1401 - Tax

Diunggah oleh

rietzhel220 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan9 halamanTAX

Judul Asli

1401 - TAX

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniTAX

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan9 halaman1401 - Tax

Diunggah oleh

rietzhel22TAX

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 9

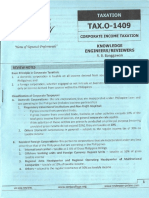

— TAX.O-1401

& r t 4 SOF TAXATION .

CPA REVIEW

KNOWLEDGE

ENGINEERS/ REVIEWERS

“Serving towards your (PA License.” R. By Bangeawan

REVIEW NOTES

Taxation

1. As a power ~ refers to the inherent power of the state to demand enforced contribution for

public purpose to support the government.

2. Asa process ~ the legislative act of laying a tax to raise income for the government to defray its

necessary expenses

Purpose of Taxation

1. Primary —to raise revenue

2. Secondary

a. Regulatory

- To regulate the conduct of businesses or professions

- Toachieve economic and social stability

- To protect local industries

b. Compensatory

= _ Key instrument of social control ~ Check inflations

~ Reduces inequities in wealth distributions- Tools on international bargains

- Strengthens anemic enterprises - Promotes science and inventions

- Provides incentives

- Uses as implement in the exercise of police power to promote general welfare

The Life Blood Doctrine

Taxes are indispensable to the existence of the state. Without taxation the state cannot raise revenue

to support is operations

Nature or Characteristics of the Power of Taxation

1, for public purpose 5, exaction payable in money

2, inherently legislative in nature 6. territorial

3. subject to international comity or treaty

4, not absolute being subject to constitutional and inherent limitations

uc cpa review ‘www.certscollege.org wonw.reviewer-online.com

‘AX.O-1401.General Principles of Taxation.RN

H

low exercised:

Legislation of laws by Congress and tax ordinances by the Local Sahgguanian

Tax collection by the administrative branch of the government

Scope of the Power of Taxation

Taxation is supreme, comprehiénsive, unlimited and plenary. Itincludes the power to destroy

Discretion of the Taxing Power- this extends to:

ak

2

3,

4

apportionment of the tax

5. situs of taxation

6, method of collection

7. purposes for its levy, provided for public purpose

the person, property and excises to be taxed, provided within it jurisdiction

amount or rate of the tax

kinds of tax to be collected

Underlying principles behind the power of taxation ;

1

Principles of Necessity ~ the existence of the government is a necessity and it cannot continue

without means to support itself ~ this is the Theory of Taxation

Benefit Received Theory — the government and the people have the reciprocal and mutual duties

of support and protectian — this is the Basis of Taxation q

Legal Basis of the Power of Taxation “Me

Benefit-received theory

the sovereign power of the state over is peoplé and property

the presumption of receipts or enjoyment of benefits and protection by the people

to protect new conditions by imposing special duties

to uplift social conditions by imposing regulatory taxes or licenses

Objects of Taxation

5. acts

6. persons

7. properties

8. privileges

businesses

interests

transactions

rights

Phases of Stages of Taxation

a

b. Assessment of tax

i

Impact of taxation

Incidence of Taxation

Levy or Imposition

‘Taxation

Payment of the tax 4

these all comprise the taxation system

Elements of the tax system

a

2

Tax structure b. Tax administration ¢. Public tax consciousness

TAX.O-1401.General Principles of Taxation, RN

Principles of a sound tax system

a. Fiscal Adequacy — sources of revenue should be sufficient to meet the demand for publie

expenditure

b. Administrative Feasibility- tax laws must be capable of convenient, just and effective

administration

Theoretical Justice- tax must be imposed with equity and certainty and must consider the

taxpayers ability to pay and benefits received

- _ Non-observance of the principles does not necessarily render a tax levy unconstitutional.

Principal Approaches in the distribution of tax burden

a, Benefit Approach — tax payment should be based on benefits received

b. Ability to Pay Approach — tax payments should be based relative to the ability of taxpayers to pay

Taxation and Economic Efficiency

1, Income Effect ~ makes people economically efficient (ex: transformation)

2. Substitution Effect — makes people economically inefficient (ex: indirect taxes)

The Inherent Powers of the Government .

1. Power of Taxation — the power to take property for the support of the government and for publle

purpose

2. Police Power ~ the power to enact laws to promote the general welfare of the people, It is wider

in application because it is the general power to make laws.

3. Power of Eminent Domain — the power to take private property for public use upon payment of

just compensation

| Point of Difference

| Exercising Authority

Point of Differences of the Inherent Powers of the State.

Taxation Police Power

Government Government

Eminent Domain

Government or private

entities

Necessity of Delegation is not There must be There must be due

Delegation necessary since it is delegation before delegation before local

inherent local governments, government oF private

could exercised it party may exerelse it

Purpose Revenue and support | Propertyistaken for, |... Property is taken or

publicuse | public use

Community or class of | Operates on the owner of

individuals the property

Persons affected

of the government.

Community or class of

individuals

Effect of transfer of Money paid as taxes | There is no transfer of | There | transfer of right

property rights becomes part of the. | title, at most there is | to property whether It be

public fund restraint on the of ownership oF lesser

injurious use of right

property

www.certscollege.org uc cpa review

www.reviewer-online.com

uc cpa review www, certicolloge olf WWW. ravieweranline. com

TAX.O-1401.General Principles of Taxation, RN

Point of Difference Taxation Police Power Eminent Domain 10. exemption from taxes of the revenues and assets of non-profit, non-stock educational

Amount of Imposition Unlimited Sufficient to cover the | No imposition, the owner institutions including grants, endowments, donations or contributions for educational

costs of regulation is paid the fair market purposes

value of his property 11. concurrence of a majority of all members of Congress for the passage of a law granting tax

Importance Most important of the Most superior exemption

three 2k te 12. non-diversification of tax collections

Relationship with the inferior to the “Non- | Superior to the “Non- Superior and may 13. non-delegation of the power of taxation

Constitution Impairment Clause” of || Impairment Clause” override the “Non- Exception:

the Constitution of the Constitution Impairment Clause” a. power to tax was delegated to the President under\the Flexibility Clause of the Tariff

because the welfare of and Customs Code

‘the state is superior to b. power to tax was delegated to the local government units under the Local Government

private contracts Code

Limitation Constitutionally and jicinterest and | Public purpose and just matters involving the expedient and effective administration and implementations of

inherently restricted | the requirement of compensation assessment and collection of taxes or certain aspects of taxing process that are not

due process legislative in character

14. .non-impairment of the jurisdiction of the Supreme Court to review tax cases

15. appropriations, revenue of tariff bills shall originate exclusively in the House of

Representatives but the Senate may propose or concur with amendments,

16. éach local government unit shall exercise the power to create its own sources of revenue

and shall have a just share in the national taxes

Similarities of the Three Powers

1, Allthree powers are necessary attributes of sovereignty, resting upon necessity

2, allare inherent powers of the State

3, Allare legislative in nature

4

They are ways in which the State interferes with private rights and property

B.

They exist independently with the Constitution although the condition for their exercise may be

prescribed or limited by the Constitution

They all presuppose an equivalent compensation received by the persons affected by the exercise

of the power, whether directly, indirectly or remote,

The exercise of these powers by the local government units may be limited by national legislature

“Police power can be used to raise revenue for the government (ex: license fee)

1, territoriality of taxation

2. subject to international comity or treaty

3. tax exemption of the government”

4, taxis for public purpose

5. _non-delegation of the power of taxation

*The last 2 limitations are also Constitutional limitations

LIMITATIONS OF TAXATION POWER

A. Constitutional Limitation

1. observance of due process of law

equal protection of the law

uniformity in taxation

progressive scheme of taxation

SITUS OF TAXATION

The place of taxation

Factors that determine the situs of taxation

1, nature, kind or classification of the tax 5. sources of income.

hon-imprisonment for non-payment debt or poll tax 2. subject matter of the tax 6. place. of exercise, business or occupation

non-impairment of obligation and contract being taxed

3. citizenship of the taxpayer 7. place where income-producing activity was

free worship rule

non-appropriation of public funds or property for the benefit of any church, sect or system of held or done

religion | 4. residence of the taxpayer

exemption of religious, charitable or educational entities, non-profit cemeteries, churches, Nee

and mosque from property taxes. Applications

1. persons ~residence of the taxpayer,

2. community development tax ~ residence or domicile of the taxpayer

3. _business taxes - where the business was conducted or place where the transaction took place y

www.reviewer-online,com waww.certscollege.org uc cpa review uc epa review www certscollege.org wwwreviewer onli

piivilege or occupation tax ~ where the privilege is exercised

veal property tax—where the property is located

personal property toxes —

‘a, tangible = where they are physically located

b. _ intangible — domicile of the owner unless the property has acquired a situs elsewhere

Income — place where the income is earned or residence or citizenship of the taxpayer

Transfer Taxes ~ residence or citizenship of the taxpayer or location of the property

Franchise Taxes ~ State that grants the franchise

10. Corporate Taxes - depend on the law of incorporation

DOUBLE TAXATION

Toxing the object or subject within the territorial jurisdiction twice, for the same period, involving the

me kind of tax by the same taxing authority

Kinds:

Direct Double Taxation — this objectionable and prohibited because it violates the constitutional

provision on uniformity and equality

Indirect Double Taxation = no constitutional violation. Ex: taxing the same property by two

different taxing authority

International Double Taxation -2 double taxation caused by two different taxing authorities, one

domestic and one foreign

Remedies to Double Taxation

1 provision for tax exemption

2, allowance for tax credit

3, allowance for principle of reciprocity

4. enter into treaties with and agreement with foreign government

Forms of Escape from Taxation

‘Those that will not result in loss of revenue to the government

Shifting -the process of transferring the tax burden from the statutory taxpayer to another

without violating the law.

Capitalization — the Seller is willing to lower the price of the commodity provided the taxes

will be shouldered by the buyers

‘Transformation - the manufacturer absorbs the additional taxes imposed by the

government without passing it to the buyers for fear of lost of his market. instead, it

increases quantity of production, thereby turning their units of production at a lower cost

resulting to the transformation of the tax into gain through the medium of productions.

1, Those that will result to loss of revenue to the government

1, Tax Evasion ~ tax dodging ~ resorting to acts and devices that illegally reduces or totally

escape the payment of taxes that are due to the taxpayer. They are prohibited and are

therefore are not subject to penalties,

TAX.O-1401.General Principles of Taxation, RN.

2. Tax Avoidance -tax minimization scheme ~ the reduction or totally escaping payment of

taxes through legally permissible means, that are not prohibited and therefore are not

subject to penalties.

3. Tax Exemption- an immunity, privilege or freedom from payment of a charge or burden to

which others are obliged to pay.

Kinds of Exemptions:

1. _Express- granted by the constitution, statute, treaties, ordinance, contracts or franchise

a. constitutional

b. statutory

c. contractual

2. Implied’ exempted by accidental or intentional omission

3. Total-exemption from all taxes (OFWs)

4. Partial exemption from certain taxes, partially or totally

Grounds for Exemption

1. Itmay be based on a contract

2. It may be based on grounds of public policy - ex: granting of exemptions to rural banks, and

sweepstakes or lotto winnings

3, It may be based on some grounds to foster charitable and other benevolent institutions:

4. Itmay be created under a treaty on grounds of reciprocity

5. Itmay be created to lessen the rigors of international double or multiple taxation

Distinction between tax evasion and tax avoidance

: Tax Evasion __ Tax Avoidance

itis scheme used outside of those lawful means and when | Its a tax saving device within the moan

availed of, it usually subjects the taxpayer to penalties

Itis accomplished by breaking the law ‘Accomplished by legal procedures and di

Itconnotes fraud, deceit and matice No fraud is involved

Tax Exemptions

> isnot automatic

>» isnon-transferable

» is revocable by the government (except when granted under a valid contract or by the

Constitution)

6 |

Www.reviewer-online.com ‘www.certscollege.org, uc cpa review

» tule shall be uniform

» does not contravene the LifeBlood Doctrine

> is always disfavored

» is allowed only under a clear and unequivocal provision of the law

» onreal property tax will be based on the Doctrine of Usage and not Doctrine of Ownership,

except for real properties owned by the government which is absolutely exempt form taxation

> — on real property tax cannot be granted by local governments but can condone real property tax

liabilities in special cases

>» on local taxes can be granted by local governments but they cannot condone existing liabilities on

local taxes =

uc cpa review www.certscollege.org www.reviewer-online,com

401.General Princi ‘TAX.O-1401,General Principles of Taxation, MC

Fundamental Doctrine in Taxation ‘MULTIPLE CHOICE QUESTIONS = bt een,

L. No court may enjoin the collection of taxes 1, The primary purpose of taxation is:

2. Claim for exemptions shall be interpreted strictly against the taxpayer A. To enforce contribution from its Subject for private purpose

3. Alaw that permit deduction from the tax base is strictly construed against the taxpayer B. To raise revenue for the government

4, Tax assessment are presumed to be correct and done in good faith ©. Toachieve economic and social stability

Tax laws are generally prospective in application D. To regulate the conduct of business or profession

Tax are not subject to compensation or set-off

Refund of taxes do not earn interest because interest do not run against the government 2. This theory underscores that taxes are indispensable to the existence of the state,

A. Doctrine of equitable recoupment C. The benefit received theory

Distinction between Tax Amnesty and Tax Condonation 8. The lifeblood doctrine D. The Holmes Doctrine

Tox Amnesty ~a general pardon or intentional overlooking by the state of its authority to impose

ponalties on persons otherwise guilty of tax evasion or violation of tax laws, The purpose is to give the | 3. Select the correct statement.

‘erring taxpayer a chance to reform and become part of the society with a clean slate. A. The benefit received theory explains that the government is obliged to serve the people

since it is benefiting from the tax collection from its subjects,

Tox Condonation ~ means to remit or to desist or refrain form exacting or imposing a tax. It cannot B. The lifeblood theory underscores that taxation is the most superior power of the stat

‘extend to refund of taxes already paid when obtaining condonation. C. ‘The police power of the state is superior to the non-impairment clause of the Constitutién

D. The power of taxation is superior to the non-impairment clause of thé Constitution

Tax Exemption Tax Amnesty

‘There is no tax liability at all Connotes condonation from payment of existing tax [| 4. The income effect of taxation is exhibited in

liability A. Forward shifting of tax C, Percentage taxes

The grantee need not pay anything The grantee pays a portion B. Value added tax D. Transformation

Can be availed of by any qualified taxpayer Not always available

5, That tax laws should be certain and consider the taxpayer's ability to pay denotes

” A.» Fiscal adequacy C. Theoretical justice

B, Administrative feasibility D. Compatibility with economic objectives

6. What is the theory of taxation?

A. Necessity C. reciprocal duties of support and protection,

B. Constitutionality D. public purpose

7. Whats the basis of taxation?

A. Constitutionality C. necessity

B, public purpose D. reciprocal duties of support and protection

8, Which of the following inappropriately describe the nature of taxation?

A.” inherent in sovereignty

B. essentially a legislative function

CC. subject to inherent and constitutional limitation

D. generally for public purpose

9.1. Forward Shifting will result in increase prices

II. Tax evasion is also known as tax dodging

A. lis correct C.land Ilare correct

i! B._ His correct D. land Il are not correct

www reviewer-online.com www certscollege.org uc cpa review luc cpa review www. certscollege.org, www.reviewer-online corn

X,0v1.401..General Principles of Taxation. MC

10, When tax is recovered by the manufacturer or producer by finding out means of improvement in

production so as savings would compensate for taxes, this is known as?

A, Capitalization C. backward shifting

B, onward shifting D. transformation

The point in which tax is levied is called?

A. Impact of taxation

B, Situs of taxation

C. Incidence of taxation

D. Assessment

12, When the impact and incidence of taxation are merged into the statutory taxpayer, the tax is

called?

A, personal tax

B, direct tax

C. indirect tax

D, national tax

LJ, The following are inherent limitation on the power to tax. Which is the exception?

A, Territoriality of taxes C.Public purpose

B, Legislative in character D. Non-appropriation for religious purpose

Which of the following is an administrative act in taxation?

A. Collection of taxes. C. Determination of the subject of the tax

B, Fixing the rate of the tax D. Determination of the purpose of the tax

Select the correct statement.

A. The substitution effect makes people economically efficient since the impact of the tax is

spread forward to the consumers.

8, Only taxation and eminent domain presupposes a form compensation when exercised by the

government since police power merely involves confiscation.

G.Any.tax laws which violate the principles of a sound tax system renders itself

unconstitutional.

D, Taxation means the apportionment of the costs of the government among those who are

benefited from its existence.

Select the correct statement.

‘A. Since taxation presupposes an equivalent form of compensation, there should be a direct

and proximate advantage received by any taxpayer before he could be required to pay tax.

8, Compensation under police power is the intangible feeling of contribution to the general

welfare of the people.

C.Both A and B

D. Neither. A nor B

17, Public improvement is a requisite to the exercise of which power of the state?

A. Police power C. Eminent domain

B. Taxation D. Eminent domain and taxation

o |

www. reviewer-online.com

www.certscollege.org uc cpa review

‘of Taxation, ME

TAX.0-1401.General Princip

“Public utility entities may in some circumstance exercise the power of eminent domain Which of

the following is not a public utility?

A. Electric cooperatives

B. Water cooperatives

. Telecommunication business

D, Manufacturing business

49. |. Police power and the power of taxation are exercised primarily by the legislature but not

eminent domain

11, Taxation and eminent domain interferes with private tight’and property but not with poliee

power

A. Lis true C.land Ware true

B. Wis true D. land Il are not true

20. Select the incorrect statement.

A. the power of eminent domain may be exercised by private’entities

B. by police power, the property taken is destroyed

€. _byeminent domain, the property taken is destroyed

D. eminent domain and taxation affects only property rights

24, The inherent powers of the state are similar in the following respect, except?

A. inherentto the existence of the state f

B. exercisable without the need for an express constitutional grant

CC. allaffects property rights

D. exercised primarily by the legislature

22. The following statement correctly states the differences among. the inherent powers of the state,

except?

A. the property taken under eminent domain and taxation are preserved but that of police

power is destroyed

B. eminent domain do not require constitutional grant but taxation being formidable does WW

order to limit its exercise by the legislature

C. police power and taxation is exercised only by the government but eminent domaly may Ne

exercised by private entities

b. Police power regulates both property and liberty; eminent domain and taxation affects only

property rights

23, Select the incorrect Statement:

‘A. since just compensation is involved, eminent domain raises money for the government

B. once a government is established, taxation is exercisable

C. the most important of the power is taxation

D. police power is more superior than the non-impairment clause of the Constitution

24. Select the correct statement

‘A. >the provision on taxation in the Philippine Constitution are grant of power

B. the power to tax includes the power to destroy

www.certscollege.org

wnat ae

www. reviewer online Gam

uc cpa review

‘3.

2

401.General Princi

C. when taxation is used as a tool for general and economic welfare this is called fiscal purpose

D. sumptuary purpose of taxation is to raise funds for the government

Which is nota legislative act?

‘A, Assessment of the tax

B. _ setting the amount of the tax

C. determination of the subject of the tax

D. determining the purpose of the tax

Which of the following is not an inherent limitation of the power to tax?

tax should be levied for public purpose

taxation is limited to its territorial jurisdiction

tax laws shall be uniform and equitable

exemption of government agencies and instrumentalities

ich of the following is not a constitutional limitation of the power to tax?

non-impairment of obligation or contracts

due process and equal protection of the law

non-appropriation for religious purposes

D, _non-delegation of the taxing power

Agreement among nation to lessen tax burden of their respective subject is called:

A. Reciprocity C. territoriality

8. international comity D. tax minimization

|, No one shall be imprisoned for non-payment of tax.

||, Double taxation is not prohibited by the Constitution.

A. lis true C. land Il are true

B, Nistrue D. land ll are’not true

The constitutional exemption of religious or charitable institution refers only to:

A. real property tax C. real property tax and income tax

By income tax D, business tax

When a legislative body taxes persons and property, rights and privilege under the same taxable

category at the same rate, this is referred to as compliance with the constitutional limitation of:

A. Equity C. due process

B, Uniformity D. equal protection clause

When a certain tax imposed base tax burden on the ability of the subject to pay the tax, this is

construed as complying with the inherent limitation of taxation which is:

A. Equity

B. Uniformity

C. due process.

D. none

The constitutional requirement for non-provision of any tax-exempt legislation without the

7 | soncurrence of the majority of all the members of Congress is intended to prevent:

www.reviewer-online,com www.certscollege.org uc cpa review

34,

35.

36.

37.

uc cpa review

TAX.0-1401.General Principles of Taxation. MG

legislation of burdensome or oppressive tax laws

to ensure that the government will no incur a deficit

ensure approval of all tax bills prior to becoming tax laws

unethical lobbying in the lawmaking body

goeP

|. Taxation is the rule; exemption is the exception,

Il, Taxation may be used to implement the police power of the state.

A, listrue Cl and IWare true

B. is true D, land Hare not true

Select the incorrect statement.

‘A. the power to taw includes the power to exempt

B. exemption are construed against the taxpayer and in favor of the government

C._ tax statutes are construed against the government in case of doubt

D. taxes should be collected only for public improvement

This refer to the privilege or immunity from a tax burden of which others are subjected to!

A. Exclusion C.tax holiday

B. Deduction D, reciprocity

Mr: Sorotski, isa professional practitioner as a management adviser. In addition, he held various

properties and currently engaged in diverse business operations.As a result, he has

P1,895,000.00 in personal tax aside from his basic tax of P5.00. If Mr. Sorotsktintentionally

disregard to pay his total personal tax, which of the following is correct?

‘A. Mr. Sorotski can be imprisoned for non-payment of the P5.00 personal tax,

B. Mr. Sorotski cannot be imprisoned for non-payment 'of the personal tax because he is #

professional wherein his imprisonment could cause economic loss to the country

C. If Mr. Sorotski pays only the P5.00 personal tax, he cannot be imprisoned,

D. _Non-payment of the additional tax could cause imprisonment,

. DEF Shipping Lines operates a fleet of sheep from Metro Manila to Zambonga. DEF was exempted

from payments of the franchise tax but in return it has to transport government mails and other

government correspondence to and from Metro Manila and Zamboanga. Subsequently, a new

law was passed removing such exemptions and requiring DEF to pay the franchise tax. Which of

the following is correct?

‘A. The tax law is valid since the power of taxation is broad.

B. The new law is invalid being unconstitutional.

C. The new law is invalid since exemption, once given, can’t be revoke If it prejudice the

taxpayer.

D. The new lawis valid since tax is dictated by the needs of the governments

Wolf has many tax evasion cases. For most, he was found guilty by the courts, Which of the

following can be his sanctions?

‘A. Capital punishment

‘www.certscollege.org www, reviewer-online,con

jeneral Principles of Taxation.MC

imprisonment.

©. Confiscation of his properties

A, ABC

BAC

cB pC

D.Conly

Owl has a P5,000,000.00 tax evasion case with the BIR. BIR rendered him an assessment but his

appeal failed to meet the deadline due to his undue hesitation to answer for the notice of

ssessment, Asa result, the assessment became final and demandable, Which of the following is

correct?

A. Owl should be allowed an extension since the amount of the tax is highly material so as his

right for equal protection of the law will not be denied

B. Due process is not violated so long as the consideration isto be given by the BIR

C, Due process is not violated.

1, Owl should demand for compromise so as he will be overburdened.

The tax imposed upon the performance of an act, the enjoyment of a privilege or engaging Ina

profession is known as?

A. Income tax

B. License

C. Excise tax

D. Transfer tax

When the determination of the amount of the tax requires an assessment of the value of the

subject of tax, this type of tax is known as?

A, proportional tax

8, specific tax

C. ad valorem tax

D. progressive tax

Tax as to graduation or rate include the-following, except?

A. Progressive C. pro-rata

8, Proportional D. regressive

A tax base and tax rate of an imposition is shown as follows:

Income Tax Rate

1,000,000.00 20%

800,000.00 30%

600,000.00 40%

This taxation scheme makes use of a?

A. progressive rate

8. proportional rate

©. digressive rate

D. regressive rate

Which of the following is a local tax?

A. value added tax

8, documentary stamp tax

C.other percentage taxes

D. real property tax

|, Asa rule, taxes are not assignable.

| Debt earns interest only when stipulated or when there is legal delay.

www.reviewer-online,com www.certscollege org uuc cpa review

47.

48,

49,

50,

51.

52.

53.

uc cpa review

TAX.0-1401.General Principles of Taxat

A. listrue

B. Wistrue

C. land Iare true

D, and Il are not true

Select the incorrect statement.

A. Tax may be unlimited in amount.

B. License make the business illegal when not paid while taxes do not.

C. Special assessment is not the liability of the person owning the property.

D. Special assessment can be imposed on building’ and other real right attaching’ pertaining to

land.

1. One of the essential characteristic of tax is its being unlimited in amount.

Ii, The State has complete discretion on the amount of license to be imposed after distinguishing

between useful and non-useful activity.

A. listrue

By istrue

C. land Il are true

D. land are not true

Which of the following is correct regarding the tax table for individual taxable income for

residents and citizens?

A. the table shows purely progressive tax rates

B. the tax table is a combination of proportional and progressive tax rates

C. low income earners are subject to proportional rate while high income earners are subject to

both proportional and progressive tax rates,

D. none of the above

Which of the following is not a local tax?

A. Community tax

B. Documentary stamp tax

. Taxon banks and other financial institutions

D. Business taxes, fees and charges

A license that is imposed for revenue purposes is known as?

A. Alicense tax C. Professional tax

B Sin tax D. Mixed tax

Select the incorrect statement.

A. Taxis a demand of sovereignty just as toll is a demand of ownership

B. No one shall be imprisoned for non-payment of debt or poll tax

AA C) A and B are true

BB D. Neither A nor 8

Distinguishing between tax and debt, which is assignable? Which cannot be set-off?

A. Tax; debt C. Tax, tax

B. Debt; tax D. Debt, debt

is

www.reviewer-online com

www.certscollege.org

jeneral Principles of Taxation. MC

Select the correct statement.

The doctrine of estoppel operates against the taxpayer, not against the government.

Non-compensation or set-off violates the principle of administrative feasibility.

‘Taxes are always imprescriptible.

The principle of strictissimi juris simply states that exemption is the rule, taxation is the

exemption.

Which of the following is a power of the Commissioner of Internal Revenue?

A. Assessment and collection of taxes

1), Enforcement of all forfeitures, penalties and fines

C. Interpretation of the provisions of the NIRC

D. Giving effects to. and administering the supervisory and police powers conferred by the NIRC

and other laws

Which of the following powers of the Commissioner of Internal Revenue cannot be delegated? 62.

(A, The examination of tax return and tax due thereon

To refund or credit tax liabilities in certain cases

©. The power to compromise or abate any tax liability involving basic deficiency tax of P500,000

and minor criminal violations

D, The power to reverse a ruling of first impression

The following are the limitation on the taxing power of the state. Which of the following inherent

limitation of taxation is also categorized as a constitutional limitation?

Territoriality of taxation

8. Exemption of the government

C. Public purpose of taxation

1D. Non-impairment of contracts

f. _Non-delegation of the power to tax

A AandB

B. Bandc

C.CandE

D. DandE

Which of the following forms of escapes to taxation will more likely to result in direct loss of

revenue to the government?

A, Shifting

1. Capitalization

€. transformation

D. tax exemption

When exemption from a tax imposition is silent or not clearly stated, which statement is true?

A, Taxation applies since exemptions are construed against the government.

1. Exemption still applies since this is exemption by omission.

©, Taxation applies since exemptions are to be construed against the taxpayer.

D, Exemption applies since obligation arising from law cannot be presumed and hence

construed against the government:

When the provisions of tax laws are silent as to the taxability ofan item, which is true?

www.certscollege.org uc cpa review

wwwirevieweronline.com

61.

uc cpa review

TAX.O-1401.General Principles of Taxation. MC

Taxation applies since taxation is the rule, exemption is the exception.

Exemption applies since vague tax laws are construed against the government.

Taxation applies in accordance with the Lifeblood doctrine.

Exemption applies since obligation arising from law is presumed; ignorance of the law is not

an excuse.

9OR>

Which statement is correct?

A. Tax assessment are presumed to be correct and done in good faith

B. Tax laws should not operate retrospectively.

C. Refund of taxes should earn interest since as a principle, no one shall be enriched at the

expense of another; the state should be the model of good faith among its constituents,

A. A,BandC C.Aonly

B. AandB D.BandC

Select the incorrect statement regarding tax amnesty and condonation.

A. Intax amnesty, violators are required to pay a portion of the tax assessed.

B, When the remaining unpaid portion of the tax is condoned,:the taxpayer cannot ask for

refund for the balance already paid.

C. Tax amnesty operates as a general pardon and is always not available.

D. Tax condonation operates on the whole balance of the assessed tax and not only to the

unpaid portion

[a7

www, certscollege.org www.reviewer-online com)

Anda mungkin juga menyukai

- MS.O-1408 Cash and Marketable Securities ManagementDokumen1 halamanMS.O-1408 Cash and Marketable Securities Managementrietzhel22Belum ada peringkat

- Laborlaw - PH: Work ConditionsDokumen2 halamanLaborlaw - PH: Work Conditionsrietzhel22Belum ada peringkat

- Booking Voucher - EnglishDokumen1 halamanBooking Voucher - Englishrietzhel22Belum ada peringkat

- Booking Voucher - KoreanDokumen1 halamanBooking Voucher - Koreanrietzhel22Belum ada peringkat

- Organizational ChartDokumen3 halamanOrganizational Chartrietzhel22Belum ada peringkat

- Bit CoinDokumen3 halamanBit Coinrietzhel22Belum ada peringkat

- LlawDokumen2 halamanLlawrietzhel22Belum ada peringkat

- Company N: Employee HandbookDokumen18 halamanCompany N: Employee HandbookronsarmientoBelum ada peringkat

- Laborlaw - PH: Work ConditionsDokumen2 halamanLaborlaw - PH: Work Conditionsrietzhel22Belum ada peringkat

- Memo Break TimeDokumen1 halamanMemo Break Timerietzhel22100% (1)

- Chap 1Dokumen80 halamanChap 1rietzhel22Belum ada peringkat

- 03 Correction of Error - CTDIDokumen15 halaman03 Correction of Error - CTDIrubydelacruzBelum ada peringkat

- 1403 - TaxDokumen9 halaman1403 - Taxrietzhel22Belum ada peringkat

- 1409 - TaxDokumen10 halaman1409 - Taxrietzhel22Belum ada peringkat

- PA1.O.1408 Property, Plant and Equipment-AcquisitionDokumen1 halamanPA1.O.1408 Property, Plant and Equipment-Acquisitionrietzhel22Belum ada peringkat

- 01 Introduction To Consumption TaxesDokumen14 halaman01 Introduction To Consumption Taxesrietzhel22Belum ada peringkat

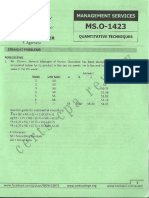

- 1423 - MasDokumen18 halaman1423 - Masrietzhel22Belum ada peringkat

- 1404 - TaxDokumen5 halaman1404 - Taxrietzhel22Belum ada peringkat

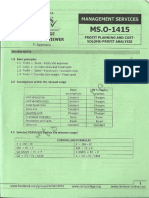

- 1415 - MasDokumen13 halaman1415 - Masrietzhel22Belum ada peringkat

- 04 Exempt Sales of Goods, Properties and Services PDFDokumen19 halaman04 Exempt Sales of Goods, Properties and Services PDFrietzhel22Belum ada peringkat

- REL OF APA - 1st PartDokumen4 halamanREL OF APA - 1st Partrietzhel22Belum ada peringkat

- AP 5902Q Liabs Supporting NotesDokumen2 halamanAP 5902Q Liabs Supporting NotesEmms Adelaine TulaganBelum ada peringkat

- Thesis Apa FormatDokumen5 halamanThesis Apa Formatrietzhel22Belum ada peringkat

- FinanceDokumen6 halamanFinancerietzhel22Belum ada peringkat

- Team Building WaiverDokumen1 halamanTeam Building Waiverrietzhel22Belum ada peringkat

- VP For CommDokumen4 halamanVP For Commrietzhel22Belum ada peringkat

- Academic EventsDokumen8 halamanAcademic Eventsrietzhel22Belum ada peringkat

- Lea Accountancy Days RealDokumen4 halamanLea Accountancy Days Realrietzhel22Belum ada peringkat

- EndorsementDokumen1 halamanEndorsementrietzhel22Belum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)