Circular No.165 Accounting Codes

Diunggah oleh

forbooksJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Circular No.165 Accounting Codes

Diunggah oleh

forbooksHak Cipta:

Format Tersedia

Circular No.

165/16/2012 -ST

F.No.341/21/2012-TRU

Government of India

Ministry of Finance

Department of Revenue

Central Board of Excise & Customs

Tax Research Unit

146-F, North Block,

New Delhi, 20th November, 2012

To

Chief Commissioners of Central Excise and Customs (All), Director General

(Service Tax), Director General(Systems), Director General (Central Excise

Intelligence), Director General (Audit),Commissioners of Service Tax (All),

Commissioners of Central Excise (All), Commissioners of Central Excise and

Customs (All)

Madam/Sir,

Subject: Restoration of service specific accounting codes for payment of

service tax - regarding.

Negative List based comprehensive approach to taxation of services came

into effect from the first day of July, 2012. Accounting code for the purpose of

payment of service tax under the Negative List approach [All Taxable Services

00441089] was prescribed vide Circular 161/12/2012 dated 6th July, 2012.

2. Subsequent to the issuance of the Circular, suggestions were received

from the field formations that the service specific old accounting codes should be

restored, for the purpose of statistical analysis; also it was suggested that list of

descriptions of services should be provided to the taxpayers for obtaining

registration. These suggestions were examined and a decision has been taken

to restore the service specific accounting codes. Accordingly, a list of 120

descriptions of services for the purpose of registration and accounting codes

corresponding to each description of service for payment of tax is provided in the

annexure to this Circular.

3. Descriptions of taxable services given in the annexure are solely for the

purpose of statistical analysis. On the advice of the office of the C & AG, a

specific sub-head has been created for payment of penalty under various

descriptions of services. Henceforth, the sub-head other receipts is meant only

for payment of interest payable on delayed payment of service tax. Accounting

Codes under the sub-head deduct refunds is not to be used by the taxpayers,

as it is meant for use by the field formations while allowing refund of tax.

4. Registrations obtained under the positive list approach continue to be

valid. New taxpayers can obtain registrations by selecting the relevant

description/s from among the list of 120 descriptions of services given in the

Annexure. Where registrations have been obtained under the description All

Taxable Services, the taxpayer should file amendment application online in

ACES and opt for relevant description/s from the list of 120 descriptions of

services given in the Annexure. If any applications for amendment of ST-1 are

pending with field formations, seeking the description all taxable services, such

amendment may not be necessary and the officers in the field formations may

provide necessary guidance to the taxpayers in this regard. Directorate General

of Systems will be making necessary arrangements for display of the list of 120

descriptions of services and their corresponding Accounting Codes in Form ST-1

and Form ST-2 as may be necessary.

5. Officers in the field formations are instructed to extend necessary

guidance to the tax payers regarding the selection of appropriate description of

taxable service and facilitate the payment of service tax/cess due under the

appropriate accounting code. Trade Notice/Public Notice may be issued to the

field formations and tax payers. Please acknowledge receipt of this Circular.

Hindi version follows.

Click here > Annexure (nine pages)

(J.M.Kennedy)

Director, TRU

Tel: 011-23092634

Email: jm.kennedy@nic.in

Anda mungkin juga menyukai

- Circular No.165 Accounting CodesDokumen2 halamanCircular No.165 Accounting CodesforbooksBelum ada peringkat

- Notfctn 54 Central Tax EnglishDokumen1 halamanNotfctn 54 Central Tax EnglishforbooksBelum ada peringkat

- Notification2 (Null)Dokumen6 halamanNotification2 (Null)forbooksBelum ada peringkat

- Notfctn 74 Central Tax EnglishDokumen1 halamanNotfctn 74 Central Tax EnglishforbooksBelum ada peringkat

- Circular No.165 Accounting CodesDokumen2 halamanCircular No.165 Accounting CodesforbooksBelum ada peringkat

- Acctng Codes Services Notfn482012Dokumen11 halamanAcctng Codes Services Notfn482012forbooksBelum ada peringkat

- Circ1053 2017cxDokumen26 halamanCirc1053 2017cxRajendra SwarnakarBelum ada peringkat

- GST Error ReportingDokumen4 halamanGST Error ReportingthecoltBelum ada peringkat

- Central Tax English 2Dokumen1 halamanCentral Tax English 2forbooksBelum ada peringkat

- Circ1053 2017cxDokumen26 halamanCirc1053 2017cxRajendra SwarnakarBelum ada peringkat

- GST Migration AdvisoryDokumen2 halamanGST Migration AdvisorySarada DalaiBelum ada peringkat

- Form GST Rfd11Dokumen63 halamanForm GST Rfd11forbooksBelum ada peringkat

- Print Media BillingDokumen1 halamanPrint Media BillingforbooksBelum ada peringkat

- Nic-2008 - Nic-2008Dokumen34 halamanNic-2008 - Nic-2008forbooksBelum ada peringkat

- Notification For 206AADokumen3 halamanNotification For 206AAforbooksBelum ada peringkat

- User Guide For MigrationDokumen4 halamanUser Guide For MigrationforbooksBelum ada peringkat

- DDQ 2007 013Dokumen9 halamanDDQ 2007 013forbooksBelum ada peringkat

- B P T Act, 1950Dokumen107 halamanB P T Act, 1950dev4allBelum ada peringkat

- List of Services Under Reverse ChargeDokumen5 halamanList of Services Under Reverse ChargeMoneycontrol News100% (18)

- Form GSTR-1: Government of India/State Department ofDokumen11 halamanForm GSTR-1: Government of India/State Department ofManish PandeyBelum ada peringkat

- Listing For GST Assessees From July 2017Dokumen2 halamanListing For GST Assessees From July 2017forbooksBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Handicapped Form 16Dokumen8 halamanHandicapped Form 16pranab_banerjee8630Belum ada peringkat

- Cir vs. Air India DigestDokumen3 halamanCir vs. Air India Digestkarlonov100% (2)

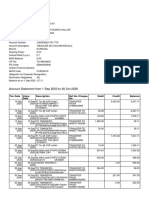

- Account Statement From 1 Sep 2020 To 30 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen3 halamanAccount Statement From 1 Sep 2020 To 30 Oct 2020: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalancebalajiBelum ada peringkat

- Guide Relevant Life InsuranceDokumen8 halamanGuide Relevant Life Insurancepderby1Belum ada peringkat

- Rework Problem 13 Assuming The Following in Problem 13 WildcatDokumen1 halamanRework Problem 13 Assuming The Following in Problem 13 WildcatAmit PandeyBelum ada peringkat

- GST andDokumen10 halamanGST andAbhishek DixitBelum ada peringkat

- Appendix 33 - Instructions - PayrollDokumen1 halamanAppendix 33 - Instructions - Payrollpdmu regionixBelum ada peringkat

- Statement For Contract # 1034143520: Muhammad SaadDokumen16 halamanStatement For Contract # 1034143520: Muhammad SaadSaad MalikBelum ada peringkat

- MPPSC Sfs Advt - SFS - 2022 - Dated - 30 - 12 - 2022 PDFDokumen19 halamanMPPSC Sfs Advt - SFS - 2022 - Dated - 30 - 12 - 2022 PDFNripeshBelum ada peringkat

- Account Transactions FDokumen7 halamanAccount Transactions FM Waqas Aajiz RajputBelum ada peringkat

- Fiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order ToDokumen2 halamanFiscal Policy: Expansionary Fiscal Policy When The Government Spend More Then It Receives in Order TominhaxxBelum ada peringkat

- 14 - Tax Planning Under Income Tax LawsDokumen35 halaman14 - Tax Planning Under Income Tax Lawsrohanfyaz00Belum ada peringkat

- Federal Income Tax Law OutlineDokumen81 halamanFederal Income Tax Law Outlinegummybear917100% (2)

- Comfort Inn & Suites Los Alamos: Your Reservation Is ConfirmedDokumen2 halamanComfort Inn & Suites Los Alamos: Your Reservation Is ConfirmedNagendra SinghBelum ada peringkat

- 2016 - Final Income Tax Ordinance, 2001 - 19.09.16 First & Second ScheduleDokumen148 halaman2016 - Final Income Tax Ordinance, 2001 - 19.09.16 First & Second ScheduletalalhaiderBelum ada peringkat

- E Bay ISAPIDokumen2 halamanE Bay ISAPIShivam AroraBelum ada peringkat

- Account Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceDokumen6 halamanAccount Statement From 1 Apr 2021 To 31 Mar 2022: TXN Date Value Date Description Ref No./Cheque No. Debit Credit BalanceSanjay SharmaBelum ada peringkat

- Quotation DotZotDokumen3 halamanQuotation DotZotGaurav singh BishtBelum ada peringkat

- Avenue Supermarts - Template With Past DataDokumen12 halamanAvenue Supermarts - Template With Past DataNJ NagarajBelum ada peringkat

- Realme GT Master Edition (Cosmos Black, 128 GB) : Grand Total 21999.00Dokumen1 halamanRealme GT Master Edition (Cosmos Black, 128 GB) : Grand Total 21999.00Satyajeet ChaterjeeBelum ada peringkat

- Business Plan - EazypayDokumen7 halamanBusiness Plan - EazypayBuchi MadukaBelum ada peringkat

- Account No: Total Amount Due:: Important InformationDokumen2 halamanAccount No: Total Amount Due:: Important InformationWinnie LuongBelum ada peringkat

- Invoice Tax CalculationDokumen1 halamanInvoice Tax CalculationsonetBelum ada peringkat

- Chapter 4 Income From SalariesDokumen106 halamanChapter 4 Income From SalariesYogesh Sahani50% (2)

- Exercise EIT and PIT 1Dokumen6 halamanExercise EIT and PIT 1Quỳnh Anh NguyễnBelum ada peringkat

- #22393419 12784202 SriwijayaDokumen3 halaman#22393419 12784202 SriwijayaAdytia AwBelum ada peringkat

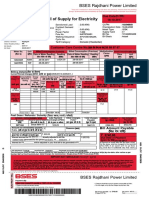

- Bill of Supply For Electricity: BSES Rajdhani Power LimitedDokumen4 halamanBill of Supply For Electricity: BSES Rajdhani Power LimitedHema KatiyarBelum ada peringkat

- GST CouncilDokumen3 halamanGST Councilaniket singhBelum ada peringkat

- Aifd Wat ResultDokumen7 halamanAifd Wat ResultMota ChashmaBelum ada peringkat

- Euro500mn ProcedureDokumen10 halamanEuro500mn ProcedureShashikanth RamamurthyBelum ada peringkat