FPA Worksheet BalanceSheet

Diunggah oleh

Mandar BahadarpurkarHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

FPA Worksheet BalanceSheet

Diunggah oleh

Mandar BahadarpurkarHak Cipta:

Format Tersedia

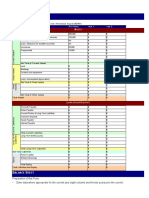

FAMILY BALANCE SHEET

Write down the value of all the things you own. For financial assets like bank and retirement accounts,

thats the balance. For things like your house or car, write down how much you can sell them for.

ASSETS (Things of value that you own)

Emergency Fund $

Checking Account $

Checking Account $

Savings Account $

Savings Account $

Cash Value of Life Insurance $

Cash Value of Life Insurance $

Retirement Account $

Retirement Account $

Stocks and Bonds $

Mutual Funds $

Value of Home $

Value of Car(s) $

Value of Other Real Estate $

Value of Personal Property $

Other $

Other $

Other $

TOTAL ASSETS $

Write down what you owe, such as the balance of your mortgage or credit cards, or bills that are due.

LIABILITIES (Debts and payments due to others)

Amount Owed on Mortgage $

Amount Owed on Car(s) $

Credit Card Balance $

Credit Card Balance $

Credit Card Balance $

Other Bank Loans $

Finance Company Loans $

Insurance Loans $

Taxes Owed $

Other $

Other $

Other $

TOTAL LIABILITIES $

Subtract what you owe from what you own. Thats how much youre worth in money terms. Dont worry

about how big it is right now. Think of it as a newly planted tree that you want to grow bigger each year.

NET WORTH CALCULATION

Value of Assets $

Minus Value of Liabilities $

NET WORTH $

This worksheet is for educational purposes only and a financial planning engagement has not

been established unless a separate Pro Bono Letter of Engagement has been signed. Any

unauthorized reproduction or copying is prohibited. 2012 Financial Planning Association

All rights reserved.

Anda mungkin juga menyukai

- c15 ldn01610 SchematicDokumen4 halamanc15 ldn01610 SchematicJacques Van Niekerk50% (2)

- Retirement Planning WorkbookDokumen8 halamanRetirement Planning Workbooktwankfanny100% (3)

- PDF 1020 Make Budget Worksheet PDFDokumen2 halamanPDF 1020 Make Budget Worksheet PDFawefawefawe100% (2)

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementDharmaMaya ChandrahasBelum ada peringkat

- Budget Worksheet: Housing Current Future Leisure Current FutureDokumen1 halamanBudget Worksheet: Housing Current Future Leisure Current FutureDarius YangBelum ada peringkat

- Retirement Budget WorksheetDokumen2 halamanRetirement Budget WorksheetBella MelendresBelum ada peringkat

- Monthly Budget Sheet: Income VARIABLE EXPENSES (Cash Envelopes)Dokumen1 halamanMonthly Budget Sheet: Income VARIABLE EXPENSES (Cash Envelopes)Hazelnuts NadBelum ada peringkat

- New Holland TM165 Shuttle Command (Mechanical Transmission) PDFDokumen44 halamanNew Holland TM165 Shuttle Command (Mechanical Transmission) PDFElena DBelum ada peringkat

- Stephen Antonioni's Net Worth TableDokumen15 halamanStephen Antonioni's Net Worth TableAbdelrahman ElkadyBelum ada peringkat

- Sap GRC TutorialDokumen79 halamanSap GRC TutorialMandar Bahadarpurkar100% (3)

- The 360 Degree Leader J MaxwellDokumen2 halamanThe 360 Degree Leader J MaxwellUzen50% (2)

- How To Dual Boot and Install Windows Server 2016 On Windows 10 PC Using Boot To VHD Step-By-Step - ITProGuru BlogDokumen9 halamanHow To Dual Boot and Install Windows Server 2016 On Windows 10 PC Using Boot To VHD Step-By-Step - ITProGuru BlogMandar Bahadarpurkar100% (1)

- Current Personal Financial StatementDokumen2 halamanCurrent Personal Financial Statementrajiverma50% (2)

- Brand Plan - SingulairDokumen11 halamanBrand Plan - Singulairshashank100% (2)

- Money Check Up WorkbookDokumen6 halamanMoney Check Up WorkbookanascopelBelum ada peringkat

- 2023 BUDGET PLANNER by Thea Sy Bautista ?Dokumen50 halaman2023 BUDGET PLANNER by Thea Sy Bautista ?AnnaBelum ada peringkat

- 3471A Renault EspaceDokumen116 halaman3471A Renault EspaceThe TrollBelum ada peringkat

- Chapter 1 - Food Quality Control ProgrammeDokumen75 halamanChapter 1 - Food Quality Control ProgrammeFattah Abu Bakar100% (1)

- SPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGDokumen3 halamanSPOUSES DAVID B. CARPO & and RECHILDA S. CARPO V. ELEANOR CHUA and ELMA DY NGRengie GaloBelum ada peringkat

- Dilip - SFDC CPQ Architect14 GCDokumen5 halamanDilip - SFDC CPQ Architect14 GCmariareddy17100% (1)

- Calculating Your Net Worth: Assets LiabilitiesDokumen1 halamanCalculating Your Net Worth: Assets LiabilitiesgowthamBelum ada peringkat

- Personal Cash Flow Statement: GoalsDokumen3 halamanPersonal Cash Flow Statement: GoalsWilliam ReeceBelum ada peringkat

- Personal Balance Sheet 14Dokumen2 halamanPersonal Balance Sheet 14k60.2113340007Belum ada peringkat

- Budget Bundle WorksheetsDokumen6 halamanBudget Bundle Worksheetsmakasam007Belum ada peringkat

- Net Worth WorksheetDokumen1 halamanNet Worth WorksheetJerry liuBelum ada peringkat

- Financial AnalysisDokumen7 halamanFinancial AnalysisJason TangBelum ada peringkat

- Certificate of Financial StatusDokumen1 halamanCertificate of Financial StatusKhalandar AlikhanBelum ada peringkat

- Profit and Loss STDokumen3 halamanProfit and Loss STJemalBelum ada peringkat

- Generic Life Insurance Needs Analysis Worksheet 2014-10Dokumen3 halamanGeneric Life Insurance Needs Analysis Worksheet 2014-10Christophe BernardBelum ada peringkat

- Liftfund Monthly Financial WorksheetDokumen4 halamanLiftfund Monthly Financial WorksheetUmair KamranBelum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial Statementloserr1Belum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementkunaldasguptaaBelum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementC44974049段承志Belum ada peringkat

- Income Analysis: Should Be IncreasingDokumen1 halamanIncome Analysis: Should Be IncreasingAnonymous gpNr8cLWBelum ada peringkat

- Calculadora Financiera PersonalDokumen1 halamanCalculadora Financiera PersonalJUAN SEBASTIAN CRUZ CASTILLOBelum ada peringkat

- Income Analysis: Should Be IncreasingDokumen1 halamanIncome Analysis: Should Be IncreasingDungBelum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementsureshBelum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementEnrico Kyle CacalBelum ada peringkat

- Personal Financial StatementDokumen1 halamanPersonal Financial StatementMiko ChavezBelum ada peringkat

- Personal Cash Flow WorksheetDokumen1 halamanPersonal Cash Flow WorksheetJerry liuBelum ada peringkat

- Shortsale Financial Information SheetDokumen1 halamanShortsale Financial Information SheetCharles LeitnerBelum ada peringkat

- Calculate Your Financial RatiosDokumen1 halamanCalculate Your Financial RatiosJerry liuBelum ada peringkat

- Estate Planning Attorney ChecklistDokumen21 halamanEstate Planning Attorney Checklistadvikaditya2Belum ada peringkat

- Collection Agency Board Personal/Corporate Financial StatementDokumen2 halamanCollection Agency Board Personal/Corporate Financial StatementCharles Jose MitchellBelum ada peringkat

- 81 Financial and Tax Tips For The Canadian Real Estate Investor Expert Money Saving Advice On Accounting and Tax Planning-33Dokumen1 halaman81 Financial and Tax Tips For The Canadian Real Estate Investor Expert Money Saving Advice On Accounting and Tax Planning-33stumeritBelum ada peringkat

- Survival Budget PlannerDokumen2 halamanSurvival Budget PlannermoBelum ada peringkat

- MYM FormsDokumen20 halamanMYM FormsFaisal AlimBelum ada peringkat

- Balance Sheet: Direct Appeal LLCDokumen2 halamanBalance Sheet: Direct Appeal LLCJames VargaBelum ada peringkat

- Profit-And-Loss-Statement WELLS FARGODokumen2 halamanProfit-And-Loss-Statement WELLS FARGOSamantha JahansouzshahiBelum ada peringkat

- Current Personal Financial StatementDokumen2 halamanCurrent Personal Financial StatementEnrico Kyle CacalBelum ada peringkat

- Spending PlanDokumen1 halamanSpending PlanjeanBelum ada peringkat

- What The Wealthy Teach Their Kids About Money That The Poor and Middle Class Don TDokumen38 halamanWhat The Wealthy Teach Their Kids About Money That The Poor and Middle Class Don TJun QiangBelum ada peringkat

- Budget Worksheet-JODokumen2 halamanBudget Worksheet-JOJames OyeniyiBelum ada peringkat

- Assets, Income Other Source of Funds, and Expenses of Proposed WardDokumen3 halamanAssets, Income Other Source of Funds, and Expenses of Proposed WardPaolo W. PanganBelum ada peringkat

- IC Balance Sheet Template 8897Dokumen2 halamanIC Balance Sheet Template 8897bagirBelum ada peringkat

- Net Worth TrackerDokumen4 halamanNet Worth TrackermaarsemarcBelum ada peringkat

- Your Personal Balance Sheet - Afinal - 8759Dokumen12 halamanYour Personal Balance Sheet - Afinal - 8759AndrewBelum ada peringkat

- Women in Banking 40m (Empty)Dokumen338 halamanWomen in Banking 40m (Empty)El rincón de las 5 EL RINCÓN DE LAS 5Belum ada peringkat

- Alance Heet: Pro-Forma Year 1: Year 2Dokumen4 halamanAlance Heet: Pro-Forma Year 1: Year 2Deep NainwaniBelum ada peringkat

- Personal Financial Statement Template 42Dokumen2 halamanPersonal Financial Statement Template 42Syrine SmaraBelum ada peringkat

- CCD Form Tenancy Financial Statement Covid19-3Dokumen4 halamanCCD Form Tenancy Financial Statement Covid19-3Bùi ThắngBelum ada peringkat

- AE1 BBC7 Ed 01Dokumen1 halamanAE1 BBC7 Ed 01sr9335Belum ada peringkat

- Assets Liabilities and Net Worth: Balance SheetDokumen1 halamanAssets Liabilities and Net Worth: Balance Sheetanon_652192649Belum ada peringkat

- Client Profile FormDokumen8 halamanClient Profile FormjazzBelum ada peringkat

- Form 2Dokumen2 halamanForm 2api-383904539Belum ada peringkat

- 2023 SDF Budget PlannerDokumen44 halaman2023 SDF Budget PlannerJoyce D. FernandezBelum ada peringkat

- SW Franchise Interest FormDokumen2 halamanSW Franchise Interest FormAudrey WitariBelum ada peringkat

- Real Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsDari EverandReal Estate Investing 101: Best Way to Buy a House and Save Big, Top 20 TipsBelum ada peringkat

- Operating Guideline On Customer ComplaintsDokumen14 halamanOperating Guideline On Customer ComplaintsSandeep ChinnaBelum ada peringkat

- Gen-Ai-Microsoft-Azure-Open-Ai-Online-Programnew (Great Learning)Dokumen14 halamanGen-Ai-Microsoft-Azure-Open-Ai-Online-Programnew (Great Learning)Mandar BahadarpurkarBelum ada peringkat

- Reimbursement ProcessDokumen2 halamanReimbursement ProcessMandar Bahadarpurkar0% (1)

- DCR From 26june To 01 July 2017Dokumen1 halamanDCR From 26june To 01 July 2017Mandar BahadarpurkarBelum ada peringkat

- EventLogAnalyzer SOX WhitepaperDokumen6 halamanEventLogAnalyzer SOX WhitepaperMandar BahadarpurkarBelum ada peringkat

- 1577-8517-v12 - 2-Dashbopards & Its UsefulnessDokumen20 halaman1577-8517-v12 - 2-Dashbopards & Its UsefulnessMandar BahadarpurkarBelum ada peringkat

- SAP Training - MM Training: RequisitionsDokumen41 halamanSAP Training - MM Training: RequisitionsMandar BahadarpurkarBelum ada peringkat

- Rev SCH VI Reference Manual-Rel 3.6Dokumen52 halamanRev SCH VI Reference Manual-Rel 3.6Mandar BahadarpurkarBelum ada peringkat

- Export Procedures Guide PDFDokumen35 halamanExport Procedures Guide PDFMandar BahadarpurkarBelum ada peringkat

- Dashboard User Interface For Measuring Performance Metrics: Concept From Virtual Factory ApproachDokumen10 halamanDashboard User Interface For Measuring Performance Metrics: Concept From Virtual Factory ApproachMandar BahadarpurkarBelum ada peringkat

- Conference Guide: Las Vegas March 8-11Dokumen96 halamanConference Guide: Las Vegas March 8-11Mandar BahadarpurkarBelum ada peringkat

- OOPS Module 1Dokumen26 halamanOOPS Module 1robinptBelum ada peringkat

- Case Study: Meera P NairDokumen9 halamanCase Study: Meera P Nairnanditha menonBelum ada peringkat

- BNBC 2017 Volume 1 DraftDokumen378 halamanBNBC 2017 Volume 1 Draftsiddharth gautamBelum ada peringkat

- ATH SR5BT DatasheetDokumen1 halamanATH SR5BT DatasheetspeedbeatBelum ada peringkat

- Impact of Dust& Dirt Accumulation On The Performance of PV PanelsDokumen4 halamanImpact of Dust& Dirt Accumulation On The Performance of PV PanelserpublicationBelum ada peringkat

- Spark - Eastern Peripheral Road Project (Epr) Weekly Quality MeetingDokumen6 halamanSpark - Eastern Peripheral Road Project (Epr) Weekly Quality Meetingengr.s.a.malik6424Belum ada peringkat

- Hippa and ISO MappingDokumen13 halamanHippa and ISO Mappingnidelel214Belum ada peringkat

- Digest of Agrarian From DAR WebsiteDokumen261 halamanDigest of Agrarian From DAR WebsiteHuzzain PangcogaBelum ada peringkat

- Questionnaire Exercise: Deals Desk Analyst Please Answer Below Questions and Email Your Responses Before First Technical Round of InterviewDokumen2 halamanQuestionnaire Exercise: Deals Desk Analyst Please Answer Below Questions and Email Your Responses Before First Technical Round of InterviewAbhinav SahaniBelum ada peringkat

- INCOME TAX AND GST. JURAZ-Module 4Dokumen8 halamanINCOME TAX AND GST. JURAZ-Module 4TERZO IncBelum ada peringkat

- Landini Tractor 7000 Special Parts Catalog 1820423m1Dokumen22 halamanLandini Tractor 7000 Special Parts Catalog 1820423m1katrinaflowers160489rde100% (122)

- Dump Truck TBTDokumen1 halamanDump Truck TBTLiaquat MuhammadBelum ada peringkat

- Super Duty - Build & PriceDokumen8 halamanSuper Duty - Build & PriceTyler DanceBelum ada peringkat

- Pipenet: A Wireless Sensor Network For Pipeline MonitoringDokumen11 halamanPipenet: A Wireless Sensor Network For Pipeline MonitoringMykola YarynovskyiBelum ada peringkat

- Lecun 20201027 AttDokumen72 halamanLecun 20201027 AttEfrain TitoBelum ada peringkat

- Sustainable Project Management. The GPM Reference Guide: March 2018Dokumen26 halamanSustainable Project Management. The GPM Reference Guide: March 2018Carlos Andres PinzonBelum ada peringkat

- Part - A (Short Answer Questions) : S. No. Questions Bloom's Taxonomy Level Course OutcomeDokumen11 halamanPart - A (Short Answer Questions) : S. No. Questions Bloom's Taxonomy Level Course OutcomeDevendra BhavsarBelum ada peringkat

- IT Quiz QuestionsDokumen10 halamanIT Quiz QuestionsbrittosabuBelum ada peringkat

- MBA CurriculumDokumen93 halamanMBA CurriculumkaranBelum ada peringkat

- Unit I Lesson Ii Roles of A TeacherDokumen7 halamanUnit I Lesson Ii Roles of A TeacherEvergreens SalongaBelum ada peringkat

- Thesis-Android-Based Health-Care Management System: July 2016Dokumen66 halamanThesis-Android-Based Health-Care Management System: July 2016Noor Md GolamBelum ada peringkat

- CV HariDokumen4 halamanCV HariselvaaaBelum ada peringkat