Private Companies Charts 092217

Diunggah oleh

Carolyn ProctorHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Private Companies Charts 092217

Diunggah oleh

Carolyn ProctorHak Cipta:

Format Tersedia

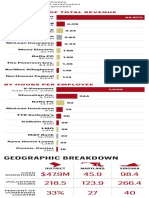

SURVEY SAYS...

We polled the regions largest private companies

on their challenges, hiring forecasts and revenue 3% 13%

expectations. Heres what they said: Unknown Revenue

14% 11% down so

far

3%: Consolidations,

40%

24%

No hiring plans

51% 83%

more looking for work Other at this time

3%: Changing Flat, little to no

customer priorities change from 2016

GROWING

2%: Boost in

marketing/social media 5% BUSINESS/ YES, A FEW

PEOPLE

GROWTH

IN 2017

Increased ECONOMY

2%: Increase in cyber REVENUE

threats/awareness regulations/costs

2%: Political discord

1%: Worse traffic

1%: More international 5%

business Slowing business

WHAT WAS THE BIGGEST IS YOUR COMPANY HIRING WHAT DO YOU EXPECT TO

6% CHALLENGE IN 2016-2017? IN THE NEXT SIX MONTHS? SEE IN REVENUE FOR 2017?

Increased

government

Out of 86 responses

35% Out of 151 responses Out of 149 responses

contracting activity 14% Yes, a great deal

Reduced talent

pool/hard to

7% find qualified

staff

Uncertainty in

budgets/goals

12% 12%

Increased/ Increased

tougher dependence on

competition integration of

technology

SOURCE: Private companies, Washington Business Journal research

HOW GREATER WASHINGTON RANKS WITH THE 15 LARGEST METRO AREAS OUR PRIVATE COMPANIES, OVER TIME

Future growth would be welcome. The D.C. region, long cushioned by the federal government, has seen its standing fall as federal spending shrinks and job growth slows. In an effort to track the broader journey for the regions largest private companies in the last five years, we found

the total employee counts and revenue for the top 100 for each years List. While the employment has been more

Pre-recession rank Current rank unpredictable based on who made the List, total revenue is rebounding from 2014 and 2015.

Percent NUMBER OF EMPLOYEES TOTAL REVENUE In billions

Percent of owners

Per capita Top 5 of renters paying Percent Percent

Employed personal Top 5 global Net Net paying 30%+ of Annual commuting households Average

237,359 87.9

Job Gross resident Median income U.S. cities cities domestic foreign Regional Regional 30%+ of income on hours of 60+ with 1.51+ workers 87.4

growth regional growth household growth (currently (currently migration migration cost of rental income on owner vehicle minutes to occupants per

(3-year avg.) product (3-year avg.) income (3-year avg.) unrakned) unrakned) rate rate living costs rent costs delay job per room household

1 1 1 1 1 1 1

220,841 $85.4

2 2 2 2 2 2 2 2 2

3 3 3 3 3 3

210,362

4 4 4 4

5 5 5

82.0 82.0

6 6 6

7 7 7

187,544

8 8 8

9 9 9 9

10 10 10 10

172,455

11 11 11

12 12 12

13 13

14 14 14 14

15 15 15 15

2013 2014 2015 2016 2017 2013 2014 2015 2016 2017

SOURCE: Stephen S. Fuller Institute at George Mason University SOURCE: Private companies, Washington Business Journal research

Anda mungkin juga menyukai

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Aspartame Literature ReviewDokumen10 halamanAspartame Literature Reviewapi-272556824Belum ada peringkat

- Marcos & Sumulong Highway, Rizal Applicant'S Information Sheet (Non-Academic)Dokumen2 halamanMarcos & Sumulong Highway, Rizal Applicant'S Information Sheet (Non-Academic)dummy testerBelum ada peringkat

- Fitting A Logistic Curve To DataDokumen12 halamanFitting A Logistic Curve To DataXiaoyan ZouBelum ada peringkat

- VC List Extra 042619Dokumen1 halamanVC List Extra 042619Carolyn ProctorBelum ada peringkat

- Dentons Family Tree and MapDokumen1 halamanDentons Family Tree and MapCarolyn ProctorBelum ada peringkat

- Public Companies Winners LosersDokumen1 halamanPublic Companies Winners LosersCarolyn ProctorBelum ada peringkat

- Public Companies CEO Pay Ratios RaisesDokumen1 halamanPublic Companies CEO Pay Ratios RaisesCarolyn ProctorBelum ada peringkat

- List Extra HotelsDokumen1 halamanList Extra HotelsCarolyn ProctorBelum ada peringkat

- Wealthiest Zip Codes - 1Dokumen1 halamanWealthiest Zip Codes - 1Carolyn ProctorBelum ada peringkat

- Floorplan SpacesNoMaDokumen1 halamanFloorplan SpacesNoMaCarolyn ProctorBelum ada peringkat

- Exec Pay 2018Dokumen1 halamanExec Pay 2018Carolyn ProctorBelum ada peringkat

- Public Companies 2018Dokumen1 halamanPublic Companies 2018Carolyn ProctorBelum ada peringkat

- List Extra 7.21.17Dokumen1 halamanList Extra 7.21.17Carolyn ProctorBelum ada peringkat

- Federal Building Requests - List Extra 101317Dokumen1 halamanFederal Building Requests - List Extra 101317Carolyn ProctorBelum ada peringkat

- Revenue Swings: Biggest Gainers Biggest LosersDokumen1 halamanRevenue Swings: Biggest Gainers Biggest LosersCarolyn ProctorBelum ada peringkat

- Lobbying - List Extra 102017Dokumen1 halamanLobbying - List Extra 102017Carolyn ProctorBelum ada peringkat

- Metro Electricity List ExtraDokumen1 halamanMetro Electricity List ExtraCarolyn ProctorBelum ada peringkat

- List Extra 05.19.17Dokumen1 halamanList Extra 05.19.17Carolyn ProctorBelum ada peringkat

- List ExtraDokumen1 halamanList ExtraCarolyn ProctorBelum ada peringkat

- Where'S The Growth?: Fastest Growing Companies 2016Dokumen1 halamanWhere'S The Growth?: Fastest Growing Companies 2016Carolyn ProctorBelum ada peringkat

- List Extra 12/2/16Dokumen1 halamanList Extra 12/2/16Carolyn ProctorBelum ada peringkat

- List Extra 11.4.16Dokumen1 halamanList Extra 11.4.16Carolyn ProctorBelum ada peringkat

- List Extra 10-14Dokumen1 halamanList Extra 10-14Carolyn ProctorBelum ada peringkat

- Dentons Family TreeDokumen1 halamanDentons Family TreeCarolyn ProctorBelum ada peringkat

- Geographic Breakdown: by Percent of Total RevenueDokumen1 halamanGeographic Breakdown: by Percent of Total RevenueCarolyn ProctorBelum ada peringkat

- List Extra 10.7.16Dokumen1 halamanList Extra 10.7.16Carolyn ProctorBelum ada peringkat

- List Extra Private Companies 2Dokumen1 halamanList Extra Private Companies 2Carolyn ProctorBelum ada peringkat

- List Extra Millionaire MapDokumen1 halamanList Extra Millionaire MapCarolyn ProctorBelum ada peringkat

- List Extra MillionairesDokumen1 halamanList Extra MillionairesCarolyn ProctorBelum ada peringkat

- Public Companies - Winners and LosersDokumen1 halamanPublic Companies - Winners and LosersCarolyn ProctorBelum ada peringkat

- WBJ List Extra Map of D.C. BIDsDokumen1 halamanWBJ List Extra Map of D.C. BIDsCarolyn M. ProctorBelum ada peringkat

- List Extra PoliticsDokumen1 halamanList Extra PoliticsCarolyn ProctorBelum ada peringkat

- Epitalon, An Anti-Aging Serum Proven To WorkDokumen39 halamanEpitalon, An Anti-Aging Serum Proven To Workonæss100% (1)

- Heat Wave Action Plan RMC 2017Dokumen30 halamanHeat Wave Action Plan RMC 2017Saarthak BadaniBelum ada peringkat

- How to use fireworks displays at Indian weddings to create magical memoriesDokumen3 halamanHow to use fireworks displays at Indian weddings to create magical memoriesChitra NarayananBelum ada peringkat

- Arraignment PleaDokumen4 halamanArraignment PleaJoh SuhBelum ada peringkat

- Ecological Modernization Theory: Taking Stock, Moving ForwardDokumen19 halamanEcological Modernization Theory: Taking Stock, Moving ForwardFritzner PIERREBelum ada peringkat

- I CEV20052 Structureofthe Food Service IndustryDokumen98 halamanI CEV20052 Structureofthe Food Service IndustryJowee TigasBelum ada peringkat

- Practise Active and Passive Voice History of Central Europe: I Lead-InDokumen4 halamanPractise Active and Passive Voice History of Central Europe: I Lead-InCorina LuchianaBelum ada peringkat

- 1995 - Legacy SystemsDokumen5 halaman1995 - Legacy SystemsJosé MªBelum ada peringkat

- Destiny by T.D. JakesDokumen17 halamanDestiny by T.D. JakesHBG Nashville89% (9)

- A Model For Blockchain-Based Distributed Electronic Health Records - 2016Dokumen14 halamanA Model For Blockchain-Based Distributed Electronic Health Records - 2016Asif KhalidBelum ada peringkat

- BiblicalDokumen413 halamanBiblicalMichael DiazBelum ada peringkat

- Management of Dyspnoea - DR Yeat Choi LingDokumen40 halamanManagement of Dyspnoea - DR Yeat Choi Lingmalaysianhospicecouncil6240Belum ada peringkat

- Dell Market ResearchDokumen27 halamanDell Market ResearchNaved Deshmukh0% (1)

- Electrical Power System Protection BookDokumen2 halamanElectrical Power System Protection BookHimanshu Kumar SagarBelum ada peringkat

- Salzer Panel Accessories Price List - 01st January 2019Dokumen40 halamanSalzer Panel Accessories Price List - 01st January 2019Chandra SekaranBelum ada peringkat

- Eric Bennett - Workshops of Empire - Stegner, Engle, and American Creative Writing During The Cold War (2015, University of Iowa Press) - Libgen - LiDokumen231 halamanEric Bennett - Workshops of Empire - Stegner, Engle, and American Creative Writing During The Cold War (2015, University of Iowa Press) - Libgen - LiÖzge FındıkBelum ada peringkat

- Research Paper On The Hells AngelsDokumen6 halamanResearch Paper On The Hells Angelsfvg2xg5r100% (1)

- TypeDokumen20 halamanTypeakshayBelum ada peringkat

- Analysis of Cocoyam Utilisation by Rural Households in Owerri West Local Government Area of Imo StateDokumen11 halamanAnalysis of Cocoyam Utilisation by Rural Households in Owerri West Local Government Area of Imo StatePORI ENTERPRISESBelum ada peringkat

- Instafin LogbookDokumen4 halamanInstafin LogbookAnonymous gV9BmXXHBelum ada peringkat

- Postmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarDokumen4 halamanPostmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarAbdennour MaafaBelum ada peringkat

- StoreFront 3.11Dokumen162 halamanStoreFront 3.11AnonimovBelum ada peringkat

- Prospectus2023 24 PDFDokumen332 halamanProspectus2023 24 PDFramgharia sameerBelum ada peringkat

- EDUC 5240 - Creating Positive Classroom EnvironmentsDokumen5 halamanEDUC 5240 - Creating Positive Classroom EnvironmentsMay Phyo ThuBelum ada peringkat

- CH 2 Short Questions IXDokumen2 halamanCH 2 Short Questions IXLEGEND REHMAN OPBelum ada peringkat

- Public Relations & Communication Theory. J.C. Skinner-1Dokumen195 halamanPublic Relations & Communication Theory. J.C. Skinner-1Μάτζικα ντε Σπελ50% (2)

- National Train Enquiry System: 12612 Nzm-Mas Garib Rath Exp Garib Rath 12434 Nzm-Mas Rajdhani Exp RajdhaniDokumen1 halamanNational Train Enquiry System: 12612 Nzm-Mas Garib Rath Exp Garib Rath 12434 Nzm-Mas Rajdhani Exp RajdhanishubhamformeBelum ada peringkat