Constantino vs. Asia Life Insurance Company

Diunggah oleh

Anne Ausente Berja0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

80 tayangan2 halaman1) The case involves two life insurance policies that lapsed due to non-payment of premiums during the Japanese occupation of the Philippines from 1942-1945.

2) The court applied the "United States Rule" which holds that non-payment of premiums abrogates the insurance contract rather than merely suspending it during war.

3) The court ruled in favor of the insurance company, finding that reviving the lapsed policies would be unjust and inequitable given that the nature of insurance business relies on spreading risk across many policies.

Deskripsi Asli:

Constantino vs. Asia Life Insurance Company

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen Ini1) The case involves two life insurance policies that lapsed due to non-payment of premiums during the Japanese occupation of the Philippines from 1942-1945.

2) The court applied the "United States Rule" which holds that non-payment of premiums abrogates the insurance contract rather than merely suspending it during war.

3) The court ruled in favor of the insurance company, finding that reviving the lapsed policies would be unjust and inequitable given that the nature of insurance business relies on spreading risk across many policies.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

80 tayangan2 halamanConstantino vs. Asia Life Insurance Company

Diunggah oleh

Anne Ausente Berja1) The case involves two life insurance policies that lapsed due to non-payment of premiums during the Japanese occupation of the Philippines from 1942-1945.

2) The court applied the "United States Rule" which holds that non-payment of premiums abrogates the insurance contract rather than merely suspending it during war.

3) The court ruled in favor of the insurance company, finding that reviving the lapsed policies would be unjust and inequitable given that the nature of insurance business relies on spreading risk across many policies.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 2

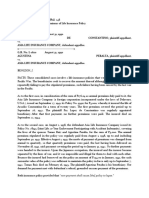

Constantino vs.

Asia Life Insurance Company

FACTS: law applicable to the situation. The Lower court

ruled in favor of ALIC.

The instant case involves two consolidated cases.

The first case involves insurance policy entered into

Issue:

between Asia life insurance Company (insurance

company incorporated in Delaware) and Arcadio May a beneficiary in a life insurance policy recover

Constantino whereby it insured the life of the latter the amount thereof although the insured died after

for 20 years, for 3 thousand pesos with Paz repeatedly failing to pay the stipulated premiums,

Constantino as beneficiary. First premium covered such failure being caused by war?

the period up to Sept. 26, 1942. No further

premiums were paid after the first premium and Held:

Arcadio died on Sept. 22, 1944.

No. The beneficiary can no longer recover because

The second case involves the insurance policy the policies in question stipulate that "all premium

covering the lives of Spouses Tomas Ruiz and payments are due in advance and any unpunctuality

Agustina Peralta for the sum of P3k for 20 years. in making any such payment shall cause this policy to

The annual premium stipulated was regularly paid lapse." Wherefore, it would seem that pursuant to

from Aug. 1, 1938 up to and including Sept. 30, 1940. the express terms of the policy, non-payment of

Last payment covered the period until Jan. 31, 1942.

premium produces its avoidance.

Tomas Ruiz died on Feb. 16, 1945 with Agustina

Peralta as his beneficiary

The conditions of contracts of Insurance, when

plainly expressed in a policy, are binding upon the

Both policies contained this provision: All premiums

are due in advance and any unpunctuality in parties and should be enforced by the courts, if the

making such payment shall cause this policy to evidence brings the case clearly within their meaning

lapse unless and except as kept in force by the and intent. It tends to bring the law itself into

grace period condition. disrepute when, by astute and subtle distinctions, a

plain case is attempted to be taken without the

Due to Jap occupation, ALIC closed its branch office operation of a clear, reasonable and material

in Manila from Jan. 2 1942-1945.

obligation of the contract.

Due to Jap occupation, it became impossible and

illegal for the insured to deal with ALIC. Aside from Forfeitures of insurance policies are not favored, but

this the insured borrowed from the policy P234.00 courts cannot for that reason alone refuse to

such that the cash surrender value of the policy was enforce an insurance contract according to its

sufficient to maintain the policy in force only up to meaning.

Sept. 7, 1942.

Paz Constantino and Agustina Peralta claim as In determining the effect of non-payment of

beneficiaries, that they are entitled to receive the premiums occasioned by war, the American cases

proceeds of the policies less all sums due for may be divided into three groups, the so-called

premiums in arrears. They also allege that non- Connecticut Rule, the New York Rule, or the United

payment of the premiums were caused by the States Rule.

closing of ALICs offices during the war and the

impossible circumstances by the war, therefore, they

The first holds the view that "there are two elements

should be excused and the policies should not be

in the consideration for which the annual premium is

forfeited.

paid First, the mere protection for the year, and

Defendant on the other hand asserts that the second, the privilege of renewing the contract for

policies had lapsed for non-payment of premiums, in each succeeding year by paying the premium for

accordance with the contract of the parties and the that year at the time agreed upon. According to this

view of the contract, the payment of premiums is a

condition precedent, the non-performance would be the good risks are never heard from; only the bad

illegal necessarily defeats the right to renew the are sought to be revived, where the person insured

contract." is either dead or dying. Those in health can get the

new policies cheaper than to pay arrearages on the

The second rule, apparently followed by the greater

old. To enforce a revival of the bad cases, whilst the

number of decisions, hold that "war between states

in which the parties reside merely suspends the company necessarily lose the cases which are

contracts of the life insurance, and that, upon tender desirable, would be manifestly unjust. The nature of

of all premiums due by the insured or his the business, as a whole, must be looked at to

representatives after the war has terminated, the understand the general equities of the parties.

contract revives and becomes fully operative."

After perusing the Insurance Act, we are firmly

The United States rule declares that the contract is persuaded that the non-payment of premiums is

not merely suspended, but is abrogated by reason of such a vital defense of insurance companies that

non-payments is peculiarly of the essence of the since the very beginning, said Act no. 2427 expressly

contract. It additionally holds that it would be unjust preserved it, by providing that after the policy shall

to allow the insurer to retain the reserve value of the have been in force for two years, it shall become

policy, which is the excess of the premiums paid over incontestable (i.e. the insurer shall have no defense)

the actual risk carried during the years when the except for fraud, non-payment of premiums, and

policy had been in force. This rule was announced in military or naval service in time of war (sec. 184 [b],

the well-known Statham6 case which, in the opinion Insurance Act). And when Congress recently

of Professor Vance, is the correct rule. amended this section (Rep. Act No. 171), the

defense of fraud was eliminated, while the defense

In support of US rule: of nonpayment of premiums was preserved. Thus

the fundamental character of the undertaking to pay

The truth is, that the doctrine of the revival of

premiums and the high importance of the defense of

contracts suspended during the war is one based on

non-payment thereof, was specifically recognized.

considerations of equity and justice, and cannot be

invoked to revive a contract which it would be unjust In keeping with such legislative policy, we feel no

or inequitable to revive. hesitation to adopt the United States Rule, which is

in effect a variation of the Connecticut rule for the

In contrast with the New York Rule:

sake of equity. In this connection, it appears that the

In the case of Life insurance, besides the materiality first policy had no reserve value, and that the

of time in the performance of the contract, another equitable values of the second had been practically

strong reason exists why the policy should not be returned to the insured in the form of loan and

revived. The parties do not stand on equal ground advance for premium.

in reference to such a revival. It would operate

most unjustly against the company. The business of

insurance is founded on the law of average; that of

life insurance eminently so. The average rate of

mortality is the basis on which it rests. By spreading

their risks over a large number of cases, the

companies calculate on this average with reasonable

certainty and safety. If every policy lapsed by reason

of the war should be revived, and all the back

premiums should be paid, the companies would

have the benefit of this average amount of risk. But

Anda mungkin juga menyukai

- Nario Vs PHILAMDokumen2 halamanNario Vs PHILAMPam Otic-Reyes100% (1)

- Insurable Interest Case DigestDokumen33 halamanInsurable Interest Case Digestmb_estanislaoBelum ada peringkat

- Qua Chee Gan vs. Law Union and Rock InsuranceDokumen2 halamanQua Chee Gan vs. Law Union and Rock InsuranceJohn Mark RevillaBelum ada peringkat

- Maglana V ConsolacionDokumen1 halamanMaglana V ConsolacionninaBelum ada peringkat

- Alfonso Vs LBP and DARDokumen15 halamanAlfonso Vs LBP and DARSugar ReeBelum ada peringkat

- Fide Takers of Insurance and The Public in GeneralDokumen2 halamanFide Takers of Insurance and The Public in GeneralRoger Montero Jr.Belum ada peringkat

- DBP Vs DoyonDokumen5 halamanDBP Vs DoyonMelody Lim DayagBelum ada peringkat

- Torts Case Digest DamagesDokumen10 halamanTorts Case Digest DamagesJohn Mark TapnioBelum ada peringkat

- Pan Malayan v. CADokumen3 halamanPan Malayan v. CAmiyumiBelum ada peringkat

- Biagtan vs. Insular LifeDokumen1 halamanBiagtan vs. Insular Lifeerxha ladoBelum ada peringkat

- Philam Care Health Systems v. Court of AppealsDokumen10 halamanPhilam Care Health Systems v. Court of AppealsNoel Cagigas FelongcoBelum ada peringkat

- Compiled Cases Batch1 UpdatedDokumen69 halamanCompiled Cases Batch1 UpdatedLorelieBelum ada peringkat

- People v. Epifanio O. ValerioDokumen3 halamanPeople v. Epifanio O. ValerioVince LeidoBelum ada peringkat

- Kiobel v. Royal Dutch Petroleum Co. (2013)Dokumen35 halamanKiobel v. Royal Dutch Petroleum Co. (2013)Scribd Government DocsBelum ada peringkat

- 02 NG v. PeopleDokumen2 halaman02 NG v. PeopleKyle SubidoBelum ada peringkat

- 120 - Pineda vs. Court of AppealsDokumen8 halaman120 - Pineda vs. Court of AppealsPatrice ThiamBelum ada peringkat

- 11-14 EvidDokumen90 halaman11-14 Evidione salveronBelum ada peringkat

- Oh Hek How Vs Republic DIGESTDokumen1 halamanOh Hek How Vs Republic DIGESTJacquelyn AlegriaBelum ada peringkat

- Antonina Lampano Vs Placida JoseDokumen1 halamanAntonina Lampano Vs Placida JoseDario G. TorresBelum ada peringkat

- 2 Artex vs. WellingtonDokumen5 halaman2 Artex vs. WellingtonMutyaAlmodienteCocjinBelum ada peringkat

- White Gold vs. PioneerDokumen2 halamanWhite Gold vs. PioneerKokoBelum ada peringkat

- Lasam vs. Sps. Ramolete G.R. No. 159132 December 8, 2008Dokumen2 halamanLasam vs. Sps. Ramolete G.R. No. 159132 December 8, 2008fabsfabsBelum ada peringkat

- Alvarado vs. Gaviola Jr.Dokumen8 halamanAlvarado vs. Gaviola Jr.Dexter CircaBelum ada peringkat

- DEVELOPMENT INSURANCE CORPORATION v. IACDokumen2 halamanDEVELOPMENT INSURANCE CORPORATION v. IACAbegail GaledoBelum ada peringkat

- Sun Insurance V CADokumen1 halamanSun Insurance V CAKristina KarenBelum ada peringkat

- Jaboneta Vs GustiloDokumen2 halamanJaboneta Vs GustiloEdward Kenneth KungBelum ada peringkat

- Sps. Cha Vs CADokumen2 halamanSps. Cha Vs CAKernell Sonny Salazar0% (1)

- Pascual v. CIRDokumen12 halamanPascual v. CIRmceline19Belum ada peringkat

- 72 - Fireman's Fund Insurance Company v. Jamila & Company, IncDokumen1 halaman72 - Fireman's Fund Insurance Company v. Jamila & Company, IncperlitainocencioBelum ada peringkat

- Butler Vs Adoption Media, LLCDokumen46 halamanButler Vs Adoption Media, LLCJanet Jamerlan-FigueroaBelum ada peringkat

- Nuguid Vs NuguidDokumen7 halamanNuguid Vs NuguidIvan Montealegre ConchasBelum ada peringkat

- Oriental Assurance vs. OngDokumen2 halamanOriental Assurance vs. OngJohn Mark RevillaBelum ada peringkat

- INSURANCE-Sales de Gonzaga v. Crown Life InsuranceDokumen1 halamanINSURANCE-Sales de Gonzaga v. Crown Life InsuranceAce Gregory AceronBelum ada peringkat

- Francisco Eizmendi, Jr. vs. Teodorico Fernandez, G.R. No. 215280, 05 September 2018Dokumen13 halamanFrancisco Eizmendi, Jr. vs. Teodorico Fernandez, G.R. No. 215280, 05 September 2018Regienald BryantBelum ada peringkat

- 6) Ty Vs Filipinas Compania de SegurosDokumen1 halaman6) Ty Vs Filipinas Compania de SegurosLanz OlivesBelum ada peringkat

- Silkair V CIR With DigestDokumen21 halamanSilkair V CIR With DigestRogie ToriagaBelum ada peringkat

- Case Digest 2019 Batch 1Dokumen9 halamanCase Digest 2019 Batch 1Anonymous aRIameBelum ada peringkat

- Philippine Health Care ProvidersDokumen4 halamanPhilippine Health Care ProvidersYanaKarununganBelum ada peringkat

- San Miguel Vs Law UnionDokumen1 halamanSan Miguel Vs Law UnionKristine Ann DikiBelum ada peringkat

- Cof Koh Vs CaDokumen43 halamanCof Koh Vs CaLeo GuillermoBelum ada peringkat

- Sun Life v. CADokumen1 halamanSun Life v. CAMacy TangBelum ada peringkat

- Soliman, National Leather, EdralinDokumen3 halamanSoliman, National Leather, EdralinjohnmiggyBelum ada peringkat

- Insurance CasesDokumen55 halamanInsurance CasesRyan RapaconBelum ada peringkat

- Luzon Surety v. QuebrarDokumen2 halamanLuzon Surety v. QuebrarFritz Frances DanielleBelum ada peringkat

- Insurance Lecture Notes ROXASDokumen34 halamanInsurance Lecture Notes ROXASjerico lopezBelum ada peringkat

- Association of Non Profit Clubs Vs BIRDokumen2 halamanAssociation of Non Profit Clubs Vs BIREllenBelum ada peringkat

- Woburn - A Civil Action by Jonathan HarrDokumen1 halamanWoburn - A Civil Action by Jonathan HarrEveBBelum ada peringkat

- Heirs of Aguilar-Reyes V MijaresDokumen2 halamanHeirs of Aguilar-Reyes V MijaresLarryBelum ada peringkat

- Sering V PlazoDokumen1 halamanSering V PlazoMarielle ReynosoBelum ada peringkat

- Verendia V Ca (Fidelity & Surety Co. of The Phils)Dokumen1 halamanVerendia V Ca (Fidelity & Surety Co. of The Phils)Praisah Marjorey PicotBelum ada peringkat

- Life Insurance Corporation, G.R. No. 169103, March 16, 2011Dokumen3 halamanLife Insurance Corporation, G.R. No. 169103, March 16, 2011Dayday AbleBelum ada peringkat

- 9 Sta. Ana v. Commercial UnionDokumen7 halaman9 Sta. Ana v. Commercial UnionEmary Gutierrez100% (1)

- Credtrans CompilationDokumen4 halamanCredtrans CompilationEditha RoxasBelum ada peringkat

- 30 Wright v. Manila Electric R.R. & Light Co.Dokumen1 halaman30 Wright v. Manila Electric R.R. & Light Co.Rem SerranoBelum ada peringkat

- LRT Vs NavidadDokumen2 halamanLRT Vs NavidadJ Velasco PeraltaBelum ada peringkat

- Gago VsDokumen5 halamanGago Vsannabanana05Belum ada peringkat

- Testate Estate of Abada vs. AbajaDokumen3 halamanTestate Estate of Abada vs. AbajaRikki BanggatBelum ada peringkat

- Philippine Bank of Commerce VsDokumen1 halamanPhilippine Bank of Commerce VsJan Aldrin AfosBelum ada peringkat

- Pan Malayan Ins. Corp. v. Court of AppealsDokumen1 halamanPan Malayan Ins. Corp. v. Court of AppealsHaryet SupeBelum ada peringkat

- Insurance Cases and NotesDokumen32 halamanInsurance Cases and NotesRessie June PedranoBelum ada peringkat

- A.M. No. 02-8-13-SC: 2004 Rules On Notarial PracticeDokumen11 halamanA.M. No. 02-8-13-SC: 2004 Rules On Notarial PracticeAnne Ausente BerjaBelum ada peringkat

- GDokumen2 halamanGAnne Ausente BerjaBelum ada peringkat

- Crim NotesDokumen1 halamanCrim NotesAnne Ausente BerjaBelum ada peringkat

- Judicial Affidavit RuleDokumen4 halamanJudicial Affidavit RuleGood FaithBelum ada peringkat

- DigestDokumen9 halamanDigestAnne Ausente BerjaBelum ada peringkat

- City Prosecution Office SOFIA VERGARA For Herself and in Behalf of Her Minor Child Jonathan VergaraDokumen4 halamanCity Prosecution Office SOFIA VERGARA For Herself and in Behalf of Her Minor Child Jonathan VergaraAnne Ausente BerjaBelum ada peringkat

- Admin Cases 4.3Dokumen74 halamanAdmin Cases 4.3Anne Ausente BerjaBelum ada peringkat

- Amended Anti-Money Laundering ActDokumen10 halamanAmended Anti-Money Laundering ActAnne Ausente BerjaBelum ada peringkat

- Sample Format - Secretary's CertificateDokumen1 halamanSample Format - Secretary's CertificateAnne Marielle MendozaBelum ada peringkat

- Forcible Entry vs. Unlawful DetainerDokumen4 halamanForcible Entry vs. Unlawful DetainerAnne Ausente BerjaBelum ada peringkat

- Conflicts 12.12 CasesDokumen8 halamanConflicts 12.12 CasesAnne Ausente BerjaBelum ada peringkat

- Addtnl Cases Transpo 1.13Dokumen3 halamanAddtnl Cases Transpo 1.13Feb Mae San DieBelum ada peringkat

- Secretary S CertificateDokumen2 halamanSecretary S CertificateMary Rose BarotBelum ada peringkat

- Admin Cases 2.18Dokumen101 halamanAdmin Cases 2.18Anne Ausente BerjaBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- SIL Cases 11.23Dokumen100 halamanSIL Cases 11.23Anne Ausente BerjaBelum ada peringkat

- NDC Vs CIRDokumen4 halamanNDC Vs CIRAnne Ausente BerjaBelum ada peringkat

- 15 Calimag vs. MacapazDokumen2 halaman15 Calimag vs. MacapazAnne Ausente Berja100% (1)

- Salient Features of The Revised Guidelines For Continuous Trial of Criminal CasesDokumen7 halamanSalient Features of The Revised Guidelines For Continuous Trial of Criminal CasesVance CeballosBelum ada peringkat

- LTD Digest IncDokumen28 halamanLTD Digest IncAnne Ausente BerjaBelum ada peringkat

- Codal ProvDokumen1 halamanCodal ProvAnne Ausente BerjaBelum ada peringkat

- Cases 1.19 Part 2Dokumen27 halamanCases 1.19 Part 2Anne Ausente BerjaBelum ada peringkat

- Cases 1.19 Part 1Dokumen29 halamanCases 1.19 Part 1Anne Ausente BerjaBelum ada peringkat

- SIL Cases 2.15Dokumen51 halamanSIL Cases 2.15Anne Ausente BerjaBelum ada peringkat

- 6th Central Pay Commission Salary CalculatorDokumen15 halaman6th Central Pay Commission Salary Calculatorrakhonde100% (436)

- 22 Marquez Vs EspejoDokumen2 halaman22 Marquez Vs EspejoAnne Ausente BerjaBelum ada peringkat

- G.R. No. L-360 November 15, 1947 Krivenko vs. Register of DeedsDokumen6 halamanG.R. No. L-360 November 15, 1947 Krivenko vs. Register of DeedsAnne Ausente BerjaBelum ada peringkat

- Cases 1.19 Part 1Dokumen29 halamanCases 1.19 Part 1Anne Ausente BerjaBelum ada peringkat

- 22 Marquez Vs EspejoDokumen2 halaman22 Marquez Vs EspejoAnne Ausente BerjaBelum ada peringkat

- 15 Calimag vs. MacapazDokumen2 halaman15 Calimag vs. MacapazAnne Ausente Berja100% (1)

- Most Important Current Affairs MCQs About All Provincial and National AssemblyDokumen4 halamanMost Important Current Affairs MCQs About All Provincial and National AssemblySarah SafdarBelum ada peringkat

- Elec Com MessDokumen10 halamanElec Com MessJerald MercadoBelum ada peringkat

- Refugee AlgeriaDokumen212 halamanRefugee AlgeriaAdrian BuculeiBelum ada peringkat

- Position Paper On Gonverment SpyingDokumen5 halamanPosition Paper On Gonverment Spyingapi-302977681Belum ada peringkat

- Political Science Project On Sarvodaya AndolanDokumen14 halamanPolitical Science Project On Sarvodaya AndolanBittu HidkoBelum ada peringkat

- Naik V Burgess and Ors (Appeal 45 of 2020) 2021 ZMCA 177 (20 October 2021)Dokumen33 halamanNaik V Burgess and Ors (Appeal 45 of 2020) 2021 ZMCA 177 (20 October 2021)JOSEPH KATONGOBelum ada peringkat

- Journalofindianh014918mbp PDFDokumen420 halamanJournalofindianh014918mbp PDFAshwin kumarBelum ada peringkat

- R.A 6981Dokumen23 halamanR.A 6981Aldrin CrutoBelum ada peringkat

- 1824Dokumen7 halaman1824William CothranBelum ada peringkat

- Commitment Information: Return To Search ResultsDokumen4 halamanCommitment Information: Return To Search ResultsJohn BrewingtonBelum ada peringkat

- The Week - USA (2021-01-30)Dokumen44 halamanThe Week - USA (2021-01-30)Vera Lucia Lopes DiasBelum ada peringkat

- Commission On Human Rights Resolution On Oceana Gold in The PhilippinesDokumen19 halamanCommission On Human Rights Resolution On Oceana Gold in The PhilippinesricolavinaBelum ada peringkat

- The PhysiocratsDokumen7 halamanThe PhysiocratsminhbeoBelum ada peringkat

- European Journal of Theoretical and Applied SciencesDokumen15 halamanEuropean Journal of Theoretical and Applied SciencesEJTAS journalBelum ada peringkat

- NDGOP 2014 ResolutionsDokumen24 halamanNDGOP 2014 ResolutionsRob PortBelum ada peringkat

- Joe Cunningham - The Tones in A Decade of Irish HistoryDokumen37 halamanJoe Cunningham - The Tones in A Decade of Irish HistorySaoirse Go DeoBelum ada peringkat

- Grand Council (Mi Kmaq)Dokumen1 halamanGrand Council (Mi Kmaq)BMikeBelum ada peringkat

- TESDA Circular No. 044-2022Dokumen11 halamanTESDA Circular No. 044-2022ajrevillaBelum ada peringkat

- Bapepam-LK Rule X.N.1 (English)Dokumen9 halamanBapepam-LK Rule X.N.1 (English)steffi_darmawanBelum ada peringkat

- PST Chapterwise Notes 2023Dokumen7 halamanPST Chapterwise Notes 2023abiBelum ada peringkat

- NDMA Guidelines On The Role of NGOs in Disaster Management - Naresh KadyanDokumen116 halamanNDMA Guidelines On The Role of NGOs in Disaster Management - Naresh KadyanNaresh KadyanBelum ada peringkat

- Conversion de LC A DeweyDokumen33 halamanConversion de LC A DeweyCesarmanBelum ada peringkat

- Chola Local Self GovermentDokumen3 halamanChola Local Self Govermentranjeet sharmaBelum ada peringkat

- MEPS Letter of TerminationDokumen1 halamanMEPS Letter of Terminationiona_hegdeBelum ada peringkat

- Texaco Discrimination LawsuitDokumen10 halamanTexaco Discrimination LawsuitMarian DobrinBelum ada peringkat

- 2022.04.22 Complaint (Girdwood Complaint Against AL Redistricting PlanDokumen19 halaman2022.04.22 Complaint (Girdwood Complaint Against AL Redistricting PlanSteveBelum ada peringkat

- Role of Cag in Meeting Challenges of Good GovernanceDokumen9 halamanRole of Cag in Meeting Challenges of Good GovernanceAditya DassaurBelum ada peringkat

- Chavez Vs Public Estates Authority - 133250 - July 9, 2002 - JDokumen35 halamanChavez Vs Public Estates Authority - 133250 - July 9, 2002 - JJon SantiagoBelum ada peringkat

- 2021 Open Letter From Retired Generals and Admirals 9 May 2021Dokumen5 halaman2021 Open Letter From Retired Generals and Admirals 9 May 2021Kristina Wong93% (28)

- Guidelines For Handling Regulatory InspectionDokumen6 halamanGuidelines For Handling Regulatory InspectionJayr Calungsod BañagaBelum ada peringkat

- Getting Through: Cold Calling Techniques To Get Your Foot In The DoorDari EverandGetting Through: Cold Calling Techniques To Get Your Foot In The DoorPenilaian: 4.5 dari 5 bintang4.5/5 (63)

- University of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingDari EverandUniversity of Berkshire Hathaway: 30 Years of Lessons Learned from Warren Buffett & Charlie Munger at the Annual Shareholders MeetingPenilaian: 4.5 dari 5 bintang4.5/5 (97)

- Wall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementDari EverandWall Street Money Machine: New and Incredible Strategies for Cash Flow and Wealth EnhancementPenilaian: 4.5 dari 5 bintang4.5/5 (20)

- Introduction to Negotiable Instruments: As per Indian LawsDari EverandIntroduction to Negotiable Instruments: As per Indian LawsPenilaian: 5 dari 5 bintang5/5 (1)

- The SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsDari EverandThe SHRM Essential Guide to Employment Law, Second Edition: A Handbook for HR Professionals, Managers, Businesses, and OrganizationsBelum ada peringkat

- Buffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorDari EverandBuffettology: The Previously Unexplained Techniques That Have Made Warren Buffett American's Most Famous InvestorPenilaian: 4.5 dari 5 bintang4.5/5 (132)

- AI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersDari EverandAI For Lawyers: How Artificial Intelligence is Adding Value, Amplifying Expertise, and Transforming CareersBelum ada peringkat

- Economics and the Law: From Posner to Postmodernism and Beyond - Second EditionDari EverandEconomics and the Law: From Posner to Postmodernism and Beyond - Second EditionPenilaian: 1 dari 5 bintang1/5 (1)

- IFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASDari EverandIFRS 9 and CECL Credit Risk Modelling and Validation: A Practical Guide with Examples Worked in R and SASPenilaian: 3 dari 5 bintang3/5 (5)

- How to Win a Merchant Dispute or Fraudulent Chargeback CaseDari EverandHow to Win a Merchant Dispute or Fraudulent Chargeback CaseBelum ada peringkat

- Disloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpDari EverandDisloyal: A Memoir: The True Story of the Former Personal Attorney to President Donald J. TrumpPenilaian: 4 dari 5 bintang4/5 (214)

- Learn the Essentials of Business Law in 15 DaysDari EverandLearn the Essentials of Business Law in 15 DaysPenilaian: 4 dari 5 bintang4/5 (13)

- Indian Polity with Indian Constitution & Parliamentary AffairsDari EverandIndian Polity with Indian Constitution & Parliamentary AffairsBelum ada peringkat

- How to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessDari EverandHow to Structure Your Business for Success: Choosing the Correct Legal Structure for Your BusinessBelum ada peringkat

- Competition and Antitrust Law: A Very Short IntroductionDari EverandCompetition and Antitrust Law: A Very Short IntroductionPenilaian: 5 dari 5 bintang5/5 (3)

- The Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesDari EverandThe Chickenshit Club: Why the Justice Department Fails to Prosecute ExecutivesPenilaian: 5 dari 5 bintang5/5 (1)

- LLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessDari EverandLLC: LLC Quick start guide - A beginner's guide to Limited liability companies, and starting a businessPenilaian: 5 dari 5 bintang5/5 (1)

- Legal Guide for Starting & Running a Small BusinessDari EverandLegal Guide for Starting & Running a Small BusinessPenilaian: 4.5 dari 5 bintang4.5/5 (9)

- Building Your Empire: Achieve Financial Freedom with Passive IncomeDari EverandBuilding Your Empire: Achieve Financial Freedom with Passive IncomeBelum ada peringkat