ME-Tut 5

Diunggah oleh

Shekhar Singh0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

45 tayangan3 halamanManagerial Economics - 2017

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniManagerial Economics - 2017

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

45 tayangan3 halamanME-Tut 5

Diunggah oleh

Shekhar SinghManagerial Economics - 2017

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 3

ME - Tutorial 5

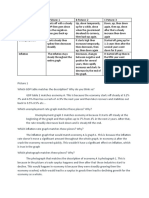

1 . Which of these is an economic activity 7. Which of the following actions is an example of

(a) A father teaching his son at home instead of sending to expansionary fiscal policy?

any coaching centre (a) a decrease in welfare payments

(b) A hair dresser doing hair cut designing on payment (b) a purchase of government securities in the open market

(c) A housewife mending her family cloths on her own (c) a decrease in the Bank rate

(d) A singer giving a show on his sons wedding anniversary (d) a decrease in the corporate profits tax rates

2. If the number of people classified as unemployed is 8. Macroeconomics is concerned with

20,000 and the number of people classified as employed is a) Only long-run trends in economic activity.

230,000, what is the unemployment rate? b) Only short-run fluctuations in the business cycle.

(a) 8% c) Both long-run trends and short-term fluctuations in

(b) 8.7% economic activity.

(c) 9.2% d) Only with changes in the overall price level.

(d) 11.5%

9. The difference between Gross National Product (GNP) and

3. It is often true that as the economy begins to recover Gross Domestic Product GDP) is

from a recession, the unemployment rate rises. Which of the (a) Excess of subsidies over indirect taxes ;

following statements would be the best explanation for this? (b) Depreciation ;

(a) The unemployment rate would rise because as the (c) Net foreign income from abroad

economy initially recovers from a recession the demand for (d) Excess of indirect taxes over subsidies

goods and services falls, so the demand for workers falls.

(b) As the economy begins to recover from a recession, 10. When the economy is facing high inflation, the government

workers who were previously discouraged about their should

chances of finding a job begin to look for work again. a) Increase spending and taxation

(c) The unemployment rate seems to rise as the economy b) Reduce spending and taxation

begins to recover from a recession because of errors in the c) Increase spending and reduce taxation

way the data are collected. d) Reduce spending and increase taxation

(d) As the economy initially recovers from a recession, firms

11. Profits earned in India by foreign-owned companies are

do not immediately increase the number of workers they

included in its

hire. Firms wait to hire more individuals until they are

a) Both GDP and GNP

convinced that the recovery is strong.

b) Neither GDP nor GNP

4. Banks can create money c) GNP but not GDP

(a) only by illegally printing additional dollar bills. d) GDP but not GNP

(b) by paying interest to their depositors.

12. A reasonable measure of the standard of living in a

(c) by making loans that result in additional deposits.

country is:

(d) by offering financial services, such as stick market

a) Real GDP per person.

brokerage.

b) Real GDP

5. When economists refer to "tight" monetary policy, they c) Nominal GDP per person

mean that the Reserve Bank of India is taking actions that d) The growth rate of nominal GDP per person.

will

13. Which of the following is a better measure of

(a) increase the demand for money.

economic development?

(b) decrease the demand for money

a. National income

(c) expand the supply of money

b. Rural consumption

(d) contract the supply of money

c. Size of exports

6. An increase in total production (real GDP) causes the d. Employment

demand for money to _____ and the interest rate to ____.

14. RBI check inflation by

(a) increase; increase

(a) Increasing bank rate ;

(b) increase; decrease

(b) Increasing CRR ;

(c) decrease; decrease

(c) Both ;

(d) decrease; increase

(d) None.

(c) Combine phenomena of demand pull and cost-push

15. If RBI wants to decrease the money supply in order to inflation. ;

check inflation it will (d) Increase in Price of precious metal

(a) Sell bonds ;

(b) Increase CRR ; 19. Cost push inflation arises due to

(c) Hike bank rate ; (a) Persistent rise in factor cost ;

(d) All or any of the above three (b) Mismatch between demand and supply of commodities

(c) Combine phenomena of demand pull and cost-push

16. If the country is passing through recession, the RBI would inflation. ;

(a) Buy bonds ; (d) Increase in price of precious metal

(b) Reduce CRR ;

(c) Ease out bank rate ; 20. The sale of government securities by the Reserve Bank of

(d) All or any of the above three India is predicted to

a. decrease reserves of the commercial banks, and eventually

17. Which of these would lead to fall in demand for money?

lead to an expansion of the money supply.

(a) Inflation ;

b. decrease reserves of the commercial banks, and eventually

(b) Increase in real income ;

cause a contraction of the money supply.

(c) Increase in real rate of interest ;

c. increase reserves of the commercial banks, and eventually

(d) Increase in wealth

cause a contraction of the money supply.

18. Demand pull inflation rises due to d. increase reserves of the commercial banks, and eventually

(a) Persistent rise in factor cost ; cause an expansion of the money supply.

(b) Mismatch between demand and supply of commodities

Solutions

1b

2a

3b

4c

5d

6a

7d

8c

9c

10 d

11 d

12 a

13 a

14 c

15 d

16 d

17 c

18 b

19 a

20 b

Anda mungkin juga menyukai

- Lecture LQT (Practice Questions)Dokumen4 halamanLecture LQT (Practice Questions)Shekhar SinghBelum ada peringkat

- Ratio & Proportion Problems SolvedDokumen10 halamanRatio & Proportion Problems SolvedShekhar SinghBelum ada peringkat

- Lecture 13 (HCF & LCM)Dokumen12 halamanLecture 13 (HCF & LCM)Shekhar SinghBelum ada peringkat

- Practice Qs - SMDADokumen3 halamanPractice Qs - SMDAShekhar SinghBelum ada peringkat

- Cash Flows Project One Project Two Cash Flows Project One Project TwoDokumen2 halamanCash Flows Project One Project Two Cash Flows Project One Project TwoShekhar SinghBelum ada peringkat

- Logical and Quantitative Techniques Logical and Quantitative TechniquesDokumen2 halamanLogical and Quantitative Techniques Logical and Quantitative TechniquesShekhar SinghBelum ada peringkat

- Lecture 15 (HCF, LCM, Fractions-Practice Questions)Dokumen13 halamanLecture 15 (HCF, LCM, Fractions-Practice Questions)Shekhar SinghBelum ada peringkat

- The Internet of ThingsDokumen1 halamanThe Internet of ThingsShekhar SinghBelum ada peringkat

- SMDA - Assignment 1 statistics problems and solutionsDokumen4 halamanSMDA - Assignment 1 statistics problems and solutionsShekhar SinghBelum ada peringkat

- Chronicle 2021 Data (SA)Dokumen1 halamanChronicle 2021 Data (SA)Shekhar SinghBelum ada peringkat

- APADokumen1 halamanAPAShekhar SinghBelum ada peringkat

- Practice Qs - SMDADokumen3 halamanPractice Qs - SMDAShekhar SinghBelum ada peringkat

- Business Analysis and Techniques Tutorial 01: Data ClassificationDokumen1 halamanBusiness Analysis and Techniques Tutorial 01: Data ClassificationShekhar SinghBelum ada peringkat

- 3Dokumen1 halaman3Shekhar SinghBelum ada peringkat

- Vice ChancellorDokumen1 halamanVice ChancellorShekhar SinghBelum ada peringkat

- ME-Tut 2Dokumen2 halamanME-Tut 2Shekhar SinghBelum ada peringkat

- 2Dokumen1 halaman2Shekhar SinghBelum ada peringkat

- Tutorial 02 DCDokumen1 halamanTutorial 02 DCShekhar SinghBelum ada peringkat

- Tut 13 Ratio and Working CapitalDokumen1 halamanTut 13 Ratio and Working CapitalShekhar SinghBelum ada peringkat

- Jumbled SentencesDokumen4 halamanJumbled SentencesShekhar SinghBelum ada peringkat

- TVM Practice QuestionsDokumen1 halamanTVM Practice QuestionsShekhar SinghBelum ada peringkat

- RCDokumen4 halamanRCShekhar SinghBelum ada peringkat

- Remedial Class Qs 2Dokumen4 halamanRemedial Class Qs 2Shekhar SinghBelum ada peringkat

- ME-Tut 1Dokumen1 halamanME-Tut 1Shekhar SinghBelum ada peringkat

- Remedial class - Supply, demand, costs and profitsDokumen3 halamanRemedial class - Supply, demand, costs and profitsShekhar SinghBelum ada peringkat

- ME - Tutorial 3 SolutionsDokumen2 halamanME - Tutorial 3 SolutionsShekhar SinghBelum ada peringkat

- ME-Tut 15Dokumen4 halamanME-Tut 15Shekhar SinghBelum ada peringkat

- Assignment 1Dokumen1 halamanAssignment 1Shekhar SinghBelum ada peringkat

- ME-Tut 4Dokumen2 halamanME-Tut 4Shekhar SinghBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5783)

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (890)

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (399)

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (587)

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (265)

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (72)

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2219)

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (119)

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)

- WRITING TASK 1 STRUCTURES AND SAMPLE 9.0Dokumen38 halamanWRITING TASK 1 STRUCTURES AND SAMPLE 9.0Jadon Hoang SanchoBelum ada peringkat

- BBE 111 Fundamentals of Entrepreneurship Module PDFDokumen92 halamanBBE 111 Fundamentals of Entrepreneurship Module PDFOnesimus Tozeyana100% (1)

- Components of External Business EnvironmentDokumen7 halamanComponents of External Business EnvironmentZoe MontillanoBelum ada peringkat

- RAJA USAMA SARWAR Manifesto For ELections and Long Term Vision FinalDokumen10 halamanRAJA USAMA SARWAR Manifesto For ELections and Long Term Vision FinalSikander Nawaz AbbasiBelum ada peringkat

- ILO Geneva document explores work-sharing and job-sharingDokumen4 halamanILO Geneva document explores work-sharing and job-sharingAxelBelum ada peringkat

- WorkDokumen12 halamanWorkkjhenyo218502Belum ada peringkat

- NN007 Commercial Real Estate in The US Industry ReportDokumen42 halamanNN007 Commercial Real Estate in The US Industry ReportchuckmorrisBelum ada peringkat

- 11th Economics Chapter 5 & 6Dokumen34 halaman11th Economics Chapter 5 & 6anupsorenBelum ada peringkat

- The Austrian Pension System: History, Development and TodayDokumen20 halamanThe Austrian Pension System: History, Development and TodayAndrzej KlimczukBelum ada peringkat

- Project in Comparative Economic Planning: Bohol Island State University-Main CampusDokumen2 halamanProject in Comparative Economic Planning: Bohol Island State University-Main CampusDevorah Jane A. AmoloBelum ada peringkat

- MacroDokumen8 halamanMacroRaindel Carl OlofernesBelum ada peringkat

- Macroeconomics Test 2 UMUCDokumen11 halamanMacroeconomics Test 2 UMUCJoshua CrawfordBelum ada peringkat

- Mongolia Country PresentationDokumen15 halamanMongolia Country PresentationADBI EventsBelum ada peringkat

- Labour LawDokumen8 halamanLabour LawDarpan MaganBelum ada peringkat

- Times Leader 05-04-2013Dokumen46 halamanTimes Leader 05-04-2013The Times LeaderBelum ada peringkat

- AP Macroeconomics Test Answers and Key ConceptsDokumen12 halamanAP Macroeconomics Test Answers and Key ConceptsNathan WongBelum ada peringkat

- Social Moral and Economic IssuesDokumen37 halamanSocial Moral and Economic IssuescasalekxianaBelum ada peringkat

- Marglin (1988) - Lessons of The Golden Age of CapitalismDokumen40 halamanMarglin (1988) - Lessons of The Golden Age of CapitalismmarceloscarvalhoBelum ada peringkat

- Bedri Foundation of Project ManagementDokumen17 halamanBedri Foundation of Project ManagementBedri M Ahmedu100% (1)

- Usha Martin Final ProjectDokumen17 halamanUsha Martin Final ProjectmanishBelum ada peringkat

- Econ PuzzleDokumen3 halamanEcon Puzzleapi-589326054Belum ada peringkat

- Economics 3 - Economic Theory & Public FinanceDokumen174 halamanEconomics 3 - Economic Theory & Public FinanceYashas Krishna100% (1)

- Buhay Estudyante The Lives of Students From Broken Families Amidst The PandemicDokumen17 halamanBuhay Estudyante The Lives of Students From Broken Families Amidst The PandemicfranzBelum ada peringkat

- Cottage Industries in PakistanDokumen1 halamanCottage Industries in Pakistanbaloch75Belum ada peringkat

- Underemployment - Definition, Causes, Effects, RateDokumen5 halamanUnderemployment - Definition, Causes, Effects, RateNirmel RanjanendranBelum ada peringkat

- Strategy FullDokumen26 halamanStrategy FullSkyng Seh Khai64% (11)

- AP Exam ReviewDokumen45 halamanAP Exam ReviewAnonymous K8b1TFPyZBelum ada peringkat

- Eating From One Pot: The Dynamics of Survival in Poor South African HouseholdsDokumen38 halamanEating From One Pot: The Dynamics of Survival in Poor South African HouseholdsLittleWhiteBakkie0% (1)

- Homeless in MalaysiaDokumen27 halamanHomeless in MalaysiaMuhamad Azlan ShahBelum ada peringkat

- Strategic Leadership Supplement: Ethics and Business MixDokumen16 halamanStrategic Leadership Supplement: Ethics and Business MixVictor ChukwuBelum ada peringkat