Material Evidence: Research

Diunggah oleh

freemind3682Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Material Evidence: Research

Diunggah oleh

freemind3682Hak Cipta:

Format Tersedia

MATERIAL EVIDENCE

OCTOBER 13TH Research Strategies Solutions

Sean Corrigan Chief Investment Strategist

Diapason Commodities Management Ltd

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

Money, Macro & Markets around the globe, making temporary heroes of was 'entering deep water' in the argot.

the foreigners with fat cheque books and happy

Almost exactly 25 years ago, Mitsubishi Estate men out of those who sold them at top dollar Then we had CASS subtly lowering its forecast

proudly announced its purchase of 51% of the land- whatever it was they desired. for this year by one percentage point to 7.3% and

mark NY property, the Rockefeller Center in a deal reducing that for next to 7% dead an act which

which was both the culmination of contemporary Nor do the parallels stop there. Arguably the best we should not so much ridicule for its spurious

Japanese hubris and the trigger for a good deal of performing index since the 3QE episode began in arithmetical exactitude as recognise for the exer-

collective psychosis in an America which feared it late 2012, the Growth Enterprise Board stocks of cise in expectations management which it so ob-

was being eclipsed by its former foes. China's rocket-fuelled 25% Chinext began their viously represents.

run only after suffering a slump of some 25%.

The deal could hardly have been more sweetly Similarly, before embarking on its final upward More importantly, Li Keqiang himself tried to

timed, coming within less than two months and bound, the Topix also shed 25% of its value in the move away from the fetish of 7.5, arguing that we

barely 7% of the all time bubble high in the Japanese Crash of 87. Superimposing the two, we find that foreigners had 'misunderstood' its import: if

stock market and thus at the very zenith of that the Astoria purchase coincides neatly in time things came in a little higher or a little lower, no-

nation's property bubble and its zaitech financial en- with the Rockefeller centre acquisition. If past is one would care as long as jobs were being created

gineering. The Topix had risen for nothing short of a in any way prologue, the New Year could be a and incomes continued to rise (as, naturally, they

quarter of a century, soaring by a factor of 34 in yen rocky one for all the new found Dama equity were at present)

and by a multiple of almost 90 when that currency's bulls in today's China.

secular appreciation was taken into account. The Beating the drum of microeconomic precision

next 25 years would not be quite so friendly, starting Meanwhile, on their return from the Golden strikes rather than that of macroeconomic carpet-

as they did - with a 2 year slump in which the Week holiday, various members of the Chinese bombing, he again declared his faith in the

index saw half its gains wiped out before it suffered regime have been keen to resume the theme of 'unleashing' of the power of the market and tried

a long series of gradually declining undulations to- the 'New Normal'. to draw a semantic distinction between policies of

wards a post-LEH nadir some 75% below that loftiest indiscriminate stimulus and of those intended to

of peaks. PBoC chief economist Ma Jun indulged in a spot stimulate specific sectors of the economy in order

of 'forward guidance' by ruling out large-scale to 'target key areas and weak links, to provide support

So today, when the relatively obscure but exquisitely stimulus 'for the foreseeable future', saying that for small and micro enterprises, agriculture, and the

'connected' Angbang (for the buck?) Insurance an- henceforth such a response will not be called for service industry.'

nounced it would be buying the no less iconic Wal- every time the economy slows down.

dorf Astoria for a whopping $1.95 billion, it was hard No change of course is yet being signalled nor,

to avoid a frisson of foreboding. For his part, NDRC Deputy Secretary-General one supposes, is one likely to emerge from the

Wang Yiming told his audience in what was de- upcoming Fourth Plenum to be held in two

No less than did Japan, China's attempts to manage scribed as a 'keynote' speech that far from being a weeks time a convocation which traditionally is

its currency against that of the global hegemon led to matter for 'pessimism', the ongoing deceleration concerned with the implementation of the poli-

an inappropriate mix of policies. No less than Japan, was, to the contrary, a positive sign that the re- cies decided at the all-important Third Plenum in

a domestic credit bubble spilt over to provoke excess form process was beginning to take hold, that it the previous autumn.

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 2

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

New Normal

Source: Bloomberg

Source: Bloomberg

New Normal

Source: Bloomberg

TOPIX

Source: Bloomberg

Uneasy parallels

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 3

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

Meanwhile, Europe staggers on its merry way, alter- And what extra, pray, will Snr. Draghi strive to our noble technocrat can hardly be accused of

nating between false dawn and repeated disillusion. deliver? Why, lower real incomes all round, of being dangerously innovative. After all, modern

As it doesand for all his pontificating about the course - sorry, no: it will stand accountable to the demand management has degenerated into

need for structural reform - Mario Draghi just can- European people for delivering price stability, which nothing more than a game of seeing whose turn it

not bring himself to step back from the limelight and today means lifting inflation from its excessively low is to ruin their balance sheets next. If businesses

mind his own knitting, as they say. level [sic]. cant or wont, surely households can be tempted;

if not, then it is the turn of the state; if the Spanish

Before heading off to that joint consortium of clueless All those of you who are constrained in your in- can no longer hold their end up, it must be time

collectivists the IMF and World Bank general meet- comes and who are struggling to pay your way in for the Germans to take a turn at the Chuck

ing, he could not forego the opportunity to do a little the world; all those of you who are earning noth- Prince Charleston. If all else fails, then the central

shameless grandstanding at the Brookings Institute. ing on your savings and so are gradually suc- bank will do whatever it takes to fill the gap and

There he contrived to conjure up the aura of fruitful cumbing to the temptation to take on too much thereby to sully the solvency of one and all by

Transatlanticism by dropping the names of the twin risk with what you have set aside; all those of you risking at best a confusion of capital pricing sig-

Titans of the worlds longest and deepest recession who face the unremitting, tax-grabbing hostility nals and at worst a complete debasement of their

and the patron saints of all subsequent perverse pro- of governments who pretend to be acting in your common money.

longation of economic woe - Keynes and Roosevelt. interest but who are simply trying to keep their

sprawling, electorally-indispensable coteries of Accordingly, Mr. Draghi was very much preach-

Yet despite the slick rhetorical opening this involved, party hacks, placemen, pen-pushers, and pettifog- ing to the choir when he popped into 1900 Penn-

the best Our Hero could offer was a promise of yet gers in the manner to which they have become sylvania Ave to speak to Lawyer Lagarde and her

more intervention along the same old lines, vaunting accustomed, you will no doubt be much reas- minions over the weekend (wheres Dick the

that for him, the risks of doing to little exceed the risks of sured by these assertions of our avuncular Mr. Butcher when you metaphorically need him?).

doing too much. He even saw fit to brag that while the Dragons. One French journalist reported that he was seen

combination of policies which would finally pull the to be unusually effusive in buttonholing people

continent out of its self-inflicted travails was Nor could the ECB chief resist an entirely disin- on the fringes of the formal sessions to try to sell

complex, it was not complicated since here comes genuous appeal to yet more mindless pyramid his three-pronged approach of yet easier money,

the punchline some six, nearly seven, years in to the building. After offering some weasel words about more particular fiscalism, and the sheer effront-

debt-and-dirigisme disaster we brought down upon how budgetary discipline ought, at all costs, to be ery of it a properly EUSA (or EUSSR) political

ourselves by following the advice of such as our ora- maintained he then completely vitiated this de- monolith within which to enact the two more ag-

tor - each of the steps involved is well understood. mand by arguing that where the relevant author- gressively.

ity found itself with a little fiscal space i.e.,

Arf! Arf! Its the way Oi tell em though one won- where it had not already exhausted the patience With the Catalans openly defying Madrid's inter-

ders whether the thousands of struggling European of its creditors it should not hesitate to use it. dict on their expression of national will; with AfD

entrepreneurs and the millions of long-term unem- No prizes for guessing at whom this injunction is rapidly establishing itself as a feature of the Ger-

ployed whom they find it unviable to engage would aimed. man electoral landscape; with Veneto calling for

find much to laugh at in this ludicrous display of secession; with Beppe Grillo striving for and

intellectual conceit. In all this and for all his inexhaustible self-regard, likely to get - a million signatures on a motion for

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 4

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

Source: Bloomberg

Source: Bloomberg

We know exactly what to do!

We know exactly what to do!

Source: Bloomberg

Trouble of a different stripe

Source: Bloomberg

We know exactly what to do!

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 5

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

an Italian exit from the Euro; with UKIP pushing Fhrerbalkon posturing of the Olympic Games and and by banning the use of disposable cups and

the established parties into unabashed platform play World Cup soccer every summer, being sure plates in the fast food business. Vive les Gastros! A

plagiarism one side of the Channel and with Marine to build anew instantly redundant and ruinously bas les MacDos!

le Pen eating Hollande's hapless crew for breakfast expensive facilities for each iteration of hop, skip,

on the other, this is a proposal hardly likely to take The Ekonomista may have waxed lyrical about how

and jump and mass pig-bladder chasing so that

wings. Yet Mario cannot resist for if the last vestige successive exercise in Panis et Circenses could exert

Valls headed the most reformist government France

of sovereignty is not extinguished across the Twi- has seen for many years (that is supposed to be a

the maximum effect. How could recovery fail to

light Zone, he cannot strut and fret upon the world be assured? challenge, right?), but his boss over in the lyse

stage and signify more than sound and fury, poor was apparently less than impressed with the volte

dear, and then that insufferable Herr Weidmann As for the idea reform, just take the case of M. face this ostensibly comprised. Le Figaro was

can continue to oppose him! Valls, the new socialist broom brought in to sweep happy to run a piece proclaiming Tension between

a little dust from the dingy corridors of the Hol- Hollande and Valls on the pace of reform, with the

As for La Tricoteuse, knitting furiously beside Citi- lande government. On a whirlwind tour of other President variously being described as being

zen Pikketys rasoir national while she awaits the European capitals, he assured Frau Merkel that he equivocal or just downright angry about some

next tumbrel load of evil capitalists to be delivered would indeed soon do something concrete before of the Wunderkinds kite-flying. Given that the staff

by Brother Blanchard, what she wants what else? vowing to David Cameron that having lived be- turnover in the Hollande cabinet would put a So-

is more accommodative monetary policy, more yond our means for forty years, he and the viet punishment battalion at Stalingrad to shame,

growth-friendly fiscal measures, and Maynard be French were eager to make up for lost time. No we will believe in the Boy Manuels programme

praised! increased investment in infrastructure. more 75% top tax rate come January and an inten- when we actually see it enacted.

tion to open the shops on Sundays were the proofs

Of course, the construction of the latter shovel positive that he brandished on that occasion. No, Not that France doesnt need a little invigoration,

ready hodge-podge of roads-to-nowhere, of unpeo- France was not sclerotic, hopeless, and downbeat industrial production in August, for example, was

pled provincial playhouses, and of half-filled, as the John Lewis boss had scathingly described it back at four year lows, 15% off the peak and at

Hadid houses for hackneyed art school earlier in the week. levels first seen way back in 1989 and Les Bleus

'installations would rapidly exhaust the remaining didnt even get to contest the latter stages of the

fiscal space if it were not for the fact that they Sadly, one such big 'reform' idea rapidly gathering Mondial by way of an excuse for malingering on

could all too easily be combined with Marios solu- support is hardly likely to mobilise an influx of the shop floor that month.

tion-in-search-of-a-problem wheeze of buying oo- private capital, viz., that of nationalizing the coun-

dles of assignat-backed-securities. This is, it has to try's toll roads. Another is to shut down a third of What about Italy? There, IP was also anaemic to

be said, exactly the sort of paper which could be the nation's nuclear reactors in the next 10 years the point that the average for the past six months

issued complete with specious state guarantee while reducing hydrocarbon use to 30% of the now lies below the trough of the Crash meaning

attached to finance an expensive, but entirely sub- total, cutting electricity consumption along the we have to go all the way back to 1987 to root out

marginal, PPP programme of public works and so way by a half and greenhouse gas production by a lower reading. Also, it is worth keeping on eye

massage up the GDP numbers for a quarter or two. 75. Aside from burning copious amounts of fairy on the fact that, despite no renewed evidence of

dust, the country will achieve this 'transformation' tightness on the capital markets - where spreads

Perhaps we should halve the interval between the partly by outlawing the biblical evil of plastic bags to Bunds in the 140s remain close to three-year

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 6

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

Source: Bloomberg

Source: Bloomberg

Source: Bloomberg

All march to the same beat

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 7

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

lows and where outright yields have never been Which finally brings us to Germany, sputtering at

Moms, all too few of these denizens of the desk-

lower - Italys T2 balance has bounced back up by last as its neighbours to the West, its new, NATO-

top seem able to conceive of the fact that the 300

50% - or by a considerable 67bln - in the past two determined foes to the East, and its capital goods

million brave little soldiers around whom they

months, reversing from a 33-month low to an 8- customers half a world away each suffer their

fluster might actually work out how to tie their

month high while total bad debt climbs inexorably, own burst of turbulence. own shoelaces and perform their own ablutions,

reaching a new high of 174 billion, more than 20% even if interest rates were to move a percent or

higher than a year ago and up 340% from late 2008. For example, unadjusted exports reckoned in two higher over the next few quarters or

USD collapsed in the space of just over four Heaven forfend! if the dollars real effective ex-

In the Netherlands, too, industrial sales have fallen weeks from a mark which was close to 3 year change rate were to advance much beyond its

sharply to the very bottom of last four years range highs (indeed, to the pre-Crash peak) to their present vantage close to the median of the entire

(at least when measured in USD), where they now lie worst in 20 months a fall which also means they four-decade floating rate era.

one-sixth below the springs 3-yr peak. are back to late 2006 levels. The 18.4% monthly

swoon was a 2.2 sigma event and the worst ex- For such nervous ninnies, there will truly never

Things were if anything worse still in Finland where perienced at least since the Wall came down. be any data strong enough for them to summon

IP is on life support some 20% below its peak, back Even measured in a shrinking euro, the magni- up the courage to act - or rather, to refrain from

below the immediate post-Crash lows at levels last tude of the air pocket has only been matched acting and hence to allow the prices of things

seen as long ago as 2002. Output is now fully one twice since Reunification - once in the midst of goods, services, short-order cooks and software

third below where a projection of 1970-2008s secular the Asian Contagion and once when the ReUni engineers, as well as of CDOs and cyclical count-

trend of 3.5% p.a. growth should have reached by boom rolled over into the Maastricht bust. ers to find their own level and so perform their

now. Of some concern is that fact that this industrial true economic function.

torpor has not been matched by any reluctance to Likewise, industrial production lurched from

continue to contract debt obligations. Bank loans to near the top to nigh on the bottom of its recent Sometimes one is driven to wondering how it

the private sector have risen more in Finland in the band suffering the worst monthly reversal since ever was that the United States of America could

past six years than anywhere else in the Zone. With the GFC with capital goods hard hit to touch 15- have been transformed from a vast, underpopu-

an increment of 25% in that period, the country pro- month low/early 2007 levels and auto sales lated, unwheeled, unhorsed, Rousseauan wilder-

vides a marked contrast with Germanys essentially evaporating by no less than 25%.ds leading and ness into the mightiest and most advanced indus-

unchanged total much less with hairshirt Spains Auto -25% trial nation known to mankind without the tender

28% reduction. It has also grown twice as much pro- ministrations of a Bill Dudley, a Charlie Evans, or

portionately as in the next fastest pairing of Austria Much more of this and Jens will be begging Mario an Ed Quince (!) to smooth the way for its hapless

and France where the gain has been of the order of to buy some Daimler paper! denizens.

12%. S&P, by the way obviously agree - they just

stripped the country of its all too rare AAA rating. As ever, the one market where there seem to be Then again, most of the hard yards in that march

few dramas at present is that in the States of progress were made in the 421 years between

Good job the Nomenklatura are not relying on top- though you would never think it to listen to the Columbus landfall and the passage of the act

ranked sovereigns to underwrite their support stimulus-junkie, 1937 bogey-ridden Doves on the which founded the Federal Reserve. One might

scheme fantasies any longer FOMC. Like a cluster of over-protective Soccer even argue that too much of that territory has

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 8

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

been relinquished once more during the last 25 years None of this is good enough for the likes of Chi- Commodity Corner

of runaway FRB intrusiveness. Do you suppose it cago Fed president Charles Evans, yet another

ever occurs to any of the inhabitants of the Marriner loose money man who worries that '...we're at a As for that same oil price, the markets have be-

S Eccles building - that Minas Morgul of macroeco- point where we need to get inflation up...' come fascinated by its ongoing and largely un-

nomics - to run their precious econometrics on the heralded decline.

coincidence of episodes of rapid central bank balance If by that faltering of 'inflation' the likes of Evans

sheet expansion and of widespread economic etiola- really mean the beneficent fall in the cost of living We market actors do love our Just So stories to be

tion or between acts of sustained central government we income-constrained monkeys are currently confirmed by the price action so that we can all

intervention and sudden industrial infarction? getting to enjoy now that the leveraged Herd is nod sagely at each other when we recycle the tale

not being so amply gavaged by the CB Gutenber- between ourselves in our written commentaries

Though not without a tally of underachievers, busi- gomanes, there is one graph at which a glance and two-minute TV slots. This becomes all the

ness sales Stateside ended the summer running should quickly tell them to cease their hand- more compelling when the trajectory has gone

pretty much on trend at around 4.5-5% a year and wringing and to rejoice in our common good for- decidedly counter to our previous shared mythol-

payroll costs are seemingly keeping pace, implying tune instead. ogy and when cognitive dissonance gives way -

that labour is both getting its fair share and that it is via mass embarrassment - to outright paradigm

not out of kilter and so threatening first the possibil- This consists of two elements: the first a plot of shift.

ity of (operational) profit and, next, its own trend's either of the wings (i.e., the 5-year or the 10-year

longevity. BEIs themselves) of the forward break-even rate The fewer dissenters there were who did not buy

to which they have all become so pseudo- into the earlier consensus, the greater the ease

All this, it should be noted, has come about while the scientifically attached despite the obvious flaw with which any half-way convincing piece of post

Federal deficit has shrunk by two-thirds, or $1 tril- that it has been largely vitiated as a signal by the hoc reasoning will tend to be adopted by the sell-

lion a year. So much for the 'fiscal cliff'. For once, do- noise arising from both the fact of and the mar- side analytical base. In the face of a perverse

mestic banks seem not to have been too unbridled in ket's second-guessing of the future possibilities of market trend what is never to be underesti-

fuelling the flames on the real side even if they may those same central bankers' actions. The second mated is the flimsiness of any case made by

have been typically too complicit in stoking up the component is a superposition of that first squig- means of what we like to flatter ourselves are

fires of financial speculation. As much as 35% of the gle with one displaying the price of crude oil. the fundamentals'. In fact, if the contrariness

$900 billion in new assets they added this year long persists - as is clearly the case with today's

wound up as cash (most of it parked idly at the Fed). Given that the two are almost indistinguishable oil prices - one should always expect the

Against this, a mere $250 billion in extra productive to the naked eye, what Friend Evans seems to 'fundamentals' themselves to be neatly mas-

lending took place, broken down into $150 in C&I imply is that the road to economic nirvana can saged to reflect the new reality. Rationalizers

loans two-thirds of that dedicated to inventory fi- only be travelled if his fellow Americans are tend to rule the roost, not rationalists.

nance and $100 in CRE lending. By contrast, the forced to pay more for the privilege when they fill

banks have made $220 billion in UST and Agency up at the gas stations they find along the way. In pure market terms, then, the worry is that the

purchases and extended $105 billion in the 'other' specs are still very long while the monstrous regi-

loans category which includes margin lending and ment of pundits is now scrambling to produce

other forms of asset speculation. 180-degree reversed justifications for why prices

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 9

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

Source: Bloomberg

One of many in real

danger

Benign Deflation

Source: Bloomberg

Wobbling

Source: Bloomberg

Another top in

Source: Bloomberg place?

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 10

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

can continue ever lower. Moreover, no-one likes to duction as depletion of current wells caught up the objective trend. What is perhaps more to the

get caught going into year-end book-closing (still with lessened drilling schedules. On similar point for our present purpose is that the market is

October for some funds) with a big fat slug of over- grounds, Seth Klarmans crew at Citibank have willing to entertain such thoughts precisely be-

exposure to losers, especially when as we are con- made a few waves in the media by pushing a cause it wants to believe that oil could trade a

stantly being reminded wherever we go these days sunk-cost argument to reckon the cut-off in the good deal lower yet.

the vast preponderance of active managers have un- near term is where ongoing operational cash flow

derperformed the index trackers this year . dries up, way down at perhaps half the present Even if one were to doubt that the price down

price. there might be long sustainable, could crude

Justifications have converged largely around the ac- therefore fall another $10/bbl beyond the 2012

tivities of the Saudis, though that is where the narra- Beyond this, there are those who see the murkier lows at which we presently and very precariously

tive rapidly becomes frayed into different strands of forces of geopolitics at play though, once again, rest and so retrace a full 50% of the post-GFC re-

hypothesis and supposition. Certainly, they spooked one can discern several completing plot lines on flation rally? Could the move extend another $10

the horses by cutting OSPs to Asian customers the storyboards of this particular Hollywood beyond that into the middle of the congestion

within days of the revelation that they were helping thriller. Is Saudi acting alone in the attempt to pattern laid down in the four years either side of

OPEC supply more than at any time in the past 12-15 weaken its internecine enemies in Iran while also 2008s blow-off and 2009s implosion?

months. Whispers have also surfaced of their agents pressuring the Russians into withdrawing their

trying to lock competing crudes out of the European support for Tehrans allies in Damascus? Is Saudi It would not be wise to become suckered into the

refinery market and of unattributed briefings in New working with the US despite the obvious pain tyros game of projecting ever lower ahead of a

York in which the acceptance of lower prices has being caused there (if not, necessarily to dyed-in- falling quotation, but it is also hard to rule out

been made clear. the-wool supporters of the Democratic admini- either of these objectives until we either get

stration or its Green fellow travellers) to the meaningful declaration of producer cutbacks or

At its least conspiratorial, the above has led some to exact same end? Is it, rather, a straight translation an end to the run of bad economic news emanat-

see it simply as the Kingdoms economic attempt to of the Neocons Cold War II with America exert- ing from all too many corners of the globe.

price out the investment capacity of its main (mostly ing a little Full Spectrum Dominance at the ex-

US onshore) competitors in a manner roughly analo- pense of Vladimir Putins coterie of resource bar-

A similar mass disillusion has been stalking PMs,

gous to the 1986 drive to discipline the likes of ons? If that latter, then might one also see the

too , with retail chucking in the towel and, more

Venezuela. White House repeal, or at least relax, the restric-

generally, commodity funds blowing up or re-

tion on US crude exports - thereby offering some

porting big losses once again. Gold having hit the

For what its worth, our friends at Tudor Holt pricing offset to the locals? $1180s and bounced for the third time of asking,

Pickering reckon that and here we paraphrase it seems we are a long enough way down to

loosely - with so many shale oil companies boasting Who can say, though there are ample hints and spook the pilot fish and so drive some restorative

negative free cash flow, a drop to the region of $75/ sufficient unguarded comments to be read to sup- short covering. The Fed-inspired hiatus in the

bbl will slow the US reinvestment rate appreciably, port each of these scenarios for example, the dollars rise, the reawakening of risk in the tradi-

perhaps even close off external sources of capital comments of Rosneft VP Mikhail Leontyev to the tional indicators such as VIX and junk spreads

completely, but that this would take perhaps another effect that the Saudis are being manipulated into typically good for the relative price of gold versus

18 months or so to make itself felt in a drop in pro- lowering prices in a way which does not reflect industrial commodities as well as signs of a

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 11

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

Source: Bloomberg

Breakdown Precarious

Source: Bloomberg

Will it hold?

Source: Bloomberg

One Way bets

come unstuck

Source: Bloomberg

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 12

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

breakdown in the 3QE ascent of several key equity

indices, a spike in correlations, in put-call ratios, and

in the count of new lows versus new highs on the

NYSE have all joined in helping the rotation higher.

The jury remains out here while we hover at the very

lower end of value in the past 18 months post-

collapse range, but with the market still not short

either on the evidence of the COT or according to the

lease rate, it is hard not to harbour the suspicion that

Jaws himself will soon be heading for the depths

once more.

Sean Corrigan

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 13

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

US Stocks v Bonds Source: Bloomberg

Reversal Time?

Are we there, yet?

Source: Bloomberg

As rich as they

get?

Source: Bloomberg

As rich as they

get?

Source: Bloomberg

DCM LLP is authorised and regulated by the Financial Conduct Authority

Please refer to the risk and legal disclaimer at the end of the document. DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 14

MATERIAL EVIDENCE BY SEAN CORRIGAN

OCTOBER 13TH

DISCLAIMER

General Disclosure

This document or the information contained in does not constitute, an offer, or a solicitation, or a recommendation to purchase or sell any investment instruments, to effect any transactions, or to conclude any

legal act of any kind whatsoever. The information contained in this document is issued for information only. An offer can be made only by the approved offering memorandum. The investments described

herein are not publicly distributed. This document is confidential and submitted to selected recipients only. It may not be reproduced nor passed to non-qualifying persons or to a non professional audience. For

distribution purposes in the USA, this document is only intended for persons who can be defined as Major Institutional Investors under U.S. regulations. Any U.S. person receiving this report and wishing to

effect a transaction in any security discussed herein, must do so through a U.S. registered broker dealer. The investment described herein carries substantial risks and potential investors should have the requi-

site knowledge and experience to assess the characteristics and risks associated therewith. Accordingly, they are deemed to understand and accept the terms, conditions and risks associated therewith and are

deemed to act for their own account, to have made their own independent decision and to declare that such transaction is appropriate or proper for them, based upon their own judgment and upon advice from

such advisers as they have deemed necessary and which they are urged to consult. Diapason Commodities Management S.A. (Diapason) disclaims all liability to any party for all expenses, lost profits or

indirect, punitive, special or consequential damages or losses, which may be incurred as a result of the information being inaccurate or incomplete in any way, and for any reason. Diapason, its directors, offi-

cers and employees may have or have had interests or long or short positions in financial products discussed herein, and may at any time make purchases and/or sales as principal or agent.

This document is issued by Diapason and may be distributed by both entities Diapason or Diapason Commodities Management UK LLP (Diapason UK). Diapason is regulated by the Swiss Financial Market

Supervisory Authority and Diapason UK is authorised and regulated by the Financial Conduct Authority. Certain statements in this presentation constitute forward-looking statements. These statements

contain the words anticipate, believe, intend, estimate, expect and words of similar meaning. Such forward-looking statements are subject to known and unknown risks, uncertainties and assump-

tions that may cause actual results to differ materially from the ones expressed or implied by such forward-looking statements. These risks, uncertainties and assumptions include, among other factors, chang-

ing business or other market conditions and the prospects for growth. These and other factors could adversely affect the outcome and financial effects of the plans and events described herein. Consequently,

any prediction of gains is to be considered with an equally prominent risk of loss. Moreover, past performance or results does not necessarily guarantee future performance or results. As a result, you are cau-

tioned not to place undue reliance on such forward-looking statements. These forward-looking statements speak only as at the date of this presentation. Diapason expressly disclaims any obligation or under-

taking to disseminate any updates or revisions to any forward-looking statements contained herein to reflect any change in Diapasons expectations with regard thereto or any change in events, conditions or

circumstances on which any such statement is based. The information and opinions contained in this document are provided as at the date of the presentation and are subject to change without notice.

Trademarks

All rights reserved. DIAPASON COMMODITIES INDEX DCI, DIAPASON COMMODITIES MANAGEMENT and DIAPASON are trademarks and service marks of Diapason. Diapason has all pro-

prietary rights with respect to the DCI. In no way does Diapason make any representation or warranty, express or implied, to the holders of the investment described herein any member of the public regard-

ing the advisability of investing therein or in commodities generally or in futures particularly, or as to results to be obtained from the use of the DCI. Diapason disclaims any liability to any party for any inac-

curacy in the data on which the DCI is based, for any errors, omissions, or interruptions in the calculation and/or dissemination of the DCI, or for the manner in which it is applied in connection with the

issue and offering of a financial product. Diapason makes no warranty, express or implied, as to results to be obtained by investors from the use of the DCI, any data included therein or linked therewith.

Diapason does not make any express or implied warranties and expressly disclaims all warranties of merchantability or fitness for a particular purpose or use with respect to the DCI and any data included

therein. Without limiting any of the foregoing, in no event shall Diapason have any liability for any lost profits or indirect, punitive, special or consequential damages or losses, even if notified of the possibility

thereof.

Electronic Communication (E-mail):

In the case that this document is sent by E-mail, the E-mail is considered as being confidential and may also be legally privileged. If you are not the addressee you may not copy, forward, disclose or use any

part of it. If you have received this message in error, please delete it and all copies from your system and notify the sender immediately by return E-mail. The sender does not accept liability for any errors,

omissions, delays in receipt, damage to your system, viruses, interruptions or interferences.

Copyright Diapason Commodities Management SA 2014

Any disclosure, copy, reproduction by any means, distribution or other action in reliance on the contents of this document without the prior written consent of Diapason is strictly prohibited and could lead to

legal action.

Last updated January 9th, 2014 Compliance approved on October 13th, 2014

Diapason Commodities Management S.A

Malley Lumires, Chemin du Viaduc 1

Case Postale 225, 1000 Lausanne 16

Switzerland, Tel: +41 21 621 13 10

www.diapason-cm.com

DCM LLP is authorised and regulated by the Financial Conduct Authority

DCM SA is authorised and regulated by the Swiss Financial Market Supervisory Authority 15

Anda mungkin juga menyukai

- Bubbles, Booms, and Busts: The Rise and Fall of Financial AssetsDari EverandBubbles, Booms, and Busts: The Rise and Fall of Financial AssetsBelum ada peringkat

- The Absolute Return Letter 0709Dokumen8 halamanThe Absolute Return Letter 0709tatsrus1Belum ada peringkat

- Q2 Full Report 2020 PDFDokumen24 halamanQ2 Full Report 2020 PDFhamefBelum ada peringkat

- True Sinews: Tangible IdeasDokumen12 halamanTrue Sinews: Tangible Ideasfreemind3682Belum ada peringkat

- Zakaria, The Capitalist Manifesto (Newsweek 22.6.2009)Dokumen5 halamanZakaria, The Capitalist Manifesto (Newsweek 22.6.2009)Pavel100% (1)

- Investment Commentary 267Dokumen8 halamanInvestment Commentary 267thecynicaleconomistBelum ada peringkat

- Stocks Surpassing January Highs: Are We Peaking, or Will That Come in Late 2019?Dokumen8 halamanStocks Surpassing January Highs: Are We Peaking, or Will That Come in Late 2019?kumar.arasu8717Belum ada peringkat

- Current Issues in Financial MarketsDokumen5 halamanCurrent Issues in Financial Marketsreb_nicoleBelum ada peringkat

- Bill Gross Investment Outlook Feb - 08Dokumen3 halamanBill Gross Investment Outlook Feb - 08Brian McMorrisBelum ada peringkat

- Investment Commentary No. 271 June 28, 2010: From Greed To DecencyDokumen8 halamanInvestment Commentary No. 271 June 28, 2010: From Greed To DecencyttiketitanBelum ada peringkat

- UBS Cio em Aug19Dokumen16 halamanUBS Cio em Aug19Blue RunnerBelum ada peringkat

- Beware of Obama No MicsDokumen0 halamanBeware of Obama No MicsLiz HackettBelum ada peringkat

- Balance Sheets, The Transfer Problem, and Financial CrisesDokumen8 halamanBalance Sheets, The Transfer Problem, and Financial Crisesvib89jBelum ada peringkat

- Bill Gross Investment Outlook May - 07Dokumen9 halamanBill Gross Investment Outlook May - 07Brian McMorrisBelum ada peringkat

- The Great American Credit Collapse Pt2Dokumen7 halamanThe Great American Credit Collapse Pt2auroradogBelum ada peringkat

- 2009-04 Miller CommentaryDokumen5 halaman2009-04 Miller CommentaryTheBusinessInsider100% (1)

- Harley Bassman - Open - Letter - To - EU - April - 2015Dokumen4 halamanHarley Bassman - Open - Letter - To - EU - April - 2015Vivien ZhengBelum ada peringkat

- Reinventing Banking: Capitalizing On CrisisDokumen28 halamanReinventing Banking: Capitalizing On Crisisworrl samBelum ada peringkat

- LL Summer09 NAIDokumen4 halamanLL Summer09 NAIapi-26443227Belum ada peringkat

- Capital Flows and Capital-Market Crises The Simple Economics of Sudden CalvoDokumen21 halamanCapital Flows and Capital-Market Crises The Simple Economics of Sudden CalvoSam samsaBelum ada peringkat

- DKAM ROE Reporter April 2020Dokumen8 halamanDKAM ROE Reporter April 2020Ganesh GuhadosBelum ada peringkat

- First Quarter 2009 - NewsletterDokumen6 halamanFirst Quarter 2009 - NewsletterEricBelum ada peringkat

- 2020 Q1 TAVFX Shareholder Letter WebDokumen6 halaman2020 Q1 TAVFX Shareholder Letter WebKan ZhouBelum ada peringkat

- Finance 1Dokumen7 halamanFinance 1Samuel ChaoBelum ada peringkat

- Hoisington Quarterly Review and Outlook - Fourth Quarter 2014Dokumen11 halamanHoisington Quarterly Review and Outlook - Fourth Quarter 2014richardck61Belum ada peringkat

- Stop The Inflation or Deflation Debate - We Have Both Until Inflation PrevailsDokumen12 halamanStop The Inflation or Deflation Debate - We Have Both Until Inflation PrevailsNathan MartinBelum ada peringkat

- Bernstein Journal Summer08Dokumen39 halamanBernstein Journal Summer08Chaitanya JagarlapudiBelum ada peringkat

- GMO 2009 1st Quarter Investor LetterDokumen14 halamanGMO 2009 1st Quarter Investor LetterBrian McMorris100% (2)

- Rethinking Globalization - NotesDokumen13 halamanRethinking Globalization - NotesLana HBelum ada peringkat

- RateLab BernankeDokumen6 halamanRateLab BernankeZerohedgeBelum ada peringkat

- Is The Credit Crisis Winding DownDokumen8 halamanIs The Credit Crisis Winding DownAnanthBelum ada peringkat

- Review of Global EconomyDokumen31 halamanReview of Global EconomyAnanthBelum ada peringkat

- Secular Outlook El Erian - GBLDokumen8 halamanSecular Outlook El Erian - GBLplato363Belum ada peringkat

- Investment Compass - Quarterly Market Commentary - Q1 2009Dokumen6 halamanInvestment Compass - Quarterly Market Commentary - Q1 2009Pacifica Partners Capital ManagementBelum ada peringkat

- Quarterly: Third QuarterDokumen16 halamanQuarterly: Third Quarterrichardck61Belum ada peringkat

- "Beware of Obamanomics": White PaperDokumen14 halaman"Beware of Obamanomics": White PaperffmarkmBelum ada peringkat

- Kindle BergerDokumen13 halamanKindle BergerABBBABelum ada peringkat

- SULTANS OF SWAP: BP Potentially More Devastating Than Lehman!Dokumen13 halamanSULTANS OF SWAP: BP Potentially More Devastating Than Lehman!ZerohedgeBelum ada peringkat

- East Coast Asset Management (Q4 2009) Investor LetterDokumen10 halamanEast Coast Asset Management (Q4 2009) Investor Lettermarketfolly.comBelum ada peringkat

- Air Phase1 0Dokumen13 halamanAir Phase1 0drkwng100% (1)

- Legg Mason StrategyDokumen6 halamanLegg Mason Strategyapi-26172897Belum ada peringkat

- First Quarter 2010 GTAA MacroDokumen38 halamanFirst Quarter 2010 GTAA MacroZerohedgeBelum ada peringkat

- Oak - Tree - Hemlines and Investment Styles 09-10-10Dokumen11 halamanOak - Tree - Hemlines and Investment Styles 09-10-10eric695Belum ada peringkat

- C CC CCCDokumen7 halamanC CC CCCKelvingrove Partners, LLCBelum ada peringkat

- Check2Dokumen58 halamanCheck2dreadpiratelynxBelum ada peringkat

- Stocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionDokumen36 halamanStocks: Once More Up, Then The Big Down: NY Times' Krugman: We Are Entering The Third DepressionAlbert L. PeiaBelum ada peringkat

- Volatility: The Twilight ZoneDokumen12 halamanVolatility: The Twilight ZoneXuehao Allen ZhangBelum ada peringkat

- 2010 09 10 HemlinesDokumen11 halaman2010 09 10 HemlinesDan-S. ErmicioiBelum ada peringkat

- Animal Spirits Redux 17 Nov 2009Dokumen2 halamanAnimal Spirits Redux 17 Nov 2009api-26869162Belum ada peringkat

- Chart 1: Leading Economic Indicators: Page 1 of 11 445 Park Avenue, 5 Floor - New York, NY 10022 - 212.201.5800Dokumen11 halamanChart 1: Leading Economic Indicators: Page 1 of 11 445 Park Avenue, 5 Floor - New York, NY 10022 - 212.201.5800sugumar_rBelum ada peringkat

- Where Has All The Money Gone, Part II - Finance SectorDokumen2 halamanWhere Has All The Money Gone, Part II - Finance SectorSimply Debt SolutionsBelum ada peringkat

- Historical View of The Financial Market We Are inDokumen8 halamanHistorical View of The Financial Market We Are indredamBelum ada peringkat

- When Will Inflation Really Hit UsDokumen3 halamanWhen Will Inflation Really Hit UsZerohedgeBelum ada peringkat

- Convexity - Maven - The - White - Swan - Harley Bassman - 20210203Dokumen8 halamanConvexity - Maven - The - White - Swan - Harley Bassman - 20210203Vivien ZhengBelum ada peringkat

- The Lost Decade - Commentary & Strategy (October 2009)Dokumen6 halamanThe Lost Decade - Commentary & Strategy (October 2009)bienvillecapBelum ada peringkat

- NJH 200823Dokumen20 halamanNJH 200823ResearchtimeBelum ada peringkat

- Nouriel Roubini John MakinDokumen15 halamanNouriel Roubini John MakinSamy SudanBelum ada peringkat

- 2015 - 3 From Risk Free Returns To Return Free RiskDokumen16 halaman2015 - 3 From Risk Free Returns To Return Free RiskSerigne Modou NDIAYEBelum ada peringkat

- 13 0470 01 Secular Outlook El Erian - GBLDokumen8 halaman13 0470 01 Secular Outlook El Erian - GBLfreemind3682Belum ada peringkat

- Social and Environmental Accounting and Reporting: From Ridicule To Revolution? From Hope To Hubris? - A Personal Review of The FieldDokumen17 halamanSocial and Environmental Accounting and Reporting: From Ridicule To Revolution? From Hope To Hubris? - A Personal Review of The Fieldfreemind3682Belum ada peringkat

- Epl 080212 FinalDokumen34 halamanEpl 080212 FinalEnergiemediaBelum ada peringkat

- About Puma e PamplDokumen3 halamanAbout Puma e Pamplfreemind3682Belum ada peringkat

- Epl 080212 FinalDokumen34 halamanEpl 080212 FinalEnergiemediaBelum ada peringkat

- Session 7 Team Presentation 9Dokumen5 halamanSession 7 Team Presentation 9freemind3682Belum ada peringkat

- Material Evidence by Sean Corrigan 4: 1 TH March 2011Dokumen13 halamanMaterial Evidence by Sean Corrigan 4: 1 TH March 2011freemind3682Belum ada peringkat

- Merits of CFROIDokumen7 halamanMerits of CFROIfreemind3682Belum ada peringkat

- The Tipping Point: Investment OutlookDokumen4 halamanThe Tipping Point: Investment Outlookfreemind3682Belum ada peringkat

- Research Division: Federal Reserve Bank of St. LouisDokumen39 halamanResearch Division: Federal Reserve Bank of St. Louisfreemind3682Belum ada peringkat

- FRM 2018 SGDokumen24 halamanFRM 2018 SGfreemind3682Belum ada peringkat

- DuD 14 08 03Dokumen3 halamanDuD 14 08 03freemind3682Belum ada peringkat

- Gold vs. Paper: Ian'S Investmentment Insights Special EditionDokumen13 halamanGold vs. Paper: Ian'S Investmentment Insights Special Editionfreemind3682Belum ada peringkat

- Material Evidence: ResearchDokumen19 halamanMaterial Evidence: Researchfreemind3682Belum ada peringkat

- Absolute Return - Letter May 2016Dokumen9 halamanAbsolute Return - Letter May 2016freemind3682Belum ada peringkat

- Publications: Books Odel. Truth and Provability, 2 Vols. (Kurt GDokumen6 halamanPublications: Books Odel. Truth and Provability, 2 Vols. (Kurt Gfreemind3682Belum ada peringkat

- Harvey DBDokumen10 halamanHarvey DBfreemind3682Belum ada peringkat

- TTMYGH Conscious-Uncouplings PDFDokumen41 halamanTTMYGH Conscious-Uncouplings PDFfreemind3682Belum ada peringkat

- Sustainability Report XYDokumen33 halamanSustainability Report XYfreemind3682Belum ada peringkat

- Sustainable Business Trends XYDokumen22 halamanSustainable Business Trends XYfreemind3682Belum ada peringkat

- Oaktree Liquidity LetterDokumen12 halamanOaktree Liquidity LetterZerohedgeBelum ada peringkat

- The Cyclical Inflation Pick-Up: Down Under Daily, 9 June 2014Dokumen3 halamanThe Cyclical Inflation Pick-Up: Down Under Daily, 9 June 2014freemind3682Belum ada peringkat

- Jeremy Grantham - Immigration and BrexitDokumen7 halamanJeremy Grantham - Immigration and BrexitsuperinvestorbulletiBelum ada peringkat

- CSR-Konzeptionen Im Vergleich (16) Konzeptionen Demokratischer Governance Im VergleichDokumen25 halamanCSR-Konzeptionen Im Vergleich (16) Konzeptionen Demokratischer Governance Im Vergleichfreemind3682Belum ada peringkat

- Eclectica Absolute Macro Fund: Manager CommentDokumen3 halamanEclectica Absolute Macro Fund: Manager Commentfreemind3682Belum ada peringkat

- Flat at The Margin: Down Under Daily, 27 August 2014Dokumen3 halamanFlat at The Margin: Down Under Daily, 27 August 2014freemind3682Belum ada peringkat

- Waiting For Godot's Pay Rise: Down Under Daily, 4 August 2015Dokumen3 halamanWaiting For Godot's Pay Rise: Down Under Daily, 4 August 2015freemind3682Belum ada peringkat

- DuD 14 12 13Dokumen3 halamanDuD 14 12 13freemind3682Belum ada peringkat

- 5 Charts For 2015: Down Under Daily, 22 December 2014Dokumen3 halaman5 Charts For 2015: Down Under Daily, 22 December 2014freemind3682Belum ada peringkat

- HDFC Life InsuranceDokumen12 halamanHDFC Life Insurancesaswat mohantyBelum ada peringkat

- Microeconometría BancariaDokumen62 halamanMicroeconometría BancariaJhon Diego Vargas OliveiraBelum ada peringkat

- UNFFD Case Study Ethiopia PDFDokumen13 halamanUNFFD Case Study Ethiopia PDFGondelcar1Belum ada peringkat

- Account Opening-Board ResolutionDokumen3 halamanAccount Opening-Board ResolutionAbubakar ShabbirBelum ada peringkat

- December 2023 1Dokumen41 halamanDecember 2023 1rs5002595Belum ada peringkat

- Double Entry SystemDokumen17 halamanDouble Entry SystemDastaan Ali100% (1)

- IELTS Workshop Test Schedule 2015Dokumen2 halamanIELTS Workshop Test Schedule 2015Raihan YamangBelum ada peringkat

- Marketing Strategy of Axis Bank ( General Management) NewDokumen39 halamanMarketing Strategy of Axis Bank ( General Management) NewrohitBelum ada peringkat

- BNI Mobile Banking: Histori TransaksiDokumen7 halamanBNI Mobile Banking: Histori TransaksiErwin NasrullahBelum ada peringkat

- 34 Analysis of Demat Account and Online Trading HimanshuDokumen74 halaman34 Analysis of Demat Account and Online Trading HimanshuVasant Kumar VarmaBelum ada peringkat

- CSP Vendor Maintenance FormDokumen4 halamanCSP Vendor Maintenance FormKurt FinkBelum ada peringkat

- IIBF Vision July 2019Dokumen8 halamanIIBF Vision July 2019Rakesh KumarBelum ada peringkat

- Backup of Gopal Insurence PDFDokumen5 halamanBackup of Gopal Insurence PDFmkm969100% (1)

- Sbi PDFDokumen5 halamanSbi PDFshweta pundirBelum ada peringkat

- Performance Evaluation of Bancassurance - Bankers POV PDFDokumen10 halamanPerformance Evaluation of Bancassurance - Bankers POV PDFcrescidaBelum ada peringkat

- Someone Elses Pay Off I Put The Link Here N A TexDokumen3 halamanSomeone Elses Pay Off I Put The Link Here N A Texjulianthacker100% (1)

- IC 34 New - Q&A Module NewDokumen25 halamanIC 34 New - Q&A Module NewAmanjit Singh100% (1)

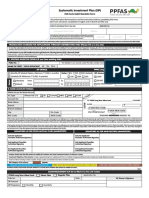

- Ppfas Sip FormDokumen2 halamanPpfas Sip FormAmol ChikhalkarBelum ada peringkat

- Keeping Ahead of The CurveDokumen36 halamanKeeping Ahead of The Curvegagandhillon10Belum ada peringkat

- Continuing Guaranty - TemplateDokumen4 halamanContinuing Guaranty - TemplateRamon UntalanBelum ada peringkat

- OPM Part - B Volume - 1 ENGDokumen42 halamanOPM Part - B Volume - 1 ENGkiflesemusimaBelum ada peringkat

- Sewalem SSisayDokumen90 halamanSewalem SSisaychuchu100% (1)

- Development Bank of The Philippines vs. Prudential BankDokumen2 halamanDevelopment Bank of The Philippines vs. Prudential BankKaye Miranda LaurenteBelum ada peringkat

- ReportDokumen1 halamanReportumaganBelum ada peringkat

- State Police Travel - Forfeiture FundsDokumen6 halamanState Police Travel - Forfeiture FundsMark BrackenburyBelum ada peringkat

- Enter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryDokumen1 halamanEnter Amount To Be Added in Wallet: Search For A Product, Brand or CategoryHowaxBelum ada peringkat

- BCOM V Sem - Principles of Insurance Business - Unit II NotesDokumen3 halamanBCOM V Sem - Principles of Insurance Business - Unit II NotesMona Sharma DudhaleBelum ada peringkat

- Chap-6-Verification of Assets and LiabilitiesDokumen48 halamanChap-6-Verification of Assets and LiabilitiesAkash GuptaBelum ada peringkat

- Rbi ThesisDokumen51 halamanRbi ThesisAnil Anayath100% (8)

- Statement For Account No 60258865747 From 01/11/2019 To 31/01/2020Dokumen8 halamanStatement For Account No 60258865747 From 01/11/2019 To 31/01/2020Hargur BediBelum ada peringkat