DDQ 2007 013

Diunggah oleh

forbooksJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

DDQ 2007 013

Diunggah oleh

forbooksHak Cipta:

Format Tersedia

Read: 1) Application dt. 12/12/2005 from M/s. Thermodors Pvt. Ltd.

2) This office letter dt. 26/7/2007 calling the applicant for hearing on dt.

7/8/2007.

Heard: Shri A.B. Ghanekar, S.T.P., attended the hearing on dt. 7/8/2007.

PROCEEDINGS

(Under section 56 of the Maharashtra Value Added Tax Act, 2002.)

No.DDQ-11/2005/Adm-2/106/B- 01 Mumbai, dt. 22.08.2007

An application is received from M/s. Thermodors Pvt. Ltd., situated at 40, WMDC,

Industrial Complex, Ambethan Road, Kharabwadi, Chakan, Tal. Khed, Pune - 410501 for

determination of the rate of tax applicable to the product as Three Piece Eye Dropper

sold by the invoice no. 146 dt. 09/12/2005.

02. FACTS OF THE CASE

The applicant is a private limited company registered under the Companies Act,

1956. The applicant has a unit at Pimpri manufacturing Fiberglass reinforced plastic

products. Another unit at Chakan under the Package Scheme of Incentives is

manufacturing preimpregnated rovings. One more unit at Kharabwadi Village, Ambethan

Road, Chakan, is manufacturing Three Piece Eye Droppers in plastic consisting of bottle,

nozzle and cap used as presterilised primary packing for eye formulations.

The raw materials required for manufacturing of the above Three Piece Eye

Droppers are mainly LDPE (LUPOLEN), HDPE, pigment, etc. All these raw materials are

also known as 'plastic granules'. The raw materials are mainly imported. The applicant has

described the manufacturing process as follows :-

Manufacturing process

1. The bottles are manufactured using fully automatic injection blow moulding machine

with injection base mould, core for injection and blowing cavity.

2. The process involves granules of linear density polyethylene fed automatically into a

hopper which then passes through heated electronically controlled extruder. The

indirect heating is provided by two numbers of indirect heating units for moulds.

3. The preplasticised material is injected into the Injection Cavity after the injection core

closes. With this a perform for the bottle is made.

4. The above perform is swung into the blowing cavity and the bottles are blown to

exact size.

5. The bottles are ejected automatically after a built-in-cooling cycle.

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -1-

6. The moulded bottles get deposited on to the conveyor in a clean room with a clean air

facility and transported to the clean room packing area.

7. The caps are moulded with injection moulding process using High Density

Polyethylene and Nozzles using Low Density Polyethylene. The caps and nozzles are

also converted in a clean room environment.

8. The bottles/caps and nozzles untouched by hand gets deposited into a specially made

plastic bag and an online sealing machine double seals.

9. Every pack of 1800 bottles are, along with 1800 each of caps and nozzles, packed into a

pre-normed container which is sent out for irradiation to B.A.R.C., Mumbai, before

supplies are effected.

All the three components are packed independently in equal quantities and

dispatched to customers. After the medicine manufacturing companies fill the medicine in

the bottle, the nozzle is fitted and finally the bottle is sealed with the cap which is

automatically locked to maintain the ingredient of the medicine as it is.

At present the applicant is charging Vat @ 4% on the impugned product, being

covered by the entry at sr. no. 164 for the excise heading 3923 of the notification dt.

1/4/2005 issued for the purposes of the schedule entry C-54 of the Maharashtra Value

Added Tax Act, 2002.

03. CONTENTION & HEARING

The case was taken up for hearing on dt. 7/8/2007. Shri A.B. Ghanekar, STP,

attended the hearing. He contended that, the impugned product is an industrial input

covered by the excise heading 3923 and therefore taxable @ 4%. He reiterated the facts that,

the product is sold to pharmaceutical companies.

The applicant submits that, the products of the applicant are exclusively purchased

by the medicine manufacturing units. The product is specially designed on computerized

imported machinery which is exclusively for pharmaceutical manufacturing industries.

Since, the product to be packed is a medicine, the product of the applicant is specially

designed to pack the said medicines so as to ensure long term stability of storage in

normal condition and to retain the original ingredients. There are no sales at all directly to

the consumers/traders or non manufacturing units. The applicant contends that, the

product is exclusively used for primary packing of the medicines manufactured by the

pharmaceutical manufacturing companies. The applicant submits that, the product is used

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -2-

for conveyance of the goods in the distribution channels to the consumers. In the light of

the above, the applicant contends that, the product being a packing material for the

industrial units, would be covered by the sr. no. 164 of the notification dt. 1/4/2005 and sr.

no. 203 of the notification dt. 1/9/2005 issued for the purposes of the schedule entry C-54.

04. OBSERVATIONS

I have gone through all the facts of the case. The product under consideration is

Three Piece Eye Dropper. The question before me is the determination of the rate of tax

applicable to the impugned product. Let me begin with ascertaining the claim of the

applicant in respect of the schedule entry applicable to the impugned product. As has been

mentioned in the preceeding para, the applicant claims that, the relevant schedule entry of

the Maharashtra Value Added Tax Act, 2002 is C-54. Hence, let me reproduce the said

entry as below :-

Industrial inputs and packing materials as may be notified from time to time by the

State Government in the Official Gazette

As can be seen the above schedule entry pertains to,

1. Industrial inputs and packing materials.

2. Industrial inputs and packing materials as may be notified from time to time.

Thus, it is not only essential that, the product should be an Industrial input and

packing material BUT the same should have been notified for the purposes of the schedule

entry C-54. This means that, there would be cases wherein the product may qualify as an

Industrial input and packing material. However, the product may not have been notified for

the purposes of the schedule entry under the Maharashtra Value Added Tax Act, 2002.

In the present case, the claim of the applicant is that, the product is an industrial

packing material. In the light of the same, I would proceed by ascertaining first as to

whether the product qualifies as a packing material and thereafter whether the product

has been notified for the purposes of the schedule entry C-54.

To qualify as an industrial packing material, the product should have application

in industries as a packing material. This is essential as a packing material has use in

industries as well as day to day use. Herein, I would reproduce the observations from

cases which have adjudicated on a like matter as involved in the present case :-

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -3-

1. M/s. Samrudhi Industries [DDQ-11/2003/Adm-5/40/B-8 Mumbai, dt. 20/02/2004]

The then Commissioner while deciding the issue had observed thus,

Since the term Input is qualified as Industrial Inputs in the notification it does not include all

inputs but only inputs of an industry. The very qualification for judicious interpretation shall

equally be applicable to Packing Material since they are placed together in conjunction by the

word and. As such the entry C-I-29 covers Industrial Inputs and Industrial Packing Materials

alone in it.

2. M/s. Samrudhi Industries vs. State of Maharashtra [32 MTJ 226]

Against the aforementioned Determination Order as at 1. above, the applicant M/s.

Samrudhi Industries preferred an appeal before the Tribunal in which the Determination

Order has been upheld. While deciding the issue, the Hon. Tribunal had an opportunity to

discuss the meaning of the term Industrial inputs and packing materials as understood

for the purposes of the then schedule entry C-I-29 for Industrial inputs and packing

materials. The same could be reproduced thus,

The plain reading of the entry indicates that the articles required for industrial purposes are only

covered under the entry. The Commissioner of Sales Tax has rightly considered the importance of

conjuncture "and". It is impossible to bifurcate "Industrial Inputs" from Packing Material. It is

impossible because the aims and objects to incorporate the entry is to give benefit in taxes for

growth of the industry. This aim and object is discussed by the Commissioner of Sales Tax in his

order and that cannot be disbelieved.

The Tribunal further observed that,

This case mainly involves the interpretation of the Schedule Entry C-I-29 and the notifications

issued thereunder. The genesis of the Schedule Entry C-I-29 has been discussed at length in para 6

of this Tribunal's Judgment in the case of M/s. Thermolite Packaging (India) Pvt. Ltd., Appeal No.

4 of 2003 decided on 4.9.2004. Right from the inception of the Bombay Act, the endeavour of the

Legislature was to keep at the minimum the tax incidence on the Industrial Inputs and the Packing

Materials (including the conveyance materials), which go into the making and supply of the final

manufactured product. It is from that point of view that the provisions enabling the manufacturers

to effect purchases on Form 15 at concessional tax rate and those allowing set-off in respect of the

tax paid in excess of that rate were made. Subsequently, the withdrawal of the Form 15 provisions

from 1.10.1995 caused hardships to the industry and it is to mitigate them that the

Legislature/Government introduced the Notification Entry A-88 under Section 41 of the Bombay

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -4-

Act as also the aforesaid Schedule Entry C-I-29. So far as the said Schedule Entry C-I-29 is

concerned, the Legislature did not extend the benefit to all the Industrial Inputs and Packing

Materials as was the position prior to 1.10.1995. The benefit was given to only such Industrial

Inputs and Packing Materials as are specified by the State Government from time to time by the

notification in the Government Gazette. The Government has to take a conscious decision as

regards whether any Industrial Input or Packing Material is to be notified for the purposes of the

said Schedule Entry C-I-29. It is only on the Government's so notifying an item that it would befall

the said Schedule Entry as an Industrial Input and Packing Material.

3. M/s. B. G. Shirke Construction Technologies (P) Limited v. Addl. Commissioner of

Commercial Taxes [(2007) 5 VST 655]

The Supreme Court of India while interpreting the meaning of the term industrial

inputs had observed that, the expression industrial inputs means either component part

or raw material or packing material.

The above can be best understood from the following examples :-

1. The packing material used in packing of goods coming out of industries to be sent to

the wholesellers/retailers for ultimate delivery to the final consumers. For e,g. the

packing used for cement, etc.,

2. The packing material used in packing of goods to be given as gifts. For e,g. coloured

wrapping paper used to wrap gift articles.

The schedule entry is very specific in the sense that, it covers only Industrial

inputs and packing materials, thereby, leaving no scope for any other type of packing

material, other than industrial packing material, to be included in the impugned entry.

Turning to the facts of the present case, the applicant has submitted that, his

product is used mainly in pharmaceutical manufacturing industries. The applicant has

submitted the sample of the product. It can be seen that, the impugned product is indeed a

product used for the packing of medicines/formulations which are to be administered in

drops. For e.g. eye/ear/nose formulations. The product comes in a 3 piece set i.e., bottle,

nozzle and closure caps. From the sample of the product, it can be said that, the product

would have use in pharmaceutical manufacturing industries and not otherwise. I am

satisfied that, the impugned product would qualify to be termed as an industrial packing

material.

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -5-

Having decided as above, the question now is whether the impugned product is

notified for the purposes of the schedule entry C-54 of the Maharashtra Value Added Tax

Act, 2002. The notification for the purposes of the above entry is based on the classification

of products under the Central Excise Act. The description against any particular excise

heading may not necessarily match the description against the heading notified for the

purposes of the schedule entry C-54. There would be cases wherein a particular excise

heading matches the description against the heading notified but an exclusion clause may

have been provided in the description against the heading notified for restricting the

coverage of certain products. The method of taxation under Sales Tax and Central Excise

being different, it is not necessary that, the heading descriptions under both the statutes

must match. Herein, I would reproduce the Note 2 and 3 to the notification on Industrial

inputs and packing materials as below :-

Note.- (2) Where any commodities are described against any heading or, as the

case may be, sub-heading, and the aforesaid description is different in any

manner from the corresponding description in the Central Excise tariff, 1985,

then only those commodities described as aforesaid will be covered by the scope

of this notification and other commodities though covered by the corresponding

description in the Central Excise Tariff will not be covered by the scope of this

notification.

Note.-(3) Subject to Note 2, for the purpose of any entry contained in this

notification, where the description against any heading or, as the case may be,

sub-heading, matches fully with the corresponding description in the Central

Excise Tariff, then all the commodities covered for the purposes of the said tariff

under that heading or sub-heading will be covered by the scope of this

notification.

The above notes are self explanatory and hence, without delving any further, I

move on to ascertain the claim of the applicant in respect of the heading 3923 notified for

the purposes of the schedule entry C-54. The applicant has submitted a copy of the excise

invoice evidencing the sale of the impugned product. The excise heading mentioned

thereon is 3923.50.90. The description under Central Excise against this heading is as

follows :-

392350 Stoppers, lids, caps and other closures:

39235010 - - - Caps and closures for bottles

39235090 --- Other

So far 2 notifications have been notified for the purposes of the impugned schedule

entry. Let me reproduce the descriptions against the aforementioned heading notified for

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -6-

the purposes of both the notifications along with the description against the same heading

under the Central Excise Act as follows :-

Heading Notification dt. 1/4/2005 Notification dt. 1/9/2005 Central Excise

Sr. No. 164 Sr. No. 203

39.23 Articles for the conveyance Articles for the conveyance Articles for

or packing of goods, of or packing of goods, of the

plastics, stoppers, lids, caps plastics; stoppers, lids, conveyance

and other closures, of caps and other closures, of or packing of

plastics but not including- plastics but not including- goods, of

(a) insulated wares (a) insulated wares plastics;

(b) bags of the type which (b) carry bags that is to stoppers,

are used for packing of say bags of the type which lids, caps

goods at the time of sale for are used for packing of and other

the convenience of the goods at the time of sale closures, of

customer including carry for the convenience of the plastics

bags customer

The difference between the 2 notifications lies in the clause (b) of both the

notifications as follows :-

(b) in notification dt. 1/4/2005 excludes bags including carry bags

(b) in notification dt. 1/9/2005 excludes carry bags.

The above difference is not material to the facts of the impugned case as the product

involved herein is not a carry bag. The crucial point to be seen here is whether the heading

under Central Excise has been reproduced in its entirety for the purposes of the

notification. If the answer is in the affirmative, the product gets covered by the

notification. If the answer is in the negative, the difference in the descriptions is to be

examined with respect to the facts of the case under consideration.

In the present case, the heading description under Central Excise matches with the

description against the heading notified for the purposes of both the notifications subject

to an exclusion clause which has been inserted for the purposes of the notifications. There

is no such exclusion clause under Central Excise.

It can be seen that, the exclusion clause is for the following :-

1. insulated wares

2. bags including carry bags used for packing of goods at the time of

sale for the convenience of the customer.

Turning back to the heading under which the product has been covered under

Central Excise i.e 3923.50.90, it can be seen that neither the said heading nor the

description against the said heading i.e Other finds a mention in the notification for the

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -7-

purposes of the entry C-54. Herein would arise the need for application of the Rules for

interpretation and the Notes appended to the notification. I have already reproduced

herein earlier the Note 2 and 3 to the notification on Industrial inputs and packing

materials. Applying the same, it can be said that, since the description against the main

excise heading, which is 3923, has been reproduced in its entirety for the purposes of the

notification, the sub-classification is bound to be covered. Now as regards the exclusion

clause, it can be seen that, the impugned product is neither an insulated ware nor a bag

including carry bag used for packing of goods at the time of sale for the convenience of the

customer. It is an industrial packing material and is not sold across the counter to

individuals. It is not for the convenience of the customer for carrying the product at the

time of sale.

The above would, in effect, mean that, the product is covered by the description for

the purposes of both the notifications. This would further mean that, the product would be

covered by the schedule entry C-54 of the Maharashtra Value Added Tax Act, 2002,

thereby attracting tax @ 4%.

Now, there is a decision in the case of Unimed Technologies Ltd. v. Commr. of

Customs ((2006) 76 ELT 742 (Trib)) wherein it has been held that, dropper bottles, dropper

inserts and tamper proof closures are classified under the heading 39233090. The heading

392330 pertains to Carboys, bottles, flasks and similar articles. The applicant has

mentioned the excise heading applicable to his product as 3923.50.90 which pertains to

Stoppers, lids, caps and other closures. In the aforementioned case, it was held that, the

unlike conventional bottles, the dropper bottle is a container with dropper insets &

closures, each part conforming to a certain specification to render them in totality to an

Eye drop delivery entity. The classification of such specialized package/containers

delivery system would appropriately be under 3923 30 90. The present product is similar

to the product in the above case. Hence, the classification under 3923 is correct. The sub-

classification differs. However, since the main excise heading under Central Excise (which

is similar to that under Customs) has been taken in its entirety for the purposes of the

notifications, it follows that all the sub classifications within the main heading would be

covered by the notification. Hence, I would not enter into the debate as to which of the

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -8-

two i.e., 3923 30 90 or 3923.50.90 is the exact excise heading applicable to the product so far

as there is no confusion as regards the main heading .

05. In view of the discussion held hereinabove, I pass an order as follows :-

ORDER

(Under section 56 of the Maharashtra Value Added Tax Act, 2002.)

No.DDQ-11/2005/Adm-2/106/B-01 Mumbai, dt. 22.08.2007

The question posed for determination as regards the rate of tax applicable to the

product Three Piece Eye Dropper sold by the invoice no. 146 dt. 09/12/2005 is

answered as being covered by the notifications issued for the purposes of the schedule

entry C-54 of the Maharashtra Value Added Tax Act, 2002, thereby attracting tax @ 4%.

(SANJAY BHATIA)

Commissioner of Sales Tax,

Maharashtra State, Mumbai.

C:\Documents and Settings\SALESTAX\Desktop\DDQ-07\Thermodors Pvt. Ltd..doc -9-

Anda mungkin juga menyukai

- Notification2 (Null)Dokumen6 halamanNotification2 (Null)forbooksBelum ada peringkat

- User Guide For MigrationDokumen4 halamanUser Guide For MigrationforbooksBelum ada peringkat

- Print Media BillingDokumen1 halamanPrint Media BillingforbooksBelum ada peringkat

- Form GST Rfd11Dokumen63 halamanForm GST Rfd11forbooksBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (345)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- Judicial Bar Council: Ridzanna M. Abdulgafur Mohd Nehru A. MadjilonDokumen40 halamanJudicial Bar Council: Ridzanna M. Abdulgafur Mohd Nehru A. MadjilonStephany PolinarBelum ada peringkat

- 236 Samaniego vs. Aguila 334 SCRA 438.CDDokumen1 halaman236 Samaniego vs. Aguila 334 SCRA 438.CDOscar E Valero100% (1)

- Arbitration Law in India - Development ADokumen24 halamanArbitration Law in India - Development APawan RashiBelum ada peringkat

- Taxguru - In-Reverse Charge Mechanism in GST Regime With ChartDokumen20 halamanTaxguru - In-Reverse Charge Mechanism in GST Regime With Chartvikrant.chutke12Belum ada peringkat

- Articles and Issues in Kihoto Hollohon CaseDokumen2 halamanArticles and Issues in Kihoto Hollohon CaseJithinBelum ada peringkat

- Property Cases - PossessionDokumen90 halamanProperty Cases - PossessionDon TiansayBelum ada peringkat

- Motion To Defer Arraignment - Google SearchDokumen2 halamanMotion To Defer Arraignment - Google Searchbatusay575Belum ada peringkat

- GABRIEL L. DUERO, Petitioner, Hon - Court of Appeals, and Bernardo A. Eradel, Respondents. Quisumbing, J.Dokumen5 halamanGABRIEL L. DUERO, Petitioner, Hon - Court of Appeals, and Bernardo A. Eradel, Respondents. Quisumbing, J.shotyBelum ada peringkat

- Panuncillo Vs CAPDokumen1 halamanPanuncillo Vs CAPElead Gaddiel S. AlbueroBelum ada peringkat

- Ravishankar and Anr. Vs Viith Additional District Judge PDFDokumen8 halamanRavishankar and Anr. Vs Viith Additional District Judge PDFRohit JaiswalBelum ada peringkat

- Tips On Oral AdvocacyDokumen5 halamanTips On Oral AdvocacyNoel Cagigas FelongcoBelum ada peringkat

- BPI vs. Sps. SantiagoDokumen3 halamanBPI vs. Sps. SantiagoAlecsandra ChuBelum ada peringkat

- Knights of Rizal Vs DMCI Homes Inc DECISIONDokumen6 halamanKnights of Rizal Vs DMCI Homes Inc DECISIONIan Howell BoquironBelum ada peringkat

- Digested CasesDokumen5 halamanDigested CasesShane LagniracBelum ada peringkat

- Lis PendensDokumen3 halamanLis PendensRoman LumlaisoBelum ada peringkat

- DIGEST - Nessia vs. Fermin (1993)Dokumen2 halamanDIGEST - Nessia vs. Fermin (1993)カルリー カヒミBelum ada peringkat

- De La Llana V AlbaDokumen2 halamanDe La Llana V AlbaAnthony Arcilla PulhinBelum ada peringkat

- Moran v. CA, 133 SCRA 88 (1984) )Dokumen10 halamanMoran v. CA, 133 SCRA 88 (1984) )Jose IbarraBelum ada peringkat

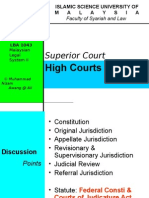

- 3 - High CourtsDokumen20 halaman3 - High CourtsMuhammad Nizam AwangBelum ada peringkat

- 5 Salient Features of RA 9285Dokumen1 halaman5 Salient Features of RA 9285Heart NuqueBelum ada peringkat

- Co Vs CADokumen2 halamanCo Vs CAJL A H-DimaculanganBelum ada peringkat

- DAR Vs Robles, GR No. 190482Dokumen3 halamanDAR Vs Robles, GR No. 190482Aileen Peñafil0% (2)

- Order of Calcutta High Court PDFDokumen7 halamanOrder of Calcutta High Court PDFBar & BenchBelum ada peringkat

- De Barreto, Et. Al. V. Villanueva, Et. Al., (1961) : Daniel Carlo M. Benipayo 11685352Dokumen24 halamanDe Barreto, Et. Al. V. Villanueva, Et. Al., (1961) : Daniel Carlo M. Benipayo 11685352Edu FajardoBelum ada peringkat

- For Collection of Sum of Money PDFDokumen26 halamanFor Collection of Sum of Money PDFMay Elaine BelgadoBelum ada peringkat

- John Yukio Gotanda - Awarding Costs and Attorneys Fees in Intl. Comm. ArbitrationDokumen51 halamanJohn Yukio Gotanda - Awarding Costs and Attorneys Fees in Intl. Comm. ArbitrationRENATO JUN HIGA GRIFFINBelum ada peringkat

- NASRI V MESAH - (1971) 1 MLJ 32Dokumen8 halamanNASRI V MESAH - (1971) 1 MLJ 32onyamBelum ada peringkat

- Continuous Trial SystemDokumen3 halamanContinuous Trial SystemIrene Mae GomosBelum ada peringkat

- Rules of Legal ReasoningDokumen22 halamanRules of Legal ReasoningLEIGHBelum ada peringkat

- Syllabus Specpro MSB '17Dokumen9 halamanSyllabus Specpro MSB '17Butch MaatBelum ada peringkat