AUG-03-Wells Fargo-US Personal Income Was Largely Unchanged in June

Diunggah oleh

Miir ViirDeskripsi Asli:

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

AUG-03-Wells Fargo-US Personal Income Was Largely Unchanged in June

Diunggah oleh

Miir ViirHak Cipta:

Format Tersedia

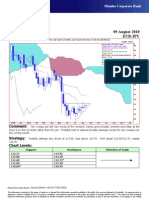

August 03, 2010

Economics Group

Mark Vitner, Senior Economist

mark.vitner@wellsfargo.com ● 704.383.5635

Tim Quinlan, Economist

tim.quinlan@wellsfargo.com ● 704.374.4407

Personal Income Was Largely Unchanged In June

Personal income and consumer spending were unchanged in June. Prices declined 0.1 percent, however,

which means spending rose slightly after adjusting for falling prices. The saving rate rose to 6.4 percent.

Personal Income Was Unchanged In June Personal Income

Month-over-Month Percent Change

Personal income was unchanged in June, with weakness evident across 4% 4%

most major categories. Wages and salaries fell 0.1 percent and proprietors’

3% 3%

income fell 0.4 percent. Nearly all the drop in wages and salaries was in

the private sector, where wages fell 0.1 percent. June marks the first time 2% 2%

personal income has been unchanged since September of last year and is

another sign that economic activity is losing momentum as various 1% 1%

stimulus programs wind down. 0% 0%

Personal tax payments fell 0.2 percent in June, which helped push after-tax

income up slightly. The rise in after-tax income combined with no change -1% -1%

in consumer spending pushed the saving rate up to 6.4 percent, which is -2% -2%

the highest it has been since May 2009. The rise in the saving rate is good Personal Income: Jun @ 0.0%

news because it means the adjustment to the negative wealth effect from -3% -3%

2000 2002 2004 2006 2008 2010

falling home prices and the financial crisis is largely complete. This means

spending will likely rise more closely in line with after-tax income growth Personal Saving Rate

Disp. Personal Income Less Spending as a % of Disp. Income

over the next few quarters. Unfortunately, income growth appears to be 15% 15%

decelerating.

The personal consumption deflator fell 0.1 percent in June, marking the 12% 12%

second consecutive decrease. With the drop, real personal income rose

0.1 percent. Real after-tax income actually rose 0.2 percent. The decline in 9% 9%

prices helped boost purchasing power and allowed real personal

consumption expenditures to rise 0.1 percent in June.

6% 6%

Real personal consumption expenditures ended the second quarter slightly

above their second quarter average and are currently running at 0.5 percent

3% 3%

annual rate above the second quarter average. Early data for July suggest

Personal Saving Rate: Jun @ 6.4%

spending was fairly weak that month. The expiration of extended Personal Saving Rate, 12-Month M.A.: Jun @ 5.7%

unemployment benefits likely cut into spending last month. We may get a 0%

60 63 66 69 72 75 78 81 84 87 90 93 96 99 02 05 08

0%

bit of a bump in August, however, when benefits began flowing again and

one-time catch-up payments were delivered. We are expecting real "Core" PCE Deflator

Both Series are 3-Month Moving Averages

personal consumption expenditures to rise at just a 1.0 percent annual rate 5% 5%

3-Month Annual Rate: Jun @ 1.1%

during the current quarter, which will likely hold real GDP growth to Year-over-Year Percent Change: Jun @ 1.5%

around a 2 percent annual rate or less. 4% 4%

The core PCE deflator, which is widely thought to be the Fed’s preferred

inflation measure, was unchanged in June, following gains of 0.1 percent 3% 3%

during each of the two previous months. The core PCE deflator has

decelerated to just a 1.1 percent annual rate over the past three months.

2% 2%

Most of the slowdown is due to still moderating housing costs. Falling food

and energy prices have been the major forces holding down overall

inflation. Food prices are being held back by an abundant harvest and 1% 1%

changing consumer buying habits, which are leading to more price cutting.

0% 0%

92 94 96 98 00 02 04 06 08 10

Source: U.S. Department of Commerce and Wells Fargo Securities, LLC.

Wells Fargo Securities, LLC Economics Group

Diane Schumaker-Krieg Global Head of Research (704) 715-8437 diane.schumaker@wellsfargo.com

& Economics (212) 214-5070

John E. Silvia, Ph.D. Chief Economist (704) 374-7034 john.silvia@wellsfargo.com

Mark Vitner Senior Economist (704) 383-5635 mark.vitner@wellsfargo.com

Jay Bryson, Ph.D. Global Economist (704) 383-3518 jay.bryson@wellsfargo.com

Scott Anderson, Ph.D. Senior Economist (612) 667-9281 scott.a.anderson@wellsfargo.com

Eugenio Aleman, Ph.D. Senior Economist (612) 667-0168 eugenio.j.aleman@wellsfargo.com

Sam Bullard Senior Economist (704) 383-7372 sam.bullard@wellsfargo.com

Anika Khan Economist (704) 715-0575 anika.khan@wellsfargo.com

Azhar Iqbal Econometrician (704) 383-6805 azhar.iqbal@wellsfargo.com

Ed Kashmarek Economist (612) 667-0479 ed.kashmarek@wellsfargo.com

Tim Quinlan Economist (704) 374-4407 tim.quinlan@wellsfargo.com

Kim Whelan Economic Analyst (704) 715-8457 kim.whelan@wellsfargo.com

Wells Fargo Securities Economics Group publications are produced by Wells Fargo Securities, LLC, a U.S broker-dealer

registered with the U.S. Securities and Exchange Commission, the Financial Industry Regulatory Authority, and the

Securities Investor Protection Corp. Wells Fargo Securities, LLC, distributes these publications directly and through

subsidiaries including, but not limited to, Wells Fargo & Company, Wells Fargo Bank N.A, Wells Fargo Advisors, LLC,

and Wells Fargo Securities International Limited. The information and opinions herein are for general information use

only. Wells Fargo Securities, LLC does not guarantee their accuracy or completeness, nor does

Wells Fargo Securities, LLC assume any liability for any loss that may result from the reliance by any person upon any

such information or opinions. Such information and opinions are subject to change without notice, are for general

information only and are not intended as an offer or solicitation with respect to the purchase or sales of any security or

as personalized investment advice. Wells Fargo Securities, LLC is a separate legal entity and distinct from affiliated

banks and is a wholly owned subsidiary of Wells Fargo & Company © 2010 Wells Fargo Securities, LLC.

SECURITIES: NOT FDIC-INSURED/NOT BANK-GUARANTEED/MAY LOSE VALUE

Anda mungkin juga menyukai

- (L) Examples of Machine Shop Practice (1910)Dokumen54 halaman(L) Examples of Machine Shop Practice (1910)Ismael 8877100% (1)

- Sample Deed of DonationDokumen2 halamanSample Deed of DonationMenchie Ann Sabandal Salinas100% (1)

- The Influence of The Transformational LeaderDokumen9 halamanThe Influence of The Transformational Leaderkenmuira100% (1)

- Cash Management Bank of IndiaDokumen52 halamanCash Management Bank of Indiaakalque shaikhBelum ada peringkat

- Scala and Spark For Big Data AnalyticsDokumen874 halamanScala and Spark For Big Data AnalyticsSneha SteevanBelum ada peringkat

- QUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsDokumen2 halamanQUIZ - PFRS 1 - FIRST TIME ADOPTION OF PFRSsGonzalo Jr. Ruales86% (7)

- EAU 2022 - Prostate CancerDokumen229 halamanEAU 2022 - Prostate Cancerpablo penguinBelum ada peringkat

- BS en 12285-1-2003 (2006)Dokumen162 halamanBS en 12285-1-2003 (2006)dahzahBelum ada peringkat

- ConsumerPriceIndex January2009Dokumen1 halamanConsumerPriceIndex January2009International Business TimesBelum ada peringkat

- JUL 07 Wells Fargo Eco OutlookDokumen6 halamanJUL 07 Wells Fargo Eco OutlookMiir ViirBelum ada peringkat

- Inflation Environment and OutlookDokumen8 halamanInflation Environment and OutlookStephen LinBelum ada peringkat

- Van Hoisington Letter, Q3 2011Dokumen5 halamanVan Hoisington Letter, Q3 2011Elliott WaveBelum ada peringkat

- Inflation: India Philippines United StatesDokumen3 halamanInflation: India Philippines United StatesKaname KuranBelum ada peringkat

- AUG 04 DBS Daily Breakfast SpreadDokumen6 halamanAUG 04 DBS Daily Breakfast SpreadMiir ViirBelum ada peringkat

- Westpack JUL 19 Weekly CommentaryDokumen7 halamanWestpack JUL 19 Weekly CommentaryMiir ViirBelum ada peringkat

- Global Economic Outlook1Dokumen2 halamanGlobal Economic Outlook1Harry CerqueiraBelum ada peringkat

- Personal Income and Outlays, March 2019: Piniwd@bea - Gov Pce@bea - Gov Jeannine - Aversa@bea - GovDokumen11 halamanPersonal Income and Outlays, March 2019: Piniwd@bea - Gov Pce@bea - Gov Jeannine - Aversa@bea - GovValter SilveiraBelum ada peringkat

- Weekly Economic & Financial Commentary 15julyDokumen13 halamanWeekly Economic & Financial Commentary 15julyErick Abraham MarlissaBelum ada peringkat

- PersonalIncome December 2008Dokumen1 halamanPersonalIncome December 2008International Business TimesBelum ada peringkat

- India - Country OverviewDokumen2 halamanIndia - Country OverviewVivekanandBelum ada peringkat

- DI Canada OutlookDokumen8 halamanDI Canada OutlookGeorge KapellosBelum ada peringkat

- Gmo Quarterly LetterDokumen22 halamanGmo Quarterly LetterAnonymous Ht0MIJBelum ada peringkat

- Finstreet Journal - 17th August 2019Dokumen9 halamanFinstreet Journal - 17th August 2019KunalDesaiBelum ada peringkat

- Inflation Sticky IIP Zooms On Base Effect 1657806344Dokumen5 halamanInflation Sticky IIP Zooms On Base Effect 1657806344Grace StylesBelum ada peringkat

- Gei Global Summary October 2023Dokumen28 halamanGei Global Summary October 2023Andi IrawanBelum ada peringkat

- Personal Income and Personal Consumption: Market GazerDokumen4 halamanPersonal Income and Personal Consumption: Market GazerAndre SetiawanBelum ada peringkat

- Swiss Re Canada Economic Outlook 3Q19Dokumen2 halamanSwiss Re Canada Economic Outlook 3Q19Fox WalkerBelum ada peringkat

- No Input Cost Pressures Yet: HighlightsDokumen3 halamanNo Input Cost Pressures Yet: HighlightsDeepak Saheb GuptaBelum ada peringkat

- MGSSI Japan Economic Quarterly October 2017Dokumen4 halamanMGSSI Japan Economic Quarterly October 2017Romy Bennouli TambunanBelum ada peringkat

- Mid-Year Investment Outlook For 2023Dokumen14 halamanMid-Year Investment Outlook For 2023ShreyBelum ada peringkat

- The Us Consumer in 2009Dokumen7 halamanThe Us Consumer in 2009Denis OuelletBelum ada peringkat

- Personal Income and Outlays: July 2009Dokumen12 halamanPersonal Income and Outlays: July 2009api-25887578Belum ada peringkat

- 11-084 ICC-Aug10 WebDokumen2 halaman11-084 ICC-Aug10 Webderailedcapitalism.comBelum ada peringkat

- PreBudgetExpectations2011-12 Anagram 180211Dokumen18 halamanPreBudgetExpectations2011-12 Anagram 180211chaterji_aBelum ada peringkat

- Coronavirus-A Fiscal ContagionDokumen7 halamanCoronavirus-A Fiscal ContagionG NANDA KISHORE REDDY 17MIS1066Belum ada peringkat

- 2011-06-02 DBS Daily Breakfast SpreadDokumen7 halaman2011-06-02 DBS Daily Breakfast SpreadkjlaqiBelum ada peringkat

- Prospects For Individual Economies: Euro AreaDokumen12 halamanProspects For Individual Economies: Euro ArealionBelum ada peringkat

- Five Key QuestionsDokumen12 halamanFive Key QuestionsInternational Business TimesBelum ada peringkat

- Current Trends Update - CanadaDokumen3 halamanCurrent Trends Update - CanadazinxyBelum ada peringkat

- Global Weekly Economic Update - Deloitte InsightsDokumen8 halamanGlobal Weekly Economic Update - Deloitte InsightsSaba SiddiquiBelum ada peringkat

- Bangladesh Economic Review 2019Dokumen366 halamanBangladesh Economic Review 2019Galiv VaiBelum ada peringkat

- Wells Far Go Monthly OutlookDokumen6 halamanWells Far Go Monthly Outlookelise_stefanikBelum ada peringkat

- Lebanese Economy Off To A Lackluster Start in 2019: April 2019Dokumen8 halamanLebanese Economy Off To A Lackluster Start in 2019: April 2019ismail hotaitBelum ada peringkat

- US Economy - en - 1346457 PDFDokumen4 halamanUS Economy - en - 1346457 PDFChristophe SieberBelum ada peringkat

- Chinese Economy - Macroeconomic Analysis For Tesla's Investment DecisionDokumen6 halamanChinese Economy - Macroeconomic Analysis For Tesla's Investment DecisionVrajesh ChitaliaBelum ada peringkat

- 2015.10 Q3 CMC Efficient Frontier NewsletterDokumen8 halaman2015.10 Q3 CMC Efficient Frontier NewsletterJohn MathiasBelum ada peringkat

- Breakfast With Dave 103009Dokumen7 halamanBreakfast With Dave 103009ZerohedgeBelum ada peringkat

- Studiu SeptDokumen3 halamanStudiu SeptGeorge ManeaBelum ada peringkat

- TD Economics: The Weekly Bottom LineDokumen8 halamanTD Economics: The Weekly Bottom LineInternational Business TimesBelum ada peringkat

- INFLATIONDokumen3 halamanINFLATIONxXx editZBelum ada peringkat

- Philippines - Briefing Sheet, Aug 2019: EIU - Country SummaryDokumen2 halamanPhilippines - Briefing Sheet, Aug 2019: EIU - Country SummaryAmethyst TurgaBelum ada peringkat

- Final Results For June 2019 Featured Chart (Or) : ExcelDokumen1 halamanFinal Results For June 2019 Featured Chart (Or) : ExcelValter SilveiraBelum ada peringkat

- Emerging Markets Economics Daily: Latin AmericaDokumen7 halamanEmerging Markets Economics Daily: Latin AmericaBetteDavisEyes00Belum ada peringkat

- The Outlook For The US Economy: White PaperDokumen8 halamanThe Outlook For The US Economy: White PaperJustin FungBelum ada peringkat

- Global Economic ResearchDokumen6 halamanGlobal Economic ResearchAndyBelum ada peringkat

- In Union Budget 2023 Detailed Analysis NoexpDokumen78 halamanIn Union Budget 2023 Detailed Analysis NoexppatrodeskBelum ada peringkat

- Canada's Economic Recovery Is Likely To Keep Sputtering in 2014Dokumen10 halamanCanada's Economic Recovery Is Likely To Keep Sputtering in 2014api-227433089Belum ada peringkat

- Seattle Faces Stronger Economic Headwinds Due To Cooling Tech Sector, Remote WorkDokumen24 halamanSeattle Faces Stronger Economic Headwinds Due To Cooling Tech Sector, Remote WorkGeekWireBelum ada peringkat

- The Economy - Oct 2019Dokumen13 halamanThe Economy - Oct 2019Angelo PuraBelum ada peringkat

- WeeklyEconomicFinancialCommentary March262010Dokumen9 halamanWeeklyEconomicFinancialCommentary March262010elise_stefanikBelum ada peringkat

- WeeklyeconomiccalednarDokumen9 halamanWeeklyeconomiccalednarelise_stefanikBelum ada peringkat

- 2010 Update BangladeshDokumen5 halaman2010 Update BangladeshimamnetBelum ada peringkat

- 2019.07.05.UNICAMP - CECON - The Brazilian Economic Contraction UPDATEDokumen4 halaman2019.07.05.UNICAMP - CECON - The Brazilian Economic Contraction UPDATECláudioBelum ada peringkat

- Baily 0407Dokumen18 halamanBaily 0407api-3699737Belum ada peringkat

- EconomicsDokumen2 halamanEconomicswarishaBelum ada peringkat

- Insights Weekly A 2020 US Slowdown Near Recession ScenarioDokumen9 halamanInsights Weekly A 2020 US Slowdown Near Recession ScenarioHandy HarisBelum ada peringkat

- Insights Weekly A 2020 US Slowdown Near Recession ScenarioDokumen9 halamanInsights Weekly A 2020 US Slowdown Near Recession ScenarioHandy HarisBelum ada peringkat

- AUG 11 UOB Global MarketsDokumen3 halamanAUG 11 UOB Global MarketsMiir ViirBelum ada peringkat

- Westpack AUG 11 Mornng ReportDokumen1 halamanWestpack AUG 11 Mornng ReportMiir ViirBelum ada peringkat

- AUG-10 Mizuho Technical Analysis EUR JPYDokumen1 halamanAUG-10 Mizuho Technical Analysis EUR JPYMiir ViirBelum ada peringkat

- AUG 11 DBS Daily Breakfast SpreadDokumen6 halamanAUG 11 DBS Daily Breakfast SpreadMiir ViirBelum ada peringkat

- AUG-10 Mizuho Technical Analysis GBP USDDokumen1 halamanAUG-10 Mizuho Technical Analysis GBP USDMiir ViirBelum ada peringkat

- AUG 10 UOB Global MarketsDokumen3 halamanAUG 10 UOB Global MarketsMiir ViirBelum ada peringkat

- AUG 10 UOB Asian MarketsDokumen2 halamanAUG 10 UOB Asian MarketsMiir ViirBelum ada peringkat

- Danske Daily: Key NewsDokumen4 halamanDanske Daily: Key NewsMiir ViirBelum ada peringkat

- JYSKE Bank AUG 10 Corp Orates DailyDokumen2 halamanJYSKE Bank AUG 10 Corp Orates DailyMiir ViirBelum ada peringkat

- Market Drivers - Currencies: Today's Comment Today's Chart - EUR/USDDokumen5 halamanMarket Drivers - Currencies: Today's Comment Today's Chart - EUR/USDMiir ViirBelum ada peringkat

- JYSKE Bank AUG 09 Market Drivers CurrenciesDokumen5 halamanJYSKE Bank AUG 09 Market Drivers CurrenciesMiir ViirBelum ada peringkat

- AUG 10 DBS Daily Breakfast SpreadDokumen8 halamanAUG 10 DBS Daily Breakfast SpreadMiir ViirBelum ada peringkat

- AUG 10 Danske EMEADailyDokumen3 halamanAUG 10 Danske EMEADailyMiir ViirBelum ada peringkat

- Westpack AUG 10 Mornng ReportDokumen1 halamanWestpack AUG 10 Mornng ReportMiir ViirBelum ada peringkat

- AUG 10 Danske FlashCommentFOMC PreviewDokumen7 halamanAUG 10 Danske FlashCommentFOMC PreviewMiir ViirBelum ada peringkat

- AUG-09 Mizuho Technical Analysis EUR JPYDokumen1 halamanAUG-09 Mizuho Technical Analysis EUR JPYMiir ViirBelum ada peringkat

- AUG-09-DJ European Forex TechnicalsDokumen3 halamanAUG-09-DJ European Forex TechnicalsMiir ViirBelum ada peringkat

- ScotiaBank AUG 09 Daily FX UpdateDokumen3 halamanScotiaBank AUG 09 Daily FX UpdateMiir ViirBelum ada peringkat

- JYSKE Bank AUG 09 Corp Orates DailyDokumen2 halamanJYSKE Bank AUG 09 Corp Orates DailyMiir ViirBelum ada peringkat

- Jyske Bank Aug 09 em DailyDokumen5 halamanJyske Bank Aug 09 em DailyMiir ViirBelum ada peringkat

- Ch08 Project SchedulingDokumen51 halamanCh08 Project SchedulingTimothy Jones100% (1)

- The Lafayette Driller: President's Message By: Lindsay LongmanDokumen7 halamanThe Lafayette Driller: President's Message By: Lindsay LongmanLoganBohannonBelum ada peringkat

- Food Safety and StandardsDokumen8 halamanFood Safety and StandardsArifSheriffBelum ada peringkat

- Winter 2016 QP3 Spreadsheet QuestionDokumen2 halamanWinter 2016 QP3 Spreadsheet Questioneegeekeek eieoieeBelum ada peringkat

- Reemployment Assistance Application EngDokumen6 halamanReemployment Assistance Application EngMelissa RatliffBelum ada peringkat

- sb485s rs232 A rs485Dokumen24 halamansb485s rs232 A rs485KAYCONSYSTECSLA KAYLA CONTROL SYSTEMBelum ada peringkat

- Danfoss Pvg32Tech InfoDokumen56 halamanDanfoss Pvg32Tech Infoifebrian100% (2)

- 24th SFCON Parallel Sessions Schedule (For Souvenir Program)Dokumen1 halaman24th SFCON Parallel Sessions Schedule (For Souvenir Program)genesistorres286Belum ada peringkat

- Analisis Pendapatan Dan Kesejahteraan Rumah Tangga Nelayan Cumi-Cumi Di Desa Sukajaya Lempasing Kecamatan Teluk Pandan Kabupaten PesawaranDokumen12 halamanAnalisis Pendapatan Dan Kesejahteraan Rumah Tangga Nelayan Cumi-Cumi Di Desa Sukajaya Lempasing Kecamatan Teluk Pandan Kabupaten PesawaranAldy Suryo KuncoroBelum ada peringkat

- Save Energy Save EarthDokumen2 halamanSave Energy Save EarthMega Ayu100% (2)

- CHAPTER 22-Audit Evidence EvaluationDokumen27 halamanCHAPTER 22-Audit Evidence EvaluationIryne Kim PalatanBelum ada peringkat

- Robert Plank's Super SixDokumen35 halamanRobert Plank's Super SixkoyworkzBelum ada peringkat

- Singh 1959 Adam Smith's Theory of Economic DevelopmentDokumen27 halamanSingh 1959 Adam Smith's Theory of Economic DevelopmentBruce WayneBelum ada peringkat

- 1Dokumen7 halaman1gosaye desalegnBelum ada peringkat

- Namma Kalvi 12th Maths Chapter 4 Study Material em 213434Dokumen17 halamanNamma Kalvi 12th Maths Chapter 4 Study Material em 213434TSG gaming 12Belum ada peringkat

- Dungeon Magazine 195 PDFDokumen5 halamanDungeon Magazine 195 PDFGuillaumeRicherBelum ada peringkat

- Modern Theory of Interest: IS-LM CurveDokumen36 halamanModern Theory of Interest: IS-LM CurveSouvik DeBelum ada peringkat

- CIVPRO - Case Compilation No. 2Dokumen95 halamanCIVPRO - Case Compilation No. 2Darla GreyBelum ada peringkat

- System Error Codes (0-499)Dokumen33 halamanSystem Error Codes (0-499)enayuBelum ada peringkat

- 6 Elements of A Healthy ChurchDokumen2 halaman6 Elements of A Healthy ChurchJayhia Malaga JarlegaBelum ada peringkat

- River Planning AetasDokumen4 halamanRiver Planning AetasErika ReyesBelum ada peringkat

- Teit Cbgs Dmbi Lab Manual FH 2015Dokumen60 halamanTeit Cbgs Dmbi Lab Manual FH 2015Soumya PandeyBelum ada peringkat