Case Questions on GPS and Surveillance Projects NPV

Diunggah oleh

Farhanie NordinDeskripsi Asli:

Judul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Case Questions on GPS and Surveillance Projects NPV

Diunggah oleh

Farhanie NordinHak Cipta:

Format Tersedia

Case Questions

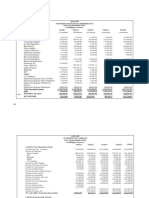

1. What are the appropriate costs of capital for the GPS transmitter and surveillance aircraft

projects?

GPS Transmitter Projections

Average Beta 1.666

Premium 5%

Cost of Equity 12.33%

Cost of Debt 2%

Weighted Equity 60%

Weighted Debt 40%

WACC 7.96%

WACC = ( ) + ( )(1 )

+ +

WACC = (0.6) (12.33%) + (0.4) (0.02) (1-0.03)

= 7.96%

Surveillance Aircraft Projections

Average Beta

Premium

Cost of Equity

Cost of Debt

Weighted Equity

Weighted Debt

WACC

2. What are the net present values of the two projects?

GPS Transmitter Projections

Selling and

Corporate Administration software

Year Units Sales Cost of good sold Overhead Cost mainatenane CF before tax Tax CF after tax Initial cost NPV

1 5000 2,500,000.00 (1,750,000.00) (250,000.00) (750,000.00) (50,000.00) (300,000.00) (90,000.00) (390,000.00) 2,500,000.00 $ (611,011.01)

2 5500 2,750,000.00 (1,925,000.00) (250,000.00) (750,000.00) (50,000.00) (225,000.00) (67,500.00) (292,500.00)

3 6050 3,025,000.00 (2,117,500.00) (250,000.00) (750,000.00) (50,000.00) (142,500.00) (42,750.00) (185,250.00)

4 6655 3,327,500.00 (2,329,250.00) (250,000.00) (750,000.00) (50,000.00) (51,750.00) (15,525.00) (67,275.00)

5 7320.5 3,660,250.00 (2,562,175.00) (250,000.00) (750,000.00) (50,000.00) 48,075.00 14,422.50 62,497.50

6 8052.55 4,026,275.00 (2,818,392.50) (250,000.00) (750,000.00) (50,000.00) 157,882.50 47,364.75 205,247.25

7 8857.805 4,428,902.50 (3,100,231.75) (250,000.00) (750,000.00) (50,000.00) 278,670.75 83,601.23 362,271.98

8 9743.586 4,871,792.75 (3,410,254.93) (250,000.00) (750,000.00) (50,000.00) 411,537.83 123,461.35 534,999.17

9 10717.94 5,358,972.03 (3,751,280.42) (250,000.00) (750,000.00) (50,000.00) 557,691.61 167,307.48 724,999.09

10 11789.74 5,894,869.23 (4,126,408.46) (250,000.00) (750,000.00) (50,000.00) 718,460.77 215,538.23 933,999.00

Total 1,888,988.99

Sales = Unit $500

COGS = Unit $350

Surveillance Aircraft Projections

Selling and

Corporate Administration

Year Units Sales Cost of good sold Overhead Cost CF before tax Tax CF after tax Initial cost NPV

1 250 15000000 (13,500,000.00) (750,000.00) (2500000.00) (1,750,000.00) (525,000.00) (2,275,000.00) 2,500,000.00 19,925,000.00

2 500 30000000 (27,000,000.00) (750,000.00) (2500000.00) (250,000.00) (75,000.00) (325,000.00)

3 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

4 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

5 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

6 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

7 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

8 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

10 1000 60000000 (54,000,000.00) (750,000.00) (2500000.00) 2,750,000.00 825,000.00 3,575,000.00

Total 22,425,000.00

Sales = Unit $60,000

COGS = Unit $54,000

3. Which projects would you recommend to the NPRC? Why?

Anda mungkin juga menyukai

- NPV Lesson 2Dokumen5 halamanNPV Lesson 2Barack MikeBelum ada peringkat

- NPV Lesson 2 Workings - Class BDokumen6 halamanNPV Lesson 2 Workings - Class BBarack MikeBelum ada peringkat

- Corporate Finance Case Study WorkingDokumen11 halamanCorporate Finance Case Study WorkingS.H. Rustam16% (19)

- RetoSA - EmirDokumen21 halamanRetoSA - EmirEdward Marcell BasiaBelum ada peringkat

- 660 Final Assignment M-1Dokumen16 halaman660 Final Assignment M-1Maruf ChowdhuryBelum ada peringkat

- Complete Investment Appraisal - 2Dokumen7 halamanComplete Investment Appraisal - 2Reagan SsebbaaleBelum ada peringkat

- A. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramDokumen13 halamanA. Generate The Cumulative (Non-Discounted) After-Tax Cash Flow DiagramHaziq Hakimi100% (1)

- Capital Budgeting Techniques and Cash Flows Class ExerciseDokumen6 halamanCapital Budgeting Techniques and Cash Flows Class ExerciseReynaldi DimasBelum ada peringkat

- Calpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01Dokumen68 halamanCalpine - CGT19008, 19018, 19024, 19027, 19029 - Rev01KshitishBelum ada peringkat

- BUS 5110 - Written Assignment - Unit 6Dokumen5 halamanBUS 5110 - Written Assignment - Unit 6Aliyazahra KamilaBelum ada peringkat

- CTA LEVEL 2 FT - Financial Accounting Test 2 2021 - SolutionDokumen3 halamanCTA LEVEL 2 FT - Financial Accounting Test 2 2021 - SolutioncuthbertBelum ada peringkat

- Financial Statement Activity W AnswersDokumen4 halamanFinancial Statement Activity W AnswersLizlee LaluanBelum ada peringkat

- ENTI Ver 1Dokumen72 halamanENTI Ver 1krishna chaitanyaBelum ada peringkat

- Project Payback & IRR AnalysisDokumen5 halamanProject Payback & IRR AnalysisYashwini KomagenBelum ada peringkat

- BRS3B Assessment Opportunity 1 2019Dokumen11 halamanBRS3B Assessment Opportunity 1 2019221103909Belum ada peringkat

- Nike Inc - Cost of Capital - Syndicate 10Dokumen16 halamanNike Inc - Cost of Capital - Syndicate 10Anthony KwoBelum ada peringkat

- Chapter 28Dokumen6 halamanChapter 28Shane Ivory ClaudioBelum ada peringkat

- essayFIN202Dokumen5 halamanessayFIN202thaindnds180468Belum ada peringkat

- The Directors of Ayr Co. Effiong James NDokumen36 halamanThe Directors of Ayr Co. Effiong James NRob Van Helden100% (3)

- Financial ProjectionDokumen55 halamanFinancial ProjectionVinayak SilverlineswapBelum ada peringkat

- Earned Value ChartDokumen4 halamanEarned Value ChartRanda S JowaBelum ada peringkat

- Sneaker 2013Dokumen13 halamanSneaker 2013Hirosha Vejian100% (2)

- Jawaban Soal Quiz No 2 Dan 3Dokumen4 halamanJawaban Soal Quiz No 2 Dan 3Anthony indrahalimBelum ada peringkat

- SSBPloanDokumen6 halamanSSBPloanSyahmi Samsudin100% (1)

- CF AssignDokumen7 halamanCF AssignKhanh LinhBelum ada peringkat

- ABC Corporation's 2019 Financial Statement AnalysisDokumen15 halamanABC Corporation's 2019 Financial Statement AnalysisHallasgo, Elymar SorianoBelum ada peringkat

- NPV & MatrixDokumen10 halamanNPV & MatrixEricka Alipio AusteroBelum ada peringkat

- Written Assignment Solution Unit 6Dokumen6 halamanWritten Assignment Solution Unit 6Emmanuel Gift Bernard100% (1)

- Valuation Final ExamDokumen4 halamanValuation Final ExamJeane Mae Boo100% (1)

- Case 5Dokumen12 halamanCase 5JIAXUAN WANGBelum ada peringkat

- SamigroupDokumen9 halamanSamigroupsamidan tubeBelum ada peringkat

- Buy or Rent CalculatorDokumen34 halamanBuy or Rent CalculatorfgrfvrnmsBelum ada peringkat

- Ffa ADokumen5 halamanFfa Aaccounts officerBelum ada peringkat

- Finals Quiz Assignment Private Equity Valuation Methods With AnswersDokumen7 halamanFinals Quiz Assignment Private Equity Valuation Methods With AnswersRille Estrada CabanesBelum ada peringkat

- Project PDA Conch Republic: Ebit 13,000,000 9,300,000Dokumen4 halamanProject PDA Conch Republic: Ebit 13,000,000 9,300,000Harsya FitrioBelum ada peringkat

- V!s!t!l!ty Statement of Financial Performance Table 1Dokumen15 halamanV!s!t!l!ty Statement of Financial Performance Table 1Carl Toks Bien InocetoBelum ada peringkat

- Capital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallyDokumen14 halamanCapital Budgeting Machine Purchase Saves Rs. 11 Lacs AnnuallybhaskkarBelum ada peringkat

- Financial Slide For ReportDokumen6 halamanFinancial Slide For ReportTuan Noridham Tuan LahBelum ada peringkat

- AF Ch. 4 - Analysis FS - ExcelDokumen9 halamanAF Ch. 4 - Analysis FS - ExcelAlfiandriAdinBelum ada peringkat

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDokumen14 halamanCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeBelum ada peringkat

- Cost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentDokumen9 halamanCost Residual Value Dapriciable Amount Useful Life Building Machinery EquipmentcharlottevinsmokeBelum ada peringkat

- Girum Tsega PerfectDokumen13 halamanGirum Tsega PerfectMesi YE GIBelum ada peringkat

- Break-Even Point (BEP) Waktu Balik ModalDokumen2 halamanBreak-Even Point (BEP) Waktu Balik ModalDodik ArviantoBelum ada peringkat

- Cement Factory Financial PlanDokumen4 halamanCement Factory Financial PlanJoey MWBelum ada peringkat

- Rack Draft - 01.08-2021Dokumen42 halamanRack Draft - 01.08-2021Rashan Jida ReshanBelum ada peringkat

- Mini Case: Bethesda Mining Company: Disusun OlehDokumen5 halamanMini Case: Bethesda Mining Company: Disusun Olehrica100% (2)

- Mandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Dokumen4 halamanMandaluyong Corporation Comparative Statement of Financial Position Assets 2022 2021Mohammad Raffe GuroBelum ada peringkat

- EVA, VPL e CVA 2003Dokumen4 halamanEVA, VPL e CVA 2003Pedro CoutinhoBelum ada peringkat

- Economic Feasibility Workbook: Created By: Date Created: August 27, 2021 Purpose: WorksheetsDokumen9 halamanEconomic Feasibility Workbook: Created By: Date Created: August 27, 2021 Purpose: WorksheetsAashutosh ChandraBelum ada peringkat

- Spinning Project FeasibilityDokumen19 halamanSpinning Project FeasibilityMaira ShahidBelum ada peringkat

- Iceland Financial Projections 5 YearsDokumen10 halamanIceland Financial Projections 5 YearsShiela Mae Azarcon TuvillaBelum ada peringkat

- Making Capital Investment DecisionsDokumen48 halamanMaking Capital Investment DecisionsJerico ClarosBelum ada peringkat

- Earned Value Calculation: Old Designations Bcws BCWP AcwpDokumen4 halamanEarned Value Calculation: Old Designations Bcws BCWP Acwpguy88Belum ada peringkat

- JaletaDokumen8 halamanJaletaአረጋዊ ሐይለማርያምBelum ada peringkat

- United MetalDokumen2 halamanUnited MetalshakilnaimaBelum ada peringkat

- Capital BudgetingDokumen20 halamanCapital BudgetingAngelo VilladoresBelum ada peringkat

- Revenue Projection:: 47.6 Accounts Receivable 37.6 Inventory Accounts PayableDokumen8 halamanRevenue Projection:: 47.6 Accounts Receivable 37.6 Inventory Accounts Payablesaqibriaz8771Belum ada peringkat

- Q1Dokumen31 halamanQ1Bhaskkar SinhaBelum ada peringkat

- Personal ProfileDokumen13 halamanPersonal ProfileKristine Lei Del MundoBelum ada peringkat

- Quantitative Finance: Its Development, Mathematical Foundations, and Current ScopeDari EverandQuantitative Finance: Its Development, Mathematical Foundations, and Current ScopeBelum ada peringkat

- Blaine Kitchenware Case Study SolutionDokumen5 halamanBlaine Kitchenware Case Study SolutionFarhanie Nordin100% (2)

- Risk and Return Note 1Dokumen12 halamanRisk and Return Note 1Farhanie NordinBelum ada peringkat

- Revenue Recognition of AirAsiaDokumen5 halamanRevenue Recognition of AirAsiaFarhanie NordinBelum ada peringkat

- Current IssueDokumen10 halamanCurrent IssueFarhanie NordinBelum ada peringkat

- Case 1 - Financial Statements 2014 Using Financial Ratios To Identify CompaniesDokumen3 halamanCase 1 - Financial Statements 2014 Using Financial Ratios To Identify CompaniesFarhanie Nordin0% (1)

- Analysis of DELLDokumen12 halamanAnalysis of DELLMuhammad Afzal100% (1)

- Chapter 12 Mini Case SolutionsDokumen10 halamanChapter 12 Mini Case SolutionsFarhanie NordinBelum ada peringkat

- Risk-Profiling - Understanding Your Risk Tolerance Towards InvestingDokumen3 halamanRisk-Profiling - Understanding Your Risk Tolerance Towards InvestingFarhanie NordinBelum ada peringkat

- Case Study 5Dokumen3 halamanCase Study 5Farhanie NordinBelum ada peringkat

- Case 1 - Financial Statements 2014 Using Financial Ratios To Identify Companies PDFDokumen3 halamanCase 1 - Financial Statements 2014 Using Financial Ratios To Identify Companies PDFFarhanie NordinBelum ada peringkat

- Chapter 12 Mini Case SolutionsDokumen10 halamanChapter 12 Mini Case SolutionsFarhanie NordinBelum ada peringkat

- Group Assignment-2 AnswerDokumen6 halamanGroup Assignment-2 AnswerFarhanie NordinBelum ada peringkat

- Chapter 4: Financial Planning and Forecasting: Multiple ChoiceDokumen19 halamanChapter 4: Financial Planning and Forecasting: Multiple ChoiceFarhanie NordinBelum ada peringkat

- Dell Working CapitalDokumen3 halamanDell Working CapitalShashank Agarwal89% (9)

- Latest Seminar Case Study 2Dokumen4 halamanLatest Seminar Case Study 2Farhanie Nordin100% (1)

- Case Study 1stDokumen2 halamanCase Study 1stFarhanie Nordin100% (1)

- Chapter 1Dokumen22 halamanChapter 1Farhanie NordinBelum ada peringkat

- 03-Report Case Study Chapter 2Dokumen6 halaman03-Report Case Study Chapter 2Farhanie Nordin100% (1)

- What Is TPPADokumen4 halamanWhat Is TPPAFarhanie NordinBelum ada peringkat

- IntroductionDokumen2 halamanIntroductionFarhanie NordinBelum ada peringkat

- Case 1 - Financial Statements 2014 Using Financial Ratios To Identify CompaniesDokumen3 halamanCase 1 - Financial Statements 2014 Using Financial Ratios To Identify CompaniesFarhanie Nordin0% (1)

- What Is TPPADokumen4 halamanWhat Is TPPAFarhanie NordinBelum ada peringkat

- Result Obtained +solution+ Recomend To Society (Written Report)Dokumen9 halamanResult Obtained +solution+ Recomend To Society (Written Report)Farhanie NordinBelum ada peringkat

- MethodologyDokumen1 halamanMethodologyFarhanie NordinBelum ada peringkat

- Takaful Questionare LatestDokumen4 halamanTakaful Questionare LatestFarhanie NordinBelum ada peringkat

- Chapter 1-The Scope of Corporate Finance: Multiple ChoiceDokumen13 halamanChapter 1-The Scope of Corporate Finance: Multiple ChoiceFarhanie NordinBelum ada peringkat

- Final Revised ResearchDokumen35 halamanFinal Revised ResearchRia Joy SanchezBelum ada peringkat

- Good Paper On Time SerisDokumen15 halamanGood Paper On Time SerisNamdev UpadhyayBelum ada peringkat

- इंटरनेट मानक का उपयोगDokumen16 halamanइंटरनेट मानक का उपयोगUdit Kumar SarkarBelum ada peringkat

- Prospectus2023 24 PDFDokumen332 halamanProspectus2023 24 PDFramgharia sameerBelum ada peringkat

- Basic Unix Commands: Cat - List A FileDokumen3 halamanBasic Unix Commands: Cat - List A Filekathir_tkBelum ada peringkat

- Nursing Effective Leadership in Career DevelopmentDokumen4 halamanNursing Effective Leadership in Career DevelopmentAlan Divine BBelum ada peringkat

- How To Write A Cover Letter For A Training ProgramDokumen4 halamanHow To Write A Cover Letter For A Training Programgyv0vipinem3100% (2)

- January 2008 Ecobon Newsletter Hilton Head Island Audubon SocietyDokumen6 halamanJanuary 2008 Ecobon Newsletter Hilton Head Island Audubon SocietyHilton Head Island Audubon SocietyBelum ada peringkat

- Portland Cement: Material Safety Data Sheet (MSDS)Dokumen6 halamanPortland Cement: Material Safety Data Sheet (MSDS)eslam sokaBelum ada peringkat

- AIX For System Administrators - AdaptersDokumen2 halamanAIX For System Administrators - Adaptersdanielvp21Belum ada peringkat

- Reaction PaperDokumen1 halamanReaction Papermarvin125Belum ada peringkat

- The Alkazi Collection of Photography Vis PDFDokumen68 halamanThe Alkazi Collection of Photography Vis PDFMochamadRizkyNoorBelum ada peringkat

- Building Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What AreDokumen22 halamanBuilding Materials Alia Bint Khalid 19091AA001: Q) What Are The Constituents of Paint? What Arealiyah khalidBelum ada peringkat

- 6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston CollegeDokumen17 halaman6 Lesson Writing Unit: Personal Recount For Grade 3 SEI, WIDA Level 2 Writing Kelsie Drown Boston Collegeapi-498419042Belum ada peringkat

- Abhivyakti Yearbook 2019 20Dokumen316 halamanAbhivyakti Yearbook 2019 20desaisarkarrajvardhanBelum ada peringkat

- Postmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarDokumen4 halamanPostmodern Dystopian Fiction: An Analysis of Bradbury's Fahrenheit 451' Maria AnwarAbdennour MaafaBelum ada peringkat

- AIESEC - Exchange Participant (EP) GuidebookDokumen24 halamanAIESEC - Exchange Participant (EP) GuidebookAnonymous aoQ8gc1Belum ada peringkat

- Sikkim Public Works Liability of Government and Contractor Act 1983Dokumen11 halamanSikkim Public Works Liability of Government and Contractor Act 1983Latest Laws TeamBelum ada peringkat

- Ferret Fiasco: Archie Carr IIIDokumen8 halamanFerret Fiasco: Archie Carr IIIArchie Carr III100% (1)

- The Man of Sorrows Wednesday of Holy Week Divine IntimacyDokumen5 halamanThe Man of Sorrows Wednesday of Holy Week Divine IntimacyTerri ThomasBelum ada peringkat

- Credit Suisse AI ResearchDokumen38 halamanCredit Suisse AI ResearchGianca DevinaBelum ada peringkat

- Recommender Systems Research GuideDokumen28 halamanRecommender Systems Research GuideSube Singh InsanBelum ada peringkat

- Financial Management-Capital BudgetingDokumen39 halamanFinancial Management-Capital BudgetingParamjit Sharma100% (53)

- Grammar Level 1 2013-2014 Part 2Dokumen54 halamanGrammar Level 1 2013-2014 Part 2Temur SaidkhodjaevBelum ada peringkat

- MAT 1100 Mathematical Literacy For College StudentsDokumen4 halamanMAT 1100 Mathematical Literacy For College StudentsCornerstoneFYEBelum ada peringkat

- Court of Appeals: DecisionDokumen11 halamanCourt of Appeals: DecisionBrian del MundoBelum ada peringkat

- Connotative Vs Denotative Lesson Plan PDFDokumen5 halamanConnotative Vs Denotative Lesson Plan PDFangiela goc-ongBelum ada peringkat

- JSP - How To Edit Table of Data Displayed Using JSP When Clicked On Edit ButtonDokumen8 halamanJSP - How To Edit Table of Data Displayed Using JSP When Clicked On Edit Buttonrithuik1598Belum ada peringkat

- Practise Active and Passive Voice History of Central Europe: I Lead-InDokumen4 halamanPractise Active and Passive Voice History of Central Europe: I Lead-InCorina LuchianaBelum ada peringkat

- 01 ElectricalDokumen15 halaman01 ElectricalKrishna KrishBelum ada peringkat