 1701Q, 1701, 1702Q, 1702, 2550M, 2550Q,

2551M, 2553

Header:

FIELD NAME TYPE WIDT FORMAT DESCRIPTION

H

1. ALPHA_TYPE TEXT 5 HSAWT Type of Alpha List

2. FTYPE_CODE TEXT 6 H1700 or Form Type Code

H1701Q or

H1701 or

H1702Q or

H1702 or

H2550M or

H2550Q or

H2551M or

H2553

3. TIN_PAYEE TEXT 9 999999999 Payees TIN

4. BRANCH_CODE_ PAYEE TEXT 3 999 Payees Branch Code

5. REGISTERED_NAME_ TEXT 50 X(50) Payees Registered Name

PAYEE

6. LAST_NAME_PAYEE TEXT 30 X(30) Payees Last Name

7. FIRST_NAME_PAYEE TEXT 30 X(30) Payees First Name

8. MIDDLE_NAME_PAYEE TEXT 30 X(30) Payees Middle Name

9. RETRN_PERIOD DATE 7 MM/YYYY Return Period

10. RDO_CODE_PAYEE TEXT 3 999 Payees RDO Code

Details:

FIELD NAME TYPE WIDT FORMAT DESCRIPTION

H

1. ALPHA_TYPE TEXT 5 DSAWT Type of Alpha List

2. FTYPE_CODE TEXT 6 D1700 or Form Type Code

D1701Q or

D1701 or

D1702Q or

D1702 or

D2550M or

D2550Q or

D2551M or

D2553

3. SEQ_NUM NUMBER 8 99999999 Sequence Number

4. TIN_WA TEXT 9 999999999 Withholding Agents (WA) TIN

5. BRANCH_CODE_WA TEXT 3 999 Withholding Agents Branch

Code

6. REGISTERED_NAME_WA TEXT 50 X(50) WAs Registered Name

7. LAST_NAME_WA TEXT 30 X(30) WAs Last Name

8. FIRST_NAME_WA TEXT 30 X(30) WAs First Name

9. MIDDLE_NAME_WA TEXT 30 X(30) WAs Middle Name

10 RETRN_PERIOD DATE 7 MM/YYYY Return Period

11 NATURE_INCOME TEXT 50 X(50) Nature of Income Payment

12 ATC_CODE TEXT 5 X(5) ATC Code

13 TAX RATE NUMBER 5 9(2).99 Rate of Tax

14 TAX_BASE NUMBER 14 9(11).99 Amount of Income Payment

(Tax Base)

15 ACTUAL_AMT_WTHLD NUMBER 14 9(11).99 Amount of Tax Withheld

Control:

FIELD NAME TYPE WIDTH FORMAT DESCRIPTION

1. ALPHA_TYPE TEXT 5 CSAWT Type of Alpha List

2. FTYPE_CODE TEXT 6 C1700 or Form Type Code

C1701Q or

C1701 or

C1702Q or

C1702 or

C2550M or

C2550Q or

C2551M or

C2553

3. TIN_PAYEE TEXT 9 999999999 Payees TIN

4. BRANCH_CODE_PAYEE TEXT 3 999 Payees Branch Code

5. RETRN_PERIOD DATE 7 MM/YYYY Return Period

6. TAX_BASE NUMBER 14 9(11).99 Total Amount of Income Payment

7. ACTUAL_AMT_WTHLD NUMBER 14 9(11).99 Total Amount of Tax Withheld

NOTE: Shaded areas contain ACTUAL VALUES.

Anda mungkin juga menyukai

- 27815rmc No. 3-2006 - Annex A PDFDokumen2 halaman27815rmc No. 3-2006 - Annex A PDFTin LicoBelum ada peringkat

- Introductory Guideline for Using Twilio Programmable Messaging and Programmable Voice ServicesDari EverandIntroductory Guideline for Using Twilio Programmable Messaging and Programmable Voice ServicesBelum ada peringkat

- 27815rmc No. 3-2006 - Annex ADokumen2 halaman27815rmc No. 3-2006 - Annex AAnn ShizueBelum ada peringkat

- BIR Forms (Official)Dokumen10 halamanBIR Forms (Official)annBelum ada peringkat

- RMC No. 7-2021 Annex ADokumen12 halamanRMC No. 7-2021 Annex AJuan FrivaldoBelum ada peringkat

- RMC No. 25-2024 - Annex ADokumen12 halamanRMC No. 25-2024 - Annex AAnostasia NemusBelum ada peringkat

- AnnexDokumen15 halamanAnnexannBelum ada peringkat

- SQL Test (MSSQL/Oracle) : Lotno Stepid in - Qty in - Date Out - Qty Out - DateDokumen2 halamanSQL Test (MSSQL/Oracle) : Lotno Stepid in - Qty in - Date Out - Qty Out - Datetjm.stkrBelum ada peringkat

- Type FIELD Name Length SR - N oDokumen13 halamanType FIELD Name Length SR - N okaranthsatishBelum ada peringkat

- Deutsche Post Customer Portal - Shipment Data Import Specification PDFDokumen13 halamanDeutsche Post Customer Portal - Shipment Data Import Specification PDFJulien DechanetBelum ada peringkat

- Open Financial Service: Temenos Education CentreDokumen15 halamanOpen Financial Service: Temenos Education Centrenana yaw100% (2)

- DBMS Lab 2Dokumen12 halamanDBMS Lab 2chauhansumi143Belum ada peringkat

- ING Format Description MT.940 Customer Statement Message: Usage GuidelineDokumen33 halamanING Format Description MT.940 Customer Statement Message: Usage GuidelineTestspotyfireal EsyBelum ada peringkat

- Sage300 ParametersForCustomizingPrintedFormsDokumen166 halamanSage300 ParametersForCustomizingPrintedFormsElio ZerpaBelum ada peringkat

- Information System Management Assignment-1: InputDokumen53 halamanInformation System Management Assignment-1: InputRahul GoswamiBelum ada peringkat

- X12 820 004010Dokumen13 halamanX12 820 004010Mahesh UmaBelum ada peringkat

- After Completing This Module, You Will Be Able ToDokumen0 halamanAfter Completing This Module, You Will Be Able TojayanthskBelum ada peringkat

- 27815rmc No. 03-2006 - Annex BDokumen2 halaman27815rmc No. 03-2006 - Annex BClarineRamosBelum ada peringkat

- PM51xx - PM53xx - PMC Register List - v2013 - v2043 - R01 DataType2pdfDokumen6 halamanPM51xx - PM53xx - PMC Register List - v2013 - v2043 - R01 DataType2pdfBOsy Ying LoBelum ada peringkat

- Full Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFDokumen54 halamanFull Income Tax Fundamentals 2018 36Th Edition Whittenburg Solutions Manual PDFstephen.crawford258100% (15)

- SQL DocDokumen15 halamanSQL Docvaibhav gaikwadBelum ada peringkat

- 1Z0 007introDokumen59 halaman1Z0 007introshrikant tilekarBelum ada peringkat

- Manual StepsDokumen13 halamanManual Stepstarun_menezesBelum ada peringkat

- Zoning Tables DefinedDokumen30 halamanZoning Tables DefinedPatrick GoBelum ada peringkat

- X12-810 4010 SpecsDokumen24 halamanX12-810 4010 SpecsJavier BernabeuBelum ada peringkat

- SQL SERVER Weekly Test2 Complex QuestionsDokumen24 halamanSQL SERVER Weekly Test2 Complex QuestionsManish SinghBelum ada peringkat

- Create and Insert CommandsDokumen20 halamanCreate and Insert Commandsapi-92498388Belum ada peringkat

- Assignment-3 DatabaseDokumen6 halamanAssignment-3 Databasekishan maniyarBelum ada peringkat

- Not For Quotation: Theory of Cost and ProfitDokumen8 halamanNot For Quotation: Theory of Cost and ProfitFrancis Thomas LimBelum ada peringkat

- Sem 3: DBMS Practical FileDokumen34 halamanSem 3: DBMS Practical Filemetalwihen0% (1)

- Class and Object Set 1 SolutionDokumen10 halamanClass and Object Set 1 Solutionamishadalal0% (1)

- Phpmyadmin: MysqlDokumen26 halamanPhpmyadmin: MysqlNishant MishraBelum ada peringkat

- Usefull Function - 1Dokumen45 halamanUsefull Function - 1rasedBelum ada peringkat

- Table ControlDokumen16 halamanTable ControlNiloy BiswasBelum ada peringkat

- RDBMS Lab ManualDokumen10 halamanRDBMS Lab ManualElias PetrosBelum ada peringkat

- How To Connect MyPBX To TA FXO Gateway enDokumen12 halamanHow To Connect MyPBX To TA FXO Gateway endodikBelum ada peringkat

- DBMS Lab Ass3Dokumen2 halamanDBMS Lab Ass3ankita galgalikarBelum ada peringkat

- Fundamentals To Database CIT10303 Assignment 2Dokumen5 halamanFundamentals To Database CIT10303 Assignment 2EkalmacoBelum ada peringkat

- MT940 Format Specifications.v4Dokumen9 halamanMT940 Format Specifications.v4mostafa SaidBelum ada peringkat

- DB Mangmnt ExamplesDokumen6 halamanDB Mangmnt ExamplesMustafa AdilBelum ada peringkat

- Delphi - Technical Reference Card 7.210Dokumen2 halamanDelphi - Technical Reference Card 7.210naxo128Belum ada peringkat

- AP Invoice MappingDokumen8 halamanAP Invoice MappingBala KulandaiBelum ada peringkat

- Heinz Family Foundation 2006 990Dokumen82 halamanHeinz Family Foundation 2006 990TheSceneOfTheCrimeBelum ada peringkat

- S.No Content Page No.: ContentsDokumen18 halamanS.No Content Page No.: ContentsmbhagavanprasadBelum ada peringkat

- Nofile Enquiry: T24 Api ProgrammingDokumen29 halamanNofile Enquiry: T24 Api ProgrammingTe Akphecheat100% (1)

- Table Doc Field MappingDokumen29 halamanTable Doc Field MappingFernando AndradeBelum ada peringkat

- SQL Exam QuestoinsDokumen6 halamanSQL Exam Questoinsvamsi krishnaBelum ada peringkat

- Earl H Carroll Financial Disclosure Report For 2010Dokumen8 halamanEarl H Carroll Financial Disclosure Report For 2010Judicial Watch, Inc.Belum ada peringkat

- Select Sum (LINE - UNITS From Line Group by INV - NUMBERDokumen10 halamanSelect Sum (LINE - UNITS From Line Group by INV - NUMBERAlgn AdityaBelum ada peringkat

- RMC No. 25-2024 - Annex BDokumen1 halamanRMC No. 25-2024 - Annex BAnostasia NemusBelum ada peringkat

- ABAP Dialog Programming Examples (Scribd)Dokumen52 halamanABAP Dialog Programming Examples (Scribd)wyfwongBelum ada peringkat

- Dbms Lab FileDokumen31 halamanDbms Lab Filesaqlain4462Belum ada peringkat

- Good SQL2Dokumen4 halamanGood SQL2balasukBelum ada peringkat

- Yealink Action URIDokumen2 halamanYealink Action URIakkaBelum ada peringkat

- Titleseqid: T - Retail - Master Target Table Name Description Column DescriptionDokumen52 halamanTitleseqid: T - Retail - Master Target Table Name Description Column DescriptionRaju ChhachaBelum ada peringkat

- Soln 20 Mar 23Dokumen5 halamanSoln 20 Mar 23payalssc21Belum ada peringkat

- T24 Field FormatsDokumen13 halamanT24 Field FormatsHamza SandliBelum ada peringkat

- SAP S4 HANA Tcode FICODokumen1.264 halamanSAP S4 HANA Tcode FICOArshad40% (5)

- Specifications MT940 BNPP BelgiumDokumen63 halamanSpecifications MT940 BNPP BelgiumljsilvercoolBelum ada peringkat

- How Do Different Political Ideologies and Perspectives On Gun Control Implicate The Individuals and Societies?Dokumen12 halamanHow Do Different Political Ideologies and Perspectives On Gun Control Implicate The Individuals and Societies?Andy HuỳnhBelum ada peringkat

- Lending Guidelines For Motorcycle Loan 2024Dokumen1 halamanLending Guidelines For Motorcycle Loan 2024Arnel AycoBelum ada peringkat

- Form - U17 - UIF - Payment AdviceDokumen2 halamanForm - U17 - UIF - Payment Advicesenzo scholarBelum ada peringkat

- Mortgage Broker Resume SampleDokumen2 halamanMortgage Broker Resume Sampleresume7.com100% (1)

- Jones v. Superior CourtDokumen4 halamanJones v. Superior CourtKerriganJamesRoiMaulitBelum ada peringkat

- RHYTHM JAIN - RKMP - NZM - 8april23 - 8201794717Dokumen3 halamanRHYTHM JAIN - RKMP - NZM - 8april23 - 8201794717Puru AppBelum ada peringkat

- July 5, 2014Dokumen16 halamanJuly 5, 2014Thief River Falls Times & Northern WatchBelum ada peringkat

- Punjab Rented Premises Act 2009Dokumen13 halamanPunjab Rented Premises Act 2009humayun naseerBelum ada peringkat

- Buddhist Art in AsiaDokumen282 halamanBuddhist Art in Asiaخورشيد أحمد السعيدي100% (3)

- Va Tech ReportDokumen260 halamanVa Tech Reportbigcee64Belum ada peringkat

- Laurel Training Non IndDokumen27 halamanLaurel Training Non Indmadhukar sahayBelum ada peringkat

- Internship Report On Capital Structure of Islamic Bank LimitedDokumen47 halamanInternship Report On Capital Structure of Islamic Bank LimitedFahimBelum ada peringkat

- All India Bank Officers AssociationDokumen14 halamanAll India Bank Officers AssociationIndiranBelum ada peringkat

- PO Interview Questions and AnswersDokumen6 halamanPO Interview Questions and AnswersSuneelTejBelum ada peringkat

- 01 Baguio Country Club Corp. v. National Labor Relations CommissionDokumen4 halaman01 Baguio Country Club Corp. v. National Labor Relations CommissionGina RothBelum ada peringkat

- Agael Et - Al vs. Mega-Matrix (Motion For Reconsideration)Dokumen5 halamanAgael Et - Al vs. Mega-Matrix (Motion For Reconsideration)John TorreBelum ada peringkat

- Chapter 11 - Public FinanceDokumen52 halamanChapter 11 - Public FinanceYuki Shatanov100% (1)

- Contract of Insurance - Classification of Contract of InsuranceDokumen10 halamanContract of Insurance - Classification of Contract of Insurancesakshi lohan100% (1)

- II Sem English NotesDokumen8 halamanII Sem English NotesAbishek RajuBelum ada peringkat

- Contemporary Populists in Power: Edited by Alain Dieckhoff Christophe JaffrelotDokumen317 halamanContemporary Populists in Power: Edited by Alain Dieckhoff Christophe JaffrelotRahul ShastriBelum ada peringkat

- Noccbseicse 11102011Dokumen6 halamanNoccbseicse 11102011josh2life100% (1)

- Dist. Level Police Training KandhmalDokumen9 halamanDist. Level Police Training Kandhmalsankalp mohantyBelum ada peringkat

- Ellen G. White's Writings - Their Role and FunctionDokumen108 halamanEllen G. White's Writings - Their Role and FunctionAntonio BernardBelum ada peringkat

- Emmanuel Ekhator - Nigerian Law Firm Scam IndictmentDokumen22 halamanEmmanuel Ekhator - Nigerian Law Firm Scam IndictmentJustia.comBelum ada peringkat

- Syllabus UCC Business Law and Taxation IntegrationDokumen9 halamanSyllabus UCC Business Law and Taxation IntegrationArki Torni100% (1)

- Alabama LawsuitDokumen8 halamanAlabama LawsuitSteveBelum ada peringkat

- Database For Delhi-FinalDokumen797 halamanDatabase For Delhi-Finalmailabhinav0% (1)

- Civil Law (And Practical Exercises) 2022 Bar SyllabusDokumen45 halamanCivil Law (And Practical Exercises) 2022 Bar SyllabusAndrew M. AcederaBelum ada peringkat

- I WANT THIS. NYCTCM Catalog 2017-2018 PDFDokumen55 halamanI WANT THIS. NYCTCM Catalog 2017-2018 PDFLisa BraffBelum ada peringkat

- Texto 2 - Donnelly - Human Rights - A New Standard of CivilizationDokumen23 halamanTexto 2 - Donnelly - Human Rights - A New Standard of CivilizationGabriel AzevedoBelum ada peringkat