Asignación de Problemas - Glosario Financiero

Diunggah oleh

Paola MartinezHak Cipta

Format Tersedia

Bagikan dokumen Ini

Apakah menurut Anda dokumen ini bermanfaat?

Apakah konten ini tidak pantas?

Laporkan Dokumen IniHak Cipta:

Format Tersedia

Asignación de Problemas - Glosario Financiero

Diunggah oleh

Paola MartinezHak Cipta:

Format Tersedia

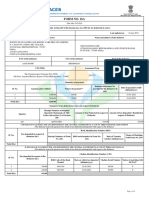

No.

Problem Asignado a:

Grey market Is the trade of a commodity through distribution channels that are legal but

unintended by the original manufacturer. The most common type of grey market is the sale,

by individuals or small companies not authorized by the manufacturer, of imported goods

which would otherwise be either more expensive or unavailable in the country to which they

Luisa

are being imported.

1 Fernanda's

Muy claro.

CIPAS

Question . Redaccin larga

From your point of view, what do you think that the government should do to adjust the grey pero clara. DOs

market without affecting the existing companies of our country? ajustes en

palabras

Financial loan is a fundamental tool for obtaining a sum of money that can fill a need or

purchase a good or service by performing various payments, generating an interest rate

according to the monetary policy to handle the financial institution.

Therefore in Colombia one increment presented in the amount of financial loans required,

Yeison Lpez's

2 presenting a drop in borrowing capacity becoming a problem, since financial institutions

CIPAS

sometimes manage interest rates high so borrowers get into bad financial habits.

What actions should financial entitites implement to prevent debtors have bad financial

habits?

Corto y concreto. Muy bien expresado. Hubo ajustes en la pregunta

Nowadays it is dealing in the congress of the republic of Colombia the tributary reform that

as it informs about the government, Hairdresser's shop and small shops of neighborhood

pay tax in order that with this well versed only one they fulfill his tax debts.

The tributary reform supports the exemption of revenue to the Non-profit-making Entities as

long as fulfill his function for the one that they were created As for The monotax, The

secretary Crdenas indicated that there are many small informal merchants who have

income between 40 $ million and 100 $ million, which would do that they pay revenue Yeni Rocio's

3

Because of it the tributary reform believes the option to pay the tax of revenue with rate of 3 CIPAS

% or the monotax with rate of 1 %.

Other products that will be exempt from VAT are the eggs, meats, notebooks and books,

secondhand housings and new housings of prices lower than 800 $ million.

Question

How can these microcompanies offset this load of taxes since they would stay in

disadvantage as for already consolidated companies? Buen contexto y claro. Revisin en el primer prrafo muy breve.

The gross domestic product this year has shown a slight decline due to rising inflation in

various productive sectors, with the emergence of a new tax reform this situation will worsen

due to the increase in various taxes in some products essential to sustaining economic of

4 Colombian households which will cause an even stronger impact on gross domestic Mishell's CIPAS

product.

As economist, what actions or solutions will you present to change the situation?

Anda mungkin juga menyukai

- The Yellow House: A Memoir (2019 National Book Award Winner)Dari EverandThe Yellow House: A Memoir (2019 National Book Award Winner)Penilaian: 4 dari 5 bintang4/5 (98)

- Final Askari Bank Report HamzaDokumen41 halamanFinal Askari Bank Report HamzaSO HaBelum ada peringkat

- Hidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RaceDari EverandHidden Figures: The American Dream and the Untold Story of the Black Women Mathematicians Who Helped Win the Space RacePenilaian: 4 dari 5 bintang4/5 (895)

- Review Material Secured Transactions Fall Semester 2021Dokumen13 halamanReview Material Secured Transactions Fall Semester 2021OlavoBelum ada peringkat

- The Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifeDari EverandThe Subtle Art of Not Giving a F*ck: A Counterintuitive Approach to Living a Good LifePenilaian: 4 dari 5 bintang4/5 (5794)

- Igkc TanDokumen2 halamanIgkc TanJyoti prakash MohapatraBelum ada peringkat

- The Little Book of Hygge: Danish Secrets to Happy LivingDari EverandThe Little Book of Hygge: Danish Secrets to Happy LivingPenilaian: 3.5 dari 5 bintang3.5/5 (400)

- Multiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)Dokumen4 halamanMultiple Choice. (Write Your Answers Before The Number. Use Capital Letter.)april bentadanBelum ada peringkat

- Devil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaDari EverandDevil in the Grove: Thurgood Marshall, the Groveland Boys, and the Dawn of a New AmericaPenilaian: 4.5 dari 5 bintang4.5/5 (266)

- The Third Curve - The End of Growth As We Know ItDokumen223 halamanThe Third Curve - The End of Growth As We Know ItBhawna RBelum ada peringkat

- Shoe Dog: A Memoir by the Creator of NikeDari EverandShoe Dog: A Memoir by the Creator of NikePenilaian: 4.5 dari 5 bintang4.5/5 (537)

- 03 Handout 2Dokumen9 halaman03 Handout 2Hezrone OcampoBelum ada peringkat

- Elon Musk: Tesla, SpaceX, and the Quest for a Fantastic FutureDari EverandElon Musk: Tesla, SpaceX, and the Quest for a Fantastic FuturePenilaian: 4.5 dari 5 bintang4.5/5 (474)

- H C D C, I .: OLY Ross OF Avao Ollege NCDokumen14 halamanH C D C, I .: OLY Ross OF Avao Ollege NCerikka june forosueloBelum ada peringkat

- Never Split the Difference: Negotiating As If Your Life Depended On ItDari EverandNever Split the Difference: Negotiating As If Your Life Depended On ItPenilaian: 4.5 dari 5 bintang4.5/5 (838)

- Gen - Math TG Shs v.1Dokumen316 halamanGen - Math TG Shs v.1Leopold Laset69% (13)

- Grit: The Power of Passion and PerseveranceDari EverandGrit: The Power of Passion and PerseverancePenilaian: 4 dari 5 bintang4/5 (588)

- Aptitude Solved Questions: Compound InterestDokumen10 halamanAptitude Solved Questions: Compound InterestnavyaBelum ada peringkat

- A Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryDari EverandA Heartbreaking Work Of Staggering Genius: A Memoir Based on a True StoryPenilaian: 3.5 dari 5 bintang3.5/5 (231)

- Annual Equivalent MethodDokumen14 halamanAnnual Equivalent MethodUsmanBelum ada peringkat

- Exit 1: Friends and Neighbors: Cross TalkDokumen28 halamanExit 1: Friends and Neighbors: Cross TalkJoyce EnriqueBelum ada peringkat

- The Emperor of All Maladies: A Biography of CancerDari EverandThe Emperor of All Maladies: A Biography of CancerPenilaian: 4.5 dari 5 bintang4.5/5 (271)

- City Bank Report GB PDFDokumen77 halamanCity Bank Report GB PDFEkram EkuBelum ada peringkat

- Samuel Gachie Kamiti V Equity Bank LTDDokumen13 halamanSamuel Gachie Kamiti V Equity Bank LTDSamuel NgureBelum ada peringkat

- The World Is Flat 3.0: A Brief History of the Twenty-first CenturyDari EverandThe World Is Flat 3.0: A Brief History of the Twenty-first CenturyPenilaian: 3.5 dari 5 bintang3.5/5 (2259)

- UniCredit Auto ABS in EuropeDokumen16 halamanUniCredit Auto ABS in EuropeMaxF_2015Belum ada peringkat

- On Fire: The (Burning) Case for a Green New DealDari EverandOn Fire: The (Burning) Case for a Green New DealPenilaian: 4 dari 5 bintang4/5 (73)

- Bond ValuationDokumen36 halamanBond ValuationBhavesh RoheraBelum ada peringkat

- The Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersDari EverandThe Hard Thing About Hard Things: Building a Business When There Are No Easy AnswersPenilaian: 4.5 dari 5 bintang4.5/5 (344)

- Application For A European Order For PaymentDokumen8 halamanApplication For A European Order For PaymentebenbryBelum ada peringkat

- Rise of ISIS: A Threat We Can't IgnoreDari EverandRise of ISIS: A Threat We Can't IgnorePenilaian: 3.5 dari 5 bintang3.5/5 (137)

- Tutorial Questions - Financial InstrumentsDokumen2 halamanTutorial Questions - Financial InstrumentsAlegria Gonzalez PalaciosBelum ada peringkat

- Team of Rivals: The Political Genius of Abraham LincolnDari EverandTeam of Rivals: The Political Genius of Abraham LincolnPenilaian: 4.5 dari 5 bintang4.5/5 (234)

- English: Bank of India Banking Officer Paper - 2017 (Practice Set)Dokumen29 halamanEnglish: Bank of India Banking Officer Paper - 2017 (Practice Set)hermandeep5Belum ada peringkat

- Zica t1 Financial AccountingDokumen363 halamanZica t1 Financial Accountinglord100% (2)

- EDHEC Valuation Manual PDFDokumen40 halamanEDHEC Valuation Manual PDFradhika1992Belum ada peringkat

- The Unwinding: An Inner History of the New AmericaDari EverandThe Unwinding: An Inner History of the New AmericaPenilaian: 4 dari 5 bintang4/5 (45)

- Week 10Dokumen3 halamanWeek 10PrateekBelum ada peringkat

- The Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You AreDari EverandThe Gifts of Imperfection: Let Go of Who You Think You're Supposed to Be and Embrace Who You ArePenilaian: 4 dari 5 bintang4/5 (1090)

- MAE - P4 Chapter 5Dokumen2 halamanMAE - P4 Chapter 5Leah Mae NolascoBelum ada peringkat

- Equipment Economics Ch04DDokumen12 halamanEquipment Economics Ch04DMahmoud A. YousefBelum ada peringkat

- Sukuk-Mufti Taqi UsmaniDokumen28 halamanSukuk-Mufti Taqi UsmaniAshurboki KurbonovBelum ada peringkat

- Housing Loan DetailsDokumen9 halamanHousing Loan DetailsPandurangbaligaBelum ada peringkat

- Finance Module 5 Sources of Short Term FundsDokumen5 halamanFinance Module 5 Sources of Short Term FundsJOHN PAUL LAGAOBelum ada peringkat

- Rev 00Dokumen9 halamanRev 00Trần Tuấn VũBelum ada peringkat

- The Sympathizer: A Novel (Pulitzer Prize for Fiction)Dari EverandThe Sympathizer: A Novel (Pulitzer Prize for Fiction)Penilaian: 4.5 dari 5 bintang4.5/5 (121)

- Precious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan ReceivableDokumen6 halamanPrecious Grace Ann R. Loja IA1 April 13, 2020: Initial Measurement of Loan Receivableprecious2lojaBelum ada peringkat

- What Kills StartupsDokumen12 halamanWhat Kills StartupsTimothy ChanBelum ada peringkat

- Assets and Liabilities Form 1994Dokumen2 halamanAssets and Liabilities Form 1994Leonil EstañoBelum ada peringkat

- Her Body and Other Parties: StoriesDari EverandHer Body and Other Parties: StoriesPenilaian: 4 dari 5 bintang4/5 (821)