Equilibrium and Social Welfare: Theoretical Tools of Public Finance

Diunggah oleh

penelopegerhardJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Equilibrium and Social Welfare: Theoretical Tools of Public Finance

Diunggah oleh

penelopegerhardHak Cipta:

Format Tersedia

CHAPTER 2 THEORETICAL TOOLS OF PUBLIC FINANCE 43

hours of leisure and work 90 hours per year (point A, where her indifference

curve is tangent to the budget constraint with a $5,000 guarantee). At that

level of labor supply, her wage earnings are $900. Because her TANF guaran-

tee is reduced by $0.50 for each $1 of earnings, however, her total income is

the $900 in earnings plus a net TANF benefit of $5,000 0.5 $900

$4,550. So her total consumption expenditures are $900 $4,550 $5,450.

(The mathematics of this example is shown in the appendix to this chapter.)

When the TANF guarantee is reduced to $3,000, Sarah chooses to reduce

her leisure since she is now poorer (the income effect), moving to point B on

the new budget constraint. At that point, she takes only 1,655 hours of leisure

per year, works 345 hours, and earns $3,450. For this mother, the governor is

right; the reduction in TANF guarantee has raised her labor supply from

90 hours to 345 hours. Note that because Sarahs TANF benefits are reduced by

half her earnings, her TANF benefits are now $3,000 0.5 $3,450 $1,275.

Thus, her total budget is $4,725; her consumption has fallen by $725 from the

days of the higher TANF guarantee ($5,450 $4,725 $725). Her consump-

tion has not fallen by the full $2,000 cut in the guarantee because she has

compensated for the guarantee reduction by working harder.

Figure 2-11 illustrates the case of a different single mother, Naomi, with a

utility function U 75 ln(C) 300 ln(L). Naomi puts a much larger

weight on leisure relative to consumption, when compared to Sarah. (Her

indifference curves are steeper, indicating that a larger increase in consumption

is required to compensate for any reduction in leisure.) For Naomi, the optimal

choice when the TANF guarantee is $5,000 is to not work at all; she consumes

2,000 hours of leisure and $5,000 of food (point A). When the guarantee is

reduced to $3,000, this mother continues not to work, and just lets her con-

sumption fall to $3,000. That is, she cares so much more about leisure than

about consumption that she wont supplement her TANF guarantee with

earnings even at the lower guarantee level. For this mother, the secretary is

right; the reduction in TANF guarantee has had no effect on labor supply, it

has simply cut her level of food consumption.

Thus, theory alone cannot tell you whether this policy change will increase

labor supply, or by how much. Theoretically, labor supply could rise, but it

might not. To move beyond this uncertainty, you will have to analyze available

data on single mother labor supply, and the next chapter presents the empirical

methods for doing so. From these various methods, you will conclude that the

governor is right: there is strong evidence that cutting TANF benefits will

increase labor supply.

2.3

Equilibrium and Social Welfare

he disagreement we have been discussing is over whether the labor sup-

T ply of single mothers will rise or not when TANF benefits are cut. As a

good public finance economist, however, you know not to stop there. What

Anda mungkin juga menyukai

- Math Mammoth Grade1A Samples PDFDokumen47 halamanMath Mammoth Grade1A Samples PDFNithiyarajan Masilamany100% (1)

- X30531Dokumen48 halamanX30531Conrado Pinho Junior50% (2)

- Denial of Right Warning of Arrest Intent To Lien Affidavit of Complaint Walmart GM Lee Store #2360 in Play Time Is Over The TruthDokumen11 halamanDenial of Right Warning of Arrest Intent To Lien Affidavit of Complaint Walmart GM Lee Store #2360 in Play Time Is Over The Truthahmal coaxumBelum ada peringkat

- Final Year Project Proposal in Food Science and TechnologyDokumen11 halamanFinal Year Project Proposal in Food Science and TechnologyDEBORAH OSOSANYABelum ada peringkat

- 2018 Curriculum Guide CompleteDokumen139 halaman2018 Curriculum Guide Completepenelopegerhard100% (2)

- SOP Customer ComplaintDokumen2 halamanSOP Customer ComplaintMohd Kamil77% (52)

- 20201002181018YWLEE003Consumer Theory SolutionDokumen28 halaman20201002181018YWLEE003Consumer Theory SolutionDương DươngBelum ada peringkat

- Man Kiw Chapter 21 Solutions ProblemsDokumen9 halamanMan Kiw Chapter 21 Solutions Problemswincist67% (3)

- 6 Habits of True Strategic ThinkersDokumen64 halaman6 Habits of True Strategic ThinkersPraveen Kumar JhaBelum ada peringkat

- Security Awareness TrainingDokumen95 halamanSecurity Awareness TrainingChandra RaoBelum ada peringkat

- Isa 75.03 1992 PDFDokumen14 halamanIsa 75.03 1992 PDFQuang Duan NguyenBelum ada peringkat

- Bar Business PlanDokumen30 halamanBar Business Planharshkhemka108Belum ada peringkat

- Bar Business PlanDokumen30 halamanBar Business Planharshkhemka108Belum ada peringkat

- Bar Business PlanDokumen30 halamanBar Business Planharshkhemka108Belum ada peringkat

- FineScale Modeler - September 2021Dokumen60 halamanFineScale Modeler - September 2021Vasile Pop100% (2)

- Division Worksheet PacketDokumen16 halamanDivision Worksheet Packetpenelopegerhard100% (1)

- Bus Math-Module 5.5 Standard DeductionsDokumen67 halamanBus Math-Module 5.5 Standard Deductionsaibee patatagBelum ada peringkat

- Account Statement 2012 August RONDokumen5 halamanAccount Statement 2012 August RONAna-Maria DincaBelum ada peringkat

- Basic Review CardDokumen6 halamanBasic Review CardSheena LeavittBelum ada peringkat

- Basic Review CardDokumen6 halamanBasic Review CardSheena LeavittBelum ada peringkat

- Computation of TaxDokumen17 halamanComputation of TaxJo LouiseBelum ada peringkat

- Essay On FamilyDokumen2 halamanEssay On Familyapi-277963081Belum ada peringkat

- Puyat vs. Arco Amusement Co (Gaspar)Dokumen2 halamanPuyat vs. Arco Amusement Co (Gaspar)Maria Angela GasparBelum ada peringkat

- Income and Substitution Effects Introduced Earlier. Suppose, For Example, ThatDokumen1 halamanIncome and Substitution Effects Introduced Earlier. Suppose, For Example, ThatpenelopegerhardBelum ada peringkat

- Meyer/Corinth Response To CritiqueDokumen7 halamanMeyer/Corinth Response To CritiqueGlennKesslerWPBelum ada peringkat

- Module 8 HomeworkDokumen3 halamanModule 8 HomeworkRuth KatakaBelum ada peringkat

- Chapter 5 - RedistributionDokumen21 halamanChapter 5 - RedistributionRosemaryTanBelum ada peringkat

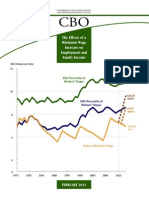

- CBO Minimum Wage ReportDokumen55 halamanCBO Minimum Wage Reportgerald brittBelum ada peringkat

- Labor Econ Problem Set AnswersDokumen19 halamanLabor Econ Problem Set AnswerspoipojopoBelum ada peringkat

- Assignment No. 1 Micro Economics Syed Atif Ali GR NO. 230633Dokumen11 halamanAssignment No. 1 Micro Economics Syed Atif Ali GR NO. 230633Syed Atif AliBelum ada peringkat

- HW1-Fiscal Policy Homework Sadler's AnswersDokumen4 halamanHW1-Fiscal Policy Homework Sadler's AnswersindiraBelum ada peringkat

- Chapter 6 Reviewer 2Dokumen8 halamanChapter 6 Reviewer 2Mark Alvin De LeonBelum ada peringkat

- Backward Bending CurveDokumen5 halamanBackward Bending CurveUrvashi BhatnagarBelum ada peringkat

- The Effects of A Minimum-Wage Increase On Employment and Family IncomeDokumen43 halamanThe Effects of A Minimum-Wage Increase On Employment and Family IncomeJeffrey DunetzBelum ada peringkat

- 07 - The MultiplierDokumen26 halaman07 - The MultiplierZarin TasnimBelum ada peringkat

- REPORT: The Impact of The Tax Framework On Middle Class FamiliesDokumen3 halamanREPORT: The Impact of The Tax Framework On Middle Class FamiliesbwingfieldBelum ada peringkat

- Economics Graded Homework - UnemploymentDokumen2 halamanEconomics Graded Homework - UnemploymentMedia GuyBelum ada peringkat

- Chap 003 SolutionsDokumen10 halamanChap 003 SolutionsFreeBooksandMaterialBelum ada peringkat

- Campaign Media Releas2Dokumen3 halamanCampaign Media Releas2Political AlertBelum ada peringkat

- Salary Wage Income BenefitsDokumen23 halamanSalary Wage Income BenefitsIan SumastreBelum ada peringkat

- Chap 013 SolutionsDokumen7 halamanChap 013 SolutionsNg Hai Woon AlwinBelum ada peringkat

- Module 13Dokumen5 halamanModule 13Carla Mae F. DaduralBelum ada peringkat

- 130 PS1 SolutionsDokumen4 halaman130 PS1 Solutionsbel pinheiroBelum ada peringkat

- Week 011-012-Module Salaries and Wages (Part 1 - 2)Dokumen9 halamanWeek 011-012-Module Salaries and Wages (Part 1 - 2)Joana MarieBelum ada peringkat

- Why It Is Mathematically Impossible To Live On Minimum WageDokumen7 halamanWhy It Is Mathematically Impossible To Live On Minimum Wageeg0538959Belum ada peringkat

- ECO209 Macroeconomic Theory: Consumption and SavingDokumen5 halamanECO209 Macroeconomic Theory: Consumption and SavingKiranBelum ada peringkat

- Chap 002Dokumen8 halamanChap 002crazyaznraver13Belum ada peringkat

- Dube MinwageDokumen7 halamanDube MinwageTBP_Think_Tank100% (1)

- I Cant RetireDokumen7 halamanI Cant RetireDoy E. RussellBelum ada peringkat

- p98 PDFDokumen1 halamanp98 PDFpenelopegerhardBelum ada peringkat

- Eissa Leibman1996Dokumen37 halamanEissa Leibman1996andreaBelum ada peringkat

- HB4285 - SB255 Cost ImpactDokumen2 halamanHB4285 - SB255 Cost ImpactRob LawrenceBelum ada peringkat

- Solution Manual For Macroeconomics 15th Canadian Edition Campbell R Mcconnell Stanley L Brue Sean Masaki Flynn Tom BarbieroDokumen17 halamanSolution Manual For Macroeconomics 15th Canadian Edition Campbell R Mcconnell Stanley L Brue Sean Masaki Flynn Tom Barbierothomaslucasikwjeqyonm100% (24)

- Member and Fund ImpactDokumen2 halamanMember and Fund ImpactWCCO - CBS MinnesotaBelum ada peringkat

- I. True, False and UncertainDokumen4 halamanI. True, False and UncertainNeemaBelum ada peringkat

- Topic 5-MANAGING THE ECONOMY 1 - FISCAL POLICYDokumen24 halamanTopic 5-MANAGING THE ECONOMY 1 - FISCAL POLICYBENTRY MSUKUBelum ada peringkat

- All Past YeAR PAPERSDokumen131 halamanAll Past YeAR PAPERSmehtashlok100Belum ada peringkat

- BUS 5213 Lesson 3: Fiscal Policy Objectives: 4. Examine The Supply of and Demand For MoneyDokumen27 halamanBUS 5213 Lesson 3: Fiscal Policy Objectives: 4. Examine The Supply of and Demand For MoneyAChristensen1299Belum ada peringkat

- HSC403R Final ExamsDokumen6 halamanHSC403R Final ExamsAchu Miranda 'MahBelum ada peringkat

- Essentials of Economics 3rd Edition Brue Solutions ManualDokumen6 halamanEssentials of Economics 3rd Edition Brue Solutions Manualfloroncozwkk100% (15)

- Lecture4 PublicDokumen8 halamanLecture4 PublicNikunjBelum ada peringkat

- Modern Labor Economics Theory and Public Policy 12th Edition Ehrenberg Solutions Manual DownloadDokumen8 halamanModern Labor Economics Theory and Public Policy 12th Edition Ehrenberg Solutions Manual DownloadMichael West100% (18)

- Greater Financial Security For Women With Personal Retirement Accounts, Cato Briefing PaperDokumen10 halamanGreater Financial Security For Women With Personal Retirement Accounts, Cato Briefing PaperCato InstituteBelum ada peringkat

- Is There Really An Inflation Tax - Not For The Middle Class and The Ultra-Wealthy by Edward N. WolffDokumen66 halamanIs There Really An Inflation Tax - Not For The Middle Class and The Ultra-Wealthy by Edward N. WolffMoazzamDarBelum ada peringkat

- Answers To Homework Macro QuestionsDokumen38 halamanAnswers To Homework Macro QuestionsAmna ShahBelum ada peringkat

- Problem SetDokumen10 halamanProblem SetRachael MutheuBelum ada peringkat

- 2nd YearDokumen5 halaman2nd YearShalini DasBelum ada peringkat

- 1ST Assignment Ipl01075Dokumen8 halaman1ST Assignment Ipl01075Md MujtabaBelum ada peringkat

- Supply of Labor To The Economy: The Decision To Work: SummaryDokumen7 halamanSupply of Labor To The Economy: The Decision To Work: SummaryOona NiallBelum ada peringkat

- Av Eba 2013 - Wage Proposal AnalysisDokumen4 halamanAv Eba 2013 - Wage Proposal AnalysisSteve McGhieBelum ada peringkat

- Geriel I Fajardo FM 3 AsssssDokumen2 halamanGeriel I Fajardo FM 3 AsssssGeriel FajardoBelum ada peringkat

- Eco104 MidtermDokumen5 halamanEco104 Midtermfazle rabby MobinBelum ada peringkat

- Supply Curve of LabourDokumen3 halamanSupply Curve of LabourTim InawsavBelum ada peringkat

- Contemporary Labor Economics 11th Edition Mcconnell Solutions ManualDokumen35 halamanContemporary Labor Economics 11th Edition Mcconnell Solutions Manualexedentzigzag.96ewc100% (26)

- A Wage Is A CompensationDokumen14 halamanA Wage Is A CompensationAkshay BadheBelum ada peringkat

- Understanding Life Insurance and Imputed Income: Table 1 RatesDokumen3 halamanUnderstanding Life Insurance and Imputed Income: Table 1 RatesarbindokiluBelum ada peringkat

- Macroeconomic Analysis AnswersDokumen4 halamanMacroeconomic Analysis Answersibrahim b s kamaraBelum ada peringkat

- The Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsDari EverandThe Incentive Plan for Efficiency in Government Operations: A Program to Eliminate Government DeficitsBelum ada peringkat

- Chap 001Dokumen34 halamanChap 001penelopegerhardBelum ada peringkat

- Business CommunicationDokumen3 halamanBusiness CommunicationpenelopegerhardBelum ada peringkat

- My Getting Ready For 1st Grade Math Summer PracticeBook CommoDokumen10 halamanMy Getting Ready For 1st Grade Math Summer PracticeBook CommopenelopegerhardBelum ada peringkat

- Moose Mountain 0Dokumen28 halamanMoose Mountain 0gavinbuzzBelum ada peringkat

- BB Business Plan Example102111Dokumen31 halamanBB Business Plan Example102111penelopegerhardBelum ada peringkat

- Sample Business Plan PDFDokumen12 halamanSample Business Plan PDFpenelopegerhardBelum ada peringkat

- p03 PDFDokumen1 halamanp03 PDFpenelopegerhardBelum ada peringkat

- This Page Intentionally Left BlankDokumen1 halamanThis Page Intentionally Left BlankpenelopegerhardBelum ada peringkat

- Health Insurance I: Health Economics and Private Health InsuranceDokumen1 halamanHealth Insurance I: Health Economics and Private Health InsurancepenelopegerhardBelum ada peringkat

- 20 Things Kids Need To Know To Live Financially Smart Lives: Make ChoicesDokumen1 halaman20 Things Kids Need To Know To Live Financially Smart Lives: Make ChoicespenelopegerhardBelum ada peringkat

- An Overview of Health Care in The United StatesDokumen1 halamanAn Overview of Health Care in The United StatespenelopegerhardBelum ada peringkat

- Social Insurance and RedistributionDokumen1 halamanSocial Insurance and RedistributionpenelopegerhardBelum ada peringkat

- Market EquilibriumDokumen1 halamanMarket EquilibriumpenelopegerhardBelum ada peringkat

- p99 PDFDokumen1 halamanp99 PDFpenelopegerhardBelum ada peringkat

- p98 PDFDokumen1 halamanp98 PDFpenelopegerhardBelum ada peringkat

- Rawlsian Social Welfare Function: Choosing An Equity CriterionDokumen1 halamanRawlsian Social Welfare Function: Choosing An Equity CriterionpenelopegerhardBelum ada peringkat

- p91 PDFDokumen1 halamanp91 PDFpenelopegerhardBelum ada peringkat

- p97 PDFDokumen1 halamanp97 PDFpenelopegerhardBelum ada peringkat

- p92 PDFDokumen1 halamanp92 PDFpenelopegerhardBelum ada peringkat

- Equity: Introduction and BackgroundDokumen1 halamanEquity: Introduction and BackgroundpenelopegerhardBelum ada peringkat

- p93 PDFDokumen1 halamanp93 PDFpenelopegerhardBelum ada peringkat

- Producer SurplusDokumen1 halamanProducer SurpluspenelopegerhardBelum ada peringkat

- Verbal Reasoning 8Dokumen64 halamanVerbal Reasoning 8cyoung360% (1)

- MCQ Chapter 1Dokumen9 halamanMCQ Chapter 1K57 TRAN THI MINH NGOCBelum ada peringkat

- This PDF by Stockmock - in Is For Personal Use Only. Do Not Share With OthersDokumen4 halamanThis PDF by Stockmock - in Is For Personal Use Only. Do Not Share With OthersPdffBelum ada peringkat

- A Review On The Political Awareness of Senior High School Students of St. Paul University ManilaDokumen34 halamanA Review On The Political Awareness of Senior High School Students of St. Paul University ManilaAloisia Rem RoxasBelum ada peringkat

- User Manual: RAID 5 and RAID 10 Setup in Windows 10Dokumen31 halamanUser Manual: RAID 5 and RAID 10 Setup in Windows 10Ical RedHatBelum ada peringkat

- Letter of Appeal Pacheck Kay Tita ConnieDokumen2 halamanLetter of Appeal Pacheck Kay Tita ConnieNikko Avila IgdalinoBelum ada peringkat

- EEE Assignment 3Dokumen8 halamanEEE Assignment 3shirleyBelum ada peringkat

- Chapter 4 ProjDokumen15 halamanChapter 4 ProjEphrem ChernetBelum ada peringkat

- Strategy Output Activity (Ppa) : Activities (Ppas) For The Social Sector Activities (Ppas) For The Education Sub-SectorDokumen3 halamanStrategy Output Activity (Ppa) : Activities (Ppas) For The Social Sector Activities (Ppas) For The Education Sub-Sectorstella marizBelum ada peringkat

- Change Your Life PDF FreeDokumen51 halamanChange Your Life PDF FreeJochebed MukandaBelum ada peringkat

- Comparative Analysis On Renaissance and 20th Century Modern ArchitectureDokumen2 halamanComparative Analysis On Renaissance and 20th Century Modern ArchitectureJeriel CandidatoBelum ada peringkat

- Glossary of Fashion Terms: Powered by Mambo Generated: 7 October, 2009, 00:47Dokumen4 halamanGlossary of Fashion Terms: Powered by Mambo Generated: 7 October, 2009, 00:47Chetna Shetty DikkarBelum ada peringkat

- Policies Toward Monopolies and Oligopolies Privatization and DeregulationDokumen10 halamanPolicies Toward Monopolies and Oligopolies Privatization and DeregulationJamaica RamosBelum ada peringkat

- The Ethiopian Electoral and Political Parties Proclamation PDFDokumen65 halamanThe Ethiopian Electoral and Political Parties Proclamation PDFAlebel BelayBelum ada peringkat

- Power Quality Improvement in Distribution Networks Containing DistributedDokumen6 halamanPower Quality Improvement in Distribution Networks Containing DistributedsmruthiBelum ada peringkat

- Course SyllabusDokumen9 halamanCourse SyllabusJae MadridBelum ada peringkat

- Continuous Improvement Requires A Quality CultureDokumen12 halamanContinuous Improvement Requires A Quality Culturespitraberg100% (19)

- Research Paper On RapunzelDokumen8 halamanResearch Paper On RapunzelfvgcaatdBelum ada peringkat

- 4 - ISO - 19650 - Guidance - Part - A - The - Information - Management - Function - and - Resources - Edition 3Dokumen16 halaman4 - ISO - 19650 - Guidance - Part - A - The - Information - Management - Function - and - Resources - Edition 3Rahul Tidke - ExcelizeBelum ada peringkat