A Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.viji

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

A Study On Profitability Ratio Analysis of Britannia Biscuts India LTD - S.viji

Hak Cipta:

Format Tersedia

Volume 2, Issue 6, June 2017 International Journal of Innovative Science and Research Technology

ISSN No: - 2456 2165

A Study on Profitability Ratio Analysis of Britannia

Biscuits Ltd

Prof. P.UMA ESWARI, S. VIJI,

M.com., MBA., M.phil., M.com.,

Department of commerce Department of commerce

PRIST UNIVERSITY PRIST UNIVERSITY

Thanjavur - 613 403 Thanjavur - 613 403

Tamilnadu-INDIA. Tamilnadu-INDIA.

Abstract :- The Financial Statement analysis is largely a Balance Sheet and Trading and Profit and Loss Account in the

study of relationship among the various financial factors in module titled Financial Statements of Profit and Not for

a business as disclosed by a single set of statements, and a Profit Organizations. After preparation of the financial

study of the trend of these factors as shown in a series of statements, one may be interested in analyzing the financial

statements. This project report covers all the aspects statements with the help of different tools such as comparative

relating to the Profitability ratios of Britannia industries statement, common size statement, ratio analysis, trend

Ltd interpreted according to standards. Britannia was analysis, fund flow analysis, cash flow analysis, etc. In this

incorporated in 1918 as Britannia Biscuits Co LTD in lesson you will learn about analyzing the financial statements

Calcutta. In 1924, Pea Frean UK acquired a controlling by using comparative statement, common size statement and

stake, which later passed on to the Associated Biscuits trend analysis.

International (ABI) and UK based company. The company

is engaged in the manufacture of biscuits, Rusks, cookies This project report covers all the aspects relating to

and cakes. Britannia operates in a single segment, foods the Profitability ratios of Britannia industries Ltd interpreted

including bakery products such as biscuits, bread, cakes, according to standards. This project was done with the help of

Rusk, and dairy products. The company is headquarter in secondary data as research in finance subjects is done on

Kolkata, India and employs 2,358 people Global Markets performance and not potential. The project selected by me is

Direct, the leading business information provider, presents to do statement the financial ratio analysis. The main intention

an in-depth business, strategic and financial analysis of was to group or regroup the various figures and information

Britannia Industries Ltd. appearing on the financial statement (either profitability

statement or balance sheet or both) to draw the fruitful

Key words: Gross profit Ratio, Operating Ratio and Net conclusions there from.

profit Ratio. Profitability ratios are valuable as they depict how are you

utilizing and managing your resources.

I. ISNTRODUCTION II. OBJECTIVES OF THE STUDY

Analysis and Interpretation of financial statements

To identify the financial analysis of Britannia industries

refers to the process of determining the significant operating

Ltd.

and financial characteristics from the accounting data with a

view to getting an insight into the activities of an enterprise.

The Gross profit ratio, Net profit ratio and other

Financial Statement analysis is largely a study of

profitability ratio position of the Company.

relationship among the various financial factors in a business

s

as disclosed by a single set of statements, and a study of the

The financial ratio analysis and determining the financial

trend of these factors as shown in a series of statements.

capability of the Company.

Financial statement analysis allows analysts to III. COMPANY PROFILE

identify trends by comparing ratios across multiple time

periods and statement types. These statements allow analysts Britannia was incorporated in 1918 as Britannia

to measure liquidity, profitability, company-wide efficiency Biscuits Co LTD in Calcutta. In 1924, Pea Frean UK acquired

and cash flow. The preparation of financial statements i.e. a controlling stake, which later passed on to the Associated

IJISRT17JU90 www.ijisrt.com 223

Volume 2, Issue 6, June 2017 International Journal of Innovative Science and Research Technology

ISSN No: - 2456 2165

Biscuits International (ABI) and UK based company. During VII. PROFITABILITY RATIO

the 50s and 60s, Britannia expanded operations to Mumbai,

Delhi and Chennai. In 1989, J M Pillai, a Singapore based Measures that indicate how well a firm is performing in

NRI businessman along with the Group DANONE acquired terms of its ability to generate profit and Formulae of some of

Asian operations of Nabisco, thus acquiring controlling stake the common ratios are as follows:

in Britannia. Later, Group DANONE and Nusli Wadia took Gross profit percentage: Total cost of sales in

over Pillais holdings. Britannia Industries Limited is one of a period x 100 Total sales revenue for that period.

the largest biscuit manufacturing companies in India. The Net income percentage: Net income for a period x

company is engaged in the manufacture of biscuits, Rusks, 100 Total sales revenue for that period. Operating

cookies and cakes. Britannia operates in a single segment, profit percentage: Earnings before interest and taxes

foods including bakery products such as biscuits, bread, cakes, (EBIT) in a period x 100 Total sales revenue in

Rusk, and dairy products. the same period.

Return on Investment: Net income Total assets.

Britannia's plants are located in the 4 major metro cities

Kolkata, Mumbai, Delhi, and Chennai. A large part of VIII. PROFITABILITY OPERATING SYSTEMS

products are also outsourced from third party producers. Dairy

products are outsourced from three producers - Dynamic The relevant literature on the role of profitability in

Dairy based in Baramati, Maharashtra, and Modern Dairy at competition analyses and to show the benefits and drawbacks

Karnal in Haryana and Thacker Dairy Products at Howrah in of relying on profit measures as indicators of market power or

West Bengal. the abuse thereof in competition cases. This is particularly

relevant given that other jurisdictions have taken the approach

IV. RESEARCH METHODOLOGY of investigating markets for competition problems when

profitability is found to be excessive, despite that this

Research Methodology is a way to systematically solve approach is a controversial one. In the ongoing healthcare

the problems. It may be understood to study how research is market inquiry, this may be one possible point of departure,

done scientifically. In this, we study various steps that are given such precedents.

generally adopted by the researcher in studying research

problems along with the logic behind them, to understand why A. Concept of Profitability

we are using particular method or technique so that the

research results are capable of being evaluated. During my Profit is the main objective behind the establishment

project work, I have used a lot of data to understand concept of an any business organization. It is the engine that drives the

of Ratio Analysis. The data collected was interpreted and then business enterprise. Importance of profit to different parties

used as information in project. Weston and Brigham pointed To the financial management,

profit is the test of efficiency and a measure of control, to the

V . SOURCES OF DATA COLLECTION owners; a measure of the worth of their investment, to the

creditors, the margin of safety, to the government a measure of

Data for this project is collected through Secondary taxable capacity and basis of legislative action; and the

sources. Secondary data is collected with the help of country profit is an index of economic progress.

following:

B. Accounting Profit

A. Annual report

The excess of revenue over related costs applicable to

Majority of information gathered from data exhibited a transaction, a group of transactions or the transactions of an

in the annual reports of the company. These includes annual operating period is profit. In accounting terminology The

reports of the year 2011-12,2012-13,2013-14,2014-15 and profit of a business during given period is the excess of

2015-16, the Theory relating to the various financial income over expenditure for the period.

reference books. Gross Profit: The excess of total gross revenue over the

revenue expenditure is the gross profit.

VI. RATIO ANALYSIS Operating Profit: The excess of the total operating revenue

over the total cost of operation is the operating profit.

Ratio analysis is an important technique, which is

Net Profit: The excess of the total gross revenue over the total

widely used for interpreting financial statement. The technique

cost of operation is the net profit. Net profit further divided

serves as a tool for assessing the current and long-term

into three parts:

financial soundness of a business. It is also used to analysis

Net Profit before interest

various aspects of operating efficiency and level of

Net Profit before tax

profitability. A German scholar used ratios for the first time in

Net Profit before interest and tax

1919.

IJISRT17JU90 www.ijisrt.com 224

Volume 2, Issue 6, June 2017 International Journal of Innovative Science and Research Technology

ISSN No: - 2456 2165

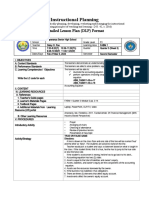

RAW

CASH MATERIA

L

DEBTORS OPERATING CYCLE

WORK IN

& BILLS

PROGRESS

RECEIVAB

LES

FINISH

SALES

GOODS

IX. DATA AND INTERPRETATION essentially the percentage markup on cost of goods sold. This

is the pure profit from the sale of inventory that can go to

A. Gross Profit paying operating expenses.

Gross profit ratio is a profitability ratio that compares

the gross profit of a business to the net sales. This ratio Gross Profit Ratio = Gross Profit X 100

measures how profitable a company sells its inventory or

merchandise. In other words, the gross profit ratio is Sales

Table 1

Year 2011-12 2012-13 2013-14 2014-15 2015-16

G/P Ratio 11 5 8 6 5

Result Level Best Low Best Normal Low

Sources: secondary of data

IJISRT17JU90 www.ijisrt.com 225

Volume 2, Issue 6, June 2017 International Journal of Innovative Science and Research Technology

ISSN No: - 2456 2165

Chart 1

G/P Ratio

11

8

6

5 5

2011-12 2012-13 2013-14 2014-15 2015-16

Norm: - Higher the ratio shows higher efficiency and vice versa.

The analysis of table 1 and chart 1: In 2011-12, the It may be broadly classified into the following four stages viz.

Gross Profit Ratio was highly 11percentage and it went to 8% 1. Raw materials and stores storage stage.

low highly for the 2013-14. As there is no standard Ratio, 2. Work-in-progress stage.

company has to determine its standard ratio based on past GP 3. Finished goods inventory stage.

ratios or GP ratios of other concern. The Ratio if we compare 4. Receivables collection stage.

it shows that

The operating cycle of the firm reveals the days

Failure in managing purchases, production, sales and within which the inventory procured gets converted to sales or

inventory revenue for the firm. This time period is of importance to the

Lose control over direct costs of labour, fuel, freights etc. firm as a lag here could significantly affect the profitability,

Lower productivity and lower margin to meet other liquidity, credit terms, and the policies of the firm. All the

expenses firms would like to reduce it to such extend that their cash

inflows are timely enough to meet their obligations and

X. OPERATING RATIO support the operations.

The operating cycle begins with the acquisition of Operating Ratio = Cogs + Operating Expenses X 100

raw materials and ends with the collection of receivables

Sales

Table 2

Year 2011-12 2012-13 2013-14 2014-15 2015-16

O/P Ratio 12 6 9 8 6

Result Level Highly Best Highly Normal Best

Sources: secondary of data

Chart 2

O/P Ratio

2011-12 2012-13 2013-14 2014-15 2015-16

15%

29%

19%

22% 15%

IJISRT17JU90 www.ijisrt.com 226

Volume 2, Issue 6, June 2017 International Journal of Innovative Science and Research Technology

ISSN No: - 2456 2165

XI. INTERPRETATION A. Net Profit Ratio

The above table 2 and chart 2 shows that in Britannia, Net profit represents the number of sales rupees

Operating ratio is decreasing year by year from 2012 to 2016. remaining after all operating expenses, interest, taxes and

In 2011-12, the Operating Ratio was 12% and it went to 9% preferred stock dividends have been deducted from a

next year 2013-14. It indicates the cost of Expenses. As there companys total revenue. Net profit is also referred to as the

is no standard Ratio, company has to determine its standard bottom line, net income, or net earnings. Net profit is found on

ratio based on past GP ratios or GP ratios of other concern. the last line of the income statement, which is why it is often

The Ratio if we compare it shows that- referred to as the bottom line. The formula for net profit is as

follows: Total revenue Total expenses = Net profit

1) High efficiency in managing the Operations of the

concern like purchases made at lower prices, NET PROFIT RATIO:

optimum level of production, good inventory

management and good control of direct cost of NET PROFIT RATIO = NPAT X 100

labour, fuel, freight etc.

2) A very good Margin available to meet non-operating SALES

Expenses.

Table 3

Year 2011-12 2012-13 2013-14 2014-15 2015-16

N/P Ratio 8 5 7 6 4

Result Level Best Low Best Normal Low

Sources: secondary of data

Chart 3

N/P Ratio

9

8

7

6

5

4

3

2

1

0

2011-12 2012-13 2013-14 2014-15 2015-16

The above table 3 and chart 3, shows that in based on past NP ratios or NP ratios of other concern. The

Britannia, the net profit is increasing year by year like it in Ratio if we compare it shows that:

2011-12 and 2013-14. It was decreasing from 2014-15 and

2015-16 was 6% and it went up 4%. It indicates the 1) Inefficiency in managing its activities like

relationship between net profit and sales. As there is no trading.production, financing and investment.

standard Ratio, company has to determine its standard ratio 2) unsatisfactory control over operating as well as non

operating costs

IJISRT17JU90 www.ijisrt.com 227

Volume 2, Issue 6, June 2017 International Journal of Innovative Science and Research Technology

ISSN No: - 2456 2165

3) Unusual losses like loss by fire, flood etc. improvement may also bring up its return on investment

4) Low increase in the net worth or the proprietors funds. and overall efficiency to the company.

5) Weak capacity of the concern to face bad economic

situation.

XII. OBSERVATION AND FINDINGS BIBLIOGRAPHY

In this project I calculate some ratios; these ratios are very Following books were referred for carrying out the project: -

useful to interpret financial position of the company.

From that it is clear that the Britannia India Ltd is in 1. Financial Management by N.M. Venchalekar.

advanced stage. From the ratios calculated above

following conclusions can be drawn. 2. Financial Management by KHAN AND JAIN.

The gross profit earned by the Britannia Company is 3. Annual Reports of Britannia and Cadbury India Ltd.

declining every year. From 2012-13 to 2015-16, it is

fluctuating a lot which is due to failure in managing 4. Financial Management by Ainapure Ainapure

purchases, production, sales and inventory or loses

control over direct costs of labor, fuel, freights etc.

Operating ratio of Britannia going down from 2012-13 to Following websites were referred: -

2015-16, which is nothing but due to certain reasons like

low efficiency in managing the operations of the company 1. www.money.rediff.com

or low margin available to meet non-operating expenses. 2. www.cadburyindia.com

3. www.wikipedia.com

The net profit is nothing but profit earned by the company 4. www.cadbury.com

after deducting interest and taxes. The graph is showing

that in Britannia from the year 2012-13 and 2015-16, the

net profit is declining which is due to inefficiency in

managing its activities like trading, production, financing

and investment or unsatisfactory control over operating or

non operating costs.

XIII. SUGGESTIONS AND CONCLUSION

The in-depth analysis of key financial ratios in this project

helps in measuring the financial strength, liquidity

conditions and operating efficiency of the company. It

also provides valuable interpretation separately for each

ratio that helps organization implementing the findings

that would help the organization to increase its efficiency.

The position of the company in the interim period not

revealed by analysis, moreover they give no clue about

the future. Ratio analysis in view of its several limitations

should be considered only as a tool for analysis rather

than as an end itself.

From the analysis it is evident that the gross profit ratio is

good, whereas the operating ratio is around optimum level

to the industry standards. As a whole the liquidity position

of the company is good.

The company not very well used its fixed assets

efficiently company has reduce it in order to invest the

major portion in working capital or investment in current

assets. This is one of the reasons for profit fluctuation.

Thus finally the company must try to improve its profit

margins as they are below industry levels. This

IJISRT17JU90 www.ijisrt.com 228

Anda mungkin juga menyukai

- Amazon vs Netflix Indian BattleDokumen29 halamanAmazon vs Netflix Indian BattleVibhor SharmaBelum ada peringkat

- Case Presentation Marico LimitedDokumen26 halamanCase Presentation Marico LimiteddishaBelum ada peringkat

- Strategies of Pantaloon Retail (India) LimitedDokumen10 halamanStrategies of Pantaloon Retail (India) LimitedPavan R Kulkarni75% (4)

- M1906 Heet General Management Project ReportDokumen65 halamanM1906 Heet General Management Project ReportSatish WagholeBelum ada peringkat

- Hypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDDokumen25 halamanHypothetical Capital Structure and Cost of Capital of Mahindra Finance Services LTDlovels_agrawal6313Belum ada peringkat

- North South University (NSU) : Research ReportDokumen21 halamanNorth South University (NSU) : Research ReportEvana YasminBelum ada peringkat

- Impact of Narsimhan Committee II On Banking Sector, Banking Law, Yashveer, Semester IXDokumen7 halamanImpact of Narsimhan Committee II On Banking Sector, Banking Law, Yashveer, Semester IXYashveer Singh YadavBelum ada peringkat

- Financial Statement Analysis of Relaxo Footwear and Bata IndiaDokumen13 halamanFinancial Statement Analysis of Relaxo Footwear and Bata IndiaPriyank RawatBelum ada peringkat

- Profitability Ratio Fieldwork Report Preparation For Bank.Dokumen27 halamanProfitability Ratio Fieldwork Report Preparation For Bank.Arpan GhimireBelum ada peringkat

- Financial Analysis of Leading FMCG Companies in IndiaDokumen8 halamanFinancial Analysis of Leading FMCG Companies in Indiaviral ChavdaBelum ada peringkat

- Tata Motors Annual Report AnalysisDokumen55 halamanTata Motors Annual Report AnalysisPrathibha TiwariBelum ada peringkat

- ICICI Case StudiesDokumen4 halamanICICI Case StudiesSupriyo Sen100% (1)

- BA Group 1 CIA 3Dokumen19 halamanBA Group 1 CIA 3Vaishali MoitraBelum ada peringkat

- Financial Analysis of Bagalkot DCC Bank, BagalkotDokumen4 halamanFinancial Analysis of Bagalkot DCC Bank, BagalkotInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Sunfeast Biscuits - Sales and DistributionDokumen17 halamanSunfeast Biscuits - Sales and Distributionsandeepjalebar100% (1)

- Brand Image & Price Leadership of Apollo TyresDokumen95 halamanBrand Image & Price Leadership of Apollo TyresSubramanya DgBelum ada peringkat

- Nacco Marketing JamDokumen8 halamanNacco Marketing Jammiriel JonBelum ada peringkat

- Tata MotorsDokumen18 halamanTata MotorsManoranjan MallickBelum ada peringkat

- Mansa Building: Indian Institute of Management Ahmedabad IIMA/F&A0089Dokumen6 halamanMansa Building: Indian Institute of Management Ahmedabad IIMA/F&A0089shriBelum ada peringkat

- Chapter No. Names of Chapters 1.: Introduction To Hero CycleDokumen63 halamanChapter No. Names of Chapters 1.: Introduction To Hero CycleBHARATBelum ada peringkat

- Financial Analysis Dr. Reddy'sDokumen9 halamanFinancial Analysis Dr. Reddy'sSoumya ChakrabortyBelum ada peringkat

- BRM Group Project - Group 3Dokumen11 halamanBRM Group Project - Group 3Yawar Ali KhanBelum ada peringkat

- Marketing by ITC For Its Sunfeast Biscuits in IndiaDokumen6 halamanMarketing by ITC For Its Sunfeast Biscuits in IndiaBhavesh PandyaBelum ada peringkat

- Positioning - Small Cars, IndiaDokumen9 halamanPositioning - Small Cars, Indiasankalp_iet100% (4)

- Complete SM Group AssignmentDokumen46 halamanComplete SM Group AssignmentJson S KYBelum ada peringkat

- Marginal Costing Godreja PDFDokumen11 halamanMarginal Costing Godreja PDFuday100% (1)

- Export Performance of IndiaDokumen31 halamanExport Performance of IndiaJeevan JainBelum ada peringkat

- VivaDokumen29 halamanVivaA. ShanmugamBelum ada peringkat

- Customer Relationship Management and Marketing Strategies in Axis BankDokumen12 halamanCustomer Relationship Management and Marketing Strategies in Axis BankSwarup DeshbhratarBelum ada peringkat

- Impact of Covid 19 On Bankig SectorDokumen3 halamanImpact of Covid 19 On Bankig SectorShaloo MinzBelum ada peringkat

- Vishal Amballa - Project - 3 PDFDokumen45 halamanVishal Amballa - Project - 3 PDFBhupendra Bhangale100% (1)

- CAPITAL STRUCTURE Ultratech 2018Dokumen75 halamanCAPITAL STRUCTURE Ultratech 2018jeevanBelum ada peringkat

- ITC Report and Accounts 2021Dokumen382 halamanITC Report and Accounts 2021Avril FerreiraBelum ada peringkat

- Preeti Narang IrctcDokumen55 halamanPreeti Narang IrctcshobhitBelum ada peringkat

- Process of Issue of Commercial PapersDokumen14 halamanProcess of Issue of Commercial PapersApoorv Gupta100% (1)

- A Minor Project ON Comparative Study of Life Insurane Companies Submitted To Amity School of Insurance, Banking and Actuarial Science (Asibas)Dokumen29 halamanA Minor Project ON Comparative Study of Life Insurane Companies Submitted To Amity School of Insurance, Banking and Actuarial Science (Asibas)Naman JainBelum ada peringkat

- Shiva Tourist DhabaDokumen7 halamanShiva Tourist DhabaChaitanya JethaniBelum ada peringkat

- Literature ReviewDokumen9 halamanLiterature ReviewreksmanotiyaBelum ada peringkat

- Ratio Analysis of Samsung Electronics Co., LTDDokumen21 halamanRatio Analysis of Samsung Electronics Co., LTDUroOj SaleEm100% (1)

- Reliance PowerDokumen21 halamanReliance PowerAiaz Ul Majid100% (4)

- "A Study On The Financial Performance of Hindustan Unilever Limited"Dokumen60 halaman"A Study On The Financial Performance of Hindustan Unilever Limited"career pathBelum ada peringkat

- Case: Alpha Electronics' Global StrategyDokumen2 halamanCase: Alpha Electronics' Global StrategyMadhurima BhandariBelum ada peringkat

- How to Increase Operational Sales on Floor in Big BazaarDokumen88 halamanHow to Increase Operational Sales on Floor in Big BazaarAntesh SinghBelum ada peringkat

- Micromax Case Study - Operations ManagementDokumen7 halamanMicromax Case Study - Operations Managementkhem_singhBelum ada peringkat

- School of Management (PG) Faculty of Management - MITWPU: April 2020 - 20 June 2020Dokumen22 halamanSchool of Management (PG) Faculty of Management - MITWPU: April 2020 - 20 June 2020Mrunal WaghchaureBelum ada peringkat

- SKS MicrofinanceDokumen13 halamanSKS MicrofinanceprojectbpfpBelum ada peringkat

- Project Report On Basel IIIDokumen8 halamanProject Report On Basel IIICharles DeoraBelum ada peringkat

- A Detail Study On Working Capital Management in Lakshmi MillDokumen76 halamanA Detail Study On Working Capital Management in Lakshmi MillGleeto Thimothy100% (1)

- Packed and Unpacked Milk ProductDokumen34 halamanPacked and Unpacked Milk ProductRicha TiwariBelum ada peringkat

- By Mariyam Habibullah M.Sc. F.P.P (II) Roll No. 07: 100% Sin. 0% GuiltDokumen17 halamanBy Mariyam Habibullah M.Sc. F.P.P (II) Roll No. 07: 100% Sin. 0% GuiltMaryam HabibullahBelum ada peringkat

- FInal PPT For AmalgamationDokumen16 halamanFInal PPT For Amalgamationmyjio100% (2)

- SWOT analysis of Shopper's stop reveals strengths and weaknessesDokumen8 halamanSWOT analysis of Shopper's stop reveals strengths and weaknessessubham kunduBelum ada peringkat

- Assignment SCMDokumen6 halamanAssignment SCMSyeda Sana Amir100% (1)

- FrootiDokumen24 halamanFrootiProfessor Sameer Kulkarni100% (35)

- Gamification in Consumer Research A Clear and Concise ReferenceDari EverandGamification in Consumer Research A Clear and Concise ReferenceBelum ada peringkat

- AOL.com (Review and Analysis of Swisher's Book)Dari EverandAOL.com (Review and Analysis of Swisher's Book)Belum ada peringkat

- Study On Financial Ratio Analysis of Vellore Cooperative Sugar MillsDokumen7 halamanStudy On Financial Ratio Analysis of Vellore Cooperative Sugar MillsTim CechiniBelum ada peringkat

- PAPER Financial Statement Analysis Using Common Size On Mahindra Sindol MotorsDokumen10 halamanPAPER Financial Statement Analysis Using Common Size On Mahindra Sindol MotorsDr Bhadrappa HaralayyaBelum ada peringkat

- Comparative Ratio Analysis of Britannia and CadburyDokumen19 halamanComparative Ratio Analysis of Britannia and Cadburyramachie29Belum ada peringkat

- Financial Performance of HulDokumen44 halamanFinancial Performance of HulSubhendu GhoshBelum ada peringkat

- Adoption of International Public Sector Accounting Standards and Quality of Financial Reporting in National Government Agricultural Sector Entities, KenyaDokumen12 halamanAdoption of International Public Sector Accounting Standards and Quality of Financial Reporting in National Government Agricultural Sector Entities, KenyaInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Analysis of Financial Ratios that Relate to Market Value of Listed Companies that have Announced the Results of their Sustainable Stock Assessment, SET ESG Ratings 2023Dokumen10 halamanAnalysis of Financial Ratios that Relate to Market Value of Listed Companies that have Announced the Results of their Sustainable Stock Assessment, SET ESG Ratings 2023International Journal of Innovative Science and Research TechnologyBelum ada peringkat

- A Curious Case of QuadriplegiaDokumen4 halamanA Curious Case of QuadriplegiaInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Forensic Evidence Management Using Blockchain TechnologyDokumen6 halamanForensic Evidence Management Using Blockchain TechnologyInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Improvement Functional Capacity In Adult After Percutaneous ASD ClosureDokumen7 halamanImprovement Functional Capacity In Adult After Percutaneous ASD ClosureInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Fruit of the Pomegranate (Punica granatum) Plant: Nutrients, Phytochemical Composition and Antioxidant Activity of Fresh and Dried FruitsDokumen6 halamanFruit of the Pomegranate (Punica granatum) Plant: Nutrients, Phytochemical Composition and Antioxidant Activity of Fresh and Dried FruitsInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Pdf to Voice by Using Deep LearningDokumen5 halamanPdf to Voice by Using Deep LearningInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Machine Learning and Big Data Analytics for Precision Cardiac RiskStratification and Heart DiseasesDokumen6 halamanMachine Learning and Big Data Analytics for Precision Cardiac RiskStratification and Heart DiseasesInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Late Presentation of Pulmonary Hypertension Crisis Concurrent with Atrial Arrhythmia after Atrial Septal Defect Device ClosureDokumen12 halamanLate Presentation of Pulmonary Hypertension Crisis Concurrent with Atrial Arrhythmia after Atrial Septal Defect Device ClosureInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Severe Residual Pulmonary Stenosis after Surgical Repair of Tetralogy of Fallot: What’s Our Next Strategy?Dokumen11 halamanSevere Residual Pulmonary Stenosis after Surgical Repair of Tetralogy of Fallot: What’s Our Next Strategy?International Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Food habits and food inflation in the US and India; An experience in Covid-19 pandemicDokumen3 halamanFood habits and food inflation in the US and India; An experience in Covid-19 pandemicInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- The Students’ Assessment of Family Influences on their Academic MotivationDokumen8 halamanThe Students’ Assessment of Family Influences on their Academic MotivationInternational Journal of Innovative Science and Research Technology100% (1)

- Scrolls, Likes, and Filters: The New Age Factor Causing Body Image IssuesDokumen6 halamanScrolls, Likes, and Filters: The New Age Factor Causing Body Image IssuesInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Optimization of Process Parameters for Turning Operation on D3 Die SteelDokumen4 halamanOptimization of Process Parameters for Turning Operation on D3 Die SteelInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Design and Implementation of Homemade Food Delivery Mobile Application Using Flutter-FlowDokumen7 halamanDesign and Implementation of Homemade Food Delivery Mobile Application Using Flutter-FlowInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Blockchain-Enabled Security Solutions for Medical Device Integrity and Provenance in Cloud EnvironmentsDokumen13 halamanBlockchain-Enabled Security Solutions for Medical Device Integrity and Provenance in Cloud EnvironmentsInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Investigating the Impact of the Central Agricultural Research Institute's (CARI) Agricultural Extension Services on the Productivity and Livelihoods of Farmers in Bong County, Liberia, from 2013 to 2017Dokumen12 halamanInvestigating the Impact of the Central Agricultural Research Institute's (CARI) Agricultural Extension Services on the Productivity and Livelihoods of Farmers in Bong County, Liberia, from 2013 to 2017International Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Optimizing Sound Quality and Immersion of a Proposed Cinema in Victoria Island, NigeriaDokumen4 halamanOptimizing Sound Quality and Immersion of a Proposed Cinema in Victoria Island, NigeriaInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Enhancing Biometric Attendance Systems for Educational InstitutionsDokumen7 halamanEnhancing Biometric Attendance Systems for Educational InstitutionsInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- The Experiences of Non-PE Teachers in Teaching First Aid and Emergency Response: A Phenomenological StudyDokumen89 halamanThe Experiences of Non-PE Teachers in Teaching First Aid and Emergency Response: A Phenomenological StudyInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Development of a Local Government Service Delivery Framework in Zambia: A Case of the Lusaka City Council, Ndola City Council and Kafue Town Council Roads and Storm Drain DepartmentDokumen13 halamanDevelopment of a Local Government Service Delivery Framework in Zambia: A Case of the Lusaka City Council, Ndola City Council and Kafue Town Council Roads and Storm Drain DepartmentInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Targeted Drug Delivery through the Synthesis of Magnetite Nanoparticle by Co-Precipitation Method and Creating a Silica Coating on itDokumen6 halamanTargeted Drug Delivery through the Synthesis of Magnetite Nanoparticle by Co-Precipitation Method and Creating a Silica Coating on itInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Databricks- Data Intelligence Platform for Advanced Data ArchitectureDokumen5 halamanDatabricks- Data Intelligence Platform for Advanced Data ArchitectureInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Design and Development of Controller for Electric VehicleDokumen4 halamanDesign and Development of Controller for Electric VehicleInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Quality By Plan Approach-To Explanatory Strategy ApprovalDokumen4 halamanQuality By Plan Approach-To Explanatory Strategy ApprovalInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- A Review on Process Parameter Optimization in Material Extrusion Additive Manufacturing using ThermoplasticDokumen4 halamanA Review on Process Parameter Optimization in Material Extrusion Additive Manufacturing using ThermoplasticInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Digital Pathways to Empowerment: Unraveling Women's Journeys in Atmanirbhar Bharat through ICT - A Qualitative ExplorationDokumen7 halamanDigital Pathways to Empowerment: Unraveling Women's Journeys in Atmanirbhar Bharat through ICT - A Qualitative ExplorationInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Gardening Business System Using CNN – With Plant Recognition FeatureDokumen4 halamanGardening Business System Using CNN – With Plant Recognition FeatureInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Anxiety, Stress and Depression in Overseas Medical Students and its Associated Factors: A Descriptive Cross-Sectional Study at Jalalabad State University, Jalalabad, KyrgyzstanDokumen7 halamanAnxiety, Stress and Depression in Overseas Medical Students and its Associated Factors: A Descriptive Cross-Sectional Study at Jalalabad State University, Jalalabad, KyrgyzstanInternational Journal of Innovative Science and Research Technology90% (10)

- Comparison of Lateral Cephalograms with Photographs for Assessing Anterior Malar Prominence in Maharashtrian PopulationDokumen8 halamanComparison of Lateral Cephalograms with Photographs for Assessing Anterior Malar Prominence in Maharashtrian PopulationInternational Journal of Innovative Science and Research TechnologyBelum ada peringkat

- Risk and Return 2Dokumen2 halamanRisk and Return 2Nitya BhakriBelum ada peringkat

- Information Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsDokumen4 halamanInformation Systems, Organizations, and Strategy: Chapter 3-Key Terms, Review Questions and Discussion QuestionsPeter BensonBelum ada peringkat

- Ub23m03 561476Dokumen1 halamanUb23m03 561476Ratul KochBelum ada peringkat

- Factors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryDokumen17 halamanFactors Affecting Adoption of Electronic Banking System in Ethiopian Banking IndustryaleneBelum ada peringkat

- RESA FAR PreWeek (B43)Dokumen10 halamanRESA FAR PreWeek (B43)MellaniBelum ada peringkat

- Monetary and Fiscal Policy Review in Islamic Sharia Syahril ToonawuDokumen20 halamanMonetary and Fiscal Policy Review in Islamic Sharia Syahril ToonawuSyahril XtreelBelum ada peringkat

- Country Profile Serbia enDokumen16 halamanCountry Profile Serbia enKatarina VujovićBelum ada peringkat

- India's Leading Infrastructure Companies 2017Dokumen192 halamanIndia's Leading Infrastructure Companies 2017Navin JollyBelum ada peringkat

- Market Failure Case StudyDokumen2 halamanMarket Failure Case Studyshahriar sayeedBelum ada peringkat

- Principles of Economics - 1 - 2Dokumen81 halamanPrinciples of Economics - 1 - 2KENMOGNE TAMO MARTIALBelum ada peringkat

- General Profile: CanadaDokumen3 halamanGeneral Profile: CanadaDaniela CarauşBelum ada peringkat

- Government AccountsDokumen36 halamanGovernment AccountskunalBelum ada peringkat

- Wholesale Juice Business PlanDokumen25 halamanWholesale Juice Business PlanKiza Kura CyberBelum ada peringkat

- Samart Bank Form - V 310118 PDFDokumen2 halamanSamart Bank Form - V 310118 PDFJoe Pianist Samart RukpanyaBelum ada peringkat

- MTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingDokumen7 halamanMTP - Intermediate - Syllabus 2016 - Jun 2020 - Set 1: Paper 8-Cost AccountingJagannath RaoBelum ada peringkat

- Review LeapFrogDokumen2 halamanReview LeapFrogDhil HutomoBelum ada peringkat

- AIS Prelim ExamDokumen4 halamanAIS Prelim Examsharielles /Belum ada peringkat

- Multi Modal Logistics HubDokumen33 halamanMulti Modal Logistics HubsinghranjanBelum ada peringkat

- EfasDokumen2 halamanEfasapi-282412620100% (1)

- General Information SheetDokumen6 halamanGeneral Information SheetInnoKal100% (2)

- Senario Case StudyDokumen19 halamanSenario Case Studymaya100% (1)

- New Microsoft Word DocumentDokumen3 halamanNew Microsoft Word Documentishagoyal595160100% (1)

- Assignment 1: Course Name & Code: Assignment Title: Student Name: Student ID: Submitted To: Date of SubmissionDokumen7 halamanAssignment 1: Course Name & Code: Assignment Title: Student Name: Student ID: Submitted To: Date of Submission4basilalhasaniBelum ada peringkat

- Executive Order No. 398: DteiacDokumen2 halamanExecutive Order No. 398: DteiacDanBelum ada peringkat

- Job Desc - Packaging Dev. SpecialistDokumen2 halamanJob Desc - Packaging Dev. SpecialistAmirCysers100% (1)

- DLP Fundamentals of Accounting 1 - Q3 - W3Dokumen5 halamanDLP Fundamentals of Accounting 1 - Q3 - W3Daisy PaoBelum ada peringkat

- From Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantDokumen13 halamanFrom Beds, To Burgers, To Booze - Grand Metropolitan and The Creation of A Drinks GiantHomme zyBelum ada peringkat

- The Ultimate Guide To Profitable Option Selling - Predicting AlphaDokumen4 halamanThe Ultimate Guide To Profitable Option Selling - Predicting AlphaCristian AdascalitaBelum ada peringkat

- Govt ch3Dokumen21 halamanGovt ch3Belay MekonenBelum ada peringkat