Simple Discount Exercises

Diunggah oleh

Faizal Syahrul0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

16 tayangan1 halamanThe document contains 10 word problems involving simple interest rates, cash discounts, promissory notes, time value of money, and consolidating multiple debts into single payments. The problems calculate interest earned or owed on loans over various time periods, the price of Treasury bills, equivalent debts over different time horizons, and determining single payments that settle multiple debts.

Deskripsi Asli:

simple discount

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOC, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document contains 10 word problems involving simple interest rates, cash discounts, promissory notes, time value of money, and consolidating multiple debts into single payments. The problems calculate interest earned or owed on loans over various time periods, the price of Treasury bills, equivalent debts over different time horizons, and determining single payments that settle multiple debts.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

16 tayangan1 halamanSimple Discount Exercises

Diunggah oleh

Faizal SyahrulThe document contains 10 word problems involving simple interest rates, cash discounts, promissory notes, time value of money, and consolidating multiple debts into single payments. The problems calculate interest earned or owed on loans over various time periods, the price of Treasury bills, equivalent debts over different time horizons, and determining single payments that settle multiple debts.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOC, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 1

1. Three months after borrowing money, a person pays back exactly $200.

How much was

borrowed if the $200 payment includes the principal and simple interest at 9%?

2. Jennifer wishes to have $1000 in eight months time. If she can earn 6%, how much does she

need to invest on September 15? What is the simple discount?

3. The promissory note described in the beginning of this section is sold by Mr. A on October 1,

2006 to a bank that discounts notes at a simple interest rate. a) How much money would Mr.

A receive for the note? b) What rate of interest will the bank realize on its investment, if it

holds the note till maturity? c) What rate of interest will Mr. A realize on his investment,

when he sells the note on October 1, 2006?

4. On April 21, a retailer buys goods amounting to $5000. If he pays cash he will get a 4% cash

discount. To take advantage of this cash discount, he signs a 90- day noninterest-bearing note

at his bank that discounts notes at an interest rate of 9%. What should be the face value of

this note to give him the exact amount needed to pay cash for the goods?

5. A 182-day T-bill with a face value of $25 000 is purchased by an investor who wishes to yield

3.80%. What price is paid?

6. A 91-day T-bill with a face value of $100 000 is purchased for $97 250. What rate of interest

is assumed?

7. A debt of $1000 is due at the end of 9 months. Determine an equivalent debt at a simple

interest rate of 9% at the end of 4 months and at the end of 1 year.

8. A person owes $300 due in 3 months and $500 due in 8 months. The lender agrees to allow

the person to pay off these two debts with a single payment. What single payment a) now; b)

in 6 months; c) in 1 year, will liquidate these obligations if money is worth 8%?

9. Debts of $500 due 20 days ago and $400 due in 50 days are to be settled by a payment of

$600 now and a final payment 90 days from now. Determine the value of the final payment

at a simple interest rate of 11% with a focal date at the present

10. A woman owes $3000 in 4 months with interest at 8% and another $4000 is due in 10

months with interest at 7%. These two debts are to be replaced with a single payment due in

8 months. Determine the value of the single payment if money is worth 6.5%, using the end

of 8 months as the focal date.

Anda mungkin juga menyukai

- CFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Dari EverandCFP Exam Calculation Workbook: 400+ Calculations to Prepare for the CFP Exam (2018 Edition)Penilaian: 5 dari 5 bintang5/5 (1)

- 23 Q in Math 2 PDFDokumen30 halaman23 Q in Math 2 PDFobadfaisal24Belum ada peringkat

- Tutorial 5Dokumen1 halamanTutorial 5Rajneet ChandBelum ada peringkat

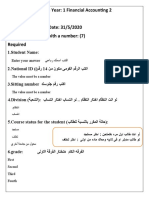

- Faculty of Commerce Year: 1 Financial Accounting 2 May 2020 Time: Three Hours - Date: 31/5/2020 The Questions Start With A Number: (7) RequiredDokumen8 halamanFaculty of Commerce Year: 1 Financial Accounting 2 May 2020 Time: Three Hours - Date: 31/5/2020 The Questions Start With A Number: (7) Requiredmagdy kamelBelum ada peringkat

- Screenshot 2023-12-08 at 11.56.27Dokumen3 halamanScreenshot 2023-12-08 at 11.56.27alcantarakyara530Belum ada peringkat

- solution of math first امتحانDokumen8 halamansolution of math first امتحانMagdy KamelBelum ada peringkat

- Cases For review-SIMPLE INTERESTDokumen1 halamanCases For review-SIMPLE INTERESTRogers BuzaileBelum ada peringkat

- Name: - 5.1 Problem Set 115Dokumen14 halamanName: - 5.1 Problem Set 115Clair BlushBelum ada peringkat

- QuestionnaireDokumen6 halamanQuestionnaireKenshin SophisticBelum ada peringkat

- Practice Problems - Simple Interest, Bank Discount, and Promissory NotesDokumen1 halamanPractice Problems - Simple Interest, Bank Discount, and Promissory Noteskillerair0% (2)

- Time Value of Money 1Dokumen5 halamanTime Value of Money 1k61.2211155018Belum ada peringkat

- MODULE 4 - Consumer MathDokumen10 halamanMODULE 4 - Consumer MathALMIRA LOUISE PALOMARIABelum ada peringkat

- Tutorial For Time Value of MoneyDokumen4 halamanTutorial For Time Value of MoneyKim NgânBelum ada peringkat

- Activity 7Dokumen1 halamanActivity 7hanna enadBelum ada peringkat

- Fundamentals of Business Mathematics in Canada Canadian 2Nd Edition Jerome Test Bank Full Chapter PDFDokumen68 halamanFundamentals of Business Mathematics in Canada Canadian 2Nd Edition Jerome Test Bank Full Chapter PDFadelehuu9y4100% (13)

- Worksheet No2Dokumen2 halamanWorksheet No2juvaniecamerino462Belum ada peringkat

- Mraj 3 AaDokumen2 halamanMraj 3 AaAhmad Rahhal100% (1)

- Tutorial 2Dokumen4 halamanTutorial 2Funny CatBelum ada peringkat

- Debt and TaxDokumen1 halamanDebt and TaxChandramani JhaBelum ada peringkat

- Tutorial 2Dokumen5 halamanTutorial 2K60 Trần Công KhảiBelum ada peringkat

- QM Tutorial Simple and Compound InterestDokumen6 halamanQM Tutorial Simple and Compound InterestLishalini GunasagaranBelum ada peringkat

- Tutorial 4 TVM ApplicationDokumen4 halamanTutorial 4 TVM ApplicationTrần ThảoBelum ada peringkat

- Test 3 Review Part 1Dokumen2 halamanTest 3 Review Part 1Bhuvnesh KumawatBelum ada peringkat

- Exercises Chapter 2Dokumen1 halamanExercises Chapter 2ntxthuy04Belum ada peringkat

- لقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مDokumen4 halamanلقطة شاشة ٢٠٢٣-٠١-١٣ في ٨.٣٩.٥١ مAhmed RokaBelum ada peringkat

- Compilation For Final Exam 1 Converted 1Dokumen7 halamanCompilation For Final Exam 1 Converted 1Trending News and TechnologyBelum ada peringkat

- Tutorial 3Dokumen4 halamanTutorial 3Nguyễn Quan Minh PhúBelum ada peringkat

- Final Exam Review-VrettaDokumen4 halamanFinal Exam Review-VrettaAna Cláudia de Souza0% (2)

- Practice Problem Set #1: Time Value of Money I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)Dokumen15 halamanPractice Problem Set #1: Time Value of Money I Theoretical and Conceptual Questions: (See Notes or Textbook For Solutions)raymondBelum ada peringkat

- Supplementary Problems On Signage CreationDokumen2 halamanSupplementary Problems On Signage CreationArman AliBelum ada peringkat

- Problem Set Time Value of MoneyDokumen5 halamanProblem Set Time Value of MoneyRohit SharmaBelum ada peringkat

- Practical Business Math Procedures 11th Edition Slater Test BankDokumen31 halamanPractical Business Math Procedures 11th Edition Slater Test Bankhelgasophie7478k0100% (31)

- Practical Business Math Procedures 11Th Edition Slater Test Bank Full Chapter PDFDokumen52 halamanPractical Business Math Procedures 11Th Edition Slater Test Bank Full Chapter PDFmichelleortizpxnzkycmbw100% (7)

- Bond ValuationDokumen1 halamanBond ValuationBeomiBelum ada peringkat

- PALOMARIA-MODULE 4 - Consumer MathDokumen16 halamanPALOMARIA-MODULE 4 - Consumer MathALMIRA LOUISE PALOMARIABelum ada peringkat

- Es FOR TIME VALUE OF MONEYDokumen6 halamanEs FOR TIME VALUE OF MONEYphuongnhitran26Belum ada peringkat

- Tutorial 5 TVM Application - SVDokumen5 halamanTutorial 5 TVM Application - SVHiền NguyễnBelum ada peringkat

- Homework Assignment - Week 2Dokumen5 halamanHomework Assignment - Week 2Kristine LaraBelum ada peringkat

- Chapter 3 - Review Financial AlgebraDokumen4 halamanChapter 3 - Review Financial AlgebramariaBelum ada peringkat

- Beirut Arab University Faculty of Engineering Department of Industrial Engineering and ManagementDokumen2 halamanBeirut Arab University Faculty of Engineering Department of Industrial Engineering and ManagementGempf GisBelum ada peringkat

- Basic Long Term Concepts ActivityDokumen2 halamanBasic Long Term Concepts ActivityRonald CatapangBelum ada peringkat

- Time Value of MoneyDokumen16 halamanTime Value of MoneyneerajgangaBelum ada peringkat

- FM PracticeDokumen1 halamanFM PracticeNaveed NawazBelum ada peringkat

- TMU1053 Consumer Maths S2 16-17 v2Dokumen4 halamanTMU1053 Consumer Maths S2 16-17 v2Iffah AnisahBelum ada peringkat

- Session 2 - Exercises (BBA, Sep16) - Without SolutionsDokumen2 halamanSession 2 - Exercises (BBA, Sep16) - Without SolutionsBlaise Aly-berilBelum ada peringkat

- Chapter 12Dokumen2 halamanChapter 12Gursimran BaidwanBelum ada peringkat

- OutputDokumen7 halamanOutputUna Balloons0% (1)

- HWChapter 5Dokumen20 halamanHWChapter 5Yawar Abbas KhanBelum ada peringkat

- FM A Assignment 19-40659-1Dokumen11 halamanFM A Assignment 19-40659-1Pacific Hunter JohnnyBelum ada peringkat

- Name: Bolocon, Harvey Jon D. Section: CEIT-03-302A Subject: EECO Assignment # 1Dokumen4 halamanName: Bolocon, Harvey Jon D. Section: CEIT-03-302A Subject: EECO Assignment # 1Bolocon, Harvey Jon DelfinBelum ada peringkat

- Time ValuDokumen3 halamanTime Valueaglefly7864696Belum ada peringkat

- General Mathematics Summative Assessment 11.2.2 Name: - Section: - Date: - ScoreDokumen2 halamanGeneral Mathematics Summative Assessment 11.2.2 Name: - Section: - Date: - ScoreMarc NillasBelum ada peringkat

- BKM9e Answers Chap014Dokumen2 halamanBKM9e Answers Chap014Tayba AwanBelum ada peringkat

- TVM WorksheetsDokumen4 halamanTVM WorksheetsRia PiusBelum ada peringkat

- TVM WorksheetsDokumen4 halamanTVM WorksheetsRia Pius100% (1)

- Tutorial 1 Time Value of Money PDFDokumen2 halamanTutorial 1 Time Value of Money PDFLâm TÚc NgânBelum ada peringkat

- Review Test in General Mathematics 11: Clara Mae Macatangay 1Dokumen5 halamanReview Test in General Mathematics 11: Clara Mae Macatangay 1Clara Mae0% (1)

- QuizDokumen7 halamanQuizJennifer Rasonabe100% (1)

- Tutorial 2 (TVM) - Questions: Present Value Years Future ValueDokumen2 halamanTutorial 2 (TVM) - Questions: Present Value Years Future ValueSadia R ChowdhuryBelum ada peringkat

- TVM Practice Questions Fall 2018Dokumen4 halamanTVM Practice Questions Fall 2018ZarakKhanBelum ada peringkat