Sa4 Pu 14 PDF

Diunggah oleh

PolelarJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Sa4 Pu 14 PDF

Diunggah oleh

PolelarHak Cipta:

Format Tersedia

SA4: CMP Upgrade 2013/14 Page 1

Subject SA4

CMP Upgrade 2013/14

CMP Upgrade

ActEd often produces a free CMP Upgrade, which provides details of changes to the

syllabus, Core Reading and ActEd materials. This year, however, due to the large

number of changes to the Course Notes, Q&A Bank and X Assignments, it is not

practical to produce a full upgrade.

We offer a full replacement set of up-to-date Course Notes/CMP at a discounted price if

you have previously bought the full-price Course Notes/CMP respectively in this

subject. The prices are given in Section 0 below.

This document provides a summary of the major changes so that you are aware of the

main themes of these changes and the chapters that have been subject to the greatest

change.

0 Retaker discounts

When ordering retaker-price material, please use the designated place on the order

form or tick the relevant box when using the e-store.

Students have the choice of purchasing the full CMP (printed or eBook) or just the

Course Notes (printed). You may need to add dispatch charges to the prices below.

Retaker price

2014 printed CMP for those having previously purchased the 60

full-price Subject SA4 CMP

2014 CMP eBook for those having previously purchased the 20 (+VAT in EU)

full-price Subject SA4 CMP

2014 printed Course Notes for those having previously 45

purchased the full-price Subject SA4 Course Notes or CMP

The Actuarial Education Company IFE: 2014 Examinations

Page 2 SA4: CMP Upgrade 2013/14

1 Summary of the changes

Numerous references to the expected introduction of auto-enrolment with effect from

October 2012 have been updated to reflect the fact that this has now occurred.

References have also been added concerning the proposed abolition of contracting out

through defined benefit arrangements by April 2016.

The Transformations TAS now forms part of Core Reading.

The names of various bodies have changed and been updated throughout the course as

follows:

From To

The Board for Actuarial Standards Financial Reporting Council

The Financial Services Authority Two regulatory authorities;

The Prudential Regulation Authority

The Financial Conduct Authority

UK Actuarial Profession Institute and Faculty of Actuaries

Accounting Standards Board The Accounting Council

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 3

2 Changes to the Core Reading

Below is a summary of the significant changes to the Core Reading:

Chapter 1, Page 13

Later versions of various documents in the required reading have been updated as

follows:

Scope & Authority of Technical standards - August 2012

Pensions TAS - November 2012

Transformations TAS - December 2010

Chapter 1, Page 17

The 2013 version of the Pensions Pocket Book is referenced ie:

Pensions Pocket Book 2013

Chapter 2, Page 5

The first paragraph now reads:

The full basic state pension (BSP) payable during the 2013/2014 tax year is

110.15 per week. The married persons pension for 2013/14 is 176.15 per

week.

Chapter 2, Page 7

The penultimate paragraph of the page now reads:

The QEF is equal to the lower earnings limit and for 2013/2014 is 5,668. The

LET for 2013/2014 is 15,000.

Chapter 2, Page 10

Two new paragraphs have been added to the after the third paragraph on page 10 as

follows:

As part of its single-tier pension reforms (see section 1.6), the Government is

intending to abolish contracting out through defined benefit arrangements by

April 2017 at the earliest, to coincide with the introduction of the single-tier

pension.

The Actuarial Education Company IFE: 2014 Examinations

Page 4 SA4: CMP Upgrade 2013/14

At the time of writing (May 2013) this date has been moved forward to April 2016 and

it is expected that:

accrual under S2P and the ability to contract out will cease from a date to be

agreed (April 2016 at the earliest).

a single tier State pension will be introduced to replace all State pension benefits

(ie the BSP, S2P and Pension Credit). A current amount of around 140 per

week has been proposed.

Chapter 2, Page 15

The final paragraph under the section on eligibility is now:

To protect individuals, employers must not offer employees incentives to opt out

of a workplace pension, either during employment for existing employees or

during recruitment for prospective employees.

The part from the Core Reading onwards under the section on qualifying schemes has

been changed to:

Minimum contributions required to qualifying schemes, including NEST are described

below.

Broadly, auto-enrolment is being phased in depending on the size of the

employer as follows:

120,000 or more employees: auto-enrolment started from 1 October 2012

Less than 120,000 but 250 or more employees: auto-enrolment will be

phased in between October 2012 to February 2014;

50-249 employees: auto-enrolment will be phased in from April 2014 to

April 2015;

49 employees or less: auto-enrolment will be phased in from June 2015 to

April 2017.

For employers established after April 2012, auto-enrolment will be phased in

from May 2017 to February 2018.

For employers who choose to use defined benefit or hybrid schemes, auto-

enrolment can be delayed to September 2017.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 5

Chapter 2, Page 16

The section on NEST now reads:

NEST

The National Employment Savings Trust (NEST) was set up by the Government

to provide a vehicle for auto-enrolment which may be offered to employees by

employers who do not wish to set up their own scheme, or do not currently

support a suitable arrangement. NEST will operate as a single multi-employer

defined contribution scheme.

Minimum contributions required to qualifying schemes, including NEST, are a

total of 8% of Upper Band Earnings, with the employer paying at least 3% and the

employee making up the difference. Contributions will be set out in legislation

and will attract tax relief. If an employee opts out of the scheme, the employer

would not be obliged to contribute.

Contributions to NEST are actually based on qualifying earnings rather than Upper

Band Earnings. However at present the definition is actually the same as Upper Band

Earnings were earnings between the Lower Earnings Limit and the Upper Earnings

Limit (which are 5,668 pa and 41,450 pa for 2013/14).

The eligibility and contribution requirements will be phased in, in stages, from

October 2012, as follows:

Minimum contribution (% of earnings)

Employer Total

1 October 2012 to 30 September 2016 1% 2%

1 October 2016 to 30 September 2017 2% 5%

From 1 October 2017 onwards 3% 8%

Employees will be required to make up the difference between the employer

contributions and the total. Employers may pay more than the minimum

specified, in which case employees contributions can be lower to reach the

overall minimum total.

More information about automatic enrolment can be found on TPRs website at:

http://www.thepensionsregulator.gov.uk/automatic-enrolment.aspx

The Actuarial Education Company IFE: 2014 Examinations

Page 6 SA4: CMP Upgrade 2013/14

Chapter 2, Pages 16 and 17

Section 1.6 now reads:

The UK Government published its White Paper on pensions reform in January

2013, focusing primarily on the introduction of a higher flat-rate State pension,

but also considering the future direction of the State Pension Age.

The main reason behind this reform is the view that unless people save more, work for

longer and/or pay more tax they will have a standard of living in retirement which is

worse, in real terms, than those currently retiring.

State Pension benefits

The key features of the proposals are:

The new single-tier pension will replace the current BSP and S2P and will

be set above the level of the Pension Credit Standard Minimum Guarantee

(see section 1.1).

Currently a single tier State pension of around 140 per week has been

proposed.

The minimum legislative requirement for pension increases is in line with

earnings. However, it is anticipated that, as for BSP, this pension will

increase in line with the triple lock.

The new pension will apply only to individuals who reach State Pension

Age after the implementation date, expected to be no earlier than April

2017 (at the time of writing (May 2013) this has been moved forward to April

2016). Older individuals will continue to receive State benefits under the

current system.

The full pension will require 35 qualifying years of National Insurance

contributions or credits, but those with less than a minimum qualifying

period (expected to be between seven and ten years) will not receive any

entitlement. Those with fewer than 35 qualifying years, but more than the

minimum will receive a pro-rated benefit.

Contracting out

Contracting out of S2P will cease from the implementation date so employees

and employers in contracted-out schemes will see an increase in their national

Insurance contributions.

Remember that many private DB schemes are closed to new hires and some are also

closed to future accrual. In the latter case, the cessation of the ability to contract out is

irrelevant. Those DB schemes open to future accrual for some members will need to

cease contracting out and this will impact on these members benefits.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 7

Employers will be allowed to reduce future service benefits in order to offset

these increased costs. The Government is proposing to enable employers to do

this without trustee consent to safeguard the ongoing viability of defined benefit

pension schemes. However, there are concerns that this will be another catalyst

for the closure of defined benefit schemes.

It is proposed that a power be introduced through legislation to allow employers to

amend a schemes rules to offset the impact of these increased costs without trustee

consent, regardless of what is set out in the amendment power of the scheme, for

example by reducing future benefits or increasing employee contribution rates.

This power will be available for a limited period of time and will only allow an

amendment to be made insofar as the value of the change is not more than the annual

increase in the employers National Insurance contributions in respect of that member.

Various transitional arrangements will be in place. For example individuals who

have been contracted out at any time since 1978 can expect to see their State

benefit reduced to reflect the private scheme benefit earned through contracting-

out. However such individuals would be able to accrue further State benefits.

Individuals who have already accrued a State benefit in excess of the new single-

tier amount will be able to retain that higher benefit.

State Pension Age

Currently the State Pension Age for men is 65 and for women will be rising from

60 to 65 gradually from 2010 to 2020. The Pensions Bill 2011 proposes that SPA

for females will increase to 65 by 2018 rather than 2020, in order to comply with

the EU Directive for equal treatment for men and women. It is then proposed that

the SPA will increase gradually to 66 between 2018 and 2020 with further

increases planned after that time.

As part of the review of the single-tier pension the Government has announced

that it will carry out a review of the State Pension Age every five years.

At the time of writing (May 2013) it is further proposed that:

SPA will increase to age 67 between 2026 and 2028

subsequent increases in SPA will be linked to changes in life expectancy.

The Actuarial Education Company IFE: 2014 Examinations

Page 8 SA4: CMP Upgrade 2013/14

Regulatory reforms

The UK Government is proposing to:

allow schemes to convert Guaranteed Minimum Pension rights into

scheme benefits

Increases to GMPs are different from those that apply to other pension benefits.

Converting GMP into scheme benefits should simplify scheme administration

and make communication to members easier in the long run. However, it is

difficult to achieve without making some members worse off.

introduce a rolling deregulatory review of pensions regulation, in the light

of the Pensions Act 2004.

Many commentators believe that the UKs pension legislation and regulation is

too complicated. Any ongoing review would hopefully aim to simplify it.

Chapter 2, Page 28

A paragraph has been added, after the first paragraph, as follows:

The duties above outline the trustees fiduciary duties. A fiduciary duty is

defined as a legal or ethical relationship of trust between two or more parties. In

such a relationship one party, in this case the trustees, acts in a fiduciary

capacity to the other one, in this case the scheme beneficiaries, in a manner

which gives rise to a relationship of trust and confidence.

Chapter 3, Page 6

The contracting-out rebates are now as follows:

The reductions for the 2012/2013 tax year are 3.4% for the employer and 1.4% for

the employee. These rates will apply up to and including the 2016/17 tax year.

Chapter 3, Page 10

The second sentence of the final paragraph has been updated, with an additional

sentence added, as follows:

The AA for the 2013/14 tax year is 50,000. From the tax year 2014/15 onwards,

the AA will reduce to 40,000.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 9

Chapter 3, Page 12

The final sentence in the section Lifetime Allowance of the third paragraph has been

updated as follows:

The LTA is currently 1,500,000 from the 2012/13 tax year but will reduce to

1,250,000 from 6 April 2014.

Chapter 4, Page 31

The fourth sentence of the second paragraph of Section 7.1 has been updated as follows:

The cap for the year 2013/2014 is currently set at approximately 34,867 for an

NPA of 65 and will increase in line with earnings.

Chapter 4, Page 34

The first four paragraphs are now:

Schemes will be invoiced each year.

The cost of the PPF is met by a combination of scheme-based and risk-based

levies.

At the start of each financial year, the PPF Board estimate the total levies

required to fund the PPF. The levy estimate for the 2013/14 financial year is 630

million.

This is lower than the levy estimate had the parameters remained unchanged

from 2012/2013 which would have been some 765 million, breaching the

legislative restriction that a levy estimate can be no greater than 25% higher than

the previous years estimate (of 550 million). However, to reflect the current

economic environment, the PPF has changed the levy parameters to target a levy

of 630 million. The PPF has announced that it expects to increase the levy for

2014/2015 and thereafter should the current economic conditions continue.

The PPF did intend to maintain a stable levy of 550 million for three years from

2012/13 but this was not possible due to economic conditions.

The Actuarial Education Company IFE: 2014 Examinations

Page 10 SA4: CMP Upgrade 2013/14

Chapter 4, Pages 34, 35 and 36

Various parameters have been updated as follows:

SLM is the scheme-based levy multiplier, set at 0.000056 for the 2013/14

levy year.

LSF = risk-based levy scaling factor, set at 0.73 for the 2013/14 levy year.

The risk-based levy will be capped at a maximum of 0.75% of unstressed

liabilities for the 2013/2014 levy year.

To determine the smoothed deficit, the values of the assets and liabilities will be

smoothed using five-year financial market averages up to March 2013.

Chapter 5, page 7

The second paragraph is now:

Version 1 of TAS P applies to reserved work and work performed for aggregate

reports completed on or after April 2011 and before 1 January 2013. Version 2

(which is summarised below) applies subsequently.

A final point is added at the bottom of the page as follows:

incentive exercises.

Chapter 6, Page 11

A new paragraph has been added after the The sponsor heading:

Over the years an increasing number of employers are finding the risks

associated with defined benefit pension schemes to be unacceptable. As a

result, the majority of defined benefit schemes are now closed to new entrants

with a significant proportion also closed to future accrual. Employers are still,

however, left with past service liabilities which have to be managed.

Chapter 6, Page 13

A new section was added to the bottom of the page. As a convenient way to add to your

notes, this follows on the next page:

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 11

De-risking

A number of options exist for the employer to facilitate de-risking of the defined

benefit scheme as follows.

Investment strategy

Chapter 12 discusses various approaches the employer may wish to consider in order to

mitigate investment risk.

Investments are covered in detail in Chapters 11 and 12. Most de-risking

strategies involve a switch of assets from return-seeking assets to those which

provide a better match for the liabilities. Such switches can be driven by the

investment manager, or triggers can be set up, both asset and liability based, in

order to lock into favourable returns.

Insurance products

Insurance products are covered in Chapters 11 and 26. The scheme can either

undertake a buy-out, where all or part of the schemes liabilities are passed to an

insurance company at an agreed price, or a buy-in, where annuities are

purchased and held as scheme assets to protect against the investment,

inflation and longevity risks.

In order to extinguish the defined benefit risk the liabilities would need to be bought out

in the name of each member with an insurance company (this is known as a buy-out).

A buy-in is where annuities are purchased by the scheme, usually to match specific

liabilities, and are an asset of the scheme. A buy-in would mitigate risks but not

extinguish them.

Incentive Exercises

These are exercises where the members are given an incentive to take up an

option. The two exercises most commonly undertaken in the UK are Enhanced

Transfer Values and Pension Increase Exchanges.

Incentive exercises are discussed in Chapter 23 Options and guarantees.

Chapter 6, Section 7

Section 7 has been moved back to become Section 8 and a new Section 7 has been

added. As a convenient way to add to your notes, this follows on the next page:

The Actuarial Education Company IFE: 2014 Examinations

Page 12 SA4: CMP Upgrade 2013/14

7 Defined Ambition

In November 2012 the Department for Work and Pensions published a strategy

document entitled Reinvigorating workplace pensions which proposed a new

category of pension known as Defined ambition (DA).

This document discusses the desire to increase the range of products available to savers in order

to provide more certainty.

At the time of writing (May 2013), this document can be found as follows:

http://www.dwp.gov.uk/docs/reinvigorating-workplace-pensions.pdf

The aim of DA is to provide greater certainty for scheme members about the

value of their pension fund in a DC arrangement, but also less cost volatility for

employers than a DB arrangement. The intention is that these aims are met by

sharing the risks among a number of parties including scheme members,

employers and insurance and investment businesses. The rest of this section

covers defined ambition schemes in more detail.

These arrangements are often DB or DC schemes which have been adapted to transfer

some risk from one party to another eg from the employer to the member in a DB

scheme and the member to an investment business in a DC scheme.

Defined Ambition is a proposed structure for risk-sharing among the different

parties involved in pension schemes. An Industry Working Group has identified

a number of existing arrangements and proposed a number of new

arrangements as shown below.

7.1 Defined benefit schemes

Current defined benefit arrangements which involve some sharing of risk include

the following:

Career Average Revalued Earnings (CARE) schemes: (see section 3

above);

Here the risk of high salary increases (resulting in larger benefits and higher

costs) associated with a final salary defined benefit scheme is reduced. So

effectively the salary risk to the employer is passed to the member.

cash balance schemes: (see section 3 above);

Here a defined lump sum is provided at retirement, and so the post-retirement

risks are transferred from the employer to the member.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 13

longevity adjustment factors: the retirement age is increased for future

service in light of increasing longevity, thus mitigating the financial cost

to the employer of increasing life expectancy;

In this case, the variable retirement age means that the post-retirement longevity

risk is transferred from the employer to the member.

risk management options: including longevity swaps & bonds and

insurance company investments (see Chapter 11).

Investments can be chosen to mitigate some of the defined benefit risks. In this

way the risk is shared between the employer and the provider of the investment

(usually investment business or insurance company). This will be discussed

further in Chapter 11.

New defined benefit models

Some proposed new models for risk-sharing arrangements include:

Simplified/Core DB schemes: a basic, core level of DB benefits is

offered with other benefits such as indexation and spouses benefits

being discretionary and subject to less regulation;

New legislation would be required before such an arrangement could be set up.

This is because for some periods of service and some types of benefit current

legislation requires indexation and dependants benefits to be provided.

Here the cost and risk associated with these other benefits (eg inflation risk in

respect of indexation, longevity risk of the dependant) is reduced. So effectively

these costs and risks to the employer are passed to the member.

Conversion of Benefits: a defined level of benefit is promised to the

member which is converted to a DC fund of equivalent value when the

member leaves the scheme (through withdrawal, death or retirement);

Fluctuating Pensions: the scheme provides a core non-increasing

pension on retirement with an additional element which is entirely

discretionary and subject to the financial status of the scheme;

Simply put, this may be the provision of flat pensions with discretionary pension

increases provided out of surplus. This was common practice for private defined

benefit schemes in the UK before statutory pension increases were introduced

(post April 1997 accrual). However, at that time there were fewer statutory

funding restrictions, and schemes in surplus were more common.

In this case the inflation risk and cost is passed from the employer to the

member.

The Actuarial Education Company IFE: 2014 Examinations

Page 14 SA4: CMP Upgrade 2013/14

Links to changes in SPA: the schemes retirement age would be permitted

to be adjusted in line with revisions to the State Pension Age (SPA).

In this case, the variable retirement age means that some of the post-retirement

longevity risk is transferred from the employer to the member.

7.2 Defined contribution schemes

Current defined contribution arrangements which involve some sharing of risk

include the following:

with-profit funds: (see Chapter 11)

In such funds, the risk is shared between the member and the provider of the

fund (usually the investment business or insurance company). This will be

discussed further in Chapter 11.

deferred annuities: (see Chapter 11)

The Core Reading refers to Chapter 11 which discusses both with-profit and

non-profit deferred annuities. In the former case this is an investment option

and in the latter case this is an insurance option. These policies can be used to

mitigate some investment risk, and in the latter case longevity risk, to the

member. In this way the risk is shared between the member and the provider of

the policy (usually investment business or insurance company). This will be

discussed further in Chapter 11.

targeted DC benefit (see below).

New defined contribution models

Some proposed new models for risk-sharing arrangements include:

Mutualised guarantees and risk-sharing: to include a money-back

guarantee where members are guaranteed to get back the contributions

paid in, and a retirement income guarantee where a guarantee fund is set

up to pay pensions on survival beyond a certain age, thus taking on some

of the longevity risk. Guarantees would be funded by a levy on members

funds.

The money-back guarantee is effectively an investment guarantee. The value of

the fund would be guaranteed not to fall below the amount of the member (and

possibly employer) contributions. This removes some of the investment risk

from the individual member.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 15

The retirement income guarantee means that members will need to purchase a

fixed term annuity rather than a whole of life annuity. Members who live

beyond the fixed term would then receive their subsequent pension from the

guarantee fund. This removes some of the longevity risk from the individual

member.

Guarantees are discussed further in Chapter 23.

Guarantees and risk-sharing provided by the insurance industry:

guarantees on the return on the fund and the income at retirement

whereby the member is not subject to the downside risk but takes a share

in the upside risk, as opposed to a standard DC arrangement where the

member shoulders all of the downside and upside risk.

Examples here could be with-profit and deposit administration arrangements

with insurance companies as discussed in Chapter 11.

Plan design; employer-funded smoothing fund: the employer pays a

percentage of core contributions into a central fund which is used to

manage a targeted income at retirement. There is no longevity risk for the

employer, but there is some uncertainty surrounding the contributions

payable.

The intention would then be that some risk is shared between the members and

investment returns can be smoothed and contributions adjusted accordingly.

A further consideration for a DA arrangement is a collective DC scheme such as

those which exist currently in the Netherlands and Denmark. The key features of

such a scheme are as follows:

the employer pays a fixed rate of contributions into the fund

the risk is shared collectively by the members rather than individually

benefits paid to members on retirement are dependent on the funding

level of the scheme

pensions may be subject to variation once in payment, depending on the

funding level of the scheme, with a minimum level payable and the

balance being discretionary

as the fund is collective, it can follow a more risk-seeking investment

strategy in the long-term compared to individual funds where members

traditionally opt to switch into low-risk, low-yielding assets in the years

before retirement.

The Actuarial Education Company IFE: 2014 Examinations

Page 16 SA4: CMP Upgrade 2013/14

Chapter 7, Page 16

The final paragraph has been replaced with the following:

Future legislation changes may also cause problems, such as the proposed

State Pension reform as described in Chapter 2. For example, the deduction

stated in methods (2), (3) and (4) could be changed by legislation.

As noted in Chapter 2, under the proposals to cease contracting out of S2P,

employers may be allowed to adjust future service benefits without the need for

trustee consent, in order to offset the increased National Insurance costs.

The proposed changes to State benefits, as discussed in Chapter 2, mean that sponsors

who want their schemes to integrate with State benefits may need to take action, in

particular:

as the ability to contract out for a DB scheme will cease, integration through this

approach will no longer be possible

a single tier State pension will be introduced as a level expected to exceed the

BSP and therefore a lower amount of private provision may be appropriate.

However, the scheme is unlikely to be able to reduce accrued rights and so may only

make changes in respect of future accrual of benefits.

Chapter 15, Section 3.2

Section 3.2 has been moved back to become Section 3.3 and a new Section 3.2 has been

added. As a convenient way to add to your notes, this follows on the next page:

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 17

3.2 Smoothing

Smoothing is a process whereby short-term fluctuations in the market are

reduced. One possible approach is to use an average discount rate, taking

market yields over an averaging period, such as 2-5 years, rather than the yield

as at the date of the valuation.

Due to concerns raised in the light of current low gilt yields, the Department for

Work and Pensions undertook a consultation on whether smoothing should be

permitted.

DWPs consultation asked for views on:

whether the smoothing of assets and liabilities would be appropriate in schemes

undertaking SFO valuations, considering impacts on members, sponsoring

employers and the PPF

how smoothing might be applied.

However, in early 2013 it (the DWP) announced that it would not be introducing

smoothing following concerns raised that smoothing would mean that the effect

of low gilt yields would still be felt after the economy had recovered, and the loss

of transparency when using smoothed asset and liability values. In addition the

call for evidence had not revealed a strong case for pursuing such measures.

DWPs consultation also asked for views on whether a new statutory objective for TPR

is necessary and this is to go ahead. The new objective will ensure an employers need

for sustainable growth is considered during scheme funding negotiations and is properly

reflected in trustees dealings with the employer.

Chapter 22, Section 3.1

Section 3.1 has been amended. As a convenient way to add to your notes, this follows

on the next page:

The Actuarial Education Company IFE: 2014 Examinations

Page 18 SA4: CMP Upgrade 2013/14

3.1 Introduction

FRS 17 was introduced in December 2000 by the UK Accounting Standards

Board (ASB). The Accounting Council replaced the ASB in July 2012, and reports into

the Codes and Standards Committee of the FRC.

The full requirements were introduced for accounting periods beginning on or

after 1 January 2005 and replaced the Statement of Standard Accounting

Practice (SSAP24). (SSAP24 was an accounting standard under which pension

assets/liabilities and pension costs were calculated on smoothed long-term

actuarial assumptions.) In the next few years, the ASB is proposing to withdraw

FRS17 and defer substantially to the international accounting standards.

FRS 102 (Section 28 applies to employee benefits) replaces FRS 17 for accounting

periods beginning on or after 1 January 2015. Early application of FRS 102 is

permitted for accounting periods ending on or after 31 December 2012.

Note that any requirements to account under International Accounting Standards (IAS)

override country-specific requirements. IAS came into force in the UK for accounting

periods beginning on or after 1 January 2005 from this date, listed companies had to

use IAS 19 to account for pension costs in their group consolidated accounts.

Therefore, some UK companies may have moved directly from SSAP 24 to IAS 19.

The purpose of FRS 17 is to ensure that:

company pension assets and liabilities are measured at fair value

operating, financing, and other costs are recognised in the appropriate

period

there is proper disclosure.

FRS 17, and not FRS 102, is discussed in the rest of this section in detail. The focus of

FRS 17 is that a realistic assessment of the difference between the pension and assets

should be recognised in the balance sheet, ie it is a balance sheet focused standard.

For accounting periods beginning on or after 6 April 2007, the disclosure

requirements were aligned with IAS19.

The Accounting Council amended the disclosure requirements of FRS 17 to bring them

broadly into line with the disclosures required under the previous version of IAS 19 (but

not the current version of IAS 19). FRS 102 will replace FRS 17 but its disclosure

requirements are not aligned with the current version of IAS 19.

The Accounting Councils best practice disclosure guidelines, which apply to both

FRS 17 and IAS 19, are described in Section 5.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 19

Chapter 15, Section 4

Section 4 has been updated and is reproduced below:

4 IAS 19

4.1 Introduction

The current international practice standards are set out in International

Accounting Standard 19 (IAS 19) as revised in 1998, and subsequently amended.

A revised IAS19 was issued in June 2011, being applicable to accounting years

beginning from 1 January 2013.

IAS 19 has become a requirement in the UK for listed companies consolidated

accounts replacing FRS 17. For unlisted companies, the use of IAS 19 is

optional.

The emphasis in this standard is towards the balance sheet.

4.2 The pension cost

With the exception of actuarial gains and losses the elements of the pension

cost under IAS 19 are calculated using much the same method as FRS 17.

The pension costs should be calculated as:

service cost

+/ interest on the net liability / asset

+/ remeasurement effects

The first two elements of the pension costs (ie the service cost and interest) are

disclosed through the profit and loss account. The final element, the remeasurement

effects, is disclosed through Other Comprehensive Income (OCI). This is discussed

further in section 4.5 below.

The Actuarial Education Company IFE: 2014 Examinations

Page 20 SA4: CMP Upgrade 2013/14

The service cost is equal to:

current service cost

+/ past service cost / credit (including changes to the DBO due to

curtailments)

+/ the effects of settlements.

The remeasurement effects consist of the gains or losses arising from:

changes in the assumptions used to measure the DBO

differences between actual and assumed experience in the scheme

differences between the actual return on the scheme assets and the

interest income assumed using the assumed discount rate

changes in the asset ceiling not included in the interest cost.

The asset ceiling is defined as the present value of the sum of refunds of surplus to

which the sponsor has an unconditional right and reductions in future contributions. It

is discussed further in section 4.6 below.

Thus the element of pension cost which passes through the profit and loss account, and

set out consistently with the other standards, is calculated as:

the current service cost

plus interest cost on the liabilities

less interest income assumed using the assumed discount rate on assets

plus past service cost the liability arising due to benefit improvements can be

amortised over the period until the benefit vests

less gains (losses) on settlements or curtailments.

Do note however that this is not how the pension cost would be presented in the

accounts.

4.3 Valuation of assets and liabilities

Assets are measured at fair value at the balance sheet date. Auditors now

require this to be bid value rather than mid-market value (based on wording in

other international accounting standards).

The liabilities are calculated using the Projected Unit method.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 21

There is no guidance under IAS 19 on the treatment of risk benefits. One

possible method is the attribution method (as used under FAS 87/158) whereby

benefits that are not service related are allocated in proportion to the ratio of

completed years of service to either the vesting period or, if the benefit is

unvested, total projected years of service.

In practice, this usually means that the uniform accrual to date of payment method is

used as described in Chapter 16.

In some circumstances, administration expenses may be capitalised and that

part attributable to non-actives added to the present value of the liabilities.

4.4 Assumptions

As for FRS 17 the assumptions are the responsibility of the directors. The

involvement of a qualified actuary is encouraged but not required.

The assumptions should be unbiased and mutually compatible and overall

should represent the best estimate of the future cash flows from the scheme.

Financial assumptions should reflect market conditions at the balance sheet

date.

The discount rate used to value the liabilities should be determined by reference

to market yields at the balance sheet date on high quality corporate bonds of

consistent term and currency or, if there is no deep market in such bonds, the

market yields on government bonds.

In the UK, actuaries and auditors often base the discount rate on the yield on long-dated

AA-rated corporate bonds. This discount rate is used to value the liabilities and also

used to determine the interest on the difference between the assets and liabilities.

Allowance should be made for discretionary benefit increases if there is a constructive

obligation to award them.

The Actuarial Education Company IFE: 2014 Examinations

Page 22 SA4: CMP Upgrade 2013/14

4.5 Actuarial gains and losses

Under the current version of IAS 19, all gains and losses are to be recognised

immediately outside the profit and loss account, under Other Comprehensive

Income (OCI).

In fact these gains and losses are the remeasurement effects discussed above. They

therefore are the result of:

the impact of any changes in the assumptions in valuing the liabilities

the difference between the expected value of the liabilities and the actual value

due to experience differing from that assumed

the difference between the expected value of the assets (calculated using the

discount rate to determine the expected return on the assets) and the actual value

due to experience differing from that assumed

and any changes in the asset ceiling not included in the interest cost.

This method is analogous to the recognition of gains and losses through the Statement

of Total Recognised Gains and Losses (STRGL) under FRS 17 where gains and losses

are recognised immediately and not through the profit and loss account.

Prior to the current arrangement, many companies adopted the 10% corridor

option a method of delaying recognition of gains and losses. These

companies are likely to see a one-off significant change in their balance sheet

liability the first time they adopt the current approach as any currently

unrecognized gains and losses are taken onto the balance sheet.

IAS 19 previously offered companies a choice of approaches in respect of the treatment

of actuarial gains and losses. One approach was similar to that prescribed by

FAS 87/158 (the 10% corridor option referred to above) another was the current version

(similar to FRS 17).

4.6 Balance sheet

The amount recognised as a liability in the balance sheet should be calculated

as:

The present value of the defined benefit obligation (DBO)

less the fair value of the scheme assets.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 23

If the result is negative ie an asset, then it should be limited to the asset ceiling

which is defined as the present value of the economic benefits in the form of

refunds from the scheme (more specifically, refunds to which the sponsor has an

unconditional right) or reductions in future contributions.

In practice, the calculation of the asset to be shown on the balance sheet can be very

complicated. For example:

it may be difficult to determine the extent to which an employer has an

unconditional right to a refund of surplus

arguably, even if the scheme is in surplus on an accounting basis, a reduction in

future contributions may not be available if these funds are needed to meet past

service liabilities under the SFO.

As noted above, companies which adopted the corridor approach in their

balance sheets will see an immediate effect on the balance sheet of

implementing the new approach and this is likely to result in a balance sheet

deterioration. Going forward, balance sheet positions will become more volatile

for these companies as the effects of gains and losses from scheme experience

will be recognised immediately.

4.7 Disclosure

The disclosures required under IAS 19 include the following:

Objectives: an explanation of the characteristics and risks associated with

DB schemes and how the characteristics of the scheme may affect the

amount, timing and uncertainty of the companys cashflows.

Characteristics: a description of the scheme benefits and any risks the

scheme poses to the company, in particular unusual risks or

concentrations of risk.

Benefit obligation: a reconciliation of the opening and closing balance of

the schemes liabilities.

Scheme assets: a reconciliation of the opening and closing balance of the

schemes assets and any asset / liability matching strategies. Detail of

any self-investment included in the fair value of assets.

Pension cost: the pension cost recognised in the profit and loss accounts

consisting of:

- current service cost

- interest on net liability / asset

- remeasurement effects.

The Actuarial Education Company IFE: 2014 Examinations

Page 24 SA4: CMP Upgrade 2013/14

Cash flows: expected employer contributions over the coming year

together with a description of the funding arrangements and the weighted

average duration of the scheme.

Assumptions: the significant assumptions used and the sensitivity of the

value of the liabilities to changes in these assumptions, together with

commentary on the methods used in the sensitivity analysis.

Multiple plans: disclosures for plans with materially different risk

characteristics should be separate rather than combined.

Disclosure items no longer required under the current version of IAS19

compared to the previous version include:

Reconciliation of funded status (though this can be determined from other

information disclosed).

Detail of the net periodic cost (though this information is included in the

reconciliation of the liabilities and assets).

Five-year history of asset value, liabilities, surplus/deficit and experience

gains and losses.

4.8 Example

In this section, we show by way of a worked example the figures that might appear in a

companys accounts relating to pension costs under IAS 19. In practice figures would

probably be rounded and some detail may be ignored due to materiality.

You will gain the most benefit from this example if you attempt the calculations

yourself.

We will consider how the figures calculated in the previous example would differ if the

company were reporting under IAS 19. We will assume the same assumptions can be

used for IAS 19 in this instance.

Summary of results

The calculations in the previous example showed that, using the FRS 17 methodology

and assumptions:

Current service cost (CSC): 0.68m

Past service cost and gains/losses from settlements and curtailments are nil

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 25

The table below shows the value of the liabilities on the FRS 17 basis and the bid value

of the assets at 1 January X and 1 January X+1:

Value at 1 Value at 1

January X January X+1

Bid value of assets 40.0m 35.0m

Value of liabilities 38.4m 42.0m

Contributions totalled 0.6m (0.15 4m) during year X.

Additional information

In addition:

During the year X actual benefit outgo was as expected, ie 1.0m.

Calculation of the pension cost for year X

The interest cost on the net liability / asset is calculated as:

Interest on liabilities of 2.11m as under FRS 17.

less

Interest on assets of

40m 0.055 15% 4m 1m 1.0550.5 1 2.19m

Net interest cost = - 0.08m.

This could also be calculated by determining the interest on the net asset/liability at the

start of the year and the net cashflow as follows:

1.6m 0.055 0.68 10% 4m 1.0550.5 1 0.08m

The pension cost which passes through the profit and loss account for year X is:

CSC 0.68m

Interest cost on net liability / asset (0.08)m

Past service cost 0.00m

Gains/losses from settlements/curtailments 0.00m

Pension cost 0.60m

The Actuarial Education Company IFE: 2014 Examinations

Page 26 SA4: CMP Upgrade 2013/14

Calculation of the balance sheet item at 31 December X

The expected value of the defined benefit obligation at the year-end is:

Value of obligation at 1/1/X 38.40m

Value of accruing benefits (CSC + employee contributions) 0.88m

Interest on liabilities 2.11m

Past service cost 0.00m

Benefits paid (1.00m)

Expected value of the obligation at 31/12/X 40.39m

Employee contributions are equal to 0.2m (5% of 4m).

The actual value of the obligation is 42.0m. Therefore, there is an actuarial loss on the

obligation of 1.61m (42.00m - 40.39m) .

The expected value of the assets at the year-end is:

Value of the assets at 1/1/X 40.00m

Interest on the assets 2.19m

Contributions received 0.60m

Benefits paid (1.00m)

Expected value of the assets at 31/12/X 41.79m

The actual value of the assets is 35m. Therefore, there is an actuarial loss on the assets

of 6.79m (35.00m - 41.79m) .

Therefore, overall there is an actuarial loss of 8.40m (1.61m + 6.79m) during year X

and this will be recognised through the OCI.

The pension liability shown in the balance sheet at 31 December X will be:

Value of obligation 42.0m

Value of assets (35.0m)

Obligation recognised in the balance sheet at the year-end 7.0m

Chapter 23, Section 8

Section 8 has been moved back to become Section 9 and a new Section 8 has been

added. As a convenient way to add to your notes, this follows on the next page:

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 27

8 Incentive exercises

8.1 Description of the option

These are exercises where the members are given an incentive to take up an

option. The two exercises most commonly undertaken in the UK are Enhanced

Transfer Values and Pension Increase Exchanges.

As discussed in Chapter 6 an incentive exercise is one of the options that can be

considered in order for the employer to facilitate de-risking of the defined benefit

scheme.

Enhanced Transfer Values

Enhanced Transfer Values (ETVs): these are options offered to non-pensioners.

Members are offered an enhancement to their benefits in order to encourage

them to transfer out of the scheme. Enhancements are usually in the form of an

uplift to the transfer value or a cash lump sum incentive.

ETVs may also be offered to members as an alternative to buying out their deferred

benefits with an insurance company. Which option is beneficial to each member

depends on a number of factors, including the level of the enhancement and the

members personal circumstances. For example, single members may benefit from the

ETV option as they may be able to use all the funds to provide benefits for themselves

only.

Pension Increase Exchange

Pension Increase Exchange (PIE) exercise: these are options offered to members

whereby they exchange their entitlement to non-statutory pension increases for

a one-off uplift to their pension. This option can be offered to existing

pensioners as a one-off exercise and also to future pensioners as an option on

retirement. The level of uplift can be set such that the overall liability is reduced.

The Actuarial Education Company IFE: 2014 Examinations

Page 28 SA4: CMP Upgrade 2013/14

Non-statutory increases on a pension would be reduced or removed and the amount of

initial pension would be increased. The reduction in the non-statutory increases may be

applied to a tranche of pension:

which is receiving increases but has no statutory entitlement to increase, or

which has a statutory entitlement to increase but is receiving a higher level of

increase than required by law and the reduction will not take it below the

statutory entitlement.

8.2 Restrictions

Concerns have existed as to whether pension scheme members are being

treated fairly and fully understand the implications of taking up the option. A

voluntary Code of Good Practice for Incentive Exercises has been published with

the purpose of ensuring that such exercises are carried out to a high standard.

A Code of Good Practice for Incentive Exercises was introduced in response to industry

and government concerns that incentive exercises could be conducted in a way that

disadvantaged pension scheme members. The Code was written by an industry working

group and published in June 2012.

More details can be found at:

http://www.incentiveexercises.org.uk

The key features of the Code include:

Cash and other non-pension incentives are not permitted if they are to be

paid only if the member agrees to exercise the option.

Incentives include anything which has a value to the member that is not a

pension benefit arising from a UK registered pension scheme. This includes cash

payments and receipt of goods and services.

Cash payments designed to encourage engagement with the process are allowed,

eg incentives to encourage members to seek advice.

Communications with members should be fair, clear, unbiased and

straightforward.

Members cannot accept any offer until they have received impartial

financial advice, paid for by the party initiating the offer (usually the

employer).

Remuneration for advice must not be related to take up rates or involve

commission.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 29

Advice should be tailored to the individual and their circumstances as a whole

including consideration of all materially relevant factors known after reasonable

enquiries.

Exercises should allow sufficient time for members to make up their mind with

no undue pressure applied. Members must be given a cooling-off period

of at least two weeks after accepting the offer, during which they can

change their minds.

For PIE exercise this means designing option forms such that they allow

members to change their decisions within two weeks. For ETVs this means

retaining the transfer value within the scheme for two weeks, before transferring

it.

For PIE exercises, the percentage by which the present value of members

pensions would be altered should be communicated clearly and

prominently.

The percentage quoted in the Code is the Balanced Deal Percentage (BDP),

which is defined as:

Present value of the additional pension following the PIE

Present value of the pension increases given up as part of the PIE

This calculation must be undertaken using the framework for actuarial

equivalence tests as described in Chapter 4, Section 1- Modification of schemes.

Where a PIE exercise results in no change to the present value of the

liabilities (this is hard to determine and depends on the assumptions chosen, but

some advisers may consider this to be the case if for example the BDP is 100%),

members must receive guidance before accepting the offer.

Where it results in a reduction (similarly this may be considered to be the case

if the BDP is less than 100%), members must be offered advice.

For ETV exercises advice should be provided to the member.

For ETV exercises, advice should be given by a party regulated by the

FSA.

This is because this advice is regulated by the Financial Conduct Authority

(FCA) (previously the FSA) and therefore the adviser will need to comply with

the FCAs requirements.

Records should be retained by the various parties involved in an exercise so that

an audit trail is maintained and can be examined in future.

The Code is not retrospective but employers are encouraged to apply it

retrospectively.

The Actuarial Education Company IFE: 2014 Examinations

Page 30 SA4: CMP Upgrade 2013/14

Incentive exercises should only be offered to members who are over age 80 on

an opt-in basis. Advisers should adhere to a vulnerable client policy when

providing advice.

All parties involved in an incentive exercise should ensure that they are aware of

their roles and responsibilities and act in good faith in the areas over which they

have direct control.

The Pensions Regulator has also issued guidance on incentive exercises and this can be

found at:

http://www.thepensionsregulator.gov.uk/guidance/incentive-exercises.aspx

8.3 Assumptions

Enhanced Transfer Values

ETVs are often calculated by adding a margin to the unreduced CETV (the ICE), for

example a margin of 20% could be added (ie applying a factor of 1.2 to the ICE).

However, a variety of techniques could be used, for example:

adding a margin to the reduced CETV

reducing the discount rate used in the calculation by 1% pa

adding 1,000 to each CETV.

Pension Increase Exchange

The same principles apply as for Section 7 but as the Code proposes that the calculation

must be undertaken using the framework for actuarial equivalence tests it would be

appropriate for the CETV basis to be used.

So the critical calculation is a ratio of two annuities that reflects the members sex, age

and marital status, and the different pension increases in the two annuities. Thus, the

key assumption is the level of pension increases in the two annuities. The level of

price inflation will be particularly important if the increases relate to price inflation.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 31

Glossary

Some new definitions have been added as follows:

Auto-enrolment

A requirement in the UK such that employees not currently in an employer-

related pension arrangement must be automatically enrolled into a scheme

provided by their employer. A multi-employer scheme has been set up to be

used as a vehicle for auto-enrolment (see NEST).

Fiduciary

A legal or ethical relationship between two parties. A fiduciary is a party who

typically takes care of money for another party and acts at all times for the sole

benefit of the other party. Pension scheme trustees have a fiduciary relationship

with the scheme members.

National Employment Savings Trust (NEST)

A multi-employer defined contribution scheme set up by the UK Government to

act as a vehicle for auto-enrolment which may be offered by employers who do

not wish to set up their own scheme.

The Actuarial Education Company IFE: 2014 Examinations

Page 32 SA4: CMP Upgrade 2013/14

3 Changes to the ActEd Course Notes

We recommend that you read the whole of the new version of the Course Notes and

Study Guide to ensure that you are familiar with the course. There have been a large

number of changes to the ActEd text and we do not attempt to list all of these changes

here.

However, in order to help you focus your preparation we summarise the significant

changes to the content of the Course Notes not covered by the Core Reading changes

above. For example, there are various updates for the date of the latest professional

guidance which are referenced in the Core Reading changes (in particular in Chapters 1

and 5) and so these are not repeated again here.

This document should be read in conjunction with the Corrections document.

Chapter 1

The table of current UK data has been updated for the 2013/14 tax year.

Chapter 2

The objectives of the Pensions Regulator, which can be found on its website, have been

updated on page 14.

Chapter 4: Section 5.5

The ActEd text at the start of Section 5.5 has been updated. As a convenient way to add

to your notes, this follows on the next page:

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 33

5.5 Regulation of funding of defined benefit schemes

TPR is keen to identify those schemes where members benefits appear to be at greatest

risk. The Regulator may question the trustees of such schemes further to see whether

they have taken all reasonable steps to maximise the security of members benefits.

The security of members benefits is influenced by the prudence of the assumptions

used to calculate the liabilities and the method and time period over which any deficit is

removed.

In order to identify these schemes TPR use a filter mechanism based on risk indicators.

This is a move away from setting triggers focused on individual items such as technical

provisions. These indicators include:

whether recovery plan contributions and the amount of investment risk

appropriately reflect the relative strength of the employer and also the

affordability of contributions

any specific issues and concerns relating to deterioration in sponsor covenant

strength or possible avoidance

the shape of recovery plans including initial low levels of contributions

the investment performance assumed over the life of the recovery plan

any significant issues from previous valuation submissions.

Further details can be found in the 2013 DB annual funding statement at:

http://www.thepensionsregulator.gov.uk/docs/db-annual-funding-statement-

2013.pdf

The Actuarial Education Company IFE: 2014 Examinations

Page 34 SA4: CMP Upgrade 2013/14

Chapter 4: Section 8

Section 8 has been updated as follows:

The Pensions Act 2004 made provisions for the Financial Assistance Scheme (FAS).

The FAS compensates some people who have had benefits reduced because:

they were members of an under-funded defined benefit scheme that started to

wind-up between 1 January 1997 and 5 April 2005, and

their scheme began to wind-up and did not have enough money to pay members

benefits, and

the employer cannot pay the shortfall because it is insolvent, no longer exists or

no longer has to meet its commitment to pay its debt to the pension scheme, or

the scheme started to wind up after 5 April 2005 but is ineligible for help from

the PPF due to the employer becoming insolvent before this date.

The scheme came into operation on 1 September 2005 and the benefits have been

improved on a number of occasions since then and are now closer to those payable from

the PPF. The FAS will now top up members benefits so that, overall, they receive 90%

of their expected pension, subject to a maximum overall cap of 32,575 pa, payable

from scheme normal retirement age (but not before age 60), increasing with CPI up to a

maximum of 2.5% pa.

The cap is increased annually in line with inflation, as measured by the CPI, and the

figure of 32,575 pa applies to anyone whose entitlement starts between 1 April 2013

and 31 March 2014.

The FAS is administered by the Board of the Pension Protection Fund.

Chapter 7

Section 1 on eligibility has been updated to allow for the auto-enrolment provisions. In

particular a new paragraph has been added after the first Core Reading paragraph on

page 2, as follows:

Whilst membership must be voluntary, with the introduction of auto-enrolment the

emphasis has changed. Employers are required to place employees in a scheme to meet

the auto-enrolment requirements (if they are not in one already). Employees can then

opt out, which requires an active decision by the employee, and this should help

encourage provision. Auto-enrolment was discussed in detail in Chapters 2 and 3.

IFE: 2014 Examinations The Actuarial Education Company

SA4: CMP Upgrade 2013/14 Page 35

Chapter 8

References to the European Court of Justices gender directive have been added on

pages 4 and 5. The directive states that with effect from 21 December 2012 it is not

lawful for insurers to take gender into account when deciding the price of insurance.

The judgment does not apply directly to pension schemes but implies that gender

specific calculations may contravene the European Unions general principles of non-

discrimination.

Chapter 27

Section 2.2 on multi-employer schemes has been updated and the ActEd text in this

section now reads as follows:

The rules governing debt on employer for multi-employer schemes are complicated and

were amended with effect from April 2010 and January 2012. However, in summary

the regulations permit an employer that is ceasing to participate in a multi-employer

scheme to pay less than its share of the statutory debt on employer (Section 75 debt),

provided certain conditions are met. Depending on the regulatory mechanism used, the

debt may not be triggered or may be modified or apportioned to another employer.

TPR has issued guidance on multi-employer schemes and employer departures. This

guidance, which was issued in July 2012, can be viewed on TPRs website at:

http://www.thepensionsregulator.gov.uk/guidance/multi-employer-schemes-and-

employer-departures.aspx

The Actuarial Education Company IFE: 2014 Examinations

Page 36 SA4: CMP Upgrade 2013/14

4 Changes to the Q&A Bank and X Assignments

We have updated questions and solutions for the changes in the Core Reading and

ActEd text. There have been changes to the Q&A Bank, and in particular to the X

assignments. Assignments X2 and X4 have been extensively rewritten, and include a

number of new questions.

We only accept the current version of assignments for marking, ie those published for

the sessions leading to the 2014 exams. If you wish to submit your script for marking

but have only an old version, then you can order the current assignments free of charge

if you have purchased the same assignments in the same subject the previous year (ie

sessions leading to the 2013 exams), and have purchased marking for the 2014 session.

IFE: 2014 Examinations The Actuarial Education Company

Anda mungkin juga menyukai

- ST6 Pu 15 PDFDokumen60 halamanST6 Pu 15 PDFPolelarBelum ada peringkat

- ST2 Pu 15 PDFDokumen26 halamanST2 Pu 15 PDFPolelarBelum ada peringkat

- ST7 Pu 15 PDFDokumen82 halamanST7 Pu 15 PDFPolelarBelum ada peringkat

- ST4 Pu 15 PDFDokumen106 halamanST4 Pu 15 PDFPolelarBelum ada peringkat

- Sa5 Pu 15 PDFDokumen52 halamanSa5 Pu 15 PDFPolelarBelum ada peringkat

- ST8 Pu 15 PDFDokumen58 halamanST8 Pu 15 PDFPolelarBelum ada peringkat

- ST5 Pu 15 PDFDokumen30 halamanST5 Pu 15 PDFPolelarBelum ada peringkat

- Sa2 Pu 15 PDFDokumen108 halamanSa2 Pu 15 PDFPolelarBelum ada peringkat

- ST9 Pu 15 PDFDokumen10 halamanST9 Pu 15 PDFPolelarBelum ada peringkat

- Sa1 Pu 15 PDFDokumen78 halamanSa1 Pu 15 PDFPolelarBelum ada peringkat

- Ca3 Pu 15 PDFDokumen10 halamanCa3 Pu 15 PDFPolelarBelum ada peringkat

- ST9 Pu 14 PDFDokumen6 halamanST9 Pu 14 PDFPolelarBelum ada peringkat

- CT7 Pu 15 PDFDokumen8 halamanCT7 Pu 15 PDFPolelarBelum ada peringkat

- ST8 Pu 14 PDFDokumen42 halamanST8 Pu 14 PDFPolelarBelum ada peringkat

- Sa5 Pu 14 PDFDokumen102 halamanSa5 Pu 14 PDFPolelarBelum ada peringkat

- Sa4 Pu 15 PDFDokumen9 halamanSa4 Pu 15 PDFPolelarBelum ada peringkat

- Ca1 Pu 15 PDFDokumen30 halamanCa1 Pu 15 PDFPolelar0% (1)

- ST7 Pu 14 PDFDokumen84 halamanST7 Pu 14 PDFPolelarBelum ada peringkat

- ST6 Pu 14 PDFDokumen60 halamanST6 Pu 14 PDFPolelarBelum ada peringkat

- ST4 Pu 14 PDFDokumen10 halamanST4 Pu 14 PDFPolelarBelum ada peringkat

- ST5 Pu 14 PDFDokumen12 halamanST5 Pu 14 PDFPolelarBelum ada peringkat

- ST2 Pu 14 PDFDokumen26 halamanST2 Pu 14 PDFPolelarBelum ada peringkat

- Sa1 Pu 14 PDFDokumen212 halamanSa1 Pu 14 PDFPolelarBelum ada peringkat

- Sa2 Pu 14 PDFDokumen150 halamanSa2 Pu 14 PDFPolelarBelum ada peringkat

- Sa3 Pu 14 PDFDokumen114 halamanSa3 Pu 14 PDFPolelarBelum ada peringkat

- Sa6 Pu 14 PDFDokumen118 halamanSa6 Pu 14 PDFPolelarBelum ada peringkat

- R.C. Sproul and Greg Bahnsen Debate - Greg Bahnsen's IntroductionDokumen2 halamanR.C. Sproul and Greg Bahnsen Debate - Greg Bahnsen's IntroductionPolelarBelum ada peringkat

- Subject CA2: CMP Upgrade 2013/14Dokumen7 halamanSubject CA2: CMP Upgrade 2013/14PolelarBelum ada peringkat

- Ca3 Pu 14 PDFDokumen16 halamanCa3 Pu 14 PDFPolelarBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (74)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- IESE GlovoDokumen17 halamanIESE GlovoBill Jason Duckworth100% (1)

- 100 000 Worth of The Biggest Money Making Secrets Ever RevealedDokumen102 halaman100 000 Worth of The Biggest Money Making Secrets Ever Revealedyoosha100% (2)

- Global Brand - Mcdonalds' StrategiesDokumen7 halamanGlobal Brand - Mcdonalds' StrategiesRajvi DesaiBelum ada peringkat

- Top Qualities of A Successful BusinessmanDokumen40 halamanTop Qualities of A Successful Businessmansufyanbutt007Belum ada peringkat

- A Study On Investor S Perception Towards Online Trading (Srinivalula Reddy)Dokumen30 halamanA Study On Investor S Perception Towards Online Trading (Srinivalula Reddy)DowlathAhmedBelum ada peringkat

- MOU With DCB Bank 9may16Dokumen10 halamanMOU With DCB Bank 9may16Sainik AddaBelum ada peringkat

- Merrita Francis ResumeDokumen2 halamanMerrita Francis Resumeapi-534828135Belum ada peringkat

- Fin546 Islamic Finance Soalan Final SampleDokumen7 halamanFin546 Islamic Finance Soalan Final Samplehazra fazreendaBelum ada peringkat

- Alphaex Capital Candlestick Pattern Cheat SheetDokumen5 halamanAlphaex Capital Candlestick Pattern Cheat SheetMuraliSankar Mahalingam100% (1)

- MUDRA - The Way ForwardDokumen14 halamanMUDRA - The Way ForwardManishGuptaBelum ada peringkat

- Sales GST 31Dokumen1 halamanSales GST 31ashish.asati1Belum ada peringkat

- Larsen & ToubroDokumen15 halamanLarsen & ToubroAngel BrokingBelum ada peringkat

- Questionnaire: TITLE: The Effect of Liquidity Management On Financial Performance Section A: Demographic ProfileDokumen4 halamanQuestionnaire: TITLE: The Effect of Liquidity Management On Financial Performance Section A: Demographic ProfileDeeqow XayeesiBelum ada peringkat

- Group 6 - Joline CaseDokumen11 halamanGroup 6 - Joline CaseSamhitha ABBelum ada peringkat

- Solutions Manual For Operations Management 11E Jay Heizer Barry Render (PDFDrive)Dokumen9 halamanSolutions Manual For Operations Management 11E Jay Heizer Barry Render (PDFDrive)ASAD ULLAH0% (2)

- Case Study (ENT530)Dokumen12 halamanCase Study (ENT530)Nur Diyana50% (2)

- IT OS Part 5Dokumen4 halamanIT OS Part 5Business RecoveryBelum ada peringkat

- Registered Engineer Ramesh MDokumen9 halamanRegistered Engineer Ramesh MVenkatBelum ada peringkat

- ZNM STJV Qac ST XX 000037 (00) 1111Dokumen2 halamanZNM STJV Qac ST XX 000037 (00) 1111Roshan George PhilipBelum ada peringkat

- EVA and Compensation Management at TCSDokumen9 halamanEVA and Compensation Management at TCSioeuser100% (1)

- Reformulation of Financial StatementsDokumen30 halamanReformulation of Financial StatementsKatty MothaBelum ada peringkat

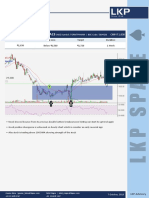

- LKP Spade - Torrent Pharma - 7octDokumen3 halamanLKP Spade - Torrent Pharma - 7octpremBelum ada peringkat

- The Sticking Point SolutionDokumen9 halamanThe Sticking Point SolutionTim JoyceBelum ada peringkat

- Quiz 14 - Financial ManagementDokumen9 halamanQuiz 14 - Financial ManagementAurelio Delos Santos Macatulad Jr.Belum ada peringkat

- Official Attachment ReportDokumen27 halamanOfficial Attachment ReporttawandaBelum ada peringkat

- Cost New Suggested IanDokumen609 halamanCost New Suggested IanSuZan DhaMiBelum ada peringkat

- Crude Oil MethodologyDokumen63 halamanCrude Oil MethodologyKingsuk BurmanBelum ada peringkat

- Introduction To Accounting Chapter 1 (ABM)Dokumen31 halamanIntroduction To Accounting Chapter 1 (ABM)Ofelia RagpaBelum ada peringkat

- An Analysis of Case 16-59 From Managerial Accounting by Hilton 8th EditionDokumen7 halamanAn Analysis of Case 16-59 From Managerial Accounting by Hilton 8th EditionTyrelle CastilloBelum ada peringkat

- HRM in Nishat MillsDokumen6 halamanHRM in Nishat MillsSabaBelum ada peringkat