Asia and Middle-East

Diunggah oleh

Zafar Imam KhanJudul Asli

Hak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Asia and Middle-East

Diunggah oleh

Zafar Imam KhanHak Cipta:

Format Tersedia

Growing Economic relation between Asia and Middle-East

Introduction

With the opening of the global market and globalization at full swing business

firms all over the world is recognizing the potential and are engaged in exploring and

exploiting the worldwide markets. Countries all over the globe are getting involved in

this globalization process and opening up their market and are doing a lot to attract

foreign investments in the form of trade relation, infrastructural development and

technology transfer. The intensity of participation in the globalized world can be also

viewed in terms of imports and exports which are totally governed by a countrys

competitiveness and its ability to deliver innovative goods and services which meets

consumers expectations in terms of quality, reliability and price. The unprecedented

growth in the economy of China and India and their economic influence in the Middle

East region and Africa has been a cause of concern for USA and other western

economies which have vested interested in the MENA region. (Alsatty & Sawyer,

2012)

Economic relations of GCC with Asian countries

The oil-rich Arab countries of the Gulf Cooperation Council (GCC) have

rapidly expanded their economic relations with Asian countries recently,

particularly China and India. The main reason behind this development is

that the regions complement each other in several dimensions. China and

India are the fastest-growing, oil-consuming nations in the world, while

GCC countries have the largest proven deposits of oil and gas. The GCC is

interested in China and India as reliable oil customers over the long-run

and the latter look at the GCC as reliable suppliers of oil and gas. The two

regions are also attracted to each other because both are enjoying strong

economic growth and offer many investment opportunities to the other. It

is expected that GCC economic relations with China and India will grow

stronger in the coming decades and serve as a good example of South

South economic cooperation for other developing countries.

The latest trade statistics for the United Arab

Emirates reveal that in 2011, India and China

emerged as that countrys largest trade partners.

Trade statistics for other oil-exporting

monarchies of the Arabian Peninsula (Bahrain,

Kuwait, Oman, Qatar, and Saudi Arabia) also

show a rapid expansion of trade with emerging

Asian economies, especially China and

India (together, these six oil monarchies constitute

the Gulf Cooperation Council, GCC). The

expansion of bilateral economic relations is not

limited to trade, however. Investment flows

between the GCC and China and India (which

are referred to as C&I from here forward,

whenever mentioned as a block,) have also

enjoyed a significant expansion in recent years.

The GCC countries

have benefited from the high price of crude oil

since 2000. This rapid growth in both regions

has increased their financial resources while

increasing each regions demand for the export

products of the other.

While there were strong trade relations

between East Asia and the Middle East before

the rise of European colonialism, these relations

diminished sharply after the 17th century.

Both regions were forced to reorient their trade

towards their colonial masters. After World

War II, with the decline of European colonialism,

both regions were preoccupied with modernisation

and industrialisation; but they had

little to offer each other as they were both

exporting agricultural products and raw materials

and importing industrial goods and

machinery.

GCC exports to China and India are dominated

by crude oil, whose increasing price has been

partly responsible for the increased value of

GCC exports to these countries. Another contributing

factor is the sharp increase in the

volume of crude oil that the GCC has exported

to China and India where oil demand has

increased steadily since 2000.

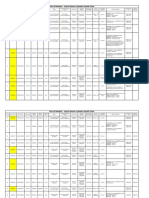

The total value of GCC exports to China rose

more than eight-fold from US$5.9 billion in

2000 to US$49.5 billion in 2008. GCC imports

from China grew at an even faster pace during

2000-08up 1,121 per cent, fromUS$3.8 billion

to US$42.6 billion.

Although the Indian economy is several times

smaller than Chinas, the volume of GCC

exports to India has risen faster than exports to

China in recent years; and in 2007 the GCC

exported more to India than China (a difference

of US$9.7 billion). The large community of

Indian workers and professionals in the GCC

has made a positive contribution to the growth

of bilateral trade and investment. The Indian

expatriate community in the GCC exceeds six

million and has shown a strong preference for

Indian products (Karayil 2007).

India

and China have both gained market share,

while the market shares of the USA and major

European exporters have declined. In 2010,

both India and China saw their market shares

exceed the US share.

On the other

hand, the market shares of the USA and

leading European economies have gradually

declined. Further, we see that by 2010 India

and China were importing larger shares of

GCC exports in comparison to the USA and

Europe, which had been the main importers of

GCC oil products.

Source: IMF, Direction of Trade Statistics (2010).

In the manufactured goods category, which

includes the more labour-intensive industrial

products, India and China have been able to

capture sizable market shares in the GCC

market. As shown in Figure 10, they each now

control more than 20 per cent of the GCC

market. Note that the market shares of India

and China have followed a very similar path.

Both the USA and Western Europe have lost

sizable market share to India and China since

1998.

The past decade not only saw a sharp increase

in bilateral trade between the GCC and C&I

but also significant growth in bilateral investment

among these nations as well. A large part

of these investments were intended to enhance

long-term trade and create deeper economic

interdependency, particularly in the energy

sector.

A World Bank study of survey data on FDI

outflows from Middle East and North Africa

(MENA) countries investigated why MENA

investors, dominated by GCC countries, are

attracted to China and India (World Bank

2008:56).4 The most important reasons were:

participation in industrial clusters, strong

growth potential of markets, and low production

costs. Other, less frequent, explanations

were: opportunities for joint venture partnerships,

proximity to markets, and access to technology

or innovation.

(Habibi, 2011)

Beijing has adopted a business-like approach to the Gulf region, based on trade and economic

benefits.39 Cooperation in energy is at the heart of the growing relationship between China and the Gulf.

The two sides need each other. On the one hand, China needs to secure reliable oil and natural gas

suppliers and, on the other, Gulf producers need to secure an expanding market for their hydrocarbons

resources. The Gulf region is also likely to meet Chinas growing needs for natural gas.

(Bahgat, 2005)

Anda mungkin juga menyukai

- The Impact of Foreign Direct Investment (FDI) On Stock Market Development in GCC CountriesDokumen16 halamanThe Impact of Foreign Direct Investment (FDI) On Stock Market Development in GCC Countrieshazemsamman83Belum ada peringkat

- India-China - Trade RelationshipDokumen9 halamanIndia-China - Trade Relationshipविशाल कुमारBelum ada peringkat

- India's Foreign Trade - The Challenges andDokumen31 halamanIndia's Foreign Trade - The Challenges andAmit Kumar Rai100% (1)

- Trade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamDokumen14 halamanTrade Liberalization, Economic Reforms and Foreign Direct Investment - A Critical Analysis of The Political Transformation in VietnamTRn JasonBelum ada peringkat

- The Internationalization of Chinese and Indian Firms: Trends, Motivations and Policy ImplicationsDokumen8 halamanThe Internationalization of Chinese and Indian Firms: Trends, Motivations and Policy ImplicationsMudit VermaBelum ada peringkat

- India's cement industry outpaces China's growthDokumen92 halamanIndia's cement industry outpaces China's growthAbdulgafoor NellogiBelum ada peringkat

- Executive Summary: Cement IndustryDokumen97 halamanExecutive Summary: Cement Industryst miraBelum ada peringkat

- IT&D Assignment on Role of Int'l TradeDokumen3 halamanIT&D Assignment on Role of Int'l TradeRaman SehgalBelum ada peringkat

- Executive Summary: Cement IndustryDokumen81 halamanExecutive Summary: Cement IndustrySankaraharan ShanmugamBelum ada peringkat

- China Global PDFDokumen16 halamanChina Global PDFUrmi Mehta100% (1)

- Regression Analysisi MariaDokumen11 halamanRegression Analysisi MariaInnocent escoBelum ada peringkat

- Trends in Global Trade - v1Dokumen13 halamanTrends in Global Trade - v1castro dasBelum ada peringkat

- Indian Cement Industry ReportDokumen92 halamanIndian Cement Industry ReportShone ThattilBelum ada peringkat

- Indian Cement Industry ReportDokumen92 halamanIndian Cement Industry ReportShone ThattilBelum ada peringkat

- Executive Summary: Cement IndustryDokumen92 halamanExecutive Summary: Cement Industrypratap_sivasaiBelum ada peringkat

- International Marketing - ChinaDokumen10 halamanInternational Marketing - ChinaNaijalegendBelum ada peringkat

- MOSPI Present 1Dokumen58 halamanMOSPI Present 1Spandan GhoshalBelum ada peringkat

- India - UAE Import Export RelationDokumen6 halamanIndia - UAE Import Export RelationTaha DholfarBelum ada peringkat

- Evaluate The Contribution of Fdi in Industrial Sector in MalaysiaDokumen30 halamanEvaluate The Contribution of Fdi in Industrial Sector in MalaysiaA Ayie AzhariBelum ada peringkat

- Asymmetric Effects of Trade Openness on Economic Growth in ASEAN CountriesDokumen17 halamanAsymmetric Effects of Trade Openness on Economic Growth in ASEAN CountriesJaka SriyanaBelum ada peringkat

- Trade As An Engine For Growth-Developing EconomiesDokumen57 halamanTrade As An Engine For Growth-Developing EconomiesAmit BehalBelum ada peringkat

- Global Trade PracticesDokumen32 halamanGlobal Trade PracticesGleny SequiraBelum ada peringkat

- Fdi Impact Iferp Ext - 14273Dokumen4 halamanFdi Impact Iferp Ext - 14273Naresh GuduruBelum ada peringkat

- South SouthDokumen17 halamanSouth SouthAna M. RodriguezBelum ada peringkat

- IntroductiontoEconomicDiversificationintheGCCRegion-Chapter1Dokumen27 halamanIntroductiontoEconomicDiversificationintheGCCRegion-Chapter1Eleni AnastasovaBelum ada peringkat

- FDI Effects on Oil, Gas, Refinery Production and ExportsDokumen17 halamanFDI Effects on Oil, Gas, Refinery Production and ExportsgUIDOBelum ada peringkat

- Are Economic Relations With India Helping Africa?: Trade, Investment and Development in The Middle-Income SouthDokumen31 halamanAre Economic Relations With India Helping Africa?: Trade, Investment and Development in The Middle-Income SouthPrincessqueenBelum ada peringkat

- Foreign Direct Investment in MultiDokumen13 halamanForeign Direct Investment in MultiPriya OberoiBelum ada peringkat

- India and Its BOPDokumen19 halamanIndia and Its BOPAshish KhetadeBelum ada peringkat

- Topic: The Increasing Reliance On Foreign Direct Investment Sector: A Big IssueDokumen3 halamanTopic: The Increasing Reliance On Foreign Direct Investment Sector: A Big IssueThương Thanh ĐàmBelum ada peringkat

- Role of India in Global Economy: Adnan Ul Haque Business Globalization Word Count: 1801Dokumen9 halamanRole of India in Global Economy: Adnan Ul Haque Business Globalization Word Count: 1801Adnan YusufzaiBelum ada peringkat

- What Is Fta? India'S Ftas?Dokumen6 halamanWhat Is Fta? India'S Ftas?2K20SE164YASHBelum ada peringkat

- Analysis of Intra-Regional Trade Among BRCS and India: Perspective and ChallengesDokumen9 halamanAnalysis of Intra-Regional Trade Among BRCS and India: Perspective and ChallengesrohanBelum ada peringkat

- Final ITDokumen14 halamanFinal ITNgoc Huỳnh HyBelum ada peringkat

- India S Foreign TradeDokumen21 halamanIndia S Foreign Tradeapi-3771480Belum ada peringkat

- India-China Trade Imbalance ExplainedDokumen16 halamanIndia-China Trade Imbalance ExplainedSameer AnsariBelum ada peringkat

- China and WTO - 945391065Dokumen20 halamanChina and WTO - 945391065lidyaBelum ada peringkat

- Manufacturing Management: To, Mr. Subramaniyam From-Deepak Chauhan Roll Number-3180 Class-Ty-DDokumen15 halamanManufacturing Management: To, Mr. Subramaniyam From-Deepak Chauhan Roll Number-3180 Class-Ty-DalishajosephBelum ada peringkat

- Economic Reforms, Regionalism, and Exports:: Comparing China and IndiaDokumen100 halamanEconomic Reforms, Regionalism, and Exports:: Comparing China and IndiaYopie ShinodaBelum ada peringkat

- Managing FIIs Inflows - .RKSDokumen8 halamanManaging FIIs Inflows - .RKSAnonymous Y0M10GZVBelum ada peringkat

- Implications of The Growth of China and India For The Middle EastDokumen26 halamanImplications of The Growth of China and India For The Middle EastM AdeelBelum ada peringkat

- David Dollar, 2016) - in The Year 2016 To 2018 Both Export and Import Were Relatively Increased That Implies HigherDokumen3 halamanDavid Dollar, 2016) - in The Year 2016 To 2018 Both Export and Import Were Relatively Increased That Implies HigherBarakaBelum ada peringkat

- Vietnam's Economic Integration Benefits and ChallengesDokumen8 halamanVietnam's Economic Integration Benefits and ChallengesNguyễn Nhật Duy LongBelum ada peringkat

- International Business: Digital Assignment IIIDokumen8 halamanInternational Business: Digital Assignment IIIAntony Deric CostaBelum ada peringkat

- Cross-Border Acquisitions Are Powering Growth India Goes GlobalDokumen8 halamanCross-Border Acquisitions Are Powering Growth India Goes GlobalVipul KaushikBelum ada peringkat

- Trade and Capital Flows - GCC and India - Final - May 02 2012Dokumen55 halamanTrade and Capital Flows - GCC and India - Final - May 02 2012aakashblueBelum ada peringkat

- Doing Business With ChinaDokumen28 halamanDoing Business With ChinanrkscribdacBelum ada peringkat

- GRA - GLOBAL RESEARCH ANALYSIS X 40Dokumen2 halamanGRA - GLOBAL RESEARCH ANALYSIS X 40RajDoshiBelum ada peringkat

- Grant Thornton FICCI MSMEDokumen76 halamanGrant Thornton FICCI MSMEIshan GuptaBelum ada peringkat

- Foriegn Trade PolicyDokumen16 halamanForiegn Trade Policykayathri kumarBelum ada peringkat

- Rcep - MC ArticleDokumen10 halamanRcep - MC ArticleJanastus LouieBelum ada peringkat

- FDI A Catalyst For Growth of The Textile & Apparel IndustryDokumen10 halamanFDI A Catalyst For Growth of The Textile & Apparel Industryshobu_iujBelum ada peringkat

- GCC Trade and Foreign InvestmentDokumen41 halamanGCC Trade and Foreign InvestmentluluBelum ada peringkat

- Indo-China Trade Trends Composition and FutureDokumen10 halamanIndo-China Trade Trends Composition and FutureMohammed RazikBelum ada peringkat

- Anwar, Nguyen (2010) Foreign Direct Investment and Economic Growth in VietnamDokumen21 halamanAnwar, Nguyen (2010) Foreign Direct Investment and Economic Growth in VietnamNajaha GasimBelum ada peringkat

- Asian Foreign Direct InvestmentDokumen14 halamanAsian Foreign Direct Investmentadrian retardoBelum ada peringkat

- Country-India: (Economics - Macro)Dokumen17 halamanCountry-India: (Economics - Macro)Hamza AjmeriBelum ada peringkat

- 19 Trade Liberalization and Economic Growth in ChinaDokumen16 halaman19 Trade Liberalization and Economic Growth in ChinaAdel MohsenBelum ada peringkat

- Thailand: Industrialization and Economic Catch-UpDari EverandThailand: Industrialization and Economic Catch-UpBelum ada peringkat

- Accepted ManuscriptDokumen21 halamanAccepted ManuscriptZafar Imam KhanBelum ada peringkat

- Knowledge Management Capabilities and Hotel Performance in Malaysia The Role of Market OrientationDokumen15 halamanKnowledge Management Capabilities and Hotel Performance in Malaysia The Role of Market OrientationZafar Imam KhanBelum ada peringkat

- Alhazmi, 2019Dokumen18 halamanAlhazmi, 2019Zafar Imam KhanBelum ada peringkat

- Assessment Practices in Saudi Higher Education During The COVID-19 PandemicDokumen10 halamanAssessment Practices in Saudi Higher Education During The COVID-19 PandemicZafar Imam KhanBelum ada peringkat

- Kaldeen & Nawaz 2020Dokumen12 halamanKaldeen & Nawaz 2020Zafar Imam KhanBelum ada peringkat

- A Case Study of Knowledge Management Practices at The Intercontinental Hotels' GroupDokumen13 halamanA Case Study of Knowledge Management Practices at The Intercontinental Hotels' GroupZafar Imam KhanBelum ada peringkat

- Journal of Business Research: Rana Mostaghel, Koteshwar ChirumallaDokumen10 halamanJournal of Business Research: Rana Mostaghel, Koteshwar ChirumallaZafar Imam KhanBelum ada peringkat

- Circular Manufacturing 1Dokumen14 halamanCircular Manufacturing 1FABIANBelum ada peringkat

- Bag 2020Dokumen12 halamanBag 2020Zafar Imam KhanBelum ada peringkat

- Empowering Leadership and Knowledge Management: The Mediating Role of Followers ' Technology UseDokumen18 halamanEmpowering Leadership and Knowledge Management: The Mediating Role of Followers ' Technology UseZafar Imam KhanBelum ada peringkat

- 12I 1112 Musova Et AlDokumen21 halaman12I 1112 Musova Et AlZafar Imam KhanBelum ada peringkat

- Employee performance at Sahid Jaya Hotel SoloDokumen8 halamanEmployee performance at Sahid Jaya Hotel SoloZafar Imam KhanBelum ada peringkat

- Environmental Challenges: Wareerath Akkalatham, Amirhossein TaghipourDokumen11 halamanEnvironmental Challenges: Wareerath Akkalatham, Amirhossein TaghipourZafar Imam KhanBelum ada peringkat

- Emotional Intelligence and Tacit Knowledge Management in HospitalityDokumen9 halamanEmotional Intelligence and Tacit Knowledge Management in HospitalityZafar Imam KhanBelum ada peringkat

- The Impact of Knowledge Management On The Internationalization, Organizational Ambidexterity and Performance of Spanish Hotel ChainsDokumen25 halamanThe Impact of Knowledge Management On The Internationalization, Organizational Ambidexterity and Performance of Spanish Hotel ChainsZafar Imam KhanBelum ada peringkat

- Impact of It Infrastructure and Knowledge Management Capability On Organisational Performance of Star Hotels in Sri LankaDokumen7 halamanImpact of It Infrastructure and Knowledge Management Capability On Organisational Performance of Star Hotels in Sri LankaZafar Imam KhanBelum ada peringkat

- Theories International RelationsDokumen21 halamanTheories International RelationsZafar Imam KhanBelum ada peringkat

- Prediction of Knowledge Management For Success of Franchise Hospitality in A Post-Pandemic EconomyDokumen27 halamanPrediction of Knowledge Management For Success of Franchise Hospitality in A Post-Pandemic EconomyZafar Imam KhanBelum ada peringkat

- Quentin Blake, Roald Dahl,-The Enormous Crocodile (2001) PDFDokumen22 halamanQuentin Blake, Roald Dahl,-The Enormous Crocodile (2001) PDFCamila BastosBelum ada peringkat

- India China border clashes: A global concernDokumen8 halamanIndia China border clashes: A global concernZafar Imam KhanBelum ada peringkat

- Women in Hospitality Travel and Leisure Final ReportDokumen80 halamanWomen in Hospitality Travel and Leisure Final ReportZafar Imam KhanBelum ada peringkat

- PEST Analysis SudanDokumen8 halamanPEST Analysis SudanZafar Imam KhanBelum ada peringkat

- RESEARCH Mars MissionDokumen2 halamanRESEARCH Mars MissionZafar Imam KhanBelum ada peringkat

- Quentin Blake, Roald Dahl,-The Enormous Crocodile (2001) PDFDokumen22 halamanQuentin Blake, Roald Dahl,-The Enormous Crocodile (2001) PDFCamila BastosBelum ada peringkat

- Working Women Worldwide. Age Effects in Female Labor Force Participation in 117 CountriesDokumen19 halamanWorking Women Worldwide. Age Effects in Female Labor Force Participation in 117 CountriesZafar Imam KhanBelum ada peringkat

- Aesthetic FrontofficeDokumen10 halamanAesthetic FrontofficeZafar Imam KhanBelum ada peringkat

- HadeethDokumen2 halamanHadeethZafar Imam KhanBelum ada peringkat

- The Softening of Adventure TourismDokumen20 halamanThe Softening of Adventure TourismZafar Imam KhanBelum ada peringkat

- Price List: ApartmentsDokumen1 halamanPrice List: ApartmentsZafar Imam KhanBelum ada peringkat

- The Impact of Tourism The Travel Research Association Sixth Annu 1976Dokumen1 halamanThe Impact of Tourism The Travel Research Association Sixth Annu 1976Zafar Imam KhanBelum ada peringkat

- Resume of Deliagonzalez34 - 1Dokumen2 halamanResume of Deliagonzalez34 - 1api-24443855Belum ada peringkat

- IoT BASED HEALTH MONITORING SYSTEMDokumen18 halamanIoT BASED HEALTH MONITORING SYSTEMArunkumar Kuti100% (2)

- TheEconomist 2023 04 01Dokumen297 halamanTheEconomist 2023 04 01Sh FBelum ada peringkat

- IDokumen2 halamanIsometoiajeBelum ada peringkat

- John Titor TIME MACHINEDokumen21 halamanJohn Titor TIME MACHINEKevin Carey100% (1)

- Sentinel 2 Products Specification DocumentDokumen510 halamanSentinel 2 Products Specification DocumentSherly BhengeBelum ada peringkat

- Rohit Patil Black BookDokumen19 halamanRohit Patil Black BookNaresh KhutikarBelum ada peringkat

- Riddles For KidsDokumen15 halamanRiddles For KidsAmin Reza100% (8)

- Attributes and DialogsDokumen29 halamanAttributes and DialogsErdenegombo MunkhbaatarBelum ada peringkat

- 08 Sepam - Understand Sepam Control LogicDokumen20 halaman08 Sepam - Understand Sepam Control LogicThức Võ100% (1)

- Exercises2 SolutionsDokumen7 halamanExercises2 Solutionspedroagv08Belum ada peringkat

- India Today 11-02-2019 PDFDokumen85 halamanIndia Today 11-02-2019 PDFGBelum ada peringkat

- CMC Ready ReckonerxlsxDokumen3 halamanCMC Ready ReckonerxlsxShalaniBelum ada peringkat

- Malware Reverse Engineering Part 1 Static AnalysisDokumen27 halamanMalware Reverse Engineering Part 1 Static AnalysisBik AshBelum ada peringkat

- Fernandez ArmestoDokumen10 halamanFernandez Armestosrodriguezlorenzo3288Belum ada peringkat

- Striedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsDokumen22 halamanStriedter - 2015 - Evolution of The Hippocampus in Reptiles and BirdsOsny SillasBelum ada peringkat

- Case Study Hotel The OrchidDokumen5 halamanCase Study Hotel The Orchidkkarankapoor100% (4)

- GROSS DOMESTIC PRODUCT STATISTICS (Report) - Powerpoint PresentationDokumen37 halamanGROSS DOMESTIC PRODUCT STATISTICS (Report) - Powerpoint PresentationCyryhl GutlayBelum ada peringkat

- Motor Master 20000 SeriesDokumen56 halamanMotor Master 20000 SeriesArnulfo Lavares100% (1)

- BPL Millipacs 2mm Hardmetrics RarDokumen3 halamanBPL Millipacs 2mm Hardmetrics RarGunter BragaBelum ada peringkat

- Portfolio Artifact Entry Form - Ostp Standard 3Dokumen1 halamanPortfolio Artifact Entry Form - Ostp Standard 3api-253007574Belum ada peringkat

- Theory of Linear Programming: Standard Form and HistoryDokumen42 halamanTheory of Linear Programming: Standard Form and HistoryJayakumarBelum ada peringkat

- Pita Cyrel R. Activity 7Dokumen5 halamanPita Cyrel R. Activity 7Lucky Lynn AbreraBelum ada peringkat

- S5-42 DatasheetDokumen2 halamanS5-42 Datasheetchillin_in_bots100% (1)

- Exp 8 - GPG - D12B - 74 PDFDokumen4 halamanExp 8 - GPG - D12B - 74 PDFPRATIKSHA WADIBHASMEBelum ada peringkat

- International Certificate in WealthDokumen388 halamanInternational Certificate in Wealthabhishek210585100% (2)

- AATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsDokumen3 halamanAATCC 100-2004 Assesment of Antibacterial Dinishes On Textile MaterialsAdrian CBelum ada peringkat

- Os PPT-1Dokumen12 halamanOs PPT-1Dhanush MudigereBelum ada peringkat

- Obstetrical Hemorrhage: Reynold John D. ValenciaDokumen82 halamanObstetrical Hemorrhage: Reynold John D. ValenciaReynold John ValenciaBelum ada peringkat

- Brick TiesDokumen15 halamanBrick TiesengrfarhanAAABelum ada peringkat