Agoa Uganda May 2017

Diunggah oleh

The Independent MagazineHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Agoa Uganda May 2017

Diunggah oleh

The Independent MagazineHak Cipta:

Format Tersedia

AGOA 101 UGANDA

How To Export Duty-Free From Uganda To The U.S. Under The

African Growth And Opportunity Act (AGOA)

Competitive AGOA Exports From Uganda To USA

2 AGOA 101 Uganda

What is AGOA?

The African Growth and Opportunity Act (AGOA) is a United States Trade Act enacted on May 18, 2000 as

Public Law 106 of the 200th Congress. On June 29, 2015, U.S. President Barack Obama signed the AGOA

Trade Preferences Extension Act 2015 into law, extending the AGOA legislation by a further 10 years, to

2025. The legislation significantly enhances market access to the U.S. for qualifying sub-Saharan African

(SSA) countries. AGOA builds on existing U.S. trade programs by expanding the duty-free benefits previously

available only under the Generalized System of Preferences (GSP) program. GSP is a trade program designed

to promote economic growth in developing countries by providing preferential duty-free entry.

AGOA combined with GSP, provides duty-free access to the U.S. for approximately 7,000 products.

Why this guide?

The USAID East Africa Trade and Investment Hub supports East African businesses to take advantage of

AGOA. This guide outlines the step-by-step process that Ugandan businesses should take to export to the

U.S. duty-free through AGOA. Exporting can be a challenging process, but it can also be profitable for the

individual or company that manages to do it successfully. Exporters must follow two sets of requirements:

1.) The Ugandan laws and regulations that govern the export process, and

2.) The laws and regulations that govern the destination countrys imports, in this case, the U.S.

Regulations vary according to the product being exported; exporters must research to ensure that their product

meets the necessary requirements for export. Exporters should identify the correct tariff code and its eligibility

for duty free export under AGOA. This status can be established by referring to https://agoa.info/about-agoa/

products.html and inserting the product name, searching for correct tariff code and confirming its AGOA

AGOA 101 Uganda 3

status - denoted by letter D in the special tariff category column. Exporters should familiarize themselves

with US industry standards and product-specific regulations which may require additional documentation and

procedures. This guide assumes that the exporter or potential exporter has already conducted the necessary

market research, and is ready to export. It highlights the process of exporting goods from Uganda to the U.S.

under AGOA, with a focus on the following sectors: textile and apparel, floriculture, home dcor and fashion

accessories, footwear and specialty foods and products, including:

Coffee Fish Casein Vanilla Dried Fruits Shea Butter

A Ugandan AGOA exporter of Shea Butter products.

AGOA Export Requirements

Step 1: Business Registration

The exporting entity must be registered. It is a statutory requirement that every business operating in Uganda

must be registered and/or fully incorporated. This registration is important for businesses and export-related

transactions, and demonstrates credibility and legality of the entity. The business registration process in

Uganda is managed by the Uganda Registration Services Bureau (URSB).

The process is as follows:

Make an application for reservation of a name.

Upon payment of the required fee, the suggested name is subjected to a search in the Business Registry

Database. Once the name passes the similarity, defensive, offensive, desirability test then it is reserved.

Reservation is valid for 30 days.

Submit all the documents for business registration with

applications and receipts of payment of necessary fees.

4 AGOA 101 Uganda

Information on assessment or payment registration of the required fee is done at the Business Registry, found

at the URSB offices; or, the client may use the self-assessment option on the Uganda Revenue Authority

(URA) web portal. In most cases, this payment for registration is done at the bank. Present the documents

for registration with the receipt, after which you can now obtain a certificate of incorporation/registration

within 16-24 working hours.

Step 2: Prepare And Obtain Export Documents

The following is a list of documents required for export transactions:

Commercial Invoice

Bill of Lading or Airway Bill

Export Packing List

Certificate of Origin or AGOA Certificate of Origin for textile and apparel (visa) (annex)

Commercial Invoice

A commercial invoice is the bill for the products from seller to buyer. It is required for most imports into

the United States. The buyer needs the invoice to prove ownership and arrange payment. It may also be used

for transactions such as goods not intended for further sale, returned products and goods intended only for

temporary import among other purposes.

The invoice must contain the following:

Complete name and address of the buyer or importer, seller or manufacturer and the shipper;

Detailed description of the products with quantities, and the Harmonized System (HS) codes of the goods;

Total value per item;

The country of origin, with reason for export; and

A statement certifying that the invoice is true, and a signature.

Bill of Lading or Airway Bill:

This is a contract between the owner of the products and the carrier. They are two types, namely:

1. A straight bill of lading, which is non-negotiable, and

2. The negotiable/shippers order bill of lading, which can be bought, sold, or traded while

goods are in transit and is used for letter-of-credit transactions. The customer usually needs a copy

of the bill of lading as proof of ownership to take possession of the goods.

Export-Packing List

An export-packing list specifies the material in each individual package and shows the individual net, legal,

tare and gross weights in U.S. and metric values. The packing list is normally attached to the outside of the

package in a clearly marked waterproof envelope. It is a useful document for customs officials who use it to

check consignments at inspection points.

Certificate of Origin

The Certificate of Origin (CoO) is a document indicating the country of origin for products being imported. It

is usually issued by exporting countries, official authorities or by other agencies designated by the governments

AGOA 101 Uganda 5

where the products originate from. It is used to ensure that products originating in certain countries get

the preferential treatment to which they are entitled.

It includes information such as contact information for the importer, exporter and producer; the basis for

which preferential treatment is claimed; and a description of the imported merchandise. Importers are

required to have the certificate in their possession at the time of the claim and to provide it to Customs

and Border Protection (CBP) officers upon request.

In Uganda, the AGOA Certificate of Origin for Textiles and Apparel (Visa) issued by the Ministry of

Trade, Industry and Cooperatives. The procedure is as follows:

1. First-time exporters are required to fill in an application/registration form;

2. Present the duly-filled-out form to Ministry of Trade, Industry and Cooperatives for assessment;

3. Once the product has been cleared, you will receive a certificate of origin to fill out. This is

done at no cost;

4. Present the filled-out certificate to the designated signatories in the Ministry of Trade, Industry and

Cooperatives for endorsement.

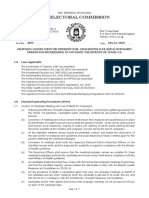

AGOA Certificate of Origin for Textiles and Apparel (Visa)

This is a visa arrangement that establishes documentary procedures for each shipment of AGOA-eligible

textile and apparel products from a designated beneficiary sub-Saharan African country to the U.S.

Normally, the AGOA visa stamp is issued by official authorities designated by the governments where

the products are originating from and is fixed on the commercial invoice. Its main purpose is to avoid

transshipment of products from non-AGOA eligible countries to the U.S.

The Ministry of Trade, Industry and Cooperatives is required to verify that the products intended for

export actually originate from Uganda.

Guidelines for AGOA visa application and processing in Uganda are as highlighted below:

1. A firm visits or writes to the Ministry of Trade, Industry and Cooperatives expressing interest in

exporting under AGOA;

2. The Ministry of Trade, Industry and Cooperatives representatives are then required to verify that the

products intended for export do originate from Uganda. To do this, Ministry of Trade, Industry and

Cooperatives representatives conduct firm visits.

3. On confirmation of origin of the products, the exporter is included in the list of exporters and becomes

eligible for an AGOA visa stamp.

4. The exporter is then required to submit three documents (with four copies each) as part of the process

to apply for the AGOA visa. The documents include:

a. An AGOA visa certificate application form;

b. An invoice with details of the exporter, the importer, the product quantities and values;

c. A packing list indicating the specifics of the products to be exported.

5. If the documents are accurately filled, an AGOA visa stamp is issued to the exporter within a period

of three days. Normally it is issued on the same day (24 hours).

6 AGOA 101 Uganda

The exporter then ships the products with the certificate and declares it to U.S Customs as duty-free under

the AGOA.

Note:

The AGOA visa application process is free.

An AGOA visa is valid for six months.

An AGOA visa is issued for each consignment/invoice.

If an exporter is shipping two different consignments using one invoice, the Ministry of

Trade will issue one AGOA visa.

If an exporter is shipping two different consignments using two different invoices, the

Ministry of Trade will issue two AGOA Visas

If an order or invoice changes, the exporter must apply for a new AGOA visa.

Step 3: Export Logistics

Sending products from one country to another involves many parties. Generally, finished products are

delivered to the U.S. buyers destination. In order to deliver to a U.S. buyers warehouse, or to comply with

certain shipping requirements, large exporters typically have logistics specialists to coordinate and track

shipment. In most cases, exporters rely on international freight forwarders and agencies to perform these

services. Some companies utilize the services of shippers associations. Other companies use express delivery

or mail services. It is also possible for exporters to arrange their own shipping.

In Uganda, most exporters do not carry out the logistics processes on their own; quite often they engage the

services of international freight forwarders to perform these services for them.

AGOA 101 Uganda 7

It is also important to note that export logistics may involve knowing the buyers requirements, including

specifications, quality levels, price, place and time of delivery, packaging, labeling, documentation and

insurance requirements as part of a commercial transaction.

Step 4: Declaration to Customs at U.S. Port of Entry

If you are travel to the U.S with goods for sale or other commercial purposes, you must declare them to a

Custom and Border Protection (CBP) officer. On arrival at the port of entry, you must complete the CBP

Declaration Form 6059B. This form provides basic information about who you are and what you are taking

into the United States. This form is normally provided on the plane for passengers to fill out and submit to

CBP staff.

Additional conditions governing the entry of products according to

the United States International Trade webpage:

Cut Flowers

Cut flowers are admissible for importation into the United States. A cut flower includes the severed portion

of a plant, the inflorescence and any attached plant parts, in a fresh state. In addition to the general import

documentation described earlier, Phytosanitary Certificates is required: Phytosanitary Certificates are

documents for specific plants or plant products issued by an official of an exporting country, or country of re-

export, attesting to freedom from pests and admissibility into the destination country. But even when plants

or plant products are accompanied by a Phytosanitary Certificate, the US Customs and Border Patrol (CBP)

regulatory officials will still inspect the importations to confirm admissibility.

https://www.aphis.usda.gov/import_export/plants/manuals/ports/downloads/cut_flower_imports.pdf

Childrens Footwear

The Consumer Product Safety Improvement Act (CPSIA) enacted in 2008 regulates specific substances in

childrens products, including childrens footwear. The CPSIA sets limits for lead content and phthalates in

childrens products. A childrens product is defined as a consumer product designed or intended primarily

for children 12 years or younger. With respect to childrens footwear, Section 101(a) of the CPSIA restricts

childrens products, including childrens footwear, and components of childrens footwear, to a lead content

limit.

CPSIA Mandatory Third-Party Testing requires every manufacturer or importer of all consumer products

that are subject to a consumer product safety rule enforced by the US Consumer Product Safety Commission

is issued with a general certificate of conformity based on testing the product and stating that the product

complies with the applicable standard, regulation, or ban. The certificate must accompany the product and be

furnished to the retailer or distributor. Section 102 also requires the manufacturers or importers of childrens

products (products designed and intended primarily for children 12 years or younger) to certify that the

products comply with all relevant product safety standards by issuing a childrens product certificate supported

by tests performed by a CPSC-accepted third-party testing laboratory that has been accredited.

https://www.nist.gov/sites/default/files/06272016-guidetousfootwear.pdf

Food Products

Under provisions of the U.S. law contained in the U.S. Federal Food, Drug and Cosmetic Act, importers of

food products intended for introduction into U.S. interstate commerce are responsible for ensuring that the

products are safe, sanitary, and labelled according to U.S. requirements. (All imported food is considered to

8 AGOA 101 Uganda

be interstate commerce). Thus, exporters must meet requirements of U.S. food regulations that includes

food facility registration, U.S. import procedures and Prior Notice.

If your buyer is a first-time importer of food products to the US, they may want to contract the services of

a customs broker (entry filer). Customs brokers are the only persons authorized by the tariff laws of the

United States to act as agents for importers in the transaction of their customs business. Customs brokers

are private individuals or firms licensed by CBP to prepare and file the necessary customs entries, arrange

for the payment of duties, take steps to effect the release of the goods in CBP custody, and otherwise

represent their principals in customs matters.

https://www.fda.gov/food/guidanceregulation/importsexports/importing/default.htm

http://apeda.gov.in/apedawebsite/Announcements/Food-Imports-ino-the-US.pdf

Other Requirements

Textile Product Labels

The Textile Fiber Products Identification Act (TPIA) requires that products have labels. A label is to be

affixed to each textile product and/or its package or container in a secure manner

The label shall be conspicuous and durable enough to remain attached to the product and it package

throughout distribution, sale or resale and until sold and delivered to the ultimate consumer. The label

shall contain the following information:

the generic names and percentages by weight of the constituent fibers in the product

the name under which the manufacturer or other responsible company does business, or in lieu

thereof, the registered identification number (RN number) of such company

The name of the country where the product was processed or manufactured

AGOA 101 Uganda 9

Care Labelling

The Federal Trade Commission (FTC) enforces the Care Labelling rule, requiring manufacturers and

importers or any person or organization that directs or controls the manufacturing of textile wearing

apparel and pieces goods sold to consumers for making piece goods sold to consumer for wearing apparel

to attach care instructions to garments. Goods exempt from this requirement include shoes, gloves, hats,

handkerchiefs, belts, suspenders, neckties and non-woven garments made of one-time use.

Useful Resources

East Africa Trade and Investment Hub

www.eatradehub.org/info

Ministry of Trade, Industry and Co-operatives

Farmers House 3rd Foor

Plot 6-8 Parliament Avenue

P.o.Box 7103 Kampala, Uganda

Tel: +256 414 314226

email: mintrade@mtic.go.ug

www.mtic.go.ug

AGOA Country Response Office

9th Floor, South Wing

Workers House

Tel; +256 414 343222, 343252

susan.muhwezi@agoa.ug

www.agoa.go.ug

Uganda Revenue Authority

Crested Towers 8th Floor

P.o.Box 7279 Kampala, Uganda

Tel: +256 417 440000

dkateshumbwa@ura.go.ug

www.ura.go.ug

Uganda Registration Services Bureau

http://ursb.go.ug

10 AGOA 101 Uganda

Uganda Revenue Authority

www.ura.go.ug

Federal Trade Commission- textile label guidelines

https://www.ftc.gov/tips-advice/business-center/guidance/clothes-captioning-complying-care-labeling-rule

AGOA

www.agoa.info

https://agoa.info/about-agoa/product-eligibility.html

US Customs and Border Protection

www.cbp.gov

Tralac Trade Law Centre

www.tralac.org

United States Consumer Product Safety Commission

http://www.cpsc.gov

United States International Trade Commission - Harmonized Tariff Schedule

https://hts.usitc.gov

Federal Trade Commission - Textile Label Guidelines

https://www.ftc.gov/tips-advice/business-center/guidance/clothes-captioning-complying-care-labeling-rule

Annexes

Sample Commercial Invoice

Sample Certificate of Origin Form

Sample AGOA Textile Certificate of Origin Form

Sample US Customs Entry Form 7501

AGOA 101 Uganda 11

SAMPLE COMMERCIAL INVOICE

12 AGOA 101 Uganda

SAMPLE CERTIFICATE OF ORIGIN FORM

AGOA 101 Uganda 13

14 AGOA 101 Uganda

SAMPLE AGOA TEXTILE CERTIFICATE OF ORIGIN FORM

AGOA 101 Uganda 15

16 AGOA 101 Uganda

SAMPLE US CUSTOMS ENTRY FORM 7501

AGOA 101 Uganda 17

18 AGOA 101 Uganda

About the USAID East Africa Trade

and Investment Hub

The USAID East Africa Trade and Investment Hub works to boost trade and investment with and

within East Africa.

The goal of the Hub is to deepen regional integration, increase the competitiveness of select regional

agriculture value chains, promote two-way trade with the U.S. under the African Growth and

Opportunity Act (AGOA) and facilitate investment and technology that drives trade growth intra-

regionally and to global markets.

Our main focus is on the East African Community countries - Kenya, Rwanda, Tanzania and

Uganda. We also provide AGOA-related support in Ethiopia, Madagascar and Mauritius.

The USAID East Africa Trade and Investment Hub is a proud component of two U.S. presidential

initiatives, Trade Africa and Feed the Future.

Contact:

The East Africa Trade and Investment Hub Andrew Kaggwa

Goodman Tower, Westlands. Country Representative - Uganda

P.O. Box 13403 - 00800 The East Africa Trade and Investment Hub

Nairobi, Kenya. T: +256 (0) 722 602 874

E: AKaggwa@eatradehub.org

T: +254 (0) 787 685 389

E: info@eatradehub.org

@InvestEAfrica

www.eatradehub.org AGOA 101 Uganda 19

www.eatradehub.org

Anda mungkin juga menyukai

- Smooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1Dari EverandSmooth Sailing: A Quick Guide to Effective Cargo Import and Export: Logistics, #1Belum ada peringkat

- Export Incentives in IndiaDokumen12 halamanExport Incentives in IndiaFasee NunuBelum ada peringkat

- Uganda Import/Export ProceduresDokumen3 halamanUganda Import/Export ProceduresIvan TumazeBelum ada peringkat

- Customs AssignmentDokumen6 halamanCustoms AssignmentBlessing MapokaBelum ada peringkat

- Import Business: A Guide on Starting Up Your Own Import BusinessDari EverandImport Business: A Guide on Starting Up Your Own Import BusinessPenilaian: 4 dari 5 bintang4/5 (1)

- International Marketing Management: TOPIC: India's Trade Policy & Export DocumentationDokumen6 halamanInternational Marketing Management: TOPIC: India's Trade Policy & Export DocumentationAshiq MohammedBelum ada peringkat

- Ev 7 PauDokumen9 halamanEv 7 PauPaulina LozanoBelum ada peringkat

- Actividad de Aprendizaje 10 Evidencia 6 InglesDokumen11 halamanActividad de Aprendizaje 10 Evidencia 6 InglesMaria Emilcen Sanchez UribeBelum ada peringkat

- Export Import DocumentationDokumen21 halamanExport Import DocumentationSabir ShaikhBelum ada peringkat

- Evidencia 7 Compliance With Foreign LawDokumen11 halamanEvidencia 7 Compliance With Foreign LawAngie VegaBelum ada peringkat

- Evidence 6 Video Steps To ExportDokumen7 halamanEvidence 6 Video Steps To ExportMonika RendónBelum ada peringkat

- SAP GTS - Common Export DocumentsDokumen7 halamanSAP GTS - Common Export DocumentsTapas KunduBelum ada peringkat

- Export Process in ColombiaDokumen23 halamanExport Process in ColombiaFrank QuinteroBelum ada peringkat

- Certificates of Origin ExplainedDokumen5 halamanCertificates of Origin ExplainedSandeepa BiswasBelum ada peringkat

- Export Procedure & Documentation: VIVA College S.Y.B.M.S Roll No. 61to70Dokumen27 halamanExport Procedure & Documentation: VIVA College S.Y.B.M.S Roll No. 61to70Nitin ChauhanBelum ada peringkat

- Apparel Export DocumentationDokumen68 halamanApparel Export DocumentationarivaazhiBelum ada peringkat

- Hub Agoa Primer For Afad Oct 2016Dokumen5 halamanHub Agoa Primer For Afad Oct 2016ireneBelum ada peringkat

- Compliance with foreign lawsDokumen11 halamanCompliance with foreign lawsJorge DeviaBelum ada peringkat

- Import & Export Documentations in International Trade - PPTX - Week - 3Dokumen37 halamanImport & Export Documentations in International Trade - PPTX - Week - 3Kennedy HarrisBelum ada peringkat

- Exim DocumentationDokumen25 halamanExim DocumentationKARCHISANJANABelum ada peringkat

- Compliance with Foreign Laws and RegulationsDokumen6 halamanCompliance with Foreign Laws and Regulationslorena HernandezBelum ada peringkat

- Compliance with foreign laws for export salesDokumen7 halamanCompliance with foreign laws for export salesBrayan MorenoBelum ada peringkat

- Steps To ExportDokumen3 halamanSteps To Exportliceth carolina polo gomezBelum ada peringkat

- Export Procedure and DocumentationDokumen22 halamanExport Procedure and DocumentationnandiniBelum ada peringkat

- EXPORT MANAGEMENT GUIDEDokumen18 halamanEXPORT MANAGEMENT GUIDErash4ever2uBelum ada peringkat

- Actividad de Aprendizaje 11 Evidencia 3: Compliance With Foreign LawDokumen9 halamanActividad de Aprendizaje 11 Evidencia 3: Compliance With Foreign Lawhumberto fabian diaz gamezBelum ada peringkat

- Compliance with foreign law key considerationsDokumen11 halamanCompliance with foreign law key considerationswillian gomezBelum ada peringkat

- Zimflex business documents guide exportsDokumen10 halamanZimflex business documents guide exportsdumisaniBelum ada peringkat

- Determine HS Codes and Tariff RatesDokumen2 halamanDetermine HS Codes and Tariff Ratesnikita sharmaBelum ada peringkat

- Export Import ProcedureDokumen11 halamanExport Import Procedureradia3990Belum ada peringkat

- Presentation "Steps To Export, Jazmin HernándezDokumen10 halamanPresentation "Steps To Export, Jazmin Hernándezsara molinaBelum ada peringkat

- Compliance With Foreign Law Borrador Evidence 7thDokumen7 halamanCompliance With Foreign Law Borrador Evidence 7thCristhiam Esteban Saldaña GuzmánBelum ada peringkat

- UnitDokumen11 halamanUnitRohanBelum ada peringkat

- Common Export Documents GuideDokumen6 halamanCommon Export Documents GuideBeenish Khawaja100% (1)

- Export Documentation and ProceduresDokumen180 halamanExport Documentation and ProceduresTUSHER14767% (3)

- Evidencia 7 Compliance With Foreign Law PDFDokumen7 halamanEvidencia 7 Compliance With Foreign Law PDFAnonymous as2wVcvBelum ada peringkat

- Steps To Export: Presented By: Jeyson Gerley Forero Lozano Presented To: Jenny Emilce Ordoñez MuñozDokumen12 halamanSteps To Export: Presented By: Jeyson Gerley Forero Lozano Presented To: Jenny Emilce Ordoñez MuñozJeison ForeroBelum ada peringkat

- Export DocumentationDokumen10 halamanExport DocumentationCharu ModiBelum ada peringkat

- Export Procedure of Agricultural Products: Registration As A Business EntityDokumen5 halamanExport Procedure of Agricultural Products: Registration As A Business Entityvinnie10Belum ada peringkat

- 1) Establishing An Organisation: Click HereDokumen6 halaman1) Establishing An Organisation: Click HerePraWin KharateBelum ada peringkat

- Guide to Pharmaceutical Export and Import ProceduresDokumen28 halamanGuide to Pharmaceutical Export and Import ProceduresSunil PatelBelum ada peringkat

- Export Documents & ProcedureDokumen17 halamanExport Documents & Procedureshail_18Belum ada peringkat

- Import Export of IndiaDokumen10 halamanImport Export of IndiaTanya KholiBelum ada peringkat

- EXPORT GUIDEDokumen5 halamanEXPORT GUIDEarpit85Belum ada peringkat

- Ibo-4 Unit-3 Export Import Documents OverviewDokumen35 halamanIbo-4 Unit-3 Export Import Documents OverviewSudhir Kochhar Fema Author100% (1)

- FTA Colombia USADokumen17 halamanFTA Colombia USAAnonymous gRIEdLNidBelum ada peringkat

- Export Procedures in India - Export Documents Required, Documents Required For ExportDokumen2 halamanExport Procedures in India - Export Documents Required, Documents Required For Exportశ్రీనివాసకిరణ్కుమార్చతుర్వేదులBelum ada peringkat

- Export DocumentationDokumen19 halamanExport DocumentationShivam OberoiBelum ada peringkat

- Export ProcessDokumen18 halamanExport ProcessemmabrowneinfoBelum ada peringkat

- Export DocumentationDokumen21 halamanExport DocumentationIndrani ThotaBelum ada peringkat

- Custom Clerarance: Area of Operations and AuthorityDokumen4 halamanCustom Clerarance: Area of Operations and AuthorityRajeev VyasBelum ada peringkat

- Export Fruits & Vegetables-19-29Dokumen11 halamanExport Fruits & Vegetables-19-29manutdudaBelum ada peringkat

- VinitDokumen22 halamanVinitRonak ShahBelum ada peringkat

- David IL 4e Chapter09Dokumen49 halamanDavid IL 4e Chapter09Klint Allen Amblon MariñasBelum ada peringkat

- Export Procedur E: Presented By:-Omkar Darade - 11 Anurag Dhawane-12 Anushka Gaikwad-13 Priyanka Gaikwad - 14Dokumen14 halamanExport Procedur E: Presented By:-Omkar Darade - 11 Anurag Dhawane-12 Anushka Gaikwad-13 Priyanka Gaikwad - 14Anushka GaikwadBelum ada peringkat

- Guia de Aprendizaje 11 2 1Dokumen8 halamanGuia de Aprendizaje 11 2 1Ministerio Concejería MatrimonialBelum ada peringkat

- Quality Control Inspection Pharmaceutical Product: International TradeDokumen4 halamanQuality Control Inspection Pharmaceutical Product: International TradeSanal B. KrishnanBelum ada peringkat

- Import License Procedure in IndiaDokumen6 halamanImport License Procedure in IndiaArpitSoniBelum ada peringkat

- Statement by The Minister of Internal Affairs On The Matter of Alleged Kidnaps On 4th February 2021Dokumen5 halamanStatement by The Minister of Internal Affairs On The Matter of Alleged Kidnaps On 4th February 2021The Independent MagazineBelum ada peringkat

- Eu Statement On Uganda 2021 Ta-9-2021-0057 - enDokumen7 halamanEu Statement On Uganda 2021 Ta-9-2021-0057 - enThe Independent MagazineBelum ada peringkat

- Uganda Elections Petition NUP 2021Dokumen20 halamanUganda Elections Petition NUP 2021The Independent Magazine100% (1)

- Janet Museveni School Reopening StatementDokumen21 halamanJanet Museveni School Reopening StatementThe Independent MagazineBelum ada peringkat

- KeepItOn Open Letter Uganda ElectionDokumen7 halamanKeepItOn Open Letter Uganda ElectionThe Independent MagazineBelum ada peringkat

- Uganda Voter Education Handbook 2020Dokumen72 halamanUganda Voter Education Handbook 2020The Independent MagazineBelum ada peringkat

- UGANDA Voter Count by District 2021Dokumen4 halamanUGANDA Voter Count by District 2021The Independent MagazineBelum ada peringkat

- NEW UGANDA School-CalendarDokumen6 halamanNEW UGANDA School-CalendarThe Independent Magazine0% (1)

- Uganda Presidential Campaign Programme As at 26.12.2020Dokumen9 halamanUganda Presidential Campaign Programme As at 26.12.2020The Independent MagazineBelum ada peringkat

- Uganda Election Results 2021Dokumen1 halamanUganda Election Results 2021The Independent MagazineBelum ada peringkat

- Uganda's Presidential Election Act 2005Dokumen63 halamanUganda's Presidential Election Act 2005The Independent MagazineBelum ada peringkat

- Presidential Campaign Guidelines 2020Dokumen7 halamanPresidential Campaign Guidelines 2020The Independent MagazineBelum ada peringkat

- UGANDA - Press Statement On Suspension of General Election Campaign Meetings in Specified AreasDokumen3 halamanUGANDA - Press Statement On Suspension of General Election Campaign Meetings in Specified AreasThe Independent MagazineBelum ada peringkat

- Constitutional Court Uganda 2019-11-0 JUSTICE MUSOTADokumen12 halamanConstitutional Court Uganda 2019-11-0 JUSTICE MUSOTAThe Independent MagazineBelum ada peringkat

- Circular To NRM Chairpersons - Campaign Facilitation For NRM Flag BearersDokumen7 halamanCircular To NRM Chairpersons - Campaign Facilitation For NRM Flag BearersThe Independent MagazineBelum ada peringkat

- UGANDA Health Sector Annual Budget Monitoring Report FY2019 - 2020Dokumen150 halamanUGANDA Health Sector Annual Budget Monitoring Report FY2019 - 2020The Independent MagazineBelum ada peringkat

- Bou Statement On Financial Institutions Business Regulated by Bou Under The Fiaa2016Dokumen4 halamanBou Statement On Financial Institutions Business Regulated by Bou Under The Fiaa2016The Independent MagazineBelum ada peringkat

- NRM Campaign Facilitation For Flag Bearers 2021Dokumen6 halamanNRM Campaign Facilitation For Flag Bearers 2021The Independent MagazineBelum ada peringkat

- NEC-1-20-Proposal by Government To Borrow Up To UGX 4,307,3 Billion Through Domestic Borrowing To Finance Budget Deficit For The FY 2020 210001Dokumen19 halamanNEC-1-20-Proposal by Government To Borrow Up To UGX 4,307,3 Billion Through Domestic Borrowing To Finance Budget Deficit For The FY 2020 210001Okema LennyBelum ada peringkat

- The United States Reiterates Its Call For A Free ELECTION in UGANDADokumen1 halamanThe United States Reiterates Its Call For A Free ELECTION in UGANDAThe Independent MagazineBelum ada peringkat

- Basic Information For Covid 19 Patients Undergoing Home Based Isolation and CareDokumen14 halamanBasic Information For Covid 19 Patients Undergoing Home Based Isolation and CareThe Independent MagazineBelum ada peringkat

- Uganda's National 4IR StrategyDokumen15 halamanUganda's National 4IR StrategyThe Independent Magazine100% (1)

- UGANDA Guidelines For Reopening Schs-2020Dokumen6 halamanUGANDA Guidelines For Reopening Schs-2020The Independent MagazineBelum ada peringkat

- MV Validation and TransferDokumen4 halamanMV Validation and TransferIsaac DanBelum ada peringkat

- NEC-1-20-Proposal by Government To Borrow Up To USD 600 Million From The IMF To Finance The Budget Deficit For The FY 2020 2100010001Dokumen19 halamanNEC-1-20-Proposal by Government To Borrow Up To USD 600 Million From The IMF To Finance The Budget Deficit For The FY 2020 2100010001Okema LennyBelum ada peringkat

- REVISED Presidential Campaign Programme 21.11.2020Dokumen18 halamanREVISED Presidential Campaign Programme 21.11.2020The Independent Magazine100% (1)

- Report On The Supplementary Expenditure Schedule 3 and Addendum 1 2 To Schedule 3 For FY 2020'21Dokumen19 halamanReport On The Supplementary Expenditure Schedule 3 and Addendum 1 2 To Schedule 3 For FY 2020'21The Independent MagazineBelum ada peringkat

- UGANDA Final Guidelines For Implementation of Covid-19 Sops in Education Instions-1Dokumen10 halamanUGANDA Final Guidelines For Implementation of Covid-19 Sops in Education Instions-1The Independent MagazineBelum ada peringkat

- Museveni Response SEPTEMBER 3 2020Dokumen24 halamanMuseveni Response SEPTEMBER 3 2020The Independent MagazineBelum ada peringkat

- President Museveni - Address On Corona-19 Virus 20th September, 2020Dokumen19 halamanPresident Museveni - Address On Corona-19 Virus 20th September, 2020The Independent MagazineBelum ada peringkat

- Horno BekoDokumen69 halamanHorno BekoManuel Castro EdiolaBelum ada peringkat

- Englishchange CookingDokumen7 halamanEnglishchange Cookingjaz_abrilBelum ada peringkat

- Hipster Field GuideDokumen7 halamanHipster Field GuideCaleb GarrettBelum ada peringkat

- Castlegar/Slocan Valley Pennywise Dec. 22, 2015Dokumen48 halamanCastlegar/Slocan Valley Pennywise Dec. 22, 2015Pennywise PublishingBelum ada peringkat

- Spiff BookDokumen29 halamanSpiff BookAnonymous FRk8B63ZBGBelum ada peringkat

- Ben Likes Peppers.: Reinforcement Worksheet 3Dokumen8 halamanBen Likes Peppers.: Reinforcement Worksheet 3Carla Rico100% (1)

- PMM 1Dokumen33 halamanPMM 1ShreyaHiremathBelum ada peringkat

- Her Possessive Lover (To Be Self-Published)Dokumen399 halamanHer Possessive Lover (To Be Self-Published)Kierra Shaizeyy50% (2)

- CBI Channel and Segments:: Honey in EuropeDokumen5 halamanCBI Channel and Segments:: Honey in EuropeArjun AhujaBelum ada peringkat

- Craftsman Drill Press 137.219090 L0711529Dokumen22 halamanCraftsman Drill Press 137.219090 L0711529sunnymidnight1412Belum ada peringkat

- BCI Members List 20150113Dokumen27 halamanBCI Members List 20150113Muhammad SadiqBelum ada peringkat

- Brooklyn Brew Shop Everyday IPA InstructionsDokumen3 halamanBrooklyn Brew Shop Everyday IPA InstructionsCarlos Hernandez MontesBelum ada peringkat

- PowerShip Training DeckDokumen33 halamanPowerShip Training DeckRam KumarBelum ada peringkat

- Target Electric Blanket InstructionsDokumen15 halamanTarget Electric Blanket Instructionsbritt16110% (1)

- GCF and LCM Word ProblemsDokumen2 halamanGCF and LCM Word Problemsallan_apduaBelum ada peringkat

- N Rivigo Ot - The - 37th - Caste PDFDokumen33 halamanN Rivigo Ot - The - 37th - Caste PDFAbhilash SrivastavaBelum ada peringkat

- Improvised PDFDokumen1 halamanImprovised PDFWonderful Vibrant Diversity GoyBelum ada peringkat

- Research Paper About Procter and Gamble CompanyDokumen10 halamanResearch Paper About Procter and Gamble CompanyRafaiza Mano0% (1)

- Cake ProcessDokumen13 halamanCake ProcessHaiderBelum ada peringkat

- BT Anh 6 Unit 2Dokumen6 halamanBT Anh 6 Unit 2ThuHiềnBelum ada peringkat

- Reefer GuideDokumen46 halamanReefer GuideJuan Carlos Ibarguen100% (2)

- Introduction To MarketingDokumen95 halamanIntroduction To MarketingV Priya GuptaBelum ada peringkat

- STIHL TS 410 420 Instruction Manual PDFDokumen112 halamanSTIHL TS 410 420 Instruction Manual PDFaleluja100% (1)

- I Direct TaxDokumen155 halamanI Direct TaxRajnish ShastriBelum ada peringkat

- Furukawa HCR 910Dokumen272 halamanFurukawa HCR 910julio83% (6)

- A Group2 Eco7Dokumen7 halamanA Group2 Eco7Harsh ParasrampuriaBelum ada peringkat

- ESL LESSON For IntermdiateDokumen5 halamanESL LESSON For IntermdiateElle MagieBelum ada peringkat

- List of Fresh Auctionable Lots / Containers Under Schedule No. 44/2021 at KictDokumen2 halamanList of Fresh Auctionable Lots / Containers Under Schedule No. 44/2021 at KictAli HussainBelum ada peringkat

- Demand Analysis On Chosen Product MaggiDokumen35 halamanDemand Analysis On Chosen Product Maggisusmita_tripathy64% (53)

- Hospital Housekeeping ManualDokumen14 halamanHospital Housekeeping ManualphilipBelum ada peringkat

- 2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Dari Everand2023/2024 ASVAB For Dummies (+ 7 Practice Tests, Flashcards, & Videos Online)Belum ada peringkat

- Outliers by Malcolm Gladwell - Book Summary: The Story of SuccessDari EverandOutliers by Malcolm Gladwell - Book Summary: The Story of SuccessPenilaian: 4.5 dari 5 bintang4.5/5 (17)

- The PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptDari EverandThe PMP Project Management Professional Certification Exam Study Guide PMBOK Seventh 7th Edition: The Complete Exam Prep With Practice Tests and Insider Tips & Tricks | Achieve a 98% Pass Rate on Your First AttemptBelum ada peringkat

- Auto Parts Storekeeper: Passbooks Study GuideDari EverandAuto Parts Storekeeper: Passbooks Study GuideBelum ada peringkat

- Radiographic Testing: Theory, Formulas, Terminology, and Interviews Q&ADari EverandRadiographic Testing: Theory, Formulas, Terminology, and Interviews Q&ABelum ada peringkat

- EMT (Emergency Medical Technician) Crash Course Book + OnlineDari EverandEMT (Emergency Medical Technician) Crash Course Book + OnlinePenilaian: 4.5 dari 5 bintang4.5/5 (4)

- The NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersDari EverandThe NCLEX-RN Exam Study Guide: Premium Edition: Proven Methods to Pass the NCLEX-RN Examination with Confidence – Extensive Next Generation NCLEX (NGN) Practice Test Questions with AnswersBelum ada peringkat

- The Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsDari EverandThe Science of Self-Discipline: The Willpower, Mental Toughness, and Self-Control to Resist Temptation and Achieve Your GoalsPenilaian: 4.5 dari 5 bintang4.5/5 (76)

- ASE A1 Engine Repair Study Guide: Complete Review & Test Prep For The ASE A1 Engine Repair Exam: With Three Full-Length Practice Tests & AnswersDari EverandASE A1 Engine Repair Study Guide: Complete Review & Test Prep For The ASE A1 Engine Repair Exam: With Three Full-Length Practice Tests & AnswersBelum ada peringkat

- Real Property, Law Essentials: Governing Law for Law School and Bar Exam PrepDari EverandReal Property, Law Essentials: Governing Law for Law School and Bar Exam PrepBelum ada peringkat

- Programmer Aptitude Test (PAT): Passbooks Study GuideDari EverandProgrammer Aptitude Test (PAT): Passbooks Study GuideBelum ada peringkat

- Tactical Combat Casualty Care Field GuideDari EverandTactical Combat Casualty Care Field GuidePenilaian: 3 dari 5 bintang3/5 (1)

- 2024 – 2025 FAA Drone License Exam Guide: A Simplified Approach to Passing the FAA Part 107 Drone License Exam at a sitting With Test Questions and AnswersDari Everand2024 – 2025 FAA Drone License Exam Guide: A Simplified Approach to Passing the FAA Part 107 Drone License Exam at a sitting With Test Questions and AnswersBelum ada peringkat

- USMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewDari EverandUSMLE Step 1: Integrated Vignettes: Must-know, high-yield reviewPenilaian: 4.5 dari 5 bintang4.5/5 (7)

- EMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimeDari EverandEMT (Emergency Medical Technician) Crash Course with Online Practice Test, 2nd Edition: Get a Passing Score in Less TimePenilaian: 3.5 dari 5 bintang3.5/5 (3)

- Summary of Sapiens: A Brief History of Humankind By Yuval Noah HarariDari EverandSummary of Sapiens: A Brief History of Humankind By Yuval Noah HarariPenilaian: 1 dari 5 bintang1/5 (3)

- Nursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASDari EverandNursing School Entrance Exams: HESI A2 / NLN PAX-RN / PSB-RN / RNEE / TEASBelum ada peringkat

- Improve Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersDari EverandImprove Your Global Business English: The Essential Toolkit for Writing and Communicating Across BordersPenilaian: 4 dari 5 bintang4/5 (14)

- Intermediate Accounting 2: a QuickStudy Digital Reference GuideDari EverandIntermediate Accounting 2: a QuickStudy Digital Reference GuideBelum ada peringkat

- PTCE - Pharmacy Technician Certification Exam Flashcard Book + OnlineDari EverandPTCE - Pharmacy Technician Certification Exam Flashcard Book + OnlineBelum ada peringkat