PIDA FactSheet 2017

Diunggah oleh

Ken KnickerbockerHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

PIDA FactSheet 2017

Diunggah oleh

Ken KnickerbockerHak Cipta:

Format Tersedia

PENNSYLVANIA INDUSTRIAL

DEVELOPMENT AUTHORITY (PIDA)

HELPING BUSINESSES CREATE JOBS THAT PAY

Listrak

Lititz,PA

Administered through the Pennsylvania Department of Community and PA-based businesses across a variety

Economic Development (DCED), the Pennsylvania Industrial of industries are eligible to apply.

Development Authority (PIDA) loan program provides low-interest

agriculture

loans and lines of credit to Pennsylvania businesses that commit to

creating and retaining full-time jobs within the commonwealth, as well manufacturing

as for the development of industrial parks and multi-tenant facilities.

industrial

Loan applications are packaged and underwritten by a network of

certified economic development organizations (CEDOs) that partner research and development

with PIDA.

hospitality

ELIGIBILITY & USE defense conversion

PIDA financing can be used for:

recycling

Land and building acquisitions

computer-related services

Construction and renovation costs

Machinery and equipment purchases construction

Working capital and accounts receivable lines of credit child daycare

Working capital term loans mining

retail and service enterprises

FUNDING & PARTICIPATION

PIDAs maximum participation amount for a project is determined by developers

the proposed use of PIDA funds, the amount of matching financing

from sources outside of PIDA, and the number of full-time jobs to be

created or retained. Generally, a 50 percent match is required. However,

some exceptions do apply.

PENNSYLVANIA INDUSTRIAL DEVELOPMENT AUTHORITY (PIDA)

Landis Farm

Manheim, PA

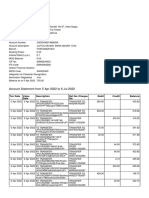

LENDING AMOUNTS COLLATERAL

Listed below are the maximum lending amounts through Collateral is required and is based on the asset being

PIDA. Please note the lending limits vary based on the type financed. The project cash-flow, credit, and collateral loan

of business being financed: to value are taken into consideration when determining

Real estate loans up to $2,250,000 the overall collateral package for a project. In general:

Machinery and equipment loans up to $1,500,000 For real estate financing, a mortgage on the project

property being financed is required. For real estate

Working capital term loans and lines of credit

loans over $400,000, a mortgage in no less than a

up to $100,000

second position is required.

INTEREST RATES AND FEES Machinery and equipment loans are secured by no

The interest rates and fees charged by PIDA are very less than a second lien on either the equipment

competitive. Rates are typically 1-2 percent below the being financed or by a blanket lien on all equipment

industry standard. Contact PIDA for current rates: / business assets owned by the company.

Interest rate options for real estate loans include fixed Working capital term loans and lines of credit are

and variable reset rates. generally secured by a first lien on the inventory and

receivables of the company.

Machinery and equipment and working capital rates are

fixed over the life of the loan. Personal guarantees are generally required by the

principal owners, which typically is limited to

A 1 percent commitment fee is charged for loans

individuals with 20 percent or more ownership in the

greater than $400,000.

operating entity.

Borrowers are also responsible for applicable closing

costs and associated fees charged by the CEDO. HOW TO APPLY

PIDA partners with a network of nonprofit organizations

LOAN TERMS AND RENEWALS called certified economic development organizations

Up to 15 years: Land and building acquisitions; (CEDOs) to administer the PIDA loan program. Generally,

construction and renovation costs. Qualifying projects the CEDOs service a one county area or a multicounty

are also eligible for a 10 year term with a 20 year region, and work directly with the applicant company to

amortization period whereas a balloon payment is due package and underwrite the loan application. The loan

at the end of the 10 year period. application is submitted to the PIDA Office by the CEDO

Up to 10 years: Machinery & equipment purchases. for final approval by PIDA.

Up to 3 years: Working capital term loans.

You can determine which CEDO(s) serve your businesss

Line of credit maturities are 12 months and can be county and view additional information about the PIDA

renewed on an annual basis up to a maximum of 6 years. program at dced.pa.gov/PIDA.

PADCEDnews

07/10/2017

Commonwealth Keystone Building | 400 North Street, 4th Floor | Harrisburg, PA 17120-0225 | +1.866.466.3972 | dced.pa.gov/pida

Jared Lucas | 717.346.8006 | jarlucas@pa.gov

Anda mungkin juga menyukai

- Chester County 2021 Economic ReportDokumen92 halamanChester County 2021 Economic ReportKen KnickerbockerBelum ada peringkat

- PREIT 2021 Sustainability ReportDokumen13 halamanPREIT 2021 Sustainability ReportKen KnickerbockerBelum ada peringkat

- 2021 Chester County Guide To Local Farm ProductsDokumen32 halaman2021 Chester County Guide To Local Farm ProductsKen KnickerbockerBelum ada peringkat

- MONTCO Millennial Superstar Sponsorship Options (7.6.2021)Dokumen4 halamanMONTCO Millennial Superstar Sponsorship Options (7.6.2021)Ken KnickerbockerBelum ada peringkat

- Zoom Whitelabel Brochure - Haverford SystemDokumen2 halamanZoom Whitelabel Brochure - Haverford SystemKen KnickerbockerBelum ada peringkat

- MONTCO Millennial Superstar Sponsorship Options (7.6.2021)Dokumen4 halamanMONTCO Millennial Superstar Sponsorship Options (7.6.2021)Ken KnickerbockerBelum ada peringkat

- Montgomery County Homes For All Report & VisionDokumen124 halamanMontgomery County Homes For All Report & VisionKen KnickerbockerBelum ada peringkat

- MONTCO Millennial Superstar Sponsorship Options (7.6.2021)Dokumen4 halamanMONTCO Millennial Superstar Sponsorship Options (7.6.2021)Ken KnickerbockerBelum ada peringkat

- Getting Results Through Others BrochureDokumen12 halamanGetting Results Through Others BrochureKen KnickerbockerBelum ada peringkat

- Getting Results Through Others BrochureDokumen12 halamanGetting Results Through Others BrochureKen KnickerbockerBelum ada peringkat

- Montgomery County 2021 Quarterly Construction ReportDokumen2 halamanMontgomery County 2021 Quarterly Construction ReportKen KnickerbockerBelum ada peringkat

- Leadership Chester County BrochureDokumen2 halamanLeadership Chester County BrochureKen KnickerbockerBelum ada peringkat

- Chester County Hospital COVID - 19 DONATION CENTERDokumen2 halamanChester County Hospital COVID - 19 DONATION CENTERKen KnickerbockerBelum ada peringkat

- Montgomery County COVID-19 Thanksgiving GuidanceDokumen3 halamanMontgomery County COVID-19 Thanksgiving GuidanceKen KnickerbockerBelum ada peringkat

- The Financial Health of Greater Philadelphia Nonprofits.Dokumen22 halamanThe Financial Health of Greater Philadelphia Nonprofits.Ken KnickerbockerBelum ada peringkat

- Western View 1st Quarter 2020Dokumen16 halamanWestern View 1st Quarter 2020Ken KnickerbockerBelum ada peringkat

- The Official Dining Magazine of Montgomery County, PaDokumen5 halamanThe Official Dining Magazine of Montgomery County, PaKen KnickerbockerBelum ada peringkat

- 2020 Guide To Local Farm Products in Chester CountyDokumen32 halaman2020 Guide To Local Farm Products in Chester CountyKen KnickerbockerBelum ada peringkat

- Invest Philadelphia 2020 - Montgomery County Focus ChapterDokumen16 halamanInvest Philadelphia 2020 - Montgomery County Focus ChapterKen Knickerbocker100% (1)

- The Chamber of Commerce For Greater Montgomery County Buy A Gift Card FlyerDokumen1 halamanThe Chamber of Commerce For Greater Montgomery County Buy A Gift Card FlyerKen KnickerbockerBelum ada peringkat

- Chester County Hospital COVID - 19 DONATION CENTERDokumen2 halamanChester County Hospital COVID - 19 DONATION CENTERKen KnickerbockerBelum ada peringkat

- The Sedo ToolDokumen1 halamanThe Sedo ToolKen KnickerbockerBelum ada peringkat

- Chester County Hospital COVID - 19 DONATION CENTERDokumen2 halamanChester County Hospital COVID - 19 DONATION CENTERKen KnickerbockerBelum ada peringkat

- 2020 Chester County Salute To Women of Achievement Nomination FormDokumen2 halaman2020 Chester County Salute To Women of Achievement Nomination FormKen KnickerbockerBelum ada peringkat

- 2020 Race For Traditions - 000043Dokumen4 halaman2020 Race For Traditions - 000043Ken KnickerbockerBelum ada peringkat

- VFTCB 2019 Annual ReportDokumen47 halamanVFTCB 2019 Annual ReportKen KnickerbockerBelum ada peringkat

- Event Flyer HH 2020Dokumen1 halamanEvent Flyer HH 2020Ken KnickerbockerBelum ada peringkat

- Guide To Local Farm Products in Chester CountyDokumen32 halamanGuide To Local Farm Products in Chester CountyKen KnickerbockerBelum ada peringkat

- One Tower Bridge BrochureDokumen16 halamanOne Tower Bridge BrochureKen KnickerbockerBelum ada peringkat

- Chester County Open Space ROIDokumen110 halamanChester County Open Space ROIKen KnickerbockerBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- MFRS 120 Government GrantsDokumen21 halamanMFRS 120 Government Grantsyym cindyyBelum ada peringkat

- Your Combined Statement: Aisiatou Barry 10740 Guy R Brewer BLVD JAMAICA, NY 11433-2380Dokumen10 halamanYour Combined Statement: Aisiatou Barry 10740 Guy R Brewer BLVD JAMAICA, NY 11433-2380Ayesha ShaikhBelum ada peringkat

- Icci BankDokumen23 halamanIcci BankPhateh Krishna AgrawalBelum ada peringkat

- Statement of Changes in EquityDokumen3 halamanStatement of Changes in EquitybarrylucasBelum ada peringkat

- AARON AIKENS - Oct 2019 PDFDokumen6 halamanAARON AIKENS - Oct 2019 PDFbombie bomboxBelum ada peringkat

- Appendix A - Labuan Substance Listing (Updated) 210201Dokumen2 halamanAppendix A - Labuan Substance Listing (Updated) 210201Shahrani KassimBelum ada peringkat

- OverviewDokumen18 halamanOverviewGaurav SinghBelum ada peringkat

- Financial Analysis of Highway Project ModelsDokumen3 halamanFinancial Analysis of Highway Project ModelsPayal ChauhanBelum ada peringkat

- April JuneDokumen15 halamanApril JuneSanjivBelum ada peringkat

- Journal Ledger & Trial BalanceDokumen32 halamanJournal Ledger & Trial BalanceMr. Demon ExtraBelum ada peringkat

- Co Signers Statement2Dokumen1 halamanCo Signers Statement2Pharmastar Int'l Trading Corp.Belum ada peringkat

- 04 The Full Syllabus - Management Level Continued: Paper F2 Assessment StrategyDokumen3 halaman04 The Full Syllabus - Management Level Continued: Paper F2 Assessment StrategyRehman MuzaffarBelum ada peringkat

- Icici Fyfm Efs ProjectDokumen9 halamanIcici Fyfm Efs ProjectMihir DeliwalaBelum ada peringkat

- Currency Exchange Rate and International Trade and Capital FlowsDokumen39 halamanCurrency Exchange Rate and International Trade and Capital FlowsudBelum ada peringkat

- Kitten Company journal entries auditDokumen16 halamanKitten Company journal entries auditapatos80% (5)

- Housing Finance in AfricaDokumen12 halamanHousing Finance in AfricaOluwole DaramolaBelum ada peringkat

- Andleeb Abbas - Declaration of Assets Liabilities - Dec 2013Dokumen4 halamanAndleeb Abbas - Declaration of Assets Liabilities - Dec 2013PTI Official100% (1)

- E Math Exam PracticeCh5 8Dokumen4 halamanE Math Exam PracticeCh5 8chitminthu560345Belum ada peringkat

- Bengal Money Lenders Act, 1940 PDFDokumen27 halamanBengal Money Lenders Act, 1940 PDFSutirtha BanerjeeBelum ada peringkat

- IDBI Bank Powerpoint PresentationDokumen7 halamanIDBI Bank Powerpoint Presentationaritra0123Belum ada peringkat

- Effects of Merchant Banking on Financial Growth of ICICIDokumen62 halamanEffects of Merchant Banking on Financial Growth of ICICIij EducationBelum ada peringkat

- CHAPTER-15 - Bank Reconciliation System Practical QuestionsDokumen49 halamanCHAPTER-15 - Bank Reconciliation System Practical QuestionsBHARAT MAHAN RAI 22BBA10031Belum ada peringkat

- Cash & Bank Break Up AuditDokumen87 halamanCash & Bank Break Up AuditFaraz KhanBelum ada peringkat

- MOCK UP SOAL UAS AKL II Dan ADV II 2018Dokumen5 halamanMOCK UP SOAL UAS AKL II Dan ADV II 2018Nathalie Christnindita DecidBelum ada peringkat

- Chapter 04 Test Bank - StaticDokumen13 halamanChapter 04 Test Bank - StaticCaioGamaBelum ada peringkat

- General Banking Activities of Al-Arafah Islami Bank LimitedDokumen42 halamanGeneral Banking Activities of Al-Arafah Islami Bank LimitedAmazing SongBelum ada peringkat

- Harshad Mehta's Connection to BPL ScamDokumen9 halamanHarshad Mehta's Connection to BPL ScamDharmendra SinghBelum ada peringkat

- Risk and Return 2Dokumen2 halamanRisk and Return 2Nitya BhakriBelum ada peringkat

- Negotiable Instruments Act, 1881Dokumen24 halamanNegotiable Instruments Act, 1881vikramjeet_22100% (1)

- ECGC Export Credit Guarantee Corp of India Summer TrainingDokumen24 halamanECGC Export Credit Guarantee Corp of India Summer TrainingPhxx619Belum ada peringkat