See Record On Cellphone. Taxation Laws 1 Final Exam Pointers To Review: Bring Permit Exam Is On Thursday, October 19 2017

Diunggah oleh

Jp Karl Gonzales Uligan0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

27 tayangan5 halamanThe document provides pointers for a taxation law exam on October 19, 2017 including to bring your permit. It asks several questions about taxation of retirement benefits, life insurance, income tax exemptions, and deductions. Examples are provided about calculating taxable income for an employee and businessman by subtracting allowable deductions from gross income. Corporate income tax is also discussed with an example using a 32% rate.

Deskripsi Asli:

walasnqhdbscowecl

Judul Asli

tex

Hak Cipta

© © All Rights Reserved

Format Tersedia

DOCX, PDF, TXT atau baca online dari Scribd

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniThe document provides pointers for a taxation law exam on October 19, 2017 including to bring your permit. It asks several questions about taxation of retirement benefits, life insurance, income tax exemptions, and deductions. Examples are provided about calculating taxable income for an employee and businessman by subtracting allowable deductions from gross income. Corporate income tax is also discussed with an example using a 32% rate.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

0 penilaian0% menganggap dokumen ini bermanfaat (0 suara)

27 tayangan5 halamanSee Record On Cellphone. Taxation Laws 1 Final Exam Pointers To Review: Bring Permit Exam Is On Thursday, October 19 2017

Diunggah oleh

Jp Karl Gonzales UliganThe document provides pointers for a taxation law exam on October 19, 2017 including to bring your permit. It asks several questions about taxation of retirement benefits, life insurance, income tax exemptions, and deductions. Examples are provided about calculating taxable income for an employee and businessman by subtracting allowable deductions from gross income. Corporate income tax is also discussed with an example using a 32% rate.

Hak Cipta:

© All Rights Reserved

Format Tersedia

Unduh sebagai DOCX, PDF, TXT atau baca online dari Scribd

Anda di halaman 1dari 5

See record on cellphone.

Taxation laws 1 Final Exam

Pointers To Review:

*Bring permit

*Exam is on Thursday, October

19 2017.

1.) Are retirement benefits taxable?

2.) Is life insurance taxable?

3.) Exemption in Income tax

4.) Income tax

5.) Singers/ entertainers mga kinita nila,

subject for income tax (see percentage in

National Internal Revenue Code)

6.) Who are allowed deductions from their

gross income?

7.) Motto in life

Example:

Mr. Cruz is an employee

Salary in 2017 P 300,000

Less. P.E 50,000

A.E 100,000 equals to P 150,000

Child 1 22 years old (Becomes 22 in January 9,

2011 *still incapacitated*)

Child 2 19 years old

Child 3 18 years old

Child 4 - 17 years old

If reach majority age but still incapacitated

considered still as a child. (see record)

Who is a child?

A person who is 21 years old

Who are allowed deductions from their gross

income? (Example edition)

Mr. Cruz is a businessman

2017 Business income is 2 million

LESS: Allowable deductions (what are those?)

1.5 Million over all. Natira is P 500,000 na lang

for his income tax.

Salary

Rent

May anakis siya: Magkano taxable income nya?

(see Section 24, NIRC)

Less. P.E P 50,000

A.E P 100,000 P150,000

Taxable income total: P 300,000

Voluntary computation (tax trend)

Corporate income tax (32 percent) see NIRC

and notes in yellow paper.

Example:

Trece Corporation (selling beer)

Sales or revenues P 10 Million pesos

Allowable deductions (less:)

Bought P 7 Million worth of beer

Gross Income: P 3 Million multiply (x) 2 % = P

60,000

Allowable deductions (AD) 3 M

NET INCOME:

Anda mungkin juga menyukai

- The Trump Tax Cut: Your Personal Guide to the New Tax LawDari EverandThe Trump Tax Cut: Your Personal Guide to the New Tax LawBelum ada peringkat

- Individual Income TaxDokumen13 halamanIndividual Income TaxGIRLBelum ada peringkat

- Annual Income Tax Return For Individuals Earning Purely Compensation IncomeDokumen2 halamanAnnual Income Tax Return For Individuals Earning Purely Compensation IncomeErikaBelum ada peringkat

- Tax2 - Dela Cruz Recit Questions (3C1819)Dokumen6 halamanTax2 - Dela Cruz Recit Questions (3C1819)Deanne ViBelum ada peringkat

- Compute Income TaxDokumen24 halamanCompute Income TaxMelody Fabreag76% (25)

- INCOME TAX OF INDIVIDUALS Part 2 PDFDokumen3 halamanINCOME TAX OF INDIVIDUALS Part 2 PDFADBelum ada peringkat

- BIR 1702Q FormDokumen3 halamanBIR 1702Q FormyellahfellahBelum ada peringkat

- CHAPTER 4 Regular Income Taxation Individuals ModuleDokumen10 halamanCHAPTER 4 Regular Income Taxation Individuals ModuleShane Mark Cabiasa100% (1)

- Tax6148-Income Taxation Assignment 001Dokumen30 halamanTax6148-Income Taxation Assignment 001Regine VegaBelum ada peringkat

- Tax6148 Reviewer (Autorecovered)Dokumen37 halamanTax6148 Reviewer (Autorecovered)Regine VegaBelum ada peringkat

- ITR Filing Project Report by VenkyDokumen38 halamanITR Filing Project Report by VenkyVyankatesh Gotalkar50% (6)

- Fundamentals of Accountancy, Business and Management 2: Senior High SchoolDokumen21 halamanFundamentals of Accountancy, Business and Management 2: Senior High SchoolLee ann ReyesBelum ada peringkat

- My Phil Tax FinalDokumen11 halamanMy Phil Tax FinalRochelle Ann DianeBelum ada peringkat

- Assessment#2Dokumen2 halamanAssessment#2Lai SinghBelum ada peringkat

- Module 8.2Dokumen28 halamanModule 8.2Yen AllejeBelum ada peringkat

- Dy - 2017 Tax 2 RecitsDokumen6 halamanDy - 2017 Tax 2 RecitsJAIRA MANAOISBelum ada peringkat

- Edited FABM2 Q2 MOD3 Income and Business TaxationDokumen17 halamanEdited FABM2 Q2 MOD3 Income and Business Taxationleslie sabateBelum ada peringkat

- National Income AccountingDokumen9 halamanNational Income AccountingJanelle DominguezBelum ada peringkat

- Income TaxationDokumen32 halamanIncome Taxationblackphoenix303Belum ada peringkat

- Planters BankDokumen52 halamanPlanters BankkimBelum ada peringkat

- Annual Income Tax ReturnDokumen1 halamanAnnual Income Tax ReturnQueenel MabbayadBelum ada peringkat

- Income TaxDokumen51 halamanIncome TaxInternet 223Belum ada peringkat

- Quiz 9+10 TaxDokumen7 halamanQuiz 9+10 TaxĐào Huyền Trang 4KT-20ACNBelum ada peringkat

- What Is Macroeconomics? Its OriginDokumen30 halamanWhat Is Macroeconomics? Its Origintheanuuradha1993gmaiBelum ada peringkat

- PUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredDokumen12 halamanPUP - Assignment No. 3 - Income Taxation - 2nd Sem AY 2020-2021: RequiredGabrielle Marie RiveraBelum ada peringkat

- Assignment 1 Outline and Guideline UpdateDokumen3 halamanAssignment 1 Outline and Guideline UpdateĐan Nguyễn PhươngBelum ada peringkat

- Philippines - Income Tax: Tax Returns and ComplianceDokumen11 halamanPhilippines - Income Tax: Tax Returns and ComplianceUnknown NameBelum ada peringkat

- Various Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinDokumen26 halamanVarious Income Taxes & Income Tax Returns Forms: Group 3 Ortega Angel Duterte Dela Cruz Argonsola Marquez AgustinTophe ProvidoBelum ada peringkat

- Direct and Indirect Taxes ExplainedDokumen42 halamanDirect and Indirect Taxes ExplainedArpit MadaanBelum ada peringkat

- Assignment No. 3 Income Taxation 2nd Sem AY 2020 2021Dokumen12 halamanAssignment No. 3 Income Taxation 2nd Sem AY 2020 2021Gabrielle Marie RiveraBelum ada peringkat

- Philippine Income Tax Explained in 40 CharactersDokumen5 halamanPhilippine Income Tax Explained in 40 CharactersGarcia Alizsandra L.Belum ada peringkat

- BIR FORM 1701 GUIDE FOR SELF-EMPLOYEDDokumen22 halamanBIR FORM 1701 GUIDE FOR SELF-EMPLOYEDAlexander Cooley0% (1)

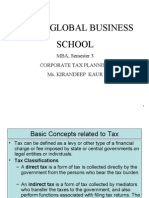

- Amity Global Business School: MBA, Semester 3 Corporate Tax Planning Ms. Kirandeep KaurDokumen14 halamanAmity Global Business School: MBA, Semester 3 Corporate Tax Planning Ms. Kirandeep KaurAditya SinghBelum ada peringkat

- Individual TaxationDokumen38 halamanIndividual TaxationannyeongchinguBelum ada peringkat

- 1mba FM 042mbaDokumen3 halaman1mba FM 042mbaAtindra ShahiBelum ada peringkat

- Taxation Ans AnsDokumen10 halamanTaxation Ans AnsTebashiniBelum ada peringkat

- Income TaxDokumen35 halamanIncome TaxAmer Hussien ManarosBelum ada peringkat

- My Phil Tax Final PDF FreeDokumen11 halamanMy Phil Tax Final PDF Freepaolo suaresBelum ada peringkat

- Basic Concepts On Income Tax LawDokumen14 halamanBasic Concepts On Income Tax Lawgaganhungama007Belum ada peringkat

- Study of The New Income Tax Schedule of The TRAIN LawDokumen16 halamanStudy of The New Income Tax Schedule of The TRAIN LawJeannie de leon82% (17)

- Measuring GDP and National IncomeDokumen19 halamanMeasuring GDP and National IncomeMell's Kingdom100% (2)

- Principles of Macroeconomics July 16, 2016: A. Three Most Common Barriers To TradeDokumen8 halamanPrinciples of Macroeconomics July 16, 2016: A. Three Most Common Barriers To TradeAllie ContrerasBelum ada peringkat

- 3 Income Tax ConceptsDokumen37 halaman3 Income Tax ConceptsRommel Espinocilla Jr.Belum ada peringkat

- Javier Assignment 28Dokumen9 halamanJavier Assignment 28Shamraj E. SunderamurthyBelum ada peringkat

- IT 2 MARKS Q& ADokumen5 halamanIT 2 MARKS Q& Adhanalakshmis0310Belum ada peringkat

- Community Tax and Donor's TaxDokumen27 halamanCommunity Tax and Donor's TaxMa.annBelum ada peringkat

- BIR Form No. 1700 1709Dokumen5 halamanBIR Form No. 1700 1709FaithBelum ada peringkat

- Approved By: Director: Issue No: 02 Issue Date: 1, May 2010Dokumen3 halamanApproved By: Director: Issue No: 02 Issue Date: 1, May 2010Parul BajajBelum ada peringkat

- Income Taxation QuizDokumen3 halamanIncome Taxation QuizJoriz Justin Opelinia AuzaBelum ada peringkat

- Tax AmnestyDokumen15 halamanTax AmnestyYani UlyBelum ada peringkat

- Tax TranscribeDokumen6 halamanTax TranscribeAgapito De AsisBelum ada peringkat

- Measuring national income and its categoriesDokumen2 halamanMeasuring national income and its categoriesirwanBelum ada peringkat

- Introduction To Income TaxDokumen215 halamanIntroduction To Income Taxvikashkumar657Belum ada peringkat

- Income Tax PracticalsDokumen20 halamanIncome Tax Practicalsshatrughan loveBelum ada peringkat

- 1601e - August 2011Dokumen2 halaman1601e - August 2011Jefrie MagdadaroBelum ada peringkat

- The Macroeconomic PerspectiveDokumen28 halamanThe Macroeconomic PerspectiveSyed Muhammad Haider ZaidiBelum ada peringkat

- IPCC Income Tax Material for AY 2016-17Dokumen69 halamanIPCC Income Tax Material for AY 2016-17KunalKumarBelum ada peringkat

- Indonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaDari EverandIndonesian Taxation: for Academics and Foreign Business Practitioners Doing Business in IndonesiaBelum ada peringkat

- QQQQQDokumen1 halamanQQQQQJp Karl Gonzales UliganBelum ada peringkat

- Syllabus LinksDokumen1 halamanSyllabus LinksJp Karl Gonzales UliganBelum ada peringkat

- Transportation Law: Submitted To: Atty. Felipe FraganteDokumen3 halamanTransportation Law: Submitted To: Atty. Felipe FraganteJp Karl Gonzales UliganBelum ada peringkat

- Revision History: Learning Management System For The College of The Holy Spirit ManilaDokumen36 halamanRevision History: Learning Management System For The College of The Holy Spirit ManilaJp Karl Gonzales UliganBelum ada peringkat

- LLLLDokumen1 halamanLLLLJp Karl Gonzales UliganBelum ada peringkat

- The CaseDokumen7 halamanThe CaseJp Karl Gonzales UliganBelum ada peringkat

- IiiiDokumen1 halamanIiiiJp Karl Gonzales UliganBelum ada peringkat

- Alternative Dispute Resolution: R.A 9285 of 2004Dokumen1 halamanAlternative Dispute Resolution: R.A 9285 of 2004Jp Karl Gonzales UliganBelum ada peringkat

- Cruz vs. CA (And Umali) : - Francisco G.R. No. 122445, November 18, 1997 - 282 SCRA 188Dokumen2 halamanCruz vs. CA (And Umali) : - Francisco G.R. No. 122445, November 18, 1997 - 282 SCRA 188Jp Karl Gonzales UliganBelum ada peringkat

- ZZZZDokumen1 halamanZZZZJp Karl Gonzales UliganBelum ada peringkat

- Simple Forms Present Tense: Simple Forms Progressive Forms Perfect Forms Perfect Progressive FormsDokumen8 halamanSimple Forms Present Tense: Simple Forms Progressive Forms Perfect Forms Perfect Progressive FormsJp Karl Gonzales UliganBelum ada peringkat

- Credit Card Billing Authorization FormDokumen1 halamanCredit Card Billing Authorization FormJp Karl Gonzales UliganBelum ada peringkat

- L 1 LDokumen1 halamanL 1 LJp Karl Gonzales UliganBelum ada peringkat

- S 1 SDokumen1 halamanS 1 SJp Karl Gonzales UliganBelum ada peringkat

- G 1 GDokumen1 halamanG 1 GJp Karl Gonzales UliganBelum ada peringkat

- Aaaaaaaaaaaaaaaaaaaaaaaa AaaaaaaaaaaaaaaaaaaaaaaaaaDokumen1 halamanAaaaaaaaaaaaaaaaaaaaaaaa AaaaaaaaaaaaaaaaaaaaaaaaaaJp Karl Gonzales UliganBelum ada peringkat

- Agency DigestsDokumen11 halamanAgency DigestsKlarence OrjaloBelum ada peringkat

- J 1 JDokumen1 halamanJ 1 JJp Karl Gonzales UliganBelum ada peringkat

- EeeeeeeeeeeeeeeeeeeeeDokumen1 halamanEeeeeeeeeeeeeeeeeeeeeJp Karl Gonzales UliganBelum ada peringkat

- T 1 TDokumen1 halamanT 1 TJp Karl Gonzales UliganBelum ada peringkat

- U 1 UDokumen1 halamanU 1 UJp Karl Gonzales UliganBelum ada peringkat

- Alawi vs. AlauyaDokumen3 halamanAlawi vs. AlauyaJp Karl Gonzales UliganBelum ada peringkat

- Uno Bday PartyDokumen2 halamanUno Bday PartyJp Karl Gonzales UliganBelum ada peringkat

- R 1 RDokumen1 halamanR 1 RJp Karl Gonzales UliganBelum ada peringkat

- Eeeeeeeeeeeeeeeeeeeee EeeeeeeeeeeeeeeeeeDokumen1 halamanEeeeeeeeeeeeeeeeeeeee EeeeeeeeeeeeeeeeeeJp Karl Gonzales UliganBelum ada peringkat

- Adobe Photoshop CC Legal NoticesDokumen25 halamanAdobe Photoshop CC Legal NoticesRichard BirchBelum ada peringkat

- Feu Official LetterheadDokumen1 halamanFeu Official LetterheadJp Karl Gonzales UliganBelum ada peringkat

- Land title case digestDokumen3 halamanLand title case digestJp Karl Gonzales UliganBelum ada peringkat

- Law School SayingDokumen1 halamanLaw School SayingJp Karl Gonzales UliganBelum ada peringkat