Altman Form 6 - 2014

Diunggah oleh

Matthew Daniel Nye0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan8 halamanAltman Form 6 - 2014

Hak Cipta

© © All Rights Reserved

Format Tersedia

PDF atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniAltman Form 6 - 2014

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

15 tayangan8 halamanAltman Form 6 - 2014

Diunggah oleh

Matthew Daniel NyeAltman Form 6 - 2014

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai PDF atau baca online dari Scribd

Anda di halaman 1dari 8

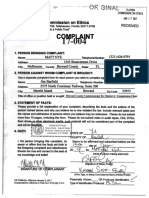

FORM 6 FULL AND PUBLIC DISCLOSURE

OF FINANCIAL INTERESTS,

FOR OFFICE USE ONLY:

FLORIDA

COMMISSION ON ETHICS

SSUREE ppocessep AT

Senate i 1

Elected Consttuonal Ofer ocose {NNT |

2237 Rockledge Dr

Rockledge FL 32955-5403 IDNo. 74566

beet HOU oe yet

Conf. Code

Altman , Thirrel (Thad) Adolphus

CHECK IF THIS IS AFILING BYAcANOIDATE OD

PART A— NET WORTH

Please enter the value of your net worth as of December 31, 2014. [Note: Net worth is not calculated by

subtracting your reported liabilities from your reported assets, so please see the instructions on page 3.]

PART B— ASSETS.

HOUSEHOLD GOODS AND PERSONAL EFFECTS:

Household goods and personal eects may be reported in a lump sum if their aggregate value exceeds $1,000. This category includes any of the

{aliwing, not held for investment purposes: jewelry: colectons of stamps, guns. and numismatic Rams; at objects; householé equipment and

fumishings; clothing, other housahald items; and vehicles for personal use, nnether owned or leased,

Te aggregate value of my houses goods and personal fects (described aboveyies WS, ODO

[ASSETS INDIVIDUALLY VALUED AT OVER $1,000:

DESCRIPTION OF ASSET (specific description is required - see instructions 4) VALUE OF ASSET

See Kit: 2, “AN

PART C ~ LIABILITIES

LIABILITIES IN EXCESS OF $1,000 (See instructions on page 4)

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY

| See Attachment “B"

JOINT AND SEVERAL LIABILITIES NOT REPORTED ABOVE:

NAME AND ADDRESS OF CREDITOR AMOUNT OF LIABILITY.

Ban ee airae Corinto sa) ET

PART D ~ INCOME

‘You may EITHER (1) file @ complete copy of your 2014 federal income tax rtur, including all W2's, schedules, and attachments, OR (2) fle a sworn

Statement identifying each separate source and amount of income which exceeds $9,000, ining secondary sources of Income, by completing the

femainder of Part D, below.

1 etect ote copy of my 2014 federal income tax rtum and all W2's, schedules, and attachments

I you check this box and attach copy of your 2014 tax return, you neee not complete the remainder of Part ©.)

PRIMARY SOURCES OF INCOME (Seo instructions on page 5):

NAME OF SOURCE OF INCONE EXCEEDING $1,000 ADDRESS OF SOURCE OF INCOME AMOUNT

s A { yo

SECONDARY SOURCES OF INCOME [Major customers, clenis, etc, of businesses owned by reporting person~see instuctons on page 5}

NAME OF NAME OF MAJOR SOURCES. ADRESS PRINCIPAL BUSINESS

BUSINESS ENTITY (OF BUSINESS INCOME OF SOURCE ACTIVITY OF SOURCE

PART E ~ INTERESTS IN SPECIFIED BUSINESSES [Instructions on page 6]

BUSINESS ENTITY #1 BUSINESS ENTITY #2 BUSINESS ENTITY #3

TAUE OF

BUSINESS enTTY

"ADDRESS OF

BUSINESS ENTITY

‘PRINCIPAL BUSINESS

AcTWITY

POSITION HELD

WITH ENTIFY

TOWN MORE THAN AS

INTEREST IN THE BUSINESS

NATURE OF MY.

OWNERSHIP INTEREST

PART “TRAINING

For offers required to complete annual ethics training pursuant to section 112.9142, FS.

| CERTIFY THAT:I HAVE COMPLETED THE REQUIRED TRAINING.

STATE OF FLORDA

OATH county OF Brevard _

|, te porson whose name appears atthe ‘sworn (or feed) and subscribed betore me tis LF day ot

Deciing of is tm, do depose on tho amaon mis by Thavcve| (Thad) Al donan

‘and say thatthe information disclosed on this form

and ary tachment hereto is re, accurate, co Mase Berra a

and complete

KD eric. A Herta A, M4 by vagy, mone

SIGNATURE OF REPORTING OFFICIAL OR CANDIDATE Typ of Keniicaton Produced

Ifa certified public accountant licensed under Chapter 473, or attomey in good standing withthe Florida Bar prepared this form for you, he or

she must complete the following statement

\ prepared the CE Form 6 in accordance with At. Il, Sec. 8, Florida Constitution,

‘Sacion 112.8144, Florida Statutes, and the insuctons to the form. Upon my reasonable knowledge and belie, the disclosure herein is rue

Signature Date

Preparation of this form by a CPA or attorney docs not relieve the filer of the responsibility to sign the form under oath.

TEFORNG. eleane Janay 2

‘pea by tron fie 344.0020), FAC.

ATTACHMENT “A”

Part B - Assets

2106 Lionel Drive, Melbourne, FL 32955 (Rental House)

2237 Rockledge Drive, Rockledge, FL 32955 (Home)

The Pines Resort LLC (Parcel ID 27-37-11-00-00264.0-0000.00)

114 Snead Road A-F, Indian Harbour Beach, FL 32937

(15% Ownership, Banana River Dr. Resort LLC)

P.O. Box 360911, Melbourne, FL 32936-0911

Surrender Value of Life Insurance

Genworth Life Insurance Company

3100 Albert Langford Drive,

Lynchburg, Virginia 24501

‘Surrender Value of Life Insurance

State Farm

366 N. Babcock Street, Suite 102,

Melbourne, FL 32935-6800

TIAA CREF (Retirement Portfolio) See Attachment "C”

Bank of America (Checking)

175 E NASA Blvd, Melbourne, FL 32901

Space Coast Credit Union (Savings)

20 S Wickham Rd, Melbourne, FL 32904

Attachment “B”

Part C - Liabilities

‘Space Coast Credit Union (Car Loan)

8045 N. Wickham Rd. Melbourne, FL 32940

‘Space Coast Credit Union (Car Loan)

8045 N. Wickham Rd. Melbourne, FL 32940

Space Coast Credit Union (Car Loan)

8045 N. Wickham Rd. Melbourne, FL 32940

Nissan Motor Acceptance Corp. (Car Loan)

P.O. Box 660360 Dallas, Texas

Altman, Thirrel A TR, (Mortgage)

P.O. Box 360911, Melbourne, FL 32936

171,080

600,420

682,500

62,354

11,310

25,911

23,332

1,270

4,567

18,848

34,297

10,582

600,005

Anda mungkin juga menyukai

- Matt Nye For Florida House 2020 NRA Candidate QuestionnaireDokumen5 halamanMatt Nye For Florida House 2020 NRA Candidate QuestionnaireMatthew Daniel NyeBelum ada peringkat

- Florida Medicaid Pharmacy Claims AnalysisDokumen203 halamanFlorida Medicaid Pharmacy Claims AnalysisMatthew Daniel NyeBelum ada peringkat

- RPOF Model Constitution 04-28-17Dokumen9 halamanRPOF Model Constitution 04-28-17Matthew Daniel NyeBelum ada peringkat

- 2014-15 Astronauts Memorial Foundation Audited Financial StatementsDokumen26 halaman2014-15 Astronauts Memorial Foundation Audited Financial StatementsMatthew Daniel NyeBelum ada peringkat

- Whistleblower Response ProcessDokumen4 halamanWhistleblower Response ProcessMatthew Daniel NyeBelum ada peringkat

- 2015-16 Astronauts Memorial Foundation Audited Financial StatementsDokumen26 halaman2015-16 Astronauts Memorial Foundation Audited Financial StatementsMatthew Daniel NyeBelum ada peringkat

- Republican Liberty Caucus of Central East Florida Bylaws: Article I: NameDokumen8 halamanRepublican Liberty Caucus of Central East Florida Bylaws: Article I: NameMatthew Daniel NyeBelum ada peringkat

- Item I.1., Civility Ordinance and Policy - D3Dokumen4 halamanItem I.1., Civility Ordinance and Policy - D3Matthew Daniel NyeBelum ada peringkat

- Whistleblower WB18-001 Investigation - Final ReportDokumen12 halamanWhistleblower WB18-001 Investigation - Final ReportMatthew Daniel Nye100% (1)

- BREC Bylaws (As Revised On 11-08-2017)Dokumen5 halamanBREC Bylaws (As Revised On 11-08-2017)Matthew Daniel NyeBelum ada peringkat

- 2013-14 Astronuats Memorial Foundation Audited Financial StatementsDokumen28 halaman2013-14 Astronuats Memorial Foundation Audited Financial StatementsMatthew Daniel NyeBelum ada peringkat

- District 4 County Commission Office Time Cards PPE 180907Dokumen3 halamanDistrict 4 County Commission Office Time Cards PPE 180907Matthew Daniel NyeBelum ada peringkat

- 5 17003 ComplaintDokumen19 halaman5 17003 ComplaintMatthew Daniel NyeBelum ada peringkat

- Altman 2018 Form 6 Financial DisclosureDokumen8 halamanAltman 2018 Form 6 Financial DisclosureMatthew Daniel NyeBelum ada peringkat

- 1 - 17003 Pre-Probable Cause Joint StipulationDokumen5 halaman1 - 17003 Pre-Probable Cause Joint StipulationMatthew Daniel NyeBelum ada peringkat

- 2 - 17003 Advocate's RecommendationDokumen7 halaman2 - 17003 Advocate's RecommendationMatthew Daniel NyeBelum ada peringkat

- 6 17004 ComplaintDokumen19 halaman6 17004 ComplaintMatthew Daniel NyeBelum ada peringkat

- 3 - 17003 Report of InvestigationDokumen27 halaman3 - 17003 Report of InvestigationMatthew Daniel NyeBelum ada peringkat

- 5 - 17004 Order To InvestigateDokumen2 halaman5 - 17004 Order To InvestigateMatthew Daniel NyeBelum ada peringkat

- 4 - 17004 Report of InvestigationDokumen29 halaman4 - 17004 Report of InvestigationMatthew Daniel NyeBelum ada peringkat

- 2 - 17004 Advocate's RecommendationDokumen6 halaman2 - 17004 Advocate's RecommendationMatthew Daniel NyeBelum ada peringkat

- Astronaut Memorial Foundation Financials 2013-2014Dokumen27 halamanAstronaut Memorial Foundation Financials 2013-2014Matthew Daniel NyeBelum ada peringkat

- 1 - 17004 Pre-Probable Cause Joint StipulationDokumen4 halaman1 - 17004 Pre-Probable Cause Joint StipulationMatthew Daniel NyeBelum ada peringkat

- Altman Form 6 - 2011Dokumen2 halamanAltman Form 6 - 2011Matthew Daniel NyeBelum ada peringkat

- Altman Form 6 - 2016Dokumen7 halamanAltman Form 6 - 2016Matthew Daniel NyeBelum ada peringkat

- 120517-Add-On VI.F.2Dokumen5 halaman120517-Add-On VI.F.2Matthew Daniel NyeBelum ada peringkat

- Altman Form 6 - 2013Dokumen9 halamanAltman Form 6 - 2013Matthew Daniel NyeBelum ada peringkat

- FL Chapter 2013-235 TRDA RemovedDokumen3 halamanFL Chapter 2013-235 TRDA RemovedMatthew Daniel NyeBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (894)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)