Place of Supply

Diunggah oleh

vaibhav patwariJudul Asli

Hak Cipta

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniPlace of Supply

Diunggah oleh

vaibhav patwariLAWEMPIRE

PLACE OF SUPPLY

PLACE OF SUPPLY INTER STATE AND INTRA STATE

SUPPLY

1. If supplier of goods or service and place of supply of goods or service are located

in same state - (CGST and SGST payable)

2. If supplier and place of supply are located in different state - (IGST payable)

IGST Act,2017 : Statutory provision of place of supply of goods or service are given in

section 10 to 13 of IGST Act.

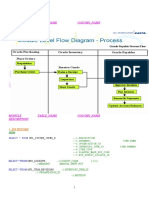

Supply involves movement of Where movement of

goods goods terminates

Where goods are delivered by

Place of supply will be

supplier to recipients on

location of third person

direction of third person

Supply doesnt involve Place of supply shall be location of

movement of goods such goods

Where goods are assembled and

install at site The place of installation

or assembly

Goods are supplied on board a

conveyance Place where goods are

loaded

OTHER SUPPLY Decided by CG on

recommendation of GST

council

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 9

LAWEMPIRE

PLACE OF SUPPLY

A. PLACE OF SUPPLY [POS] - Supply involves movement of

goods

Case 1. Mr X Of Mumbai receive an order for supply of one ton metal from Mr.Y who is also

from mumbai (Price quoted by Mr. X is including freight amount) So mr. X arranges for

transportation of goods to Mr. Y at Ahmadabad The movement of goods terminates at

Ahmadabad place of supply of goods.

Case 2. But in above case, Mr. Y says that I will send Mr.A with Truck and Load the goods in

that Truck from Mumbai then also movement of goods terminate at Ahmadabad for place of

supply of goods.

B. PLACE OF SUPPLY [POS] - Where goods are delivered by

supplier to recipients on direction of third person

CASE 1 Where the goods are delivered by the supplier to a recipients or any other person on

direction of third person

Place of supply shall be deemed to be office of the person who has directed to

deliver such goods[i.e. location of third person]

Place of termination of movement of goods will not be place of supply.

But mr. X company directs Mr. Y to deliver the goods to Mr. Z in Gujarat

So Mr. X company directs Mr. Y to deliver the goods to Mr. in Gujarat

Delivery of goods takes place in Gujarat

[In this place of supply is location of Mr.X act as agent for m/s Z as

principal]

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 10

LAWEMPIRE

PLACE OF SUPPLY

C : PLACE OF SUPPLY [POS] - Where supply doesnt involve

movement of goods:

Place of supply shall be location of such goods at the time of delivery to recipient.

It doesnt matter what is location of buyer and location of supplier

Case 1 : X goods stored at godown located in Bhopal(M.P.) Mr.A owner of goods located in

Mumbai and Mr. B also located in Mumbai approaches Mr.A for purchase of goods lying in

Bhopal and Mr. B further inform that he doesnt want delivery of goods in Mumbai

- So Mr A can issue document for transfer of ownership of goods lying in Bhopal to Mr.B

- Then Place of supply is Bhopal it is an interstate supply IGST will be applicable.

Case 2 : We can say in financial leasing Where lease period over, then property can pass to

lessee at very normal amount and it doesnt involve movement of goods from one place to

another

Then also place of supply will be as per this rule.

Case 3 : No movement - job worker making capital goods for the principal but himself uses for

making goods for the principal.

D : PLACE OF SUPPLY [POS]section 5(4) - When goods are assembled

or installed at site(clause (d) of section 10(1) ) place of supply shall be the place

of installation or assembly It doesnt matter what is location of buyer and

seller.

Case 1 : X from Mumbai place order to Mr. Y for installation of generator in his factory located

at branch, Gujrat

- Mr. y procures Generator, set of chimney, Electrical cable, distribution board, other item

from different state in the country and arrange for delivery in branch ,gujrat, IGST will

be applicable

E. PLACE OF SUPPLY [POS]section 5(5) - Where goods are supplied

on board a conveyance - if goods are supplied in a train / aircraft / vessel to the

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 11

LAWEMPIRE

PLACE OF SUPPLY

passenger then Goods are loaded in the train from particular station But actual consumption of

goods may take place at subsequence station Place of supply will be the place where goods

are loaded

Case 1: Rajdhani train(Mumbai to delhi) : Mr. X supplied bed rolls which are given to the

passengers at night times. Bed rolls are loaded at Mumbai central station and it supplied when

passenger require then place of supply will be Mumbai.

F. Other supply [Residuary Rule] section 5(6): Place of supply decided by

CG on recommendation of GST council.

PLACE OF SUPPLY IN CASE OF INSURANCE BUSINESS

Life insurance

Service to registered

Service to

person like keyman

unregistered person

policy,group policy

POS= location of POS = principal

receipt of service on place of business of

record of supplier registered person

IF THERE IS CHANGE IN THE ADDRESS OF RECIPIENT

Intimate to insurance

Not intimated to

company by recipients

insurance company by

receipient

POS = on the basis of

POS = on the basis of

new records available

old records available

with insurance company

with insurance co.

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 12

LAWEMPIRE

PLACE OF SUPPLY

General insurance

Insurance on various types of assets : building, plant

and machinery, stock in trade etc.

POS = location of reciepients of service (not the

location of assets of business)

Example: X company has factory in Himachal Pradesh, Chennai, and Karnataka and

office in Mumbai. X company has registered in Mumbai under GST. The X company

obtains insurance for the assets located at Himachal Pradesh, Chennai, Karnataka

and Mumbai from insurance company located at delhi.

The place of supply of service by the insurance company would be Mumbai

i.e. the location of X company where it has obtained registration. The location

of assets which are insured has no relevance in determining the place of

supply of service.

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 13

LAWEMPIRE

PLACE OF SUPPLY

Banking/ other financial

services 6(13)

Address of recipient is Address of recipient is not known

known

POS = location of supplier

POS = location of recipient

of service

of service on record of

supplier of service

Example : If the customer who does not have any

account with the bank comes for obtaining a Demand

Draft. He deposits Rs. 5,000 across the counter and

fill up the form the address of the recipient of service

is not on the record of the bank . therefore as per the

provision the place of supply shall be the location of

the supplier

Stock broking services

As per SEBI regulation every client of stock broker is required to keep

certain margin deposit with the broker which shall be payable by

broker to S.E.[STOCK EXCHANGE]

Address of client in the record of stock broker is generally available

POS = place of location of recipients of service on the record of the service

Example: stockbroker is located in Mumbai but his clients are spread over Kolkata,

Chennai, Bangalore, etc. The stockbroker purchase and sell all securities on behalf of

client as per the record of stockbroker. As these clients are located in Kolkata,

Chennai, Bangalore etc. The place of supply of service will be the respective places of

recipient of service. Since these person are located outside Mumbai the stockbroker

will have to charge IGST in each of the case

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 14

LAWEMPIRE

PLACE OF SUPPLY

SERVICE PROVIDED BY WAY TELECOMMUNICATION[6(12)]

A) B) C) D)

Fixed Post paid

In case where mobile In case where

telecommunicati basis

connection for not covered

on line, leased

telecommunication are under (b) and (c)

circuits cable or

provided on

dish anteena Location of prepayment through

billing address voucher

of receipient of

ADDRESS OF

POS = location service on

RECIPIENT AS

where record of

PER RECORDS

telecommunication supplier of

OF SUPPLIER

line leased circuit or service

cable connection or

dish antenna is

installed for receipt By any person to final

Through selling agent

of service subscriber = location

= address of selling

agent or reseller or where such pre pay .

distribution as per is received or such

records of supplier at voucher are sold

the time of supply

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 15

LAWEMPIRE

PLACE OF SUPPLY

PLACE OF SUPPLY IN CASE OF IMPORT AND EXPORT

OF GOODS

Section 11 of IGST Act

Section 11(1) Section 11(2) Place of

Determination of supply in case of

place of supply of export from india

goods imported in

india

POS = location of POS = location

importer outside india

PLACE OF SUPPLY OF SERVICE SHALL BE PLACE OF ACTUAL

PERFORMANCE:

The place of supply of the said services shall be the location where the

services are actually performed.

a. Student X joins coaching class Y located in Kota , Rajasthan. The student enrolls

himself and pays the fee. In such case, the service receiver is student himself . The

location of coaching class at Kota, Rajasthan will be considered as place of supply.

b. Company X deputes manager Y for certain course conducted by IIM ahmedabad in

ahmedabad. The manager undergoes training in the course at ahmendabad.

Manager Y is representing the company X and has not joined the course in his

personal capacity. In this case Mr.Y also is acting on behalf of the service receiver

X. In such case also the place of supply of service is where the services are

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 16

LAWEMPIRE

PLACE OF SUPPLY

performed. As the course is conducted in ahmedabad, the place of supply of service

will be ahmedabad.

Place of supply of:

Restaurant services,

catering services,

Personal grooming services,

Fitness services,

beauty treatment services, and

Health service including cosmetic and plastic surgery

shall be the location where the services are actually performed.

Some of the above services may relate to businesses and business events - it would have

been better to tax esp. Catering at the place where the recipient is located (in case of

businesses)

What would be the place of supply in case where the home delivery of food by

restaurant. Whether it would be the

location of restaurant i.e. where the food is actually prepared or

it will be the location where the food is delivered

Whether place of supply for delivery charges would also be governed as per the said

subsection

If personal grooming services provided over internet such as english

speaking classes then how to determine place of supply

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 17

LAWEMPIRE

PLACE OF SUPPLY

Place of supply for services in relation to immovable property

It Shall be the place where the immovable property is located or is intended to

be located.

Place of supply of services

1. in relation to:

immovable property, including services provided by:

architects,

interior decorators,

surveyors,

engineers

and other related experts or estate agents,

any service provided by way of grant of rights to use immovable

property or for carrying out or co-ordination of construction work, or

2. By way of lodging accommodation by a:

hotel,

Inn,

Guest house,

Homestay,

Club,

Campsite, by whatever name called,

houseboat, or

Any other vessel

3. By way of accommodation in any immovable property for organizing any marriage or

reception or matters related therewith, official , social, cultural, religious, or business

function including services provided in relation to such function at such property

4. Any service ancillary to the services above shall be the location at which the

immovable property or boat or vessel is located or intended to be located.

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 18

LAWEMPIRE

PLACE OF SUPPLY

When the property/boat/vessel is located in more than one State, the supply

of service shall be treated as made in each of these states in proportion to the

value for services separately collected or determined, in terms of the contract

or agreement entered into in this regard

Section 6(6) Services relating to training and performance appraisal

Place of supply of services in relation to training and performance appraisal:

To a registered person shall be the location of such person

To a person other than registered person shall be location where the

Section 6(7) Services relating to admission to event/ park

Place of supply services provided by way of:

1. Admission to a

cultural event,

Artistic event,

Sporting event,

Scientific event,

Educational event,

entertainment event,

Amusement park, or

Any other place

AND

1. Services ancillary to admission

2. shall be the place where the event is actually held or such place is located.

Section 6(8) Services relating to events

Place of supply of services provided by way of:

Organization of a cultural, artistic, sporting, scientific, educational or

entertainment event including supply of services in relation to a conference,

fair, exhibition, celebration or similar events, or

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 19

LAWEMPIRE

PLACE OF SUPPLY

Services ancillary to organization of any of the above events or services, or

assigning of sponsorship of any of the above events:

To a registered person shall be the location of such person

To a person other than a registered person shall be the place where

the event is actually held

Where the event is held in more than one State and a consolidated amount is charged for

supply of services relating to such event, the place of supply of such services shall be taken

as being in the each of the states in proportion to the value of services so provided in each

State as ascertained from the terms of the contract or agreement entered into in this regard

or, in absence of such contract or agreement, on such other reasonable basis as may be

prescribed in this behalf

Section 6 (9) Transportation of goods service

Place of supply of services by way of transportation of goods including mail or

courier:

To a registered person - shall be the location of such person

To a person other than registered person shall be the location of at which

such goods are handed over for their transportation.

Analysis

Contradictory with the current Rule. As per the current rule place of supply of such

services is the location where the goods are destined for.

As per this sub-section, if a person exports some goods out of India, the place of

provision service for transporting such goods would be in India and thus it the said

service would not qualify as export of service: all recipients outside India would be

unregistered persons only.

Likewise, if a person situated outside India sends some goods to India the place of

provision would be outside India.

Section 6(10) Passenger transportation service

continuous journey means a journey for which a single or more than one ticket or

invoice is issued at the same time, either by a single supplier of service or through an

agent acting on behalf of more than one supplier of service, and which involves no

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 20

LAWEMPIRE

PLACE OF SUPPLY

stop over between any of the legs of the journey for which one or more separate

tickets or invoices are issued;

o For the purposes of this clause, stopover means a place where a passenger

can disembark either to transfer to another conveyance or break his journey

for a certain period in order to resume it at a later point of time.

Section 6 (11) Services on board a conveyance

Place of supply for services on board a conveyance such as vessel, aircraft, train or

motor vehicle shall be

the location of the first scheduled point of departure of that conveyance for the

journey

Manner of determining the place of provision of services under this sub-section is

same as that in the current place of provision of service rules.

Section 6 (12) Telecommunication services

Place of supply of Telecommunication services including data transfer, broadcasting,

cable and direct to home television to any person shall:-

In case of services by way of fixed telecommunication line, leased circuits,

internet leased circuit, cable or dish antenna location where the

telecommunication line, leased circuit, cable connection or dish antenna is

installed for receipt of services.

In case of mobile connection for telecommunication and internet services

provided on-

post-paid basis be the location of billing address of service recipient

on record of service provider.

pre-paid basis be the location of where such pre-payment is received

or such vouchers are sold.

Provided that if such service is availed through internet banking or

other electronic mode of payment, place of supply shall be the location

of the service receiver on record of service provider.

Section 6 (13) Banking and other financial services

Place of supply for banking and other financial services including stock broking

services to any person shall be

the location of the recipient of services on records of the supplier of services.

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 21

LAWEMPIRE

PLACE OF SUPPLY

If the service is not linked to the account of the recipient of services, the place of

supply shall be the location of the supplier of services.

Some examples of such service can be 1) Currency Exchanges; 2) preparation

of demand draft by banks on cash deposit; 3) discounting of bills of exchange

etc.

It is not clear if this sub-section is applicable to services provided by

commodity exchanges or commodity traders.

Section 6 (14) Insurance Services

Section 6(15) Advertisement services to Government

Place of supply of Advertisement services to:

CG/ SG/ Statutory body/ local authority

meant for identifiable states

shall be taken as located in each of such States.

THANK YOU

To get Practical case study booklet

CONTACT US : SHWETA AGARWAL & CO.

(CHARTERED ACCOUNTANTS)

Ist floor,law empire,Near income tax office,Shastri

nagar,Bhilwara-311001

Mobile No.+91-9672405697

Email id : d15_shweta@yahoo.co.in

SHWETA AGARWAL [CA,CS,CMA] +9672405697 Page 22

Anda mungkin juga menyukai

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- R12 Oracle Payables Management Fundamentals - PracticesDokumen349 halamanR12 Oracle Payables Management Fundamentals - Practicessatissh79100% (1)

- Accounting For Share CapitalDokumen72 halamanAccounting For Share CapitalApollo Institute of Hospital Administration100% (5)

- Invoice Print PDFDokumen1 halamanInvoice Print PDFKuladeep Naidu PatibandlaBelum ada peringkat

- JD Edwards World Advanced Pricing A91 GuideDokumen229 halamanJD Edwards World Advanced Pricing A91 GuidestrikerjaxBelum ada peringkat

- Tax Case Digest IDokumen53 halamanTax Case Digest INiño Galeon MurilloBelum ada peringkat

- Macroeconomic Indicators: What They Are & How To Use ThemDokumen32 halamanMacroeconomic Indicators: What They Are & How To Use Themvaibhav patwariBelum ada peringkat

- Receipt Summary BuchuDokumen1 halamanReceipt Summary BuchuAnkit NandeBelum ada peringkat

- Borgwarner Supplier ManualDokumen63 halamanBorgwarner Supplier ManualBertha Uribe100% (1)

- SAP Brazil GRC NFE OverviewDokumen29 halamanSAP Brazil GRC NFE OverviewdhanahbalBelum ada peringkat

- In V 1575339299Dokumen3 halamanIn V 1575339299abdullah amanullahBelum ada peringkat

- Overview of Oracle Project BillingDokumen125 halamanOverview of Oracle Project Billingmukesh697100% (2)

- SAP Retail SAP Press Irt100Dokumen257 halamanSAP Retail SAP Press Irt100BismilBelum ada peringkat

- Maintain Gr/IR Clearing AccountDokumen2 halamanMaintain Gr/IR Clearing AccountfaxmolderBelum ada peringkat

- 19620873833337AI21128Dokumen1 halaman19620873833337AI21128Muhammad Al BulushiBelum ada peringkat

- UAE VAT LawDokumen307 halamanUAE VAT LawRajendran Suresh100% (1)

- PPP Credit Basics I Cba August 82017Dokumen26 halamanPPP Credit Basics I Cba August 82017vaibhav patwariBelum ada peringkat

- The Business Plan PDFDokumen42 halamanThe Business Plan PDFvaibhav patwariBelum ada peringkat

- Economy TermsDokumen90 halamanEconomy TermsSabyasachi SahuBelum ada peringkat

- When You Succeed Don't Fly Saugata Gupta Marico CEO - The EDokumen1 halamanWhen You Succeed Don't Fly Saugata Gupta Marico CEO - The Evaibhav patwariBelum ada peringkat

- Lunenburg, Fred C, Communication Schooling V1 N1 2010 - 2Dokumen11 halamanLunenburg, Fred C, Communication Schooling V1 N1 2010 - 2Faisal MunirBelum ada peringkat

- English Learning CourseDokumen23 halamanEnglish Learning CourseIsmeet SinghBelum ada peringkat

- EF - English Grammar Writing Your CVDokumen16 halamanEF - English Grammar Writing Your CVEdson Ribeiro100% (2)

- Lunenburg, Fred C, Communication Schooling V1 N1 2010 - 2Dokumen11 halamanLunenburg, Fred C, Communication Schooling V1 N1 2010 - 2Faisal MunirBelum ada peringkat

- Bom PresentationDokumen12 halamanBom Presentationvaibhav patwariBelum ada peringkat

- Portfolio ConstituencyDokumen5 halamanPortfolio Constituencyvaibhav patwariBelum ada peringkat

- The Business Plan PDFDokumen42 halamanThe Business Plan PDFvaibhav patwariBelum ada peringkat

- English Conversation-Ebook PDFDokumen36 halamanEnglish Conversation-Ebook PDFRizka Sitti MuliyaBelum ada peringkat

- Interview English: The Ef Englishtown Guide ToDokumen17 halamanInterview English: The Ef Englishtown Guide Toviraj adhikariBelum ada peringkat

- SWOT Analysis of TITAN - 62004382Dokumen11 halamanSWOT Analysis of TITAN - 62004382vaibhav patwariBelum ada peringkat

- Types of Capital: Dharmesh Patel E-12Dokumen7 halamanTypes of Capital: Dharmesh Patel E-12vaibhav patwariBelum ada peringkat

- 0 - Level 1cell Ref & Logical OperatorsDokumen29 halaman0 - Level 1cell Ref & Logical Operatorsvaibhav patwariBelum ada peringkat

- Sales Report 1Dokumen13 halamanSales Report 1D Wahyu BawonoBelum ada peringkat

- Importance of Research DesignDokumen3 halamanImportance of Research Designvaibhav patwariBelum ada peringkat

- Start With 2008 and Find Values Till 2020, of RevenuesDokumen8 halamanStart With 2008 and Find Values Till 2020, of Revenuesvaibhav patwariBelum ada peringkat

- 0 Zero Level ExcelDokumen12 halaman0 Zero Level Excelvaibhav patwariBelum ada peringkat

- Case Study NewDokumen128 halamanCase Study Newvaibhav patwariBelum ada peringkat

- Intro To Pivot Tables and Dashboards - Part 3Dokumen46 halamanIntro To Pivot Tables and Dashboards - Part 3vaibhav patwariBelum ada peringkat

- 28895cpt Fa SM cp3Dokumen28 halaman28895cpt Fa SM cp3Lenin KumarBelum ada peringkat

- 28895cpt Fa SM cp3Dokumen28 halaman28895cpt Fa SM cp3Lenin KumarBelum ada peringkat

- He Wanted To Know AboutDokumen1 halamanHe Wanted To Know Aboutvaibhav patwariBelum ada peringkat

- Expansion Project - ABC Company Wants To Setup A New Project. Following Are The Investment Needed - BuildingDokumen4 halamanExpansion Project - ABC Company Wants To Setup A New Project. Following Are The Investment Needed - Buildingvaibhav patwariBelum ada peringkat

- Microsoft EdgeDokumen3 halamanMicrosoft Edgevaibhav patwariBelum ada peringkat

- 28895cpt Fa SM cp3Dokumen28 halaman28895cpt Fa SM cp3Lenin KumarBelum ada peringkat

- Nafith Logistics Services LLC Tax InvoiceDokumen1 halamanNafith Logistics Services LLC Tax InvoiceMaan JuttBelum ada peringkat

- Flow of Source DocumentsDokumen2 halamanFlow of Source DocumentsManjari RelanBelum ada peringkat

- Taco 230803PF00985414 2Dokumen1 halamanTaco 230803PF00985414 2roy.somnath.wkBelum ada peringkat

- Configuration T Codes in SAP MMDokumen18 halamanConfiguration T Codes in SAP MMbeema1977100% (1)

- Smart Aug 2018Dokumen6 halamanSmart Aug 2018Ash MangueraBelum ada peringkat

- Discounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights ReservedDokumen23 halamanDiscounts: Trade and Cash: Mcgraw-Hill/Irwin ©2008 The Mcgraw-Hill Companies, All Rights Reservedmohamed atlamBelum ada peringkat

- Tax Invoice 67Dokumen1 halamanTax Invoice 67shiva kumarBelum ada peringkat

- SMC Nov2023, Kolkata OfficeDokumen12 halamanSMC Nov2023, Kolkata OfficeSib MktgBelum ada peringkat

- Credito Document A RioDokumen2 halamanCredito Document A RioFrancescoHernándetzBelum ada peringkat

- Table - Name Column - Name Description: 1. InventoryDokumen17 halamanTable - Name Column - Name Description: 1. InventorypolimerasubbareddyBelum ada peringkat

- Lesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSDokumen6 halamanLesson 9 - JOURNALIZING EXTERNAL TRANSACTIONSMayeng MonayBelum ada peringkat

- Service & Rate GUIDE 2022: JapanDokumen27 halamanService & Rate GUIDE 2022: JapanLebleuBelum ada peringkat

- Compound Wall Tender (Kadapa)Dokumen90 halamanCompound Wall Tender (Kadapa)div_misBelum ada peringkat

- 1905 (Encs) 2000Dokumen2 halaman1905 (Encs) 2000Victor BiacoloBelum ada peringkat

- AC InvoiceDokumen1 halamanAC InvoiceKamal ShaivaBelum ada peringkat

- Oracle® E-Commerce Gateway: User's Guide Release 12.2Dokumen148 halamanOracle® E-Commerce Gateway: User's Guide Release 12.2yadavdevenderBelum ada peringkat

- Coc Project FinalDokumen46 halamanCoc Project FinalMYTHRIYA DEVANANDHANBelum ada peringkat