Wassim Zhani Corporate Taxation 1 Corporate Tax Return - Trial Balance

Diunggah oleh

wassimzhaniHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Wassim Zhani Corporate Taxation 1 Corporate Tax Return - Trial Balance

Diunggah oleh

wassimzhaniHak Cipta:

Format Tersedia

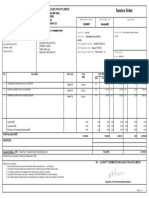

UnAdjusted Adjusted Tax Tax 1120

Book Balance Adjustment Book Balance Adjustment Trial Balance Tax Return

Description DR CR DR CR DR CR DR CR DR CR Summary Tic Marks

Sales 2,100,000 2,100,000 2,100,000

Dividend Received 5,000 5,000 5,000

Interest Income on US Treasury Bonds 10,000 10,000 10,000

Long Ter Capital gain 7,000 7,000 7,000 -

Purchases 700,000 700,000 700,000

Salaries-Officers 210,000 210,000 210,000

Salaries-Sales & Clerical 265,000 265,000 265,000

Repairs & Maintenance 20,000 20,000 20,000

Bad Debt expense 5,000 5,000 4,000 1,000

Interest Expense 14,000 14,000 14,000

Charitable Contributions 60,000 60,000 60,000

Depreciation (per book) 40,000 40,000 10,000 50,000

Advertising 14,000 14,000 14,000

Meals & Entertainment 16,000 16,000 11,000 5,000

Taxes (State, local & payroll) 50,000 50,000 50,000

Life Insurance Premiums 10,000 10,000 10,000 -

Long Term Capital Loss 9,000 9,000 9,000 -

Federal Income Taxes paid 150,000 90,550 240,550 240,550 - 1,407,500 2,115,000

Dividend Paid 60,000 60,000 60,000 -

Dividend Received Deduction 3,500 3,500

Stock Valuation Loss 15,000 15,000 15,000 707,500 Taxable Income

Penalty for Underpayment 3,268 3,268 3,268 -

Cash 691,000 691,000 691,000

Accounts Receivable 31,000 31,000 31,000

Allowance for Doubtful accounts (6,000) (6,000) (6,000)

US Treasury Bonds 20,000 20,000 20,000

Stocks 70,000 70,000 70,000

Inventory 375,000 15,000 360,000 360,000

Equipment 405,000 405,000 405,000

Land 164,000 164,000 164,000

Building 500,000 500,000 500,000

Accumulated Depreciation (251,000) (251,000) (10,000) (261,000)

Accounts Payable-Tax Liability 93,818 93,818 334,318 334,318

Accounts Payable 350,000 350,000 - 350,000

Notes payable 400,000 400,000 - 400,000

Capital Stock 150,000 150,000 - 150,000

Retained Earnings 600,000 600,000 - 700,818

3,622,000 3,622,000 108,818 108,818 3,715,818 3,715,818 341,318 341,318 3,715,818 3,715,818

- - -

COMPUTATION OF NET INCOME

Sales 2,100,000

Dividend Received 5,000

Interest Income on US Treasury Bonds 10,000

Long Ter Capital gain 7,000

2,122,000

Less: Cost of Goods Sold

Opening Stock 375,000

Purchases 700,000

1,075,000

Closing Inventory 360,000

Gross Profit 715,000

Gross Profit 1,407,000

Operating Expenses

Salaries-Officers 210,000

Salaries-Sales & Clerical 265,000

Repairs & Maintenance 20,000

Bad Debt expense 5,000

Interest Expense 14,000

Charitable Contributions 60,000

Depreciation (per book) 40,000

Advertisng 14,000

Meals & Entertainment 16,000

Taxes (State, local & payroll) 50,000

Life Insurance Premiums 10,000

Long Term Capital Loss 9,000

Federal Income Taxes paid 240,550

Penalty Underpayment 3,268

956,818

Net Income B/4 Taxes 450,182

COMPUTATION OF TAXABLE INCOME

Sales 2,100,000

Dividend Received 5,000

Interest Income on US Treasury Bonds 10,000

Long Ter Capital gain

2,115,000

Less: Cost of Goods Sold

Opening Stock 375,000

Purchases 700,000

1,075,000

Closing Inventory 360,000

Gross Profit 715,000

Gross Profit 1,400,000

Operating Expenses

Salaries-Officers 210,000

Salaries-Sales & Clerical 265,000

Repairs & Maintenance 20,000

Bad Debt expense 1,000

Interest Expense 14,000

Charitable Contributions 60,000

Depreciation (per book) 50,000

Advertisng 14,000

Meals & Entertainment 5,000

Taxes (State, local & payroll) 50,000

Dividend Received Deductions 3,500

Total Allowable Deductions 692,500

Taxable Income before DRD & NOL 707,500

Dividend Received Deduction

Step 1: Tentative DRD

Dividend Received 5,000

70% Limitation 3,500

Step 2: Tentitative Taxable Income

- -

Less: Tentative DRD 3,500

Tentative Taxable Income (3,500)

Step 3: Taxable Income Limitation

- -

Multiply By: 70%

Taxable Income Limitation -

Step 4: Compare

Tentative DRD 3,500

Taxable Income Limitation -

Choose the lower 3,500

Meals & Entertainment

Cost 16,000

Less: Cost of Suite 6,000

10,000

50% Allowable Deduction 5,000

Charitable Contribution

Actual paid during the year 60,000

Limitation -

Underpayment Penalty Statement

Event Date Amount Due Amount Paid Balance Due Percent # of days Penalty

Amount Due 4/15/2012 60,136 60136 6% 0

Payment 4/15/2012 37500 22636 6% 61 227

Amount Due 6/15/2012 60138 82774 6% 0

Payment 6/15/2012 37500 45274 6% 92 685

Amount Due 9/15/2012 60138 105412 6% 0

Payment 37500 67912 6% 91 1016

Amount Due 12/15/2012 60138 128050 6% 0

Payment 12/15/2012 37500 90550 6% 90 1340

Date Filed 3/15/2013 90550

Total 3268

Anda mungkin juga menyukai

- Wassim Zhani Bank of America Management Final Project Part IIIDokumen7 halamanWassim Zhani Bank of America Management Final Project Part IIIwassimzhaniBelum ada peringkat

- Bank of America Wassim Zhani Management Final Project Part IVDokumen5 halamanBank of America Wassim Zhani Management Final Project Part IVwassimzhaniBelum ada peringkat

- Wassim Zhani Bank of America Management Final Project Part IDokumen6 halamanWassim Zhani Bank of America Management Final Project Part IwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Underpayment Penalty StatementDokumen2 halamanWassim Zhani Corporate Taxation Underpayment Penalty StatementwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Tax Return S Corp UpdatedDokumen6 halamanWassim Zhani Corporate Taxation Tax Return S Corp UpdatedwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Tax Return S Corp UpdatedDokumen6 halamanWassim Zhani Corporate Taxation Tax Return S Corp UpdatedwassimzhaniBelum ada peringkat

- Wassim Zhani Bank of America Management Final Project Part IDokumen6 halamanWassim Zhani Bank of America Management Final Project Part IwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Tax Return S Corp 1Dokumen6 halamanWassim Zhani Corporate Taxation Tax Return S Corp 1wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation The Bike Shop - Scope of WorkDokumen2 halamanWassim Zhani Corporate Taxation The Bike Shop - Scope of WorkwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Tax Return S Corp UpdatedDokumen6 halamanWassim Zhani Corporate Taxation Tax Return S Corp UpdatedwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation ScopeDokumen17 halamanWassim Zhani Corporate Taxation ScopewassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation The Schedule M1 and M2 Aim at Reconciling The Book and Tax DifferenceDokumen3 halamanWassim Zhani Corporate Taxation The Schedule M1 and M2 Aim at Reconciling The Book and Tax DifferencewassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation ScopeDokumen17 halamanWassim Zhani Corporate Taxation ScopewassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation The Schedule M1 and M2 Aim at Reconciling The Book and Tax DifferenceDokumen3 halamanWassim Zhani Corporate Taxation The Schedule M1 and M2 Aim at Reconciling The Book and Tax DifferencewassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Tax Return S Corp UpdatedDokumen6 halamanWassim Zhani Corporate Taxation Tax Return S Corp UpdatedwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation SLATTERYS INC Rough DraftDokumen2 halamanWassim Zhani Corporate Taxation SLATTERYS INC Rough DraftwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation 1 Reconcialiation of Income Per BooksDokumen3 halamanWassim Zhani Corporate Taxation 1 Reconcialiation of Income Per BookswassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation 1 Corporate Tax Return - Trial BalanceDokumen1 halamanWassim Zhani Corporate Taxation 1 Corporate Tax Return - Trial BalancewassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation SCorp Return 1Dokumen5 halamanWassim Zhani Corporate Taxation SCorp Return 1wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation SCorp Return 2Dokumen1 halamanWassim Zhani Corporate Taxation SCorp Return 2wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation 1120S TB Updated 11-14Dokumen6 halamanWassim Zhani Corporate Taxation 1120S TB Updated 11-14wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Reconcialiation of Income Per BooksDokumen7 halamanWassim Zhani Corporate Taxation Reconcialiation of Income Per BookswassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Reconcialiation of Income Per BooksDokumen7 halamanWassim Zhani Corporate Taxation Reconcialiation of Income Per BookswassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Tax Return S Corp 1Dokumen6 halamanWassim Zhani Corporate Taxation Tax Return S Corp 1wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation 1 Schedule M-1Dokumen7 halamanWassim Zhani Corporate Taxation 1 Schedule M-1wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation 1120S TB Updated 11-14Dokumen4 halamanWassim Zhani Corporate Taxation 1120S TB Updated 11-14wassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Book To Tax ReconciliationDokumen2 halamanWassim Zhani Corporate Taxation Book To Tax ReconciliationwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation AAA and BasisDokumen2 halamanWassim Zhani Corporate Taxation AAA and BasiswassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation Copy of 1120 Tax ReturnDokumen3 halamanWassim Zhani Corporate Taxation Copy of 1120 Tax ReturnwassimzhaniBelum ada peringkat

- Wassim Zhani Corporate Taxation 1120S TB Updated 11-14Dokumen6 halamanWassim Zhani Corporate Taxation 1120S TB Updated 11-14wassimzhaniBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5784)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Property List - ST - Bernard - Parish-Lien-2022-06-22Dokumen21 halamanProperty List - ST - Bernard - Parish-Lien-2022-06-22Sai KesavBelum ada peringkat

- Annex F RR 11-2018Dokumen1 halamanAnnex F RR 11-2018reneth davidBelum ada peringkat

- CIR vs. Filinvest on Taxation of Property Exchange and AdvancesDokumen3 halamanCIR vs. Filinvest on Taxation of Property Exchange and AdvancesLeica Jayme50% (2)

- Annex F RR 11-2018Dokumen1 halamanAnnex F RR 11-2018Kisu ShuteBelum ada peringkat

- Invoice-Uber-Statement UBX008673Dokumen11 halamanInvoice-Uber-Statement UBX008673TanmoyBelum ada peringkat

- Aegon Life iTerm 3 Plan InvoiceDokumen2 halamanAegon Life iTerm 3 Plan InvoiceIndrasen DewanganBelum ada peringkat

- Direct Taxes 639034004081721340Dokumen1 halamanDirect Taxes 639034004081721340AshishBelum ada peringkat

- Deemed Export Under GSTDokumen2 halamanDeemed Export Under GSTRISHIKA PALRIWALBelum ada peringkat

- CIR v. American Express PHIL. BranchDokumen2 halamanCIR v. American Express PHIL. BranchJaypoll DiazBelum ada peringkat

- TAX INVOICEDokumen3 halamanTAX INVOICETechnetBelum ada peringkat

- Green Clean Homes Projected Income Statement AnalysisDokumen3 halamanGreen Clean Homes Projected Income Statement AnalysisRalph MorganBelum ada peringkat

- 2011 Federal 1040Dokumen2 halaman2011 Federal 1040Swati SarangBelum ada peringkat

- Visayan Cebu Terminal Vs CirDokumen2 halamanVisayan Cebu Terminal Vs CirylaineBelum ada peringkat

- Navin Fluorine Advanced Sciences LTD - 346 - 22-11-2021Dokumen1 halamanNavin Fluorine Advanced Sciences LTD - 346 - 22-11-2021Pragnesh PrajapatiBelum ada peringkat

- Made Easy Edutech Private Limited: Tax InvoiceDokumen1 halamanMade Easy Edutech Private Limited: Tax InvoiceAbhishek KumarBelum ada peringkat

- Delhi Cargo Terminal InvoiceDokumen2 halamanDelhi Cargo Terminal InvoiceHuskee CokBelum ada peringkat

- Round Up Nominal GajiDokumen7 halamanRound Up Nominal GajiHeny KusumawatiBelum ada peringkat

- Water Flow MeterDokumen1 halamanWater Flow MeterKali CharanBelum ada peringkat

- TourDokumen4 halamanTourAnup SahBelum ada peringkat

- Service Tax, 1994 - SectionsDokumen2 halamanService Tax, 1994 - SectionsVipul DesaiBelum ada peringkat

- Chap 009Dokumen16 halamanChap 009AHMED MOHAMED YUSUFBelum ada peringkat

- JAYAMURGANDokumen2 halamanJAYAMURGANvsp1412Belum ada peringkat

- Will Frost 2013 Tax Return - T13 - For - RecordsDokumen146 halamanWill Frost 2013 Tax Return - T13 - For - RecordsjessicaBelum ada peringkat

- 2550Q InstructionsDokumen1 halaman2550Q InstructionsMay RamosBelum ada peringkat

- Stellar Manufacturing Company Financial Statements for Fiscal Year 2010Dokumen2 halamanStellar Manufacturing Company Financial Statements for Fiscal Year 2010ebat11Belum ada peringkat

- Policydownload 230207 000615-43Dokumen1 halamanPolicydownload 230207 000615-43Anindya SundarBelum ada peringkat

- Guidelines For TDS Deduction On Purchase of Immovable PropertyDokumen4 halamanGuidelines For TDS Deduction On Purchase of Immovable Propertymib_santoshBelum ada peringkat

- Pub 505 - Estimated Tax (2002)Dokumen49 halamanPub 505 - Estimated Tax (2002)andrewh3Belum ada peringkat

- Nepal Telecom VAT Report SummaryDokumen1 halamanNepal Telecom VAT Report Summaryntc7035Belum ada peringkat

- ADAMSON UNIVERSITY INCOME TAXATION QUIZ 1Dokumen2 halamanADAMSON UNIVERSITY INCOME TAXATION QUIZ 1Joyce Marie SablayanBelum ada peringkat