QUIZ - FS - Solution

Diunggah oleh

Richelle ManocayHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

QUIZ - FS - Solution

Diunggah oleh

Richelle ManocayHak Cipta:

Format Tersedia

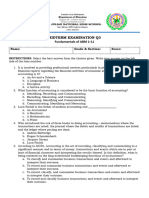

XFINACR3 MIDTERM QUIZ THEORY ON FS b. Information on contingencies d.

Information on financial position and results of operations

Multiple Choice: Using the left side of your paper and number it 1 to 20 and 21 to 35, then write your answer in UPPER CASE 10. Which of the following events will appear in the cash flows from financing activities section of the cash flows statements?

format, erasure in any form will be considered wrong. a. Cash purchase of equipment c. Cash purchase of bonds issued by another company

1. Which statement is NOT correct concerning the line items on the face of the statement of financial position? b. Cash received as repayment for funds loaned d. Cash purchase of treasury stock

a. As a minimum, PAS 1 requires that the face of the statement of financial position shall include certain line items. 11. Retained earnings appropriated account is created for the purpose of

b. PAS 1 prescribes the order or format in which items are to be presented on the face of the statement of financial a. Earmarking cash to be used for particular purposes c. Insuring the payment of dividends

position. b. Protecting the working capital position d. Preventing losses from contingencies

c. Additional line items, headings and subtotals shall be presented on the face of the statement of financial position when such 12. It is the ability of the enterprise to pay interest and principal amounts on its maturing indebtedness, as well as its ability to pay

presentation is relevant to an understanding of the entitys financial position regular dividends to the owners.

d. PAS 1 simply provides a list of items that are sufficiently different in nature or function to warrant separate presentation on a. solvency b. profitability c. stability d. liquidity

the face of the statement of financial position. 13. Which is a non-cash investing and financing activity?

2. Which of the following is NOT included in the non-financial disclosures? a. Converting debt to equity c. Acquiring asset by assuming directly the related liability

a. Name of the parent and the ultimate parent of the group b. Obtaining an asset by entering into a capital lease d. All of the above

b. Contingencies and commitments 14. In a statement of cash flows (indirect method), a decrease in prepaid expenses should be

c. Description of the nature of the entitys operations or principal activities a. Reported as an outflow and inflow of cash c. Deducted from net income

d. Domicile and legal form of the entity, its country of incorporation and address of the registered office. b. Reported as an outflow of cash d. Added to net income

3. Which of the following statements is INCORRECT concerning a statement of operation? 15. Examples of disclosures by a business enterprise commonly required with respect to accounting policies include the following,

a. When items of income and expense are material, their nature and amount shall be disclosed separately. except

b. All items of income and expense recorded in a period shall be included in profit or loss unless a standard or an interpretation a. Basis of consolidation c. Inventory pricing

requires otherwise. b. Depreciation and amortization d. Profile of corporate officers

c. An entity shall present any items of income and expense classified as extraordinary either on the face of the 16. Which of the following is NOT a noncurrent asset?

statement of operation or in the notes. a. Building that is vacant but is held to be leased out under an operating lease.

d. Additional line items, headings and subtotals shall be presented on the face of the statement of operation when such b. A cash deposit on machinery ordered, delivery of which will be made within six months

presentation is relevant to an understanding of the entitys financial performance. c. Installment notes receivable due over 15 months in accordance with normal trade practice.

4. Which statement is INCORRECT concerning the concepts of capital? d. Cash surrender value of a life insurance policy of which the company is the beneficiary.

a. Financial capital is synonymous with the net assets or equity of the entity. 17. Which of the following is NOT a criterion of PAS 1 in the classification of both current assets and current liabilities?

b. The financial capital concept is adopted if the users of financial statements are primarily concerned with the maintenance of a. It is held primarily for the purpose of being traded.

nominal invested capital or purchasing power of invested capital. b. It is expected to be realized or due to be settled within twelve months after the statement of financial position date.

c. The physical capital concept is adopted if the main concern of users is the operating capability of the entity. c. It is used in business such as in production or supply of goods and services, for rental purposes and for

d. The physical capital concept is adopted by most entities in preparing their financial statements. administrative purposes

5. How are the results of a discontinued operation, net of tax presented? d. It is expected to be realized or intended for sale or consumption or to be settled in the entitys normal operating cycle.

a. As a single amount on the face of the statement of operation with appropriate disclosure of the details in the notes. 18. Which of the following statements is true?

b. As a single amount on the face of the statement of operation with no details disclosed in the notes. a. Estimated liabilities are obligations which exist on statement of financial position date but their amounts are not

c. Side by side with continuing operations with the details of revenue and expenses attributable to discontinued operation shown definite.

on the face of the statement of operation. b. A contingent liability, which is either probable or measurable, is recognized in the financial statements.

d. As a disclosure in the notes to financial statements. c. A contingent asset is disclosed whether it is probable or possible or remote.

6. When are the financial statements authorized for issue? d. When an entity presents current and noncurrent liabilities as separate classifications on the face of the statement of financial

a. When the board of directors reviews and authorizes the financial statements for issue. position, it shall also classify deferred tax liability as current liability.

b. When the shareholders approve the financial statements at their annual meeting. 19. Which is NOT presented in the statement of changes in equity?

c. When the financial statements are filed with Securities and Exchange Commission. a. Each item of income or expense for the period that is recognized directly in equity as required by the standards and the total

d. When a supervisory board made solely of non-executives approves the financial statements issued by the management of of these items.

an entity. b. The balance of retained earnings at the beginning and the end of the period and the changes during the period.

7. As a minimum, disclosures of related party transactions necessary for an understanding of the financial statements include all of c. The effects of changes in accounting estimates and a reconciliation of the amount of cash in bank.

the following, except for the d. For each component of equity, the effects of changes in accounting policies and correction of errors

a. amount of outstanding balances c. amount of the transactions 20. The following statements relate to the two approaches of income performance of an entity. Which statement(s) is (are) correct?

b. provision for doubtful debts related to the amount of outstanding balances d. pricing policies I. Capital maintenance approach means that net income is the amount an entity can distribute to its owners and be as well-off

8. Which statement is INCORRECT concerning the materiality and aggregation? at the end of the year as at the beginning.

a. Materiality depends on the size and nature of the item judged in the particular circumstances of its omission. II. Transaction approach offers a detailed presentation of all the income and expenses incurred in earning the revenue.

b. Materiality provides that specific disclosure requirements of Philippine Financial Reporting Standards must be met a. I only b. II only c. Both I and II d. Neither I nor II

even if the resulting information is immaterial. 21. Which of the following is an example of current liability?

c. Immaterial amounts shall be aggregated with amounts of similar nature or function and need not be presented separately. a. Stock dividends payable c. Forfeited gift certificate payable

d. Information is material if its non-disclosure could influence the economic decision of users taken on the basis of the financial b. Deferred tax liability d. Deposits from customers

statements. 22. Which of the following is the correct order of presenting the notes to financial statements?

9. Which information is not shown in the notes to financial statements I. Supporting information the items presented on the face of the financial statements

a. Information on accounting policies c. Information on subsequent events II. Commitments, contingent liabilities and other financial and non-financial disclosures

III. Summary of significant accounting policies 32. Which of the following statements is INCORRECT?

IV. Statement of compliance with GAAP a. Working capital usually is viewed as one measure of liquidity.

a. I, II, III and IV b. III, IV, II and I c. II, III, IV and I d. IV, III, I and II b. Current liabilities are short-term liabilities whose liquidation is reasonably expected to require the use of current assets or the

23. A fair presentation of financial statements requires the following except creation of other current liabilities.

a. selecting and applying appropriate accounting policies c. All assets reported on the statement of financial position are reported at acquisition cost in conformity with the historical cost

b. presenting information, including accounting policies in a manner, which provides relevant, reliable, comparable and principle.

understandable information. d. In financial reporting, it is improper to offset current assets with current liabilities unless there is a legal right of

c. inappropriate accounting treatments are rectified either by disclosure of the accounting policies used or by notes or setoff.

explanatory material 33. Which of the following statements is FALSE?

d. providing additional disclosures when the requirements of Philippine Accounting Standards are not sufficient. a. A trucking firm which has contracted to pack, load, transport and deliver goods would most appropriately recognize all revenue

24. Income, which is an inflow of future economic benefit that increases equity, other than contribution by owners, is derived from the when they had completed delivery of goods.

following ordinary activities except for b. Sales with right of return can be recognized at the point of sale if the amount of future returns can be reasonably estimated,

a. sales of merchandise to customers c. acquisition of investment property and other criteria for recognition of a sale have been met.

b. use of equity resources d. disposal of resources other than products c. Generally accepted accounting standards allow for the recording of sales with right of return until the return period has

25. Each component of the financial statements shall be clearly identified. In addition, the following information should be prominently elapsed.

displayed on the face of the financial statements except for d. Expenses can be divided into two categories, those directly related to the sales of products or services, and those

a. the name of reporting entity and the statement of financial position date or the period covered by the financial statements. that result from peripheral or incidental transactions.

b. whether the financial statements cover the individual entity or a group of entities and the reporting currency. 34. Most interim period gains and losses, for the purpose of interim disclosure, are

c. the names of major stockholders and the board of directors. a. deferred until year-end. c. allowed to be offset against each other.

d. the level of precision used in the presentation of figures in the financial statements. b. recognized in the interim period of incurrence. d. allocated ratably over the remaining interim periods.

26. Which of the following items should NOT be included on the face of the statement of financial position? 35. When an entity breaches a covenant under a long-term loan agreement on or before the statement of financial position date, the

a. Share in minority interest and contributions. c. Financial liabilities and provisions. liability becomes payable on demand. In what circumstance(s) is (are) the liability still classified as noncurrent?

b. Deferred tax asset and deferred tax liability. d. Investment property and issued capital and reserves. I. The lender has agreed on or before the statement of financial position date to provide a grace period ending at least twelve

27. Which of the following is (are) correct concerning the presentation of the statement of operation? months after the statement of financial position date.

I. Expenses should be analyzed either by function or by nature. II. The lender has agreed after the statement of financial position date and before the financial statements are authorized for

II. The minimum items or the face of the statement of operations and revenue, finances, share of statement of operations and joint issue not to demand payment as a consequence of the breach.

venture accounted for using the equity method, pretax gain or loss recognized in disposal of settlement of liabilities attributes a. I only b. II only c. Both I and II d. Neither I nor II

to discontinued operations, defined tax expense and profit or loss.

a. I only b. II only c. Both I and II d. Neither I nor II

28. Which of the given statement(s) is (are) true of a discontinued operation?

I. PFRS 5 paragraph allows the retroactive classification as a discontinued operation when the discontinued criteria are met

after the BS date. MODIFIED TRUE OR FALSE. If the statement is correct, write the word TRUE, if the statement is incorrect, write the word or

II. A component of an entity is classified as discontinued operation at the date the entity has actually disposed of the operation, group of words that will make the statement true. (Use the right side of your paper and number it 1 to 20.)

or when the operation meets the criteria to be classified as held for sale. 1. Financial flexibility indicates how much is borrowed capital and how much is equity capital.

a. I only b. II only c. Both I and II d. Neither I nor II 2. Assets are resources owned by the entity as a result of past transactions and events and from which present economic benefits

29. Disclosure of prior period errors includes the following except for are expected to flow to the entity.

a. the amount of corrections at the beginning of the earliest prior period presented. 3. Trading securities which are non-financial assets are acquired principally for the purpose of generating a profit from short-term

b. the nature of the prior period. fluctuations in price or dealers margin.

c. the effect of a change shall be recognized currently and prospectively by including it in income or loss. 4. Solvency ratios are used to measure the firms ability to meet cash needs as they arise.

d. the circumstances that led to the existence of that condition and a description of how and from when the error has been 5. The line items in the current assets section are presented in accordance with the principle of consistency.

corrected, if retrospective statements is impracticable for a particular prior period. 6. Liabilities arise primarily from deferring payment for goods or services received and from borrowing funds.

30. Which of the following statements is NOT correct? 7. PAS 1 stipulates that an entity shall not present any items of income and expense as extraordinary items on the face of the

a. An asset is a resource controlled by the entity as a result of past transaction and event from which future economic benefits statement of operation but can be disclosed in the notes.

are expected to flow to the entity. 8. Physical assets, leased assets and intangible assets are regarded non-financial assets.

b. PAS 16 defines property, plant and equipment as tangible assets, which are held by an entity for use in production or supply 9. The statement of financial position is a statement of financial position that presents assets, liabilities and equity at a given point in

of goods and services, for rental to others, or for administrative purposes and are expected to be used for more than one time.

period. 10. PAS 37 defines intangible asset as an identifiable non-monetary asset without physical substance.

c. PAS 38 defines intangible asset as an unidentifiable non-monetary asset without physical substance. 11. Compensating balances are often attached to borrowing agreements which represent undertakings by the borrower.

d. Investment is an asset held by an entity for the accretion of wealth through capital distribution, for capital appreciation or for 12. Constructive obligations as defined in PAS 37 Provisions, Contingent Liabilities and Contingent Assets, do not arise from contracts

other benefits to the investing entity. and are not financial liabilities.

31. The following elements of the stockholders equity can be found in the equity section except for 13. PAS 1 uses the term non-current to include tangible, intangible, non-operating and financial assets of a long-term nature.

a. preference share capital, ordinary share capital and share premium 14. A liability is to be classified as non-current if refinancing or rolling over the obligation is at the discretion of the entity.

b. subscribed share capital less subscription receivable currently collectible 15. A current investment by its nature is readily realizable and is intended to be held for a period of one year or more.

c. accumulated profits (losses) and appropriation reserve 16. A contingent liability is recorded in the financial statement as an expense and estimated liability because the present obligation is

d. revaluation reserve, treasury share and share capital probable and the amount can be measured reliably.

17. Treasury share like discount on share capital is a deduction from the shareholders equity.

18. The IAS term for retained earnings with a debit balance is accumulated losses.

19. Estimated liabilities are obligations which are non-existent on statement of financial position date but their amount is not definite.

20. The capital maintenance approach requires the determination of how much income was earned during the year and how much

expense is incurred in earning the revenue.

1. Financial flexibility indicates how much is borrowed capital and how much is equity capital.

STRUCTURE

2. Assets are resources owned by the entity as a result of past transactions and events and from which

present economic benefits are expected to flow to the entity. CONTROLLED/FUTURE

3. Trading securities which are non-financial assets are acquired principally for the purpose of generating

a profit from short-term fluctuations in price or dealers margin. FINANCIAL

4. Solvency ratios are used to measure the firms ability to meet cash needs as they arise. LIQUIDITY

5. The line items in the current assets section are presented in accordance with the principle of

consistency. AGGREGATION

6. Liabilities arise primarily from deferring payment for goods or services received and from borrowing

funds. TRUE

7. PAS 1 stipulates that an entity shall not present any items of income and expense as extraordinary

items on the face of the statement of operation but can be disclosed in the notes. AND IN THE NOTES

8. Physical assets, leased assets and intangible assets are regarded non-financial assets. TRUE

9. The statement of financial position is a statement of financial position that presents assets, liabilities

and equity at a given point in time. TRUE

10. PAS 37 defines intangible asset as an identifiable non-monetary asset without physical substance. PAS

38

11. Compensating balances are often attached to borrowing agreements which represent undertakings by

the borrower. COVENANTS

12. Constructive obligations as defined in PAS 37 Provisions, Contingent Liabilities and Contingent Assets,

do not arise from contracts and are not financial liabilities. TRUE

13. PAS 1 uses the term non-current to include tangible, intangible, non-operating and financial assets

of a long-term nature. OPERATING

14. A liability is to be classified as non-current if refinancing or rolling over the obligation is at the discretion

of the entity. TRUE

15. A current investment by its nature is readily realizable and is intended to be held for a period of one

year or more. LESS THAN ONE YEAR

16. A contingent liability is recorded in the financial statement as an expense and estimated liability because

the present obligation is probable and the amount can be measured reliably. PROVISION

17. Treasury share like discount on share capital is a deduction from the shareholders equity. TRUE

18. The IAS term for retained earnings with a debit balance is accumulated losses. TRUE

19. Estimated liabilities are obligations which are non-existent on statement of financial position date but

their amount is not definite. EXIST

20. The capital maintenance approach requires the determination of how much income was earned during

the year and how much expense is incurred in earning the revenue. TRANSACTION

Anda mungkin juga menyukai

- Discussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoDokumen4 halamanDiscussion Problems: Manila Cavite Laguna Cebu Cagayan de Oro DavaoTatianaBelum ada peringkat

- Balance Sheet and Statement of Cash FlowsDokumen55 halamanBalance Sheet and Statement of Cash FlowsJayne Carly Cabardo100% (2)

- 6 - Consolidated Financial Statements P2 PDFDokumen5 halaman6 - Consolidated Financial Statements P2 PDFDarlene Faye Cabral RosalesBelum ada peringkat

- Daily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayDokumen5 halamanDaily Lesson Log/Plan: Monday Tuesday Wednesday ThursdayJovelyn Ignacio VinluanBelum ada peringkat

- Guerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleDokumen6 halamanGuerrero Book Chapter1 - Cost Acoounting Basic Concepts and The Job Order Cost CycleJenny Brozas JuarezBelum ada peringkat

- Financial AccountingDokumen8 halamanFinancial AccountingAshish Kumar YadavBelum ada peringkat

- This Study Resource Was: Business Transactions and Their AnalysisDokumen8 halamanThis Study Resource Was: Business Transactions and Their AnalysisJames CastañedaBelum ada peringkat

- Tagum College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Dokumen14 halamanTagum College: Self-Instructional Manual (SIM) For Self-Directed Learning (SDL)Pia SurilBelum ada peringkat

- Quiz Bee Final 2Dokumen101 halamanQuiz Bee Final 2joshBelum ada peringkat

- Chapter 1 LiabilitiesDokumen16 halamanChapter 1 LiabilitiesAlvin Dantes100% (1)

- Pas 20, 23Dokumen32 halamanPas 20, 23Angela WaganBelum ada peringkat

- Fabm 1 Quiz TheoriesDokumen4 halamanFabm 1 Quiz TheoriesJanafaye Krisha100% (1)

- College of Accountancy & FinanceDokumen7 halamanCollege of Accountancy & Financei aBelum ada peringkat

- Philippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Dokumen27 halamanPhilippine Financial Reporting Standards: (Adopted by SEC As of December 31, 2011)Ana Liza MendozaBelum ada peringkat

- Accounting For Branches and Combined FSDokumen112 halamanAccounting For Branches and Combined FSEcka Tubay100% (1)

- ch04.ppt - Income Statement and Related InformationDokumen68 halamanch04.ppt - Income Statement and Related InformationAmir ContrerasBelum ada peringkat

- Midterms Q3 FABM1Dokumen10 halamanMidterms Q3 FABM1Emerita MercadoBelum ada peringkat

- Accounting For LeasesDokumen59 halamanAccounting For LeasesMei Chien Yap100% (2)

- FABM2 Module - 1Dokumen3 halamanFABM2 Module - 1Jennifer NayveBelum ada peringkat

- Mock Examination QuestionnaireDokumen9 halamanMock Examination QuestionnaireRenabelle CagaBelum ada peringkat

- 4th FABM 2Dokumen2 halaman4th FABM 2Keisha MarieBelum ada peringkat

- Practice SetDokumen5 halamanPractice SetgnlynBelum ada peringkat

- New - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021Dokumen6 halamanNew - OBTL Modular Fundamentals of Accounting Part1 - First Semester AY2020 2021rebecca lisingBelum ada peringkat

- IAS 21: Accounting Foreign Currency Transaction & Financial Statement TranslationDokumen38 halamanIAS 21: Accounting Foreign Currency Transaction & Financial Statement Translationmesfin yemer100% (1)

- ACCT101 - Prelim - THEORY (25 PTS)Dokumen3 halamanACCT101 - Prelim - THEORY (25 PTS)Accounting 201100% (1)

- Identify The Choice That Best Completes The Statement or Answers The QuestionDokumen13 halamanIdentify The Choice That Best Completes The Statement or Answers The QuestionMarielle Mae BurbosBelum ada peringkat

- GoodwillDokumen16 halamanGoodwillapoorva100% (1)

- Chapter 18 IAS 2 InventoriesDokumen6 halamanChapter 18 IAS 2 InventoriesKelvin Chu JYBelum ada peringkat

- Calculating Average Production CostsDokumen22 halamanCalculating Average Production CostsephreenBelum ada peringkat

- 3 Adjusting Entries HandoutsDokumen10 halaman3 Adjusting Entries HandoutsJuan Dela CruzBelum ada peringkat

- Robert Z. San Juan Management Consultancy Chapter 14-15 May 1, 2020Dokumen13 halamanRobert Z. San Juan Management Consultancy Chapter 14-15 May 1, 2020Parki jiminsBelum ada peringkat

- Quiz Working Cap-StudentsDokumen4 halamanQuiz Working Cap-StudentsJennifer RasonabeBelum ada peringkat

- SIC InterpretationsDokumen42 halamanSIC InterpretationsJean Fajardo Badillo100% (1)

- Chapter 13 - Partnership DissolutionDokumen13 halamanChapter 13 - Partnership DissolutionVillanueva, Jane G.Belum ada peringkat

- Accounting - Answer Key Quiz - Investments in Associates and Additional ConceptsDokumen2 halamanAccounting - Answer Key Quiz - Investments in Associates and Additional ConceptsNavsBelum ada peringkat

- Sample Exam 2Dokumen16 halamanSample Exam 2Zenni T XinBelum ada peringkat

- Quiz - Chapter 5 - Statement of Changes in EquityDokumen1 halamanQuiz - Chapter 5 - Statement of Changes in Equityarlynajero.ckcBelum ada peringkat

- Exams BookkeepigDokumen5 halamanExams BookkeepigRosita Aquino PacibeBelum ada peringkat

- Language of businessDokumen3 halamanLanguage of businesslemerleBelum ada peringkat

- aCCOUNTING cONCEPTS AND pRINCIPLESDokumen4 halamanaCCOUNTING cONCEPTS AND pRINCIPLESMarjealyn PortugalBelum ada peringkat

- Quizzes - Chapter 4 - Types of Major Accounts.Dokumen3 halamanQuizzes - Chapter 4 - Types of Major Accounts.Mechaella Shella Ningal ApolinarioBelum ada peringkat

- Notes To FS - Part 1Dokumen24 halamanNotes To FS - Part 1Precious Jireh100% (1)

- Business Finance Summative Test 3Dokumen3 halamanBusiness Finance Summative Test 3Juanito II Balingsat100% (1)

- Property, Plant and Equipment (PAS 16)Dokumen10 halamanProperty, Plant and Equipment (PAS 16)VIRGIL KIT AUGUSTIN ABANILLABelum ada peringkat

- Finals Conceptual Framework and Accounting Standards AnswerkeyDokumen7 halamanFinals Conceptual Framework and Accounting Standards AnswerkeyMay Anne MenesesBelum ada peringkat

- Pas 2 InventoriesDokumen10 halamanPas 2 InventoriesAnne100% (1)

- AC 501 (Pre-Mid)Dokumen3 halamanAC 501 (Pre-Mid)RodBelum ada peringkat

- Worksheet 1 q2 Acctg. 2Dokumen11 halamanWorksheet 1 q2 Acctg. 2Allan TaripeBelum ada peringkat

- IAS 41 - AgricultureDokumen17 halamanIAS 41 - AgricultureArshad BhuttaBelum ada peringkat

- 20201st Sem Syllabus Auditing Assurance PrinciplesDokumen10 halaman20201st Sem Syllabus Auditing Assurance PrinciplesJamie Rose AragonesBelum ada peringkat

- Chapter 1 Statement of Financial PositionDokumen21 halamanChapter 1 Statement of Financial PositionNo Mercy100% (1)

- CFAS Easy To Learn (Conceptual Framework)Dokumen61 halamanCFAS Easy To Learn (Conceptual Framework)Borg Camlan100% (1)

- Conceptual Framework For Financial ReportingDokumen54 halamanConceptual Framework For Financial ReportingAlthea Claire Yhapon100% (1)

- IAS 7 Cash Flow Statement NotesDokumen14 halamanIAS 7 Cash Flow Statement Notesmusic niBelum ada peringkat

- University of San Jose-Recoletos Theory of AccountsDokumen9 halamanUniversity of San Jose-Recoletos Theory of AccountsChelseyBelum ada peringkat

- Cfas ReviewerDokumen6 halamanCfas ReviewerMaycacayan, Charlene M.Belum ada peringkat

- Inacc3 BalucanDokumen8 halamanInacc3 BalucanLuigi Enderez BalucanBelum ada peringkat

- Nfjpia Mockboard 2011 ToaDokumen12 halamanNfjpia Mockboard 2011 ToaKaguraBelum ada peringkat

- Far 05 - Long Quiz2Dokumen11 halamanFar 05 - Long Quiz2Mark Domingo MendozaBelum ada peringkat

- QUIZ 2Dokumen2 halamanQUIZ 2Jaypee BignoBelum ada peringkat

- Minimization of The Occurrence of Bad Merchandise of 7-Eleven Telabastagan Branch, City of San Fernando, PampangaDokumen23 halamanMinimization of The Occurrence of Bad Merchandise of 7-Eleven Telabastagan Branch, City of San Fernando, PampangaRichelle ManocayBelum ada peringkat

- Revenue Recognition & Construction ContractsDokumen9 halamanRevenue Recognition & Construction Contractsrietzhel22Belum ada peringkat

- Special Laws PDFDokumen36 halamanSpecial Laws PDFRichelle ManocayBelum ada peringkat

- Chapter 14Dokumen59 halamanChapter 14TẤN LỘC LouisBelum ada peringkat

- Synthesis DemoDokumen16 halamanSynthesis DemoRichelle ManocayBelum ada peringkat

- Finalquiz 1Dokumen16 halamanFinalquiz 1Richelle ManocayBelum ada peringkat

- Tessmer ManufacturingDokumen2 halamanTessmer ManufacturingRaiza OlandescaBelum ada peringkat

- MRP5Dokumen42 halamanMRP5Richelle ManocayBelum ada peringkat

- 18 SolutionDokumen8 halaman18 SolutionBandar AllehyaniBelum ada peringkat

- Internship Application FormDokumen2 halamanInternship Application FormRichelle ManocayBelum ada peringkat

- Reviewer For Advac2Dokumen22 halamanReviewer For Advac2Richelle ManocayBelum ada peringkat

- FinancialquizDokumen4 halamanFinancialquizcontactalok100% (1)

- Xitsad PDFDokumen239 halamanXitsad PDFRichelle ManocayBelum ada peringkat

- Dole FormDokumen1 halamanDole FormAnne Camille AlfonsoBelum ada peringkat

- Quiz 1Dokumen2 halamanQuiz 1Richelle ManocayBelum ada peringkat

- Philippine Tax FactsDokumen9 halamanPhilippine Tax FactsAizel MaronillaBelum ada peringkat

- R-AsianBeauty Cleanser PH Spreadsheet (Responses)Dokumen18 halamanR-AsianBeauty Cleanser PH Spreadsheet (Responses)Richelle ManocayBelum ada peringkat

- Complaint Versus Jeffrey Christian MabilogDokumen3 halamanComplaint Versus Jeffrey Christian MabilogManuel MejoradaBelum ada peringkat

- Question Excerpt From SAP Business One Practice Exam - EspañolDokumen25 halamanQuestion Excerpt From SAP Business One Practice Exam - EspañolAndrea OsorioBelum ada peringkat

- Finman Chap3Dokumen66 halamanFinman Chap3Jollybelleann MarcosBelum ada peringkat

- The ROI of Optimizing Product ManagementDokumen6 halamanThe ROI of Optimizing Product ManagementicrapperBelum ada peringkat

- Mba Interview QuestionsDokumen3 halamanMba Interview QuestionsAxis BankBelum ada peringkat

- 9706 s09 Ms 21,22Dokumen13 halaman9706 s09 Ms 21,22roukaiya_peerkhan100% (1)

- FX Risk Hedging and Exchange Rate EffectsDokumen6 halamanFX Risk Hedging and Exchange Rate EffectssmileseptemberBelum ada peringkat

- Bank of America NT & SA vs. CA, GR No. 105395, December 10, 1993Dokumen2 halamanBank of America NT & SA vs. CA, GR No. 105395, December 10, 1993Rom100% (1)

- Principles of Banking MCQsDokumen34 halamanPrinciples of Banking MCQsUmar100% (2)

- Accounting & Control: Cost ManagementDokumen21 halamanAccounting & Control: Cost ManagementAgus WijayaBelum ada peringkat

- GST Past Exam AnalysisDokumen17 halamanGST Past Exam AnalysisSuraj PawarBelum ada peringkat

- Trust Deed FormatDokumen6 halamanTrust Deed Formatchandraadv100% (4)

- Sindh Workers Welfare Fund Act SummaryDokumen4 halamanSindh Workers Welfare Fund Act SummaryAamir ShehzadBelum ada peringkat

- FIN3102 Fall14 Investments SyllabusDokumen5 halamanFIN3102 Fall14 Investments SyllabuscoffeedanceBelum ada peringkat

- Donor S TaxDokumen68 halamanDonor S TaxLuna CakesBelum ada peringkat

- AdaptiveStrategies MattRadtke 02oct2018Dokumen27 halamanAdaptiveStrategies MattRadtke 02oct2018Pradeep AroraBelum ada peringkat

- Sbi 8853 Dec 23 RecoDokumen9 halamanSbi 8853 Dec 23 RecoShivam pandeyBelum ada peringkat

- Chapter 1: Accounting in ActionDokumen31 halamanChapter 1: Accounting in ActionMohammed Merajul IslamBelum ada peringkat

- Bank StatementDokumen8 halamanBank StatementMy Comparison Rwanda TvBelum ada peringkat

- Assembly Bicycle Project Proposal EthiopiaDokumen1 halamanAssembly Bicycle Project Proposal EthiopiaSulemanBelum ada peringkat

- Bclte Part 2Dokumen141 halamanBclte Part 2Jennylyn Favila Magdadaro96% (25)

- SCM Batch B - Group 3 - Madura Accessories LTDDokumen35 halamanSCM Batch B - Group 3 - Madura Accessories LTDSHILPA GOPINATHAN100% (1)

- Incometax Act 1961Dokumen22 halamanIncometax Act 1961Mohd. Shadab khanBelum ada peringkat

- PrivatizationDokumen69 halamanPrivatizationgakibhaiBelum ada peringkat

- Dalit EntrepreneurshipDokumen5 halamanDalit EntrepreneurshipSuraj GawandeBelum ada peringkat

- Types of Assessment and Tax ProceduresDokumen9 halamanTypes of Assessment and Tax ProceduresRasel AshrafulBelum ada peringkat

- MC0-04: Business Environment Term-End ExamDokumen8 halamanMC0-04: Business Environment Term-End ExamRohit GhuseBelum ada peringkat

- Loan Agreement - Sanction Letter and General Terms and Conditions As Applicable For Unsecured Loan Facilities of Incred Financial Services LimitedDokumen9 halamanLoan Agreement - Sanction Letter and General Terms and Conditions As Applicable For Unsecured Loan Facilities of Incred Financial Services LimitedJayanth RamBelum ada peringkat

- Oracle Financials TheoryDokumen173 halamanOracle Financials TheoryUdayraj SinghBelum ada peringkat

- Professional Legal Services and Attorneys in ArmeniaDokumen17 halamanProfessional Legal Services and Attorneys in ArmeniaAMLawFirmBelum ada peringkat