I. Balance Sheet DEC 31ST, 2014 DEC 31ST, 2015

Diunggah oleh

WawerudasDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

I. Balance Sheet DEC 31ST, 2014 DEC 31ST, 2015

Diunggah oleh

WawerudasHak Cipta:

Format Tersedia

ECOBANK KENYA LIMITED AUDITED FINANCIAL STATEMENTS AND OTHER

DISCLOSURES FOR THE YEAR ENDED 31ST DECEMBER, 2015

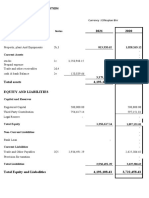

I. BALANCE SHEET DEC 31ST, 2014 DEC 31ST, 2015

Shs.000 Shs.000

Audited Audited

A ASSETS

1 Cash (Both local and Foreign) 905,034 873,575

2 Balances due from Central Bank Of Kenya 2,050,977 2,714,656

3 Kenya Government and other securities held for dealing purposes

4 Financial Assets at fair value through profit and loss

5 Investment Securities: - -

a) Held to Maturity: - -

a. Kenya Government securities - -

b. Other securities - -

b) Available for sale: - -

a. Kenya Government securities 9,897,471 9,144,181

b. Other securities 6,250 5,000

6 Deposits and balances due from local banking Institutions 2,468,931 2,772,834

7 Deposits and balances due from banking Institutions abroad 2,959,883 2,623,578

8 Tax recoverable 33,341 25,428

9 Loans and advances to customers (net) 22,982,094 29,621,166

10 Balances due from banking institutions in the group - -

11 Investments in associates 2,441 2,441

12 Investments in subsidiary companies - -

13 Investments in joint ventures

14 Investment properties 552,923 607,929

15 Property and equipment 766,981 697,962

16 Prepaid lease rentals - -

17 Intangible assets 290,465 241,326

18 Deferred tax asset 2,475,454 2,494,346

19 Retirement benefit asset - -

20 Other assets 542,213 602,091

21 TOTAL ASSETS 45,934,458 52,426,513

B LIABILITIES

22 Balances due to Central Bank of Kenya

23 Customer deposits 32,413,989 34,478,949

24 Deposits and balances due to local banking institutions - -

25 Deposits and balances due to foreign banking institutions

26 Other money market deposits - -

27 Borrowed funds 5,178,933 10,009,138

28 Balances due to group companies - -

29 Tax payable - -

30 Dividends payable

31 Deferred tax liability - 14,435

32 Retirement benefit liability - -

33 Other liabilities 513,594 363,320

34 TOTAL LIABILITIES 38,106,516 44,865,842

C SHAREHOLDERS FUNDS

35 Paid up/Assigned capital 12,194,050 12,194,050

36 Share premium/(discount) 38,363 38,363

37 Revaluation reserves (1,940,919) (2,298,576)

38 Retained earnings/Accumulated losses (2,463,552) (2,516,725)

39 Statutory Loan Loss Reserve - 143,559

40 Proposed dividends - -

41 Capital grants - -

42 TOTAL SHAREHOLDERS FUNDS 7,827,942 7,560,671

43 TOTAL LIABILITIES AND SHAREHOLDERS FUNDS 45,934,458 52,426,513

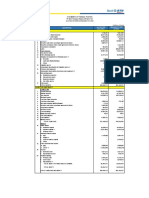

II. PROFIT AND LOSS ACCOUNT

1 INTEREST INCOME

1.1 Loans and advances 2,319,914 3,246,032

1.2 Government securities 597,756 787,037

1.3 Deposits and placements with banking institutions 75,150 160,714

1.4 Other Interest Income 872 717

1.5 Total interest Income 2,993,692 4,194,500

2 INTEREST EXPENSES

2.1 Customer deposits 1,520,402 1,680,228

2.2 Deposits and placements from banking institutions 475,738 804,530

2.3 Other Interest Expenses - -

2.4 Total interest expenses 1,996,140 2,484,758

3 NET INTEREST INCOME/(LOSS) 997,552 1,709,742

4 NON-OPERATING INCOME

4.1 Fees and commissions on loans and advances 292,436 314,411

4.2 Other fees and commissions. 551,152 645,519

4.3 Foreign exchange trading income (Loss) 217,979 247,229

4.4 Dividend income - -

4.5 Other income. 111,354 107,211

4.6 Total non-interest income 1,172,921 1,314,371

5 TOTAL OPERATING INCOME 2,170,472 3,024,113

6 OTHER OPERATING EXPENSES

6.1 Loan loss provisions (56,171) 48,303

6.2 Staff costs 1,060,859 1,120,617

6.3 Directors emoluments 91,062 112,923

6.4 Rentals charges 175,652 191,337

6.5 Depreciation charge on property and equipment 153,549 195,942

6.6 Armortisation charges 109,404 43,053

6.7 Other operating expenses 1,135,368 1,219,069

6.8 Total other operating expenses 2,669,724 2,931,244

7 Profit/(loss) before tax and exceptional items (499,252) 92,869

8 Exceptional items

9 Profit/(loss) after exceptional items (499,252) 92,869

10 Current tax - -

11 Deferred tax 179,039 (2,496)

12 Profit/(loss) after tax and exceptional items (320,212) 90,373

III. OTHER DISCLOSURES

1. NON-PERFORMING LOANS AND ADVANCES

a) Gross Non-performing loans and advances 2,460,719 2,444,338

Less:

b) Interest in suspense 458,657 602,736

c) Total non-performing loans and advances (a-b) 2,002,062 1,841,602

Less:

d) Loan loss provisions 675,046 678,137

e) Net Non- Performing loans (c-d) 1,327,016 1,163,465

f) Realisable Value of Securities 1,327,016 1,163,465

g) Net NPLs Exposure (e-f) - -

2. INSIDER LOANS AND ADVANCES

a) Directors, shareholders and associates 230,276 -

b) Employees 825,303 899,326

c) Total insider loans, advances and Other Facilities 1,055,579 899,326

3. OFF-BALANCE SHEET ITEMS

a) Letters of credit, guarantees, acceptances 3,844,270 14,663,737

b) Other contingent liabilities 4,948,778 6,169,032

c) Total Contingent liabilties 8,793,048 20,832,769

4. CAPITAL STRENGTH

a) Core capital 9,044,102 9,083,122

b) Minimum Statutory Capital 1,000,000 1,000,000

c) Excess/(Deficiency) 8,044,102 8,083,122

d) Supplementary capital 1,451,200 821,323

e) Total capital (a+d) 10,495,302 9,904,445

f) Total risk weighted assets 32,967,062 39,685,462

g) Core capital/total deposit liabilities 27.9% 22.9%

h) Minimum Statutory Ratio 10.5% 10.5%

i) Excess/(Deficiency) 17.4% 12.4%

j) Core capital/total risk weighted assets 27.4% 26.3%

k) Minimum Statutory Ratio 10.5% 10.5%

l) Excess/(Deficiency)(j-k) 16.9% 15.8%

m) Total capital /total risk weighted assets 32.5% 25.0%

n) Minimum Statutory Ratio 14.5% 14.5%

o) Excess/(Deficiency)(m-n) 18.0% 10.5%

5. LIQUIDITY

a) Liquidity Ratio 39.9% 40.0%

b) Minimum Statutory Ratio 20.0% 20.0%

c) Excess/(Deficiency)(a-b)

19.9% 20.0%

The financial statements are extracts from the audited books of the institution.

Signed -------------- Signed --------------

Kassi Ehouman Charles Orony Ogalo

Managing Director Chairman

Registered Office: Ecobank Towers,15th Floor, P.O. Box 49584-00100, Nairobi, Kenya. Tel: 2883000. E-mail: kenya@ecobank.com

Anda mungkin juga menyukai

- Discounted Cash Flow: A Theory of the Valuation of FirmsDari EverandDiscounted Cash Flow: A Theory of the Valuation of FirmsBelum ada peringkat

- NIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Dokumen3 halamanNIC Group PLC Audited Financial Results For The Period Ended 31st December 2017Anonymous KAIoUxP7Belum ada peringkat

- 6 Supplementary Accounting StatementDokumen11 halaman6 Supplementary Accounting StatementNithinMannepalliBelum ada peringkat

- Barclays Results q1 2014Dokumen2 halamanBarclays Results q1 2014Manil UniqueBelum ada peringkat

- Standard Chartered Bank Kenya LTD - Financial Results For The Year Ended 31-Dec-2021Dokumen12 halamanStandard Chartered Bank Kenya LTD - Financial Results For The Year Ended 31-Dec-2021K MBelum ada peringkat

- Bitfarms Q4 2021 FS FinalDokumen46 halamanBitfarms Q4 2021 FS FinalAlexandru IonescuBelum ada peringkat

- Financial Report 30 09 2019 ENDokumen38 halamanFinancial Report 30 09 2019 ENVenture ConsultancyBelum ada peringkat

- Development AssignmentDokumen19 halamanDevelopment AssignmentMuhammad hanzla mehmoodBelum ada peringkat

- IMCC 31.12.2023 FS - FinalDokumen77 halamanIMCC 31.12.2023 FS - FinalBrian ManyauBelum ada peringkat

- Cash Flow Questions RucuDokumen5 halamanCash Flow Questions RucuWalton Jr Kobe TZBelum ada peringkat

- PIOCORE 2022 - ThousandDokumen7 halamanPIOCORE 2022 - ThousandAbhishek RaiBelum ada peringkat

- ADIB Consalidated Condensed Dec 2022Dokumen109 halamanADIB Consalidated Condensed Dec 2022Youssef NabilBelum ada peringkat

- Ca - FS23 697 707Dokumen11 halamanCa - FS23 697 707thelilskywalkerBelum ada peringkat

- Dec 22 Management ConsolidatedDokumen23 halamanDec 22 Management ConsolidatedKhalid KhanBelum ada peringkat

- A04 Zur57zgu4yzwvtfj.1Dokumen47 halamanA04 Zur57zgu4yzwvtfj.1Paul BluemnerBelum ada peringkat

- Adidas - Financial Statements With NotesDokumen104 halamanAdidas - Financial Statements With NotesJammie ObenitaBelum ada peringkat

- Lii Hen - Q1 (2017) 1Dokumen15 halamanLii Hen - Q1 (2017) 1Jordan YiiBelum ada peringkat

- RHB Group Soci SofpDokumen3 halamanRHB Group Soci SofpAnis SuhailaBelum ada peringkat

- Dialog Finance PLC: ConfidentialDokumen12 halamanDialog Finance PLC: ConfidentialgirihellBelum ada peringkat

- 2020 6 Months Financial Statements Usd ImzaliDokumen57 halaman2020 6 Months Financial Statements Usd Imzalihero111983Belum ada peringkat

- Inter American Development Bank Annual Report 2022 The Year in ReviewDokumen46 halamanInter American Development Bank Annual Report 2022 The Year in ReviewDani GuzmánBelum ada peringkat

- Unaudited Condensed Consolidated Financial ReportsDokumen33 halamanUnaudited Condensed Consolidated Financial ReportsinforumdocsBelum ada peringkat

- PAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedDokumen60 halamanPAIR Accounts - December 2018 - Formatted 14 Feb 2019 UpdatedMuhammad SamiBelum ada peringkat

- A04 T86uxmwsyll4x6ve.1Dokumen44 halamanA04 T86uxmwsyll4x6ve.1citybizlist11Belum ada peringkat

- HBL 2000Dokumen2 halamanHBL 2000Shahid AwanBelum ada peringkat

- PT Masi - 31 Dec 2020Dokumen67 halamanPT Masi - 31 Dec 2020jf testBelum ada peringkat

- Comparative FSDokumen4 halamanComparative FSSuper GenerationBelum ada peringkat

- Coca ColaDokumen10 halamanCoca ColaJelyn JagolinoBelum ada peringkat

- Consolidated Financial Highlights: - Amortized Cost: Investment SecuritiesDokumen2 halamanConsolidated Financial Highlights: - Amortized Cost: Investment SecuritiesRimsha SiafBelum ada peringkat

- Analysing Financial Performance: Centre For Financial Management, BangaloreDokumen24 halamanAnalysing Financial Performance: Centre For Financial Management, Bangalorepankaj9mayBelum ada peringkat

- Co Op Bank Group Full 2022 FinancialsDokumen1 halamanCo Op Bank Group Full 2022 Financialscarolm790Belum ada peringkat

- Co Operative Bank of Kenya LTD Audited Financial Results For The Period Ended 31 Dec 2021Dokumen3 halamanCo Operative Bank of Kenya LTD Audited Financial Results For The Period Ended 31 Dec 2021gilton amadadiBelum ada peringkat

- Cons Financial Statements Adidas Ar22Dokumen10 halamanCons Financial Statements Adidas Ar22Mónica Jaramillo GonzálezBelum ada peringkat

- Hellas Telecommunications II Sca Windgr 2011 05 11 Hellas III Hellas IVDokumen31 halamanHellas Telecommunications II Sca Windgr 2011 05 11 Hellas III Hellas IVabuknan5502007Belum ada peringkat

- Statement of Cash Flows: AS 31 DEC 2015Dokumen6 halamanStatement of Cash Flows: AS 31 DEC 2015Arif AmsyarBelum ada peringkat

- Enterprise GroupDokumen8 halamanEnterprise GroupFuaad DodooBelum ada peringkat

- Liyu - 2021 G.CDokumen8 halamanLiyu - 2021 G.CElias Abubeker AhmedBelum ada peringkat

- PT Matahari Department Store TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianDokumen103 halamanPT Matahari Department Store TBK Dan Entitas Anak/And Subsidiaries Laporan Keuangan KonsolidasianStevi MujonoBelum ada peringkat

- StateHouse Holdings Inc - Form Interim Financial Statements (Nov-22-2022)Dokumen60 halamanStateHouse Holdings Inc - Form Interim Financial Statements (Nov-22-2022)ScridbyBelum ada peringkat

- Consolidated Balance SheetDokumen1 halamanConsolidated Balance SheetSukhmanBelum ada peringkat

- Annual Report: The Year in ReviewDokumen42 halamanAnnual Report: The Year in ReviewSabina MunteanuBelum ada peringkat

- Karora Q2 2022 FSDokumen19 halamanKarora Q2 2022 FSprenges prengesBelum ada peringkat

- CIB Separate Financial Statements Mar 2022 EnglishDokumen29 halamanCIB Separate Financial Statements Mar 2022 EnglishPT l Pardox TechBelum ada peringkat

- Karora Resources FS Q3 2021Dokumen19 halamanKarora Resources FS Q3 2021prenges prengesBelum ada peringkat

- Ratio Analysis SumsDokumen8 halamanRatio Analysis Sumshabibi 101Belum ada peringkat

- 2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColaDokumen1 halaman2022 Q4 Earnings Release (Ex-99.1) - Full Release Coca-ColakusshhalBelum ada peringkat

- Receipts and Payments AccountDokumen2 halamanReceipts and Payments AccountUmapathi MBelum ada peringkat

- Contentdamnexuseninvestorquarterly Results2020 2021q4fy21consolidated Financial Statement q4 Fy21Dokumen33 halamanContentdamnexuseninvestorquarterly Results2020 2021q4fy21consolidated Financial Statement q4 Fy21Prasad RohitBelum ada peringkat

- Dec09 Inv Presentation GAAPDokumen23 halamanDec09 Inv Presentation GAAPOladipupo Mayowa PaulBelum ada peringkat

- Separate Statement of Financial PositionDokumen1 halamanSeparate Statement of Financial PositionJorge VeraBelum ada peringkat

- Karora FS Q1 2021Dokumen16 halamanKarora FS Q1 2021Predrag MarkovicBelum ada peringkat

- QCT Energy Private Limited Balance Sheet As at 31 MARCH 2021Dokumen10 halamanQCT Energy Private Limited Balance Sheet As at 31 MARCH 2021Swapnil WankhedeBelum ada peringkat

- Fancy Phone Trust - Trust - Financial StatementsDokumen15 halamanFancy Phone Trust - Trust - Financial Statementsjerry dela cruzBelum ada peringkat

- FA AssignmentDokumen21 halamanFA AssignmentMuzammil khanBelum ada peringkat

- Lapkeu TW II 2023 EngDokumen21 halamanLapkeu TW II 2023 EngNur Arif Setya HendraBelum ada peringkat

- EvergrandeDokumen5 halamanEvergrandeTrần QuyênBelum ada peringkat

- Statement of Financial Position: Samba Bank Annual Report 2021Dokumen2 halamanStatement of Financial Position: Samba Bank Annual Report 2021Ahmad KhalidBelum ada peringkat

- CompleteDokumen17 halamanCompletesanket patilBelum ada peringkat

- Balance Sheet VW Ar18Dokumen1 halamanBalance Sheet VW Ar18Sneha SinghBelum ada peringkat

- 1.2 Maliyye Hesabatlari Eng III Rub 2022Dokumen2 halaman1.2 Maliyye Hesabatlari Eng III Rub 2022Zakir KhalilovBelum ada peringkat

- Corporate Governance and Sustainability SlidesDokumen177 halamanCorporate Governance and Sustainability SlidesWawerudas100% (2)

- Students TemplateDokumen27 halamanStudents TemplateWawerudasBelum ada peringkat

- Preparation of Basic Final StatementsDokumen5 halamanPreparation of Basic Final StatementsWawerudasBelum ada peringkat

- Debits and CreditsDokumen19 halamanDebits and CreditsWawerudasBelum ada peringkat

- Book OlyDokumen68 halamanBook OlyWawerudasBelum ada peringkat

- Lyapunov 1Dokumen4 halamanLyapunov 1Wawerudas100% (1)

- UntitledDokumen9 halamanUntitledWawerudasBelum ada peringkat

- The Hidden Traps in Decision MakingDokumen10 halamanThe Hidden Traps in Decision MakingWawerudasBelum ada peringkat

- CH 23 Mini CaseDokumen4 halamanCH 23 Mini CaseWawerudasBelum ada peringkat

- CPA - Advanced Financial Reporting Mock 2009Dokumen8 halamanCPA - Advanced Financial Reporting Mock 2009WawerudasBelum ada peringkat

- Lyapunov ExponentDokumen5 halamanLyapunov ExponentWawerudasBelum ada peringkat

- Bank AnalysisDokumen4 halamanBank AnalysisWawerudasBelum ada peringkat

- HANSSON CASE Individual AssignmentDokumen2 halamanHANSSON CASE Individual AssignmentWawerudasBelum ada peringkat

- HBL Kenya Audited Annual Accounts 2016Dokumen65 halamanHBL Kenya Audited Annual Accounts 2016WawerudasBelum ada peringkat

- In Search of Stability:: The Economics and Politics of The Global Financial CrisisDokumen36 halamanIn Search of Stability:: The Economics and Politics of The Global Financial CrisisWawerudasBelum ada peringkat

- Body in A Bag PDFDokumen12 halamanBody in A Bag PDFWawerudasBelum ada peringkat

- Bank AnalysisDokumen73 halamanBank AnalysisWawerudasBelum ada peringkat

- Annual Report 2016Dokumen176 halamanAnnual Report 2016WawerudasBelum ada peringkat

- A Sinful ProposalDokumen3 halamanA Sinful ProposalWawerudasBelum ada peringkat

- ch03 - Free Cash Flow ValuationDokumen66 halamanch03 - Free Cash Flow Valuationmahnoor javaidBelum ada peringkat

- RIC Volume 3 Issue 1 Shivangi Agarwal Nawazish MirzaDokumen20 halamanRIC Volume 3 Issue 1 Shivangi Agarwal Nawazish MirzaHimanshiBelum ada peringkat

- Merger and AcquisitionsDokumen126 halamanMerger and AcquisitionsFaye Lyn Alvezo ValdezBelum ada peringkat

- Babasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceDokumen8 halamanBabasaheb Bhimrao Ambedkar University: Karan Shukla 194120 B.B.A. 5 Managing Personal FinanceShivani ShuklaBelum ada peringkat

- ATS - Daily Trading Plan 27agustus2018Dokumen1 halamanATS - Daily Trading Plan 27agustus2018wahidBelum ada peringkat

- Uas Distribusi 8Dokumen1 halamanUas Distribusi 8riocahBelum ada peringkat

- RBI Monetary Policy FinalDokumen28 halamanRBI Monetary Policy FinaltejassuraBelum ada peringkat

- Balance Sheet: AssetsDokumen19 halamanBalance Sheet: Assetssumeer shafiqBelum ada peringkat

- CH 03Dokumen17 halamanCH 03时家欣Belum ada peringkat

- Financial Markets Finals FinalsDokumen6 halamanFinancial Markets Finals FinalsAmie Jane MirandaBelum ada peringkat

- Investment Management Module 1Dokumen21 halamanInvestment Management Module 1rijochacko87Belum ada peringkat

- AccountingDokumen72 halamanAccountingOmar SanadBelum ada peringkat

- Auditing TheoryDokumen24 halamanAuditing TheoryLuisitoBelum ada peringkat

- Test 5 BDokumen2 halamanTest 5 BOfentse RanalaBelum ada peringkat

- 2021 Tutorial 9 Nov26 Problem SheetDokumen7 halaman2021 Tutorial 9 Nov26 Problem SheetdsfghBelum ada peringkat

- Module-5 Problems On Performance Evaluation of Mutual FundDokumen4 halamanModule-5 Problems On Performance Evaluation of Mutual Fundgaurav supadeBelum ada peringkat

- Dolibarr and Odoo ComparisionDokumen10 halamanDolibarr and Odoo ComparisionPrinceKhurramBelum ada peringkat

- Solution Manual For Principles of Finance 6th Edition by BesleyDokumen5 halamanSolution Manual For Principles of Finance 6th Edition by Besleya8707008010% (1)

- Birla CableDokumen4 halamanBirla Cablejanam shahBelum ada peringkat

- FARAP-4412 (Income Taxes)Dokumen6 halamanFARAP-4412 (Income Taxes)Dizon Ropalito P.Belum ada peringkat

- Di OutlineDokumen81 halamanDi OutlineRobert E. BrannBelum ada peringkat

- Financial Modeling & Valuation Analyst (FMVA) ® Certification ProgramDokumen2 halamanFinancial Modeling & Valuation Analyst (FMVA) ® Certification ProgramJoseph KachereBelum ada peringkat

- Unit 1Dokumen48 halamanUnit 1DeshikBelum ada peringkat

- Final Corporate Finance GROUP 4Dokumen10 halamanFinal Corporate Finance GROUP 4sudipta shrivastavaBelum ada peringkat

- (TEST BANK and SOL) Bonds PayableDokumen6 halaman(TEST BANK and SOL) Bonds PayableJhazz DoBelum ada peringkat

- Q2'23 Earnings PresentationDokumen24 halamanQ2'23 Earnings PresentationDinheirama.comBelum ada peringkat

- Salim Sir+SyllabusDokumen2 halamanSalim Sir+SyllabusMohammad Salim HossainBelum ada peringkat

- AAII InvestingBasicsEBookDokumen63 halamanAAII InvestingBasicsEBookee1993Belum ada peringkat

- Unit 6 - Capital Structure and LeverageDokumen12 halamanUnit 6 - Capital Structure and LeverageGizaw BelayBelum ada peringkat

- Forex Trading and Investment PDFDokumen160 halamanForex Trading and Investment PDFManop Metha100% (1)