Property Tax CGT

Diunggah oleh

roneyewuJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Property Tax CGT

Diunggah oleh

roneyewuHak Cipta:

Format Tersedia

TCGA 1992 s 162 provides relief for the incorporation of a business, whereby the gain on transfer can

be rolled over into the base cost of shares issued on transfer. Historically, HMRCs view was that s 162

could not apply to property investments. This view was successfully challenged at the Upper Tribunal

in Ramsay v HMRC [2013] UKUT 226 (TCC), [2013] STC 1764.

Mrs Ramsay owned a block of 15 flats. She had inherited a one-third share, but later acquired the other

two thirds from her brothers with a bank loan. The property was later transferred to a company. She applied

for planning permission to refurbish and redevelop the property, although no work had been done at the

time of the transfer. The Ramsays dealt with the management and maintenance of the property themselves,

spending around 20 hours per week on it, and had no other occupation during the period.

The UT decided that the correct approach was to consider whether Mrs Ramsays activities were a serious

undertaking earnestly pursued or a serious occupation; whether they were an occupation or function

pursued with reasonable or recognisable continuity; whether they had substance in terms of turnover;

whether they were conducted in a regular manner and on sound recognised business principles; and

whether they were of a kind that are commonly made by those who seek to profit by them. It concluded

they were.

The First Tier Tribunal had previously decided in favour of HMRC. The Upper Tribunal said the FTTs approach

was incorrect, because the FTT had focused on the meaning of trade rather than business.

Previously, HMRCs guideline stated that passive holding of investments or the holding of properties

as investment does not amount to a business. These words since been removed and now it states that

there has to be some activities to qualify for a business and just a modes degree of activity would not

suffice. It shows us that the quantity of the activity involved is important.

The UT decision and updated HMRC guidance leave some uncertainty. What degree of activity is

required by the taxpayer? If the Ramsays had not applied for planning permission for redevelopment,

would their activity still have constituted a business? If the Ramsays had used a managing agent, would

it still have constituted a business? As with a trade, it should not matter whether the taxpayer uses an

agent, but this isnt certain from the case, or HMRCs guidance. Where the gains on the portfolio are

large, it can be advisable to seek an HMRC non-statutory clearance.

Anda mungkin juga menyukai

- About RioTinto BrochureDokumen16 halamanAbout RioTinto BrochureAleksandarBelum ada peringkat

- FINANCIAL REHABILITATION AND INSOLVENCY ACTDokumen39 halamanFINANCIAL REHABILITATION AND INSOLVENCY ACTMark Joseph M. VirgilioBelum ada peringkat

- Xero Training ManualDokumen84 halamanXero Training Manualroneyewu100% (3)

- Quality Manual for ISO 9001 CertificationDokumen56 halamanQuality Manual for ISO 9001 CertificationMunavwar Khan100% (1)

- Conjoint AnalysisDokumen9 halamanConjoint AnalysisgunjeshthakurBelum ada peringkat

- MR Holdings v. Sheriff Bajar Case SummaryDokumen4 halamanMR Holdings v. Sheriff Bajar Case SummaryMusha SheeBelum ada peringkat

- Start-Ups LeadDokumen275 halamanStart-Ups Leadsachin m33% (3)

- Designing A Microsoft SharePoint 2010 Infrastructure Vol 2Dokumen419 halamanDesigning A Microsoft SharePoint 2010 Infrastructure Vol 2Angel Iulian PopescuBelum ada peringkat

- Introduction To SHRM: By: Sonam Sachdeva Assistant Professor GibsDokumen65 halamanIntroduction To SHRM: By: Sonam Sachdeva Assistant Professor GibsRicha Garg100% (1)

- Linberg V MakatiDokumen2 halamanLinberg V MakatiChimney sweepBelum ada peringkat

- HB 403-2004 Best Practice Board ReportingDokumen6 halamanHB 403-2004 Best Practice Board ReportingSAI Global - APAC0% (1)

- SC rules on labor-only contracting caseDokumen2 halamanSC rules on labor-only contracting caseKarisse ViajeBelum ada peringkat

- Central Azucarera Del Danao v. Ca Case DigestDokumen2 halamanCentral Azucarera Del Danao v. Ca Case DigestKian FajardoBelum ada peringkat

- MR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002Dokumen3 halamanMR Holdings, Ltd. vs. Bajar, 380 SCRA 617, April 11, 2002idolbondocBelum ada peringkat

- An Example ITIL Based Model For Effective Service Integration and ManagementDokumen30 halamanAn Example ITIL Based Model For Effective Service Integration and ManagementSudhanshu Sinha100% (3)

- HOSP2110 04 DepreciationDokumen4 halamanHOSP2110 04 DepreciationVtgBelum ada peringkat

- Vodafone International Holdings Vs Union of IndiaDokumen33 halamanVodafone International Holdings Vs Union of IndiaSwaraj SiddhantBelum ada peringkat

- Tax Alert - Delivering Clarity: 10 June 2020Dokumen6 halamanTax Alert - Delivering Clarity: 10 June 2020UTKARSHBelum ada peringkat

- City Government of Taguig FRIADokumen3 halamanCity Government of Taguig FRIAWILMAR PLANCIA SALUTABelum ada peringkat

- Advance Planning For Capital Gain - Generally (Contd) ControllingDokumen14 halamanAdvance Planning For Capital Gain - Generally (Contd) Controllingtemp tempBelum ada peringkat

- Law ReportDokumen13 halamanLaw ReportYuuki Tay Jia ChyiBelum ada peringkat

- Company Law - 1965: Q1: What Is The Ultra Vires Doctrine in Company Law?Dokumen12 halamanCompany Law - 1965: Q1: What Is The Ultra Vires Doctrine in Company Law?Nitish PednekarBelum ada peringkat

- Piercing The Corporate Veil in Taxation Matters (Autosaved)Dokumen17 halamanPiercing The Corporate Veil in Taxation Matters (Autosaved)PRERNA BAHETIBelum ada peringkat

- Discuss To What Extent The Common Law Doctrine of Ultra Vires Has Been Modified by The Provisions of The Companies Act.Dokumen3 halamanDiscuss To What Extent The Common Law Doctrine of Ultra Vires Has Been Modified by The Provisions of The Companies Act.Eve_93Belum ada peringkat

- HMRC Vs Curzon Capital LTDDokumen29 halamanHMRC Vs Curzon Capital LTDhyenadogBelum ada peringkat

- GST Compliance in The Corporate Insolvency Resolution ProcessDokumen23 halamanGST Compliance in The Corporate Insolvency Resolution ProcessIsha SenBelum ada peringkat

- Vodafone Case Analysis: Internal Assignment-2Dokumen7 halamanVodafone Case Analysis: Internal Assignment-2KK SinghBelum ada peringkat

- Trial Instructions for Piercing Corporate VeilDokumen5 halamanTrial Instructions for Piercing Corporate VeilMarius AwriliusBelum ada peringkat

- Helvering v. Minnesota Tea Co., 296 U.S. 378 (1935)Dokumen7 halamanHelvering v. Minnesota Tea Co., 296 U.S. 378 (1935)Scribd Government DocsBelum ada peringkat

- Labor Case Digests Marquez P13Dokumen96 halamanLabor Case Digests Marquez P13NiellaBelum ada peringkat

- Birla Institute of TechnologyDokumen17 halamanBirla Institute of TechnologyDevanshi GarodiaBelum ada peringkat

- Provisions of Companies Act: Theintactfront 23 APR 2018 1 CommentDokumen16 halamanProvisions of Companies Act: Theintactfront 23 APR 2018 1 CommentTinu Burmi AnandBelum ada peringkat

- Beck v. Deloitte & Touche, 144 F.3d 732, 11th Cir. (1998)Dokumen7 halamanBeck v. Deloitte & Touche, 144 F.3d 732, 11th Cir. (1998)Scribd Government DocsBelum ada peringkat

- ONUmnk 4 MDokumen24 halamanONUmnk 4 MSunil ShahBelum ada peringkat

- KPMG FLASH NEWS - Vodafone Supreme Court Decision SummaryDokumen6 halamanKPMG FLASH NEWS - Vodafone Supreme Court Decision SummaryManisha SinghBelum ada peringkat

- GREPALIFE EMPLOYEE RULINGDokumen4 halamanGREPALIFE EMPLOYEE RULINGBenina BautistaBelum ada peringkat

- Piercing The Corporate VeilDokumen7 halamanPiercing The Corporate VeilShruthi P RBelum ada peringkat

- PNB vs HRCC Philippine bank liability piercing corporate veil caseDokumen2 halamanPNB vs HRCC Philippine bank liability piercing corporate veil caseYvet KatBelum ada peringkat

- Director's DutiesDokumen4 halamanDirector's DutiesAmir KayBelum ada peringkat

- Lowry Case Note On de Facto DirectorsDokumen7 halamanLowry Case Note On de Facto DirectorsRachel SilverBelum ada peringkat

- Insolvency Cause 10 of 2017Dokumen11 halamanInsolvency Cause 10 of 2017moses machiraBelum ada peringkat

- Updated Law PPT-2Dokumen45 halamanUpdated Law PPT-2arti guptaBelum ada peringkat

- Vodafone International Holdings BV v. UnionDokumen5 halamanVodafone International Holdings BV v. UnionruhanisinghBelum ada peringkat

- SC Rules on Labor-Only Contracting CaseDokumen2 halamanSC Rules on Labor-Only Contracting CaseGui EshBelum ada peringkat

- General Anti Avoidance Rules SuggestionsDokumen8 halamanGeneral Anti Avoidance Rules SuggestionsSandeep GuptaBelum ada peringkat

- LMR PART B Case LawsDokumen210 halamanLMR PART B Case LawsAnurag KhatriBelum ada peringkat

- Sale of Business As Slump Sale Vis A Vis Itemised SaleDokumen11 halamanSale of Business As Slump Sale Vis A Vis Itemised SaleychichghareBelum ada peringkat

- Hindustan Lever Employees' Union Vs Hindustan Lever Limited and Ors On 24 October, 1994Dokumen20 halamanHindustan Lever Employees' Union Vs Hindustan Lever Limited and Ors On 24 October, 1994Aditi Tank0% (1)

- Separate Legal EntityDokumen18 halamanSeparate Legal EntityJagdesh SinghBelum ada peringkat

- Restructure, Re-Organisation AND RetrenchmentDokumen59 halamanRestructure, Re-Organisation AND Retrenchmentcmyasot100% (2)

- Transfer DutyDokumen9 halamanTransfer DutyZia ParkerBelum ada peringkat

- Tax CIA Bryna 2011346Dokumen14 halamanTax CIA Bryna 2011346BRYNA BHAVESH 2011346Belum ada peringkat

- DO 186 17 Revised Rules For The Issuance of Employment Permits To Foreign NationalsDokumen2 halamanDO 186 17 Revised Rules For The Issuance of Employment Permits To Foreign NationalsBANanaispleetBelum ada peringkat

- 1c II Doctrine of Indoor Management CorporateDokumen6 halaman1c II Doctrine of Indoor Management Corporatechetanyadutt03Belum ada peringkat

- ACL - Module 1 Summay DocumentDokumen7 halamanACL - Module 1 Summay DocumentRoel WillsBelum ada peringkat

- November 5 Cases 27-33Dokumen7 halamanNovember 5 Cases 27-33CSAAccounting CPABelum ada peringkat

- Duties of DirectorsDokumen28 halamanDuties of DirectorsGraysonBelum ada peringkat

- Regulating M&As: The Intent of The LawDokumen3 halamanRegulating M&As: The Intent of The LawMats LuceroBelum ada peringkat

- Ebook Corporate Partnership Estate and Gift Taxation 6Th Edition Pratt Solutions Manual Full Chapter PDFDokumen29 halamanEbook Corporate Partnership Estate and Gift Taxation 6Th Edition Pratt Solutions Manual Full Chapter PDFselenatanloj0xa100% (10)

- Corporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions ManualDokumen21 halamanCorporate Partnership Estate and Gift Taxation 6th Edition Pratt Solutions Manualtaylorhughesrfnaebgxyk100% (21)

- Pre EmptiveDokumen18 halamanPre EmptiveharshitanandBelum ada peringkat

- Company Law ProjectDokumen9 halamanCompany Law ProjectAmlan ChakrabortyBelum ada peringkat

- Forensic Accounting 11Dokumen4 halamanForensic Accounting 11silvernitrate1953Belum ada peringkat

- Tupe or Not Tupe Spring Edition Surrey Lawyer 2015Dokumen1 halamanTupe or Not Tupe Spring Edition Surrey Lawyer 2015Ryan ClementBelum ada peringkat

- Zambian Open University Company Law Assignment Delves Into Importance of Business RescueDokumen10 halamanZambian Open University Company Law Assignment Delves Into Importance of Business RescueBanji KalengaBelum ada peringkat

- Doctrine of Lifting of Corporate VeilDokumen7 halamanDoctrine of Lifting of Corporate VeilHarsh BansalBelum ada peringkat

- HMRC Guidance 5Dokumen4 halamanHMRC Guidance 5daniel prastowoBelum ada peringkat

- Turnaround Management: Unlocking and Preserving Value in Distressed BusinessesDari EverandTurnaround Management: Unlocking and Preserving Value in Distressed BusinessesBelum ada peringkat

- Calculate Depreciation Expenses of Construction MachineryDokumen7 halamanCalculate Depreciation Expenses of Construction MachineryAli MuhammadBelum ada peringkat

- Make It MaterialDokumen4 halamanMake It MaterialroneyewuBelum ada peringkat

- Make It MaterialDokumen4 halamanMake It MaterialroneyewuBelum ada peringkat

- Template Slip Gaji - V2.1 - enDokumen35 halamanTemplate Slip Gaji - V2.1 - enHk ThBelum ada peringkat

- S 296001-1 A3 APQP Status Report enDokumen2 halamanS 296001-1 A3 APQP Status Report enfdsa01Belum ada peringkat

- Managerial Economics Chapter 2 PresentationDokumen31 halamanManagerial Economics Chapter 2 PresentationtarekffBelum ada peringkat

- Balance Sheet Analysis FY 2017-18Dokumen1 halamanBalance Sheet Analysis FY 2017-18AINDRILA BERA100% (1)

- Customer Satisfaction Survey ISO9001 TemplateDokumen1 halamanCustomer Satisfaction Survey ISO9001 TemplateCabrelBelum ada peringkat

- Importance of Accounting and Finance For IndustryDokumen16 halamanImportance of Accounting and Finance For IndustryDragosBelum ada peringkat

- 2014 2015 Sustainability ReportDokumen102 halaman2014 2015 Sustainability ReportViệt Vớ VẩnBelum ada peringkat

- Profile of Resource PersonDokumen4 halamanProfile of Resource Personnotes.mcpuBelum ada peringkat

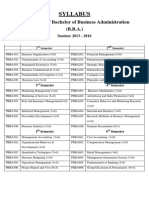

- BBA Syllabus 2013-2016Dokumen59 halamanBBA Syllabus 2013-2016GauravsBelum ada peringkat

- StarbucksDokumen9 halamanStarbucksMeenal MalhotraBelum ada peringkat

- WA CalculationsDokumen3 halamanWA CalculationsAhmed EzzBelum ada peringkat

- Cost Accounting For Decision-MakingDokumen56 halamanCost Accounting For Decision-MakingRita ChingBelum ada peringkat

- Javeria Essay 3Dokumen7 halamanJaveria Essay 3api-241524631Belum ada peringkat

- Conversation Questions English For Business 1516Dokumen22 halamanConversation Questions English For Business 1516Alex PetriciBelum ada peringkat

- MIS AssignmentDokumen16 halamanMIS AssignmentUsman Tariq100% (1)

- Philippine Government Electronic Procurement System GuideDokumen11 halamanPhilippine Government Electronic Procurement System GuideDustin FormalejoBelum ada peringkat

- Mega Cities ExtractDokumen27 halamanMega Cities ExtractAnn DwyerBelum ada peringkat

- Types of TaxesDokumen6 halamanTypes of TaxesRohan DangeBelum ada peringkat

- Bahasa Inggris AkunDokumen2 halamanBahasa Inggris AkunGaptek IDBelum ada peringkat

- Unit 32 QCF Quality Management in BusinessDokumen6 halamanUnit 32 QCF Quality Management in BusinessdrakhtaraliBelum ada peringkat

- Solutions For Week 8Dokumen2 halamanSolutions For Week 8Guru KandhanBelum ada peringkat

- A Guide To Business PHD ApplicationsDokumen24 halamanA Guide To Business PHD ApplicationsSampad AcharyaBelum ada peringkat